Market news

-

20:09

Major US stock indexes finished trading with an increase

Major US stock indexes rose on Friday as Citigroup Inc. quarterly results (C) and JPMorgan Chase & Co. (JPM) strengthened optimism about corporate earnings season. Furthermore, as the US Census Bureau reported that the preliminary estimates of retail sales and food service in the US in September, adjusted for seasonal variations and trading-day differences amounted to $ 459.8 billion, increased by 0.6% compared with the previous month and It was 2.7% higher than in September 2015. However, as shown by the preliminary results of the studies submitted by Thomson-Reuters and Institute of Michigan, in October, the US consumers feel more pessimistic about the economy than last month. According to reports, in October consumer sentiment index fell to 87.9 points versus 91.2 points last month. It was predicted that the index was 91.9 points. It should also be noted that inventories in the US rose in August, due to a large increase in stocks in the retail trade than previously thought, supporting the view that the investment in inventories will contribute to economic growth in the third quarter. The Commerce Department reported that inventories rose 0.2% after no change in July.

Most DOW components of the index closed in positive territory (22 of 30). More rest up shares The Goldman Sachs Group, Inc. (GS, + 2.10%). Outsider were shares of McDonald's Corp. (MCD, -0.94%).

Almost all sectors of the S & P showed an increase. The leader turned out to be the financial sector (+ 0.6%). the health sector fell the most (-0.6%).

-

19:00

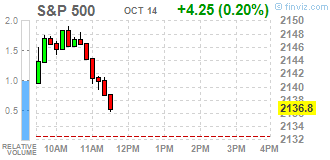

DJIA +0.37% 18,166.05 +67.11 Nasdaq +0.07% 5,217.04 +3.71 S&P +0.16% 2,135.87 +3.32

-

16:00

European stocks closed: FTSE 100 +35.81 7013.55 +0.51% DAX +166.31 10580.38 +1.60% CAC 40 +65.75 4470.92 +1.49%

-

15:37

Wall Street. Major U.S. stock-indexes slightly rose

ajor U.S. stock-indexes rose as results from Citigroup Inc. (C) and JPMorgan Chase & Co. (JPM) bolstered optimism over corporate earnings, while data indicated growth is expanding enough to handle higher borrowing costs.

Most of Dow stocks in positive area (27 of 30). Top gainer - The Goldman Sachs Group, Inc. (GS, +1.87%). Top loser - McDonald's Corp. (MCD, -0.71%).

Almost all S&P sectors in positive area. Top gainer - Technology (+0.7%). Top loser - Healthcare (-0.1%).

At the moment:

