Market news

-

22:29

Stocks. Daily history for Oct 13’2016:

(index / closing price / change items /% change)

Nikkei 225 16,774.26 -65.74 -0.39%

Shanghai Composite 3,061.35 +2.85 +0.09%

S&P/ASX 200 5,435.54 -39.07 -0.71%

FTSE 100 6,977.74 -46.27 -0.66%

CAC 40 4,405.17 -47.07 -1.06%

Xetra DAX 10,414.07 -109.00 -1.04%

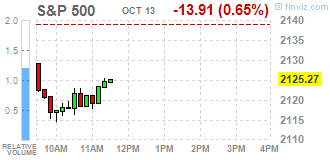

S&P 500 2,132.55 -6.63 -0.31%

Dow Jones Industrial Average 18,098.94 -45.26 -0.25%

S&P/TSX Composite 14,643.71 +24.74 +0.17%

-

20:08

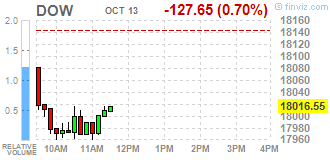

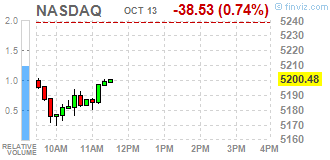

Major US stock indices closed in the red zone

Major US stock indexes fell slightly today, as an unexpected drop in China's exports in September at 10% increased concerns about the deterioration in the global economy, while the Federal Reserve is considering a rate hike.

The focus is also report of the Ministry of Labor, which showed that the number of Americans filing applications for unemployment benefits remained near 43-year low last week, pointing to sustained strength of the labor market, which could pave the way for an increase in interest rates The Fed in December. According to the data, initial applications for state unemployment benefits have not changed and amounted to a seasonally adjusted 246,000 for the week ending on 8 October. This is the lowest since November 1973. Applications for the previous week were revised to show 3,000 fewer applications received than previously reported. It was the 84th week in a row, when the primary circulation remained below the threshold of 300 000, which is associated with robust labor market conditions. This is the longest period since 1970.

In addition, the report published by the Ministry of Labour found that import prices in the US have shown modest growth in the month of September. The report said that import prices rose by 0.1% in September after falling 0.2% in August. A slight increase in import prices reflects the jump in prices for fuel imports, which rose to 1.1% in September after added 2.4% in August.

Most DOW components of the index closed in negative territory (21 of 30). Most remaining shares rose Merck & Co., Inc. (MRK, + 1.68%). Outsider were shares of Chevron Corporation (CVX, -1.30%).

Almost all sectors of the S & P index showed a drop. The leader turned utilities sector (+ 1.1%). conglomerates (-0.8%) sectors fell most.

At the close:

Dow -0.25% 18,099.35 -44.85

Nasdaq -0.49% 5,213.33 -25.69

S & P -0.31% 2,132.58 -6.60

-

19:00

DJIA -0.06% 18,132.63 -11.57 Nasdaq -0.26% 5,225.60 -13.42 S&P -0.10% 2,136.97 -2.21

-

16:00

European stocks closed: FTSE 100 -46.27 6977.74 -0.66% DAX -109.00 10414.07 -1.04% CAC 40 -47.07 4405.17 -1.06%

