Market news

-

20:08

Major US stock indices closed today's trading near zero

Major US stock indexes fell slightly, as robust US economic data and upbeat company results Alphabet (GOOG) and Chevron (CVX) compensated for the decline in the health sector and a weak report Amazon (AMZN).

As it became known, the real gross domestic product grew at an annualized rate of 2.9% in the third quarter of 2016, according to "preliminary" assessment of the Bureau of Economic Analysis. In the second quarter, real GDP increased by 1.4%. Real GDP growth in the third quarter reflected positive contributions from personal consumption expenditures (PCE), exports, private investments, stocks, costs the federal government as well as non-residential investment in fixed assets, which were partially offset by a negative contribution from residential fixed capital investment and government costs and expenses of local government. Imports, which are subtracted in the calculation of GDP, increased.

DOW index components closed mostly in the red (17 of 30). Most remaining shares rose Chevron Corporation (CVX, + 4.08%). Outsider were shares of Merck & Co., Inc. (MRK, -4.15%).

Most Sector S & P index showed a decline. The leader turned out to be the industrial goods sector (+ 0.7%). the health sector fell the most (-1.7%).

-

19:00

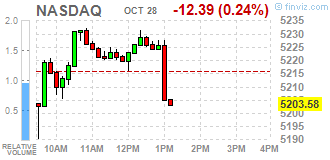

Dow +0.07% 18,182.45 +12.77 Nasdaq -0.40% 5,195.18 -20.79 S&P -0.20% 2,128.72 -4.32

-

17:11

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Friday as robust economic data shone light on the strength of the U.S. economy, while upbeat results from Alphabet and Chevron offset the decline in health stocks and Amazon. The U.S. Commerce Department's first estimate on gross domestic product showed the U.S. economy grew at its fastest pace in two years. GDP increased at a 2,9% annual rate in the third quarter, helped by a surge in exports.

Most of Dow stocks in positive area (21 of 30). Top gainer - Chevron Corporation (CVX, +4.88%). Top loser - Merck & Co., Inc. (MRK, -3.11%).

Almost all S&P sectors also in positive area. Top gainer - Industrial goods (+1.3%). Top loser - Healthcare (-1.3%).

At the moment:

Dow 18163.00 +81.00 +0.45%

S&P 500 2134.25 +10.75 +0.51%

Nasdaq 100 4835.00 +28.00 +0.58%

Oil 49.17 -0.55 -1.11%

Gold 1270.90 +1.40 +0.11%

U.S. 10yr 1.85 +0.01

-

16:00

European stocks closed: FTSE 100 +9.69 6996.26 +0.14% DAX -20.89 10696.19 -0.19% CAC 40 +15.01 4548.58 +0.33%

