Market news

-

22:29

Stocks. Daily history for Oct 27’2016:

(index / closing price / change items /% change)

Nikkei 225 17,336.42 0.00 0.00%

Shanghai Composite 3,112.32 -3.99 -0.13%

S&P/ASX 200 5,295.55 0.00 0.00%

FTSE 100 6,986.57 +28.48 +0.41%

CAC 40 4,533.57 -1.02 -0.02%

Xetra DAX 10,717.08 +7.40 +0.07%

S&P 500 2,133.04 -6.39 -0.30%

Dow Jones Industrial Average 18,169.68 -29.65 -0.16%

S&P/TSX Composite 14,833.75 +26.19 +0.18%

-

20:06

Major US stock indexes finished trading in the red zone

Major US stock indexes showed a slight decrease, as the poor results of several companies of industrial and consumer sector eclipsed revenues from healthcare growth stocks.

In addition, as it became known today, the number of Americans who applied for unemployment benefits fell last week, pointing to sustained strength of the labor market and strengthen economic growth. Primary applications for unemployment benefits fell by 3,000 and reached a seasonally adjusted 258,000 for the week ended October 22, reported Thursday the Ministry of Labour. It marked 86 consecutive weeks, when the treatment was below the threshold of 300 000, which is usually associated with a strong labor market. This is the longest period since 1970, when the labor market was much smaller.

However, new orders for manufactured durable goods decreased by $ 0.3 billion in September, or 0.1% to $ 227.3 billion, the US Census Bureau reported today. This decline came after two consecutive monthly increases, including growth of 0.3% in August. Except for transportation, new orders increased by 0.2%. With the exception of defense orders, new orders increased by 0.7%. Orders transport equipment also declined after two consecutive monthly increases, to $ 0.6 billion or 0.8% to $ 77.5 billion.

It should also be noted that the number of signed contracts for the purchase of housing on the secondary market in the US rose more than expected in September, becoming yet another sign of the momentum in the housing market. The National Association of Realtors reported Thursday that its index of pending home sales, based on contracts signed in the past month increased by 1.5% to 110.0 after falling in August.

DOW index components closed in different directions (12 against 18 in the black in the red). Most remaining shares rose Verizon Communications Inc. (VZ, + 2.02%). Outsider were shares of The Boeing Company (BA, -1.61%).

Most of the S & P sectors registered a decline. The leader turned out to be the health sector (+ 0.2%). conglomerates (-1.3%) sectors fell most.

At the close:

Dow -0.14% 18,173.38 -25.95

Nasdaq -0.65% 5,215.97 -34.30

S & P -0.28% 2,133.36 -6.07

-

19:00

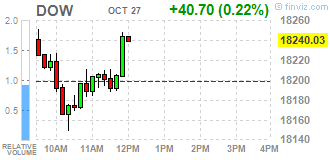

Dow -0.02% 18,195.43 -3.90 Nasdaq -0.50% 5,224.23 -26.04 S&P -0.12% 2,136.79 -2.64

-

16:03

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Thursday as weak results from several industrial and consumer discretionary companies eclipsed gains from healthcare stocks.

Dow stocks mixed (17 in positive area, 13 in negative area). Top gainer - E. I. du Pont de Nemours and Company (DD, +1.54%). Top loser - The Boeing Company (BA, -1.94%).

Almost all S&P sectors also in negative area. Top gainer - Healthcare (+0.5%). Top loser - Conglomerates (-1.0%).

At the moment:

Dow 18124.00 -4.00 -0.02%

S&P 500 2131.50 -2.50 -0.12%

Nasdaq 100 4844.00 -9.75 -0.20%

Oil 49.85 +0.67 +1.36%

Gold 1270.10 +3.50 +0.28%

U.S. 10yr 1.85 +0.06

-

16:00

European stocks closed: FTSE 100 +28.48 6986.57 +0.41% DAX +7.40 10717.08 +0.07% CAC 40 -1.02 4533.57 -0.02%