-

15:32

WSE: Session Results

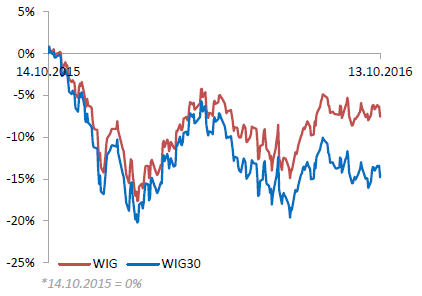

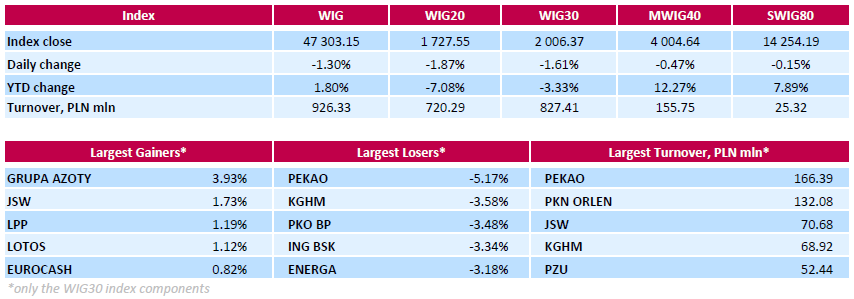

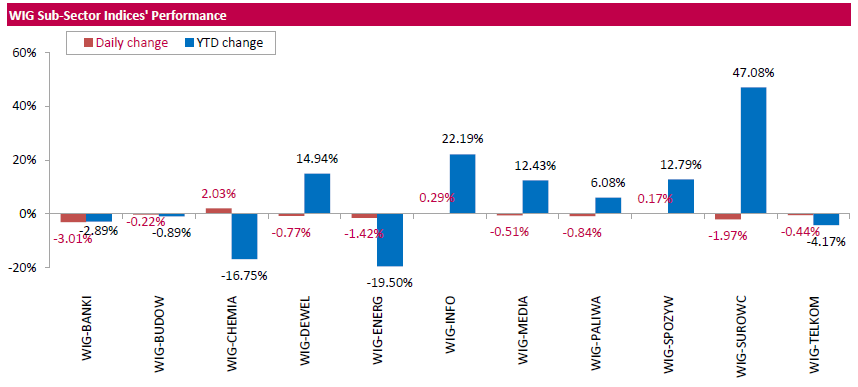

Polish equity market closed lower on Thursday with the broad market measure, the WIG Index, losing 1.3%. The WIG sub-sector indices were mainly lower with banking sector measure (-3.01%) underperforming.

Large-cap stocks' measure WIG30 declined by 1.61%. Nearly 2/3 of the 30 companies in the index basket retreated, and bank PEKAO (WSE: PEO) performed particularly poorly, tumbling 5.17%. Other major decliners were copper producer KGHM (WSE: KGH), genco ENERGA (WSE: ENG) and two banks PKO BP (WSE: PKO) and ING BSK (WSE: ING), falling by 3.18%-3.58%. On the contrary, chemical producer GRUPA AZOTY (WSE: ATT) became the session's biggest advancer with a 3.93% gain, followed by coking coal producer JSW (WSE: JSW), clothing retailer LPP (WSE: LPP) and oil refiner LOTOS (WSE: LTS), adding 1.73%, 1.19% and 1.12% respectively.

-

15:32

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell on Thursday. The number of Americans filing for unemployment benefits held at a 43-year low last week, pointing to sustained labor market strength that could pave the way for the Federal Reserve to raise interest rates in December. Initial claims for state unemployment benefits were unchanged at a seasonally adjusted 246,000 for the week ended Oct. 8, the lowest reading since November 1973, the Labor Department said. Claims for the prior week were revised to show 3,000 fewer applications received than previously reported.

Most of Dow stocks in negative area (28 of 30). Top gainer - Wal-Mart Stores Inc. (WMT, +1.38%). Top loser - Chevron Corporation (CVX, -2.29%).

Almost all S&P sectors in negative area. Top gainer - Utilities (+0.8%). Top loser - Basic Materials (-1.7%).

At the moment:

Dow 17914.00 -139.00 -0.77%

S&P 500 2117.25 -14.25 -0.67%

Nasdaq 100 4778.25 -35.25 -0.73%

Oil 49.81 -0.37 -0.74%

Gold 1259.00 +5.20 +0.41%

U.S. 10yr 1.74 -0.04

-

13:57

WSE: After start on Wall Street

The Americans began the trade on a clear negative territory, which in the first minutes of the regular session on Wall Street still growing. The situation may soon be even more nervous because the valuation of the S&P500 rapidly approaching the level of key support at a month ago minima. Any break of this support can have unpleasant consequences for the bulls. The market unrest IS similar to that of September, but the cause is somewhat different, Today is mainly about China.

Our market did not wait for what happens and enter into a deeper sell-off. We may see additional nervousness on KGHM values (decline in copper prices) and Pekao (WSE: PEO). We go, of course, to new session lows. An hour before the end of the session the WIG20 index was at 1,733 points (-1.53%).

-

13:31

U.S. Stocks open: Dow -0.54%, Nasdaq -0.75%, S&P -0.57%

-

13:17

Before the bell: S&P futures -0.72%, NASDAQ futures -0.72%

U.S. stock-index futures fell after an unexpected drop in Chinese exports (-10% y-o-y in September) revived concerns about the global economy as the Federal Reserve considers raising borrowing costs.

Global Stocks:

Nikkei 16,774.24 -65.76 -0.39%

Hang Seng 23,031.30 -375.75 -1.61%

Shanghai 3,061.35 +2.85 +0.09%

FTSE 6,945.99 -78.02 -1.11%

CAC 4,385.52 -66.72 -1.50%

DAX 10,383.41 -139.66 -1.33%

Crude $50.12 (-0.12%)

Gold $1258.30 (+0.36%)

-

12:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

26.6

-0.51(-1.8812%)

50318

ALTRIA GROUP INC.

