Market news

-

22:30

Commodities. Daily history for Oct 24’2016:

(raw materials / closing price /% change)

Oil 50.49 -0.06%

Gold 1,265.00 +0.10%

-

22:29

Stocks. Daily history for Oct 24’2016:

(index / closing price / change items /% change)

Nikkei 225 17,234.42 0.00 0.00%

Shanghai Composite 3,128.41 +37.47 +1.21%

S&P/ASX 200 5,408.49 0.00 0.00%

FTSE 100 6,986.40 -34.07 -0.49%

CAC 40 4,552.58 +16.51 +0.36%

Xetra DAX 10,761.17 +50.44 +0.47%

S&P 500 2,151.33 +10.17 +0.47%

Dow Jones Industrial Average 18,223.03 +77.32 +0.43%

S&P/TSX Composite 14,923.01 -16.03 -0.11%

-

22:28

Currencies. Daily history for Oct 24’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0874 -0,06%

GBP/USD $1,2221 -0,07%

USD/CHF Chf0,9939 +0,06%

USD/JPY Y104,22 +0,37%

EUR/JPY Y113,34 +0,31%

GBP/JPY Y127,36 +0,31%

AUD/USD $0,7598 -0,11%

NZD/USD $0,7117 -0,59%

USD/CAD C$1,3347 +0,12%

-

22:01

Schedule for today, Tuesday, Oct 25’2016

08:00 Germany IFO - Expectations October 104.5 104.5

08:00 Germany IFO - Current Assessment October 114.7 114.9

08:00 Germany IFO - Business Climate October 109.5 109.5

13:00 U.S. Housing Price Index, m/m August 0.5%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y August 5% 5.1%

14:00 U.S. Richmond Fed Manufacturing Index October -8

14:00 U.S. Consumer confidence October 104.1 101

14:35 United Kingdom BOE Gov Mark Carney Speaks

15:30 Eurozone ECB President Mario Draghi Speaks

-

20:05

Major US stock indexes finished trading in the "green zone"

Major US stock indices closed in positive territory on the background of growth of business activity and strong quarterly results, stimulating investor confidence.

"Now everything is determined by the financial statements," - said Bill Northey, an expert U.S. Bank. He added that in the last session of the driver of the dynamics in the stock markets were the financial performance of companies rather than macro-economic events.

In addition, as shown by the October data, the US manufacturers have started confidently fourth quarter, with output and new orders rose significantly stronger than in September. The rebound in business conditions contributed to increased purchases among manufacturers and renewed pressure on capacity. At the same time, manufacturers have sought to increase their resource stocks, while the rate rose for the first time since November 2015. Manufacturers reported that supported domestic economic conditions are a key factor in the growth, helping to offset sluggish export sales in October. On a seasonally adjusted, pre-production managers' index in the US supply of Markit (PMI) jumped to 53.2 in October, with a three-month low of 51.5 in September.

The price of oil fell moderately against the background of a partial profit-taking, as well as indications that the assumption of OPEC to reduce oil production may encounter obstacles. Over the weekend, the head of Iraq's state-owned SOMO Falah al-Amri said that Iraq does not intend to reduce the current level of oil production. He also noted that the volume of oil production in the country is a matter of its sovereignty. In addition, Iraqi Oil Minister urged to resolve Iraq does not participate in the transaction on the level of oil production frozen. He said that Iraq must receive the same privileges as Libya and Nigeria.

Most DOW components of the index showed an increase (21 of 30). More rest up shares Microsoft Corporation (MSFT, + 2.10%). Outsider were shares of Chevron Corporation (CVX, -0.72%).

Most Sector S & P index closed in positive territory. The leader turned out to be the technology sector (+ 0.9%). the health sector fell the most (-0.2%).

At the close:

DOW + 0.42% 18,221.35 +75.64

Nasdaq + 1.00% 5,309.83 +52.43

S & P + 0.46% 2,151.08 +9.92

-

19:00

Dow +0.46% 18,228.68 +82.97 Nasdaq +0.88% 5,303.67 +46.27 S&P +0.46% 2,150.91 +9.75

-

16:32

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes increased as a flurry of deal activity and strong quarterly earnings boosted investor confidence. AT&T (T) was down ~2% after the telecommunications company said it would buy Time Warner Inc (TWX) for $85,4 billion. If approved by regulators, this would be the biggest deal in the world this year. Investors are also parsing quarterly earnings reports from companies. More than a third of the S&P 500 components are scheduled to report earnings this week, including heavyweights such as Apple (AAPL) and Boeing (BA).

Most of Dow stocks in positive area (24 of 30). Top gainer - The Boeing Company (BA, +1.64%). Top loser - Caterpillar Inc. (CAT, -0.73%).

Almost all S&P sectors also in positive area. Top gainer - Technology (+0.8%). Top loser - Basic Materials (-0.3%).