-

15:30

WSE: Session Results

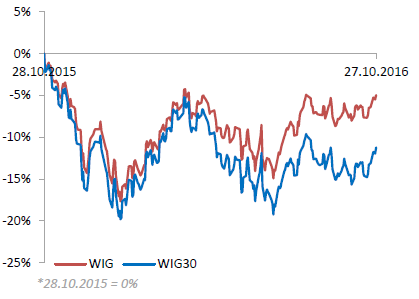

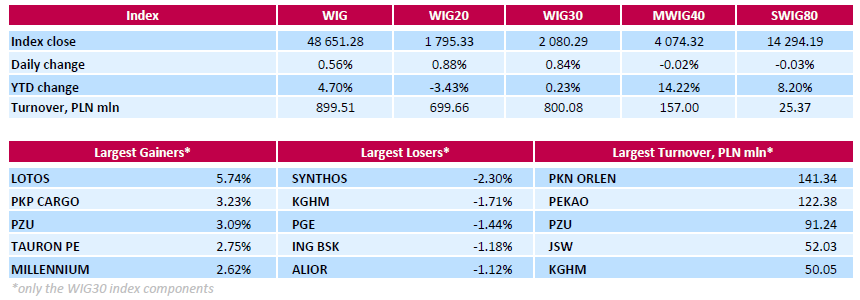

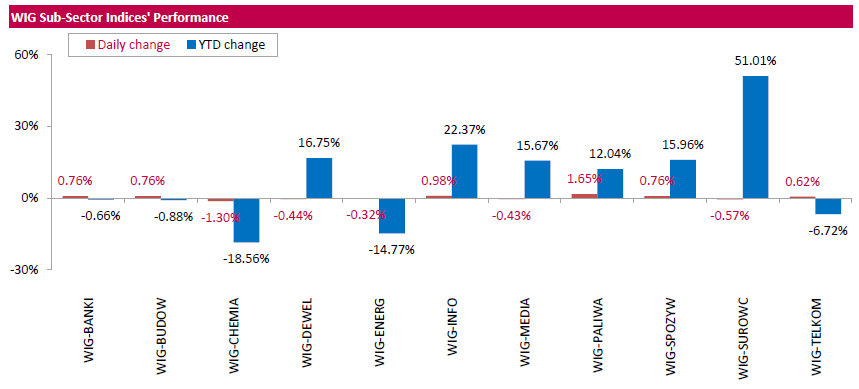

Polish equity market closed higher on Thursday. The broad market measure, the WIG Index, rose by 0.56%. Within the index performance was mixed, with oil and gas (+1.65%) outperforming and chemicals (-1.3%) lagging.

The large-cap stocks' measure, the WIG30 Index, added 0.84%. Within the WIG30 Index components, oil refiner LOTOS (WSE: LTS) led the gainers pack with a 5.74% advance, lifted up by better-than-expected Q3 earnings. The company's Q3 financial report showed its profit stood at PLN 380 mln in Q3, well above analysts' forecast for PLN 232 mln. Other major outperformers were railway freight transport operator PKP CARGO (WSE: PKP), insurer PZU (WSE: PZU), genco TAURON PE (WSE: TPE), videogame developer CD PROJEKT (WSE: CDR) and two banking names MILLENNIUM (WSE: MIL) and MBANK (WSE: MBK), surging by 2.54%-3.23%. On the other side of the ledger, chemical producer SYNTHOS (WSE: SNS) recorded the largest daily drop, down 2.3%, as the company posted net profit of PLN 81 mln for Q3, 16% below the PLN 96.2 mln expected by analysts and down by 40% y/y. Copper producer KGHM (WSE: KGH), genco PGE (WSE: PGE) and two banks ING BSK (WSE: ING) and ALIOR (WSE: ALR) also posted notable declines, sliding down 1.12%-1.71%.

-

13:32

U.S. Stocks open: Dow +0.27%, Nasdaq +0.42%, S&P +0.33%

-

13:22

Before the bell: S&P futures +0.41%, NASDAQ futures +0.52%

U.S. stock-index futures rose amid amid earnings reports and economic data.

Global Stocks:

Nikkei 17,336.42 -55.42 -0.32%

Hang Seng 23,132.35 -193.08 -0.83%

Shanghai 3,112.32 -3.99 -0.13%

FTSE 6,961.75 +3.66 +0.05%

CAC 4,526.52 -8.07 -0.18%

DAX 10,706.16 -3.52 -0.03%

Crude $49.21 (+0.06%)

Gold $1273.00 (+0.50%)

-

12:46

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

64.56

0.04(0.062%)

800

Amazon.com Inc., NASDAQ

AMZN

829.3

6.71(0.8157%)

32889

Apple Inc.

