Market news

-

23:29

Commodities. Daily history for Feb 09’2017:

(raw materials / closing price /% change)

Oil 53.14 +0.26%

Gold 1,229.40 -0.60%

-

23:28

Stocks. Daily history for Feb 09’2017:

(index / closing price / change items /% change)

Nikkei -99.93 18907.67 -0.53%

TOPIX -10.60 1513.55 -0.70%

Hang Seng +40.01 23525.14 +0.17%

CSI 300 +13.00 3396.29 +0.38%

Euro Stoxx 50 +39.75 3277.79 +1.23%

FTSE 100 +40.68 7229.50 +0.57%

DAX +99.48 11642.86 +0.86%

CAC 40 +59.64 4826.24 +1.25%

DJIA +118.06 20172.40 +0.59%

S&P 500 +13.20 2307.87 +0.58%

NASDAQ +32.73 5715.18 +0.58%

S&P/TSX +63.26 15617.30 +0.41%

-

23:27

Currencies. Daily history for Feb 09’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0654 -0,40%

GBP/USD $1,2495 -0,34%

USD/CHF Chf1,0014 +0,69%

USD/JPY Y113,24 +1,17%

EUR/JPY Y120,65 +0,75%

GBP/JPY Y141,49 +0,82%

AUD/USD $0,7623 -0,26%

NZD/USD $0,7183 -1,11%

USD/CAD C$1,3143 +0,01%

-

23:00

Schedule for today, Friday, Feb 10’2017 (GMT0)

00:30 Australia Home Loans December 0.9% 1%

00:30 Australia RBA Monetary Policy Statement

02:00 China Trade Balance, bln January 40.82 47.9

07:45 France Industrial Production, m/m December 2.2% -0.7%

07:45 France Non-Farm Payrolls (Preliminary) Quarter IV 0.3% 0.3%

09:30 United Kingdom Industrial Production (MoM) December 2.1% 0.2%

09:30 United Kingdom Industrial Production (YoY) December 2% 3.2%

09:30 United Kingdom Manufacturing Production (MoM) December 1.3% 0.5%

09:30 United Kingdom Manufacturing Production (YoY) December 1.2% 1.8%

09:30 United Kingdom Total Trade Balance December -4.17

13:30 Canada Unemployment rate January 6.9% 6.9%

13:30 Canada Employment January 53.7 -5

13:30 U.S. Import Price Index January 0.4% 0.2%

15:00 United Kingdom NIESR GDP Estimate January 0.5%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) February 98.5 97.9

19:00 U.S. Federal budget January -28 40

-

20:00

DJIA 20196.73 142.39 0.71%, NASDAQ 5720.85 38.39 0.68%, S&P 500 2310.40 15.73 0.69%

-

17:00

European stocks closed: FTSE 7229.50 40.68 0.57%, DAX 11642.86 99.48 0.86%, CAC 4826.24 59.64 1.25%

-

16:38

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Thursday, helped by higher oil prices. Oil prices rose more than 0,8%, rising for the second straight day, supported by an unexpected draw in U.S. gasoline inventories. The fourth-quarter earnings season has been largely upbeat, with combined earnings of S&P 500 companies estimated to have risen 8,3%, the highest in nine quarters. However, Wall Street's reaction to corporate earnings has been muted as investors remain cautious given the recent run-up in the market and policy uncertainty under newly elected President Donald Trump.

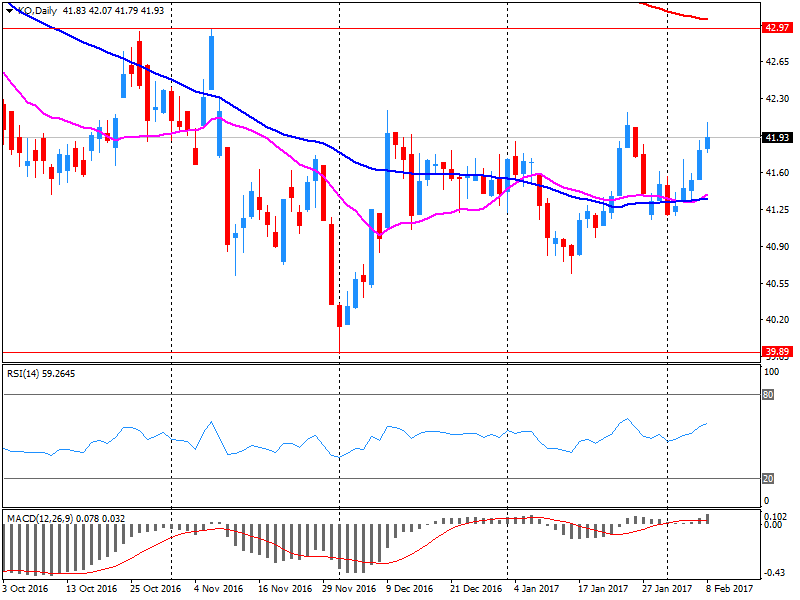

Most of Dow stocks in positive area (27 of 30). Top loser - The Coca-Cola Company (KO, -2.00%). Top gainer - NIKE, Inc. (NKE, +2.58%).