Dow 18127.00 +106.00 +0.59%

S&P 500 2135.25 +9.00 +0.42%

Nasdaq 100 4827.50 +31.50 +0.66%

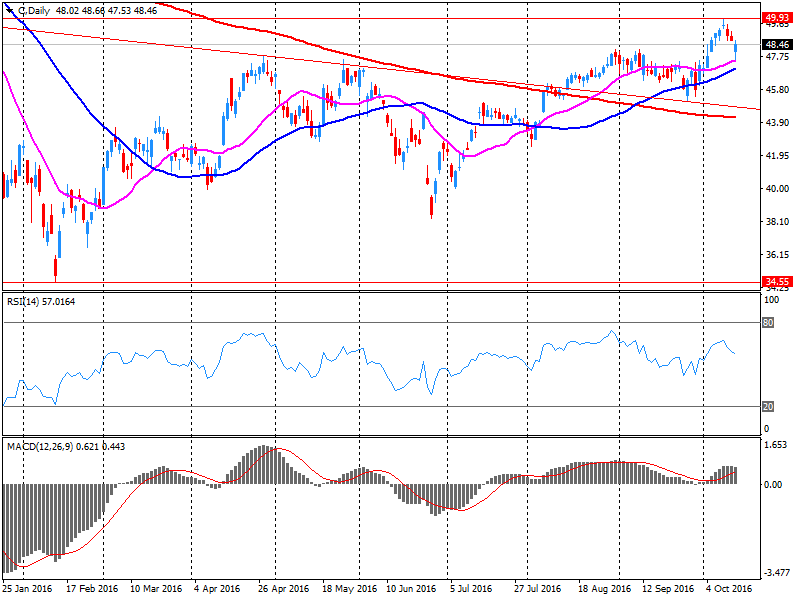

Oil 50.17 -0.27 -0.54%

Gold 1253.40 -4.20 -0.33%

U.S. 10yr 1.77 +0.03

-

15:31

WSE: Session Results

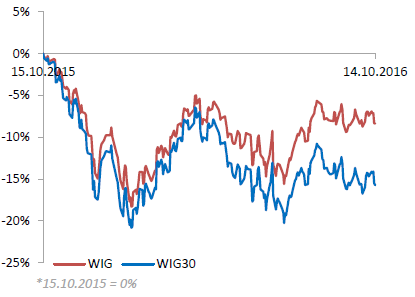

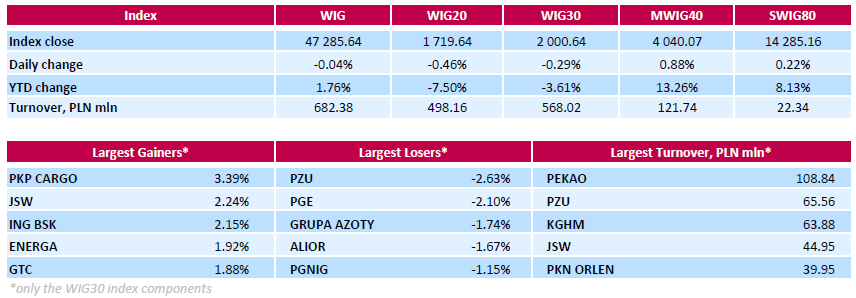

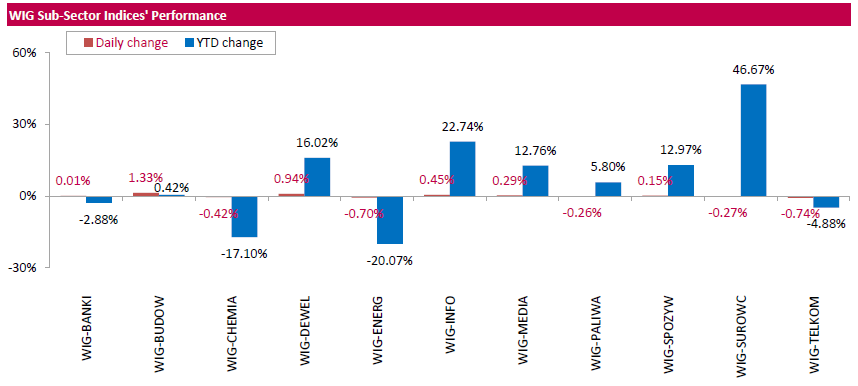

Polish equity market closed flat on Friday. The broad market benchmark, the WIG Index, edged down 0.04%. Within the WIG index performance was mixed, with construction (+1.33%) outperforming and telecoms (-0.74%) lagging.

The large-cap stocks' measure, the WIG30 Index, fell by 0.29%. The decliners were led by insurer PZU (WSE: PZU) and genco PGE (WSE: PGE), which fell by 2.63% and 2.1% respectively. They were followed by chemical producer GRUPA AZOTY (WSE: ATT) and bank ALOR (WSE: ALR), which plunged by 1.74% and 1.67% respectively. On the other side of the ledger, railway freight transport operator PKP CARGO (WSE: PKP) became the best-performing stock, rebounding by 3.39% after two consecutive sessions of declines. Other major gainers were coking coal producer JSW (WSE: JSW), bank ING BSK (WSE: ING) and genco ENERGA (WSE: ENG), advancing 2.24%, 2.15% and 1.92% respectively.