AAPL

115.49

-0.10(-0.0865%)

89384

AT&T Inc

T

36.5

0.07(0.1921%)

2935

Barrick Gold Corporation, NYSE

ABX

17.1

0.45(2.7027%)

43468

Boeing Co

BA

145.35

-0.19(-0.1305%)

4759

Caterpillar Inc

CAT

84.05

-0.08(-0.0951%)

1686

Cisco Systems Inc

CSCO

30.62

0.07(0.2291%)

3835

Citigroup Inc., NYSE

C

50.2

0.19(0.3799%)

12750

Facebook, Inc.

FB

131.6

0.56(0.4274%)

45279

Ford Motor Co.

F

11.85

-0.03(-0.2525%)

174210

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.6

0.02(0.189%)

9366

General Electric Co

GE

28.95

0.08(0.2771%)

3286

General Motors Company, NYSE

GM

31.65

0.07(0.2217%)

1045

Goldman Sachs

GS

177.9

0.83(0.4687%)

175

Google Inc.

GOOG

802.32

3.25(0.4067%)

10826

Intel Corp

INTC

35.02

0.10(0.2864%)

10679

International Paper Company

IP

45.88

-0.28(-0.6066%)

290

Johnson & Johnson

JNJ

114.9

0.34(0.2968%)

335

JPMorgan Chase and Co

JPM

69.34

0.21(0.3038%)

19473

Merck & Co Inc

MRK

61.09

0.22(0.3614%)

2150

Microsoft Corp

MSFT

60.83

0.20(0.3299%)

6013

Nike

NKE

52.32

0.35(0.6735%)

881

Pfizer Inc

PFE

32.54

0.14(0.4321%)

161

Starbucks Corporation, NASDAQ

SBUX

53.56

-0.07(-0.1305%)

660

Tesla Motors, Inc., NASDAQ

TSLA

210.9

8.66(4.282%)

137825

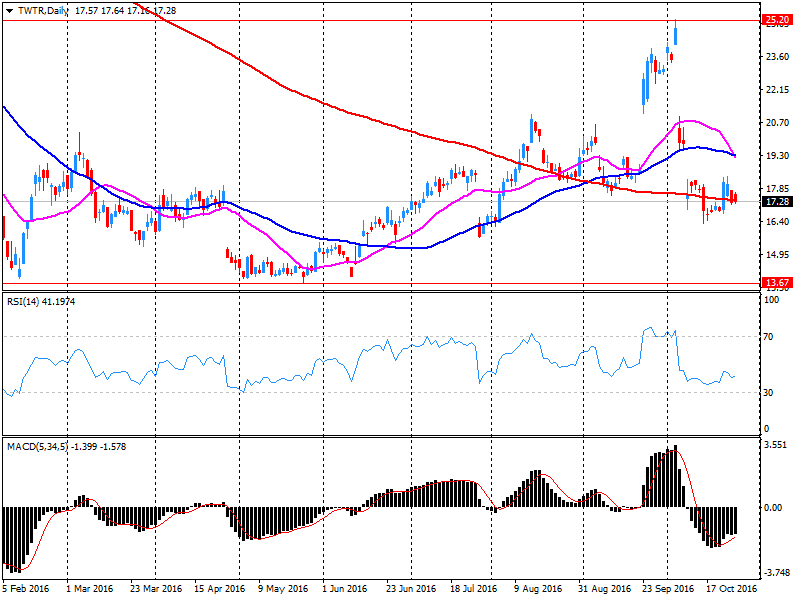

Twitter, Inc., NYSE

TWTR

18.04

0.75(4.3378%)

3295527

Verizon Communications Inc

VZ

47.72

0.09(0.189%)

800

Visa

V

82.31

0.56(0.685%)

706

Walt Disney Co

DIS

93.76

0.27(0.2888%)

1791

Yahoo! Inc., NASDAQ

YHOO

42.29

0.21(0.4991%)

541

Yandex N.V., NASDAQ

YNDX

19.93

0.98(5.1715%)

127700

-

12:43

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Tesla Motors (TSLA) target raised to $220 from $210 at RBC Capital Mkt

-

12:09

Company News: Twitter (TWTR) Q3 results beat analysts’ expectations

Twitter reported Q3 FY 2016 earnings of $0.13 per share (versus $0.10 in Q3 FY 2015), beating analysts' consensus estimate of $0.09.