Most of S&P sectors in positive area. Top gainer - Financials (+0.8%). Top loser - Utilities (-0.4%).

At the moment:

Dow 20142.00 +140.00 +0.70%

S&P 500 2305.50 +15.25 +0.67%

Nasdaq 100 5214.50 +23.25 +0.45%

Oil 52.80 +0.46 +0.88%

Gold 1234.90 -4.60 -0.37%

U.S. 10yr 2.38 +0.02

-

16:37

WSE: Session Results

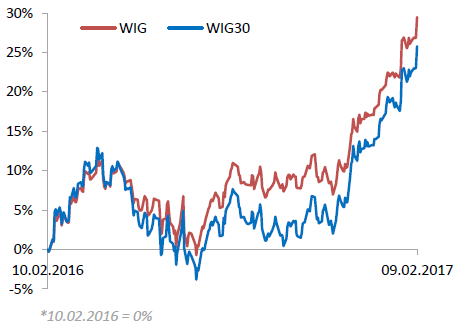

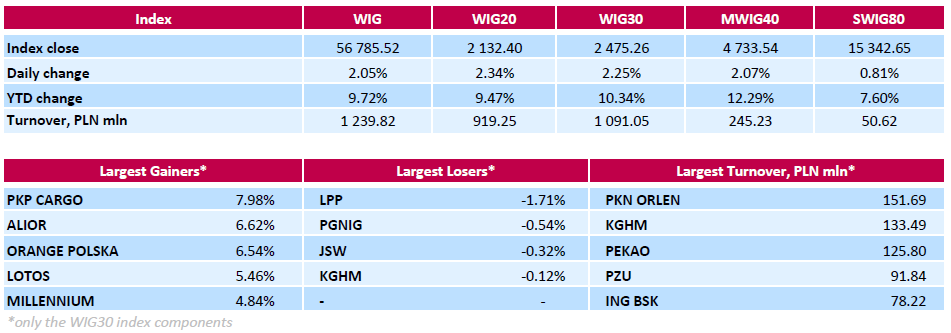

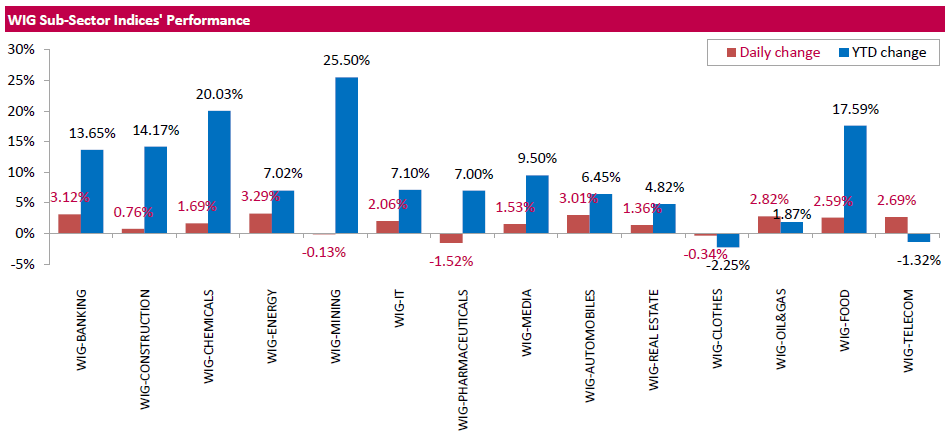

Polish equity closed higher on Thursday. The broad market measure, the WIG Index, surged by 2.05%. The WIG sub-sector indices were mainly higher with energy stocks measure (+3.29%) outperforming.

