Market news

-

23:27

Currencies. Daily history for Feb 09’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0654 -0,40%

GBP/USD $1,2495 -0,34%

USD/CHF Chf1,0014 +0,69%

USD/JPY Y113,24 +1,17%

EUR/JPY Y120,65 +0,75%

GBP/JPY Y141,49 +0,82%

AUD/USD $0,7623 -0,26%

NZD/USD $0,7183 -1,11%

USD/CAD C$1,3143 +0,01%

-

23:00

Schedule for today, Friday, Feb 10’2017 (GMT0)

00:30 Australia Home Loans December 0.9% 1%

00:30 Australia RBA Monetary Policy Statement

02:00 China Trade Balance, bln January 40.82 47.9

07:45 France Industrial Production, m/m December 2.2% -0.7%

07:45 France Non-Farm Payrolls (Preliminary) Quarter IV 0.3% 0.3%

09:30 United Kingdom Industrial Production (MoM) December 2.1% 0.2%

09:30 United Kingdom Industrial Production (YoY) December 2% 3.2%

09:30 United Kingdom Manufacturing Production (MoM) December 1.3% 0.5%

09:30 United Kingdom Manufacturing Production (YoY) December 1.2% 1.8%

09:30 United Kingdom Total Trade Balance December -4.17

13:30 Canada Unemployment rate January 6.9% 6.9%

13:30 Canada Employment January 53.7 -5

13:30 U.S. Import Price Index January 0.4% 0.2%

15:00 United Kingdom NIESR GDP Estimate January 0.5%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) February 98.5 97.9

19:00 U.S. Federal budget January -28 40

-

15:49

WSJ Survey: About a Quarter of Economists Expect Next Fed Rate Increase in March

-

11% Expect Next Fed Rate Increase at May Meeting

-

Most Economists Expect Next Fed Rate Increase in June

-

Nearly 60% of Economists Expect Next Fed Rate Increase in June

-

-

15:12

Trump is going to announce tax changes in the next few weeks - rumors

-

15:11

Final US wholesale inventories rose in line with expectations

Total inventories of merchant wholesalers, except manufacturers' sales branches and offices, after adjustment for seasonal variations but not for price changes, were $601.1 billion at the end of December, up 1.0 percent (±0.4 percent) from the revised November level. Total inventories are up 2.6 percent (±1.4 percent) from the revised December 2015 level. The November 2016 to December 2016 percent change was unrevised from the advance estimate of up 1.0 percent (± 0.4 percent).

-

15:00

U.S.: Wholesale Inventories, December 1% (forecast 1%)

-

13:57

Canadian New Housing Price Index edged up 0.1% in December

The New Housing Price Index (NHPI) edged up 0.1% in December compared with the previous month, largely reflecting price increases in Ontario and Alberta. Prices have risen at the national level for 21 consecutive months.

Among the 21 census metropolitan areas (CMAs) surveyed, new housing prices were up in 10, down in 1 and unchanged in 10.

Kitchener-Cambridge-Waterloo (+0.8%) and St. Catharines-Niagara (+0.8%) recorded the largest price gains among the CMAs covered by the survey. Builders in Kitchener-Cambridge-Waterloo reported higher construction costs, a shortage of developed land and improving market conditions as reasons for the increase. In St. Catharines-Niagara, builders attributed the price increase to improving market conditions and moving to new phases of building with higher land development costs.

Prices rose 0.3% in Ottawa-Gatineau, Hamilton, Regina and Saskatoon. Builders in Ottawa-Gatineau cited market conditions and new phases of development as reasons for the gain. Builders in Hamilton reported improving market conditions and new phases of land development as reasons for higher prices.

-

13:55

US unemployment claims continue to decline

In the week ending February 4, the advance figure for seasonally adjusted initial claims was 234,000, a decrease of 12,000 from the previous week's unrevised level of 246,000. The 4-week moving average was 244,250, a decrease of 3,750 from the previous week's unrevised average of 248,000. This is the lowest level for this average since November 3, 1973 when it was 244,000.

