Market news

-

22:31

Commodities. Daily history for Oct 25’2016:

(raw materials / closing price /% change)

Oil 49.30 -1.32%

Gold 1,274.30 +0.05%

-

22:30

Stocks. Daily history for Oct 25’2016:

(index / closing price / change items /% change)

Nikkei 225 17,365.25 +130.83 +0.76%

Shanghai Composite 3,132.08 +3.84 +0.12%

S&P/ASX 200 5,442.83 +34.34 +0.63%

FTSE 100 7,017.64 +31.24 +0.45%

CAC 40 4,540.84 -11.74 -0.26%

Xetra DAX 10,757.31 -3.86 -0.04%

S&P 500 2,143.16 -8.17 -0.38%

Dow Jones Industrial Average 18,169.27 -53.76 -0.30%

S&P/TSX Composite 14,870.63 -52.38 -0.35%

-

22:30

Currencies. Daily history for Oct 25’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0887 +0,12%

GBP/USD $1,2180 -0,34%

USD/CHF Chf0,9941 +0,02%

USD/JPY Y104,20 -0,02%

EUR/JPY Y113,45 +0,10%

GBP/JPY Y126,92 -0,35%

AUD/USD $0,7643 +0,59%

NZD/USD $0,7161 +0,61%

USD/CAD C$1,3355 +0,06%

-

22:00

Schedule for today, Wednesday, Oct 26’2016

00:30 Australia CPI, q/q Quarter III 0.4% 0.5%

00:30 Australia CPI, y/y Quarter III 1% 1.1%

00:30 Australia Trimmed Mean CPI q/q Quarter III 0.5% 0.4%

00:30 Australia Trimmed Mean CPI y/y Quarter III 1.7% 1.7%

06:00 Germany Gfk Consumer Confidence Survey November 10 10

08:30 United Kingdom BBA Mortgage Approvals September 36.97

12:45 U.S. Services PMI (Preliminary) October 52.3 52.3

13:00 U.S. New Home Sales September 609 600

14:30 U.S. Crude Oil Inventories October -5.2

21:45 New Zealand Trade Balance, mln September -1265

-

20:06

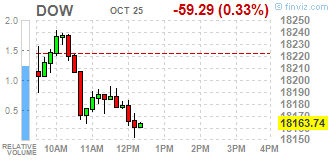

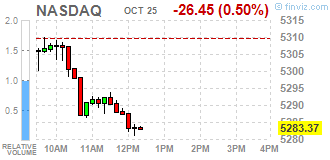

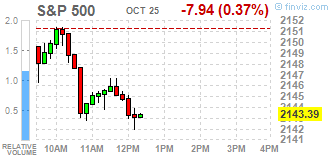

Major US stock indexes finished trading in the "red zone"

Disappointing corporate results of several "heavyweights" sent major stock indexes Wall Street into negative territory, while investors sought clues on the timing of the next increase in interest rates in anticipation of the Fed meeting next week.

In addition, a report from S & P / Case-Shiller showed that nationwide house price index rose 5.3% in August, compared with growth of 5.0% last month. The index for the 10 metropolises showed an increase of 4.3% compared with 4.1% in the previous month. to 20 mega-cities index showed an increase of 5.1% per annum compared to 5.0% in July. On a monthly basis before seasonal adjustment of the national index showed an increase of 0.5% in August.

Meanwhile, the Federal Agency for Housing Finance reported that US home prices rose in August by 0.7 percent compared to July. Previously reported increase of 0.5 percent in July remained unchanged. From August 2015 on August 2016 prices rose by 6.4 per cent.

The consumer confidence index from the Conference Board, which increased in September, declined in October. The index is currently 98.6 (1985 = 100) compared to 103.5 in September. the present situation index fell to 127.9 from 120.6, while the expectations index fell to 87.2 last month to 83.9.

It should also be noted that the index of economic optimism in the US, calculated by the newspaper Investor's Business Daily and research firm TechnoMetrica Institute of Policy and Politics, rose in October by 4.6 points, reaching 51.3 points (up to April 2015). Experts had expected the index to rise to 47.6 points.

Oil futures fell by about 1.5 percent as traders continue to analyze comments from OPEC about declining production prospects, as well as waiting for the publication in the US petroleum inventory data. Many experts remain confident that OPEC will be able to work out a final agreement at the meeting on 30 November.

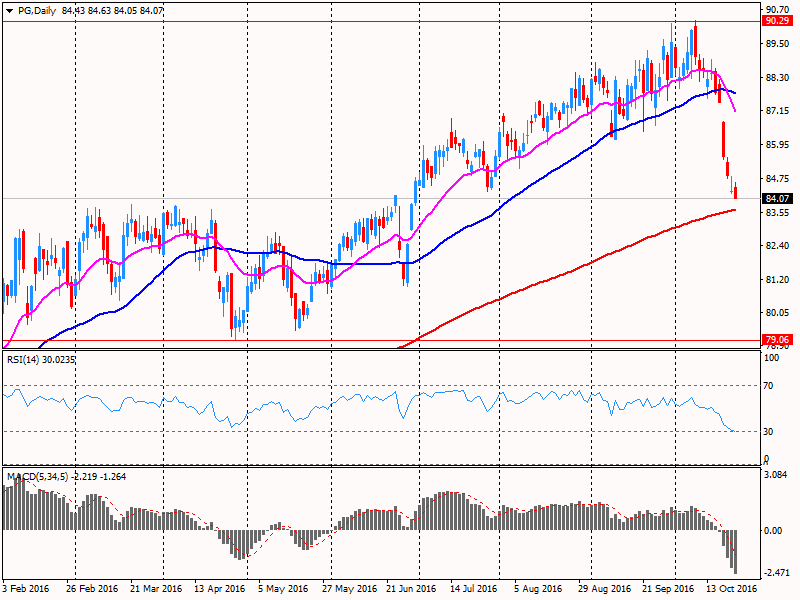

Most DOW components of the index closed in negative territory (17 of 30). Outsider were shares of The Home Depot, Inc. (HD, -3.41%). More rest up shares The Procter & Gamble Company (PG, + 3.70%).

Most sectors of the S & P showed a decline. the services sector fell the most (-0.6%). The leader turned utilities sector (+ 0.3%).

At the close:

Dow -0.29% 18,170.57 -52.46

Nasdaq -0.50% 5,283.40 -26.43

S & P -0.38% 2,143.25 -8.08

-

19:00

Dow -0.29% 18,170.23 -52.80 Nasdaq -0.54% 5,281.20 -28.63 S&P -0.36% 2,143.60 -7.73

-

16:27

Wall Street. Major U.S. stock-indexes fell

Disappointing corporate results from several heavyweights dragged Wall Street as investors looked for clues regarding the timing of the next interest rate hike ahead of a Fed meeting next week. While investors aren't expecting the Fed to raise rates when it meets next week, they will be looking for clues regarding the trajectory of future hikes.

