Market news

-

22:28

Currencies. Daily history for Oct 26’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0906 +0,17%

GBP/USD $1,2236 +0,46%

USD/CHF Chf0,9934 -0,07%

USD/JPY Y104,47 +0,26%

EUR/JPY Y113,95 +0,44%

GBP/JPY Y127,82 +0,70%

AUD/USD $0,7642 -0,01%

NZD/USD $0,7147 -0,20%

USD/CAD C$1,3376 +0,16%

-

22:00

Schedule for today, Thursday, Oct 27’2016

00:30 Australia Export Price Index, q/q Quarter III 1.4%

00:30 Australia Import Price Index, q/q Quarter III -1%

06:00 Switzerland UBS Consumption Indicator September 1.53

08:00 Eurozone M3 money supply, adjusted y/y September 5.1% 5.1%

08:00 Eurozone Private Loans, Y/Y September 1.8%

08:30 United Kingdom GDP, q/q (Preliminary) Quarter III 0.7% 0.3%

08:30 United Kingdom GDP, y/y (Preliminary) Quarter III 2.1% 2.1%

12:30 U.S. Continuing Jobless Claims 2057 2068

12:30 U.S. Durable Goods Orders September 0.0% 0.1%

12:30 U.S. Durable Goods Orders ex Transportation September -0.4% 0.2%

12:30 U.S. Durable goods orders ex defense September -1%

12:30 U.S. Initial Jobless Claims 260 255

13:00 U.S. Pending Home Sales (MoM) September -2.4% 1.2%

23:30 Japan Household spending Y/Y September -4.6% -3%

23:30 Japan Tokyo Consumer Price Index, y/y October -0.5%

23:30 Japan Tokyo CPI ex Fresh Food, y/y October -0.5% -0.5%

23:30 Japan Unemployment Rate September 3.1% 3.1%

23:30 Japan National Consumer Price Index, y/y September -0.5% -0.5%

23:30 Japan National CPI Ex-Fresh Food, y/y September -0.5% -0.5%

-

21:45

New Zealand: Trade Balance, mln, September -1436 (forecast -1125)

-

14:34

US crude and gasoline inventories decline more than expected, USD/CAD moves down

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 0.6 million barrels from the previous week. At 468.2 million barrels, U.S. crude oil inventories are near the upper limit of the average range for this time of year.

Total motor gasoline inventories decreased by 2.0 million barrels last week, but are well above the upper limit of the average range. Both finished gasoline inventories and blending components inventories decreased last week.

Distillate fuel inventories decreased by 3.4 million barrels last week but are above the upper limit of the average range for this time of year. Propane/propylene inventories fell 2.1 million barrels last week but are near the upper limit of the average range. Total commercial petroleum inventories decreased by 8.7 million barrels last week.

-

14:30

U.S.: Crude Oil Inventories, October -0.553 (forecast 1)

-

14:06

US new home sales up slightly in September

Sales of new single-family houses in September 2016 were at a seasonally adjusted annual rate of 593,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 3.1 percent (±16.2%) above the revised August rate of 575,000 and is 29.8 percent (±23.4%) above the September 2015 estimate of 457,000.

The median sales price of new houses sold in September 2016 was $313,500; the average sales price was $377,700. The seasonally adjusted estimate of new houses for sale at the end of September was 235,000. This represents a supply of 4.8 months at the current sales rate.

-

14:00

Marked improvement in growth momentum across the U.S. service sector - Markit

October data pointed to a marked improvement in growth momentum across the U.S. service sector. Business activity and incoming new work both expanded at the fastest pace for 11 months.

The latest survey also revealed an upturn in confidence towards the year-ahead business outlook, with service providers reporting the strongest optimism since August 2015. Input cost pressures meanwhile picked up from the 19-month low recorded in September, which contributed to a slightly faster rise in prices charged by service sector companies during October.

At 54.8, up from 52.3 in September, the seasonally adjusted Markit Flash U.S. Services PMI™ Business Activity Index1 signalled a robust expansion of service sector output in October. The latest reading was the highest since November 2015 and contrasted with the subdued growth patterns seen through the third quarter of 2016 (index at 51.5 on average).