At the moment:

Dow 18146.00 +80.00 +0.44%

S&P 500 2143.75 +9.00 +0.42%

Nasdaq 100 4893.25 +50.00 +1.03%

Oil 49.84 -1.01 -1.99%

Gold 1262.80 -4.90 -0.39%

U.S. 10yr 1.77 +0.03

-

16:00

European stocks closed: FTSE 100 -34.07 6986.40 -0.49% DAX +50.44 10761.17 +0.47% CAC 40 +16.51 4552.58 +0.36%

-

15:53

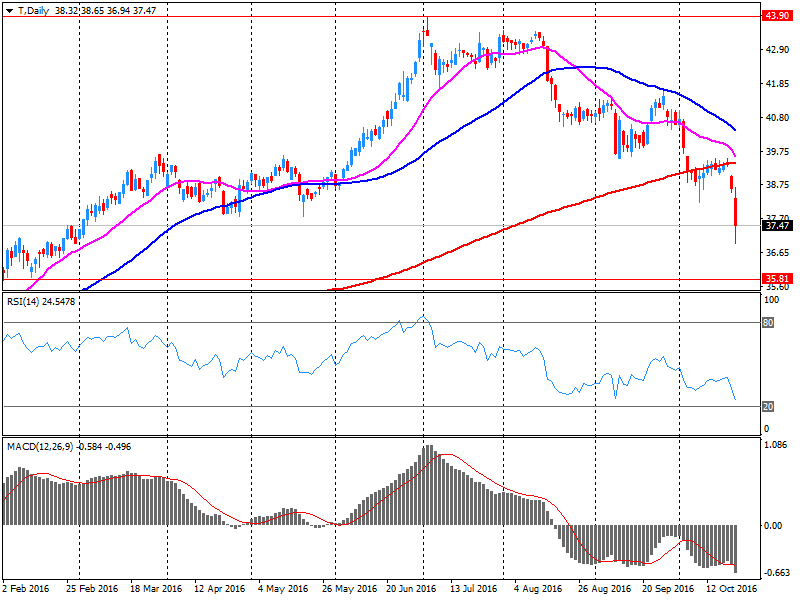

Oil quotes declined about 1%

Oil prices fell moderately against the background of partial profit-taking, as well as the assumption of OPEC to reduce oil production may encounter obstacles.

Over the weekend, the head of Iraq's state-owned State Oil Marketing Organization (SOMO) Falah al-Amri said that Iraq does not intend to reduce the current level of oil production, which currently stands at 4.7 million barrels per day. He also noted that the volume of oil production in the country is a matter of its sovereignty. He said that Iraq must receive the same privileges as Libya and Nigeria

"The collective reduction in oil production would be more difficult without the participation of Iraq - Gao Jian at analyst SCI International -. There is a risk that Iraq's failure could trigger a domino effect, and other oil producers would also want to be excluded from the plan."

The cost of the December futures for US light crude oWTI (Light Sweet Crude Oil) fell to 50.25 dollars per barrel on the New York Mercantile Exchange.

December futures price for Brent fell to 51.20 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

15:42

WSE: Session Results

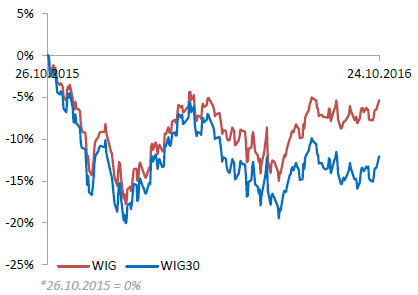

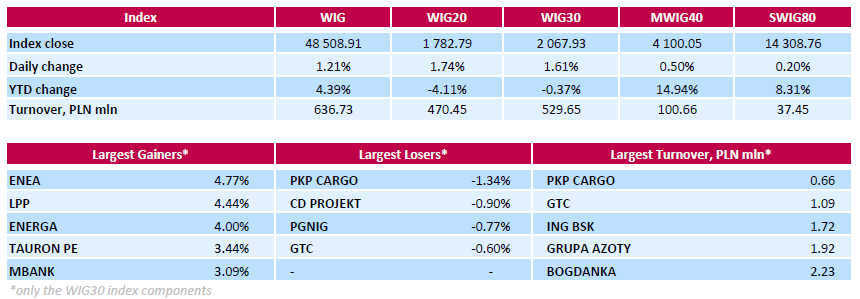

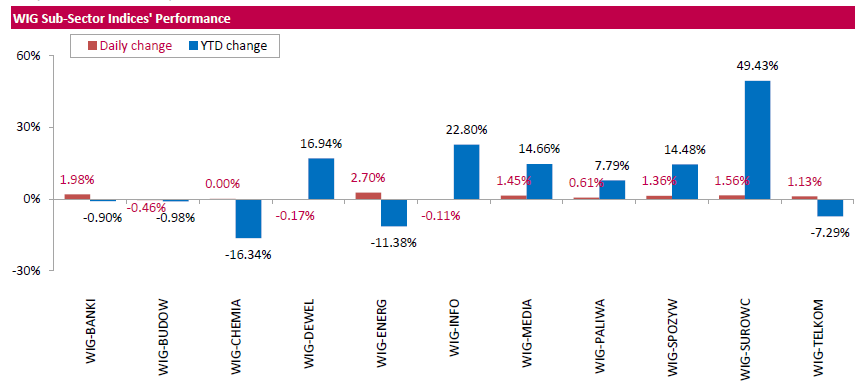

Polish equity market advanced on Monday. The broad market measure, the WIG Index, surged by 1.21%. The WIG sub-sector indices were mainly higher with utilities measure (+2.7%) outpacing.

The large-cap stocks' measure, the WIG30 Index, advanced 1.61%. A majority of the index components returned gains, with the way up led by genco ENEA (WSE: ENA) and clothing retailer LPP (WSE: LPP), climbing by 4.77% and 4.44% respectively. Other major advancers were two gencos ENERGA (WSE: ENG) and TAURON PE (WSE: TPE), banking sector name MBANK (WSE: MBK) and oil refiner LOTOS (WSE: LTS), adding between 3.08% and 4%. At the same time, the handful decliners included railway freight transport operator PKP CARGO (WSE: PKP), videogame developer CD PROJEKT (WSE: CDR), oil and gas producer PGNIG (WSE: PGN) and property developer GTC (WSE: GTC), losing between 0.6% and 1.34%.