-

15:29

WSE: Session Results

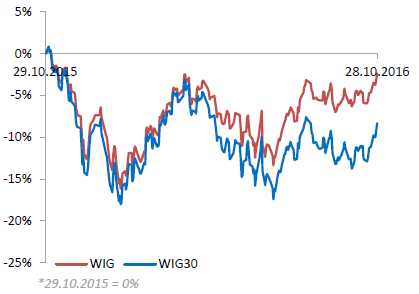

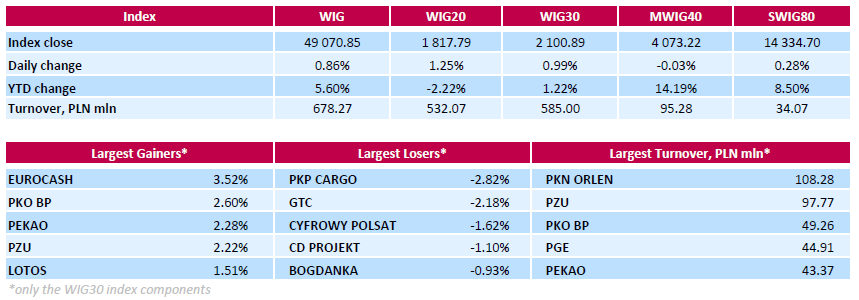

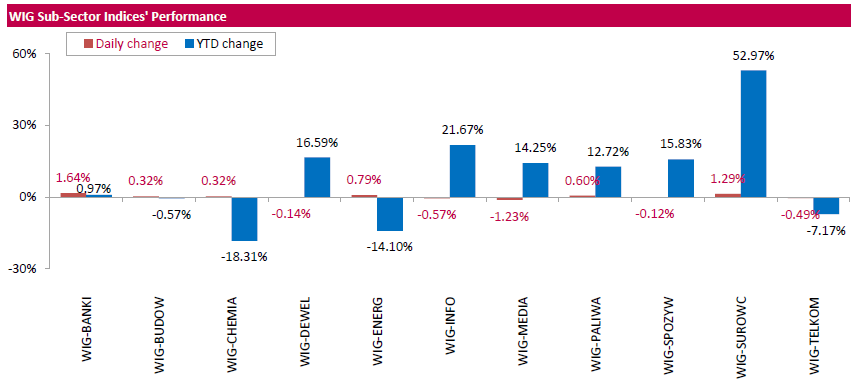

Polish equity market closed higher on Friday. The broad market measure, the WIG Index, added 0.86%. Sector performance within the WIG Index was mixed. Banking sector (+1.64%) outperformed, while media (-1.23%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, advanced 0.99%. FMCG-wholesaler EUROCASH (WSE: EUR) was the growth leader among the index components, recording advance of 3.52%. It was followed by three financials names - banks PKO BP (WSE: PKO) and PEKAO (WSE: PEO) and insurer PZU (WSE: PZU), which gained 2.6%, 2.28% and 2.22% respectively. On the other side of the ledger, railway freight transport operator PKP CARGO (WSE: PKP) was the weakest name, dropping 2.82%. Other largest decliners were property developer GTC (WSE: GTC), media group CYFROWY POLSAT (WSE: CPS) and videogame developer CD PROJEKT (WSE: CDR), dropping by 2.18%, 1.62% and 1.1% respectively.

-

13:33

U.S. Stocks open: Dow +0.18%, Nasdaq -0.29%, S&P -0.07%

-

13:26

Before the bell: S&P futures +0.12%, NASDAQ futures +0.18%

U.S. stock-index futures rose amid better-than-expected Q3 GDP data and mixed earnings reports.

Global Stocks:

Nikkei 17,446.41 +109.99 +0.63%

Hang Seng 22,954.81 -177.54 -0.77%

Shanghai 3,105.08 -7.27 -0.23%

FTSE 6,984.56 -2.01 -0.03%

CAC 4,537.04 +3.47 +0.08%

DAX 10,675.51 -41.57 -0.39%

Crude $49.28 (-0.88%)

Gold $1263.10 (-0.50%)

-

12:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

165.63

-0.13(-0.0784%)

500

Amazon.com Inc., NASDAQ

AMZN

773.5

-44.86(-5.4817%)

271323

Apple Inc.

AAPL

114.18

-0.30(-0.2621%)

52137

AT&T Inc

T

36.5

-0.02(-0.0548%)

3589

Barrick Gold Corporation, NYSE

ABX

16.6

-0.25(-1.4837%)

63951

Boeing Co

BA

143.66

0.35(0.2442%)

785

Caterpillar Inc

CAT

83.1

0.09(0.1084%)

885

Chevron Corp

CVX

100.35

0.43(0.4303%)

38065

Cisco Systems Inc

CSCO

30.36

-0.02(-0.0658%)

1673

Citigroup Inc., NYSE

C

50.09

0.16(0.3204%)

19087

E. I. du Pont de Nemours and Co

DD

70.03

0.19(0.272%)

677

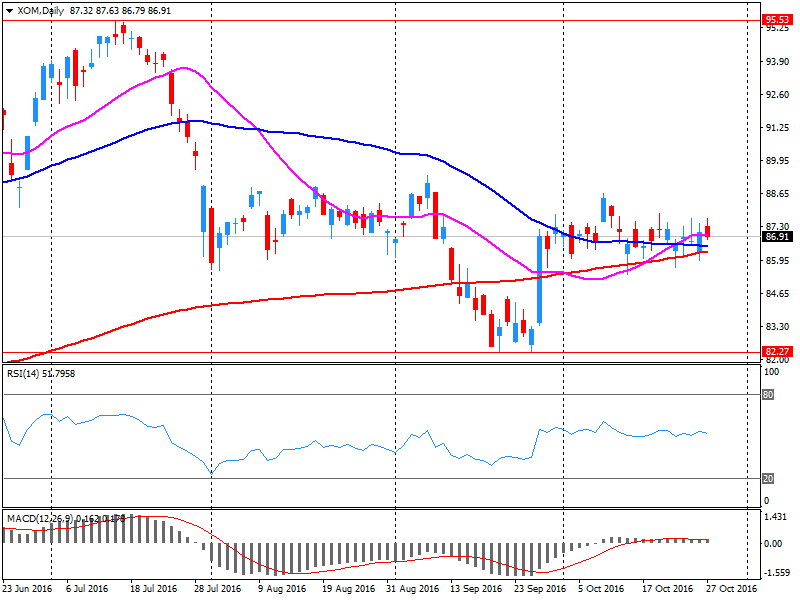

Exxon Mobil Corp

XOM

85.8

-1.12(-1.2885%)

154155

Facebook, Inc.

FB

130.2

0.51(0.3932%)

47850

Ford Motor Co.

F

11.72

-0.02(-0.1704%)

4765

General Electric Co

GE

28.66

0.03(0.1048%)

123737

General Motors Company, NYSE

GM

31.27

-0.06(-0.1915%)

1100

Goldman Sachs

GS

178.03

0.28(0.1575%)

1237

Intel Corp

INTC

34.79

-0.02(-0.0575%)

5295

International Business Machines Co...

