Market news

-

22:29

Commodities. Daily history for Oct 26’2016:

(raw materials / closing price /% change)

Oil 49.23 +0.10%

Gold 1,267.50 +0.07%

-

22:28

Stocks. Daily history for Oct 26’2016:

(index / closing price / change items /% change)

Nikkei 225 17,391.84 0.00 0.00%

Shanghai Composite 3,117.65 -14.29 -0.46%

S&P/ASX 200 5,359.80 -83.03 -1.53%

FTSE 100 6,958.09 -59.55 -0.85%

CAC 40 4,534.59 -6.25 -0.14%

Xetra DAX 10,709.68 -47.63 -0.44%

S&P 500 2,139.43 -3.73 -0.17%

Dow Jones Industrial Average 18,199.33 +30.06 +0.17%

S&P/TSX Composite 14,807.56 -63.07 -0.42%

-

22:28

Currencies. Daily history for Oct 26’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0906 +0,17%

GBP/USD $1,2236 +0,46%

USD/CHF Chf0,9934 -0,07%

USD/JPY Y104,47 +0,26%

EUR/JPY Y113,95 +0,44%

GBP/JPY Y127,82 +0,70%

AUD/USD $0,7642 -0,01%

NZD/USD $0,7147 -0,20%

USD/CAD C$1,3376 +0,16%

-

22:00

Schedule for today, Thursday, Oct 27’2016

00:30 Australia Export Price Index, q/q Quarter III 1.4%

00:30 Australia Import Price Index, q/q Quarter III -1%

06:00 Switzerland UBS Consumption Indicator September 1.53

08:00 Eurozone M3 money supply, adjusted y/y September 5.1% 5.1%

08:00 Eurozone Private Loans, Y/Y September 1.8%

08:30 United Kingdom GDP, q/q (Preliminary) Quarter III 0.7% 0.3%

08:30 United Kingdom GDP, y/y (Preliminary) Quarter III 2.1% 2.1%

12:30 U.S. Continuing Jobless Claims 2057 2068

12:30 U.S. Durable Goods Orders September 0.0% 0.1%

12:30 U.S. Durable Goods Orders ex Transportation September -0.4% 0.2%

12:30 U.S. Durable goods orders ex defense September -1%

12:30 U.S. Initial Jobless Claims 260 255

13:00 U.S. Pending Home Sales (MoM) September -2.4% 1.2%

23:30 Japan Household spending Y/Y September -4.6% -3%

23:30 Japan Tokyo Consumer Price Index, y/y October -0.5%

23:30 Japan Tokyo CPI ex Fresh Food, y/y October -0.5% -0.5%

23:30 Japan Unemployment Rate September 3.1% 3.1%

23:30 Japan National Consumer Price Index, y/y September -0.5% -0.5%

23:30 Japan National CPI Ex-Fresh Food, y/y September -0.5% -0.5%

-

21:45

New Zealand: Trade Balance, mln, September -1436 (forecast -1125)

-

20:09

Major US stock indexes finished trading in different directions

Major US stock indexes mostly fell, being under the pressure of weak quarterly results of Apple. For example, shares the most valuable public company in the world (AAPL) lost about 2.3% after the company said that sales of its flagship iPhones fell the third consecutive quarter.

In addition, as it became known today, sales of new single-family homes in the US rose in September, pointing to a steady demand for housing, despite the fact that the data for August were revised sharply downwards. The Commerce Department reported Wednesday that new construction sales increased by 3.1% to a seasonally adjusted annual rate of up to 593,000 units last month, bringing them close to a nine-year high reached in July.

However, preliminary data provided by Markit Economics, showed that activity in the US service sector continued to expand in August, and reached its highest level since November 2015. Purchasing Managers Index (PMI) for the services sector in October was 54.8 points compared with 52.3 points in the previous month. Recall, reading above 50 indicates expansion of activity in the sector. Economists had expected the figure will be 52.3 points.

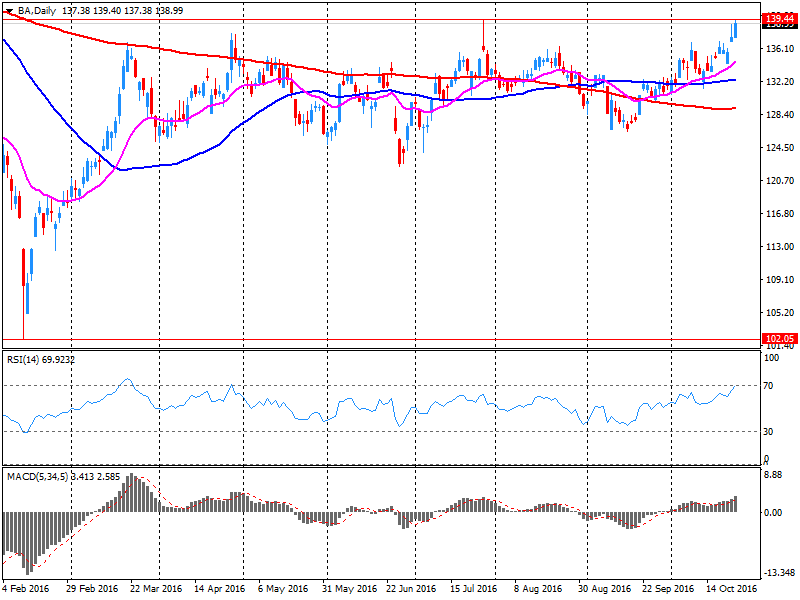

The focus of investors were also the shares of Coca-Cola (KO) and Boeing (BA). Both companies reported better than expected.