The large-cap stocks' benchmark, the WIG30 Index, rose by 2.25%. There were only four decliners among the index components. Clothing retailer LPP (WSE: LPP) posted the sharpest decline, sliding down 1.71%. It was followed by oil and gas producer PGNIG (WSE: PGN), coking coal producer JSW (WSE: JSW) and copper producer KGHM (WSE: KGH), falling by 0.54%, 0.32% and 0.12% respectively. On the plus side, railway freight transport operator PKP CARGO (WSE: PKP) topped the list of outperformers, climbing by 7.98%. Other major gainers were bank ALIOR (WSE: ALR), telecommunication services provider ORANGE POLSKA (WSE: OPL) and oil refiner LOTOS (WSE: LTS), climbing by 6.62%, 6.54% and 5.46% .respectively. Elsewhere, bank PEKAO (WSE: PEO) added 2.76%, supported by better-than-expected Q4 earnings. The bank posted net profit of PLN 494.7 mln (+13% y/y) versus analysts' consensus estimate of PLN 478.5 mln.

-

15:49

WSJ Survey: About a Quarter of Economists Expect Next Fed Rate Increase in March

-

11% Expect Next Fed Rate Increase at May Meeting

-

Most Economists Expect Next Fed Rate Increase in June

-

Nearly 60% of Economists Expect Next Fed Rate Increase in June

-

-

15:12

Trump is going to announce tax changes in the next few weeks - rumors

-

15:11

Final US wholesale inventories rose in line with expectations

Total inventories of merchant wholesalers, except manufacturers' sales branches and offices, after adjustment for seasonal variations but not for price changes, were $601.1 billion at the end of December, up 1.0 percent (±0.4 percent) from the revised November level. Total inventories are up 2.6 percent (±1.4 percent) from the revised December 2015 level. The November 2016 to December 2016 percent change was unrevised from the advance estimate of up 1.0 percent (± 0.4 percent).

-

15:00

U.S.: Wholesale Inventories, December 1% (forecast 1%)

-

14:54

WSE: After start on Wall Street

The US market started trading with a rise of 0.13% (the S&P500 index) and after the first transactions slightly went up. The market is still close to historic highs and at these levels no much happens in terms of volatility and the level of turnover. In our market dynamic growth turned into a lateral movement and bulls still have the situation under control.

An hour before the close of trading in Warsaw the WIG20 index was at the level of 2,128 points (+2,17%).

-

14:32

U.S. Stocks open: Dow +0.14%, Nasdaq +0.06%, S&P +0.13%

-

14:11

Before the bell: S&P futures +0.07%, NASDAQ futures +0.04%

U.S. stock-index futures were flat as investors focused on corporate earnings reports.

Global Stocks:

Nikkei 18,907.67 -99.93 -0.53%

Hang Seng 23,525.14 +40.01 +0.17%

Shanghai 3,183.79 +16.81 +0.53%

FTSE 7,195.99 +7.17 +0.10%

CAC 4,792.64 +26.04 +0.55%

DAX 11,581.80 +38.42 +0.33%

Crude $52.90 (+1.07%)

Gold $1,241.30 (+0.17%)

-

13:57

Canadian New Housing Price Index edged up 0.1% in December

The New Housing Price Index (NHPI) edged up 0.1% in December compared with the previous month, largely reflecting price increases in Ontario and Alberta. Prices have risen at the national level for 21 consecutive months.

Among the 21 census metropolitan areas (CMAs) surveyed, new housing prices were up in 10, down in 1 and unchanged in 10.

Kitchener-Cambridge-Waterloo (+0.8%) and St. Catharines-Niagara (+0.8%) recorded the largest price gains among the CMAs covered by the survey. Builders in Kitchener-Cambridge-Waterloo reported higher construction costs, a shortage of developed land and improving market conditions as reasons for the increase. In St. Catharines-Niagara, builders attributed the price increase to improving market conditions and moving to new phases of building with higher land development costs.

Prices rose 0.3% in Ottawa-Gatineau, Hamilton, Regina and Saskatoon. Builders in Ottawa-Gatineau cited market conditions and new phases of development as reasons for the gain. Builders in Hamilton reported improving market conditions and new phases of land development as reasons for higher prices.

-

13:55

US unemployment claims continue to decline

In the week ending February 4, the advance figure for seasonally adjusted initial claims was 234,000, a decrease of 12,000 from the previous week's unrevised level of 246,000. The 4-week moving average was 244,250, a decrease of 3,750 from the previous week's unrevised average of 248,000. This is the lowest level for this average since November 3, 1973 when it was 244,000.

-

13:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

37.45

-0.09(-0.2397%)

1250

Amazon.com Inc., NASDAQ

AMZN

821.89

2.18(0.2659%)

7323

American Express Co

AXP

77.88

0.08(0.1028%)

228

AMERICAN INTERNATIONAL GROUP

AIG

64.99

0.08(0.1232%)

300

Apple Inc.

