Market news

-

15:24

Gold price flat for the day and week

Quotes of gold rose sharply, completely leveling the day's fall and updating yesterday's high. The reason for this was a widespread weakening of the US currency, as well as the position adjustment ahead of the weekend. The up move than inverted.

The US Dollar Index, showing the US dollar against a basket of six major currencies, was trading lower by 0.20%. Since gold prices are tied to the dollar, a weaker dollar makes the precious metal cheaper for holders of foreign currencies.

USD falls despite strong economic data on US GDP. Experts point out that this report is made to take into account the imminent risks of a Fed hike, and the probability of inflation acceleration.

The cost of December futures for gold on COMEX rose to $ 1273.0 per ounce.

-

14:09

US Consumer Sentiment Index slipped in October to the same low recorded last September

Surveys of Consumers chief economist, Richard Curtin:

The Sentiment Index slipped in October to the same low recorded last September and to the lowest level since October 2014. The October decline was due to less favorable prospects for the national economy, with half of all consumers anticipating an economic downturn sometime in the next five years for the first time since October 2014. Objectively, the probability of a downturn during the next five years is far from zero-this would be the longest expansion in 150 years if it lasted just over half of the five year horizon. Nonetheless, the October rise may simply reflect a temporary bout of uncertainty caused by the election. Prospects for renewed spending gains will depend on continued growth in jobs and wages as well as low inflation and interest rates. The small rise in interest rates now expected in December will have a minimal impact on spending. Along with small increases in interest rates, consumers also anticipate a mild slowdown in job creation that is likely to prevent any further declines in the national unemployment rate. To be sure, these changes are all anticipated to be small during the year ahead. Overall, real personal consumption expenditures can be expected to increase by 2.5% through mid 2017.

-

14:00

U.S.: Reuters/Michigan Consumer Sentiment Index, October 87.2 (forecast 88.1)

-

13:44

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0800( EUR 1.58bln) 1.0870-85 (1.55bln) 1.0900 (685m) 1.0940 (401m) 1.0950 (879m) 1.1000 (657m) 1.1050 527m)

USD/JPY 104.00 (922m) 104.50 (641m) 104.75 (460m) 105.00 (1.22bln) 105.25 (870m) 106.00 400m)

GBP/USD 1.2700 ( GBP 867m)

USD/CHF 0.9900 (USD 225m) 1.0000 (265m)

AUD/USD 0.7500 ( AUD 345m) 0.7550-55 (445m) 0.7600 (484m) 0.7650 (380m) 0.7700(394m)

USD/CAD: 1.3105 (USD 314m) 1.3150 (233m) 1.3200(210m) 1.3300(1.92bln) 1.3350(232m) 1.3450 (422m)

NZD/USD 0.7140 (NZD 399m) 0.7150 331m) 0.7200 (300m)

EUR/NOK 8.9300 (EUR 430m)

AUD/NZD 1.0660 (AUD 240m)

-

12:43

US employment cost index in line with expectations

Compensation costs for civilian workers increased 0.6 percent, seasonally adjusted, for the 3-month period ending in September 2016, the U.S. Bureau of Labor Statistics reported today. Wages and salaries (which make up about 70 percent of compensation costs) increased 0.5 percent, and benefits

(which make up the remaining 30 percent of compensation) increased 0.7 percent.Among industry supersectors, compensation cost increases for private industry workers for the current 12-month period ranged from 1.7 percent for professional and business services to 3.6 percent for leisure and hospitality.

-

12:39

Huge US Q3 preliminary GDP at +2.9%

Real gross domestic product increased at an annual rate of 2.9 percent in the third quarter of 2016, according to the "advance" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 1.4 percent.

The increase in real GDP in the third quarter reflected positive contributions from personal consumption expenditures (PCE), exports, private inventory investment, federal government spending, and nonresidential fixed investment that were partly offset by negative contributions from residential fixed investment and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased .

The acceleration in real GDP growth in the third quarter reflected an upturn in private inventory investment, an acceleration in exports, a smaller decrease in state and local government spending, and an upturn in federal government spending. These were partly offset by a smaller increase in PCE, and a larger increase in imports.

