Market news

-

23:32

Japan: Unemployment Rate, September 3.0% (forecast 3.1%)

-

23:31

Japan: Household spending Y/Y, September -2.1% (forecast -3%)

-

23:31

Japan: Tokyo Consumer Price Index, y/y, October 0.1% (forecast -0.5%)

-

23:30

Japan: National Consumer Price Index, y/y, September -0.5% (forecast -0.5%)

-

23:30

Japan: National CPI Ex-Fresh Food, y/y, September -0.5% (forecast -0.5%)

-

23:30

Japan: Tokyo CPI ex Fresh Food, y/y, October -0.4% (forecast -0.5%)

-

22:30

Commodities. Daily history for Oct 27’2016:

(raw materials / closing price /% change)

Oil 49.60 -0.24%

Gold 1,269.20 -0.02%

-

22:29

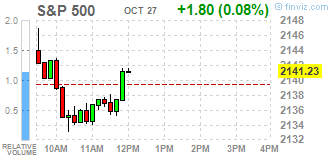

Stocks. Daily history for Oct 27’2016:

(index / closing price / change items /% change)

Nikkei 225 17,336.42 0.00 0.00%

Shanghai Composite 3,112.32 -3.99 -0.13%

S&P/ASX 200 5,295.55 0.00 0.00%

FTSE 100 6,986.57 +28.48 +0.41%

CAC 40 4,533.57 -1.02 -0.02%

Xetra DAX 10,717.08 +7.40 +0.07%

S&P 500 2,133.04 -6.39 -0.30%

Dow Jones Industrial Average 18,169.68 -29.65 -0.16%

S&P/TSX Composite 14,833.75 +26.19 +0.18%

-

22:28

Currencies. Daily history for Oct 27’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0896 -0,09%

GBP/USD $1,2165 -0,58%

USD/CHF Chf0,9935 +0,01%

USD/JPY Y105,24 +0,73%

EUR/JPY Y114,68 +0,64%

GBP/JPY Y128,03 +0,16%

AUD/USD $0,7586 -0,74%

NZD/USD $0,7118 -0,41%

USD/CAD C$1,3388 +0,09%

-

22:00

Schedule for today, Friday, Oct 28’2016

00:00 Australia HIA New Home Sales, m/m September 6.1%

00:30 Australia Producer price index, q / q Quarter III 0.1%

00:30 Australia Producer price index, y/y Quarter III 1%

07:00 Switzerland KOF Leading Indicator October 101.3 101.8

09:00 Eurozone Economic sentiment index October 104.9 104.8

09:00 Eurozone Consumer Confidence (Finally) October -8.2 -8

09:00 Eurozone Business climate indicator October 0.45 0.44

09:00 Eurozone Industrial confidence October -1.7 -1.6

12:00 Germany CPI, y/y (Preliminary) October 0.7% 0.8%

12:00 Germany CPI, m/m (Preliminary) October 0.1% 0.1%

12:30 U.S. PCE price index, q/q(Preliminary) Quarter III 2% 1.4%

12:30 U.S. PCE price index ex food, energy, q/q (Preliminary) Quarter III 1.8% 1.6%

12:30 U.S. GDP, q/q (Preliminary) Quarter III 1.4% 2.5%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) October 91.2 88.1

-

20:06

Major US stock indexes finished trading in the red zone

Major US stock indexes showed a slight decrease, as the poor results of several companies of industrial and consumer sector eclipsed revenues from healthcare growth stocks.

In addition, as it became known today, the number of Americans who applied for unemployment benefits fell last week, pointing to sustained strength of the labor market and strengthen economic growth. Primary applications for unemployment benefits fell by 3,000 and reached a seasonally adjusted 258,000 for the week ended October 22, reported Thursday the Ministry of Labour. It marked 86 consecutive weeks, when the treatment was below the threshold of 300 000, which is usually associated with a strong labor market. This is the longest period since 1970, when the labor market was much smaller.

However, new orders for manufactured durable goods decreased by $ 0.3 billion in September, or 0.1% to $ 227.3 billion, the US Census Bureau reported today. This decline came after two consecutive monthly increases, including growth of 0.3% in August. Except for transportation, new orders increased by 0.2%. With the exception of defense orders, new orders increased by 0.7%. Orders transport equipment also declined after two consecutive monthly increases, to $ 0.6 billion or 0.8% to $ 77.5 billion.

It should also be noted that the number of signed contracts for the purchase of housing on the secondary market in the US rose more than expected in September, becoming yet another sign of the momentum in the housing market. The National Association of Realtors reported Thursday that its index of pending home sales, based on contracts signed in the past month increased by 1.5% to 110.0 after falling in August.

DOW index components closed in different directions (12 against 18 in the black in the red). Most remaining shares rose Verizon Communications Inc. (VZ, + 2.02%). Outsider were shares of The Boeing Company (BA, -1.61%).

