Market news

-

22:28

Currencies. Daily history for Oct 13’2016:

(pare/closed(GMT +3)/change, %)

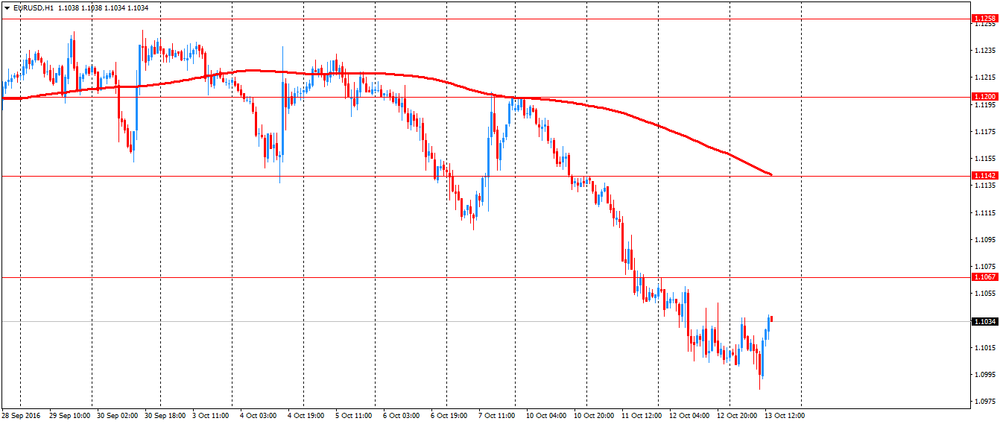

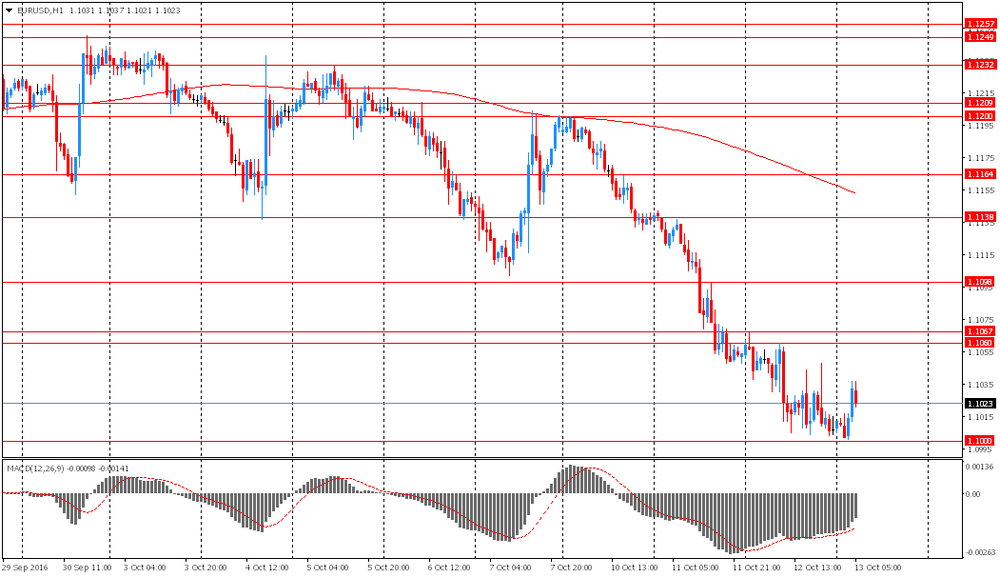

EUR/USD $1,1053 +0,42%

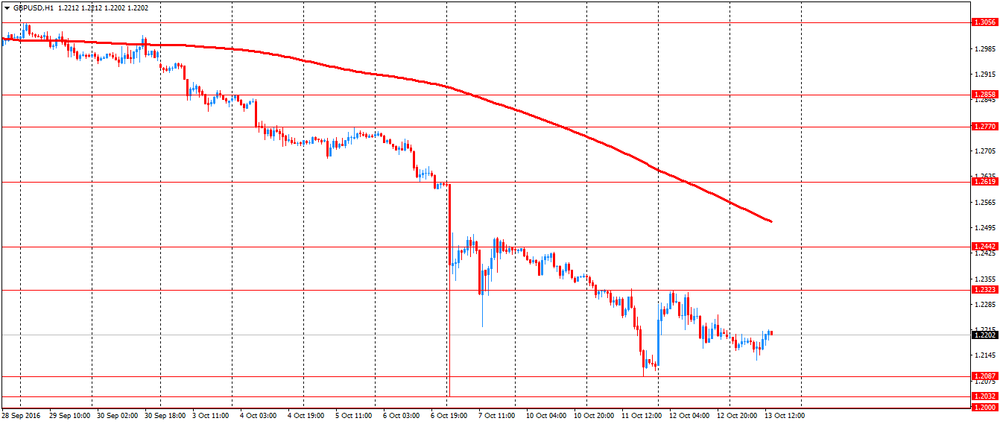

GBP/USD $1,2247 +0,42%

USD/CHF Chf0,9862 -0,44%

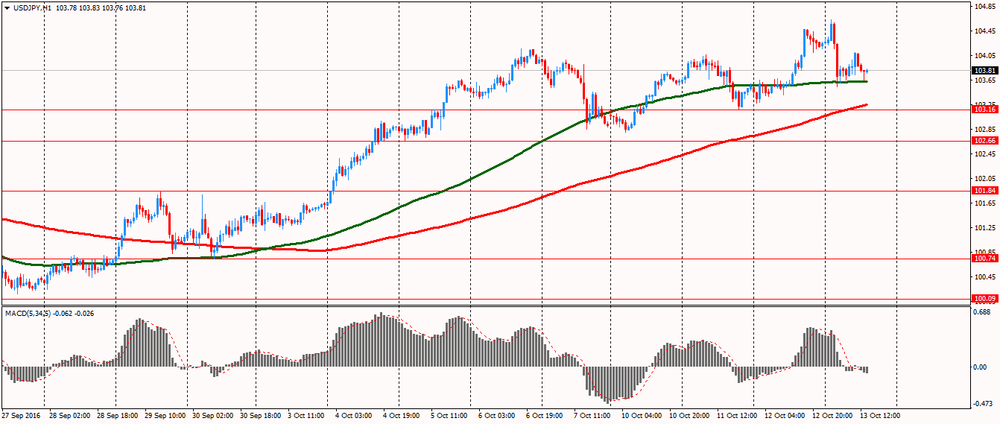

USD/JPY Y103,66 -0,56%

EUR/JPY Y114,58 -0,14%

GBP/JPY Y126,92 -0,15%

AUD/USD $0,7563 -0,01%

NZD/USD $0,7086 +0,55%

USD/CAD C$1,3192 -0,57%

-

22:00

Schedule for today, Friday, Oct 14’2016

00:30 Australia RBA Financial Stability Review

01:30 China PPI y/y September -0.8% -0.3%

01:30 China CPI y/y September 1.3% 1.6%

07:15 Switzerland Producer & Import Prices, y/y September -0.4% -0.2%

09:00 Eurozone Trade balance unadjusted August 25.3 15.3

12:30 U.S. NY Fed Empire State manufacturing index October -1.99

12:30 U.S. Retail sales September -0.3% 0.6%

12:30 U.S. Retail Sales YoY September 1.9%

12:30 U.S. PPI, m/m September 0.0% 0.2%

12:30 U.S. PPI, y/y September 0.0% 0.6%

12:30 U.S. PPI excluding food and energy, m/m September 0.1% 0.1%

12:30 U.S. PPI excluding food and energy, Y/Y September 1.0% 1.2%

12:30 U.S. FOMC Member Rosengren Speaks

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) October 91.2 91.9

14:00 U.S. Business inventories August 0.0% 0.2%

17:30 U.S. Fed Chairman Janet Yellen Speaks

18:00 U.S. Federal budget September -107 25

-

15:02

US crude inventories rose significantly but gasoline inventories decline

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 4.9 million barrels from the previous week. At 474.0 million barrels, U.S. crude oil inventories are at historically high levels for this time of year.

