Market news

-

23:28

Currencies. Daily history for Nov 21’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0629 +0,38%

GBP/USD $1,2488 +1,08%

USD/CHF Chf1,0086 -0,13%

USD/JPY Y110,81 0,00%

EUR/JPY Y117,78 +0,37%

GBP/JPY Y138,42 +1,11%

AUD/USD $0,7336 +0,01%

NZD/USD $0,7065 +0,72%

USD/CAD C$1,3416 -0,68%

-

23:00

Schedule for today,Tuesday, Nov 22’2016

07:00 Switzerland Trade Balance October 4.37

09:30 United Kingdom PSNB, bln October -10.12

11:00 United Kingdom CBI industrial order books balance November -17 -8

13:30 Canada Retail Sales, m/m September -0.1% 0.6%

13:30 Canada Retail Sales YoY September 1.6%

13:30 Canada Retail Sales ex Autos, m/m September 0.0%

15:00 Eurozone Consumer Confidence (Preliminary) November -8 -7.8

15:00 U.S. Richmond Fed Manufacturing Index November -4

15:00 U.S. Existing Home Sales October 5.47 5.42

21:45 New Zealand Retail Sales, q/q Quarter III 2.3%

21:45 New Zealand Retail Sales YoY Quarter III 6%

21:45 New Zealand PPI Input (QoQ) Quarter III 0.9%

21:45 New Zealand PPI Output (QoQ) Quarter III 0.2%

-

15:49

Aussie leading index up 0.5% in September

The Conference Board Leading Economic Index®(LEI) for Australia increased 0.5 percent in September 2016 to 104.5 (2010=100) and the Conference Board Coincident Economic Index®(CEI) increased 0.1 percent in September 2016 to 110.9 (2010=100). This index is designed to predict the direction of the economy, but it tends to have a muted impact because most of the indicators used in the calculation are released previously.

-

15:30

Australia: Conference Board Australia Leading Index, September 0.5%

-

15:21

OECD GDP doubled in the 3rd quarter

Real gross domestic product of the Member States of the Organization for Economic Cooperation and Development has grown significantly in the third quarter, data showed today.

GDP growth accelerated to to 0.6 percent from 0.3 percent in the second quarter. Growth accelerated in most major economies of the group of seven, with the exception of the UK and Germany, where growth slowed in the third quarter.

In the United States the growth improved to 0.7 percent compared with 0.4 percent in the previous quarter.

The growth also improved in Japan to 0.5 percent from 0.2 percent, and in France and Italy 0.3 percent and 0.2 percent, respectively. In the eurozone, growth was steady at 0.3 percent.

In annual terms, GDP growth of OECD countries was 1.7 percent, little changed compared with the previous quarter at 1.6 per cent.

-

13:57

Important bids on GBP/USD as the pair recovers friday’s losses. Clear accumulation on H4

-

13:52

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0625-30 (EUR 426m) 1.0675 (388m) 1.0700 (1.08bln) 1.0775 (201m)

USD/JPY 109.00 (USD 1.0bln) 109.10 (550m) 110.00 (795m)

GBP/USD 1.2500 (286m)

EUR/GBP 0.8800 (EUR 200m)

USD/CAD 1.3500 (USD 277m) 1.3580 (200m)

NZD/USD 0.6900 (301m) 0.7120 (202m)

EUR/SEK 9.8500 (EUR 469m)

-

13:47

Fischer: FOMC Will Stay Focused on Inflation Issue

-

Will Take Expected Inflation Into Account Partly Because It Has Impact on Actual Inflation

-

No Central Banker Would Ever Say They Don't Worry About Risks Like Inflation

-

Haven't Heard Anything That Suggests We Ought to Change Fed's Balance Sheet

-

Fed Has Well-Defined Task, Continues to Operate Independent of Political Cycle

-

Fed's Independence Extremely Important When Politics Is Disturbed

-

If We Don't Fix Wall Street, Unclear if We Will Have Solved 'Too Big to Fail' Problem

-

Crisis Caused by 'Bad Behavior, Bad Strategy' in Financial Sector

-

Without Fed, 2008 Crisis 'Could Have Been Very Much Worse'

-

-

13:45

Canadian Wholesale Sales decreased in September

Wholesale sales decreased 1.2% to $56.0 billion in September, following increases in four of the previous five months. Declines were recorded in five subsectors, led by lower sales in the machinery, equipment and supplies and the miscellaneous subsectors.

In volume terms, wholesale sales decreased 1.5% in September.

Sales decreased in five of seven subsectors in September, accounting for 65% of total wholesale sales.

The machinery, equipment and supplies subsector recorded the largest decline in dollar terms in September, down 4.0% to $10.9 billion, its lowest level since April 2016. In September, three out of four industries posted declines, led by the other machinery, equipment and supplies (-7.8%) and the computer and communications equipment and supplies (-4.6%) industries.

