Market news

-

22:30

Stocks. Daily history for Oct 25’2016:

(index / closing price / change items /% change)

Nikkei 225 17,365.25 +130.83 +0.76%

Shanghai Composite 3,132.08 +3.84 +0.12%

S&P/ASX 200 5,442.83 +34.34 +0.63%

FTSE 100 7,017.64 +31.24 +0.45%

CAC 40 4,540.84 -11.74 -0.26%

Xetra DAX 10,757.31 -3.86 -0.04%

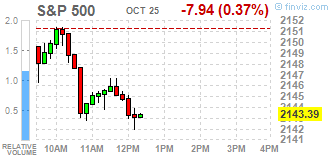

S&P 500 2,143.16 -8.17 -0.38%

Dow Jones Industrial Average 18,169.27 -53.76 -0.30%

S&P/TSX Composite 14,870.63 -52.38 -0.35%

-

20:06

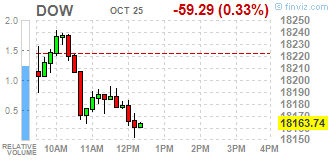

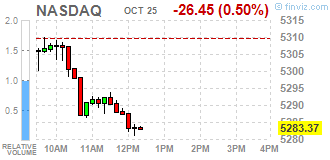

Major US stock indexes finished trading in the "red zone"

Disappointing corporate results of several "heavyweights" sent major stock indexes Wall Street into negative territory, while investors sought clues on the timing of the next increase in interest rates in anticipation of the Fed meeting next week.

In addition, a report from S & P / Case-Shiller showed that nationwide house price index rose 5.3% in August, compared with growth of 5.0% last month. The index for the 10 metropolises showed an increase of 4.3% compared with 4.1% in the previous month. to 20 mega-cities index showed an increase of 5.1% per annum compared to 5.0% in July. On a monthly basis before seasonal adjustment of the national index showed an increase of 0.5% in August.

Meanwhile, the Federal Agency for Housing Finance reported that US home prices rose in August by 0.7 percent compared to July. Previously reported increase of 0.5 percent in July remained unchanged. From August 2015 on August 2016 prices rose by 6.4 per cent.

The consumer confidence index from the Conference Board, which increased in September, declined in October. The index is currently 98.6 (1985 = 100) compared to 103.5 in September. the present situation index fell to 127.9 from 120.6, while the expectations index fell to 87.2 last month to 83.9.

It should also be noted that the index of economic optimism in the US, calculated by the newspaper Investor's Business Daily and research firm TechnoMetrica Institute of Policy and Politics, rose in October by 4.6 points, reaching 51.3 points (up to April 2015). Experts had expected the index to rise to 47.6 points.

Oil futures fell by about 1.5 percent as traders continue to analyze comments from OPEC about declining production prospects, as well as waiting for the publication in the US petroleum inventory data. Many experts remain confident that OPEC will be able to work out a final agreement at the meeting on 30 November.

Most DOW components of the index closed in negative territory (17 of 30). Outsider were shares of The Home Depot, Inc. (HD, -3.41%). More rest up shares The Procter & Gamble Company (PG, + 3.70%).

Most sectors of the S & P showed a decline. the services sector fell the most (-0.6%). The leader turned utilities sector (+ 0.3%).

At the close:

Dow -0.29% 18,170.57 -52.46

Nasdaq -0.50% 5,283.40 -26.43

S & P -0.38% 2,143.25 -8.08

-

19:00

Dow -0.29% 18,170.23 -52.80 Nasdaq -0.54% 5,281.20 -28.63 S&P -0.36% 2,143.60 -7.73

-

16:27

Wall Street. Major U.S. stock-indexes fell

Disappointing corporate results from several heavyweights dragged Wall Street as investors looked for clues regarding the timing of the next interest rate hike ahead of a Fed meeting next week. While investors aren't expecting the Fed to raise rates when it meets next week, they will be looking for clues regarding the trajectory of future hikes.

Most of Dow stocks in negative area (19 of 30). Top gainer - The Procter & Gamble Company (PG, +4.17%). Top loser - 3M Company (МММ, -3.07%).