IBM

152.76

-0.59(-0.3847%)

440

JPMorgan Chase and Co

JPM

69.49

0.26(0.3756%)

736

Microsoft Corp

MSFT

60.11

0.01(0.0166%)

31927

Nike

NKE

51.95

0.06(0.1156%)

540

Pfizer Inc

PFE

32.54

0.06(0.1847%)

1218

The Coca-Cola Co

KO

42.07

-0.05(-0.1187%)

4086

Travelers Companies Inc

TRV

108.27

0.25(0.2314%)

300

Twitter, Inc., NYSE

TWTR

17.49

0.09(0.5172%)

188267

UnitedHealth Group Inc

UNH

142

0.06(0.0423%)

785

Verizon Communications Inc

VZ

48.65

0.11(0.2266%)

2013

Visa

V

82.5

0.58(0.708%)

28066

Yandex N.V., NASDAQ

YNDX

20.22

0.30(1.506%)

8826

-

12:50

Upgrades and downgrades before the market open

Upgrades:

Twitter (TWTR) upgraded to Perform from Underperform at Oppenheimer

Downgrades:

Other:

Amazon (AMZN) target lowered to $920 from $950 at Mizuho

Amazon (AMZN) target lowered to $950 from $1000 at RBC Capital Mkts

-

12:45

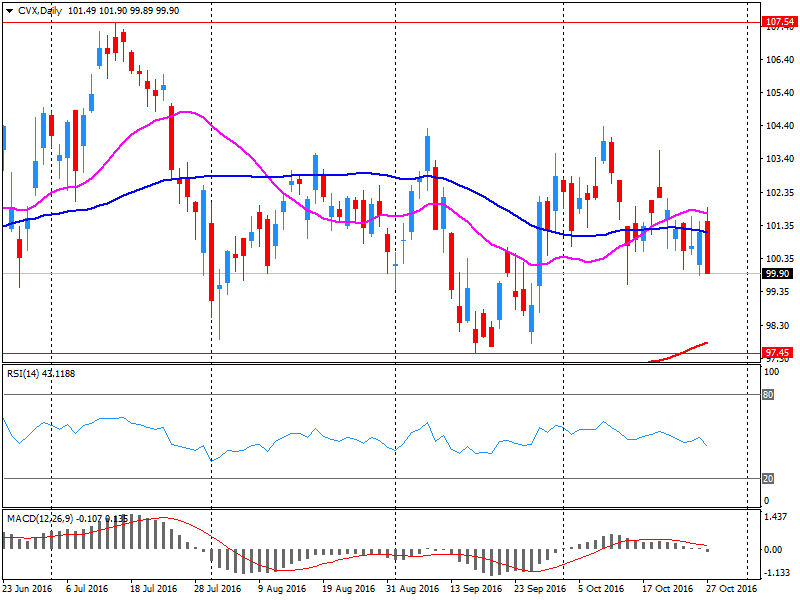

Company News: Chevron (CVX) Q3 EPS beat analysts’ estimate

Chevron reported Q3 FY 2016 earnings of $0.68 per share (versus $1.09 in Q3 FY 2015), beating analysts' consensus estimate of $0.39.

The company's quarterly revenues amounted to $30.140 bln (-12.2% y/y), missing analysts' consensus estimate of $30.578 bln.

CVX rose to $100.35 (+0.43%) in pre-market trading.

-

12:16

Company News: MasterCard (MA) Q3 results beat analysts’ expectations

MasterCard reported Q3 FY 2016 earnings of $1.08. per share (versus $0.91 in Q3 FY 2015), beating analysts' consensus estimate of $0.98.

The company's quarterly revenues amounted to $2.900 bln (+14.6% y/y), beating analysts' consensus estimate of $2.744 bln.

MA rose to $105.60 (+1.93%) in pre-market trading.

-

12:12

Company News: Exxon Mobil (XOM) Q3 EPS beat analysts’ estimate

Exxon Mobil reported Q3 FY 2016 earnings of $0.63 per share (versus $1.01 in Q3 FY 2015), beating analysts' consensus estimate of $0.60.

The company's quarterly revenues amounted to $58.677 bln (-12.9% y/y), missing analysts' consensus estimate of $60.603 bln.

XOM fell to $86.02 (-1.04%) in pre-market trading.

-

08:13

Major stock markets trading in the red zone: DAX -0,2%, FTSE -0,3%, CAC40 -0,2%, FTMIB + 0,2%, IBEX -0,1%

-

05:04

Global Stocks

European stock wobbled into the close on Thursday, as investors digested a raft of earnings reports and better-than-expected growth data from the U.K. The pan-European benchmark swung between small gains and losses throughout the day and had opened firmly lower after a downbeat session in Asia. China said industrial profits fell to 7.7% year-over-year growth in September, a sharp slowdown from the 19.5% recorded the month before.

U.S. stocks closed lower Thursday, after a session of fluctuating between slight gains and losses, as a jump in bond yields prompted a selloff in defensive sectors such as real estate while investors sifted through mixed earnings results and deal news. "The market is uneven because earnings have been uneven, investors really are looking at them on a company by company basis," said Paul Nolte, portfolio manager at Kingsview Asset Management. "When you roll it all up it doesn't amount to much in moving the market."

Asian markets were mixed by mid-morning Friday as investors parsed a deluge of economic data and corporate earnings. Global bond yields received a boost overnight fromstronger-than-expected U.K. GDP data and comments from the Bank of Japan's that it may not increase its quantitative easing program.

-