Market news

-

22:28

Stocks. Daily history for Oct 26’2016:

(index / closing price / change items /% change)

Nikkei 225 17,391.84 0.00 0.00%

Shanghai Composite 3,117.65 -14.29 -0.46%

S&P/ASX 200 5,359.80 -83.03 -1.53%

FTSE 100 6,958.09 -59.55 -0.85%

CAC 40 4,534.59 -6.25 -0.14%

Xetra DAX 10,709.68 -47.63 -0.44%

S&P 500 2,139.43 -3.73 -0.17%

Dow Jones Industrial Average 18,199.33 +30.06 +0.17%

S&P/TSX Composite 14,807.56 -63.07 -0.42%

-

20:09

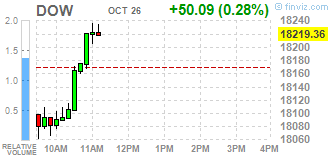

Major US stock indexes finished trading in different directions

Major US stock indexes mostly fell, being under the pressure of weak quarterly results of Apple. For example, shares the most valuable public company in the world (AAPL) lost about 2.3% after the company said that sales of its flagship iPhones fell the third consecutive quarter.

In addition, as it became known today, sales of new single-family homes in the US rose in September, pointing to a steady demand for housing, despite the fact that the data for August were revised sharply downwards. The Commerce Department reported Wednesday that new construction sales increased by 3.1% to a seasonally adjusted annual rate of up to 593,000 units last month, bringing them close to a nine-year high reached in July.

However, preliminary data provided by Markit Economics, showed that activity in the US service sector continued to expand in August, and reached its highest level since November 2015. Purchasing Managers Index (PMI) for the services sector in October was 54.8 points compared with 52.3 points in the previous month. Recall, reading above 50 indicates expansion of activity in the sector. Economists had expected the figure will be 52.3 points.

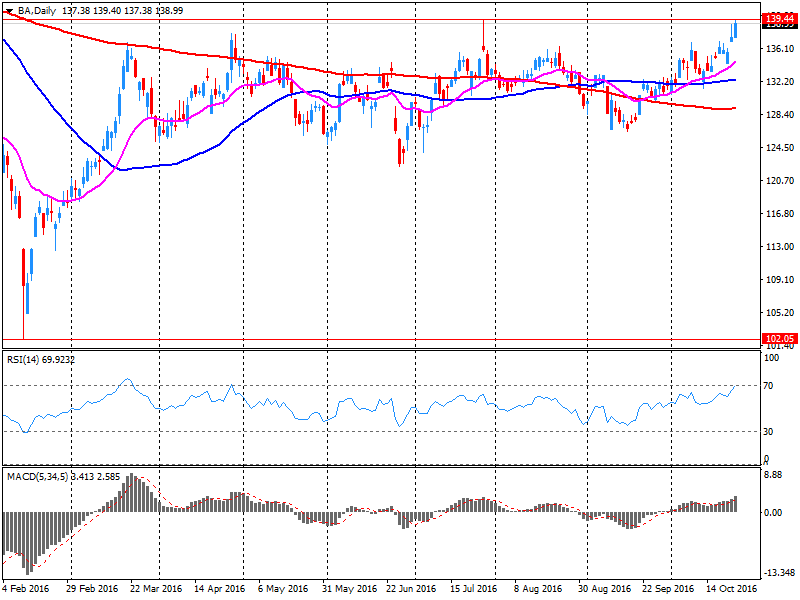

The focus of investors were also the shares of Coca-Cola (KO) and Boeing (BA). Both companies reported better than expected.

DOW index components showed mixed performance (14 red, 16 black). More rest up shares The Boeing Company (BA, + 4.96%). Outsiders were shares of Apple Inc. (AAPL, -2.34%).

Most of the S & P sectors closed in the red. The leader turned out to be the industrial goods sector (+ 0.6%). conglomerates (-1.0%) sectors fell most.

At the close:

Dow + 0.17% 18,199.47 +30.20

Nasdaq -0.63% 5,250.27 -33.13

S & P -0.17% 2,139.44 -3.72

-

19:00

Dow +0.13% 18,192.79 +23.52 Nasdaq -0.66% 5,248.66 -34.74 S&P -0.25% 2,137.74 -5.42

-

16:00

European stocks closed: FTSE 100 -59.55 6958.09 -0.85% DAX -47.63 10709.68 -0.44% CAC 40 -6.25 4534.59 -0.14%