-

13:34

U.S. Stocks open: Dow +0.77%, Nasdaq +0.64%, S&P +0.60%

-

13:29

Before the bell: S&P futures +0.49%, NASDAQ futures +0.44%

U.S. stock-index futures rose as profits at JPMorgan Chase (JPM) and Citigroup (C) exceeded estimates, and data on Chinese inflation countered worries yesterday over an unexpected drop in exports.

Global Stocks:

Nikkei 16,856.37 +82.13 +0.49%

Hang Seng 23,233.31 +202.01 +0.88%

Shanghai 3,063.73 +2.39 +0.08%

FTSE 7,041.57 +63.83 +0.91%

CAC 4,485.65 +80.48 +1.83%

DAX 10,579.49 +165.42 +1.59%

Crude $50.83 (+0.77%)

Gold $1253.70 (-0.31%)

-

12:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

27

0.25(0.9346%)

12645

Amazon.com Inc., NASDAQ

AMZN

834.5

5.22(0.6295%)

16952

Apple Inc.

AAPL

117.81

0.83(0.7095%)

206588

AT&T Inc

T

39.48

0.11(0.2794%)

7038

Barrick Gold Corporation, NYSE

ABX

15.8

-0.20(-1.25%)

68529

Caterpillar Inc

CAT

87.89

0.92(1.0578%)

1500

Chevron Corp

CVX

101.65

0.86(0.8533%)

3285

Cisco Systems Inc

CSCO

30.47

0.30(0.9944%)

570

Citigroup Inc., NYSE

C

49.35

0.88(1.8156%)

388972

Exxon Mobil Corp

XOM

86.95

0.39(0.4506%)

3952

Facebook, Inc.

FB

128.39

0.57(0.4459%)

45519

Ford Motor Co.

F

11.96

0.05(0.4198%)

30892

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.74

0.10(1.0373%)

46585

General Electric Co

GE

28.91

0.14(0.4866%)

5575

General Motors Company, NYSE

GM

31.68

0.17(0.5395%)

447

Goldman Sachs

GS

170

2.58(1.541%)

29860

Google Inc.

GOOG

781

2.81(0.3611%)

1911

Hewlett-Packard Co.

HPQ

14.88

-0.27(-1.7822%)

2247

Home Depot Inc

HD

126.8

0.51(0.4038%)

8044

HONEYWELL INTERNATIONAL INC.

HON

110.33

2.07(1.9121%)

1901

Intel Corp

INTC

37.15

0.18(0.4869%)

6150

International Business Machines Co...

IBM

153.94

0.22(0.1431%)

300

JPMorgan Chase and Co

JPM

68.87

1.13(1.6681%)

473838

McDonald's Corp

MCD

114.7

-0.71(-0.6152%)

3706

Merck & Co Inc

MRK

63.49

0.98(1.5678%)

319

Microsoft Corp

MSFT

57.2

0.28(0.4919%)

3120

Nike

NKE

52.39

0.36(0.6919%)

1645

Pfizer Inc

PFE

32.85

0.09(0.2747%)

2919

Tesla Motors, Inc., NASDAQ

TSLA

201.2

0.96(0.4794%)

4220

The Coca-Cola Co

KO

41.87

0.11(0.2634%)

620

Twitter, Inc., NYSE

TWTR

18.11

0.32(1.7988%)

425230

Visa

V

82.18

0.31(0.3786%)

435

Walt Disney Co

DIS

91.4

0.28(0.3073%)

766

Yahoo! Inc., NASDAQ

YHOO

41.99

0.37(0.889%)

5572

Yandex N.V., NASDAQ

YNDX

19

-0.08(-0.4193%)

4150

-

12:49

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

HP (HPQ) target raised to $14 from $12 at Mizuho

Hewlett Packard Enterprise (HPE) initiated with a Underperform at CLSA; target $24

-

12:22

Company News: Citigroup (C) Q3 results beat analysts’ expectations

Citigroup reported Q3 FY 2016 earnings of $1.24 per share (versus $1.31 in Q3 FY 2015), beating analysts' consensus estimate of $1.16.