The price index for gross domestic purchases increased 1.6 percent in the third quarter, compared with an increase of 2.1 percent in the second quarter. The PCE price index increased 1.4 percent, compared with an increase of 2.0 percent. Excluding food and energy prices, the PCE price index increased 1.7 percent, compared with an increase of 1.8 percent.

-

12:30

U.S.: GDP, q/q, Quarter III 2.9% (forecast 2.5%)

-

12:30

U.S.: PCE price index, q/q, Quarter III 1.4% (forecast 1.4%)

-

12:30

U.S.: PCE price index ex food, energy, q/q, Quarter III 1.7% (forecast 1.6%)

-

12:15

German CPI rise above expectations

The inflation rate in Germany as measured by the consumer price index is expected to be +0.8% in October 2016. Based on the results available so far, the Federal Statistical Office (Destatis) also reports that the consumer prices are expected to increase by 0.2% on September 2016.

The harmonised index of consumer prices for Germany calculated for European purposes is expected to be up 0.7% year on year. Compared with September 2016, it is expected to be up by 0.2%. The final results for October 2016 will be released on 11 November 2016.

-

12:00

Germany: CPI, y/y , October 0.8% (forecast 0.8%)

-

12:00

Germany: CPI, m/m, October 0.2% (forecast 0.1%)

-

11:46

Orders

EUR/USD

Offers : 1.0930 1.0950 1.09801.1000 1.1030 1.1050 1.1080 1.1100

Bids : 1.0900 1.0875-80 1.0850 1.0825-30 1.0800

GBP/USD

Offers : 1.2200 1.2225-30 1.2250 1.2280 1.2300 1.2325-301.2350

Bids : 1.2150 1.2130 1.2100 1.2080-85 1.2050 1.2000

EUR/GBP

Offers : 0.8980 0.9000 0.9025-30 0.9050

Bids : 0.8920 0.8900 0.8880-85 0.8870 0.8850-55

EUR/JPY

Offers : 115.00 115.40 115.75-80 116.00

Bids : 114.50 114.00 113.70 113.50 113.30 113.00

USD/JPY

Offers : 105.50 105.65 105.80 106.00 106.50 107.00

Bids : 105.00 104.75 104.50 104.30 104.00 103.80-85 103.50

AUD/USD

Offers : 0.7600 0.7650 0.7660 0.7685 0.7700-10

Bids : 0.7555-60 0.7540 0.7500 0.7480 0.7450 0.7400

-

11:26

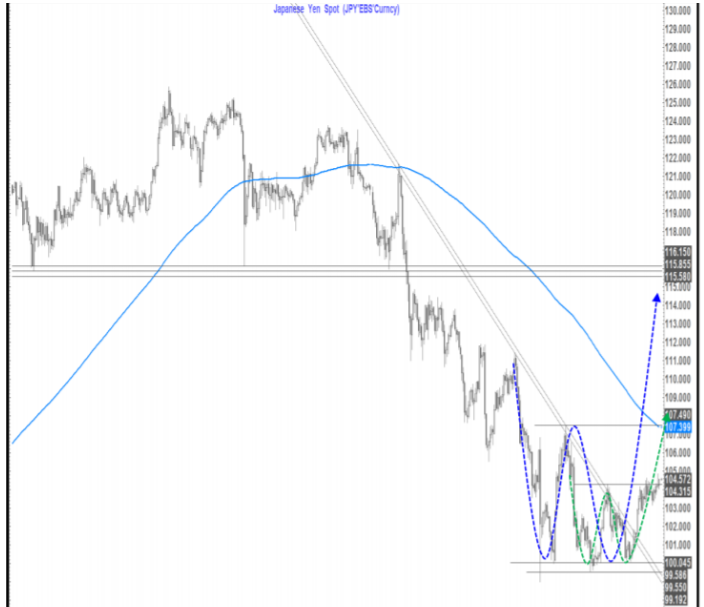

The picture looks constructive for a push higher in USDJPY - Citi

"As we head higher in US yields; prepare for a Fed rate hike in December; retain some possibility of renewed Japan stimulus and expect a US Equity market "melt up" into year end, the picture looks constructive for a push higher in USDJPY.

We have already confirmed one double bottom with a daily close above 104.32, and that pattern target gains towards 108.50. Such a move, if seen would open up the possibility of a larger double bottom forming /55 day moving average break on a close above 107.40-50

Such a close, if seen, would suggest extended gains towards 114-116.