-

13:44

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0500-1.0515 (EUR 1,065 M) 1.0550-1.0565 (EUR 725 M) 1.0595-1.0600 (EUR 720 M) 1.0615-1.0625 (EUR 913 M) 1.0650 (EUR 585 M) 1.0660-1.0670 (EUR 388 M)

GBP/USD 1.2395-1.2400 (GBP 396 M) 1.2450 (GBP 300 M) 1.2550 (GBP 202 M) 1.2685-1.2700 (GBP 846 M)

EUR/GBP 0.8500 (EUR 305 M) 0.8530-0.8532 (EUR 280 M) 0.8565 (EUR 175 M) 0.8615 (EUR 721 M)

USD/JPY 110.00 (USD 220 M) 111.00-111.15 (USD 711 M) 112.35-112.50 (USD 690 M) 112.60-112.75 (USD 224 M) 112.80-112.95 (USD 573 M) 113.00 (USD 626 M)

USD/CHF 1.0005-1.0020 (USD 210 M) 1.0150 (USD 340 M)

AUD/USD 0.7500-0.7509 (AUD 242 M) 0.7600 (AUD 385 M) 0.7640-0.7650 (AUD 365 M) 0.7680-0.7690 (AUD 308 M) 0.7700 (AUD 231 M)

USD/CAD 1.3000 (USD 810 M)

NZD/USD 0.7175 (NZD 231 M) 0.7250 (NZD 185 M)

-

13:30

U.S.: Continuing Jobless Claims, 2078 (forecast 2060)

-

13:30

Canada: New Housing Price Index, MoM, December 0.1% (forecast 0.2%)

-

13:30

U.S.: Initial Jobless Claims, 234 (forecast 250)

-

13:00

Orders

EUR/USD

Offers 1.0700-05 1.0730 1.0750 1.0780-85 1.0800

Bids 1.0670 1.0650 1.0625-301.0600 1.0580 1.0550

GBP/USD

Offers 1.2580 1.2600 1.2630 1.2650 1.2685 1.2700

Bids 1.2500 1.2475-80 1.2450 1.2430 1.2400 1.2380 1.2345-50

EUR/GBP

Offers 0.8535 0.8550 0.8585 0.8600 0.8630-35 0.8650

Bids 0.8500 0.8485 0.8465 0.8450 0.8430 0.8400

EUR/JPY

Offers 120.25-30 120.50 120.80 121.00 121.50

Bids 119.75 119.50 119.30 119.00 118.60 118.30 118.00

USD/JPY

Offers 112.50-55 112.85 113.00 113.20 113.50

Bids 112.00 111.80 111.65 111.50 111.30 111.00

AUD/USD

Offers 0.7650 0.7685 0.7700 0.7730 0.7750

Bids 0.7600 0.7580 0.7550 0.7520 0.7500

-

12:46

Pending bullish signal on AUD/USD. A weekly close above 0.7730/50 important - NAB

"Trend: Price broke down from its broad 2016 triangle in Q4 2016 and challenged the bottom of the nine-month range and our downside target at 0.7150/00 in December. The response to nine-month lows at 0.7150/00 has been positive however, setting up an impulsive bullish reversal pattern in January. On a multi-week basis the interim uptrend justifies a retest of the base of the broken LT uptrend channel at 0.7730/50 (high last week of 0.7696). Beyond this we note 2016 highs at 0.7778/0.7835 as a difficult hurdle that would need to be overcome in order to establish a more sustainable MT uptrend. This would target the May 2015 high above 0.8150 at a minimum.

Momentum: MT momentum shifted to a positive bias in January after achieving a material unwind towards oversold levels. Weekly RSI overcame two key trend lines last week while the weekly MACD broke above zero. These are powerful confirmations of the MT uptrend bias. ST momentum highlights some near term stress indicative of a ST consolidation ahead of a resumption of the uptrend.

Outlook: Price achieved our downside target at 0.7150/00 in late December before launching an impulsive uptrend in January. Bullish monthly reversal pattern in January confirms that the Q4 decline was most likely a correction and implies a reassertion of the MT/LT uptrend. Current upswing has fallen marginally short of our initial target (trend channel base at 0.7730/50). A weekly close above 0.7730/50 will target a challenge of 2016 highs at 0.7778/0.7835 and ultimately 0.8150/0.8300 in the MT".