-

15:28

Gold price moves lower

Quotes of gold fell slightly, reaching 19 October low move caused by the strengthening of the US dollar, as well as investors focus on the timing of the next Fed hike. Some support for precious metals provided signs of improvement in physical demand among major Asian consumers.

The US Dollar Index, showing the US dollar against a basket of six major currencies, traded with an increase of 0.1%, near a 9-month high. Since gold prices are tied to the dollar, a stronger dollar makes the precious metal more expensive for holders of foreign currencies.

According to the futures market, the likelihood of tighter monetary policy by tje Fed in December is 74.2% against 69.5% the previous day. Recall that in early October, the likelihood of such a step was 60%. Some experts point out that the estimated probability of a hike in December is likely to grow by about 80% before the meeting. As it is known, higher interest rates tend to have a downward pressure on gold.

The cost of the November futures for gold on the COMEX fell to $ 1260.4 per ounce.

-

14:33

Treasury's Weiss: `Compelling Benefits` for Sharing Trade Data With Public

Antonio Weiss, counselor to the Secretary of the U.S. Treasury Department, said Monday he sees a role for sharing newly collected data on government bond transactions with the public, not only the official sector.

The Treasury official said in remarks at a Federal Reserve Bank of New York conference that the question of whether newly collected data on government-bond trading should be shared with the public should shift to how and when, not whether.

-

14:01

October data signalled that U.S. manufacturers started the fourth quarter in a strong fashion - Markit

October data signalled that U.S. manufacturers started the fourth quarter in a strong fashion, with output and new order volumes rising at markedly faster rates than in September. A rebound in business conditions contributed to greater input buying among manufacturing firms and renewed pressures on capacity. At the same time, manufacturers sought to boost their stocks of inputs, with pre-production inventories rising for the first time since November 2015.

Adjusted for seasonal influences, the Markit Flash U.S. Manufacturing Purchasing Managers' Index™ (PMI™ ) 1 rebounded to 53.2 in October, from a three-month low of 51.5 in September. The latest reading signalled a solid upturn in overall business conditions, and the rate of improvement was the fastest since October 2015. Stronger output and new business growth were the key factors boosting the headline PMI, which helped offset a drag from softer job hiring in October.

-

13:45

U.S.: Manufacturing PMI, October 53.2 (forecast 51.6)

-

13:32

U.S. Stocks open: Dow +0.64%, Nasdaq +0.63%, S&P +0.48%

-

13:31

Option expiries for today's 10:00 ET NY cut

USD/JPY 99.95/100.00/05/10 (692m),100.25/30/35/40/45 (675m), 100.50 (1.4bn),101.20, 101.45/50/55/60 (1bn),102.00, 102.15, 102.50, 102.85,103.00, 103.50, 103.60, 103.75,104.00 (1.41bn), 104.25/30, 104.40, 104.50 (1.01bn), 104.65,105.00 (2.26bn)

EUR/USD 1.0810, 1.0875,1.0910, 1.0930, 1.0940 (494m), 1.0950 (634m), 1.0960,1.1000,1.1150

GBP/USD 1.2200,1.2300, 1.2350,1.2450

AUD/USD 0.7500, 0.7560, 0.7575,0.7600/05, 0.7615/20/25,0.7710, 0.7735

NZD/USD 0.7400

AUD/NZD 1.0600 (220m), 1.0680 (686m)

USD/CAD 1.3300, 1.3325/30, 1.3350 (728m),1.3500

EUR/JPY 109.00 (553),113.50 (379m),114.00 (447m), 114.50 (253m),115.00 (522m),116.45/60/65,117.00

USD/CHF 0.9630, 0.9645/55/60 (922M)

-

13:24

Before the bell: S&P futures +0.48%, NASDAQ futures +0.65%

U.S. stock-index futures rose to begin one of the earnings reporting season's busiest weeks, as a flurry of deal activity spurred optimism in equity markets.

Global Stocks:

Nikkei 17,234.42 +49.83 +0.29%

Hang Seng 23,604.08 +229.68 +0.98%

Shanghai 3,128.41 +37.47 +1.21%

FTSE 7,016.28 -4.19 -0.06%

CAC 4,573.24 +37.17 +0.82%

DAX 10,807.12 +96.39 +0.90%

Crude $50.16 (-1.36%)

Gold $1265.50 (-0.17%)

-

13:11

Global sales of Caterpillar for the 3 months to September fell by 18%

-

13:10

Fed's Dudley Weighs Scope for Sharing Treasury Data With Public

-

13:10

Fed's Bullard: Fed Rates to Remain 'Exceptionally Low'

-

12:51

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

172

2.50(1.4749%)

768

ALCOA INC.

AA

27

0.12(0.4464%)

5685

Amazon.com Inc., NASDAQ

AMZN

823.65

4.66(0.569%)

19783

American Express Co

AXP

67.85

0.49(0.7274%)

1500

Apple Inc.

AAPL

117.12

0.52(0.446%)

126263

AT&T Inc

T

36.5

-0.99(-2.6407%)

3359825

Barrick Gold Corporation, NYSE

ABX

17.02

0.10(0.591%)

28177

Caterpillar Inc

CAT

85.76

-0.57(-0.6603%)

833

Chevron Corp

CVX

101.33

0.03(0.0296%)

320

Cisco Systems Inc

CSCO

30.4

0.25(0.8292%)

2683

Citigroup Inc., NYSE

C

49.89

0.32(0.6456%)

3710

Exxon Mobil Corp

XOM

86.5

-0.12(-0.1385%)

175

Facebook, Inc.

FB

132.75

0.68(0.5149%)

185577

Ford Motor Co.