Total motor gasoline inventories decreased by 1.9 million barrels last week, but are above the upper limit of the average range.

Both finished gasoline inventories and blending components inventories decreased last week. Distillate fuel inventories decreased by 3.7 million barrels last week but are above the upper limit of the average range for this time of year.

Propane/propylene inventories fell 0.1 million barrels last week but are above the upper limit of the average range. Total commercial petroleum inventories decreased by 5.1 million barrels last week.

-

15:00

U.S.: Crude Oil Inventories, October 4.9 (forecast 1.75)

-

14:24

WSJ Survey: US GDP Forecasts Little Changed at 2.2% in 2017, 2% in 2018

-

Odds of Recession Within Next Year at 20%, Within Next Four Years at 59%

-

Most Economists Believe Recession Is Likely Within Next Four Years

-

Economists Expect Next Fed Rate Increase in December

-

-

13:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0850 (EUR 350m) 1.0900 (726m) 1.1000 (275m) 1.1030 (453m) 1.1140(352m) 1.1150 (569m) 1.1160 (279m) 1.1200 (549m) 1.1215 (328m) 1.1230 (248m)

USD/JPY: 101.00 (USD 1.17bln) 102.50 (457m) 103.00 (250m) 103.40-50 (604m) 104.10 (662m)

GBP/USD 1.2500 (GBP 212m)

USD/CHF 0.9715 (930m)

EUR/GBP 0.9000 (EUR 360m)

EUR/JPY 115.00 (EUR 864m)

USD/CAD: 1.3200 (USD 2.4bln) 1.3300.05 (420m) 1.3450 (250m)

NZD/USD 0.7150 (NZD 623m)

AUD/JPY 78.40 (AUD 324m)

-

13:39

Fed's Harker: Doesn't See Any Signs of Recession -Fox Business

-

12:37

Canadian new house prices rose below estimates in August

The New Housing Price Index (NHPI) rose 0.2% in August compared with July. While prices were up in eight census metropolitan areas, the increase was largely attributable to new housing prices in the combined region of Toronto and Oshawa.

The combined region of Toronto and Oshawa (+0.7%) was the top contributor to the national increase in August, recording the largest monthly price advance among the census metropolitan areas covered by the survey. Builders reported market conditions and higher costs for materials as reasons for the gain.

Prices also increased significantly in Kitchener-Cambridge-Waterloo (+0.5%) and the combined region of Greater Sudbury and Thunder Bay (+0.4%). Builders in Kitchener-Cambridge-Waterloo cited higher new list prices as the main reason for the gain. In the combined region of Greater Sudbury and Thunder Bay, higher costs for materials and building permits were the primary reasons for the rise in prices.

-

12:33

US unemployment claims continue to decline

In the week ending October 8, the advance figure for seasonally adjusted initial claims was 246,000, unchanged from the previous week's revised level. The previous week's level was revised down by 3,000 from 249,000 to 246,000. The 4-week moving average was 249,250, a decrease of 3,500 from the previous week's revised average.

This is the lowest level for this average since November 3, 1973 when it was 244,000. The previous week's average was revised down by 750 from 253,500 to 252,750.

There were no special factors impacting this week's initial claims. This marks 84 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

-

12:33

Higher US export prices in September

Prices for U.S. imports increased 0.1 percent in September, the U.S. Bureau of Labor Statistics reported today, following a 0.2-percent decline the previous month. The September advance was led by higher fuel prices. U.S. export prices rose 0.3 percent in September, after decreasing 0.8 percent in August.