At this point, while we think it is very possible to see such a move, we do not see anything that inclines us to believe that USDJPY could go much higher than these levels. This could therefore leave USDJPY open to renewed losses thereafter as we saw in 1991,1999, 2004 and again in 2007 after similar bounces".

Citi maintains a long USD/JPY from 104.55.

Copyright © 2016 CitiFX, eFXnews™

-

10:56

Goldman Sachs lowers the price target for Twitter shares to $ 22 from $ 23, maintains the “buy” rating

-

10:51

Pound under pressure as Northern Ireland high court passes judgement on Brexit - Forexlive

-

09:35

GBP/USD sold hard from 1.2175 resistance area. Down 50 pips so far

-

09:34

Eurozone economic confidence rose to a 10-month high in October

Eurozone economic confidence rose to a 10-month high in October, survey data from the European Commission showed Friday.

The economic sentiment index rose more-than-expected to 106.3 in October from 104.9 in September, according to rttnews. This was the highest since December 2015, when the reading was 106.6. The expected reading was 104.9.

The industrial confidence indicator climbed to -0.6 from -1.8. Increasing industry confidence resulted from a marked improvement in managers' production expectations and improved assessments of overall order books and the stocks of finished products.

The confidence index for services came in at 12.0 versus 10 in September. The marked rise in services confidence resulted from managers' significantly brighter assessment of past demand and the past business situation.

The consumer confidence index improved to -8 as initially estimated from -8.2 in the prior month.

-

09:01

Eurozone: Business climate indicator , October 0.55 (forecast 0.44)

-

09:01

Eurozone: Industrial confidence, October -0.6 (forecast -1.6)

-

09:00

Eurozone: Consumer Confidence, October -8 (forecast -8)

-

09:00

Eurozone: Economic sentiment index , October 106.3 (forecast 104.8)

-

08:31

ECB Lane: No Single Financial Center Set to Benefit if London Declines

-

Post Brexit Financial System Likely to be Decentralized, Multi-Polar

-

-

08:14

Germany's Bavaria Oct CPI +0.2% On Mo; +0.8% On Year

-

08:14

German Brandenburg Oct CPI +0.2% On Mo, +0.9% On Year

-

08:13

Germany's Hesse Oct CPI +0.3% On Mo; +0.8% On Year

-

07:54

Volatility expected as month end flows kicks in

-

07:42

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0800( EUR 1.58bln) 1.0870-85 (1.55bln) 1.0900 (685m) 1.0940 (401m) 1.0950 (879m) 1.1000 (657m) 1.1050 527m)

USD/JPY 104.00 (922m) 104.50 (641m) 104.75 (460m) 105.00 (1.22bln) 105.25 (870m) 106.00 400m)

GBP/USD 1.2700 ( GBP 867m)

USD/CHF 0.9900 (USD 225m) 1.0000 (265m)

AUD/USD 0.7500 ( AUD 345m) 0.7550-55 (445m) 0.7600 (484m) 0.7650 (380m) 0.7700(394m)

USD/CAD: 1.3105 (USD 314m) 1.3150 (233m) 1.3200(210m) 1.3300(1.92bln) 1.3350(232m) 1.3450 (422m)

NZD/USD 0.7140 (NZD 399m) 0.7150 331m) 0.7200 (300m)

EUR/NOK 8.9300 (EUR 430m)

AUD/NZD 1.0660 (AUD 240m)

-

07:20

Gross Domestic Product generated by the Spanish economy up 0.7% in Q3

Gross Domestic Product generated by the Spanish economy registers a variation 0.7% in the third quarter of 2016 compared to the quarter precedente2 , according to Quarterly GDP advance estimate. This rate is lower than the one recorded in the previous quarter (0.8%). The annual change in GDP in the third quarter of 2016 is 3.2%. The quarterly GDP advance estimate uses the same methodology as that used in the compiling the complete estimate, albeit in a simplified framework

-

07:04

In October 2016 the KOF Economic Barometer pointed visibly above its long-term average

In October 2016, the KOF Economic Barometer, with a new reading of 104.7, pointed visibly above its long-term average. The strongest impulses contributing positively to the dynamics of the Barometer came from hospitality services and manufacturing. The only negative impacts came from the financial sector.