F

12.05

0.03(0.2496%)

28967

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.1

0.06(0.5976%)

22825

General Electric Co

GE

29.06

0.08(0.2761%)

11783

General Motors Company, NYSE

GM

32.22

0.18(0.5618%)

1760

Goldman Sachs

GS

175.18

0.51(0.292%)

2110

Google Inc.

GOOG

803.5

4.13(0.5167%)

3638

Home Depot Inc

HD

126.8

0.20(0.158%)

2040

HONEYWELL INTERNATIONAL INC.

HON

108.97

0.01(0.0092%)

1100

Intel Corp

INTC

35.25

0.10(0.2845%)

8140

International Business Machines Co...

IBM

149.88

0.25(0.1671%)

2339

International Paper Company

IP

47.4

0.40(0.8511%)

8200

Johnson & Johnson

JNJ

113.85

0.41(0.3614%)

1957

JPMorgan Chase and Co

JPM

68.79

0.30(0.438%)

5531

McDonald's Corp

MCD

114.05

0.12(0.1053%)

2251

Microsoft Corp

MSFT

59.75

0.09(0.1509%)

57964

Nike

NKE

51.94

0.17(0.3284%)

9634

Pfizer Inc

PFE

32.3

0.12(0.3729%)

4364

Procter & Gamble Co

PG

84.5

0.17(0.2016%)

5104

Starbucks Corporation, NASDAQ

SBUX

53.8

0.17(0.317%)

2559

Tesla Motors, Inc., NASDAQ

TSLA

201.52

1.43(0.7147%)

12172

The Coca-Cola Co

KO

42.4

0.27(0.6409%)

31415

Travelers Companies Inc

TRV

108.08

-0.27(-0.2492%)

300

Twitter, Inc., NYSE

TWTR

17.83

-0.26(-1.4373%)

248031

Verizon Communications Inc

VZ

48.69

0.49(1.0166%)

29641

Visa

V

83.18

0.83(1.0079%)

22918

Walt Disney Co

DIS

93.4

0.37(0.3977%)

5623

Yahoo! Inc., NASDAQ

YHOO

42.39

0.22(0.5217%)

1113

Yandex N.V., NASDAQ

YNDX

19.97

0.47(2.4103%)

2950

-

12:41

Upgrades and downgrades before the market open

Upgrades:

3M (MMM) upgraded to Overweight from Equal Weight at Barclays

Downgrades:

AT&T (T) downgraded to Market Perform from Outperform at Cowen

AT&T (T) downgraded to Hold from Buy at Drexel Hamilton

Other:

-

12:36

Canadian Wholesale Sales Advanced 0.8% to $56.8 billion in August

Wholesale sales advanced 0.8% to $56.8 billion in August, a fifth consecutive gain. Five of the seven subsectors, representing 80% of total wholesale sales, reported increases. The miscellaneous subsector and machinery, equipment and supplies subsector contributed the most to the rise.

In volume terms, wholesale sales were up 0.8%.

Although sales rose in five subsectors, gains were mainly concentrated in the miscellaneous subsector and the machinery, equipment and supplies subsector.

In dollar terms, the miscellaneous subsector recorded the largest increase, up 3.9% to $7.2 billion, mostly on the strength of higher sales in the agricultural supplies industry. Sales in this industry grew 11.8% to $2.2 billion in August, the third increase in five months. The gain in August reflected higher exports of fertilizer, pesticide and other chemical products.

-

12:30

Canada: Wholesale Sales, m/m, August 0.8% (forecast 0.5%)

-

12:07

JPY: Some Catching Up To Do; NZD: N-Term Shorts Cleared Out - Credit Agricole

"Despite lower US rates, USD/JPY has been broadly range bound while other USD crosses have moved significantly more.

Indeed, USD/JPY has been broadly trapped in a range, which leaves some opportunity for the major to play catch up with rates. Importantly, interest rates remain the main driver of the USD/JPY with equities having fallen by the wayside.

Japanese labour and inflation data are unlikely to be significant drivers of the USD/JPY given that the BoJ has committed to locking in the steepness of the JGB yield curve. Inflation will likely remain weak on the back of the strong JPY.

Potentially more important drivers are the 2Y and 20Y JGB auctions as the market continues to test the BoJ's Yield Curve Control.

The rally in the NZD/USD on the back of the NZ CPI upside surprise has likely cleared out near-term short positions, so positioning will likely be less of a factor going forward.

There is little on the domestic front to drive the NZD next week. NZ's trade balance should improve from a 3-year low on the back of stronger commodity prices, but the main driver of the NZD next week will be sympathetic moves with the AUD on the back of Australian CPI data as well as shifts in expectations for FOMC rate hikes".

Copyright © 2016 Credit Agricole CIB, eFXnews™

-

11:49

Orders

EUR/USD

Offers : 1.0900 1.0915-20 1.0940-50 1.0980 1.1000

Bids : 1.0850 1.0825-30 1.0800 1.0785 1.0750 1.0700

GBP/USD

Offers : 1.2250 1.2280 1.2300 1.2325-30 1.2350 1.2380 1.2400

Bids : 1.2200 1.2185 1.2165 1.2145-50 1.2130 1.2100 1.2085 1.2050

EUR/GBP

Offers : 0.8920-25 0.8955 0.8975-80 0.9000

Bids : 0.8885 0.8870 0.8850-55 0.8830 0.8800

EUR/JPY

Offers : 113.30 113.50 113.80-85 114.00 114.20 114.70-75 115.00

Bids : 112.85-90 112.60 112.00 111.85 111.50 111.00

USD/JPY

Offers : 104.00 104.25-30 104.50 104.80 105.00

Bids : 103.50 103.20-25 103.00 102.85 102.50 102.30 102.00

AUD/USD

Offers : 0.7650 0.7665 0.7680 0.7700 0.7730-35 0.7755-60 0.7800

Bids : 0.7620 0.7600 0.7580 0.7555-60 0.7500

-

11:12

Company News: AT&T (T) posts Q3 EPS in line with analysts' estimate

AT&T reported Q3 FY 2016 earnings of $0.74 per share (versus $0.74 in Q3 FY 2015), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $40.890 bln (+4.6% y/y), slightly missing analysts' consensus estimate of $41.148 bln.