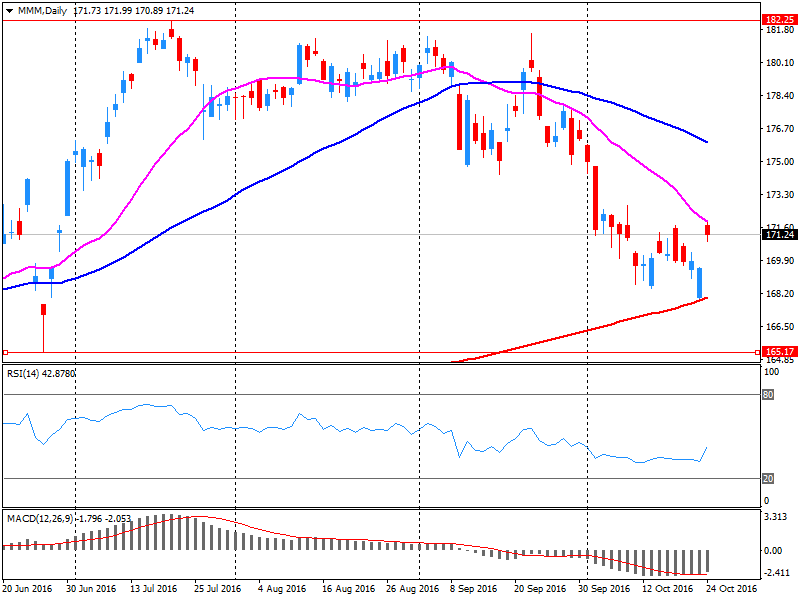

Most of Dow stocks in negative area (19 of 30). Top gainer - The Procter & Gamble Company (PG, +4.17%). Top loser - 3M Company (МММ, -3.07%).

Almost all S&P sectors also in negative area. Top gainer - Utilities (+0.1%). Top loser - Healthcare (-0.5%).

At the moment:

Dow 18085.00 -49.00 -0.27%

S&P 500 2137.25 -7.00 -0.33%

Nasdaq 100 4886.75 -16.00 -0.33%

Oil 49.86 -0.66 -1.31%

Gold 1273.70 +10.00 +0.79%

U.S. 10yr 1.75 -0.01

-

16:00

European stocks closed: FTSE 100 +31.24 7017.64 +0.45% DAX -3.86 10757.31 -0.04% CAC 40 -11.74 4540.84 -0.26%

-

15:48

Oil quotes declined

Oil prices lost earlier earned positions and moved into negative territory as traders continue to analyze comments from OPEC about declining production prospects, as well as waiting for the publication of the US petroleum inventory data.

Many experts remain confident that OPEC will be able to work out a final agreement at the meeting on 30 November. In addition, the steady decline in US oil inventories suggests that oversupply is reduced without the aid of OPEC. However, other analysts believe that OPEC will be able to achieve an effective reduction in production. One of the key problems is Iraq's refusal to use the data for the production of oil, provided by secondary sources when calculating catch limits of each of the OPEC countries.

OPEC oil production has reached record highs against the backdrop of Member States struggle for market share.

The cost of the December futures on US light crude oil WTI (Light Sweet Crude Oil) fell to 50.02 dollars per barrel on the New York Mercantile Exchange.

December futures price for Brent fell to 50.88 dollars a barrel on the London Stock Exchange ICE Futures Europe

-

15:30

Bank of England Governor Carney: monetary policy has been overburdened in many ways. GBP/USD moves up

-

15:30

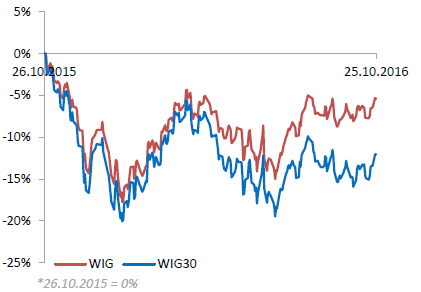

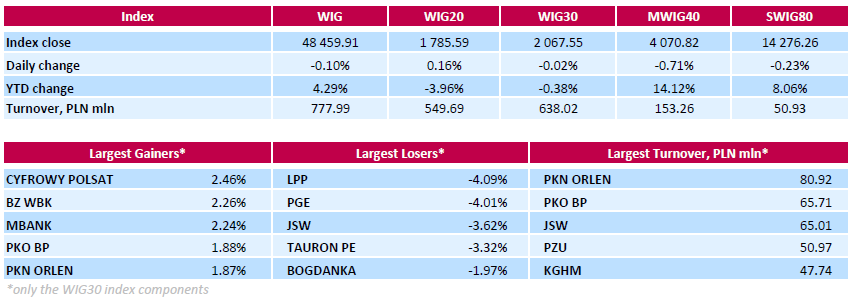

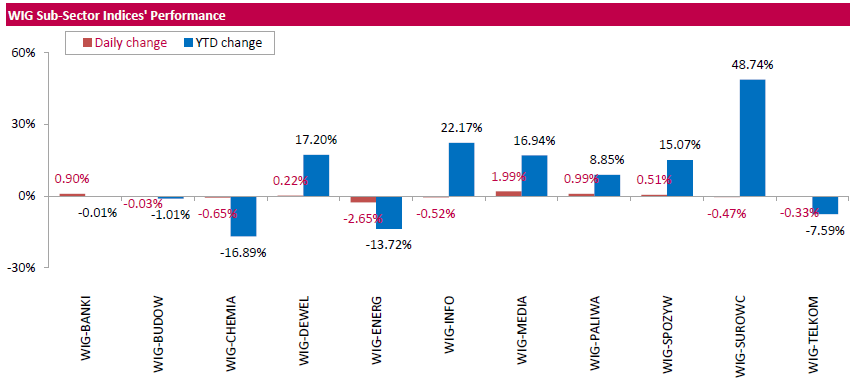

WSE: Session Results

Polish equity market closed slightly lower on Tuesday. The broad market measure, the WIG Index, fell by 0.1%. Sector performance within the WIG Index was mixed. Media sector (+1.99%) outperformed, while utilities (-2.65%) lagged behind.

The large-cap WIG30 Index edged down 0.02%. Within the index components, media group CYFROWY POLSAT (WSE: CPS) led the gainers with a 2.46% advance, followed by three banking sector names BZ WBK (WSE: BZW), MBANK (WSE: MBK) and PKO BP (WSE: PKO), jumping by 2.26%, 2.24% and 1.88% respectively. At the same time, the session's largest decliners were clothing retailer LPP (WSE: LPP), coking coal producer JSW (WSE: JSW) and two utilities names PGE (WSE: PGE) and TAURON PE (WSE: TPE), which lost between 3.32% and 4.09%.