Almost all S&P sectors also in negative area. Top gainer - Utilities (+0.1%). Top loser - Healthcare (-0.5%).

At the moment:

Dow 18085.00 -49.00 -0.27%

S&P 500 2137.25 -7.00 -0.33%

Nasdaq 100 4886.75 -16.00 -0.33%

Oil 49.86 -0.66 -1.31%

Gold 1273.70 +10.00 +0.79%

U.S. 10yr 1.75 -0.01

-

16:00

European stocks closed: FTSE 100 +31.24 7017.64 +0.45% DAX -3.86 10757.31 -0.04% CAC 40 -11.74 4540.84 -0.26%

-

15:30

WSE: Session Results

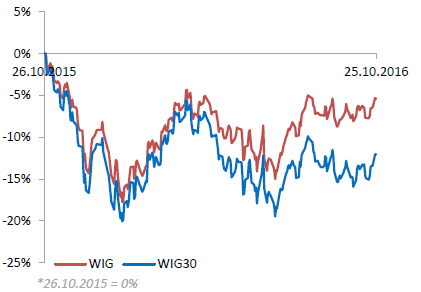

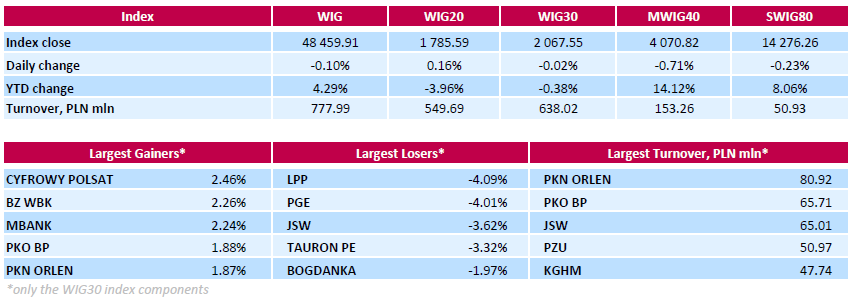

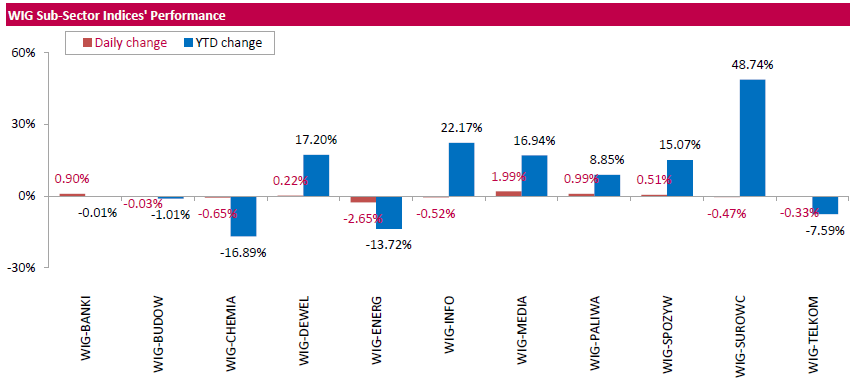

Polish equity market closed slightly lower on Tuesday. The broad market measure, the WIG Index, fell by 0.1%. Sector performance within the WIG Index was mixed. Media sector (+1.99%) outperformed, while utilities (-2.65%) lagged behind.

The large-cap WIG30 Index edged down 0.02%. Within the index components, media group CYFROWY POLSAT (WSE: CPS) led the gainers with a 2.46% advance, followed by three banking sector names BZ WBK (WSE: BZW), MBANK (WSE: MBK) and PKO BP (WSE: PKO), jumping by 2.26%, 2.24% and 1.88% respectively. At the same time, the session's largest decliners were clothing retailer LPP (WSE: LPP), coking coal producer JSW (WSE: JSW) and two utilities names PGE (WSE: PGE) and TAURON PE (WSE: TPE), which lost between 3.32% and 4.09%.

-

13:33

U.S. Stocks open: Dow -0.10%, Nasdaq -0.09%, S&P -0.13%

-

13:28

Before the bell: S&P futures +0.09%, NASDAQ futures +0.16%

U.S. stock-index futures were little changed as investors assessed the health of corporate America amid mixed earnings reports.