-

15:36

WSE: Session Results

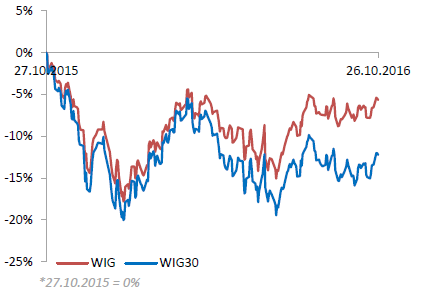

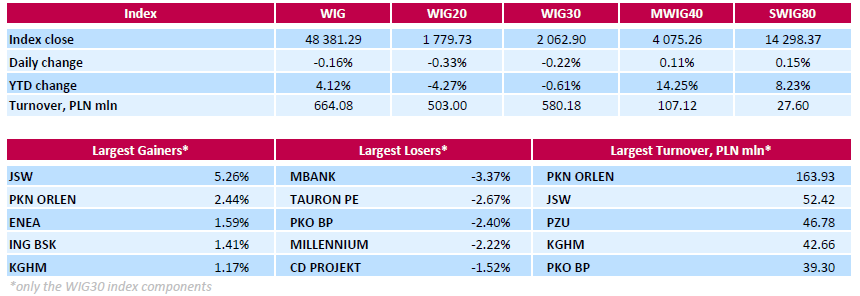

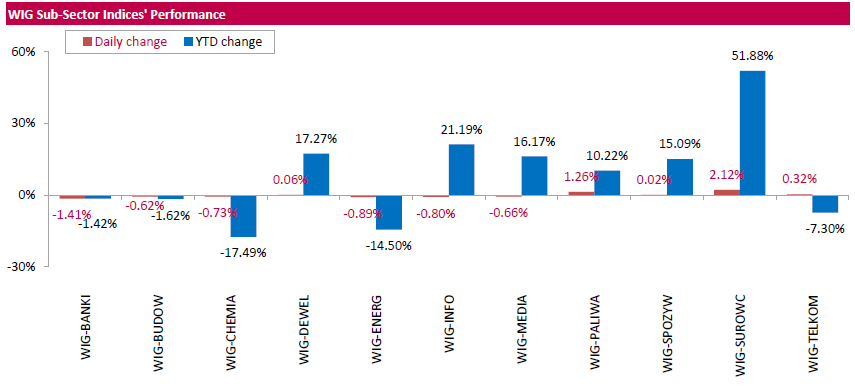

Polish equities closed lower on Wednesday. The broad market benchmark, the WIG Index, lost 0.16%. Sector performance in the WIG Index was mixed. Banking sector (-1.41%) recorded the biggest decline, while materials (+2.12%) fared the best.

The large-cap stocks fell by 0.22%, as measured by the WIG30 Index. Within the index components, banking sector name MBANK (WSE: MBK) was the worst performer, tumbling by 3.37% on the back of weak Q3 earnings results. The bank reported its net profit fell by 28% y/y to PLN 230.5 mln in Q3, but exceeded analysts' consensus estimate of PLN 219.4 mln. Other largest laggards were genco TAURON PE (WSE: TPE) and two other banks PKO BP (WSE: PKO) and MILLENNIUM (WSE: MIL), plunging by 2.67%, 2.40% and 2.22% respectively. On the plus side, coking coal miner JSW (WSE: JSW) topped the list of gainers, rebounding by 5.26% after yesterday's decline. It was followed by oil refiner PKN ORLEN (WSE: PKN), genco ENEA (WSE: ENA) and bank ING BSK (WSE: ING), climbing by 2.44%, 1.59% and 1.41% respectively.

-

15:19

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Wednesday morning. Apple showed weak results weighed on technology stocks and oil prices fell amid worries of oversupply. Shares of the world's most valuable public company (AAPL) fell ~3% - set for their worst day in six months - after the company said sales of its flagship iPhones fell for the third quarter in a row.

Most of Dow stocks in positive area (24 of 30). Top gainer - NIKE, Inc. (NKE, +1.80%). Top loser - Apple Inc. (AAPL, -2.80%).

Almost all S&P sectors also in negative area. Top gainer - Industrial goods (+0.4%). Top loser - Consumer goods (-0.4%).

At the moment:

Dow 18146.00 +49.00 +0.27%

S&P 500 2139.75 +1.75 +0.08%

Nasdaq 100 4879.00 -7.00 -0.14%

Oil 49.98 +0.02 +0.04%

Gold 1269.30 -4.30 -0.34%

U.S. 10yr 1.80 +0.04

-

13:33

U.S. Stocks open: Dow -0.48%, Nasdaq -0.52%, S&P -0.45%

-

13:30

Before the bell: S&P futures -0.36%, NASDAQ futures -0.46%

U.S. stock-index futures fell as Apple (AAPL) added to earnings queasiness.

Global Stocks:

Nikkei 17,391.84 +26.59 +0.15%

Hang Seng 23,325.43 -239.68 -1.02%

Shanghai 3,117.65 -14.29 -0.46%

FTSE 6,944.87 -72.77 -1.04%

CAC 6,944.87 -72.77 -1.04%

DAX 10,673.08 -84.23 -0.78%

Crude $49.14 (-1.64%)

Gold $1271.90 (-0.13%)

-

12:45

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

27.15

-0.14(-0.513%)

2662

Amazon.com Inc., NASDAQ

AMZN

833.7

-1.48(-0.1772%)

8982

American Express Co

AXP

66.62

-0.12(-0.1798%)

201

Apple Inc.