Sales in the miscellaneous subsector declined 3.1% to $7.0 billion, following a 4.6% increase in August. While four of five industries reported declines, a 8.0% decrease in the agricultural supplies industry contributed the most to the downturn in September.

-

13:30

Canada: Wholesale Sales, m/m, September -1.2% (forecast 0.4%)

-

12:49

Orders

EUR/USD

Offers : 1.0645-50 1.0665 1.0685 1.0700 1.0730 1.0750-60 1.0780 1.0800 1.0825-30 1.0850

Bids : 1.0620 1.0600 1.0575-80 1.0550 1.0535 1.0520 1.0500 1.0480 1.0450

GBP/USD

Offers : 1.2365 1.2385 1.2400 1.2425-30 1.2445-50 1.2485 1.2500-05

Bids : 1.2315-20 1.2300 1.2285 1.2270 1.2250-55 1.2220 1.2200

EUR/GBP

Offers : 0.8625-30 0.8660 0.8680-85 0.8700

Bids : 0.8575-80 0.8550 0.8525-30 0.8500 0.8480 0.8455-60

EUR/JPY

Offers : 118.00 118.45-50 119.00 119.50 120.00

Bids : 117.60 117.30 117.00 116.80 116.50 116.25-30 116.00

USD/JPY

Offers : 111.20 111.35 111.50 111.85 112.00 112.20 112.50

Bids : 110.80-85 110.60 110.50 110.20 110.00 109.80 109.50 109.30 109.00

AUD/USD

Offers : 0.7350 0.7380 0.7400 0.7420 0.7445-50 0.7480 0.7500-05

Bids : 0.7300 0.7285 0.7250 0.7220 0.7200

-

10:21

UK PM, May determined to deliver change demanded in EU referendum

-

EU negotiations cannot be done quickly

-

Business must commit to investing in Britain for the long term

-

Autumn statement will be ambitious for business and ambitious for Britain

-

Chancellor will commit to providing a strong and stable foundation for our economy

-

Brexit offers an opportunity to get dynamic trading agreements

-

Needs to take the time to get our Brexit negotiating position clear

*forexlive

-

-

10:21

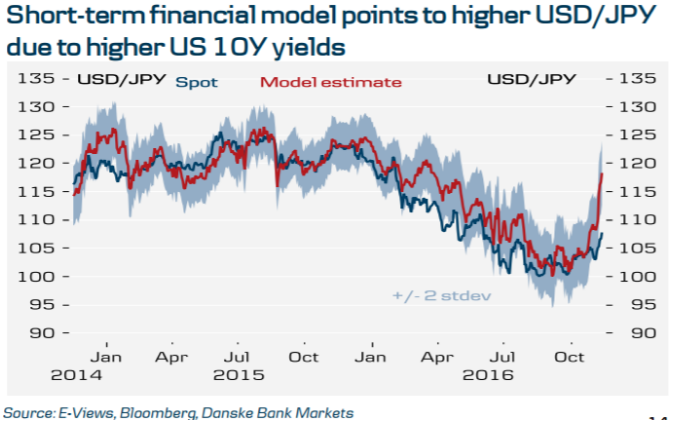

USD/JPY fair value at 115.50 due to US 10’s - Danske

"The election of Donald Trump as the next US President has prompted a significant increase in US inflation expectations and base metal prices driven by expectations of a significant boost to public spending, including a large infrastructure spending programme.

The US yield curve has steepened significantly as higher inflation expectations have driven an increase in yields on longer dated US government bonds. USD/JPY has historically been highly correlated with yields on 10Y US Treasuries as a widening of the rate spread tends to support portfolio investments flows out of Japan and into the US.

Our short-term financial model currently implies a fair value estimate of USD/JPY at 115.50 based primarily on the recent increase in the 10Y US interest rate.

Moreover, USD/JPY carry has become increasingly negative with 3M FX forwards trading at the lowest level since 2008. This has made it more expensive for Japanese investors to hedge USD assets, which might eventually start to weigh on the JPY if Japanese investors lower USD hedge ratios as long USD/JPY becomes more attractive from a carry perspective.

Hence, if the US reflation theme continues to build a case for higher US interest rates, we see a case for further portfolio investment outflows out of Japan, which in a combination with higher FX hedging costs on USD assets is likely to weigh on JPY over the medium term.

Finally, we note that higher commodity prices, in particular higher oil prices, will be a negative for the Japanese current account, which has improved substantially over the past couple of years due to the combination of previous weakening of the JPY and the oil price decline. A weakening of Japan's external balances implies less JPY appreciation pressure in the medium to long term".