DOW index components showed mixed performance (14 red, 16 black). More rest up shares The Boeing Company (BA, + 4.96%). Outsiders were shares of Apple Inc. (AAPL, -2.34%).

Most of the S & P sectors closed in the red. The leader turned out to be the industrial goods sector (+ 0.6%). conglomerates (-1.0%) sectors fell most.

At the close:

Dow + 0.17% 18,199.47 +30.20

Nasdaq -0.63% 5,250.27 -33.13

S & P -0.17% 2,139.44 -3.72

-

19:00

Dow +0.13% 18,192.79 +23.52 Nasdaq -0.66% 5,248.66 -34.74 S&P -0.25% 2,137.74 -5.42

-

16:00

European stocks closed: FTSE 100 -59.55 6958.09 -0.85% DAX -47.63 10709.68 -0.44% CAC 40 -6.25 4534.59 -0.14%

-

15:47

Oil rose amid a decline in US crude stocks

Oil prices rose markedly, returning to positive territory, aided by the official statistics on petroleum products in the US.. Support for oil was also a weakening US currency.

US Department of Energy reported that in the week from 14 to 21 October crude oil inventories fell by 553,000 barrels, while expected to grow by 1 mln barrels. Thus, oil reserves have shown reductions in seven of the last eight weeks. Oil reserves in Cushing terminal fell by 1.3 million barrels to 58.4 million barrels. Gasoline stocks fell by 2 million barrels to 226 million barrels. Analysts had expected a decline of only 600,000 barrels. Distillate stocks fell 3.4 million barrels to 152.4 million barrels, while analysts had expected a decline of 900,000 barrels. The utilization of refining capacity increased by 0.6% to 85.6%. Analysts suggested that the figure will rise to 0.7%. Meanwhile, oil production in the US rose to 8.504 million barrels per day versus 8.464 million barrels per day in the previous week.

"Traders were forced to close some short positions, however, do not expect a strong rise in prices. Investors want to understand whether the stock drop is only a one-off or it indicates improvement in the demand pattern..", - Gene McGillian said Tradition Energy.

The cost of the December futures on US light crude oil WTI (Light Sweet Crude Oil) rose to 49.72 dollars per barrel on the New York Mercantile Exchange.

December futures price for Brent crude rose to 50.40 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

15:36

WSE: Session Results

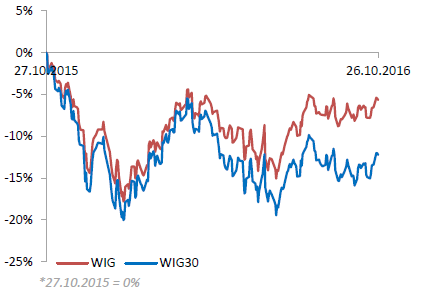

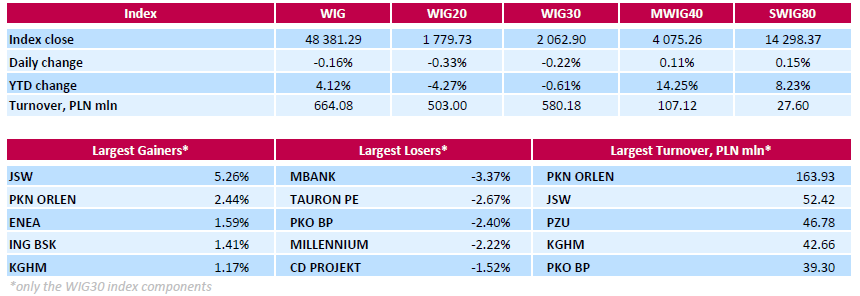

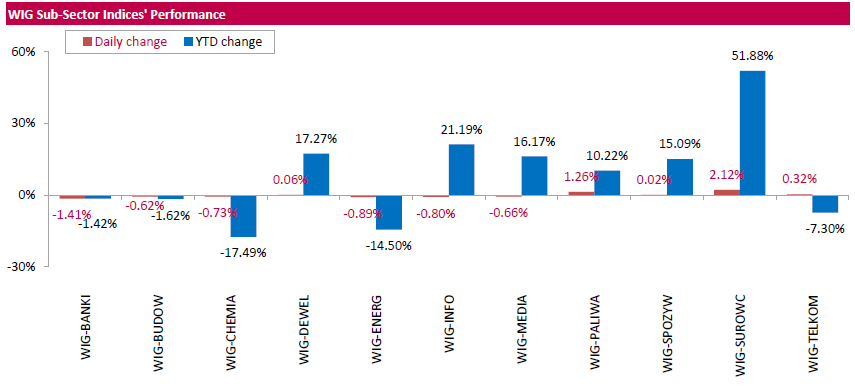

Polish equities closed lower on Wednesday. The broad market benchmark, the WIG Index, lost 0.16%. Sector performance in the WIG Index was mixed. Banking sector (-1.41%) recorded the biggest decline, while materials (+2.12%) fared the best.