Within the manufacturing sector, the improved outlook is manifesting itself primarily in the electrical and machine building industries. Wood-processing and timber were the negative outliers.

-

07:02

French CPI grew by 0.4% in October

Year-on-year, the Consumer Price Index (CPI) should grow by 0.4% in October 2016, as in the previous month, according to the provisional estimate made at the end of the month. This stability in inflation is expected to be the result of a rebound in energy prices, mitigated by a downturn in food prices and a slowdown in services prices. Moreover, manufactured product prices should continue to decline year-on-year, at the same pace than in the previous month.

Over one month, consumer prices should be unchanged in October 2016 after a dowturn by 0.2% in September. In October 2015, the prices had increased by 0.1% over one month. Energy prices are set to speed up. Conversely, manufactured product prices should decelerate strongly because of clothing and footwear prices. Furthermore, food prices and services prices should diminish again, but less than in the previous month.

Year-on-year, the Harmonised Index of Consumer Prices should increase by 0.5% in October 2016, as in the previous month. Over the month, it is set to be stable after a fall by 0.2% in September - Insee.

-

07:01

Switzerland: KOF Leading Indicator, October 104.7 (forecast 101.8)

-

06:32

Options levels on friday, October 28, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1108 (3431)

$1.1024 (1970)

$1.0967 (1014)

Price at time of writing this review: $1.0910

Support levels (open interest**, contracts):

$1.0858 (3341)

$1.0825 (2689)

$1.0786 (6502)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 43728 contracts, with the maximum number of contracts with strike price $1,1300 (3778);

- Overall open interest on the PUT options with the expiration date November, 4 is 48019 contracts, with the maximum number of contracts with strike price $1,0800 (6502);

- The ratio of PUT/CALL was 1.10 versus 1.08 from the previous trading day according to data from October, 27

GBP/USD

Resistance levels (open interest**, contracts)

$1.2402 (1184)

$1.2304 (1688)

$1.2208 (828)

Price at time of writing this review: $1.2164

Support levels (open interest**, contracts):

$1.2095 (1453)

$1.1997 (1067)

$1.1899 (549)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 32357 contracts, with the maximum number of contracts with strike price $1,2800 (1971);

- Overall open interest on the PUT options with the expiration date November, 4 is 31431 contracts, with the maximum number of contracts with strike price $1,2300 (1797);

- The ratio of PUT/CALL was 0.97 versus 0.97 from the previous trading day according to data from October, 27

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:29

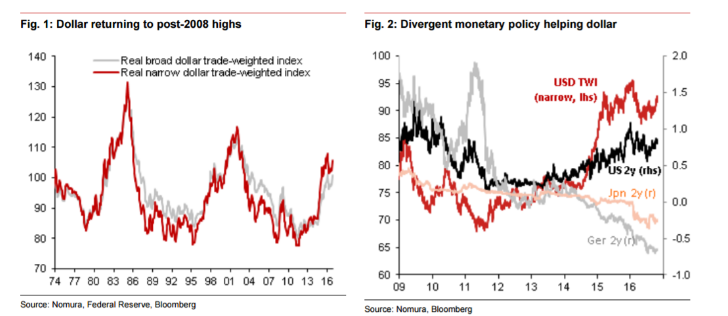

USD Rally To Target EUR/USD At 1.05 & USD/JPY At 110 - Nomura

"At last, a dollar trend appears to be developing. This month, the dollar has rallied against almost all currencies including emerging market ones. The broad trade-weighted dollar is close to its post-2008 highs last seen at the turn of the year.

Undoubtedly what has helped is a monetary policy divergence story between the Fed and its peers...One factor that could further bolster the dollar would be a Clinton victory, not least because it would bring about continuity in economic arrangements between the US and the rest of the world.

As for currency pair specific dynamics, we find that euro-area investor repatriation flows, especially in equities, appear to be coming to end, while bond outflows continue. This dynamic has been a stubborn support for the euro for much of the past year, but is unlikely to be so in the future. On the yen, we expect Japanese institutions to reduce their hedge ratios as hedging costs are higher than before. There are also more signs that Japanese investors are buying foreign equities. A less-discussed factor is the decline in Chinese buying of Japanese assets, which may well have been part of a reserve rebalancing programme earlier in the year. It likely helped yen strength over that period, but as with euro repatriation, this flow will not be forthcoming.