AAPL

114.9

-3.35(-2.833%)

1079431

AT&T Inc

T

36.55

-0.15(-0.4087%)

47779

Barrick Gold Corporation, NYSE

ABX

16.86

-0.03(-0.1776%)

61069

Boeing Co

BA

140.22

1.20(0.8632%)

197098

Caterpillar Inc

CAT

83.95

-0.53(-0.6274%)

1484

Chevron Corp

CVX

100.25

-0.52(-0.516%)

1417

Cisco Systems Inc

CSCO

30.42

0.08(0.2637%)

5175

Citigroup Inc., NYSE

C

49.5

-0.09(-0.1815%)

3400

Exxon Mobil Corp

XOM

86.2

-0.52(-0.5996%)

2033

Facebook, Inc.

FB

833.7

-1.48(-0.1772%)

8982

Ford Motor Co.

F

11.82

-0.03(-0.2532%)

16392

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.41

-0.14(-1.327%)

53185

General Motors Company, NYSE

GM

31.42

-0.18(-0.5696%)

27758

Goldman Sachs

GS

175.03

-0.52(-0.2962%)

400

Google Inc.

GOOG

806

-1.67(-0.2068%)

1116

Home Depot Inc

HD

122.7

-0.64(-0.5189%)

8035

Merck & Co Inc

MRK

62

0.05(0.0807%)

1001

Microsoft Corp

MSFT

60.85

-0.14(-0.2295%)

8426

Procter & Gamble Co

PG

86.7

-0.27(-0.3105%)

671

Starbucks Corporation, NASDAQ

SBUX

53.4

-0.27(-0.5031%)

148

Tesla Motors, Inc., NASDAQ

TSLA

81.69

-0.34(-0.4145%)

516

Twitter, Inc., NYSE

TWTR

17.8

0.54(3.1286%)

474066

Verizon Communications Inc

VZ

47.8

-0.04(-0.0836%)

1037

Visa

V

81.69

-0.34(-0.4145%)

516

Walt Disney Co

DIS

92.16

-0.59(-0.6361%)

432

Yandex N.V., NASDAQ

YNDX

19.7

0.08(0.4078%)

400

-

12:42

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Apple (AAPL) downgraded to Hold from Buy at Stifel; target lowered to $115 from $130

General Motors (GM) downgraded to Neutral from Buy at BofA/Merrill

AT&T (T) downgraded to Equal Weight from Overweight at Barclays

Other:

3M (MMM) target lowered to $155 from $159 at RBC Capital Mkts

Apple (AAPL) reiterated with a Buy rating and price target of $130 at Mizuho

-

11:59

Company News: Boeing (BA) Q3 financials beat analysts’ estimates

Boeing reported Q3 FY 2016 earnings of $3.51 per share (versus $2.52 in Q3 FY 2015), beating analysts' consensus estimate of $2.62.

The company's quarterly revenues amounted to $23.898 bln (-7.5% y/y), beating analysts' consensus estimate of $23.600 bln.

The company also reaffirmed guidance for FY 2016 profit, projecting EPS of $6.10-6.30 versus analysts' consensus estimate of $6.29. At the same time, it increased FY 2016 revenues by $500 mln to $93.5-95.5 bln versus analysts' consensus estimate of $94.04 bln.

BA rose to $140.50 (+1.06%) in pre-market trading.

-

11:20

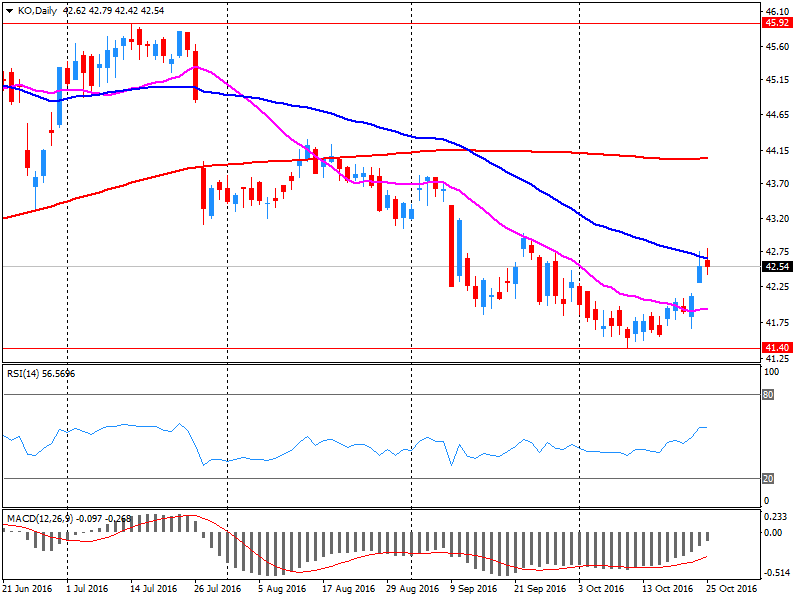

Company News: Coca-Cola (KO) Q3 results beat analysts’ expectations

Coca-Cola reported Q3 FY 2016 earnings of $0.49 per share (versus $0.51 in Q3 FY 2015), beating analysts' consensus estimate of $0.48.