The large-cap stocks fell by 0.22%, as measured by the WIG30 Index. Within the index components, banking sector name MBANK (WSE: MBK) was the worst performer, tumbling by 3.37% on the back of weak Q3 earnings results. The bank reported its net profit fell by 28% y/y to PLN 230.5 mln in Q3, but exceeded analysts' consensus estimate of PLN 219.4 mln. Other largest laggards were genco TAURON PE (WSE: TPE) and two other banks PKO BP (WSE: PKO) and MILLENNIUM (WSE: MIL), plunging by 2.67%, 2.40% and 2.22% respectively. On the plus side, coking coal miner JSW (WSE: JSW) topped the list of gainers, rebounding by 5.26% after yesterday's decline. It was followed by oil refiner PKN ORLEN (WSE: PKN), genco ENEA (WSE: ENA) and bank ING BSK (WSE: ING), climbing by 2.44%, 1.59% and 1.41% respectively.

-

15:24

Gold traded moderately lower

Gold futures fell moderately, retreating from a 3-week high. The pressure on the precious metal had prospect of a Fed hike by the end of this year. However, the decline in world stock markets restrains the further drop in prices.

"We believe that gold will be hard to resist double" headwind ", namely the strengthening of the dollar and the Fed raising interest rates", - said Edward Meir, INTL FCStone.

The US Dollar Index, showing the US dollar against a basket of six major currencies, was trading lower by 0.15%. Since early October, the index increased by 3.3%. Since gold prices are tied to the dollar, a stronger dollar makes the precious metal more expensive for holders of foreign currencies.

Some support for gold gave an increase in physical demand on the eve of the Hindu festivals. At the end of the week India will celebrate the most important Hindu festival, Diwali. During this, gold is traditionally presented as a gift. In addition, analysts have noted that there are signs of strengthening demand from China - government data indicate that up to 2020 the import of gold into the country is likely to grow.

The cost of December futures for gold on the COMEX fell to $ 1269.5 per ounce.

-

15:19

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Wednesday morning. Apple showed weak results weighed on technology stocks and oil prices fell amid worries of oversupply. Shares of the world's most valuable public company (AAPL) fell ~3% - set for their worst day in six months - after the company said sales of its flagship iPhones fell for the third quarter in a row.

Most of Dow stocks in positive area (24 of 30). Top gainer - NIKE, Inc. (NKE, +1.80%). Top loser - Apple Inc. (AAPL, -2.80%).

Almost all S&P sectors also in negative area. Top gainer - Industrial goods (+0.4%). Top loser - Consumer goods (-0.4%).

At the moment:

Dow 18146.00 +49.00 +0.27%

S&P 500 2139.75 +1.75 +0.08%

Nasdaq 100 4879.00 -7.00 -0.14%

Oil 49.98 +0.02 +0.04%

Gold 1269.30 -4.30 -0.34%

U.S. 10yr 1.80 +0.04

-

14:34

US crude and gasoline inventories decline more than expected, USD/CAD moves down

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 0.6 million barrels from the previous week. At 468.2 million barrels, U.S. crude oil inventories are near the upper limit of the average range for this time of year.

Total motor gasoline inventories decreased by 2.0 million barrels last week, but are well above the upper limit of the average range. Both finished gasoline inventories and blending components inventories decreased last week.

Distillate fuel inventories decreased by 3.4 million barrels last week but are above the upper limit of the average range for this time of year. Propane/propylene inventories fell 2.1 million barrels last week but are near the upper limit of the average range. Total commercial petroleum inventories decreased by 8.7 million barrels last week.

-

14:30

U.S.: Crude Oil Inventories, October -0.553 (forecast 1)

-

14:06

US new home sales up slightly in September

Sales of new single-family houses in September 2016 were at a seasonally adjusted annual rate of 593,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 3.1 percent (±16.2%) above the revised August rate of 575,000 and is 29.8 percent (±23.4%) above the September 2015 estimate of 457,000.

The median sales price of new houses sold in September 2016 was $313,500; the average sales price was $377,700. The seasonally adjusted estimate of new houses for sale at the end of September was 235,000. This represents a supply of 4.8 months at the current sales rate.

-

14:00

Marked improvement in growth momentum across the U.S. service sector - Markit

October data pointed to a marked improvement in growth momentum across the U.S. service sector. Business activity and incoming new work both expanded at the fastest pace for 11 months.

The latest survey also revealed an upturn in confidence towards the year-ahead business outlook, with service providers reporting the strongest optimism since August 2015. Input cost pressures meanwhile picked up from the 19-month low recorded in September, which contributed to a slightly faster rise in prices charged by service sector companies during October.

At 54.8, up from 52.3 in September, the seasonally adjusted Markit Flash U.S. Services PMI™ Business Activity Index1 signalled a robust expansion of service sector output in October. The latest reading was the highest since November 2015 and contrasted with the subdued growth patterns seen through the third quarter of 2016 (index at 51.5 on average).

-

14:00

U.S.: New Home Sales, September 593 (forecast 600)

-

13:49

ECB almost certain to keep buying bonds beyond march, adjust programme rules- central bank sources

-

13:45

U.S.: Services PMI, October 54.8 (forecast 52.3)

-

13:33

U.S. Stocks open: Dow -0.48%, Nasdaq -0.52%, S&P -0.45%

-

13:30

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0750 (EUR 802m) 1.0800 (306m) 1.0885-90 (514m) 1.0900 (543m) 1.0950 (797m) 1.1045-55 (800m)

USD/JPY 103.00 (USD 550m)

EUR/JPY: 113.75 (EUR 258m) 114.75 (224m)

EUR/GBP 0.8855 (EUR 381m)

AUD/USD 0.7500 (AUD 305m) 0.7550 (403m) 0.7600 (406m) 0.7650-55 (358m) 0.7725 (237m) 0.7750 (465m) 0.7780 (476m)

USD/CAD: 1.3175 (USD 401m) 1.3250 (450m)

-

13:30

Before the bell: S&P futures -0.36%, NASDAQ futures -0.46%

U.S. stock-index futures fell as Apple (AAPL) added to earnings queasiness.