-

15:29

Gold price traded higher today

Gold moderately risen in price on Tuesday, helped by growth in physical demand from India. However, the strengthening of the US dollar and the rising expectations of a Fed hike constrained the upward movement of the precious metal.

"The basic demand for the precious metal remains stable. In addition, a positive impact had fundamental factors, such as the stimulating monetary policy of central banks in Europe and Japan." - ANZ analyst Daniel Hynes said.

The US Dollar Index, showing the US dollar against a basket of six major currencies, traded with an increase of 0.3%, close to the highest level since the beginning of March. Since gold prices are tied to the dollar, a stronger dollar makes the precious metal more expensive for holders of foreign currencies.

The cost of the November futures for gold on COMEX rose to $ 1271.9 per ounce.

-

14:31

-

14:06

US Consumer Confidence softened while optimism regarding the short-term outlook retreated. USD reversal

The Conference Board Consumer Confidence Index, which had increased in September, declined in October. The Index now stands at 98.6 (1985=100), down from 103.5 in September. The Present Situation Index decreased from 127.9 to 120.6, while the Expectations Index declined from 87.2 last month to 83.9.

"Consumer confidence retreated in October, after back-to-back monthly gains," said Lynn Franco, Director of Economic Indicators at The Conference Board. "Consumers' assessment of current business and employment conditions softened, while optimism regarding the short-term outlook retreated somewhat. However, consumers' expectations regarding their income prospects in the coming months were relatively unchanged. Overall, sentiment is that the economy will continue to expand in the near-term, but at a moderate pace."

-

14:04

US Richmond manufacturing activity remained sluggish in October

Fifth District manufacturing activity remained sluggish in October, according to the most recent survey by the Federal Reserve Bank of Richmond. New orders and backlogs decreased this month, while shipments flattened. Hiring activity strengthened mildly across firms and wage increases were more widespread. Prices of raw materials and finished goods rose more quickly in October, compared to last month.

Firms looked for better business conditions during the next six months. Manufacturers expected positive growth in shipments and in the volume of new orders. In addition, manufacturers looked for rising backlogs of new orders.

Producers anticipated increased capacity utilization and looked for slightly longer vendor lead times. Survey participants' outlook for the months ahead included moderate growth in hiring, while future wage increases outweighed declines in the October expectations index. Producers anticipated somewhat longer average workweeks. Firms expected faster growth in prices paid and prices received.

-

14:00

U.S.: Consumer confidence , October 98.6 (forecast 101)

-

14:00

U.S.: Richmond Fed Manufacturing Index, October -4

-

13:47

Option expiries for today's 10:00 ET NY cut

USD/JPY 99.00, 99.25,100.00, 100.25, 100.65/67/70/75, 100.90, 101.00, 102.00,103.50/55, 103.75, 104.50/54, 104.75, 105.00, 105.75

EUR/USD 1.0895,1.0900 (2.38bn), 1.0925,1.1000, 1.1025, 1.1075, 1.1090,1.1100 (511m),1.1150, 1.1160,1.1200

GBP/USD 1.2400, 1.2450,1.2500, 1.2560

AUD/USD 0.7600, 0.7615, 0.7670, 0.7680

NZD/USD 0.7100,0.7235/40

AUD/NZD 1.0625 (823m)

EUR/GBP 0.9050

USD/CAD 1.3055, 1.3080/85,1.3130/35, 1.3150,1.3220, 1.3250,1.3300, 1.3350/55

USD/CHF 0.9700 (600m),0.9825,0.9925

EUR/JPY 116.00

USD/MXN 17.35 (2.31bn)

-

13:33

U.S. Stocks open: Dow -0.10%, Nasdaq -0.09%, S&P -0.13%

-

13:28

Before the bell: S&P futures +0.09%, NASDAQ futures +0.16%

U.S. stock-index futures were little changed as investors assessed the health of corporate America amid mixed earnings reports.

Global Stocks:

Nikkei 17,365.25 +130.83 +0.76%

Hang Seng 23,565.11 -38.97 -0.17%

Shanghai 3,132.08 +3.84 +0.12%

FTSE 7,017.52 +31.12 +0.45%

CAC 4,557.63 +5.05 +0.11%

DAX 10,796.44 +35.27 +0.33%

Crude $50.41 (-0.22%)

Gold $1269.20 (+0.44%)

-

13:09

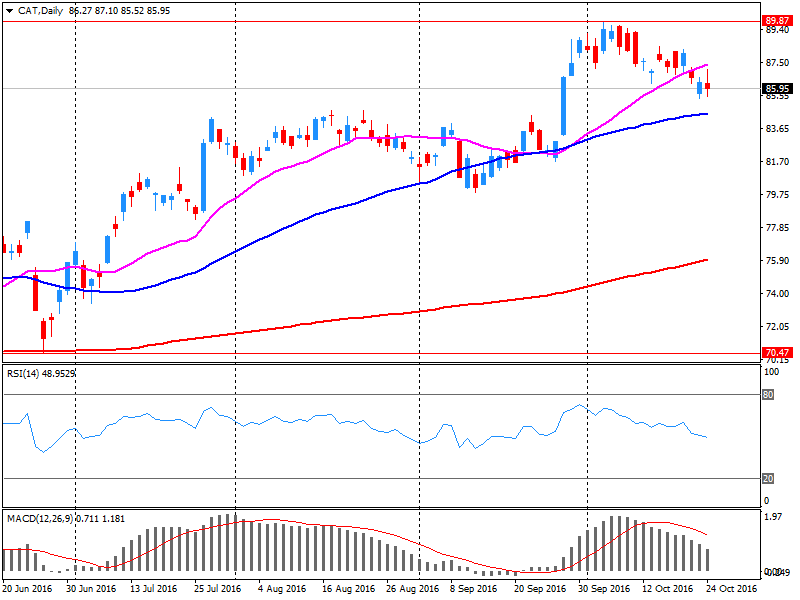

Caterpillar Warns Of "Economic Weakness Throughout Much Of The World", Cuts Guidance - Zerohedge

-

13:07

US House Prices rose more than expected. Dollar bid, EUR, GBP session lows

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.5% in August. Both the 10-City Composite and the 20-City Composite posted a 0.4% increase in August. After seasonal adjustment, the National Index recorded a 0.6% month-over-month increase, and both the 10-City Composite and the 20-City Composite reported 0.2% month-over-month increases. After seasonal adjustment, 14 cities saw prices rise, two cities were unchanged, and four cities experienced negative monthly prices changes.