The company's quarterly revenues amounted to $0.616. bln (+8.3% y/y), beating analysts' consensus estimate of $0.606 bln.

The company also announced a restructuring and reduction in force affecting approximately 9% of its positions globally.

TWTR rose to $18.25 (+5.55%) in pre-market trading.

-

12:06

Goldman Sachs increases target for Tesla Motors shares to $ 190 from $ 185, keeps rating "neutral”

-

11:47

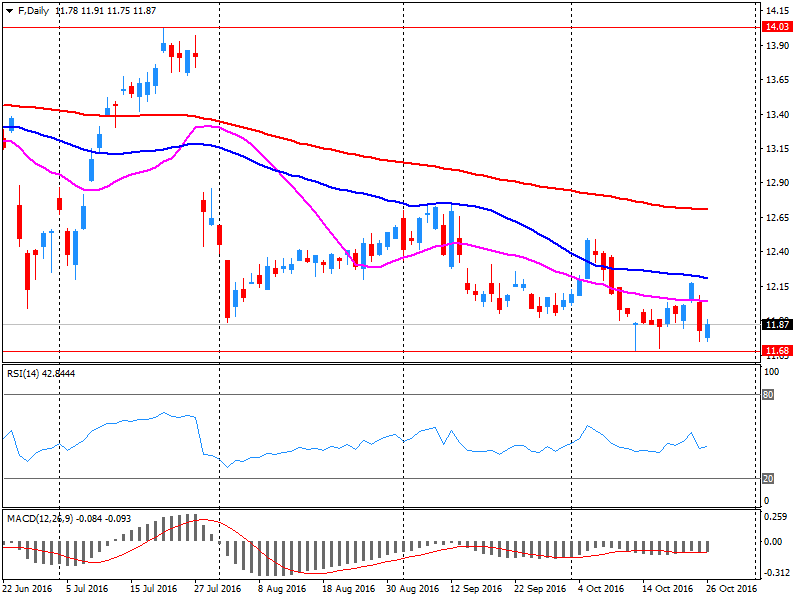

Company News: Ford Motor (F) Q3 EPS beat analysts’ estimate

Ford Motor reported Q3 FY 2016 earnings of $0.26 per share (versus $0.45 in Q3 FY 2015), beating analysts' consensus estimate of $0.20.

The company's quarterly revenues amounted to $33.331 bln (-6.9% y/y), generally in-line with analysts' consensus estimate of $33.405 bln.

F fell to $11.75 (-1.09%) in pre-market trading.

-

11:42

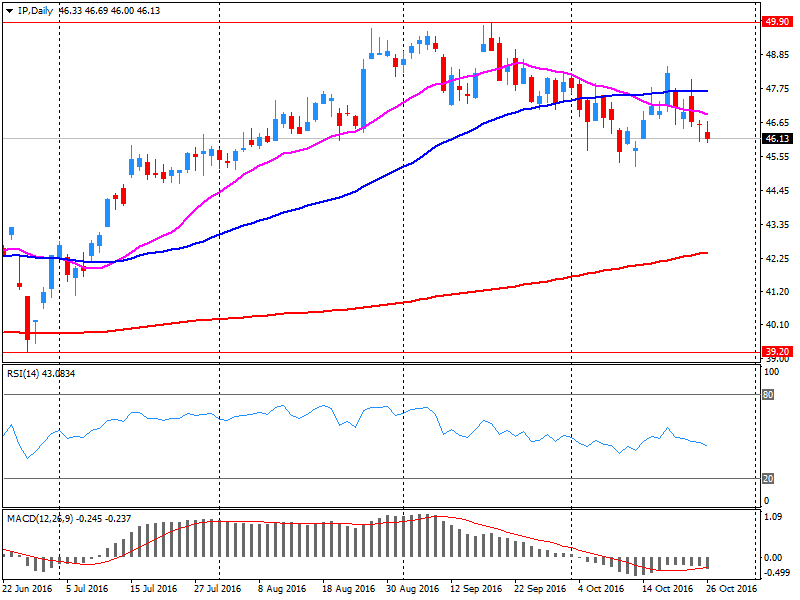

Company News: Intl Paper (IP) Q3 results miss analysts’ estimates

Intl Paper reported Q3 FY 2016 earnings of $0.91 per share (versus $0.97 in Q3 FY 2015), missing analysts' consensus estimate of $0.93.