Global Stocks:

Nikkei 17,391.84 +26.59 +0.15%

Hang Seng 23,325.43 -239.68 -1.02%

Shanghai 3,117.65 -14.29 -0.46%

FTSE 6,944.87 -72.77 -1.04%

CAC 6,944.87 -72.77 -1.04%

DAX 10,673.08 -84.23 -0.78%

Crude $49.14 (-1.64%)

Gold $1271.90 (-0.13%)

-

12:45

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

27.15

-0.14(-0.513%)

2662

Amazon.com Inc., NASDAQ

AMZN

833.7

-1.48(-0.1772%)

8982

American Express Co

AXP

66.62

-0.12(-0.1798%)

201

Apple Inc.

AAPL

114.9

-3.35(-2.833%)

1079431

AT&T Inc

T

36.55

-0.15(-0.4087%)

47779

Barrick Gold Corporation, NYSE

ABX

16.86

-0.03(-0.1776%)

61069

Boeing Co

BA

140.22

1.20(0.8632%)

197098

Caterpillar Inc

CAT

83.95

-0.53(-0.6274%)

1484

Chevron Corp

CVX

100.25

-0.52(-0.516%)

1417

Cisco Systems Inc

CSCO

30.42

0.08(0.2637%)

5175

Citigroup Inc., NYSE

C

49.5

-0.09(-0.1815%)

3400

Exxon Mobil Corp

XOM

86.2

-0.52(-0.5996%)

2033

Facebook, Inc.

FB

833.7

-1.48(-0.1772%)

8982

Ford Motor Co.

F

11.82

-0.03(-0.2532%)

16392

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.41

-0.14(-1.327%)

53185

General Motors Company, NYSE

GM

31.42

-0.18(-0.5696%)

27758

Goldman Sachs

GS

175.03

-0.52(-0.2962%)

400

Google Inc.

GOOG

806

-1.67(-0.2068%)

1116

Home Depot Inc

HD

122.7

-0.64(-0.5189%)

8035

Merck & Co Inc

MRK

62

0.05(0.0807%)

1001

Microsoft Corp

MSFT

60.85

-0.14(-0.2295%)

8426

Procter & Gamble Co

PG

86.7

-0.27(-0.3105%)

671

Starbucks Corporation, NASDAQ

SBUX

53.4

-0.27(-0.5031%)

148

Tesla Motors, Inc., NASDAQ

TSLA

81.69

-0.34(-0.4145%)

516

Twitter, Inc., NYSE

TWTR

17.8

0.54(3.1286%)

474066

Verizon Communications Inc

VZ

47.8

-0.04(-0.0836%)

1037

Visa

V

81.69

-0.34(-0.4145%)

516

Walt Disney Co

DIS

92.16

-0.59(-0.6361%)

432

Yandex N.V., NASDAQ

YNDX

19.7

0.08(0.4078%)

400

-

12:42

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Apple (AAPL) downgraded to Hold from Buy at Stifel; target lowered to $115 from $130

General Motors (GM) downgraded to Neutral from Buy at BofA/Merrill

AT&T (T) downgraded to Equal Weight from Overweight at Barclays

Other:

3M (MMM) target lowered to $155 from $159 at RBC Capital Mkts

Apple (AAPL) reiterated with a Buy rating and price target of $130 at Mizuho

-

12:41

US goods trade balance deficit improves but inventories increased

The international trade deficit was $56.1 billion in September, down $3.1 billion from $59.1 billion in August. Exports of goods for September were $125.6 billion, $1.1 billion more than August exports. Imports of goods for September were $181.7 billion, $2.0 billion less than August imports.

Advance Wholesale Inventories Wholesale inventories for September, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $590.7 billion, up 0.2 percent (±0.4 percent)* from August 2016, and virtually unchanged (±1.9 percent)* from September 2015. The July 2016 to August 2016 percentage change was revised from down 0.2 percent (±0.4 percent)* to down 0.1 percent (±0.4 percent).

-

12:30

U.S.: Goods Trade Balance, $ bln., September -56.08 (forecast -60.6)

-

12:18

European session review: the US dollar weakened

The following data was published:

(Time / country / index / period / previous value / forecast)

6:00 Germany consumer confidence index from the GfK November 10 10 9.7

8:30 UK approved applications for mortgage loans on the BBA figures, th. September 36.97 37.3 38.3

"We have seen a fairly sharp rise in the dollar, so there is nothing surprising in a turn", - says Simon Smith, chief economist at FXPro.

According to him, the focus shifted to the prospects for interest rates in 2017, which implies limited potential for the growth of the dollar due to skepticism about the likelihood of further rate hikes. The dollar index fell 0.25%.

Yesterday ECB President Draghi defended the ongoing monetary policy, saying that the extremely low interest rates did not cause harm to consumers in Germany. According to him, the ECB will pursue this policy until inflation reaches the target level. This announcement will strengthen expectations that ECB will extend the asset purchase program.