"Supported by continued moderate economic growth, home prices extended recent gains," says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. "All 20 cities saw prices higher than a year earlier with 10 enjoying larger annual gains than last month. The seasonally adjusted month-over-month data showed that home prices in 14 cities were higher in August than in July. Other housing data including sales of existing single family homes, measures of housing affordability, and permits for new construction also point to a reasonably healthy housing market".

-

13:02

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

167.76

-3.51(-2.0494%)

15389

ALCOA INC.

AA

27.16

0.30(1.1169%)

20096

ALTRIA GROUP INC.

MO

65.04

0.09(0.1386%)

2777

Amazon.com Inc., NASDAQ

AMZN

838.82

0.73(0.0871%)

22530

Apple Inc.

AAPL

118.06

0.41(0.3485%)

301750

AT&T Inc

T

36.99

0.13(0.3527%)

199453

Barrick Gold Corporation, NYSE

ABX

16.75

0.22(1.3309%)

88903

Caterpillar Inc

CAT

84.95

-1.04(-1.2094%)

105183

Chevron Corp

CVX

100.85

0.19(0.1888%)

2447

Cisco Systems Inc

CSCO

30.55

0.09(0.2955%)

49414

Deere & Company, NYSE

DE

86.3

-0.40(-0.4614%)

1205

E. I. du Pont de Nemours and Co

DD

70.45

0.31(0.442%)

3136

Facebook, Inc.

FB

133.49

0.21(0.1576%)

95160

Ford Motor Co.

F

12.08

0.04(0.3322%)

179318

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.33

0.15(1.4735%)

338211

General Electric Co

GE

28.94

0.02(0.0692%)

13577

General Motors Company, NYSE

GM

33.06

0.08(0.2426%)

965469

Google Inc.

GOOG

815.5

2.39(0.2939%)

4884

Hewlett-Packard Co.

HPQ

14

0.03(0.2147%)

51909

Home Depot Inc

HD

126.5

-1.28(-1.0017%)

7814

International Business Machines Co...

IBM

150.93

0.36(0.2391%)

25686

Merck & Co Inc

MRK

60.48

-0.27(-0.4444%)

98182

Microsoft Corp

MSFT

61.05

0.05(0.082%)

135129

Nike

NKE

51.02

-0.85(-1.6387%)

128962

Pfizer Inc

PFE

32.2

0.07(0.2179%)

2316

Procter & Gamble Co

PG

87.12

3.02(3.591%)

333145

Starbucks Corporation, NASDAQ

SBUX

54.3

0.12(0.2215%)

7883

Tesla Motors, Inc., NASDAQ

TSLA

203.06

0.30(0.148%)

2264

The Coca-Cola Co

KO

42.73

0.17(0.3994%)

25912

Twitter, Inc., NYSE

TWTR

17.93

-0.10(-0.5546%)

382922

United Technologies Corp

UTX

102

2.48(2.492%)

10611

Verizon Communications Inc

VZ

48.42

0.21(0.4356%)

99022

Visa

V

82.48

-0.69(-0.8296%)

336208

Walt Disney Co

DIS

93.34

-0.03(-0.0321%)

463

Yahoo! Inc., NASDAQ

YHOO

42.65

0.06(0.1409%)

8977

Yandex N.V., NASDAQ

YNDX

20.17

0.53(2.6986%)

7050

-

13:01

U.S.: Housing Price Index, m/m, August 0.7%

-

13:00

Upgrades and downgrades before the market open

Upgrades:

AT&T (T) upgraded to Hold from Sell at Independent Research; target $39

Downgrades:

Visa (V) downgraded to Neutral from Buy at Guggenheim

Other:

NIKE (NKE) initiated with a Perform at Oppenheimer

Visa (V) target lowered to $93 from $94 at Stifel

-

13:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, August 5.1% (forecast 5%)

-

12:55

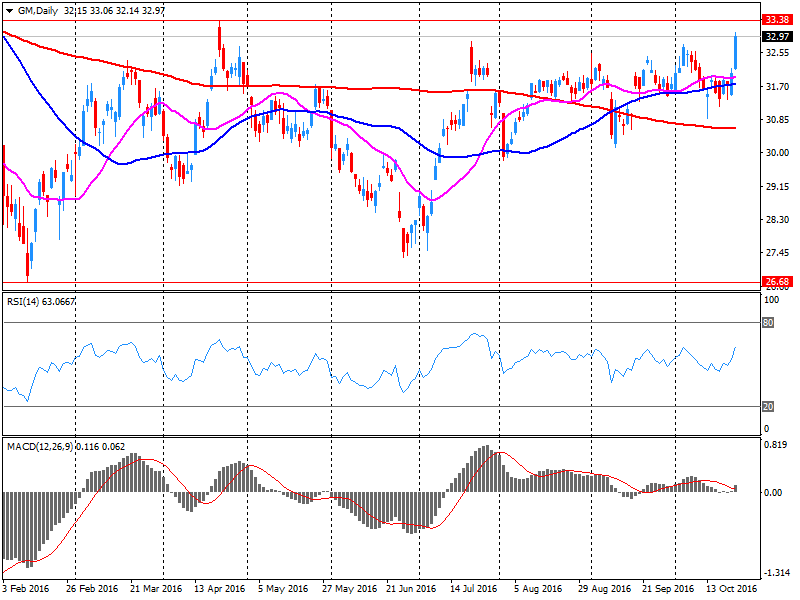

Company News: General Motors (GM) Q3 results beat analysts’ expectations

General Motors reported Q3 FY 2016 earnings of $1.72 per share (versus $1.50 in Q3 FY 2015), beating analysts' consensus estimate of $1.45.

The company's quarterly revenues amounted to $42.825 bln (+10.3% y/y), beating analysts' consensus estimate of $37.479 bln.

GM rose to $33.14 (+0.49%) in pre-market trading.