U.S. import prices resumed an upward trend in September, increasing 0.1 percent, after a 0.2 percent decline in August. Prior to August, import prices had risen in each of the previous 5 months, advancing 3.1 percent between February and July. Despite those increases, import prices continue to decline

on a 12-month basis, falling 1.1 percent between September 2015 and September 2016. The 1.1 percent decrease was the smallest drop on an over-the-year basis since the index fell 0.3 percent in August 2014.The price index for overall exports increased 0.3 percent in September, as rising nonagricultural prices more than offset declining agricultural prices. The advance followed a 0.8-percent drop the previous month and resumed an upward trend dating back to April. U.S. export prices fell 1.5 percent for the year ended in September, the smallest 12-month decline since the index decreased 0.7 percent in October 2014.

-

12:30

Canada: New Housing Price Index, MoM, August 0.2% (forecast 0.3%)

-

12:30

U.S.: Initial Jobless Claims, 246 (forecast 254)

-

12:30

U.S.: Continuing Jobless Claims, 2046

-

12:26

European session review: the US dollar weakened

The following data was published:

(Time / country / index / period / previous value / forecast)

6:00 Germany Consumer Price Index m / m (final data) September 0.0% 0.1% 0.1%

6:00 Germany CPI, y / y (final data) September 0.4% 0.7% 0.7%

The US dollar fell against major currencies, as unexpectedly weak data on China's trade balance had a negative impact on market sentiment. Such weak export data reinforced concerns about the deterioration in the global economy. Against this background, some may weaken expectations of tighter monetary policy at the Fed meeting in December, and it may temporarily suspend the observed recent strengthening of the US currency.

Also, the focus is on the FOMC minutes. Although the document has not been oversupplied with new information, it was noted that the members of the committee expected rate hikes, while the overall tone of the minutes was fairly neutral. To date, the federal funds futures assess the probability of rate hikes at a meeting in December to 69.5% (64.0% to the range of 0.50% -0.75%, and 5.5% to 0.75% -1 range, 0.0%).

Today markets will primarily monitor the data on unemployment in the US, which will be published at 12:30 GMT, as well as statistics on crude oil inventories, at 15:00 GMT.

German CPI accelerated to a 16-month high in September, showed on Thursday the final Destatis data.

Consumer prices advanced 0.7 percent year on year and faster than the growth of 0.4 percent in the previous month.

Last inflation rate was the highest since May 2015.

Consumer prices rose 0.1 percent in September after last month remained unchanged. Monthly inflation is also consistent with the preliminary estimate published on 29 September.

The harmonized index of consumer prices, HICP, advanced 0.5 percent annually after rising 0.3 percent in August. The index thus reached its highest level in the year.

The pound rose against the dollar, recovering all the ground lost earlier in the day. Little influenced by data from the RICS, that have indicated that house prices in the UK rose in September by 17% compared to the same month a year earlier. In addition, in the August value of 12% was revised upward to + 13%. It should be noted that most analysts expect to see the index increase by only 14%.

In general, the pound remains under pressure due to concerns about Brexit. Recently, French President Francois Hollande joined the negative sentiment of EU official, encouraging tough negotiations with Britain. The view from France is important because the EU's position is determined mainly by Germany and France.

EUR / USD: during the European session, the pair fell to $ 1.0984, and then rose to $ 1.1039