The company's quarterly revenues amounted to $5.266 bln (-7.5% y/y), missing analysts' consensus estimate of $5.366 bln.

IP closed Wednesday's trading session at $46.16 (-0.94%).

-

11:34

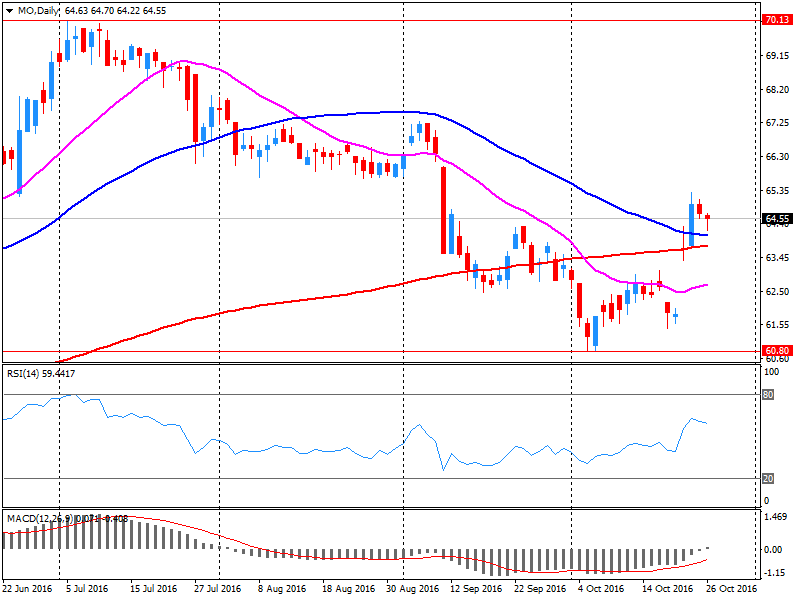

Company News: Altria (MO) Q3 results beat analysts’ forecasts

Altria reported Q3 FY 2016 earnings of $0.82 per share (versus $0.75 in Q3 FY 2015), beating analysts' consensus estimate of $0.81.

The company's quarterly revenues amounted to $5.193 bln (+4.3% y/y), beating analysts' consensus estimate of $5.111 bln.

The company reaffirmed guidance for FY2016, projecting EPS of $2.98-3.04 versus analysts' consensus estimate of $3.01

MO rose to $64.60 (+0.12%) in pre-market trading.

-

10:44

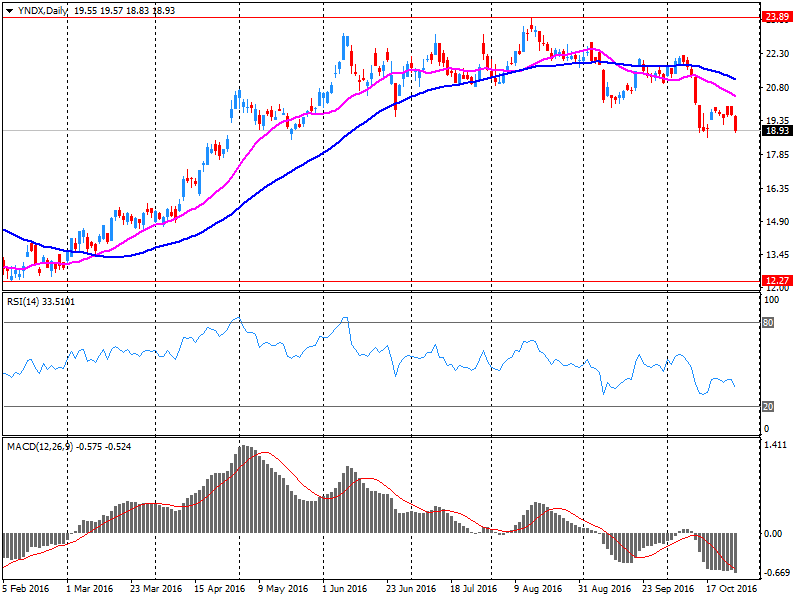

Company News: Yandex N.V. (YNDX) Q3 financials beat analysts’ estimates

Yandex N.V. reported Q3 FY 2016 earnings of RUB11.64 per share (versus RUB10.89 in Q3 FY 2015), beating analysts' consensus estimate of RUB10.51.