Published on Wednesday morning, the data on consumer confidence in Germany pointed to decrease to 9.7 index points, while analysts had expected a pullback to 10 points. This was the lowest value of the consumer confidence index in 4 months.

"Despite the slightly more pessimistic outlook for personal finances, consumers believe that the economic outlook has improved, and the corresponding index rose to a maximum of more than one year", - said Mantas Vanagas, an economist at Daiwa Capital Markets Europe.

Meanwhile, the consumer confidence index in France, compiled by the INSEE statistics agency, in October rose to the highest since 2007. The index reached a level of 98 points, but remains below 100 points, long-term average since 1987.

The head of the Bank of England Governor Mark Carney said that there are limits to monetary policy, and that monetary policy was overly burdened in recent years. Carney noted that the bank's obligations are very clear regarding the inflation rate, and that the bank will use all the tools at its disposal to achieve the inflation target. The comments supported the pound.

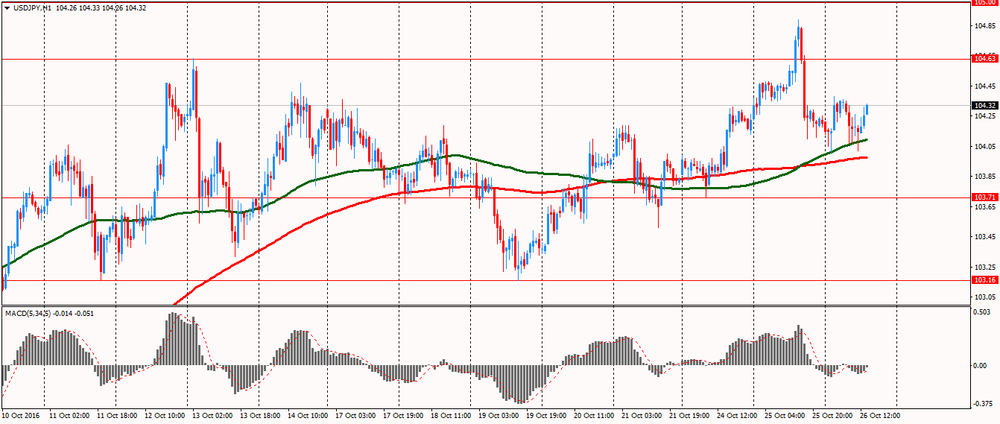

EUR / USD: during the European session, the pair rose to $ 1.0934

GBP / USD: during the European session, the pair rose to $ 1.2226

USD / JPY: during the European session, the pair fell to Y104.02

-

11:59

Company News: Boeing (BA) Q3 financials beat analysts’ estimates

Boeing reported Q3 FY 2016 earnings of $3.51 per share (versus $2.52 in Q3 FY 2015), beating analysts' consensus estimate of $2.62.

The company's quarterly revenues amounted to $23.898 bln (-7.5% y/y), beating analysts' consensus estimate of $23.600 bln.

The company also reaffirmed guidance for FY 2016 profit, projecting EPS of $6.10-6.30 versus analysts' consensus estimate of $6.29. At the same time, it increased FY 2016 revenues by $500 mln to $93.5-95.5 bln versus analysts' consensus estimate of $94.04 bln.

BA rose to $140.50 (+1.06%) in pre-market trading.