AAPL

131.7

0.23(0.1749%)

144326

Barrick Gold Corporation, NYSE

ABX

19.56

-0.03(-0.1531%)

63720

Boeing Co

BA

165.12

1.31(0.7997%)

5852

Caterpillar Inc

CAT

93.1

0.19(0.2045%)

2084

Chevron Corp

CVX

111.5

-0.08(-0.0717%)

3700

Cisco Systems Inc

CSCO

31.35

0.08(0.2558%)

1425

Citigroup Inc., NYSE

C

56.65

0.33(0.5859%)

9578

Deere & Company, NYSE

DE

107.96

-0.45(-0.4151%)

600

Exxon Mobil Corp

XOM

81.8

0.32(0.3927%)

8785

Facebook, Inc.

FB

134.55

0.35(0.2608%)

95762

Ford Motor Co.

F

12.37

-0.01(-0.0808%)

18321

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.33

-0.20(-1.2878%)

73187

General Electric Co

GE

29.59

0.16(0.5437%)

33579

General Motors Company, NYSE

GM

35.04

-0.10(-0.2846%)

6505

Goldman Sachs

GS

238.75

1.02(0.4291%)

954

Google Inc.

GOOG

810.05

1.67(0.2066%)

769

International Business Machines Co...

IBM

176.58

0.41(0.2327%)

392

International Paper Company

IP

53.64

0.54(1.0169%)

125

JPMorgan Chase and Co

JPM

86.25

0.29(0.3374%)

5075

Microsoft Corp

MSFT

63.47

0.13(0.2052%)

4494

Nike

NKE

53.85

-0.03(-0.0557%)

998

Pfizer Inc

PFE

32.3

0.16(0.4978%)

3257

Procter & Gamble Co

PG

88.35

0.02(0.0226%)

603

Starbucks Corporation, NASDAQ

SBUX

55.09

-0.13(-0.2354%)

1125

Tesla Motors, Inc., NASDAQ

TSLA

266.95

4.87(1.8582%)

252229

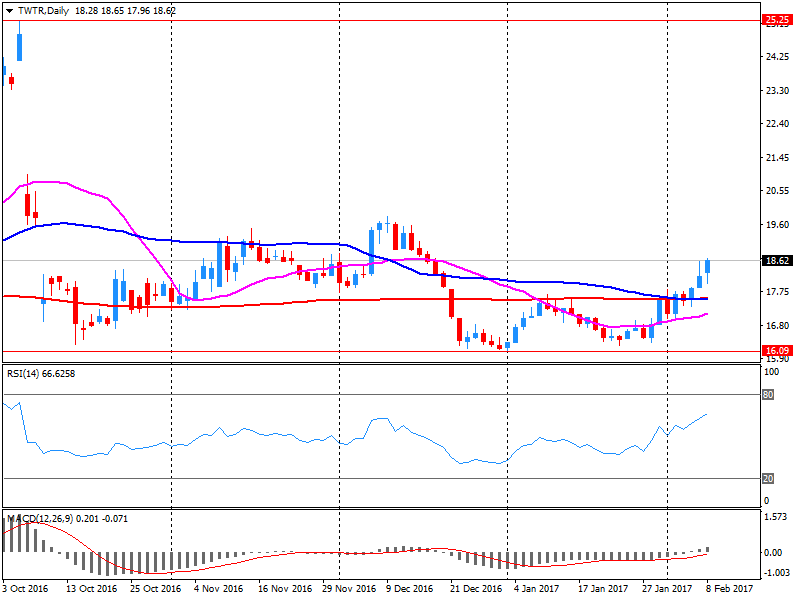

Twitter, Inc., NYSE

TWTR

16.87

-1.85(-9.8825%)

8263003

UnitedHealth Group Inc

UNH

160.5

0.19(0.1185%)

107

Verizon Communications Inc

VZ

48.45

0.08(0.1654%)

2096

Visa

V

85.5

0.41(0.4818%)

535

Walt Disney Co

DIS

109.18

0.18(0.1651%)

6138

Yahoo! Inc., NASDAQ

YHOO

45

-0.07(-0.1553%)

258

Yandex N.V., NASDAQ

YNDX

22.93

-0.12(-0.5206%)

1799

-

13:52

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Freeport-McMoRan (FCX) resumed with Neutral at JP Morgan