MO

62.47

-0.07(-0.1119%)

56397

Amazon.com Inc., NASDAQ

AMZN

828.5

-5.59(-0.6702%)

20017

American Express Co

AXP

60.05

-0.64(-1.0545%)

694

AMERICAN INTERNATIONAL GROUP

AIG

59.8

-0.64(-1.0589%)

4000

Apple Inc.

AAPL

116.5

-0.84(-0.7159%)

197860

AT&T Inc

T

39.07

-0.26(-0.6611%)

810

Boeing Co

BA

132.25

-0.91(-0.6834%)

2047

Caterpillar Inc

CAT

86.5

-1.08(-1.2332%)

6443

Chevron Corp

CVX

101.47

-0.68(-0.6657%)

790

Cisco Systems Inc

CSCO

30.01

-0.33(-1.0877%)

6934

Citigroup Inc., NYSE

C

48.06

-0.64(-1.3142%)

31139

Deere & Company, NYSE

DE

86.04

-0.90(-1.0352%)

300

Exxon Mobil Corp

XOM

86.45

-0.68(-0.7804%)

7983

Facebook, Inc.

FB

128.15

-0.90(-0.6974%)

84457

FedEx Corporation, NYSE

FDX

172.68

-0.86(-0.4956%)

1350

Ford Motor Co.

F

11.89

-0.07(-0.5853%)

69313

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.6

-0.45(-4.4776%)

337936

General Electric Co

GE

28.77

-0.13(-0.4498%)

7425

General Motors Company, NYSE

GM

31.45

-0.23(-0.726%)

2664

Google Inc.

GOOG

783.35

-2.79(-0.3549%)

23911

Intel Corp

INTC

36.84

-0.29(-0.781%)

3867

International Business Machines Co...

IBM

153.16

-1.13(-0.7324%)

988

Johnson & Johnson

JNJ

117.38

-0.59(-0.5001%)

135398

JPMorgan Chase and Co

JPM

67.43

-0.70(-1.0274%)

40288

Merck & Co Inc

MRK

61.85

0.19(0.3081%)

10540

Microsoft Corp

MSFT

56.71

-0.40(-0.7004%)

340100

Nike

NKE

52

-0.44(-0.8391%)

1999

Pfizer Inc

PFE

32.57

-0.50(-1.5119%)

20293

Procter & Gamble Co

PG

88.1

-0.47(-0.5307%)

711

Starbucks Corporation, NASDAQ

SBUX

52.75

-0.41(-0.7713%)

1919

Tesla Motors, Inc., NASDAQ

TSLA

200.04

-1.47(-0.7295%)

5673

Twitter, Inc., NYSE

TWTR

17.85

-0.20(-1.108%)

136555

Verizon Communications Inc

VZ

50.29

-0.01(-0.0199%)

1333

Visa

V

81.55

-0.70(-0.8511%)

27610

Wal-Mart Stores Inc

WMT

67

-0.46(-0.6819%)

6209

Walt Disney Co

DIS

90.78

-0.63(-0.6892%)

12278

Yahoo! Inc., NASDAQ

YHOO

41.9

-0.46(-1.0859%)

6199

Yandex N.V., NASDAQ

YNDX

20.12

-0.04(-0.1984%)

1925

-

12:45

Upgrades and downgrades before the market open

Upgrades:

Merck (MRK) upgraded to Buy from Neutral at BofA/Merrill

Downgrades:

Pfizer (PFE) downgraded to Hold from Buy at Jefferies

Other:

Alcoa (AA) target raised to $30 from $10 at Cowen

-

11:10

WSE: Mid session comment

The first half of trading on the Warsaw market generated good turnover, however, the WIG20 index fell below yesterday's minimum. New lows do not look optimistic and point to the possibility of continuing the downward movement. Since the beginning of the session the main burden of the WIG20 remains Pekao (WSE: PEO), which course losing even 3.7 percent. The reason may be the end of the "lock-up" on the sale of shares of Pekao for Unicredit. In July, the Italian owner of the bank has sold 10 percent of shares and announced that he will not sell during the next 90 days.

To the group of the most losing companies - components of the WIG20 - joined the PGE, where supply again broke the round and the psychological level of PLN 10.

In Europe, we may observe considerable discounts, the German DAX lost about 1.2%. The main falling sectors are commodity companies, banks and automotive companies, the sectors particularly sensitive to the level of economic activity. Weak data from China intensified concerns about the condition of both the local and the global economy.

In the middle of trading the WIG20 index was at the level of 1,744 points (-0,92%), the turnover was amounted to PLN 305 million.