-

14:00

U.S.: New Home Sales, September 593 (forecast 600)

-

13:49

ECB almost certain to keep buying bonds beyond march, adjust programme rules- central bank sources

-

13:45

U.S.: Services PMI, October 54.8 (forecast 52.3)

-

13:30

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0750 (EUR 802m) 1.0800 (306m) 1.0885-90 (514m) 1.0900 (543m) 1.0950 (797m) 1.1045-55 (800m)

USD/JPY 103.00 (USD 550m)

EUR/JPY: 113.75 (EUR 258m) 114.75 (224m)

EUR/GBP 0.8855 (EUR 381m)

AUD/USD 0.7500 (AUD 305m) 0.7550 (403m) 0.7600 (406m) 0.7650-55 (358m) 0.7725 (237m) 0.7750 (465m) 0.7780 (476m)

USD/CAD: 1.3175 (USD 401m) 1.3250 (450m)

-

12:41

US goods trade balance deficit improves but inventories increased

The international trade deficit was $56.1 billion in September, down $3.1 billion from $59.1 billion in August. Exports of goods for September were $125.6 billion, $1.1 billion more than August exports. Imports of goods for September were $181.7 billion, $2.0 billion less than August imports.

Advance Wholesale Inventories Wholesale inventories for September, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $590.7 billion, up 0.2 percent (±0.4 percent)* from August 2016, and virtually unchanged (±1.9 percent)* from September 2015. The July 2016 to August 2016 percentage change was revised from down 0.2 percent (±0.4 percent)* to down 0.1 percent (±0.4 percent).

-

12:30

U.S.: Goods Trade Balance, $ bln., September -56.08 (forecast -60.6)

-

12:18

European session review: the US dollar weakened

The following data was published:

(Time / country / index / period / previous value / forecast)

6:00 Germany consumer confidence index from the GfK November 10 10 9.7

8:30 UK approved applications for mortgage loans on the BBA figures, th. September 36.97 37.3 38.3

"We have seen a fairly sharp rise in the dollar, so there is nothing surprising in a turn", - says Simon Smith, chief economist at FXPro.

According to him, the focus shifted to the prospects for interest rates in 2017, which implies limited potential for the growth of the dollar due to skepticism about the likelihood of further rate hikes. The dollar index fell 0.25%.

Yesterday ECB President Draghi defended the ongoing monetary policy, saying that the extremely low interest rates did not cause harm to consumers in Germany. According to him, the ECB will pursue this policy until inflation reaches the target level. This announcement will strengthen expectations that ECB will extend the asset purchase program.

Published on Wednesday morning, the data on consumer confidence in Germany pointed to decrease to 9.7 index points, while analysts had expected a pullback to 10 points. This was the lowest value of the consumer confidence index in 4 months.

"Despite the slightly more pessimistic outlook for personal finances, consumers believe that the economic outlook has improved, and the corresponding index rose to a maximum of more than one year", - said Mantas Vanagas, an economist at Daiwa Capital Markets Europe.

Meanwhile, the consumer confidence index in France, compiled by the INSEE statistics agency, in October rose to the highest since 2007. The index reached a level of 98 points, but remains below 100 points, long-term average since 1987.

The head of the Bank of England Governor Mark Carney said that there are limits to monetary policy, and that monetary policy was overly burdened in recent years. Carney noted that the bank's obligations are very clear regarding the inflation rate, and that the bank will use all the tools at its disposal to achieve the inflation target. The comments supported the pound.