Copyright © 2016 Danske, eFXnews™

-

10:04

The number of Eurozone banks directly supervised by ECB falls to 127

-

08:49

EUR/USD off Lows, Fed Speaker Comments Eyed

-

08:35

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0625-30 (EUR 426m) 1.0675 (388m) 1.0700 (1.08bln) 1.0775 (201m)

USD/JPY 109.00 (USD 1.0bln) 109.10 (550m) 110.00 (795m)

GBP/USD 1.2500 (286m)

EUR/GBP 0.8800 (EUR 200m)

USD/CAD 1.3500 (USD 277m) 1.3580 (200m)

NZD/USD 0.6900 (301m) 0.7120 (202m)

EUR/SEK 9.8500 (EUR 469m)

-

08:06

Today’s events

-

At 13:00 GMT the Federal Reserve Vice Chairman Stanley Fischer will deliver a speech

-

At 16:00 GMT the ECB board member Benoit Coeure will deliver a speech

-

At 16:30 GMT the ECB president Mario Draghi will deliver a speech

-

At 19:25 GMT Andy Haldane of the Bank of England will make a speech

-

-

07:32

Deutsche Bank says that everything align perfectly for EUR/USD short

"In the short-term there are some factors that should at least contain the rise in Treasury yields, including: i) limits to how steep the US yield curve will get before carry constrains the long-end backup in yields. Example: US T.Note 10s minus 2s rarely trade above 250bps for any length of time.

ii) care of a global negative output gap, the world likely still has a disinflationary bias, although protectionism is bound to challenge this; and, here is the big wildcard,

iii) Trump's election and Brexit have underscored the rise in global political risk. Most immediately pressing is the French Presidential election that has enormous ramifications for the EUR's future, and global risk. Ironically, this could still lead to a desperate flight to US (and Japan) quality.

One broad point about Trump's election, is there is scope for an over-reaction, but there is even more potential for a failure of the collective imagination to understand the forces unleashed.

In some markets the impact of a probable change in fiscal policy (bond bearish, risk appetite positive) and a shift in political risk (T.bond bullish, but risk negative) will be in conflict. One trade where the economic and political risks align perfectly, in our view, is the short EUR/USD currency trade.

Deutsche Bank maintains a short EUR/USD position from 1.0750".

Copyright © 2016 DB, eFXnews™

-

07:25

Broadbent Says BoE Can Tolerate High Inflation Than Larger Rise In Unemployment - rttnews

-

07:24

Japan’s Business activity index rose in September by 0.2%

According to data released today by the Ministry of Economy, Trade and Industry of Japan, the index of business activity in all sectors of the economy rose in September by 0.2% vs +0.1% expected. This is the fourth month in a row as the figure increases. Private industry index rose by 0.2% on a monthly basis, while economists had expected the index to remain unchanged in September.

The index which measures the volume of construction activity showed an increase of 2.0%. At the same time, sub-activity index fell by 0.1% in the services sector. On an annual basis, the index of business activity in the industry has grown at a slower pace, only 1.3% after rising 1.7% in the previous month.

-

07:21

Japan's trade surplus below forecast

The positive balance of Japan's foreign trade in October totaled Y496,2 billion, lower than the forecast of Y610 billion. The total trade balance, published by Japan's Ministry of Finance estimates the balance between imports and exports. A positive value represents a trade surplus while a negative - a trade deficit. Due to the high dependence on exports the Japanese economy is highly dependent on the trade surplus.

Also, Japan's Ministry of Finance reported that exports from Japan to Europe in October fell by -9.5% y / y and to US -11.2% y / y, while to China -9.2% y / y.

-

07:16

Trump to be held to his word on Fed independence: Bullard

-

06:06

Options levels on monday, November 21, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0851 (2933)

$1.0784 (910)

$1.0731 (522)

Price at time of writing this review: $1.0599

Support levels (open interest**, contracts):

$1.0480 (4182)

$1.0420 (6042)

$1.0386 (1847)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 73608 contracts, with the maximum number of contracts with strike price $1,1200 (6182);

- Overall open interest on the PUT options with the expiration date December, 9 is 66024 contracts, with the maximum number of contracts with strike price $1,0500 (6042);

- The ratio of PUT/CALL was 0.90 versus 0.87 from the previous trading day according to data from November, 18

GBP/USD

Resistance levels (open interest**, contracts)

$1.2604 (1572)

$1.2506 (1732)

$1.2410 (782)

Price at time of writing this review: $1.2337

Support levels (open interest**, contracts):

$1.2291 (3934)

$1.2194 (1277)

$1.2097 (1089)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 34924 contracts, with the maximum number of contracts with strike price $1,3400 (2612);

- Overall open interest on the PUT options with the expiration date December, 9 is 36654 contracts, with the maximum number of contracts with strike price $1,2300 (3934);

- The ratio of PUT/CALL was 1.05 versus 1.06 from the previous trading day according to data from November, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:46

Japan: All Industry Activity Index, m/m, September 0.2% (forecast 0.1%)

-