AT&T also announced that its board of directors has approved a 2.1% increase in the company's quarterly dividend. AT&T's quarterly dividend will increase from $0.48 to $0.49 per share.

T fell to $36.75 (-1.97%) in pre-market trading.

-

10:43

Major stock indices in Europe show a positive trend

European stocks started trading on an upward trend due to the news that Spain withdrew from the political impasse and strong statistical data for the euro area economy.

The Spanish IBEX 35 jumped 1.4% on the information that the leader of the opposition Socialist Party will no longer intend to block the return of Mariano Rajoy, representing the People's Party, to the post of prime minister.

Thus, M.Rahoy can be re-elected to the post of prime minister, and the country will avoid the repeated parliamentary elections, reports BBC.

Statistical data released today, reported an increase in business activity in the euro area.

The composite PMI index of euro-zone countries rose from 52.6 points to 53.7 points - the highest since December 2015, according to preliminary data by Markit Economics.

The indicator of activity in the euro zone's services sector rose from 52.2 to 53.5, manufacturing jumped from 52.6 to 53.3 points - the highest level since April 2014.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0,5% - to 346.16 points.

Shares of Philips NV rose 4,5%. The company has increased its net profit in the third quarter of 2016 by 18.2% thanks to the strong performance in medical technology. In addition to this guide Philips announced plans to sell the unit for the production of LEDs and automotive lamps until the end of 2016.

The cost of securities of Swiss chemical company Syngenta dropped by 8.3%.

Shares of the French supplier of components for the aerospace industry Zodiac Aerospace rose by 2.7% onM & A actions.

At the moment:

FTSE 7022.62 2.15 0.03%

DAX 10799.82 89.09 0.83%

CAC 4572.25 36.18 0.80%

-

10:36

Latest UK manufacturing figures show competitiveness with EU at record high

Latest figures show competitiveness with EU at record high, according to CBI Quarterly Industrial Trends Survey.

Manufacturing output and orders grew over the last quarter, with export volumes growth the strongest for two and half years, according to the latest quarterly CBI Industrial Trends Survey.

The survey of 459 manufacturers reveals that competitiveness in EU markets rose at the fastest pace since the series began in 2000, with competitiveness outside the bloc also improving at the quickest rate since 2009.

Domestic demand grew modestly, while export orders rose for the first time in over a year. The outlook for demand over the next three months is generally positive, with export orders expected to rise further, along with more modest growth in domestic orders. But concerns persist about the availability of skilled labour, with almost a quarter of respondents observing that skilled labour availability could limit output over the next few months.

-

10:01

Earnings Season in U.S.: Major Reports of the Week

October 24

Before the Open:

AT&T (T). Consensus EPS $0.74, Consensus Revenue $41148.26 mln.

After the Close:

Visa (V). Consensus EPS $0.73, Consensus Revenue $4241.50 mln.

October 25

Before the Open:

3M (MMM). Consensus EPS $2.14, Consensus Revenue $7719.82 mln.

Caterpillar (CAT). Consensus EPS $0.76, Consensus Revenue $9884.63 mln.

DuPont (DD). Consensus EPS $0.21, Consensus Revenue $4845.32 mln.

Freeport-McMoRan (FCX). Consensus EPS $0.20, Consensus Revenue $3956.57 mln.

General Motors (GM). Consensus EPS $1.45, Consensus Revenue $37665.94 mln.

Merck (MRK). Consensus EPS $0.99, Consensus Revenue $10180.00 mln.

Procter & Gamble (PG). Consensus EPS $0.98, Consensus Revenue $16484.77 mln.

United Tech (UTX). Consensus EPS $1.67, Consensus Revenue $14286.18 mln.

After the Close:

Apple (AAPL). Consensus EPS $1.65, Consensus Revenue $46934.05 mln.

October 26

Before the Open:

Boeing (BA). Consensus EPS $2.62, Consensus Revenue $23600.13 mln.

Coca-Cola (KO). Consensus EPS $0.48, Consensus Revenue $10534.38 mln.

After the Close:

Barrick Gold (ABX). Consensus EPS $0.21, Consensus Revenue $2229.35 mln.

Tesla Motors (TSLA). Consensus EPS $0.06, Consensus Revenue $2338.10 mln.

October 27

Before the Open:

Altria (MO). Consensus EPS $0.81, Consensus Revenue $5110.94 mln.

Ford Motor (F). Consensus EPS $0.21, Consensus Revenue $33210.96 mln.

Intl Paper (IP). Consensus EPS $0.93, Consensus Revenue $5376.48 mln.

Yandex N.V. (YNDX). Consensus EPS RUB 10.74, Consensus Revenue RUB 18707.51 mln.

After the Close:

Alphabet (GOOG). Consensus EPS $8.62, Consensus Revenue $21878.94 mln.

Amazon (AMZN). Consensus EPS $0.81, Consensus Revenue $32653.99 mln.

Twitter (TWTR). Consensus EPS $0.09, Consensus Revenue $605.50 mln.

October 28

Before the Open:

Chevron (CVX). Consensus EPS $0.40, Consensus Revenue $31339.15 mln.

Exxon Mobil (XOM). Consensus EPS $0.57, Consensus Revenue $63851.56 mln.