-

12:50

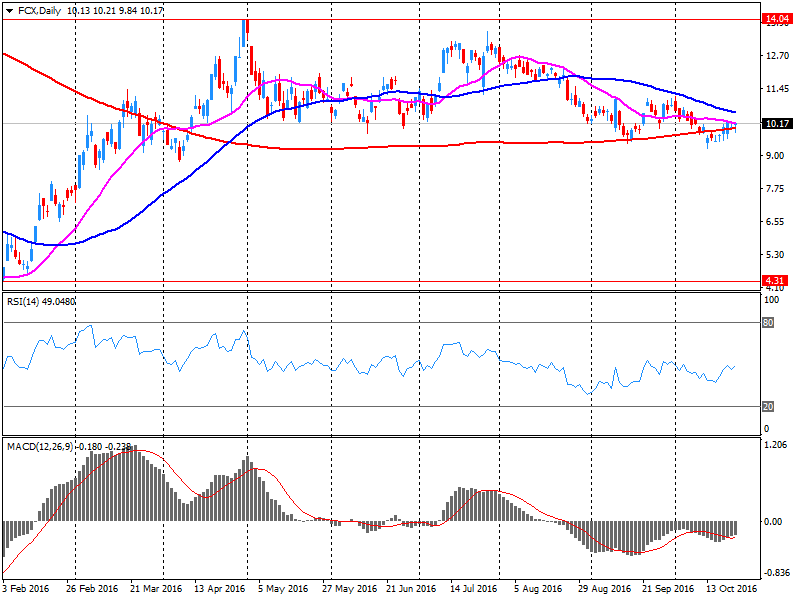

Company News: Freeport-McMoRan (FCX) Q3 results miss analysts’ estimates

Freeport-McMoRan reported Q3 FY 2016 earnings of $0.13 per share (versus net loss of $0.15 in Q3 FY 2015), missing analysts' consensus estimate of $0.19.

The company's quarterly revenues amounted to $3.877 bln (+14.6% y/y), missing analysts' consensus estimate of $3.957 bln.

FCX rose to $10.25 (+0.69%) in pre-market trading.

-

12:39

Company News: 3M (MMM) Q3 EPS beat analysts’ estimate

3M Company reported Q3 FY 2016 earnings of $2.15 per share (versus $2.05 in Q3 FY 2015), beating analysts' consensus estimate of $2.14.

The company's quarterly revenues amounted to $7.709 bln (0% y/y), generally in-line with analysts' consensus estimate of $7.720 bln.

The company also issued downside guidance for FY 2016, projecting EPS of $8.15-8.20 versus analysts' consensus estimate of $8.21 and prior guidance of $8.15-8.30.

MMM fell to $168.50 (-1.62%) in pre-market trading.

-

12:26

Company News: Caterpillar (CAT) Q3 EPS beat analysts’ estimate

Caterpillar reported Q3 FY 2016 earnings of $0.85 per share (versus $0.75 in Q3 FY 2015), beating analysts' consensus estimate of $0.76.

The company's quarterly revenues amounted to $9.160 bln (-16.4% y/y), missing analysts' consensus estimate of $9.885 bln.

The company lowered FY2016 guidance, forecasting EPS of $3.25, versus analysts' consensus estimate of $3.53 and prior forecast of $3.55, and revenues of $39.0 bln, versus analysts' consensus estimate of $40.13 bln and prior forecast of $40.0-40.5 bln.

CAT fell to $84.39 (-1.86%) in pre-market trading.

-

12:17

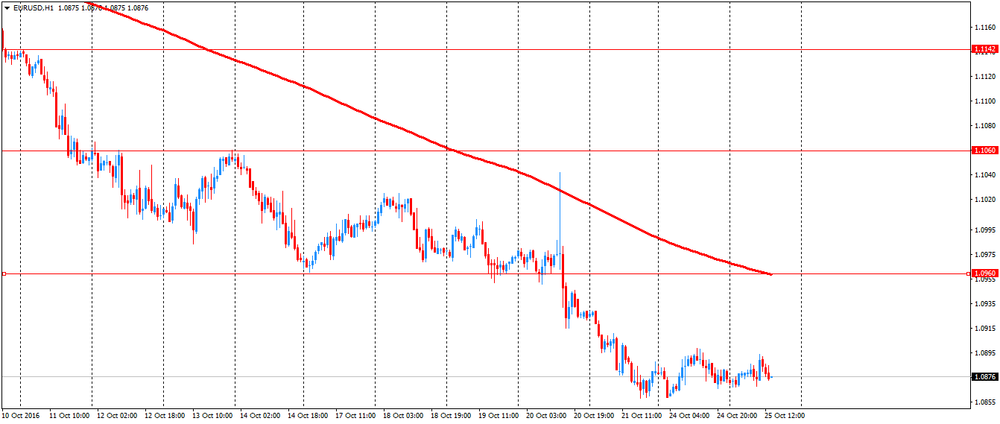

European session review: Euro rose moderately than retreats

The following data was published:

(Time / country / index / period / previous value / forecast)

8:00 Germany IFO expectations index in October 104.5 104.5 106.1

8:00 Germany IFO current conditions index in October 114.7 114.9 115

8:00 Germany IFO business climate index in October 109.5 109.5 110.5

The euro rose at the start of the session against the US dollar, supported by strong data on business confidence in Germany. Business confidence in Germany improved in October, IFO survey indicated.

The business climate index rose to 110.5 in October from 109.5 in the previous month. The expected value was 109.5.

The current conditions index rose to 115.0 from 114.7 a month ago vs 114.9 forecast.

Meanwhile, expectations rose to 106.1 compared with 104.5 the previous month.

Today, investors will also monitor the US consumer confidence and statements by ECB President Draghi.

Political issues, such as the referendum in Italy and concerns about further Brexit concerns, continue to put pressure on the euro. In addition, the possibility of further easing of monetary policy by the ECB carries risks for the banking sector of the eurozone.

At the same time, investors continue to believe in a Fed hike this year. Higher rates support the US currency, making it more attractive to investors. According to the futures market, the likelihood of tighter monetary policy in December is 73.9% against 69.5% the previous day.

EUR / USD: during the European session, the pair rose to $ 1.0894

GBP / USD: during the European session, the pair rose to $ 1.2242

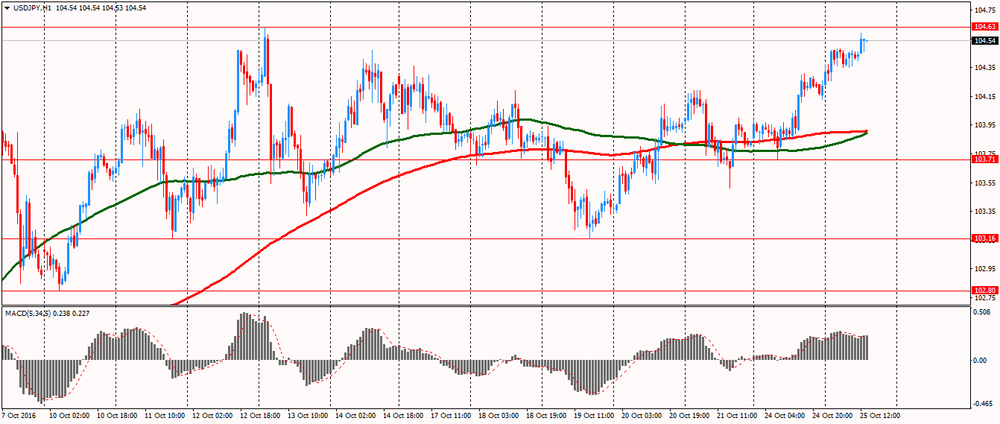

USD / JPY: during the European session, the pair rose to Y104.59

-

12:07

Company News: Procter & Gamble (PG) Q3 EPS beat analysts’ estimate

Procter & Gamble reported Q1 FY 2017 earnings of $1.03 per share (versus $0.98 in Q1 FY 2016), beating analysts' consensus estimate of $0.98.

