Market news

-

23:29

Stocks. Daily history for Nov 21’2016:

(index / closing price / change items /% change)

Nikkei 225 18,106.02 0.00 0.00%

Shanghai Composite 3,218.21 +25.35 +0.79%

S&P/ASX 200 5,364.00 +12.66 +0.24%

FTSE 100 6,777.96 +2.19 +0.03%

CAC 40 4,529.58 +25.23 +0.56%

Xetra DAX 10,685.13 +20.57 +0.19%

S&P 500 2,198.18 +16.28 +0.75%

Dow Jones Industrial Average 18,956.69 +88.76 +0.47%

S&P/TSX Composite 15,039.87 +175.84 +1.18%

-

21:06

Major US stock indexes finished trading growth

Major US stock indexes showed a moderate increase, as investors bet on Trump's policy, and expect that the market will be friendly. The dynamics of trading was also influenced by comments the vice-chairman of the US Federal Reserve Stanley Fischer and rising oil prices.

Mr. Fisher in his speech on Monday, said that some of the fiscal measures proposed by Trump, in particular those that improve productivity, can improve the capacity of the economy and help counter some of the long-term economic problems. However, as noted by the deputy chairman of the Fisher, there is not much room to increase the deficit without negative consequences in the future.

Oil prices rose by about 4 per cent, its highest level in three weeks, the reason for that was the weakening of the US dollar and investors' hopes to reach agreement by OPEC to reduce oil output in late November. In late September, at an informal meeting of OPEC in Algeria agreed production limit in the range of 32,5-33 mln. Barrels of oil per day, but on specific limits for each of the countries is no agreement.

Among the corporate nature of the message it is worth noting the news that on Friday, Facebook board (FB) approved the buyback of own shares of class A in the amount of up to $ 6 billion. According to the company, the repurchase program will enter into force in the first quarter of 2017 and will not be have a fixed expiration date. At the same time the company Citigroup (C) announced an increase in share repurchase program by $ 1.75 billion.

DOW index components closed mostly in positive territory (23 of 30). Most remaining shares grew E. I. du Pont de Nemours and Company (DD, + 1.74%). Outsider were shares of 3M Company (MMM, -0.93%).

All business sectors S & P index ended the day higher. The leader turned out to be the basic materials sector (+ 2.2%).

At the close:

Dow + 0.47% 18,956.62 +88.69

Nasdaq + 0.89% 5,368.86 +47.35

S & P + 0.75% 2,198.18 +16.28

-

20:00

DJIA +0.39% 18,942.24 +74.31 Nasdaq +0.77% 5,362.62 +41.11 S&P +0.63% 2,195.74 +13.84

-

17:00

European stocks closed: FTSE 100 +2.19 6777.96 +0.03% DAX +16.56 10681.12 +0.16% CAC 40 +23.61 4527.96 +0.52%

-

16:55

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes slightly rose as investors bet Donald Trump's policies would be market friendly. The Nasdaq hit a record intraday high on Monday, while the S&P and the Dow were within a hair's breadth of their all-time highs, helped by a jump in technology shares and as a surge in oil prices boosted energy stocks.

Oil prices jumped more 3,5% to a near three-week high on hopes that the OPEC would agree to an output cut next week and the dollar index first drop in 11 days.

Most of Dow stocks in positive area (22 of 30). Top gainer - Apple Inc. (AAPL, +1.62%). Top loser - 3M Company (MMM, -0.99%).

All S&P sectors in positive area. Top gainer - Basic Materials (+2.0%).

At the moment:

Dow 18886.00 +33.00 +0.18%

S&P 500 2190.50 +9.75 +0.45%

Nasdaq 100 4846.75 +38.25 +0.80%

Oil 48.04 +1.68 +3.62%

Gold 1210.90 +2.20 +0.18%

U.S. 10yr 2.33 +0.00

-

16:43

WSE: Session Results

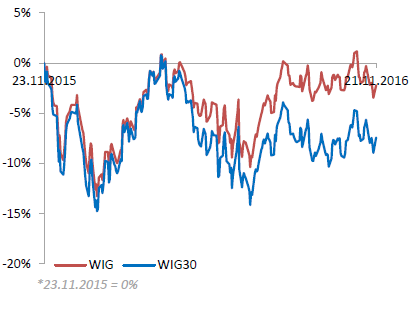

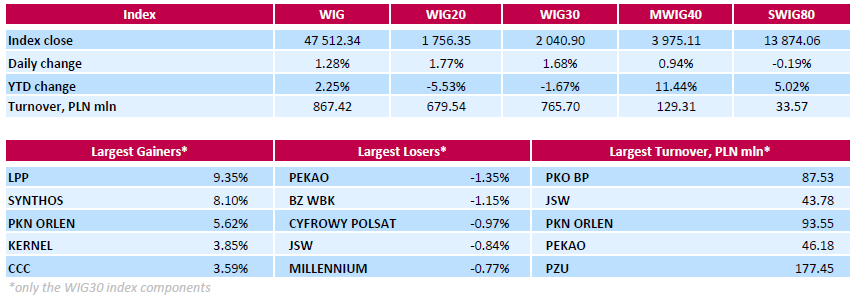

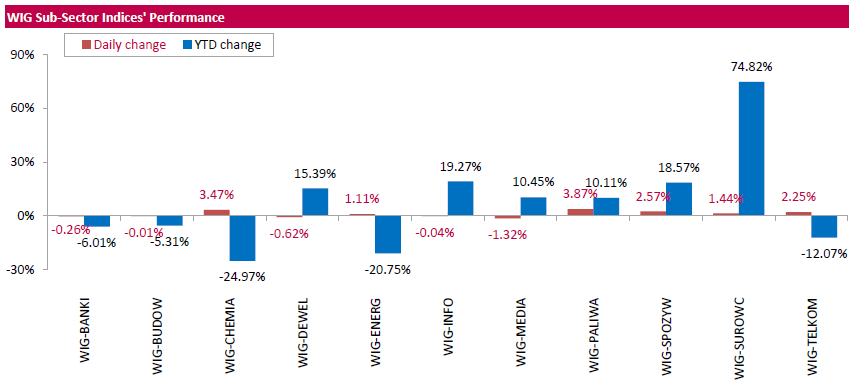

Polish equity market surged on Monday. The broad market measure, the WIG index, rose by 1.28%. Sector performance within the WIG Index was mixed. Oil and gas (+3.87%) fared the best, while media (-1.32%).fell the most.

The large-cap stocks' measure, the WIG30 Index, gained 1.68%. In the index basket, clothing retailer LPP (WSE: LPP) and chemical producer SYNTHOS (WSE: SNS) were the biggest advancers, climbing by 9.35% and 8.1% respectively. The latter was helped by the announcement the company's management decided to offer PLN 701.3 mln advance dividend from 2016 profit (or PLN 0.53 per share). Other noticeable risers were agricultural producer KERNEL (WSE: KER), footwear retailer CCC (WSE: CCC) and two oil refiners LOTOS (WSE: LTS) and PKN ORLEN (WSE: PKN), which added between 3.44% and 5.62%. On the other side of the ledger, banking names PEKAO (WSE: PEO) and BZ WBK (WSE: BZW) led the decliners, dropping by 1.35% and 1.15% respectively. They were followed by media group CYFROWY POLSAT (WSE: CPS), coking coal miner JSW (WSE: JSW) and bank MILLENNIUM (WSE: MIL), which dropped by 0.97%, 0.84% and 0.77% respectively.

-

14:52

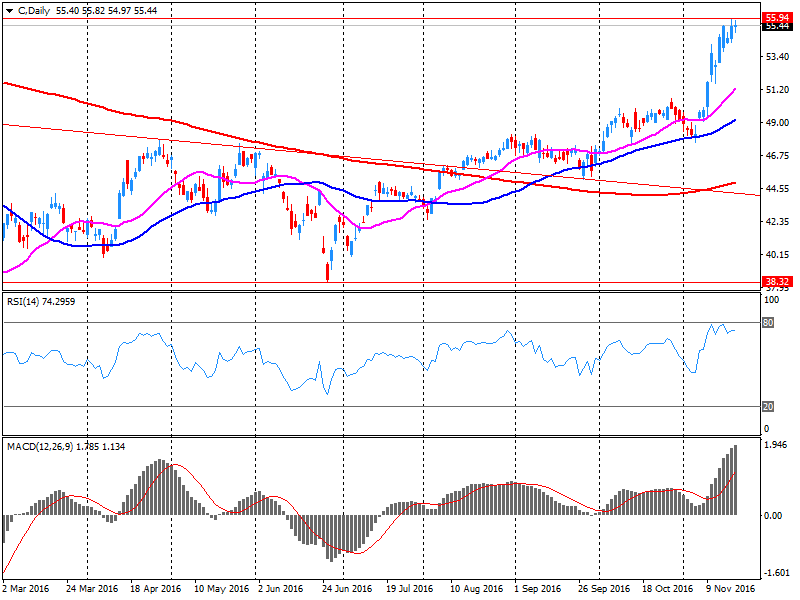

Company news: Citigroup (C) announced an increase of buyback program of $ 1.75 billion

Thus, the total amount of buybacks, taking into account those which the company announced earlier this year (including an increase in the quarterly dividend on Citi common stock to $ 0.16 / share and total share buyback program of up to $ 8.6 billion.) will total $ 10.4 bln to $ 12.2 billion.