MasterCard (MA). Consensus EPS $0.98, Consensus Revenue $2743.57 mln.

-

09:44

OPEC and Russia are committed to stabilize oil prices - Forexlive

-

There are signs the rebalancing of fundamentals are under way

-

Demand is at healthy levels but overhang remains a major concern

-

Decision in Algiers helped to calm volatility in oil markets

-

It is essential that OPEC and non-OPEC countries address overcapacity

-

Russia is crucial in addressing energy challenges

-

-

09:16

UBS raises EasyJet stock rating to "buy" from "neutral"

-

08:57

Option expiries for today's 10:00 ET NY cut

USD/JPY 99.95/100.00/05/10 (692m),100.25/30/35/40/45 (675m), 100.50 (1.4bn),101.20, 101.45/50/55/60 (1bn),102.00, 102.15, 102.50, 102.85,103.00, 103.50, 103.60, 103.75,104.00 (1.41bn), 104.25/30, 104.40, 104.50 (1.01bn), 104.65,105.00 (2.26bn)

EUR/USD 1.0810, 1.0875,1.0910, 1.0930, 1.0940 (494m), 1.0950 (634m), 1.0960,1.1000,1.1150

GBP/USD 1.2200,1.2300, 1.2350,1.2450

AUD/USD 0.7500, 0.7560, 0.7575,0.7600/05, 0.7615/20/25,0.7710, 0.7735

NZD/USD 0.7400

AUD/NZD 1.0600 (220m), 1.0680 (686m)

USD/CAD 1.3300, 1.3325/30, 1.3350 (728m),1.3500

EUR/JPY 109.00 (553),113.50 (379m),114.00 (447m), 114.50 (253m),115.00 (522m),116.45/60/65,117.00

USD/CHF 0.9630, 0.9645/55/60 (922M)

-

08:46

Oil is trading lower

This morning, the New York futures for Brent down 0.37% to $ 50.66 and WTI decreased in price by 0.23% to $ 51.66 per barrel. Thus, the black gold is traded in the red zone on the background of profit taking and growing doubts that an agreement between the major producers on the supply constraints will lead to significant changes.

Russian Energy Minister Novak showed interest in participating in the OPEC's agreement on the reduction of production and said it will make appropriate proposals colleagues from Saudi Arabia.

-

08:06

Euro Zone manufacuting and services sectors exceed expectations

The pace of economic growth in the eurozone rose to the highest seen so far this year in October, led by a growth upturn in Germany, according to PMI® survey data.

Faster growth of orders books and an acceleration in the pace of hiring also augur well for the economy to continue to strengthen in coming months. Inflationary pressures meanwhile showed signs of picking up, with the survey recording the largest increase in prices charged for over five years.

The Markit Eurozone PMI rose from 52.6 in September to 53.7 in October, signalling the fastest monthly increase in business activity since December of last year. New order growth was the highest since January, prompting firms to take on extra staff. Employment showed the biggest gain for three months.

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at IHS Markit said: "The eurozone economy showed renewed signs of life at the start of the fourth quarter, enjoying its strongest expansion so far this year with the promise of more to come. With backlogs of work accumulating at the fastest rate for over five years, business activity growth and hiring look set to accelerate further as we head towards the end of the year.

October's PMI is consistent with a quarterly GDP growth rate of 0.4%, led by a 0.5% pace of expansion in Germany. Modest growth of 0.2-0.3% is being signalled for France, but there are various indicators which suggest that France will enjoy stronger growth in coming months, including a marked build-up of uncompleted work".

-

08:01

Major stock markets trading in the green zone: FTSE 100 7,064.42 +43.95 + 0.63%, Xetra DAX 10,780.44 +69.71 + 0.65%

-

08:00

Eurozone: Manufacturing PMI, October 53.3 (forecast 52.6)

-

08:00

Eurozone: Services PMI, October 53.5 (forecast 52.4)

-

07:33

October data highlighted a solid rise in private sector output in Germany

According to Markit, October data highlighted a solid rise in private sector output in Germany. The Markit Flash Germany Composite Output Index recovered from September's 16-month low of 52.8 and posted 55.1, thereby signalling an acceleration in the rate of growth.

Moreover, underlying data revealed that faster expansions were recorded at both manufacturers and service providers. The increase in overall activity was supported by the sharpest rise in new business this year so far. Demand for German services picked up, having increased only marginally in the prior month.

Meanwhile, new orders placed with manufacturers continued to rise at a solid pace. Part of the increase was attributed to stronger demand from foreign clients, with Asia and the US mentioned specifically as sources of export growth.

-

07:30

Germany: Services PMI, October 54.1 (forecast 51.5)

-

07:30

Germany: Manufacturing PMI, October 55.1 (forecast 54.3)

-

07:03

October’s flash France PMI data indicated private sector output rose at a slightly softer rate - Markit

October's flash France PMI data indicated private sector output rose at a slightly softer rate, led lower by weaker growth in the service sector and despite manufacturers raising production to the greatest degree for over two-and-a-half years.

The Markit Flash France Composite Output Index, based on around 85% of normal monthly survey replies, registered 52.2, compared to September's 15-month peak of 52.7.

There was some divergence between the respective trends in output of the two main sectors covered by the PMI survey.

Commenting on the Flash PMI data, Paul Smith, Senior Economist at IHS Markit said: "Although growth slipped slightly in October, the latest data revealed a number of positives for the French economy, especially on the manufacturing side with rising exports supporting a marked uplift in output. With signs of intensifying capacity pressures and service providers indicating expectations for near-term growth, the outlook for the rest of 2016 looks reasonably positive."