The company's quarterly revenues amounted to $10.633 bln (-6.9% y/y), beating analysts' consensus estimate of $10.525 bln.

The company reaffirmed guidance for FY 2016, projecting EPS of $1.86-1.92 versus analysts' consensus estimate of $1.91.

KO rose to $42.99 (+1.06%) in pre-market trading.

-

11:06

Major stock indices in Europe show moderate losses

European stocks fall amid disappointing corporate reports, as well as the decline in oil prices.

On Tuesday the European market focus remained on corporate reports, with focus on some of the banks.

At the same time on Wednesday, oil prices fell more than 1% to three-week low after the American Petroleum Institute said that US crude stocks rose by 4.8 million barrels for the week ended 21 of October.

US Energy Information Administration to release its weekly report on crude oil inventories today at 14:30 GMT. The data may show growth in US crude inventories by 1.69 million barrels.

Published on Wednesday morning, the data on consumer confidence in Germany pointed to decrease to 9.7 index points, while analysts had expected a pullback to 10 points. This was the lowest value of the consumer confidence index in 4 months.

"Despite the slightly more pessimistic outlook for personal finances, consumers believe that the economic outlook has improved, and the corresponding index rose to a maximum of more than one year", - said Mantas Vanagas, an economist at Daiwa Capital Markets Europe.

Meanwhile, the consumer confidence index in France, compiled by the INSEE statistics agency, in October rose to the highest since 2007. The index reached a level of 98 points, but remains below 100 points, long-term average since 1987.

The composite index of the largest companies in the region Stoxx Europe 600 fell 0,7% - to 340.7 points.

The cost of the British bank Lloyds fell 3,1%. Lloyds has cut profits in the 3rd quarter of 2016 due to new costs for compensation. The bank committed an additional 1 billion pounds ($ 1.2 billion) for payments in this case in the last quarter.

Antofagasta shares fell 7.6%. The mining company has increased its production of copper in the third quarter of this year, but said that on the basis of production, the index is likely to be close to the lower limit of its forecast of 710-740 ths tons.

Anglo American shares fell in price by 2%, BHP Billiton - 1,8%, Rio Tinto - 0.9%.

Shares of oil companies are getting cheaper as BP Plc's share price has fallen to 1,5%, Total SA - 1,3%, Royal Dutch Shell -1.6%.

Shares of Banco Santander rose 1.2%. The Spanish bank, which has the largest market value in the euro area, increased its net profit in the 3rd quarter of this year to 1.7 billion euros compared with 1.68 billion euros a year earlier.

At the moment:

FTSE 6959.18 -58.46 -0.83%

DAX 10657.13 -100.18 -0.93%

CAC 4508.34 -32.50 -0.72%

-

06:43

Mixed start expected on the major stock exchanges in Europe: DAX futures + 0.2%, CAC40 -0.2%, FTSE -0.2%

-

04:43

Global Stocks

European stocks lost ground Tuesday as big decliners such as Italian banks and Swiss chip maker AMS AG offset an encouraging reading on German business sentiment. Italian banks also were among the big losers, as Banca Monte dei Paschi di Siena SpA said it would cut 2,600 jobs, shutter 500 branches and shed businesses as part of a make-or-break effort to persuade skeptical investors to buy into a big capital increase.

U.S. stocks finished lower on Tuesday, giving back some of the previous day's advance as worries about a lackluster spate of earnings and a slip in a reading of consumer confidence weighed on market sentiment. A drop in the price of oil below $50 a barrel, lingering uncertainty about the U.S. presidential election and growing expectations of a rate increase by the Federal Reserve, also contributed to the downbeat mood.

Shares in Asia were broadly lower early Wednesday, tracking declines on Wall Street after a spate of disappointing earnings reports and weaker-than-expected economic data. Australia's third quarter consumer price index, released early Wednesday, rose 0.7% from the second quarter, beating expectations of a 0.5% gain. Year-over-year, the nation's third-quarter CPI increased 1.3%, exceeding a consensus forecast of a 1.1% gain. The Australian currency gained 0.6% against the U.S. dollar following the data release, weighing on exporters, among others.

-