-

13:44

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0500-1.0515 (EUR 1,065 M) 1.0550-1.0565 (EUR 725 M) 1.0595-1.0600 (EUR 720 M) 1.0615-1.0625 (EUR 913 M) 1.0650 (EUR 585 M) 1.0660-1.0670 (EUR 388 M)

GBP/USD 1.2395-1.2400 (GBP 396 M) 1.2450 (GBP 300 M) 1.2550 (GBP 202 M) 1.2685-1.2700 (GBP 846 M)

EUR/GBP 0.8500 (EUR 305 M) 0.8530-0.8532 (EUR 280 M) 0.8565 (EUR 175 M) 0.8615 (EUR 721 M)

USD/JPY 110.00 (USD 220 M) 111.00-111.15 (USD 711 M) 112.35-112.50 (USD 690 M) 112.60-112.75 (USD 224 M) 112.80-112.95 (USD 573 M) 113.00 (USD 626 M)

USD/CHF 1.0005-1.0020 (USD 210 M) 1.0150 (USD 340 M)

AUD/USD 0.7500-0.7509 (AUD 242 M) 0.7600 (AUD 385 M) 0.7640-0.7650 (AUD 365 M) 0.7680-0.7690 (AUD 308 M) 0.7700 (AUD 231 M)

USD/CAD 1.3000 (USD 810 M)

NZD/USD 0.7175 (NZD 231 M) 0.7250 (NZD 185 M)

-

13:30

U.S.: Initial Jobless Claims, 234 (forecast 250)

-

13:30

U.S.: Continuing Jobless Claims, 2078 (forecast 2060)

-

13:30

Canada: New Housing Price Index, MoM, December 0.1% (forecast 0.2%)

-

13:26

Company News: Coca-Cola (KO) posts Q4 EPS in-line with analysts’ estimate

Coca-Cola reported Q4 FY 2016 earnings of $0.37 per share (versus $0.38 in Q4 FY 2015), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $9.409 bln (-5.9% y/y), beating analysts' consensus estimate of $9.170 bln.

The company also issued downside guidance for FY 2017, projecting EPS of $1.83-1.89 (-4% - -1% y/y) versus analysts' consensus estimate of $1.97.

KO fell to $41.20 (-1.95%) in pre-market trading.

-

13:12

Company News: Twitter (TWTR) beats on Q4 EPS, misses on revenues

Twitter reported Q4 FY 2016 earnings of $0.16 per share (versus $0.16 in Q4 FY 2015), beating analysts' consensus estimate of $0.12.

The company's quarterly revenues amounted to $0.717 bln (+0.9% y/y), missing analysts' consensus estimate of $0.739 bln.

The company also confirmed expectations that its revenue growth would continue to lag audience growth in 2017 and could now be further impacted by escalating competition for digital ad spending and the re-evaluation of the company's revenue product feature portfolio.

TWTR fell to $16.73 (-10.63%) in pre-market trading.

-

13:00

Orders

EUR/USD

Offers 1.0700-05 1.0730 1.0750 1.0780-85 1.0800

Bids 1.0670 1.0650 1.0625-301.0600 1.0580 1.0550

GBP/USD

Offers 1.2580 1.2600 1.2630 1.2650 1.2685 1.2700

Bids 1.2500 1.2475-80 1.2450 1.2430 1.2400 1.2380 1.2345-50

EUR/GBP

Offers 0.8535 0.8550 0.8585 0.8600 0.8630-35 0.8650

Bids 0.8500 0.8485 0.8465 0.8450 0.8430 0.8400

EUR/JPY

Offers 120.25-30 120.50 120.80 121.00 121.50

Bids 119.75 119.50 119.30 119.00 118.60 118.30 118.00

USD/JPY

Offers 112.50-55 112.85 113.00 113.20 113.50

Bids 112.00 111.80 111.65 111.50 111.30 111.00

AUD/USD

Offers 0.7650 0.7685 0.7700 0.7730 0.7750

Bids 0.7600 0.7580 0.7550 0.7520 0.7500

-

12:46

Pending bullish signal on AUD/USD. A weekly close above 0.7730/50 important - NAB

"Trend: Price broke down from its broad 2016 triangle in Q4 2016 and challenged the bottom of the nine-month range and our downside target at 0.7150/00 in December. The response to nine-month lows at 0.7150/00 has been positive however, setting up an impulsive bullish reversal pattern in January. On a multi-week basis the interim uptrend justifies a retest of the base of the broken LT uptrend channel at 0.7730/50 (high last week of 0.7696). Beyond this we note 2016 highs at 0.7778/0.7835 as a difficult hurdle that would need to be overcome in order to establish a more sustainable MT uptrend. This would target the May 2015 high above 0.8150 at a minimum.