Citi shares rose to a high of $ 55.90 (+ 0.79%).

-

14:51

WSE: After start on Wall Street

Published data from the national economy were not good. Virtually all surprised negatively, with the worst fall out of investments (the decrease in construction output by 20.1%). It did not help one working day less, but even after taking it into account the total production increased by 1.3% y/y. From the point of view of the Warsaw Stock Exchange, it is essential the poor performance of processing activities (down 0.5%). Better looks consumption but still disappointing. Moreover we may see rising of producer prices, which means the pressure on the profit margins of companies.

In general, the opening of the fourth quarter is weak. In the case of large companies (whose results are not so dependent on the domestic economy) it does not really matter, these data are more likely to affect the valuation of smaller companies. As we may see at the chart of the sWIG80, it stands out today with weakness and is close to the lows from Friday. There was also no correction on the Polish zloty, which may suggest a signal of changes in the quotations of our currency.

The American market began from a quite big increase. An hour before the close of trading in Warsaw, the WIG20 index was at the level of 1,753 points (+1,63%).

-

14:34

U.S. Stocks open: Dow +0.23%, Nasdaq +0.29%, S&P +0.39%

-

14:28

Before the bell: S&P futures +0.26%, NASDAQ futures +0.02%

U.S. stock-index futures gained, supported by higher oil prices and the lingering effects of the post-election rally.

Global Stocks:

Nikkei 18,106.02 +138.61 +0.77%

Hang Seng 22,357.78 +13.57 +0.06%

Shanghai 3,218.21 +25.35 +0.79%

FTSE 6,782.70 +6.93 +0.10%

CAC 4,527.42 +23.07 +0.51%

DAX 10,703.59 +39.03 +0.37%

Crude $46.92 (+2.69%)

Gold $1,213.60 (+0.41%)

-

13:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

170.9

-2.06(-1.191%)

4156

ALCOA INC.

AA

30.85

-1.00(-3.1397%)

8351

Amazon.com Inc., NASDAQ

AMZN

768

7.84(1.0314%)

25849

Apple Inc.

AAPL

110.5

0.44(0.3998%)

75154

AT&T Inc

T

37.66

0.25(0.6683%)

4546

Caterpillar Inc

CAT

92.7

0.36(0.3899%)

531

Chevron Corp

CVX

110.2

1.00(0.9157%)

7082

Cisco Systems Inc

CSCO

30.15

-0.03(-0.0994%)

7079

Citigroup Inc., NYSE

C

55.88

0.42(0.7573%)

48525

E. I. du Pont de Nemours and Co

DD

69

-0.17(-0.2458%)

1402

Exxon Mobil Corp

XOM

86.22

0.94(1.1023%)

12897

Facebook, Inc.

FB

118.39

1.37(1.1707%)

147893

Ford Motor Co.

F

11.81

0.05(0.4252%)

13145

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.22

0.49(3.5688%)

222797

General Electric Co

GE

30.72

0.05(0.163%)

2458

General Motors Company, NYSE

GM

33.05

0.05(0.1515%)

1047

Goldman Sachs

GS

210.9

0.55(0.2615%)

2167

Google Inc.

GOOG

763.7

3.16(0.4155%)

4673

Home Depot Inc

HD

128.88

0.55(0.4286%)

112

Intel Corp

INTC

35.1

0.15(0.4292%)

2863

International Business Machines Co...

IBM

160.3

-0.09(-0.0561%)

322

International Paper Company

IP

47.7

-0.75(-1.548%)

2910

Johnson & Johnson

JNJ

115.82

0.46(0.3988%)

1408

JPMorgan Chase and Co

JPM

78.08

0.37(0.4761%)

5690

McDonald's Corp

MCD

119.7

0.25(0.2093%)

1692

Microsoft Corp

MSFT

60.52

0.17(0.2817%)

4833

Pfizer Inc

PFE

31.6

0.12(0.3812%)

1235

Tesla Motors, Inc., NASDAQ

TSLA

186

0.98(0.5297%)

7695

The Coca-Cola Co

KO

41

-0.12(-0.2918%)

9585

Twitter, Inc., NYSE

TWTR

18.75

0.02(0.1068%)

21317

Verizon Communications Inc

VZ

48.01

-0.06(-0.1248%)

1565

Wal-Mart Stores Inc

WMT

68.7

0.16(0.2334%)

4133

Walt Disney Co

DIS

98.4

0.16(0.1629%)

4643

Yandex N.V., NASDAQ

YNDX

18.72

0.25(1.3535%)

1055

-

13:49

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

3M (MMM) downgraded to Sell from Neutral at Goldman

Other:

Starbucks (SBUX) initiated with a Neutral at Buckingham Research

McDonald's (MCD) removed from Analyst Focus List at JP Morgan

Freeport-McMoRan (FCX) target raised to $20 from $15 at Cowen

-

12:05

WSE: Mid session comment

The first half of today's trading brought significantly higher level of turnover as at the beginning of the week. Positively stand out today shares of KGHM and PZU. Generally, the Warsaw Stock Exchange presents a better attitude than the surroundings. In Western European markets declines from the second hour of trading have made up and the indices returned to light increases.