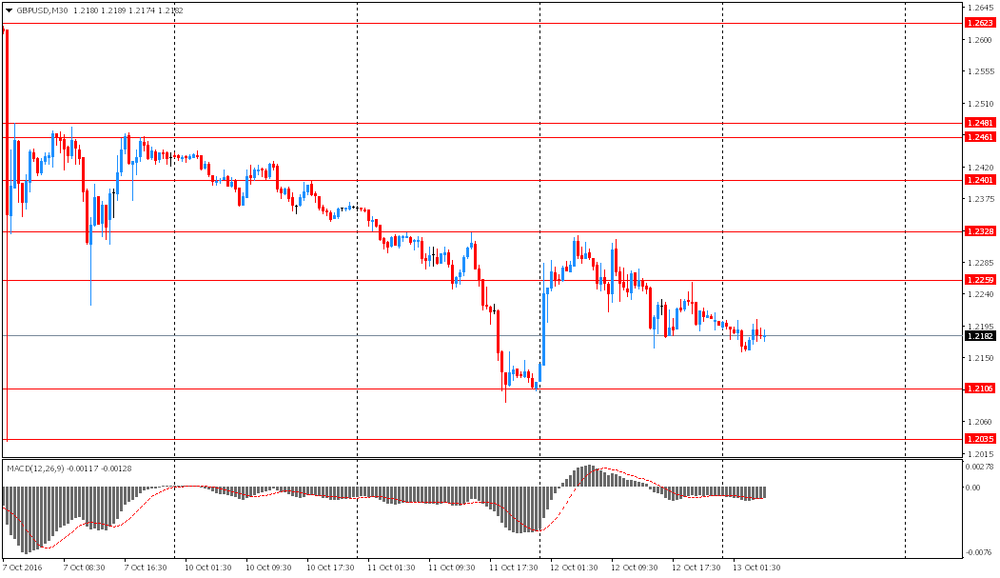

GBP / USD: during the European session, the pair rose to $ 1.2216

USD / JPY: during the European session, the pair fell to Y103.64

-

11:52

Orders

EUR/USD

Offers : 1.1025-30 1.1050 1.1070 1.1085 1.1100 1.1130 1.1150 1.1180 1.1200

Bids : 1.1000 1.0965 1.0950 1.0920 1.0900

GBP/USD

Offers : 1.2200 1.2220-25 1.2250-55 1.2285 1.2300 1.2325-30 1.2350 1.2380 1.2400 1.2430 1.2445-50 1.2480 1.2500

Bids : 1.2100 1.2085 1.2050 1.2000 1.1980 1.1945-50 1.1900

EUR/GBP

Offers : 0.9075-80 0.9100 0.9155 0.9200 0.9220 0.9250

Bids : 0.9030 0.9000 0.8985 0.8960-65 0.8900 0.8850-55 0.8835 0.8800-10

EUR/JPY

Offers : 114. 75-80 115.00 115.50 115.80 116.00 116.25-30 116.50 117.00

Bids : 114.20 114.00 113.70 113.50 113.00 112.60 112.00

USD/JPY

Offers : 104.00 104.20 104.30 104.45-50 104.80 105.00

Bids : 103.50 103.35 103.20 103.00 102.80-85 102.70 102.50

AUD/USD

Offers : 0.7550 0.7580 0.7600 0.7630 0.7650 0.7685 0.7700

Bids : 0.7500 0.7485 0.7450 0.7420-25 0.7400

-

11:43

Iran deploys two warships off the Yemen coast - Reuters

-

09:52

Mitsubishi UFJ about USD / JPY

According to analysts of the largest Japanese bank Tokyo-Mitsubishi UFJ, the further advance of USD / JPY upside is limited by Y105 resistance level. "The growth of the dollar certainly have a negative impact on US stocks because of lower corporate profits. It also hit oil prices and lead to a reluctance of market participants to risk "- Mitsubishi UFJ.

-

09:18

GBP: This Tactical GBP Rebound Is Tradable - Morgan Stanley

"After weeks of tough rhetoric pushing GBP into a trading environment closer to an EM than a DM environment, the government may aim to stabilise markets, with its rhetoric and suggestions now possibly shifting in tone. However, there is a fine line to walk as Theresa May's Conservative party wants a clean split from Europe. In addition, giving in too much, even before Article 50 negotiations have started, shifts the negotiation advantage towards the EU.

Hence, the GBP rebound should be limited and followed by another decline. Bear in mind, it is the supply side of the UK economy what matters and here we stay decisively bearish. Despite the more balanced tone coming out of Downing Street the future stance of the UK in its relation with its main export partner - the EU - remains highly uncertain, keeping the variance of anticipated investment returns wide. It will be this uncertainty undermining fixed asset investment, reducing the growth potential of the UK economy, which is not a good outcome for a country with a record 6% current account deficit.