Copyright © 2017 NAB, eFXnews™

-

11:54

Le Pen to beat Macron and Fillon in the 1st round 24% to 21% & 20%, Macron to beat Le Pen in the 2nd 65/35% Opinionway poll - Forexlive. EUR/USD around the lows of the day

-

10:55

The pound and the euro push higher against a broadly weaker dollar, helped as gains in equities encourage a slight ebb in risk aversion. EUR/USD up 0.1% at $1.0697, GBP/USD up 0.35% at $1.2567 - Dow Jones

-

10:06

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0600-05 (EUR 693m) 1.0650 (955m) 1.0700 (887m) 1.0780 (1.33bln) 1.0950 (880m)

USD/JPY: 112.00 (USD 607m) 112.50 (350m) 114.00 (670m) 115.00 (465m)

GBP/USD: 1.2565-70 (GBP 437m) 1.2600 (469m)

AUD/USD: 0.7400 (AUD 571m)

USD/CAD 1.2975 (USD 485m)

Информационно-аналитический отдел TeleTrade

-

09:24

RBA Governor Lowe: Expect GDP Growth Around 3% Over Next 2 Years

-

Unemployment Rate to Remain Close to Current Level for Some Time

-

Some Strengthening of Job Growth in Prospect

-

Inflation Not Expected to Fall Further

-

Economy to Return to Reasonable Growth in 4Q

-

3Q GDP Fall Reflected Mostly Temporary Factors

-

Decline in Terms of Trade Has Stopped

-

Australia Mining Investment Is 90% of Way Through Fall From Peak

-

-

08:00

Today’s events

-

At 09:00 GMT RBA Governor Philip Lowe will deliver a speech

-

At 09:30 GMT Spain will hold an auction of 10-year bonds

-

At 10:30 GMT, Britain will hold an auction of 30-year bonds

-

At 14:10 GMT FOMC member James Bullard will give a speech

-

At 16:35 GMT the Bank of Canada Deputy Governor Lawrence Schembri will deliver a speech

-

At 18:01 GMT the United States will hold an auction of 30-year bonds

-

At 18:10 GMT FOMC member Charles Evans will give a speech

-

At 18:30 GMT the Bank of England Governor Mark Carney will deliver a speech

-

-

07:38

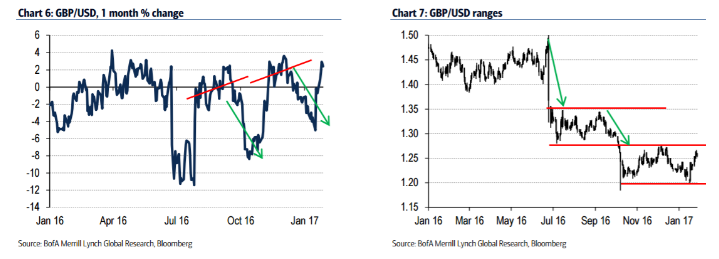

BofA Merrill getting ready to long GBP into one final dip

"We believe that some of the traditional macro drivers for GBP, such as global growth and the UK housing and labour markets, are unlikely to be significantly impacted by the Brexit negotiations in the coming months. As a result, the divergences between these key drivers and GBP, which have built up as political risk premium has dominated price action, could be closed.

We expect one final dip in GBP as Article 50 (A50) is formally triggered and as the EU formally responds and sets out its negotiating position.

We think the crystallization of risks and the start of the countdown to Brexit may prove to be the low in GBP and the opportunity to enter GBP longs.

We reiterate our view that the formal triggering of Article 50 will mark the final phase of sterling's decline and mark the low point for GBP this year.

Our Q1/Q2 forecast for GBP/USD remains $1.15, although we concede that this target is being challenged. The scale of the GBP reaction will hinge on the EU's initial response to formal triggering. We are not optimistic on this front. We expect that the EU will inject a dose of reality regarding the challenges the UK will face in forthcoming negotiations. The EU will likely reiterate its red lines (the four fundamental freedoms) and the 2-year stopwatch thus becomes live. This scenario effectively challenges the growing view that the process toward divorce will not be a smooth one.

Medium-term fundamentals bullish GBP. Even though sterling has effectively decoupled from the UK growth cycle, in doing so, it is exposing the pound to upside risks if Brexit risks fade into the backdrop or as the markets become immune to the incessant news flow. In our view, with some of main pillars that have historically driven GBP through the business cycle remaining resilient to the Brexit shock, the upside risks to sterling are building. GBP looks cheap versus domestic metrics, such as the housing and labour markets.

We are therefore more optimistic on the mediumterm outlook for GBP, notwithstanding the near-term headwinds, which we think will push GBP back towards the bottom end of its trading range and further".