Momentum: MT momentum shifted to a positive bias in January after achieving a material unwind towards oversold levels. Weekly RSI overcame two key trend lines last week while the weekly MACD broke above zero. These are powerful confirmations of the MT uptrend bias. ST momentum highlights some near term stress indicative of a ST consolidation ahead of a resumption of the uptrend.

Outlook: Price achieved our downside target at 0.7150/00 in late December before launching an impulsive uptrend in January. Bullish monthly reversal pattern in January confirms that the Q4 decline was most likely a correction and implies a reassertion of the MT/LT uptrend. Current upswing has fallen marginally short of our initial target (trend channel base at 0.7730/50). A weekly close above 0.7730/50 will target a challenge of 2016 highs at 0.7778/0.7835 and ultimately 0.8150/0.8300 in the MT".

Copyright © 2017 NAB, eFXnews™

-

12:04

WSE: Mid session comment

The long-awaited overcome of the resistance at 2,100 points in case of the WIG20 index strengthened the demand side and we may also see that to the game enters a new capital, which benefits from breaking. The chart of the WIG20 index steadily climbing to the top and the Warsaw Stock Exchange is today the strongest market in Europe.

Major European parquets, ie. France and Germany, returned to session highs which also strengthens increases in Warsaw. Additionally, in the US shot up the valuation of contracts on the S&P500.

At the halfway point of today's quotations the WIG20 index was at the level of 2,130 points (+2,26%) and the turnover among the largest companies was amounted to PLN 440 million.

-

11:54

Le Pen to beat Macron and Fillon in the 1st round 24% to 21% & 20%, Macron to beat Le Pen in the 2nd 65/35% Opinionway poll - Forexlive. EUR/USD around the lows of the day

-

10:55

The pound and the euro push higher against a broadly weaker dollar, helped as gains in equities encourage a slight ebb in risk aversion. EUR/USD up 0.1% at $1.0697, GBP/USD up 0.35% at $1.2567 - Dow Jones

-

10:06

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0600-05 (EUR 693m) 1.0650 (955m) 1.0700 (887m) 1.0780 (1.33bln) 1.0950 (880m)

USD/JPY: 112.00 (USD 607m) 112.50 (350m) 114.00 (670m) 115.00 (465m)

GBP/USD: 1.2565-70 (GBP 437m) 1.2600 (469m)

AUD/USD: 0.7400 (AUD 571m)

USD/CAD 1.2975 (USD 485m)

Информационно-аналитический отдел TeleTrade

-

09:50

Oil is trading higher

This morning the New York futures for Brent rose by 0.78% to $ 55.55 and WTI rose 0.80% to $ 52.74. Thus, the black gold prices trading in the green zone amid falling gasoline inventories in the United States.

According to the Energy Information Administration US crude stocks rose for the week to 13.83 million barrels, while gasoline stocks fell by 0.87 million barrels to 256.2 million barrels.

-

09:24

RBA Governor Lowe: Expect GDP Growth Around 3% Over Next 2 Years

-

Unemployment Rate to Remain Close to Current Level for Some Time

-

Some Strengthening of Job Growth in Prospect

-

Inflation Not Expected to Fall Further

-

Economy to Return to Reasonable Growth in 4Q

-

3Q GDP Fall Reflected Mostly Temporary Factors

-

Decline in Terms of Trade Has Stopped

-

Australia Mining Investment Is 90% of Way Through Fall From Peak

-

-

09:22

Major stock markets in Europe trading higher: FTSE + 0.2%, DAX + 0.5%, CAC40 + 0.5%, FTMIB + 0.4%, IBEX + 0.3%

-

08:18

WSE: After opening

WIG20 index opened at 2092.88 points (+0.44%)*

WIG 55902.82 0.47%

WIG30 2433.60 0.53%

mWIG40 4655.15 0.38%

*/ - change to previous close

The Warsaw spot market began trading from fairly sizeable increase with a good attitude and outstanding turnover of Pekao (WSE: PEO), which published better than expected results for the fourth quarter and announced a dividend payment of PLN 8.68 zł per share (dividend yield 6.38 percent in relation to yesterday's closing price).

Very good looks also German DAX which increased by more than 0.4%. The morning promises thinking about getting the level of 2,100 points in case of the WIG20 index.