Consequently, there is scope for dollar strength to lead to the euro heading to its 2015 lows of 1.05 and USD/JPY rising to 110 - its level before the market gave up on the Fed in June".

Copyright © 2016 Nomura, eFXnews™

-

06:22

Negative start of trading expected on the major stock exchanges in Europe: DAX futures -0.3%, CAC40 -0.1%, FTSE -0.2%

-

06:18

New home sales in Australia increased for the second straight month in September

According to rttnews, new home sales in Australia increased for the second straight month in September, the Housing Industry Association said on Wednesday.

Total home sales rose a seasonally adjusted 2.7 percent month-over-month in September, slower than August's 6.1 percent climb.

Detached house sales grew 3.8 percent over the month, while sales of units dropped by 0.8 percent.

"However, the mix of available indicators suggests that new home building activity has now passed its peak and that the 2015/16 financial year will not be matched in terms new dwelling starts," HIA Senior Economist, Shane Garrett, said.

"This is particularly the case for multi-residential sales, which have eased by 6.2 percent during the September 2016 quarter compared with the same period a year earlier."

-

06:16

Japan Consumer Price Index continues to decline

Consumer prices fell the seventh consecutive month and household spending also fell again in September, underscoring the problems, Prime Minister Shinzo Abe and the head of the Bank of Japan Haruhiko Kuroda.

The National Consumer Price Index published by Statistics Bureau of Japan, remained unchanged at -0.5% in September. The consumer price index reflects the assessment of price movements obtained by comparison of the retail prices of the relevant basket of goods and services and is the most important barometer of changes in purchasing trends.

Inflation excluding food prices was also -0.5% in September. The national consumer price index excluding food and energy prices amounted to 0.0% y / y, after rising by 0.2% a month earlier

Household spending in September fell 2.1% compared with a year earlier. Economists had expected a decline of 2.7%. According to statistics, household spending declined in 11 of the 12 months.

-

06:13

Final demand producer prices in Australia were up 0.3 percent on quarter

Final demand producer prices in Australia were up 0.3 percent on quarter in the third quarter of 2015, the Australian Bureau of Statistics said on Friday - following the 0.1 percent gain in Q2.

On a yearly basis, prices were up 0.5 percent after rising 1.0 percent in the three months prior.

Intermediate demand prices were up 0.6 percent on quarter and 0.2 percent on year, while preliminary demand prices gained 0.6 percent on quarter and 0.1 percent on year - rttnews says.

-

06:12

Japan’s unemployment rate fell

The unemployment rate published by the Ministry of Health, Labour and Welfare and the Bureau of Statistics of Japan, was 3.0% in September, lower than the previous value, and economists forecast of 3.1%. The decline indicates a strengthening of the labor market, thus, the decline in value of the indicator is positive for the Japanese currency.

However, despite the decline in unemployment to its lowest level since 1995, inflation and labor cost show a negative result, since the decline in unemployment has not yet led to a significant increase in wages, which is a key element in efforts to rebuild the Japanese economy

-

06:04

French GDP up 0.2% in Q3

In Q3 2016, gross domestic product (GDP) in volume terms recovered: +0.2%, after -0.1% in Q2.

Household consumption expenditure stagnated for the second quarter in a row, whereas gross fixed capital formation (GFCF) increased slightly (+0.3% after 0.0%). All in all, final domestic demand (excluding inventory changes) was virtually stable: it contributed to GDP growth for +0.1 points in Q3, as in the previous quarter.

Imports sharply bounced back (+2.2% after -1.7%). Exports accelerated to a lesser extent (+0.6% after +0.2%). All in all, foreign trade balance contributed negatively to GDP growth (-0.5 points after +0.6 points). Conversely, changes in inventories contributed positively (+0.6 points after -0.8 points).

-

00:30

Australia: Producer price index, q / q, Quarter III 0.3%

-

00:30

Australia: Producer price index, y/y, Quarter III 0.5%

-

00:24

Australia: HIA New Home Sales, m/m, September 2.7%

-