-

11:48

Orders

EUR/USD

Offers : 1.0915 1.0930 1.0950 1.0980 1.1000 1.1030 1.1050

Bids : 1.0875-80 1.0850 1.0825-30 1.0800 1.0785 1.0750 1.0700

GBP/USD

Offers : 1.2200 1.2230 1.2250 1.2280 1.2300 1.2325-30 1.2350

Bids : 1.2150 1.2130 1.2100 1.2080-85 1.2050 1.2000

EUR/GBP

Offers : 0.8965 0.8980 0.9000 0.9025-30 0.9050

Bids : 0.8935 0.8920 0.8900 0.8880-85 0.8870 0.8850-55

EUR/JPY

Offers : 113.85 114.00 114.20114.70-75 115.00

Bids : 113.25-30 113.00 112.85 112.60 112.00 111.85 111.50 111.00

USD/JPY

Offers : 104.45-55 104.80 105.00 105.30 105.50 106.00

Bids : 104.00 103.80-85 103.50 103.20-25 103.00 102.85 102.50

AUD/USD

Offers : 0.7700 0.7710 0.7730-35 0.7750 0.7780 0.7800

Bids : 0.7650-55 0.7630 0.7600 0.7580 0.7555-60 0.7500

-

11:20

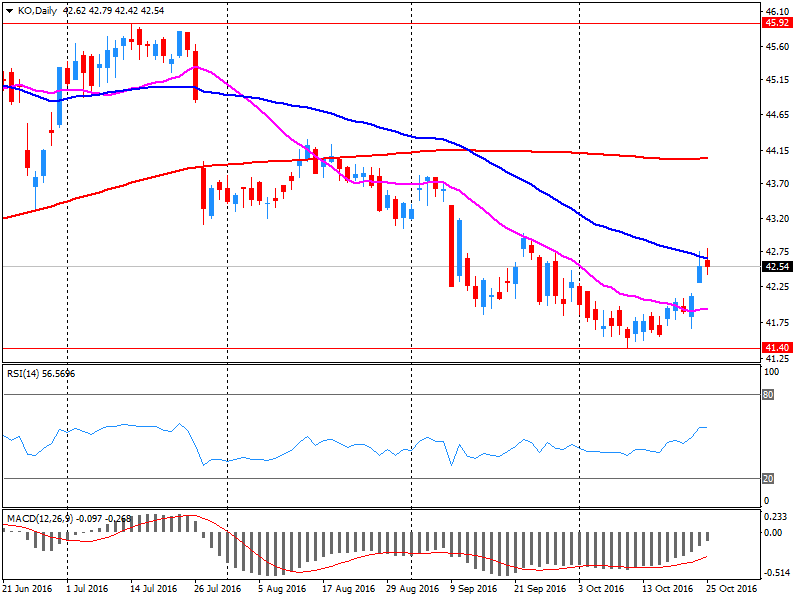

Company News: Coca-Cola (KO) Q3 results beat analysts’ expectations

Coca-Cola reported Q3 FY 2016 earnings of $0.49 per share (versus $0.51 in Q3 FY 2015), beating analysts' consensus estimate of $0.48.

The company's quarterly revenues amounted to $10.633 bln (-6.9% y/y), beating analysts' consensus estimate of $10.525 bln.

The company reaffirmed guidance for FY 2016, projecting EPS of $1.86-1.92 versus analysts' consensus estimate of $1.91.

KO rose to $42.99 (+1.06%) in pre-market trading.

-

11:09

Trump Has 2-Point Edge in Bloomberg Politics Poll of Florida

-

11:06

Major stock indices in Europe show moderate losses

European stocks fall amid disappointing corporate reports, as well as the decline in oil prices.

On Tuesday the European market focus remained on corporate reports, with focus on some of the banks.

At the same time on Wednesday, oil prices fell more than 1% to three-week low after the American Petroleum Institute said that US crude stocks rose by 4.8 million barrels for the week ended 21 of October.

US Energy Information Administration to release its weekly report on crude oil inventories today at 14:30 GMT. The data may show growth in US crude inventories by 1.69 million barrels.

Published on Wednesday morning, the data on consumer confidence in Germany pointed to decrease to 9.7 index points, while analysts had expected a pullback to 10 points. This was the lowest value of the consumer confidence index in 4 months.

"Despite the slightly more pessimistic outlook for personal finances, consumers believe that the economic outlook has improved, and the corresponding index rose to a maximum of more than one year", - said Mantas Vanagas, an economist at Daiwa Capital Markets Europe.

Meanwhile, the consumer confidence index in France, compiled by the INSEE statistics agency, in October rose to the highest since 2007. The index reached a level of 98 points, but remains below 100 points, long-term average since 1987.

The composite index of the largest companies in the region Stoxx Europe 600 fell 0,7% - to 340.7 points.

The cost of the British bank Lloyds fell 3,1%. Lloyds has cut profits in the 3rd quarter of 2016 due to new costs for compensation. The bank committed an additional 1 billion pounds ($ 1.2 billion) for payments in this case in the last quarter.

Antofagasta shares fell 7.6%. The mining company has increased its production of copper in the third quarter of this year, but said that on the basis of production, the index is likely to be close to the lower limit of its forecast of 710-740 ths tons.

Anglo American shares fell in price by 2%, BHP Billiton - 1,8%, Rio Tinto - 0.9%.

Shares of oil companies are getting cheaper as BP Plc's share price has fallen to 1,5%, Total SA - 1,3%, Royal Dutch Shell -1.6%.

Shares of Banco Santander rose 1.2%. The Spanish bank, which has the largest market value in the euro area, increased its net profit in the 3rd quarter of this year to 1.7 billion euros compared with 1.68 billion euros a year earlier.

At the moment:

FTSE 6959.18 -58.46 -0.83%

DAX 10657.13 -100.18 -0.93%

CAC 4508.34 -32.50 -0.72%

-

10:11

Rusian oil minister: Global oil freeze deal is unlikely to fail just because of Iraq

-

09:56

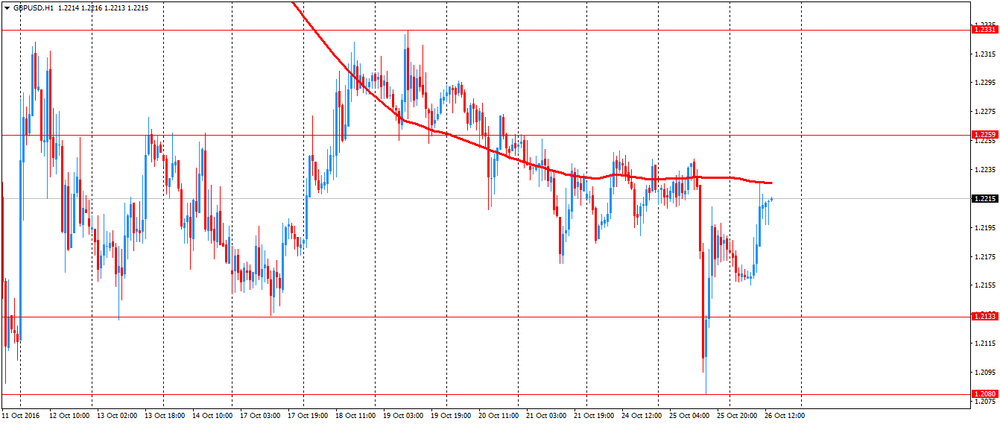

GBP: Looks 'Cheap' But The Lows Are Not In Yet; Where To Target? - Citi

"The fundamentals arguably haven't changed but the price has. This makes GBP look cheap - but we're not certain the lows are in.