EUR / USD: during the European session, the pair rose to $ 1.0934

GBP / USD: during the European session, the pair rose to $ 1.2226

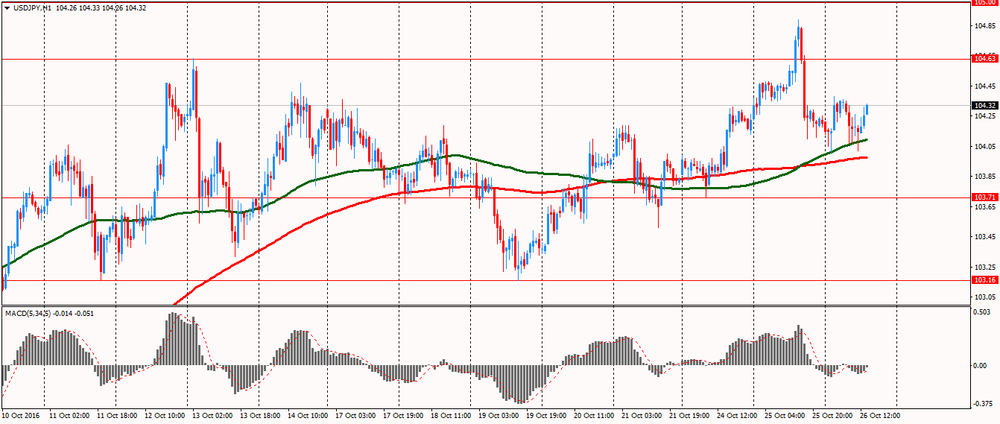

USD / JPY: during the European session, the pair fell to Y104.02

-

11:48

Orders

EUR/USD

Offers : 1.0915 1.0930 1.0950 1.0980 1.1000 1.1030 1.1050

Bids : 1.0875-80 1.0850 1.0825-30 1.0800 1.0785 1.0750 1.0700

GBP/USD

Offers : 1.2200 1.2230 1.2250 1.2280 1.2300 1.2325-30 1.2350

Bids : 1.2150 1.2130 1.2100 1.2080-85 1.2050 1.2000

EUR/GBP

Offers : 0.8965 0.8980 0.9000 0.9025-30 0.9050

Bids : 0.8935 0.8920 0.8900 0.8880-85 0.8870 0.8850-55

EUR/JPY

Offers : 113.85 114.00 114.20114.70-75 115.00

Bids : 113.25-30 113.00 112.85 112.60 112.00 111.85 111.50 111.00

USD/JPY

Offers : 104.45-55 104.80 105.00 105.30 105.50 106.00

Bids : 104.00 103.80-85 103.50 103.20-25 103.00 102.85 102.50

AUD/USD

Offers : 0.7700 0.7710 0.7730-35 0.7750 0.7780 0.7800

Bids : 0.7650-55 0.7630 0.7600 0.7580 0.7555-60 0.7500

-

11:09

Trump Has 2-Point Edge in Bloomberg Politics Poll of Florida

-

09:56

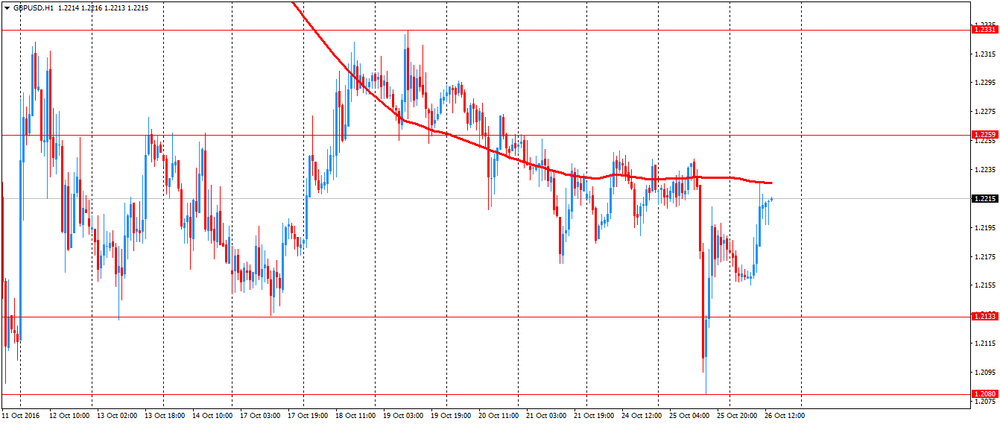

GBP: Looks 'Cheap' But The Lows Are Not In Yet; Where To Target? - Citi

"The fundamentals arguably haven't changed but the price has. This makes GBP look cheap - but we're not certain the lows are in.

Updating our model from 'GBP not objectively very cheap', GBP is now trading more cheaply vs major currencies on WERM than it ever has been (Figure 2). On PPP there is still 5-10% to reach the 'lows'.