Copyright © 2017 BofAML, eFXnews™

-

07:34

Iran launches another ballistic short-range Mersad surface-to-air missile, which impacted 35 miles away, according to a U.S. official

-

07:32

Options levels on thursday, February 9, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0784 (3304)

$1.0746 (2483)

$1.0723 (2213)

Price at time of writing this review: $1.0673

Support levels (open interest**, contracts):

$1.0615 (3430)

$1.0586 (3673)

$1.0553 (4668)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 69737 contracts, with the maximum number of contracts with strike price $1,0800 (4700);

- Overall open interest on the PUT options with the expiration date March, 13 is 81244 contracts, with the maximum number of contracts with strike price $1,0000 (5038);

- The ratio of PUT/CALL was 1.17 versus 1.17 from the previous trading day according to data from February, 8

GBP/USD

Resistance levels (open interest**, contracts)

$1.2704 (3031)

$1.2706 (2871)

$1.2610 (2120)

Price at time of writing this review: $1.2506

Support levels (open interest**, contracts):

$1.2392 (1980)

$1.2295 (3504)

$1.2197 (1556)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 33974 contracts, with the maximum number of contracts with strike price $1,2500 (3687);

- Overall open interest on the PUT options with the expiration date March, 13 is 37087 contracts, with the maximum number of contracts with strike price $1,2300 (3504);

- The ratio of PUT/CALL was 1.09 versus 1.12 from the previous trading day according to data from February, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:22

The Reserve Bank of New Zeeland left the Official Cash Rate (OCR) unchanged at 1.75 percent

The Reserve Bank today left the Official Cash Rate (OCR) unchanged at 1.75 percent.

"The recovery in commodity prices and more positive business and consumer sentiment in advanced economies have improved the global outlook. However, major challenges remain with on-going surplus capacity in the global economy and rising geo-political uncertainty.

Global headline inflation has increased, partly due to rising commodity prices. Global long-term interest rates have increased. Monetary policy is expected to remain stimulatory, but less so going forward, particularly in the US.

New Zealand's financial conditions have firmed with long-term interest rates rising and continued upward pressure on the New Zealand dollar exchange rate. The exchange rate remains higher than is sustainable for balanced growth and, together with low global inflation, continues to generate negative inflation in the tradables sector. A decline in the exchange rate is needed".

-

07:06

Swiss unemplyment rate rose 0.2% in January

According to the State Secretariat for Economic Affairs (SECO) surveys, 164,466 unemployed were registered at the Regional Employment Centers (RAV) at the end of January 2017, 5,094 more than in the previous month.

The unemployment rate thus rose from 3.5% in December 2016 to 3.7% in the reporting month. Compared to the previous month, unemployment rose by 822 persons (+ 0.5%). Youth unemployment in January 2017 Youth unemployment (15 to 24 year olds) rose by 566 persons (+ 2.9%) to 19'782. Compared to the previous year, this corresponds to a decrease of 1'398 persons (-6.6%).

-

07:04

Highest value ever recorded for German trade balance

Germany exported goods to the value of 1,207.5 billion euros and imported goods to the value of 954.6 billion euros in 2016. Based on provisional data, the Federal Statistical Office (Destatis) also reports that German exports increased by 1.2% and imports by 0.6% in 2016 compared with 2015. Exports and imports in 2016 exceeded the previous record highs of 2015, when goods to the value of 1,193.6 billion euros had been exported and goods to the value of 949.2 billion euros had been imported.

The foreign trade balance showed a surplus of 252.9 billion euros in 2016, which was the highest value ever recorded. It clearly exceeded the previous peak of 244.3 billion euros achieved in 2015.

According to provisional results of the Deutsche Bundesbank, the current account of the balance of payments showed a surplus of 266.0 billion euros in 2016, which takes into account the balances of trade in goods including supplementary trade items (+271.5 billion euros), services (-28.3 billion euros), primary income (+63.2 billion euros) and secondary income (-40.5 billion euros). In 2015, the German current account showed a surplus of 252.6 billion euros.

-

07:02

Germany: Current Account , December 24.0

-

07:01

Germany: Trade Balance (non s.a.), bln, December 18.7

-

06:45

Switzerland: Unemployment Rate (non s.a.), January 3.7% (forecast 3.6%)

-

00:31

Australia: National Australia Bank's Business Confidence, January 5

-

00:00

Australia: HIA New Home Sales, m/m, December 0.2%

-