-

07:00

France: Manufacturing PMI, October 51.3 (forecast 50)

-

07:00

France: Services PMI, October 52.1 (forecast 53)

-

06:57

Expected positive start of trading on the major stock exchanges in Europe: DAX + 0.2%, CAC40 + 0.1%, FTSE + 0.2%

-

06:36

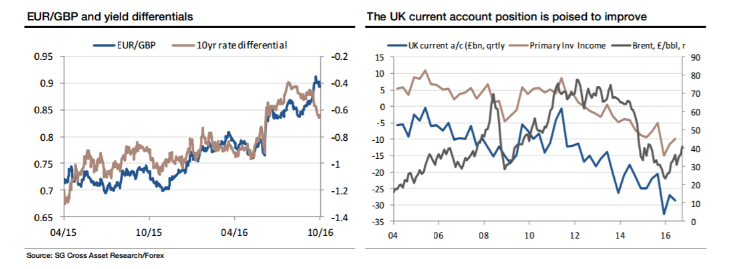

Societe Generale’s case for EUR/GBP long

"How do we profit from a period of EUR/USD drifting lower in its current range as US Treasury yields edge higher, before possibly rising sharply at some point in the next six months, which is impossible to see with any precision?

In spot, our preference is to take advantage of EUR/USD softness to buy EUR/GBP. The risk now is a broader loss of confidence in UK assets amidst political and economic uncertainty that would hurt UK bonds, currency and equities at the same time. That would send EUR/GBP up almost as much as GBP/USD fell.

Two big tail risks, for GBP down and EUR up, can make for a large move in EUR/GBP*. The danger is that now that we have seen the big adjustment in the pound, what we get from here is a tight range with low volatility, but for a directional trade, EUR/GBP looks to have a very big upward skew in the possible outcomes.

It's only fair to point out that one threat to the UK that shouldn't be overstated is the dire state of the balance of payments. Yes, the UK current account deficit is running at a quarterly rate of over £30bn, but it will soon improve. The vast bulk of the deterioration, shown in the chart below, comes from primary investment income, which mostly means the balance of income UK companies earn abroad relative to what foreign companies earn in the UK. A weak pound should help correct this, but so should higher oil and commodity prices. A strong pound and soft commodity prices really hit the overseas earnings of big UK-based resource companies, but the sterling price of oil is bouncing fast. This is worth watching, particularly when the 4Q and 1Q current account data are released next year".

SocGen maintains a long EUR/GBP position from 0.8620 in its portfolio.

Copyright © 2016 Societe Generale, eFXnews™

-

06:32

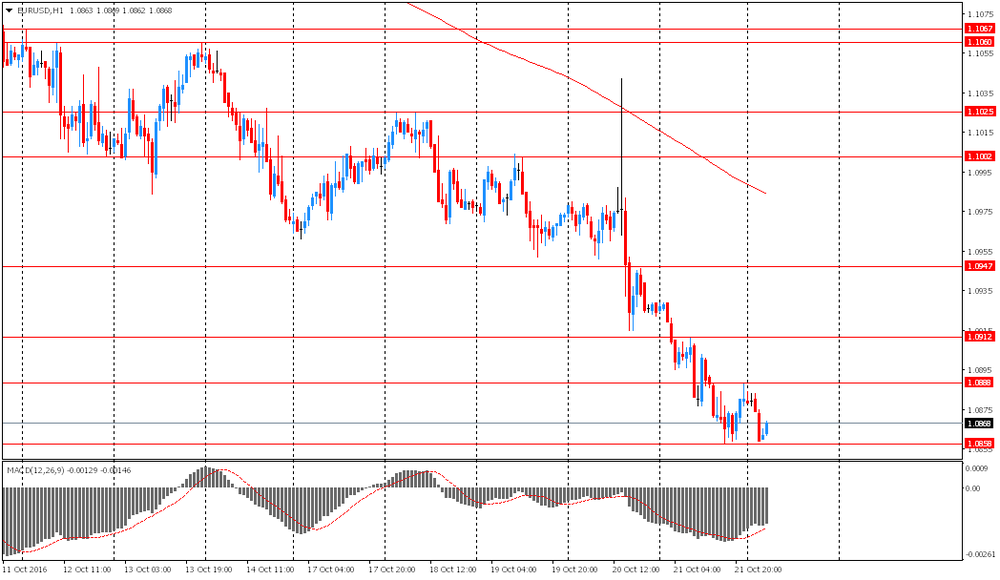

Asian session review: little change on the majors

The euro extended its decline after Friday European Central Bank President Mario Draghi has hinted on the possible extension of the program of quantitative easing.

The yen traded without significant changes, despite the more positive-than-expected data on the trade balance of Japan. As reported today by Japan's Ministry of Finance, the overall trade balance in September amounted to 498.3 billion., Which is higher than the previous value of -18.7 billion and economists forecast of 341.8 billion. Annual exports of goods and services from Japan in September decreased by -6.9%, the weakest figure since March of this year.

Also positive was preliminary data on the index of business activity in the manufacturing sector Nikkei / Markit, which in October was equal to 51.1 points, higher than the previous value of 50.4.

The US dollar rose slightly against most major currencies on growing expectations about a Fed hike due to strong economic data. According to futures on interest rates from the CME, the probability of a hike in December is 70%. A month earlier it was estimated at about 50%.

EUR / USD: during the Asian session the pair fell to $ 1.0860

GBP / USD: during the Asian session the pair fell to $ 1.2185

USD / JPY: during the Asian session, the pair was trading in the Y103.80-00 range

-

06:23

The index of business activity in the manufacturing sector of Japan increased in October

Preliminary index of business activity in the manufacturing sector, published by Nikkei / Markit, was 51.1 points higher than the previous value of 50.4. This indicator shows the business optimism in the industrial sector of the Japanese economy and is calculated based on a survey of senior executives.