Trading GBP Rebound: GBP is set for a short covering rally with the combination of bearish GBP positioning and signs of the government rethinking its hard Brexit lines triggering the rally.

This correction has upside potential to 1.2685 taking the current news flow into consideration. Should the British government take additional steps leaving markets with the impression that EU market access returns as one of the government's main objectives then GBPUSD has the potential of breaking 1.2685 targeting 1.3450".

Copyright © 2016 Morgan Stanley, eFXnews

-

08:38

Turkish Lira Hits Record Low Amid Political Worries

-

USD/TRY hit a record high of 3.1058 before the pair eased to 3.1023

-

-

07:22

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0850 (EUR 350m) 1.0900 (726m) 1.1000 (275m) 1.1030 (453m) 1.1140(352m) 1.1150 (569m) 1.1160 (279m) 1.1200 (549m) 1.1215 (328m) 1.1230 (248m)

USD/JPY: 101.00 (USD 1.17bln) 102.50 (457m) 103.00 (250m) 103.40-50 (604m) 104.10 (662m)

GBP/USD 1.2500 (GBP 212m)

USD/CHF 0.9715 (930m)

EUR/GBP 0.9000 (EUR 360m)

EUR/JPY 115.00 (EUR 864m)

USD/CAD: 1.3200 (USD 2.4bln) 1.3300.05 (420m) 1.3450 (250m)

NZD/USD 0.7150 (NZD 623m)

AUD/JPY 78.40 (AUD 324m)

-

07:20

Today’s events

-

At 19:15 GMT FOMC members Patrick T. Harker will deliver a speech

-

At 20:01 GMT the United States will hold an auction of 30-year bonds

-

At 21:00 GMT the US will publish a monthly report on budget execution

-

-

06:41

Sep FOMC Minutes: A Rate Hike In December 'Not A Done Deal By Any Means' - Barclays

"The minutes to the September FOMC meeting were largely in line with our expectation and, in our view, contained relatively little new information. We believe the main goals of the committee were to cite reasons for deferring action at the September meeting while continuing to signal that near-term action was likely. It did this through emphasizing disagreement over how much slack remained in labor markets while also emphasizing that the decision was a "close call" and noting that several members saw a rate hike "relatively soon" as appropriate.

Our base case remains for a December rate increase, but the FOMC minutes reveal widespread discord within the committee on a variety of issues.

These divisions, plus the tendency of the incoming data to be positive, but with blemishes, means a rate hike in December is not a done deal by any means.

FOMC participants saw the economic outlook as little changed at the September meeting and held favorable views about the pace of private consumption growth, labor market developments, and diminished external risks. In fact, a "substantial majority" of participants view near-term risks to the outlook as "roughly balanced". However, this was not enough to kick the committee into action as it did last December, given the disagreement over the amount of labor market slack. Several participants cited the rise in the participation rate and employment-to-population ratio as "welcome developments" and indicative of slack in labor markets. Others pointed to the slowdown in employment growth - which many expect to happen when the economy is operating at full employment - as evidence that slack had been removed. While we see little evidence that the rise in participation reflects entrants in the workforce - entrants into the workforce have actually declined in 2016 - some members of the committee see it differently.

Participants also disagreed about how much monetary policy should seek to allow the unemployment rate to undershoot the committee's estimates of its long-run value relative to what is presented in their modal forecasts. A "number" noted that some undershooting was appropriate, but there was disagreement over the benefits and costs of pushing this further. While several participants noted that this could ignite inflationary and stability concerns, others thought the historical experience was only of "limited applicability," given the low growth, low inflation environment".