The company's quarterly revenues amounted to $17.800 bln (-4.8% y/y), beating analysts' consensus estimate of $17.316 bln.

C rose to $49.40 (+1.92%) in pre-market trading.

-

11:49

WSE: Mid session comment

During the first hours of trading on European exchanges the process of catching-up was conducted in a good style and the German DAX returned strongly above the level of 10,500 points gaining more than 1.5%. In the Warsaw market the first half of trading ends with extending the drift of the morning and the response of the largest companies on the upward pressure from the environment is very poor. Much better represent the average companies. The mWIG40 index grow by 1.1 percent and chasing too close to the 1.5 percent increase of the German DAX-a. We may still count on a greater response of the WIG20 index on what will happen in the world after reports of Citi, JP Morgan and Wells Fargo.

At the halfway point of the session the WIG20 index was at the level 1,730 points (+0,19%) and the turnover was amounted to PLN 235 million.

-

11:12

Major stock indices in Europe show a positive trend

European stocks rose as positive data on China's inflation, improved the mood, while markets focused on the upcoming US economic data and Yellen's. speech.

It was reported that producer prices (PPI Index) in China in September rose by 0.1% in annual terms. This is the first increase in 4.5 years - this indicator decreased 54 consecutive months.

Consumer prices (CPI Index) in China in the past month increased by 1.9% in annual terms, which was above the average forecast of Wall Street analysts, after increasing 1.3% in August.

Positive statistics eased fears over global economic growth after data released on Thursday showed that China's trade surplus narrowed to $ 41.99 billion in September from $ 52.05 billion in the previous month.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0,8% - to 338.18 points. Since the beginning of the week the index is down 0.4%.

Dynamics of mining companies outperformed the market on upbeat economic data from China, the largest consumer of metals in the world with the world's second largest economy.

Shares of BHP Billiton rose 2,3%, Rio Tinto - by 2.9%.

Shares of Anglo American rose in price by 2.1% on rumors that Apollo Global Management Fund and Xcoal Energy & Resources intend to acquire the company's coal assets in Australia.

Man Group jumped 12.7%. The company reported an increase in assets under management by 6% in the last quarter, and announced its intention to acquire Aalto Invest Holding AG competitor.

Shares of German chemical company BASF SE rose 1.2%, supported by the quarterly income statement that beat forecasts.

At the moment:

FTSE 7034.76 57.02 0.82%

DAX 10585.37 171.30 1.64%

CAC 4487.75 82.58 1.87%

-

11:05

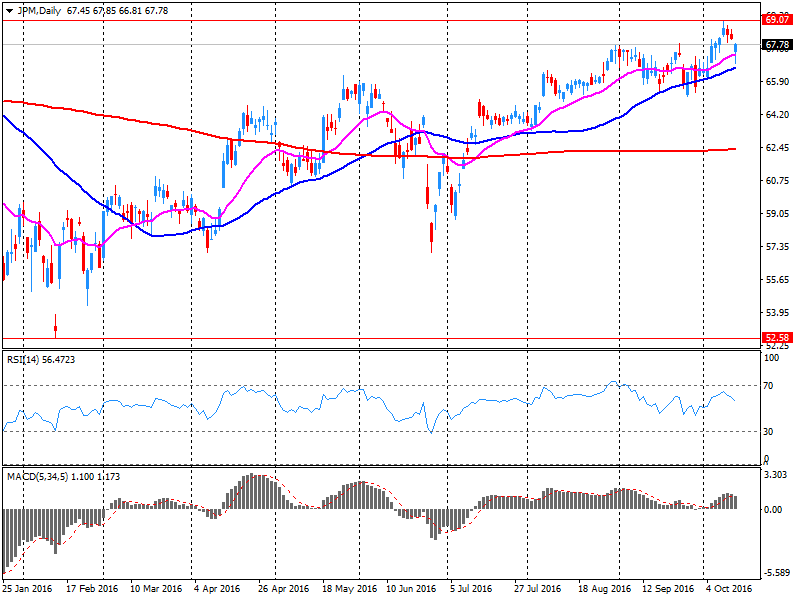

Company News: JPMorgan Chase (JPM) Q3 results beat analysts’ expectations

JPMorgan Chase reported Q3 FY 2016 earnings of $1.58 per share (versus $1.37 in Q3 FY 2015), beating analysts' consensus estimate of $1.39.

The company's quarterly revenues amounted to $24.673 bln (+8.3% y/y), beating analysts' consensus estimate of $23.687 bln.

JPM rose to $68.97 (+1.82%) in pre-market trading.

-

07:16

WSE: After opening

WIG20 index opened at 1732.81 points (+0.30%)

WIG 47459.60 0.33%

WIG30 2013.79 0.37%

mWIG40 4016.71 0.30%

*/ - change to previous close

The morning trading of futures contracts on European indices signaled that the better-than-expected end of US session will translate into improvement of atmosphere in the region. The futures market in Warsaw started the day in positive territory (+0.2 percent).

Start of the cash market in Warsaw allows a slight reflection on the WIG20 index and it already looks slightly better than the initial atmosphere of contracts. Primarily reflects KGHM plunged yesterday by falling copper prices. Also PZU and PKO contribute to above-average growth.

After fifteen minutes of trading the WIG20 index reached the level of 1,734 points (+ 0.38%).

-

06:26

WSE: Before opening

Thursday's trading in the US started with a clear declines, which then largely have been limited. Shares were down in response to signals of a possible rise in the cost of money in the US later this year, coming from the minutes of the September meeting of the Federal Reserve. Dow Jones Industrial at the end of the day lost 0.25 percent, the S&P500 fell by 0.31 percent and the Nasdaq Comp. went down by 0.49 percent.

In the afternoon fell crude oil prices. The weekly increase in crude oil inventories in the US was higher than consensus. Inventories rose by 4.85 million barrels, while Bloomberg estimates pointed to an increase of 2 million barrels. In response to the data price per barrel of WTI fell below $ 50 and Brent to around $ 51. But then the price of oil began to rise again.

In the morning the contract for the DAX is higher than the close of the session by the base index and maintain this atmosphere to the opening should give a positive start in the German market and Europe.

Another hours should bring another dose of focus on Wall Street, where it will flow portion of macro data and the results of the three major banks - Citigroup, JPMorgan Chase, Wells Fargo - which readings will dominate early afternoon in Europe and morning in the US.

A lot of confusion around the Chinese economy cast a shadow over emerging markets. Therefore, we must bear in mind the sensitivity of the Warsaw Stock Exchange on the pressure from the core markets. In addition, it must be remembered that the period of publication of quarterly results in core markets may result with technical noise in Warsaw.

-

05:04

Global Stocks

European stocks veered sharply lower Thursday, the selloff sparked after Chinese economic data highlighted worries about slowing growth in the world's second-largest economy. Equities were mired in red after data showed Chinese exports fell by a more-than-expected 10% in September. Also, imports declined by more than anticipated, by 1.9%. China is major buyer of industrial and precious metals.

U.S. stocks finished in the red Thursday as investors grew jittery following the Federal Reserve's latest meeting minutes as well as weak Chinese economic reports. But the market closed off intraday lows. The market is "missing the catalyst to push stocks higher," said Lance Roberts, chief investment strategist at Clarity Financial LLC, who noted that after a "fantastic run" in the market, the economy has started to lose steam while an earnings recovery is uncertain.

Asian stocks fluctuated after Chinese inflation beat expectations, boosting optimism about the strength of the world's second-largest economy, while Japanese shares dropped. Equities in Thailand rose on prospects for a smooth transition following the death of King Bhumibol Adulyadej.

-