According to the Nikkei report the sector was the most active in 9 months. Production conditions in Japan continued to improve in October. The growth of production contributed to the increase in sales, which increased for the first time since January.

The data also indicate that the strong expansion of external demand led to an increase in the total volume of new orders, as new export grew at the fastest pace in nine months.

-

06:18

Australian Dollar Steady Ahead of Inflation Data

The Australian dollar was relatively stable Monday, hovering around 76 U.S. cents, as traders remained on the sidelines ahead of major data releases later this week.

This morning the currency was trading at US$0.7612, barely higher from where it was when Sydney's stock market opened Monday.

Analysts said the Australian dollar's latest strength rests on soaring prices for coal and iron ore--the country's biggest export commodities.

-

06:14

Iraq says should be exempted from OPEC output freeze - Reuters

-

06:13

Japan's foreign trade balance turned to a surplus in September

According to rttnews, Japan's foreign trade balance turned to a surplus in September from a deficit in the previous year, as imports fell faster than exports, preliminary figures from the Ministry of Finance showed Monday.

The trade balance showed a surplus of JPY 498.3 billion in September versus a shortfall of JPY 121.3 billion in the same month of 2015. That was above the surplus of JPY 366.1 billion expected by economists.

Exports fell 6.9 percent year-over-year in September and imports plunged by 16.3 percent.

-

05:05

Options levels on monday, October 24, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1111 (3045)

$1.1030 (1668)

$1.0968 (657)

Price at time of writing this review: $1.0864

Support levels (open interest**, contracts):

$1.0831 (3013)

$1.0802 (1981)

$1.0768 (4378)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 41041 contracts, with the maximum number of contracts with strike price $1,1300 (3775);

- Overall open interest on the PUT options with the expiration date November, 4 is 45507 contracts, with the maximum number of contracts with strike price $1,1000 (7398);

- The ratio of PUT/CALL was 1.11 versus 1.12 from the previous trading day according to data from October, 21

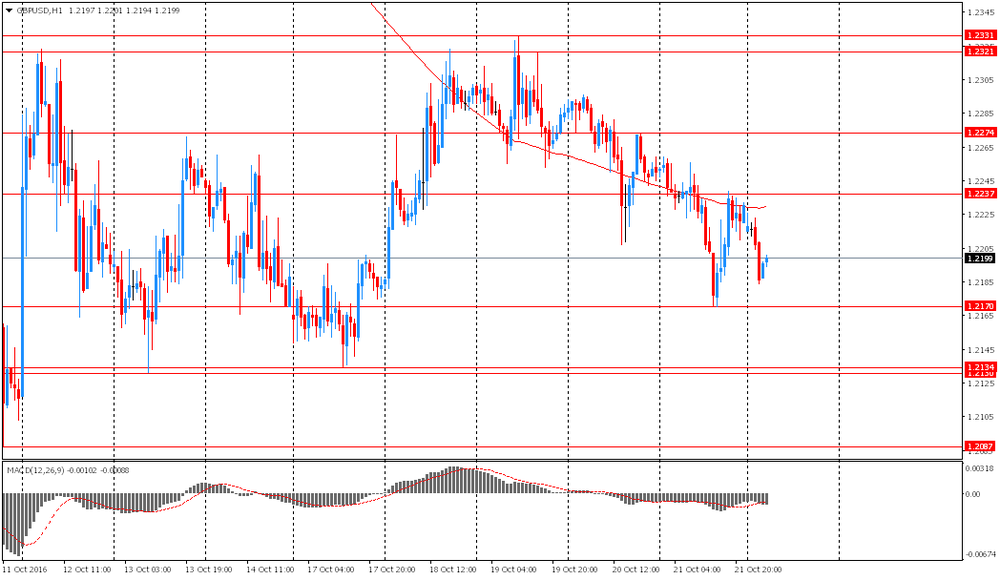

GBP/USD

Resistance levels (open interest**, contracts)

$1.2503 (1297)

$1.2405 (959)

$1.2309 (1495)

Price at time of writing this review: $1.2198

Support levels (open interest**, contracts):

$1.2094 (1405)

$1.1996 (869)

$1.1898 (654)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 30953 contracts, with the maximum number of contracts with strike price $1,2800 (2051);

- Overall open interest on the PUT options with the expiration date November, 4 is 30271 contracts, with the maximum number of contracts with strike price $1,2300 (1969);

- The ratio of PUT/CALL was 0.98 versus 1.00 from the previous trading day according to data from October, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:02

Japan: Leading Economic Index , August 100.9

-

05:02

Japan: Coincident Index, August 112.0

-

04:57

Global Stocks

European stocks finished flat Friday, with some indexes easing from multimonth highs as investors waded through corporate reports while they considered European Central Bank President Mario Draghi's hint toward the possibility of more monetary stimulus.

The Dow and S&P 500 on Friday finished near break-even, but ended well off their lows of the session, while the Nasdaq rallied and all three indexes ended a string of back-to-back weekly declines. The mixed results from the Dow components further muddied the question of whether the pace of economic activity was justifying equity valuations, especially ahead of the coming U.S. election and an expected interest-rate hike from the Federal Reserve.

Asia's main equity markets were lower early Monday, with disappointing trade data from Japan and a slightly stronger yen putting a cap on local shares. Data released Monday by Japan's Ministry of Finance showed exports falling 6.9% in September from a year earlier, in the 12th consecutive month of declines as the stronger yen continued to hurt manufacturers.

-

00:30

Japan: Manufacturing PMI, October 51.7

-