Updating our model from 'GBP not objectively very cheap', GBP is now trading more cheaply vs major currencies on WERM than it ever has been (Figure 2). On PPP there is still 5-10% to reach the 'lows'.

The problem for the UK is that its need for foreign capital falls very little with a weaker currency. In fact, if yields on primary income didn't change at all, extrapolating previous sensitivities, the CA deficit would widen on lower FX. The drag cannot be solved without a weaker economy - restraining imports and direct investment income outflows.

Domestic yields have retraced, increasing the primary income burden on the margin and at a higher level of fixed income volatility. Firming up the financial account by introducing more favorable policies for foreign direct investment and/or minimizing FX + bond volatility appear key to finding a GBP base.

We target GBPUSD at 1.15 by the end of the year".

Copyright © 2016 CitiFX, eFXnews™

-

09:02

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0750 (EUR 802m) 1.0800 (306m) 1.0885-90 (514m) 1.0900 (543m) 1.0950 (797m) 1.1045-55 (800m)

USD/JPY 103.00 (USD 550m)

EUR/JPY: 113.75 (EUR 258m) 114.75 (224m)

EUR/GBP 0.8855 (EUR 381m)

AUD/USD 0.7500 (AUD 305m) 0.7550 (403m) 0.7600 (406m) 0.7650-55 (358m) 0.7725 (237m) 0.7750 (465m) 0.7780 (476m)

USD/CAD: 1.3175 (USD 401m) 1.3250 (450m)

-

08:45

UK Consumer Credit is growing at its fastest rate since December 2006

Dr Rebecca Harding, BBA Chief Economist, said:

"Consumer credit is growing at its fastest rate since December 2006, driven by strong demand for personal loans and credit cards. Consumers are increasingly using short-term borrowing to take advantage of record low interest rates. This trend has accelerated since the Bank of England cut rates in August.

"Mortgage approvals picked up slightly this month but the housing market continues to shows signs of underlying weakness. Both house purchase and remortgaging approvals are down on the corresponding figures for 2015.

"Business borrowing decreased slightly again in September, which may be in part down to uncertainty following the EU referendum. There is a longer time lag behind corporate investment decisions so it may take longer for the effect of the interest rate cut to filter through to such borrowing."

-

08:30

United Kingdom: BBA Mortgage Approvals, September 38.3 (forecast 37.3)

-

08:08

Italian retail trade decreased by 0.1% m/m

In August 2016 the seasonally adjusted retail trade index decreased by 0.1% with respect to July 2016 (-0.8% for food goods and +0.3% for non-food goods). The average of the last three months increased with respect to the previous three months (+0.2%). The unadjusted index decreased by 0.2% with respect to August 2015.

-

08:06

Oil is trading lower amid market glut concerns

This morning, the New York futures for Brent have fallen in price by 1.06% to $ 49.43 and WTI lost 0.83% to $ 50.37 per barrel. Thus, the black gold is traded in the red zone on news about the growth of US oil reserves, increased production in Nigeria, as well as controversy about the planned OPEC production cut and revived concerns about the global oil market glut.

According to the American Petroleum Institute inventories rose by 4.8 million barrels while expectations were for +1.7 million. Energy Information Administration will publish the official data later in the US session.

According to analysts, the debate within OPEC about the planned restriction of production later this year also put considerable pressure on the oil markets.

-

08:00

China has no need to fake steady GDP growth - Xinhua

-

07:36

Major stock markets trading in the red zone: FTSE -0.3%, DAX -0.3%, CAC40 -0.4%, FTMIB -0.1%, IBEX flat

-

07:34

Today’s events

-

At 17:30 GMT the US will publish data on crude oil inventories from the Department of Energy

-

At 21:30 GMT Bank of England Deputy Governor Sam Woods will deliver a speech

-

-

06:43

Mixed start expected on the major stock exchanges in Europe: DAX futures + 0.2%, CAC40 -0.2%, FTSE -0.2%

-

06:28

Options levels on wednesday, October 26, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1109 (2910)

$1.1026 (1939)

$1.0968 (972)

Price at time of writing this review: $1.0893

Support levels (open interest**, contracts):

$1.0815 (2184)

$1.0778 (4545)

$1.0737 (2933)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 42725 contracts, with the maximum number of contracts with strike price $1,1300 (3754);

- Overall open interest on the PUT options with the expiration date November, 4 is 46220 contracts, with the maximum number of contracts with strike price $1,1000 (7358);

- The ratio of PUT/CALL was 1.08 versus 1.10 from the previous trading day according to data from October, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.2403 (1165)

$1.2306 (1606)

$1.2210 (659)

Price at time of writing this review: $1.2168

Support levels (open interest**, contracts):

$1.2094 (1455)

$1.1996 (928)

$1.1898 (584)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 32268 contracts, with the maximum number of contracts with strike price $1,2800 (1973);

- Overall open interest on the PUT options with the expiration date November, 4 is 31298 contracts, with the maximum number of contracts with strike price $1,2300 (1858);

- The ratio of PUT/CALL was 0.97 versus 0.98 from the previous trading day according to data from October, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:22

Fade USD/CAD Into 1.34; Look To Buy EUR/USD Near 1.08 - TD

"The USDCAD thrill ride persists. Notably, we are now back above 1.33 following the overnight dip to a low near 1.3280.