Copyright © 2016 Barclays Capital, eFXnews™

-

06:38

Asian session review: USD/JPY significantly lower

The New Zealand dollar rose in the second half of the trading session on positive data on consumer confidence, house prices and state budget of New Zealand. Today, New Zealand's Finance Minister Bill English shown a substantial positive balance of the state budget for the fiscal year that ended on 30 June. The surplus of the state budget was 1.8 billion New Zealand dollars against 414 million New Zealand dollars in the previous fiscal year.

Data on consumer confidence have also been positive. The consumer confidence index calculated by ANZ-Roy Morgan, in October, rose to 122.9 from 121.0 in September and peaked from mid-2015.

The US dollar lost positions previously won against the yen dropping to intraday low of Y103,55 after rising to Y104,65. Yesterday USD / JPY rose in the anticipation of the September Fed meeting minutes. At the meeting, held on 20 and 21 September, the US Federal Reserve leaders laid the groundwork for a fairly early increase in interest rates. However, the views of Fed officials are divided on the timing of the next rate hike.

Some participants considered that it would be useful in the near future to increase the target range for interest rates on federal funds, if the situation on the labor market continues to improve, as economic activity strengthens. Others would wait for a more convincing evidence that inflation moves towards the target level of the Fed, which is 2%.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1000-35 range

GBP / USD: during the Asian session, the pair was trading in the $ 1.2155-00 range

USD / JPY: declined 100 pips to 103.52

-

06:32

Options levels on thursday, October 13, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1233 (3128)

$1.1167 (1288)

$1.1118 (574)

Price at time of writing this review: $1.1015

Support levels (open interest**, contracts):

$1.0974 (3976)

$1.0950 (4740)

$1.0922 (8024)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 34707 contracts, with the maximum number of contracts with strike price $1,1300 (3750);

- Overall open interest on the PUT options with the expiration date November, 4 is 44978 contracts, with the maximum number of contracts with strike price $1,1000 (8024);

- The ratio of PUT/CALL was 1.30 versus 1.32 from the previous trading day according to data from October, 12

GBP/USD

Resistance levels (open interest**, contracts)

$1.2408 (646)

$1.2312 (1012)

$1.2217 (307)

Price at time of writing this review: $1.2175

Support levels (open interest**, contracts):

$1.2088 (1451)

$1.1991 (419)

$1.1894 (372)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 27282 contracts, with the maximum number of contracts with strike price $1,2800 (2211);

- Overall open interest on the PUT options with the expiration date November, 4 is 27391 contracts, with the maximum number of contracts with strike price $1,2250 (1479);

- The ratio of PUT/CALL was 1.00 versus 1.01 from the previous trading day according to data from October, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:29

UK housing market: new buyer enquiries increased for the first time since February

The September 2016 RICS Residential Market Survey results show new buyer enquiries increased for the first time since February, albeit the pick-up was only modest. Alongside this, new instructions to sell slipped further, with the lack of supply firmly underpinning prices at the headline level. What's more, price expectations rose at the three and twelve month horizons, although both indicators remain softer when compared to the start of the year.

The national price indicator crept higher in the latest results, with a net balance of +17% of respondents noting an increase in prices (up from +13% in August). This measure has now risen in two consecutive reports having moderated for five months in a row between February and July. The regional breakdown shows prices continue to fall in Central London and the North East, although the pace of decline eased noticeably across the latter. Elsewhere, most other parts of the UK saw prices climb higher over the month.

-

06:25

Huge decline for Chinese trade balance in September. AUD lower

China's trade surplus in September was 278.35 billion yuan (41.99 billion dollars), lower than the previous value of 346 billion yuan (52.05 billion dollars), and economists forecast of 300 billion yuan.

The data on the trade balance published by the People's Bank of China reflects the difference between exports and imports of goods and services. A positive value shows trade surplus, a negative - deficit. This data can cause a spike in volatility of the yuan. As China's economy has a strong impact on the world's GDP, this indicator also has an impact on the Forex market.