The problem for the UK is that its need for foreign capital falls very little with a weaker currency. In fact, if yields on primary income didn't change at all, extrapolating previous sensitivities, the CA deficit would widen on lower FX. The drag cannot be solved without a weaker economy - restraining imports and direct investment income outflows.

Domestic yields have retraced, increasing the primary income burden on the margin and at a higher level of fixed income volatility. Firming up the financial account by introducing more favorable policies for foreign direct investment and/or minimizing FX + bond volatility appear key to finding a GBP base.

We target GBPUSD at 1.15 by the end of the year".

Copyright © 2016 CitiFX, eFXnews™

-

09:02

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0750 (EUR 802m) 1.0800 (306m) 1.0885-90 (514m) 1.0900 (543m) 1.0950 (797m) 1.1045-55 (800m)

USD/JPY 103.00 (USD 550m)

EUR/JPY: 113.75 (EUR 258m) 114.75 (224m)

EUR/GBP 0.8855 (EUR 381m)

AUD/USD 0.7500 (AUD 305m) 0.7550 (403m) 0.7600 (406m) 0.7650-55 (358m) 0.7725 (237m) 0.7750 (465m) 0.7780 (476m)

USD/CAD: 1.3175 (USD 401m) 1.3250 (450m)

-

08:45

UK Consumer Credit is growing at its fastest rate since December 2006

Dr Rebecca Harding, BBA Chief Economist, said:

"Consumer credit is growing at its fastest rate since December 2006, driven by strong demand for personal loans and credit cards. Consumers are increasingly using short-term borrowing to take advantage of record low interest rates. This trend has accelerated since the Bank of England cut rates in August.

"Mortgage approvals picked up slightly this month but the housing market continues to shows signs of underlying weakness. Both house purchase and remortgaging approvals are down on the corresponding figures for 2015.

"Business borrowing decreased slightly again in September, which may be in part down to uncertainty following the EU referendum. There is a longer time lag behind corporate investment decisions so it may take longer for the effect of the interest rate cut to filter through to such borrowing."

-

08:30

United Kingdom: BBA Mortgage Approvals, September 38.3 (forecast 37.3)

-

08:08

Italian retail trade decreased by 0.1% m/m

In August 2016 the seasonally adjusted retail trade index decreased by 0.1% with respect to July 2016 (-0.8% for food goods and +0.3% for non-food goods). The average of the last three months increased with respect to the previous three months (+0.2%). The unadjusted index decreased by 0.2% with respect to August 2015.

-

08:00

China has no need to fake steady GDP growth - Xinhua

-

07:36

Major stock markets trading in the red zone: FTSE -0.3%, DAX -0.3%, CAC40 -0.4%, FTMIB -0.1%, IBEX flat

-

07:34

Today’s events

-

At 17:30 GMT the US will publish data on crude oil inventories from the Department of Energy

-

At 21:30 GMT Bank of England Deputy Governor Sam Woods will deliver a speech

-

-

06:28

Options levels on wednesday, October 26, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1109 (2910)

$1.1026 (1939)

$1.0968 (972)

Price at time of writing this review: $1.0893

Support levels (open interest**, contracts):

$1.0815 (2184)

$1.0778 (4545)

$1.0737 (2933)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 42725 contracts, with the maximum number of contracts with strike price $1,1300 (3754);

- Overall open interest on the PUT options with the expiration date November, 4 is 46220 contracts, with the maximum number of contracts with strike price $1,1000 (7358);

- The ratio of PUT/CALL was 1.08 versus 1.10 from the previous trading day according to data from October, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.2403 (1165)

$1.2306 (1606)

$1.2210 (659)

Price at time of writing this review: $1.2168

Support levels (open interest**, contracts):

$1.2094 (1455)

$1.1996 (928)

$1.1898 (584)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 32268 contracts, with the maximum number of contracts with strike price $1,2800 (1973);

- Overall open interest on the PUT options with the expiration date November, 4 is 31298 contracts, with the maximum number of contracts with strike price $1,2300 (1858);

- The ratio of PUT/CALL was 0.97 versus 0.98 from the previous trading day according to data from October, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:22

Fade USD/CAD Into 1.34; Look To Buy EUR/USD Near 1.08 - TD

"The USDCAD thrill ride persists. Notably, we are now back above 1.33 following the overnight dip to a low near 1.3280.