The company's quarterly revenues amounted to $16.518 bln (-0.1% y/y), generally in-line with analysts' consensus estimate of $16.485 bln.

The company reaffirmed guidance for FY 2017, projecting mid-single digit EPS growth to ~$3.82-3.89 versus analysts' consensus estimate of $3.88 and revenues growth of 1% to ~$65.95 bln versus analysts' consensus estimate of $66 bln.

PG rose to $86.00 (+2.26%) in pre-market trading.

-

11:49

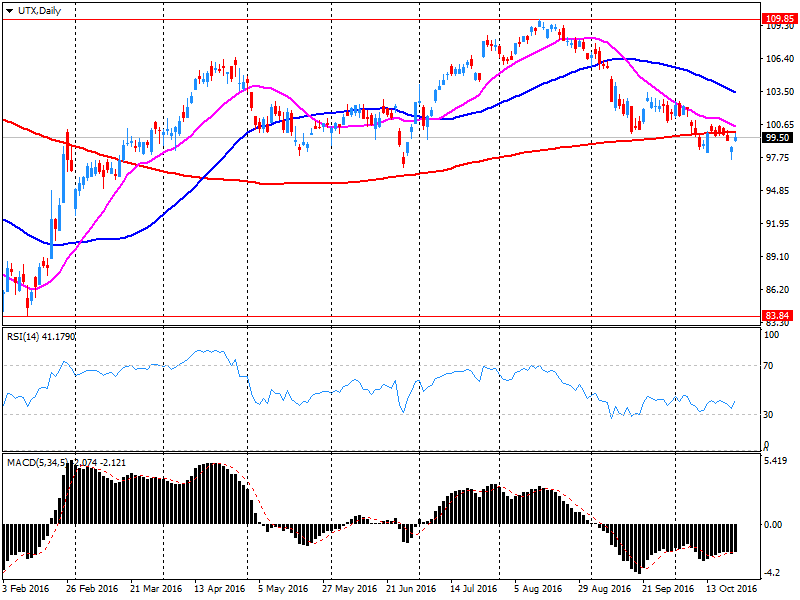

Company News: United Tech (UTX) Q3 results beat analysts’ expectations

United Tech reported Q3 FY 2016 earnings of $1.76 per share (versus $1.67 in Q3 FY 2015), beating analysts' consensus estimate of $1.67.

The company's quarterly revenues amounted to $14.354 bln (+4.1% y/y), slightly beating analysts' consensus estimate of $14.286 bln.

The company also published guidance for FY 2016, projecting EPS of $6.55-6.60 (versus analysts' consensus estimate of $6.54) and revenues of $57-58 bln (versus analysts' consensus estimate of $57.22 bln).

UTX rose to $101.49 (+1.98%) in pre-market trading.

-

11:49

Orders

EUR/USD

Offers : 1.0900 1.0915-20 1.0940-50 1.0980 1.1000

Bids : 1.0850 1.0825-30 1.0800 1.0785 1.0750 1.0700

GBP/USD

Offers : 1.2250 1.2280 1.2300 1.2325-30 1.2350 1.2380 1.2400

Bids : 1.2200 1.2185 1.2165 1.2145-50 1.2130 1.2100 1.2085 1.2050

EUR/GBP

Offers : 0.8920-25 0.8955 0.8975-80 0.9000

Bids : 0.8880-85 0.8870 0.8850-55 0.8830 0.8800

EUR/JPY

Offers : 113.80-85 114.00 114.20 114.70-75 115.00

Bids : 113.30 113.00 112.85 112.60 112.00 111.85 111.50 111.00

USD/JPY

Offers : 104.00 104.25-30 104.50 104.80 105.00

Bids : 103.50 103.20-25 103.00 102.85 102.50 102.30 102.00

AUD/USD

Offers : 0.7650 0.7665 0.7680 0.7700 0.7730-35 0.7755-60

Bids : 0.7610 0.7600 0.7580 0.7555-60 0.7500

-

11:35

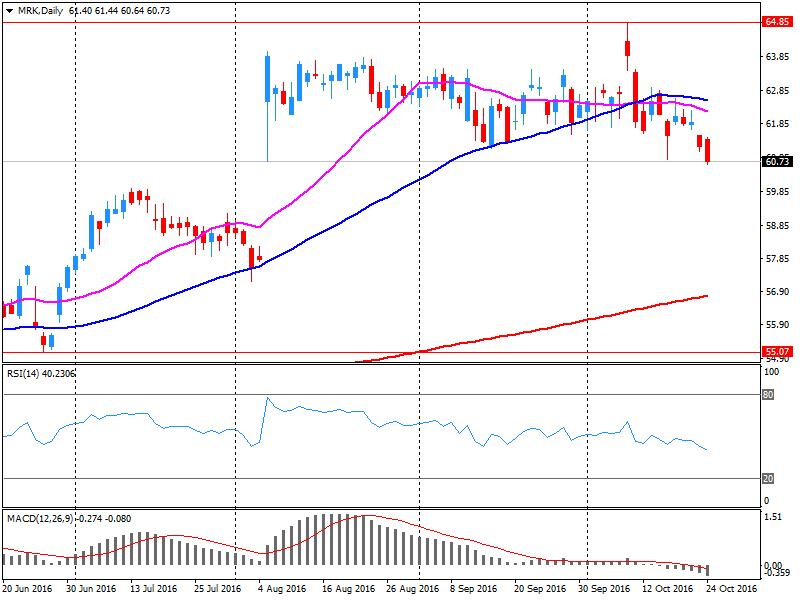

Company News: Merck (MRK) Q3 results beat analysts’ forecasts

Merck reported Q3 FY 2016 earnings of $1.07 per share (versus $0.96 in Q3 FY 2015), beating analysts' consensus estimate of $0.99.

The company's quarterly revenues amounted to $10.536 bln (+4.6% y/y), beating analysts' consensus estimate of $10.180 bln.

The company also issued guidance for FY 2016, raising EPS to $3.71-3.78 from $3.67-3.77 (versus analysts' consensus estimate of $3.75) and revenue to $39.7-40.2 bln from $39.1-40.1 bln (versus analysts' consensus estimate of $39.69 bln).

MRK rose to $$61.50 (+1.23%) in pre-market trading.