China's imports in yuan, year on year, increased by 2.2%, but the growth was lower than the previous value of 10.8% and economists' expectations of 5.5% in September. The volume of exports in RMB decreased by -5.6%, year on year, after increasing by 5.9% a year earlier. Economists had forecast the growth rate at 2.5%

The total volume of Chinese imports in the period from January decreased by 1.9% yoy to September this year, after rising by 1.5% a year earlier. Total exports declined in September, year on year, at -10.0%, after declining 2.8% previously.

The report by the Customs General Administration of China said that China had continued to face relatively greater difficulties, however, leading indicators suggest that the pressure on the exports are likely to weaken in the fourth quarter. Also the office was confident that China will pursue a policy of stabilizing the growth of foreign trade.

-

06:20

Aussie Inflationary Expectations rose in October

The expected inflation rate (30-per-cent trimmed mean measure), reported in the Melbourne Institute Survey of Consumer Inflationary Expectations, rose by 0.4 percentage points to 3.7 per cent in October from 3.3 per cent in September.

In October, the weighted proportion of respondents (excluding the 'don't know' category) expecting the inflation rate to fall within the 0-5 per cent range fell by 0.6 percentage points to 68.6 per cent. This was influenced by a jump in the proportion of respondents clustered around an expecting inflation rate of up to 6 per cent. The weighted mean of responses in the 0-5 per cent rage increased to 2.4 per cent this month from 2.1 per cent in September.

-

06:18

Divisions have emerged within the Federal Reserve regarding the timing of interest rate hikes - Rttnews

Divisions have emerged within the Federal Reserve regarding the timing of interest rate hikes, according to the minutes of the September FOMC meeting.

Three dissenters were worried about credibility and likelihood of faster pace of interest rate hikes in future if no move made.

With unemployment near the Fed's target, 'several' voters thought interest rate hike needed 'relatively soon,' lest the Fed risk its credibility.

However, a few officials were worried interest rate hike might spark recession, while 'many' voters said pressure on inflation was nowhere to be seen.

Others were simply on the fence, saying a 'reasonable argument' could be made for either interest rate hike or holding steady in September.

Ultimately, the Fed voted 7-3 to maintain their benchmark feds funds rate of 0.25 percent.

Analysts say the Fed is unlikely to raise interest rates until December at the earliest, as the November presidential election presents some economic uncertainties.

-

06:15

Bank of Korea leaves rates unchanged at 1.25% as expected

-

06:14

Consumer prices in Germany were 0.7% higher in September

Consumer prices in Germany were 0.7% higher in September 2016 than in September 2015. The inflation rate - as measured by the consumer price index - thus has gradually increased in the second half of the year. In July and August 2016, it had been +0.4% each.

An inflation rate of +0.7% was last recorded in May 2015. Compared with August 2016, the consumer price index rose just slightly by 0.1% in September 2016. The Federal Statistical Office (Destatis) thus confirms its provisional overall results of 29 September 2016.

The development of energy prices (-3.6% on September 2015) had a downward effect on the overall rise in prices in September 2016, as had been the case in the preceding months. Compared with the previous two months, the decrease of energy prices slowed slightly year on year (July 2016: -7.0%, August 2016: -5.9%). In September 2016, the prices of both motor fuels (-3.5%) and household energy (-3.7%) for consumers were down on a year earlier.

Among the household energy products, the price decrease was largest for heating oil (-12.5%). Decreases were also recorded for charges for central and district heating (-8.1%), gas prices (-3.2%) and solid fuel prices (-0.8%). Only electricity prices rose on the same month a year earlier (+0.7%). Excluding energy prices, the inflation rate in September 2016 would have been +1.2%.

-

06:00

Germany: CPI, m/m, September 0.1% (forecast 0.1%)

-

06:00

Germany: CPI, y/y , September 0.7% (forecast 0.7%)

-

04:31

Japan: Tertiary Industry Index , August 0.0% (forecast -0.2%)

-

02:02

China: Trade Balance, bln, September 278.4 (forecast 300)

-

00:01

Australia: Consumer Inflation Expectation, October 3.7%

-