We still see scope for continued CAD underperformance given the BoC rate cut theme has further room to run. The shift in rate differentials has seen our USDCAD equation inch higher, suggesting it is slightly overvalued. We see strong resistance ahead of 1.34 (upper end of our valuation band) so would look to fade there. Consistent with the weaker CAD theme in the majors we also like EURCAD higher.

Market positioning has seen a notable shift over the past few months. The USD is now flat after reaching record shorts earlier in the year. This change in positioning reflects in markets focus on December rate hike, diminished political uncertainty in the US (and possible fiscal support) and a potential drop in FX reserves from countries like China that have recently seen a drop in reserve flows. The latter could reflect a drawdown in other major currencies for the greenback.

...We think this leaves the USD confined to its recent range but are cautious about chasing the rally at current levels. Our highfrequency models favor some upside in European currencies as both SEK and GBP look cheap.

We also like to think there is value in long EUR positions near 1.08".

Copyright © 2016 TD Securities, eFXnews™

-

06:20

Mohamed El-Erian: the next few months are crucial for the UK

World famous analyst and former head of the investment fund PIMCO Mohamed El-Erian, speaking at a conference organized by Bloomberg said that the next few months will be very important and critical to the UK. "If politicians behave unprofessionally, instead of a small slowdown in the economy, Britain can enter recession,". El-Erian called the 65% probability of preserving financial stability in the UK, however, noted that it is very fragile.

-

06:17

Australian Dollar up as Robust 3Q Inflation Cools Rate-Cut Talk

-

06:13

German Consumer Sentiment mixed

Consumer sentiment has not followed a uniform trend in October. While economic prospects are improving again after three successive falls, both income expectations and propensity to buy have declined.

The overall consumer confidence indicator forecasts 9.7 points for November, after a figure of 10.0 points in October. Hence, the indicator has fallen below the ten-point mark for the first time since June 2016.

This month, consumer sentiment is currently rather mixed. While their view of overall economic prospects has become more positive for the first time in four months, consumers have become less optimistic in terms of both income prospects and propensity to buy. Consequently, consumer confidence has deteriorated, falling below the ten-point mark.

-

06:11

German import and export prices stable in September

As reported by the Federal Statistical Office (Destatis), the index of import prices decreased by 1.8% in September 2016 compared with the corresponding month of the preceding year. In August and in July 2016 the annual rates of change were -2.6% and -3.8%, respectively.

From August to September 2016 the index rose slightly by 0.1%.

The index of import prices, excluding crude oil and mineral oil products, decreased by 1.4% compared with the level of a year earlier.

The index of export prices decreased by 0.6% in September 2016 compared with the corresponding month of the preceding year. In August and in July 2016 the annual rates of change were -0.9% and -1.2%, respectively. From August to September 2016 the export price index did not change.

-

06:10

AUD supported by better than expected Australian inflation

Consumer prices in Australia were up 1.3 percent on year in the third quarter of 2016, the Australian Bureau of Statistics said on Wednesday.

That exceeded forecasts for 1.1 percent following the 1.0 percent increase in the previous three months.

On a quarterly basis, inflation jumped 0.7 percent versus forecasts for 0.5 percent and up from 0.4 percent in the three months prior.

The Reserve Bank of Australia's trimmed mean was up 0.4 percent on quarter and 1.7 percent on year, while the weighted median added 0.3 percent on quarter and 1.3 percent on year.

-

06:00

Germany: Gfk Consumer Confidence Survey, November 9.7 (forecast 10)

-

04:43

Global Stocks

European stocks lost ground Tuesday as big decliners such as Italian banks and Swiss chip maker AMS AG offset an encouraging reading on German business sentiment. Italian banks also were among the big losers, as Banca Monte dei Paschi di Siena SpA said it would cut 2,600 jobs, shutter 500 branches and shed businesses as part of a make-or-break effort to persuade skeptical investors to buy into a big capital increase.

U.S. stocks finished lower on Tuesday, giving back some of the previous day's advance as worries about a lackluster spate of earnings and a slip in a reading of consumer confidence weighed on market sentiment. A drop in the price of oil below $50 a barrel, lingering uncertainty about the U.S. presidential election and growing expectations of a rate increase by the Federal Reserve, also contributed to the downbeat mood.

Shares in Asia were broadly lower early Wednesday, tracking declines on Wall Street after a spate of disappointing earnings reports and weaker-than-expected economic data. Australia's third quarter consumer price index, released early Wednesday, rose 0.7% from the second quarter, beating expectations of a 0.5% gain. Year-over-year, the nation's third-quarter CPI increased 1.3%, exceeding a consensus forecast of a 1.1% gain. The Australian currency gained 0.6% against the U.S. dollar following the data release, weighing on exporters, among others.

-

00:31

Australia: CPI, y/y, Quarter III 1.3% (forecast 1.1%)

-

00:31

Australia: Trimmed Mean CPI q/q, Quarter III 0.4% (forecast 0.4%)

-

00:31

Australia: Trimmed Mean CPI y/y, Quarter III 1.7% (forecast 1.7%)

-

00:30

Australia: CPI, q/q, Quarter III 0.7% (forecast 0.5%)

-