Global Stocks:

Nikkei 17,365.25 +130.83 +0.76%

Hang Seng 23,565.11 -38.97 -0.17%

Shanghai 3,132.08 +3.84 +0.12%

FTSE 7,017.52 +31.12 +0.45%

CAC 4,557.63 +5.05 +0.11%

DAX 10,796.44 +35.27 +0.33%

Crude $50.41 (-0.22%)

Gold $1269.20 (+0.44%)

-

13:02

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

167.76

-3.51(-2.0494%)

15389

ALCOA INC.

AA

27.16

0.30(1.1169%)

20096

ALTRIA GROUP INC.

MO

65.04

0.09(0.1386%)

2777

Amazon.com Inc., NASDAQ

AMZN

838.82

0.73(0.0871%)

22530

Apple Inc.

AAPL

118.06

0.41(0.3485%)

301750

AT&T Inc

T

36.99

0.13(0.3527%)

199453

Barrick Gold Corporation, NYSE

ABX

16.75

0.22(1.3309%)

88903

Caterpillar Inc

CAT

84.95

-1.04(-1.2094%)

105183

Chevron Corp

CVX

100.85

0.19(0.1888%)

2447

Cisco Systems Inc

CSCO

30.55

0.09(0.2955%)

49414

Deere & Company, NYSE

DE

86.3

-0.40(-0.4614%)

1205

E. I. du Pont de Nemours and Co

DD

70.45

0.31(0.442%)

3136

Facebook, Inc.

FB

133.49

0.21(0.1576%)

95160

Ford Motor Co.

F

12.08

0.04(0.3322%)

179318

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.33

0.15(1.4735%)

338211

General Electric Co

GE

28.94

0.02(0.0692%)

13577

General Motors Company, NYSE

GM

33.06

0.08(0.2426%)

965469

Google Inc.

GOOG

815.5

2.39(0.2939%)

4884

Hewlett-Packard Co.

HPQ

14

0.03(0.2147%)

51909

Home Depot Inc

HD

126.5

-1.28(-1.0017%)

7814

International Business Machines Co...

IBM

150.93

0.36(0.2391%)

25686

Merck & Co Inc

MRK

60.48

-0.27(-0.4444%)

98182

Microsoft Corp

MSFT

61.05

0.05(0.082%)

135129

Nike

NKE

51.02

-0.85(-1.6387%)

128962

Pfizer Inc

PFE

32.2

0.07(0.2179%)

2316

Procter & Gamble Co

PG

87.12

3.02(3.591%)

333145

Starbucks Corporation, NASDAQ

SBUX

54.3

0.12(0.2215%)

7883

Tesla Motors, Inc., NASDAQ

TSLA

203.06

0.30(0.148%)

2264

The Coca-Cola Co

KO

42.73

0.17(0.3994%)

25912

Twitter, Inc., NYSE

TWTR

17.93

-0.10(-0.5546%)

382922

United Technologies Corp

UTX

102

2.48(2.492%)

10611

Verizon Communications Inc

VZ

48.42

0.21(0.4356%)

99022

Visa

V

82.48

-0.69(-0.8296%)

336208

Walt Disney Co

DIS

93.34

-0.03(-0.0321%)

463

Yahoo! Inc., NASDAQ

YHOO

42.65

0.06(0.1409%)

8977

Yandex N.V., NASDAQ

YNDX

20.17

0.53(2.6986%)

7050

-

13:00

Upgrades and downgrades before the market open

Upgrades:

AT&T (T) upgraded to Hold from Sell at Independent Research; target $39

Downgrades:

Visa (V) downgraded to Neutral from Buy at Guggenheim

Other:

NIKE (NKE) initiated with a Perform at Oppenheimer

Visa (V) target lowered to $93 from $94 at Stifel

-

12:55

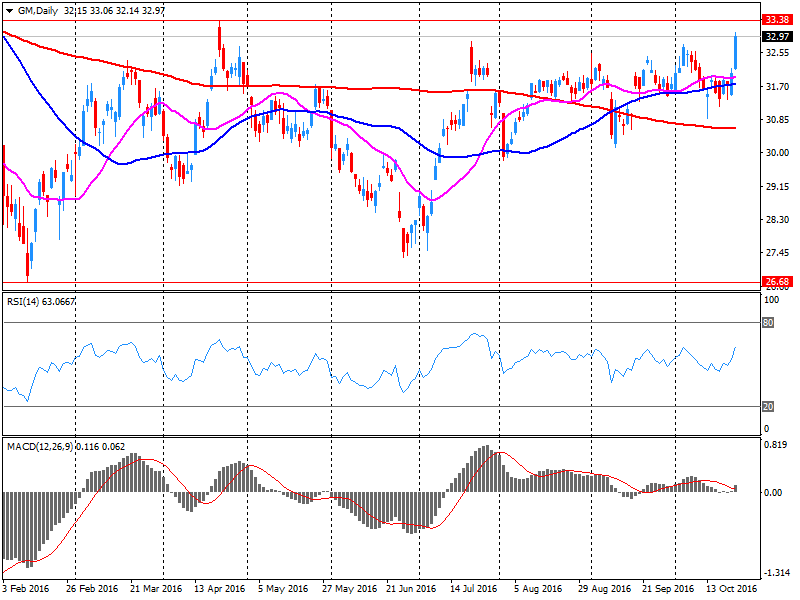

Company News: General Motors (GM) Q3 results beat analysts’ expectations

General Motors reported Q3 FY 2016 earnings of $1.72 per share (versus $1.50 in Q3 FY 2015), beating analysts' consensus estimate of $1.45.

The company's quarterly revenues amounted to $42.825 bln (+10.3% y/y), beating analysts' consensus estimate of $37.479 bln.

GM rose to $33.14 (+0.49%) in pre-market trading.

-

12:50

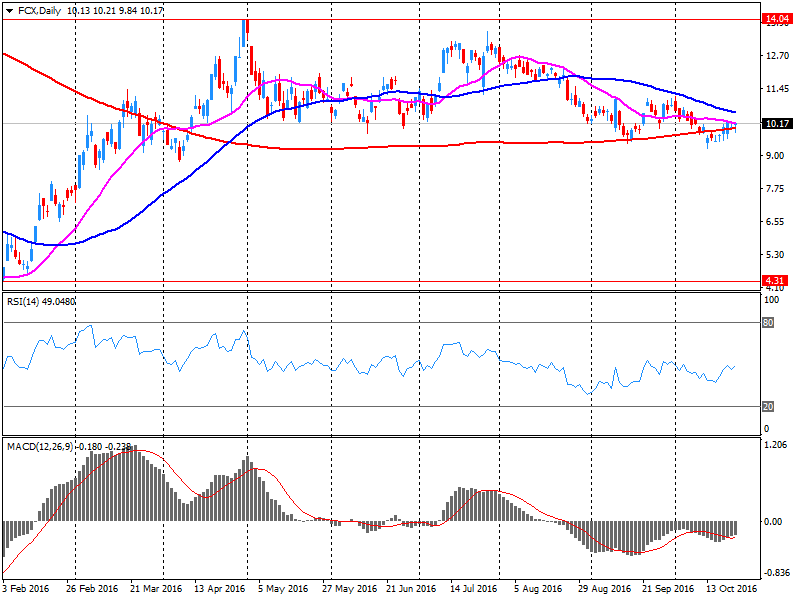

Company News: Freeport-McMoRan (FCX) Q3 results miss analysts’ estimates

Freeport-McMoRan reported Q3 FY 2016 earnings of $0.13 per share (versus net loss of $0.15 in Q3 FY 2015), missing analysts' consensus estimate of $0.19.

The company's quarterly revenues amounted to $3.877 bln (+14.6% y/y), missing analysts' consensus estimate of $3.957 bln.

FCX rose to $10.25 (+0.69%) in pre-market trading.