The company's quarterly revenues amounted to RUB19.293 bln (+25% y/y), beating analysts' consensus estimate of RUB18.755 bln.

YNDX rose to $19.78 (+4.38%) in pre-market trading.

-

10:37

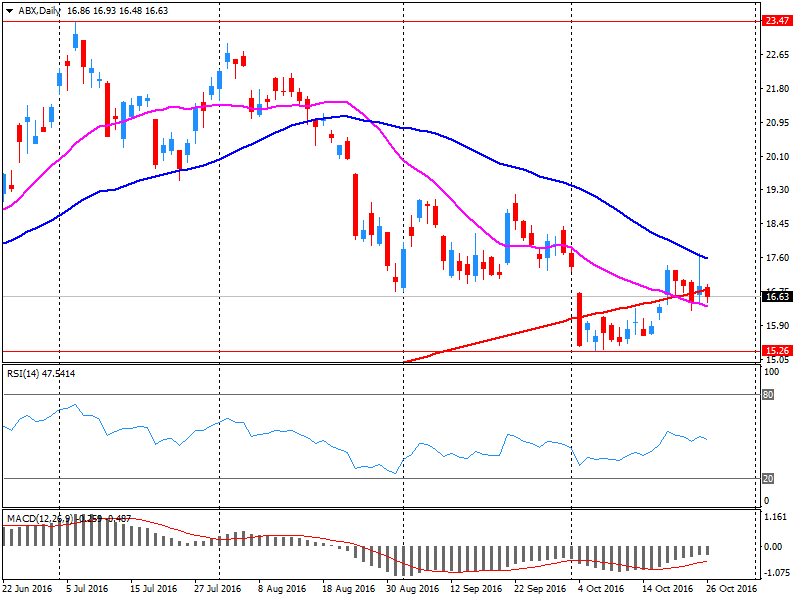

Company News: Barrick Gold (ABX) Q3 results beat analysts’ expectations

Barrick Gold reported Q3 FY 2016 earnings of $0.24 per share (versus $0.11 in Q3 FY 2015), beating analysts' consensus estimate of $0.20.

The company's quarterly revenues amounted to $2.300 bln (-0.6% y/y), beating analysts' consensus estimate of $2.234. bln.

ABX rose to $17.09 (+2.64%) in pre-market trading.

-

07:53

Major stock markets trading in the red zone: DAX -0,2%, FTSE -0,3%, CAC40 -0,2%, FTMIB + 0,2%, IBEX -0,1%

-

07:00

Negative start of trading expected on the major stock exchanges in Europe: DAX futures -0,5%, CAC40 -0.5%, FTSE -0.4%

-

04:49

Global Stocks

European stocks finished lower Wednesday, with energy shares slightly paring losses as oil prices came off session lows. Investors also expressed disappointment over a new round of financial updates.

U.S. stocks closed mostly lower Wednesday as Apple Inc., the largest U.S. company by market cap, tumbled, but the Dow Jones Industrial Average bucked the trend thanks to Boeing Inc., which soared on robust earnings.

The S&P 500 SPX, -0.17% slipped 3.73 points, or 0.2%, to end at 2,139.43, while the Nasdaq Composite Index COMP, -0.63% which is heavily weighted toward technology names, fell 33.13 points, or 0.6%, to finish at 5,250.27. The Dow Jones Industrial Average DJIA, +0.17% rose 30.06 points, or 0.2%, to close at 18,199.33.

Asian shares extended losses on Thursday after disappointing earnings from technology giant Apple dragged on Wall Street, while the dollar remained shy of this week's nearly nine-month highs.

Adding to the already subdued mood, data showed profit growth in China's industrial firms slowed last month from the previous month's rapid pace as several sectors showed weak activity, suggesting the world's second-biggest economy remains underpowered.

Tokyo's Nikkei stock index .N225 percent slumped 0.5 percent, though a weaker yen underpinned shares.

-