After fifteen minutes of trading WIG20 index was at 2,094 points (+0,45%)

-

08:00

Today’s events

-

At 09:00 GMT RBA Governor Philip Lowe will deliver a speech

-

At 09:30 GMT Spain will hold an auction of 10-year bonds

-

At 10:30 GMT, Britain will hold an auction of 30-year bonds

-

At 14:10 GMT FOMC member James Bullard will give a speech

-

At 16:35 GMT the Bank of Canada Deputy Governor Lawrence Schembri will deliver a speech

-

At 18:01 GMT the United States will hold an auction of 30-year bonds

-

At 18:10 GMT FOMC member Charles Evans will give a speech

-

At 18:30 GMT the Bank of England Governor Mark Carney will deliver a speech

-

-

07:39

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.2%, CAC40 -0.1%, FTSE -0.1%

-

07:38

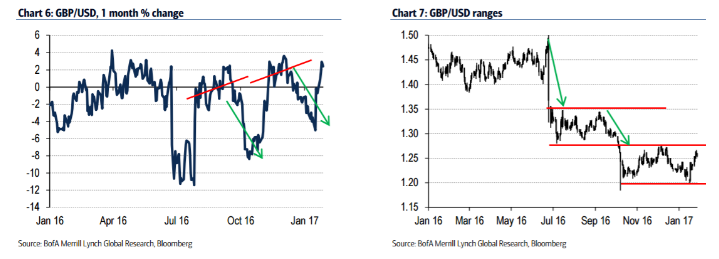

BofA Merrill getting ready to long GBP into one final dip

"We believe that some of the traditional macro drivers for GBP, such as global growth and the UK housing and labour markets, are unlikely to be significantly impacted by the Brexit negotiations in the coming months. As a result, the divergences between these key drivers and GBP, which have built up as political risk premium has dominated price action, could be closed.

We expect one final dip in GBP as Article 50 (A50) is formally triggered and as the EU formally responds and sets out its negotiating position.

We think the crystallization of risks and the start of the countdown to Brexit may prove to be the low in GBP and the opportunity to enter GBP longs.

We reiterate our view that the formal triggering of Article 50 will mark the final phase of sterling's decline and mark the low point for GBP this year.

Our Q1/Q2 forecast for GBP/USD remains $1.15, although we concede that this target is being challenged. The scale of the GBP reaction will hinge on the EU's initial response to formal triggering. We are not optimistic on this front. We expect that the EU will inject a dose of reality regarding the challenges the UK will face in forthcoming negotiations. The EU will likely reiterate its red lines (the four fundamental freedoms) and the 2-year stopwatch thus becomes live. This scenario effectively challenges the growing view that the process toward divorce will not be a smooth one.

Medium-term fundamentals bullish GBP. Even though sterling has effectively decoupled from the UK growth cycle, in doing so, it is exposing the pound to upside risks if Brexit risks fade into the backdrop or as the markets become immune to the incessant news flow. In our view, with some of main pillars that have historically driven GBP through the business cycle remaining resilient to the Brexit shock, the upside risks to sterling are building. GBP looks cheap versus domestic metrics, such as the housing and labour markets.

We are therefore more optimistic on the mediumterm outlook for GBP, notwithstanding the near-term headwinds, which we think will push GBP back towards the bottom end of its trading range and further".

Copyright © 2017 BofAML, eFXnews™

-

07:34

Iran launches another ballistic short-range Mersad surface-to-air missile, which impacted 35 miles away, according to a U.S. official

-

07:32

Options levels on thursday, February 9, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0784 (3304)

$1.0746 (2483)

$1.0723 (2213)

Price at time of writing this review: $1.0673

Support levels (open interest**, contracts):

$1.0615 (3430)

$1.0586 (3673)

$1.0553 (4668)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 69737 contracts, with the maximum number of contracts with strike price $1,0800 (4700);

- Overall open interest on the PUT options with the expiration date March, 13 is 81244 contracts, with the maximum number of contracts with strike price $1,0000 (5038);

- The ratio of PUT/CALL was 1.17 versus 1.17 from the previous trading day according to data from February, 8

GBP/USD

Resistance levels (open interest**, contracts)

$1.2704 (3031)

$1.2706 (2871)

$1.2610 (2120)

Price at time of writing this review: $1.2506

Support levels (open interest**, contracts):

$1.2392 (1980)

$1.2295 (3504)

$1.2197 (1556)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 33974 contracts, with the maximum number of contracts with strike price $1,2500 (3687);

- Overall open interest on the PUT options with the expiration date March, 13 is 37087 contracts, with the maximum number of contracts with strike price $1,2300 (3504);

- The ratio of PUT/CALL was 1.09 versus 1.12 from the previous trading day according to data from February, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:22

The Reserve Bank of New Zeeland left the Official Cash Rate (OCR) unchanged at 1.75 percent

The Reserve Bank today left the Official Cash Rate (OCR) unchanged at 1.75 percent.