-

12:39

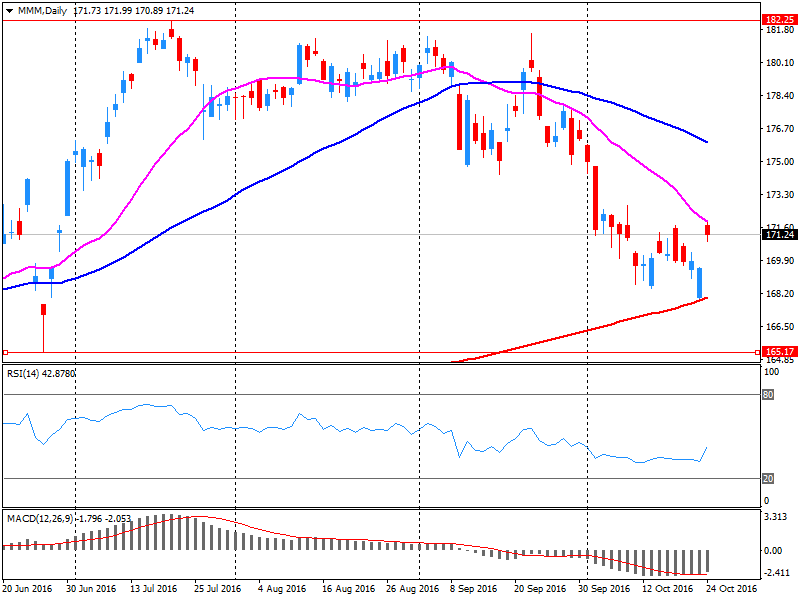

Company News: 3M (MMM) Q3 EPS beat analysts’ estimate

3M Company reported Q3 FY 2016 earnings of $2.15 per share (versus $2.05 in Q3 FY 2015), beating analysts' consensus estimate of $2.14.

The company's quarterly revenues amounted to $7.709 bln (0% y/y), generally in-line with analysts' consensus estimate of $7.720 bln.

The company also issued downside guidance for FY 2016, projecting EPS of $8.15-8.20 versus analysts' consensus estimate of $8.21 and prior guidance of $8.15-8.30.

MMM fell to $168.50 (-1.62%) in pre-market trading.

-

12:26

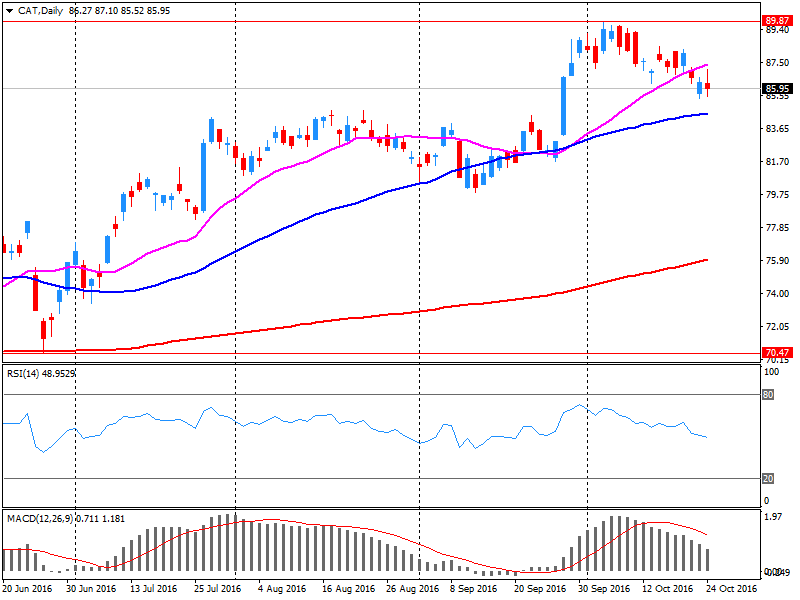

Company News: Caterpillar (CAT) Q3 EPS beat analysts’ estimate

Caterpillar reported Q3 FY 2016 earnings of $0.85 per share (versus $0.75 in Q3 FY 2015), beating analysts' consensus estimate of $0.76.

The company's quarterly revenues amounted to $9.160 bln (-16.4% y/y), missing analysts' consensus estimate of $9.885 bln.