We still see scope for continued CAD underperformance given the BoC rate cut theme has further room to run. The shift in rate differentials has seen our USDCAD equation inch higher, suggesting it is slightly overvalued. We see strong resistance ahead of 1.34 (upper end of our valuation band) so would look to fade there. Consistent with the weaker CAD theme in the majors we also like EURCAD higher.

Market positioning has seen a notable shift over the past few months. The USD is now flat after reaching record shorts earlier in the year. This change in positioning reflects in markets focus on December rate hike, diminished political uncertainty in the US (and possible fiscal support) and a potential drop in FX reserves from countries like China that have recently seen a drop in reserve flows. The latter could reflect a drawdown in other major currencies for the greenback.

...We think this leaves the USD confined to its recent range but are cautious about chasing the rally at current levels. Our highfrequency models favor some upside in European currencies as both SEK and GBP look cheap.

We also like to think there is value in long EUR positions near 1.08".

Copyright © 2016 TD Securities, eFXnews™

-

06:20

Mohamed El-Erian: the next few months are crucial for the UK

World famous analyst and former head of the investment fund PIMCO Mohamed El-Erian, speaking at a conference organized by Bloomberg said that the next few months will be very important and critical to the UK. "If politicians behave unprofessionally, instead of a small slowdown in the economy, Britain can enter recession,". El-Erian called the 65% probability of preserving financial stability in the UK, however, noted that it is very fragile.

-

06:17

Australian Dollar up as Robust 3Q Inflation Cools Rate-Cut Talk

-

06:13

German Consumer Sentiment mixed

Consumer sentiment has not followed a uniform trend in October. While economic prospects are improving again after three successive falls, both income expectations and propensity to buy have declined.

The overall consumer confidence indicator forecasts 9.7 points for November, after a figure of 10.0 points in October. Hence, the indicator has fallen below the ten-point mark for the first time since June 2016.

This month, consumer sentiment is currently rather mixed. While their view of overall economic prospects has become more positive for the first time in four months, consumers have become less optimistic in terms of both income prospects and propensity to buy. Consequently, consumer confidence has deteriorated, falling below the ten-point mark.

-

06:11

German import and export prices stable in September

As reported by the Federal Statistical Office (Destatis), the index of import prices decreased by 1.8% in September 2016 compared with the corresponding month of the preceding year. In August and in July 2016 the annual rates of change were -2.6% and -3.8%, respectively.

From August to September 2016 the index rose slightly by 0.1%.

The index of import prices, excluding crude oil and mineral oil products, decreased by 1.4% compared with the level of a year earlier.

The index of export prices decreased by 0.6% in September 2016 compared with the corresponding month of the preceding year. In August and in July 2016 the annual rates of change were -0.9% and -1.2%, respectively. From August to September 2016 the export price index did not change.

-

06:10

AUD supported by better than expected Australian inflation

Consumer prices in Australia were up 1.3 percent on year in the third quarter of 2016, the Australian Bureau of Statistics said on Wednesday.

That exceeded forecasts for 1.1 percent following the 1.0 percent increase in the previous three months.

On a quarterly basis, inflation jumped 0.7 percent versus forecasts for 0.5 percent and up from 0.4 percent in the three months prior.

The Reserve Bank of Australia's trimmed mean was up 0.4 percent on quarter and 1.7 percent on year, while the weighted median added 0.3 percent on quarter and 1.3 percent on year.

-

06:00

Germany: Gfk Consumer Confidence Survey, November 9.7 (forecast 10)

-

00:31

Australia: CPI, y/y, Quarter III 1.3% (forecast 1.1%)

-

00:31

Australia: Trimmed Mean CPI q/q, Quarter III 0.4% (forecast 0.4%)

-

00:31

Australia: Trimmed Mean CPI y/y, Quarter III 1.7% (forecast 1.7%)

-

00:30

Australia: CPI, q/q, Quarter III 0.7% (forecast 0.5%)

-