-

11:22

Wall Street skeptical about the deal between AT & T and Time Warner

-

10:40

Major stock indices in Europe rose moderately on better corporate profits

European stocks trading higher as market participants digested another series of corporate reports and reacted positively to the news from Greece and Germany.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0.34% - to 345.43 points.

Today euro zone officials have approved the third tranche of Greece bailout in the amount of 2.8 billion euros ($ 3 billion) after Athens completed the necessary reforms.

In addition, sentiment also improved after the publication of data showing that in October, the index of business confidence in Germany rose to the highest since April 2014, as uncertainty after Brexit declines.

Research Institute IFO said that the business climate index rose to a seasonally adjusted 110.5 from 109.5 in September, higher than the expected 109.5.

Meanwhile, Europe continues the corporate reporting season. The price of Orange shares increased by 4%. The company reported an increase in the 3rd quarter by 1.6%, to € 3.6 billion, on higher revenues in Spain and Africa, and the high demand for broadband services in France. The company's revenue increased by 0.8% to EUR 10.3 billion.

The Dutch employment agency Randstad Holdings increased its capitalization by 3.5%. The company's revenue in July-September exceeded market expectations.

The value of Luxottica Group SpA, which owns the brand Ray-Ban, rose 7,1% after the company confirmed the outlook for 2016 and announced its intention to accelerate revenue growth in the next year.

The capitalization of the French Air Liquide SA, one of the largest industrial gas suppliers the world increased by 2.2%. The company's revenue in the last quarter jumped by 27% and was at the level of analysts' forecasts.

The energy sector as a whole has grown, as the French Total SA gained 0.6% Italian ENI grew by 0.5%, while the Norwegian Statoil rose by 0.2%.

At the moment:

FTSE 7015.35 28.95 0.41%

DAX 10793.17 32.00 0.30%

CAC 4557.21 4.63 0.10%

-

10:27

Goldman Sachs lowers the price target of Kimberly-Clark shares to 145 dollars from 151 dollars, maintains the rating to "buy"

-

10:26

The decline of Russia's GDP in the III quarter could reach 0.5% in January - September - deputy head of the Ministry of Economic Development

-

10:15

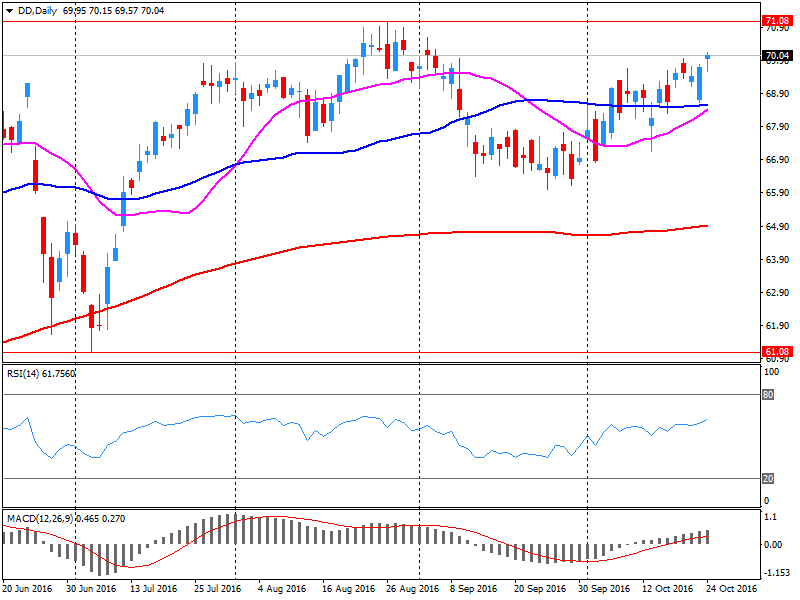

Company News: DuPont (DD) Q3 results beat analysts’ expectations

DuPont reported Q3 FY 2016 earnings of $0.34 per share (versus $0.13 in Q3 FY 2015), beating analysts' consensus estimate of $0.21.

The company's quarterly revenues amounted to $4.917 bln (+0.9% y/y), beating analysts' consensus estimate of $4.845 bln.

The company issued upside guidance for FY2016, increasing EPS to +17% to $3.25 (from $3.15-3.20) versus analysts' consensus estimate of $3.20.

DD closed Monday's trading session at $70.14 (+0.63%).

-

09:13

Option expiries for today's 10:00 ET NY cut

USD/JPY 99.00, 99.25,100.00, 100.25, 100.65/67/70/75, 100.90, 101.00, 102.00,103.50/55, 103.75, 104.50/54, 104.75, 105.00, 105.75

EUR/USD 1.0895,1.0900 (2.38bn), 1.0925,1.1000, 1.1025, 1.1075, 1.1090,1.1100 (511m),1.1150, 1.1160,1.1200

GBP/USD 1.2400, 1.2450,1.2500, 1.2560

AUD/USD 0.7600, 0.7615, 0.7670, 0.7680

NZD/USD 0.7100,0.7235/40

AUD/NZD 1.0625 (823m)

EUR/GBP 0.9050

USD/CAD 1.3055, 1.3080/85,1.3130/35, 1.3150,1.3220, 1.3250,1.3300, 1.3350/55

USD/CHF 0.9700 (600m),0.9825,0.9925

EUR/JPY 116.00

USD/MXN 17.35 (2.31bn)

-

09:00

Oil little changed in early trading

This morning, the New York futures for Brent rose by 0.16% to $ 50.60 and crude oil futures for WTI decreased in price by 0.08% to $ 51.44 per barrel. Thus, the black gold is trading without significant changes, as traders watch how the strengthening of the dollar evaluate the likelihood that OPEC members and Russia will develop a final and workable plan to reduce production.

Today, the American Petroleum Institute will publish data on stocks of crude oil and petroleum products in the United States and on Wednesday, data from the US Department of Energy, which traders are waiting with great interest. Yesterday, Iraq has asked to be relieved of his participation in an agreement to freeze the volumes of production, which caused a decline in oil prices.

OPEC members will meet on November 30 to discuss the details of global production volume freezing. Iraq occupies the second place in the OPEC in terms of production after Saudi Arabia. Russia also said it would support the agreement and is currently working with OPEC on conditions of freezing.

-

08:35

Sentiment in the German economy continued to improve this month

Sentiment in the German economy continued to improve this month. The Ifo Business Climate Index rose from 109.5 points in September to 110.5 points in October. Companies were more satisfied with their current business situation. They also expressed far greater optimism about the months ahead. The upturn in the German economy is gathering impetus.

In manufacturing the business climate index rose. This was once again due to a far more positive outlook for the months ahead, with expectations rising to a two-year high. Assessments of the current business situation also improved. Demand for capital goods is particularly strong. The capacity utilisation rate rose by 0.9 percent to 85.7 percent versus last quarter.