The company lowered FY2016 guidance, forecasting EPS of $3.25, versus analysts' consensus estimate of $3.53 and prior forecast of $3.55, and revenues of $39.0 bln, versus analysts' consensus estimate of $40.13 bln and prior forecast of $40.0-40.5 bln.

CAT fell to $84.39 (-1.86%) in pre-market trading.

-

12:07

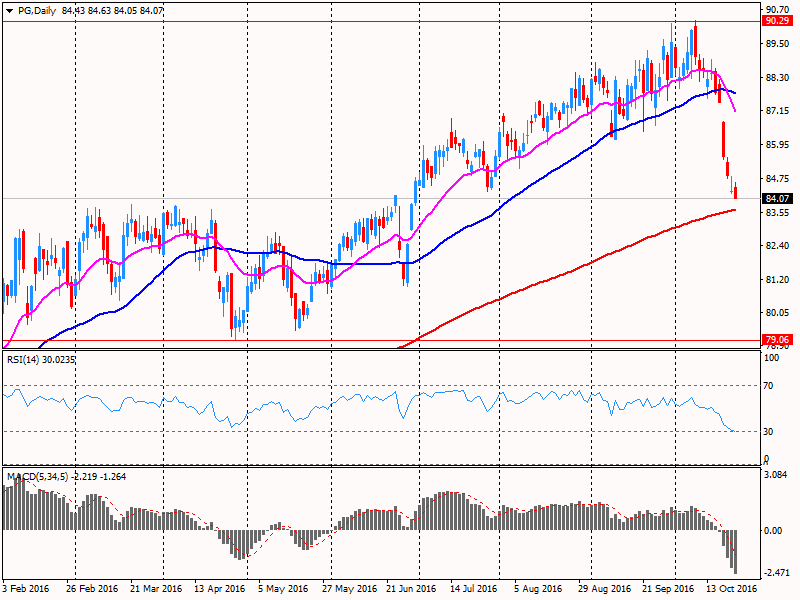

Company News: Procter & Gamble (PG) Q3 EPS beat analysts’ estimate

Procter & Gamble reported Q1 FY 2017 earnings of $1.03 per share (versus $0.98 in Q1 FY 2016), beating analysts' consensus estimate of $0.98.

The company's quarterly revenues amounted to $16.518 bln (-0.1% y/y), generally in-line with analysts' consensus estimate of $16.485 bln.

The company reaffirmed guidance for FY 2017, projecting mid-single digit EPS growth to ~$3.82-3.89 versus analysts' consensus estimate of $3.88 and revenues growth of 1% to ~$65.95 bln versus analysts' consensus estimate of $66 bln.

PG rose to $86.00 (+2.26%) in pre-market trading.

-

11:49

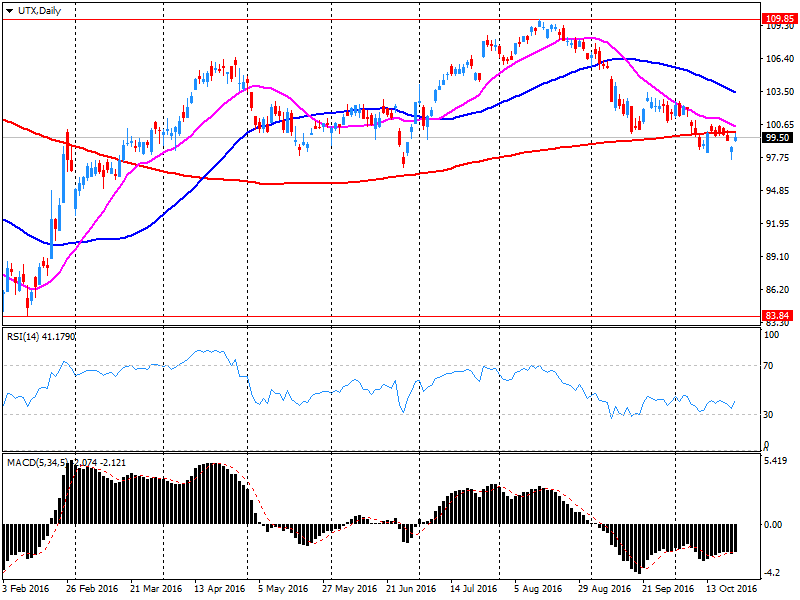

Company News: United Tech (UTX) Q3 results beat analysts’ expectations

United Tech reported Q3 FY 2016 earnings of $1.76 per share (versus $1.67 in Q3 FY 2015), beating analysts' consensus estimate of $1.67.