-

10:53

Major stock indices in Europe trading in the red zone

Stock indices in Western Europe are down due to a sudden fall of imports in China that had a negative impact on the shares of producers of raw materials.

The composite index of the largest companies in the region Stoxx Europe 600 fell 1% - to 3 months low - 335.18 points.

According to the Customs Administration of China, the export of goods and services in September fell by 5.6% on an annualized basis, while analysts had expected a growth rate of 2.5%. Imports grew by only 2.2% instead of the expected 5.5%. In particular, imports of refined copper into China fell last month for the sixth time in a row, to the lowest since February, 340 ths tons.

Shares of BHP Billiton fell today 4,2%, Rio Tinto - 4.5%.

In addition, negative factors for the European stock market are the fears for corporate profits in the 3rd quarter and expectations of a rate hike by the Federal Reserve in 2016.

As stated in the minutes of the September meeting of the Fed, many members of the FOMC considered reasonable rise in the key rate in the near future. Traders estimate the probability of a rate hike at the November meeting at 17%, and in December 68%.

Meanwhile, analysts predict a decrease in profits of companies included in the Stoxx 600 Index by 4.2% in the 3rd quarter.

Securities of the retailer Sports Direct fell 0.5% after the company's CFO Matt Pearson announced his resignation.

ProSieben Media capitalization increased by 1% due to the increase in the forecast of revenue for the years 2016 and 2018.

Booker Group Plc shares increased by 1.4% on a statement that the company will be able to achieve the planned revenue in the current year.

Shares of Siemens AG eased 1.5% after the German company announced a partnership with IBM.

Rolls-Royce shares rose 0.9% after the automaker announced Tuesday its intention to launch a new model in North America, the most notable feature of which is an artificial intelligence named Eleanor.

At the moment:

FTSE 6974.75 -49.26 -0.70%

DAX 10381.45 -141.62 -1.35%

CAC 4389.49 -62.75 -1.41%

-

07:47

Major stock markets trading lower: FTSE -0.5%, DAX -0.9%, CAC40 -0.7%, FTMIB -0.6%, IBEX -0.8%

-

07:17

WSE: After opening

WIG20 index opened at 1751.92 points (-0.48%)*

WIG 47765.20 -0.33%

WIG30 2028.46 -0.53%

mWIG40 4030.10 0.16%

*/ - change to previous close

In conditions of the global withdrawal our cash market started Thursday's session without going out of line, so right from the start we lose on the WIG20 index 0.5 percent. Down pulls us primarily Pekao (WSE: PEO), PKN Orlen, KGHM, mBank, PZU and BZ WBK. The only distinction is positive at this point LPP. The situation in the morning does not look so it's best, and so clear descent from the opening does not have to be forward-looking, as we had the opportunity several times to convince.

After fifteen minutes of the session the WIG20 index was at the level of 1,748 points (-0,67%).

-

06:42

Negative start of trading expected on the major stock exchanges in Europe: DAX futures -0.7%, CAC40 -0.7%, FTSE -0.4%

-

06:28

WSE: Before opening

Stock market indices in the United States on Wednesday recorded little change. The highlight of the day was the publication of the minutes of the September Fed meeting, at which a number of participants said that a rate hike "was close." All this shows that the December deadline is very likely to move on the side of the cost of money, that not much worse the sentiment, but it certainly does not work on its improvement.

Dow Jones Industrial at the end of the day gained 0.09 percent, the S&P500 rose by 0.11 per cent and the Nasdaq Composite lost 0.15 percent. Increases in the United States led the real estate sector and utilities, and declines - oil companies and health care. Among the currencies appreciating US dollar, decreased crude oil prices.

In the morning the contracts for US indices loses 0.4%, discounts can also be observed in Asian markets. Thus, the beginning of the session in Europe may be uncertain, however the last time the Old Continent is doing better than Wall Street.

-

05:06

Global Stocks

Stocks in Europe ended lower Wednesday, with technology shares hard hit after Ericsson AB tumbled in the wake of a profit warning, while energy stocks followed a selloff in oil prices.

U.S. stocks finished mostly higher Wednesday after minutes from the Federal Reserve's September policy meeting showed support for a rate rise relatively soon but implied a go-slow approach.

Asian stocks stumbled to three-week lows and U.S. stock futures and Treasury yields fell after China's September trade data showed a sharp decline in exports, raising fresh concerns about the health of the world's second biggest economy. Risky assets have had a torrid start to the final quarter of 2016 after recent outperformance as concerns around the outcome of U.S. elections, fallout from a "hard Brexit" and a struggling German banking sector spread turmoil in markets.

-