A big help for our market is some warming around emerging markets, a weaker dollar and stronger commodity prices. The WIG20 index has reached the new session highs and defeats peaks from Friday.

At the halfway point of today's trading, the WIG20 index was at the level of 1,746 points (+ 1.21%), the turnover in the segment of the largest companies was amounted to PLN 293 million.

-

11:38

Major stock indices in Europe trading in the green zone

Stock indices in Europe have showed gains on the background of mixed financial statements of some companies, and fears that the expectations after the US elections have been overly optimistic. At the same time the shares of mining companies continue to rise due to higher prices for oil and metals.

Today, investors expect comments from European Central Bank President Mario Draghi, after he confirmed last week that the bank is ready to implement new stimulus measures if necessary.

European stocks strengthened after ECB President Mario Draghi said on Friday that the central bank will continue to use all available tools.

Speaking at the 26th European Banking Congress in Frankfurt, Draghi added that the recovery of the eurozone economy is still largely based on the accommodative monetary policy.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0.03% to 339.49 points.

Essentra shares tumbled 19% after the deterioration of the annual profit and revenue.

The market value of Mitie Group Plc, providing cleaning services for offices, decreased by 14%, as the company forecast earnings below previous estimates and market expectations.

Meanwhile, the stock prices of mining corporations BHP Billiton, Rio Tinto and Glencore rose at least 1%. Randgold added 2.1%, Fresnillo +1,9%.

BP shares increased by 1%, Royal Dutch Shell 1,5%. Brent crude oil increased by 1.3%, to $ 45.91 per barrel.

At the moment:

FTSE 6802.06 26.29 0.39%

DAX 10689.52 24.96 0.23%

CAC 4523.99 19.64 0.44%

-

08:35

Major stock exchanges trading in the green zone: FTSE 100 6,798.56 22.79 0.34%, DAX 10,695.73 31.17 0.29%, CAC 40 4,524.04 19.69 0.44%

-

08:19

WSE: After opening

WIG20 index opened at 1731.39 points (+0.33%)*

WIG 47147.41 0.50%

WIG30 2019.12 0.60%

mWIG40 3955.02 0.43%

*/ - change to previous close

The futures market started the new week from increase of 0.7% (1,738 points). It's better preservation than in the environment, where the contract for the DAX grew by 0.3% at the opening.

In the cash market gain in the main part the shares of commodity companies or companies relying on rising prices of raw materials such as KGHM (which the rate increases by 3.5%, focusing on a main activity), JSW and Lotos. This good opening of today's trading moved away the vision of breaking the support, however does not mean a return to growth.

After fifteen minutes of trading the WIG20 index was at the level of 1,733 points (+0,44%).

-

07:28

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.1%, CAC 40 + 0.3%, FTSE + 0.1%

-

07:21

WSE: Before opening

We begin a new week, which in the case of the US market will be shortened due to Thursday's Thanksgiving Day. The mood in the morning rather not indicate any significant changes. Contracts in the US gain slightly after a slight decline in the S&P 500 on Friday. Quotations in Asia are mixed, but in China and Japan increases are observed. The dollar remains relatively strong, although we may see another attempt to its slight weakening. It is worth to pay attention to the row material market, where rising prices of copper and oil. Generally, from above mentioned factors comes out a pretty good situation for the Warsaw market.

During today's session we will be announced of important for the local market readings. These will be the data on industrial production and retail sales for October. The market expects a slowdown readings to 0.8% y/y (production) and 4.0% y/y (retail sales). However this will mainly be an impact of seasonal effects (a smaller number of working days). In the case of construction output is expected to remain negative trend (-16.3% y/y). These data will be very important, because the market can see the uncertainty as to the condition of the national economy.

The beginning of the new week in the currency market brings a little stronger PLN, but still on most lists Polish currency is the weakest for several months (except for the USD/PLN pair, where the zloty is the weakest since 2002). PLN is valued by the market as follows: PLN 4.1850 to the US dollar, PLN 4.4324 against the euro. Yields on Polish debt amounts to 3.66% for 10-year securities.

-