The company's quarterly revenues amounted to $14.354 bln (+4.1% y/y), slightly beating analysts' consensus estimate of $14.286 bln.

The company also published guidance for FY 2016, projecting EPS of $6.55-6.60 (versus analysts' consensus estimate of $6.54) and revenues of $57-58 bln (versus analysts' consensus estimate of $57.22 bln).

UTX rose to $101.49 (+1.98%) in pre-market trading.

-

11:35

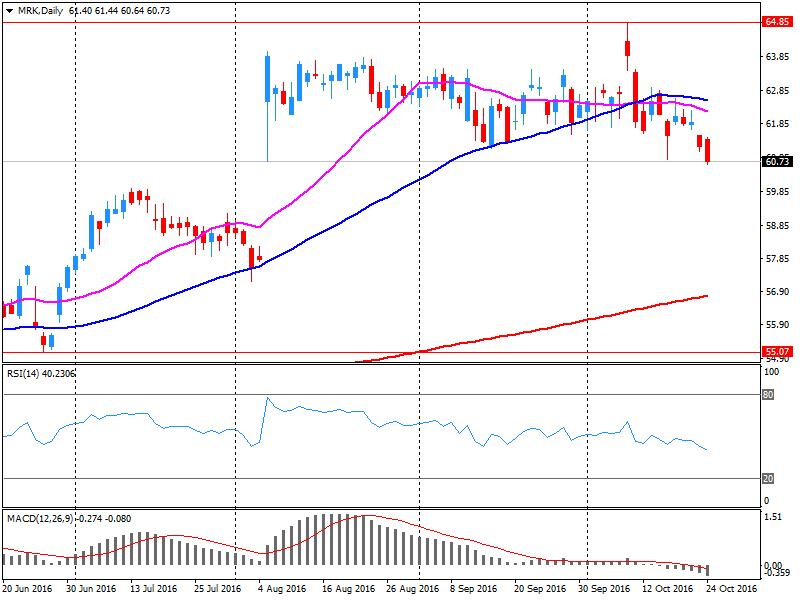

Company News: Merck (MRK) Q3 results beat analysts’ forecasts

Merck reported Q3 FY 2016 earnings of $1.07 per share (versus $0.96 in Q3 FY 2015), beating analysts' consensus estimate of $0.99.

The company's quarterly revenues amounted to $10.536 bln (+4.6% y/y), beating analysts' consensus estimate of $10.180 bln.

The company also issued guidance for FY 2016, raising EPS to $3.71-3.78 from $3.67-3.77 (versus analysts' consensus estimate of $3.75) and revenue to $39.7-40.2 bln from $39.1-40.1 bln (versus analysts' consensus estimate of $39.69 bln).

MRK rose to $$61.50 (+1.23%) in pre-market trading.

-

11:22

Wall Street skeptical about the deal between AT & T and Time Warner

-

10:40

Major stock indices in Europe rose moderately on better corporate profits

European stocks trading higher as market participants digested another series of corporate reports and reacted positively to the news from Greece and Germany.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0.34% - to 345.43 points.

Today euro zone officials have approved the third tranche of Greece bailout in the amount of 2.8 billion euros ($ 3 billion) after Athens completed the necessary reforms.

In addition, sentiment also improved after the publication of data showing that in October, the index of business confidence in Germany rose to the highest since April 2014, as uncertainty after Brexit declines.

Research Institute IFO said that the business climate index rose to a seasonally adjusted 110.5 from 109.5 in September, higher than the expected 109.5.

Meanwhile, Europe continues the corporate reporting season. The price of Orange shares increased by 4%. The company reported an increase in the 3rd quarter by 1.6%, to € 3.6 billion, on higher revenues in Spain and Africa, and the high demand for broadband services in France. The company's revenue increased by 0.8% to EUR 10.3 billion.