"The recovery in commodity prices and more positive business and consumer sentiment in advanced economies have improved the global outlook. However, major challenges remain with on-going surplus capacity in the global economy and rising geo-political uncertainty.

Global headline inflation has increased, partly due to rising commodity prices. Global long-term interest rates have increased. Monetary policy is expected to remain stimulatory, but less so going forward, particularly in the US.

New Zealand's financial conditions have firmed with long-term interest rates rising and continued upward pressure on the New Zealand dollar exchange rate. The exchange rate remains higher than is sustainable for balanced growth and, together with low global inflation, continues to generate negative inflation in the tradables sector. A decline in the exchange rate is needed".

-

07:18

WSE: Before opening

Wednesday's session on the New York stock exchange has brought small variations in the major indexes. No publication of macroeconomic data, except for the weekly crude oil inventories in the US, focused market attention on the results of companies. Tomorrow will begin a two-day meeting Donald Trump with Japan Prime Minister, where will be discussed a number of topics, including very important for the US trade issues and currencies.

Contracts in the US are stable after yesterday's neutral session and in Asia, beside of falling the Nikkei, dominate rather increases. This means a quiet start of the European markets.

The main index of the Warsaw Stock Exchange, the WIG20, remains in consolidation and, at least in the morning, there are no arguments for leaving it.

-

07:06

Swiss unemplyment rate rose 0.2% in January

According to the State Secretariat for Economic Affairs (SECO) surveys, 164,466 unemployed were registered at the Regional Employment Centers (RAV) at the end of January 2017, 5,094 more than in the previous month.

The unemployment rate thus rose from 3.5% in December 2016 to 3.7% in the reporting month. Compared to the previous month, unemployment rose by 822 persons (+ 0.5%). Youth unemployment in January 2017 Youth unemployment (15 to 24 year olds) rose by 566 persons (+ 2.9%) to 19'782. Compared to the previous year, this corresponds to a decrease of 1'398 persons (-6.6%).

-

07:04

Highest value ever recorded for German trade balance

Germany exported goods to the value of 1,207.5 billion euros and imported goods to the value of 954.6 billion euros in 2016. Based on provisional data, the Federal Statistical Office (Destatis) also reports that German exports increased by 1.2% and imports by 0.6% in 2016 compared with 2015. Exports and imports in 2016 exceeded the previous record highs of 2015, when goods to the value of 1,193.6 billion euros had been exported and goods to the value of 949.2 billion euros had been imported.

The foreign trade balance showed a surplus of 252.9 billion euros in 2016, which was the highest value ever recorded. It clearly exceeded the previous peak of 244.3 billion euros achieved in 2015.

According to provisional results of the Deutsche Bundesbank, the current account of the balance of payments showed a surplus of 266.0 billion euros in 2016, which takes into account the balances of trade in goods including supplementary trade items (+271.5 billion euros), services (-28.3 billion euros), primary income (+63.2 billion euros) and secondary income (-40.5 billion euros). In 2015, the German current account showed a surplus of 252.6 billion euros.

-

07:02

Germany: Current Account , December 24.0

-

07:01

Germany: Trade Balance (non s.a.), bln, December 18.7

-

06:45

Switzerland: Unemployment Rate (non s.a.), January 3.7% (forecast 3.6%)

-

06:33

Global Stocks

European stocks finished modestly higher Wednesday, but post-earnings drops by Maersk and Tullow Oil and a decline in oil prices kept stronger gains in check. U.S. government data out Wednesday afternoon showed a surge in supplies, to 13.8 million barrels compared with expectations of a rise of 2.5 million barrels, but oil prices managed to shake off earlier declines of more than 1% as European equity trading closed.

The Dow industrials closed lower Wednesday as financial stocks continued their slide on the week, while the S&P 500 closed fractionally higher and the Nasdaq scored a new record.

Asian stocks were mildly higher Thursday as investors sought trading cues, even as Japan's Nikkei Stock Average was pressured lower by the yen's strength overnight. "We sort of need a trigger," said Christoffer Moltke-Leth, director of global sales trading at Saxo Capital Markets. "I think [the market] will be driven very much by individual company news....It will be a stock picker's market."

-

00:31

Australia: National Australia Bank's Business Confidence, January 5

-

00:00

Australia: HIA New Home Sales, m/m, December 0.2%

-