-

08:13

Italian Industrial Orders Jump in August - Dow Jones

Strong domestic demand in August boosted Italian industrial orders, which jumped 10.2% on the month, national statistics institute Istat says. Domestic orders rose 12.3%, while foreign orders were up 7.1% from July. Orders are a proxy for future industrial output, a key metric for Italy, which has Europe's second-largest manufacturing sector after Germany. Industrial sales rose 4.1% on the month and 10.0% on the year, Istat says.

-

08:00

Germany: IFO - Business Climate, October 110.5 (forecast 109.5)

-

08:00

Germany: IFO - Current Assessment , October 115 (forecast 114.9)

-

08:00

Germany: IFO - Expectations , October 106.1 (forecast 104.5)

-

07:37

Spain's producer prices declined at the slowest pace in more than a year

Rttnews says that Spain's producer prices declined at the slowest pace in more than a year in September, the statistical office INE said Tuesday.

Producer prices declined 2 percent on a yearly basis in September, slower than the 3.2 percent decrease seen in August. This was the slowest pace of decline since July 2015.

Excluding energy, producer prices dropped 0.4 percent after easing 0.6 percent in August.

Energy prices plunged 6.5 percent and cost of intermediate goods and consumer goods slid 1.1 percent and 0.1 percent, respectively. Meanwhile, prices of capital goods gained 0.3 percent.

Month-on-month, producer prices advanced 0.3 percent in September, offsetting a 0.3 percent fall in August. This was the first increase in three months.

.

-

07:34

Eurozone Approves EUR2.8 Bln in Bailout Loans for Greece -- Bailout Fund

-

07:03

Business sentiment data from Germany due next, headlining a light day for the European economic news

-

07:01

Positive start of trading on the major stock exchanges in Europe: DAX + 0.4%, CAC40 + 0.2%, FTSE + 0.6%

-

06:30

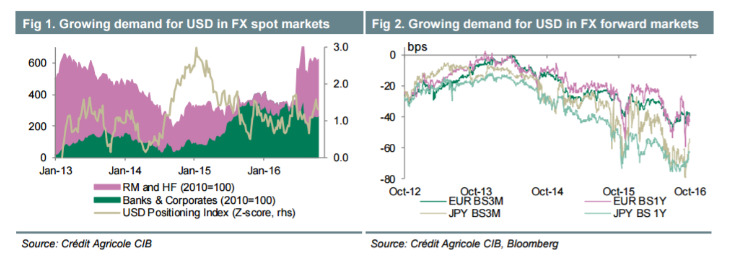

What's Really Behind The Ongoing USD Rally? - Credit Agricole

"The USD buying has intensified ahead of the December Fed meeting. Expectations of USD appreciation supports demand from both global investors and corporates, with the former trying to buy the currency to meet the payments on their sizeable USD-denominated debt.

Some EM central banks appear to respond to the growing demand for USD by selling FX reserves. Recent history further suggests that the drop in FX reserves was usually accompanied by weakness in majors like EUR, implying that the central banks sold liquid G10 holdings and converted the proceeds into USD to meet the FX demand at home.

This turns into a powerful virtuous cycle for the USD that broadens and strengthens its recent uptrend. It can explain the latest EUR/USD selloff that is seemingly at odds with currency fundamentals like rate spreads and sovereign bond yield spreads.

Recent history could suggest that the EUR-undervaluation may persist so long as global demand for USD continues to erode central bank FX reserves and forces them to liquidate assets in liquid USD-proxies".

Copyright © 2016 Credit Agricole CIB, eFXnews™

-

06:29

Options levels on tuesday, October 25, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1108 (3057)

$1.1023 (1763)

$1.0961 (676)

Price at time of writing this review: $1.0882

Support levels (open interest**, contracts):

$1.0811 (2044)

$1.0775 (4431)

$1.0735 (2903)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 41371 contracts, with the maximum number of contracts with strike price $1,1300 (3751);

- Overall open interest on the PUT options with the expiration date November, 4 is 45646 contracts, with the maximum number of contracts with strike price $1,1000 (7374);

- The ratio of PUT/CALL was 1.10 versus 1.11 from the previous trading day according to data from October, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.2502 (1333)

$1.2404 (1042)

$1.2307 (1479)

Price at time of writing this review: $1.2218

Support levels (open interest**, contracts):

$1.2191 (1012)

$1.2095 (1409)

$1.1997 (892)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 31150 contracts, with the maximum number of contracts with strike price $1,2800 (1965);

- Overall open interest on the PUT options with the expiration date November, 4 is 30416 contracts, with the maximum number of contracts with strike price $1,2300 (2007);

- The ratio of PUT/CALL was 0.98 versus 0.98 from the previous trading day according to data from October, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:28

Anglo American has reduced the forecast of coal exports per year to 20,5-21,5 million tons

-

maintains copper production for 2016 at a level of 570 000-600 000 tonnes

-

mining is expected to slightly exceed the annual forecast at 12 million tonnes

-

retains the forecast of nickel production for 2016 at the level of 45 000-47 000 tonnes

-

-

06:18

South Korea's gross domestic product expanded 2.7 percent in the third quarter

According to rttnews, South Korea's gross domestic product expanded 2.7 percent on year in the third quarter of 2016, the Bank of Korea said in Tuesday's preliminary reading.

That beat forecasts for an increase of 2.4 percent, although it slowed from 3.3 percent in the previous three months.

On a seasonally adjusted annualized basis, GDP gained 0.7 percent - also exceeding forecasts for 0.5 percent but down from 0.8 percent in the three months prior.

Real gross domestic income slipped 0.3 percent on quarter.

-

06:15

Bank of Canada, Poloz: the '18 month' comment was not about monetary policy. USD/CAD up 90 pips from the lows

-

04:57

Global Stocks

U.K. stocks fell Monday, with lower oil prices and a ratings downgrade from J.P. Morgan weighing on investor sentiment. Meanwhile, the Confederation of British Industry said Monday that U.K. exports over the last quarter grew 8%, logging its highest balance since April 2014, aided by weakness in the pound, which has been slammed in the wake of the Brexit vote in June.

U.S. stocks pulled back from session highs but ended with gains Monday, getting a lift from a heavy round of merger announcements, including AT&T's planned acquisition of Time Warner. The tech, consumer-discretionary and consumer-staples sectors led the gains, while telecoms and energy sold off. Earlier, the index had been up nearly 14 points.

Japanese shares hit a six-month top on Tuesday as the dollar advanced on the yen, while risk sentiment got a lift after factory surveys in the United States and Europe boasted the best readings of the year so far.

-