The Dutch employment agency Randstad Holdings increased its capitalization by 3.5%. The company's revenue in July-September exceeded market expectations.

The value of Luxottica Group SpA, which owns the brand Ray-Ban, rose 7,1% after the company confirmed the outlook for 2016 and announced its intention to accelerate revenue growth in the next year.

The capitalization of the French Air Liquide SA, one of the largest industrial gas suppliers the world increased by 2.2%. The company's revenue in the last quarter jumped by 27% and was at the level of analysts' forecasts.

The energy sector as a whole has grown, as the French Total SA gained 0.6% Italian ENI grew by 0.5%, while the Norwegian Statoil rose by 0.2%.

At the moment:

FTSE 7015.35 28.95 0.41%

DAX 10793.17 32.00 0.30%

CAC 4557.21 4.63 0.10%

-

10:15

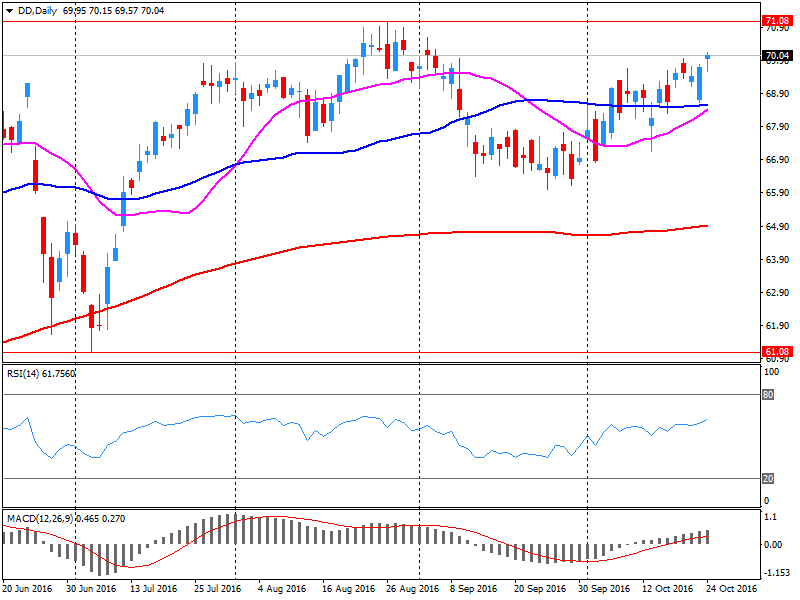

Company News: DuPont (DD) Q3 results beat analysts’ expectations

DuPont reported Q3 FY 2016 earnings of $0.34 per share (versus $0.13 in Q3 FY 2015), beating analysts' consensus estimate of $0.21.

The company's quarterly revenues amounted to $4.917 bln (+0.9% y/y), beating analysts' consensus estimate of $4.845 bln.

The company issued upside guidance for FY2016, increasing EPS to +17% to $3.25 (from $3.15-3.20) versus analysts' consensus estimate of $3.20.

DD closed Monday's trading session at $70.14 (+0.63%).

-

07:01

Positive start of trading on the major stock exchanges in Europe: DAX + 0.4%, CAC40 + 0.2%, FTSE + 0.6%

-

04:57

Global Stocks

U.K. stocks fell Monday, with lower oil prices and a ratings downgrade from J.P. Morgan weighing on investor sentiment. Meanwhile, the Confederation of British Industry said Monday that U.K. exports over the last quarter grew 8%, logging its highest balance since April 2014, aided by weakness in the pound, which has been slammed in the wake of the Brexit vote in June.

U.S. stocks pulled back from session highs but ended with gains Monday, getting a lift from a heavy round of merger announcements, including AT&T's planned acquisition of Time Warner. The tech, consumer-discretionary and consumer-staples sectors led the gains, while telecoms and energy sold off. Earlier, the index had been up nearly 14 points.

Japanese shares hit a six-month top on Tuesday as the dollar advanced on the yen, while risk sentiment got a lift after factory surveys in the United States and Europe boasted the best readings of the year so far.

-