Most of the S & P sectors registered a decline. The leader turned out to be the health sector (+ 0.2%). conglomerates (-1.3%) sectors fell most.

At the close:

Dow -0.14% 18,173.38 -25.95

Nasdaq -0.65% 5,215.97 -34.30

S & P -0.28% 2,133.36 -6.07

-

19:00

Dow -0.02% 18,195.43 -3.90 Nasdaq -0.50% 5,224.23 -26.04 S&P -0.12% 2,136.79 -2.64

-

16:03

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Thursday as weak results from several industrial and consumer discretionary companies eclipsed gains from healthcare stocks.

Dow stocks mixed (17 in positive area, 13 in negative area). Top gainer - E. I. du Pont de Nemours and Company (DD, +1.54%). Top loser - The Boeing Company (BA, -1.94%).

Almost all S&P sectors also in negative area. Top gainer - Healthcare (+0.5%). Top loser - Conglomerates (-1.0%).

At the moment:

Dow 18124.00 -4.00 -0.02%

S&P 500 2131.50 -2.50 -0.12%

Nasdaq 100 4844.00 -9.75 -0.20%

Oil 49.85 +0.67 +1.36%

Gold 1270.10 +3.50 +0.28%

U.S. 10yr 1.85 +0.06

-

16:00

European stocks closed: FTSE 100 +28.48 6986.57 +0.41% DAX +7.40 10717.08 +0.07% CAC 40 -1.02 4533.57 -0.02%

-

15:44

Oil moderately higher

Oil prices rose by more than 1 percent, helped by comments that OPEC members are ready to cut production volumes. Support for oil also provided yesterday's data on US petroleum inventories.

Sources familiar with the matter, reported that Saudi Arabia and its allies in the Persian Gulf are willing to reduce oil production by 4% and will discuss the proposal at the talks in Vienna this week. However, the source pointed out the exception ofIraq, which refuses to reduce the production, referring to the loss of the war with "Islamic state".

Some experts have warned that OPEC statements are no more than a verbal intervention, and in fact, will not be able to agree on production cuts. The only solution that can be accepted - freezing oil production by individual countries.

The cost of the December futures on US light crude oil WTI (Light Sweet Crude Oil) rose to 49.78 dollars per barrel on the New York Mercantile Exchange.

December futures price for Brent crude rose to 50.62 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

15:30

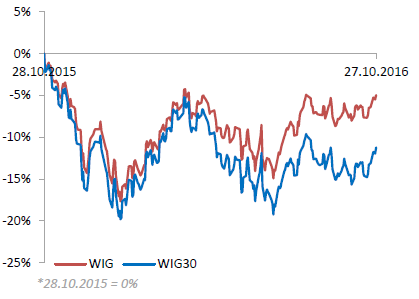

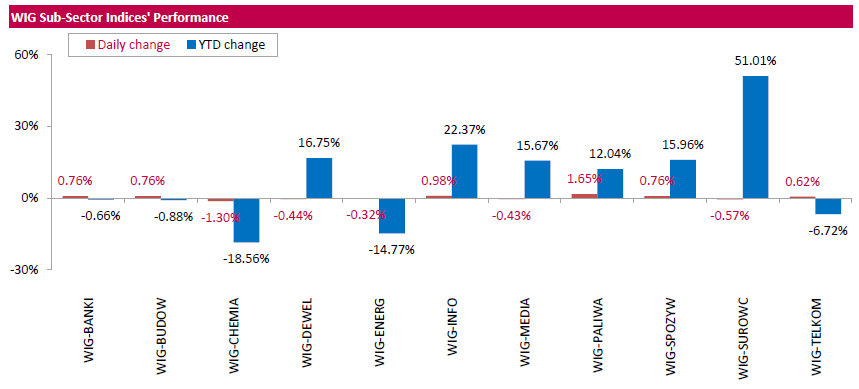

WSE: Session Results

Polish equity market closed higher on Thursday. The broad market measure, the WIG Index, rose by 0.56%. Within the index performance was mixed, with oil and gas (+1.65%) outperforming and chemicals (-1.3%) lagging.

The large-cap stocks' measure, the WIG30 Index, added 0.84%. Within the WIG30 Index components, oil refiner LOTOS (WSE: LTS) led the gainers pack with a 5.74% advance, lifted up by better-than-expected Q3 earnings. The company's Q3 financial report showed its profit stood at PLN 380 mln in Q3, well above analysts' forecast for PLN 232 mln. Other major outperformers were railway freight transport operator PKP CARGO (WSE: PKP), insurer PZU (WSE: PZU), genco TAURON PE (WSE: TPE), videogame developer CD PROJEKT (WSE: CDR) and two banking names MILLENNIUM (WSE: MIL) and MBANK (WSE: MBK), surging by 2.54%-3.23%. On the other side of the ledger, chemical producer SYNTHOS (WSE: SNS) recorded the largest daily drop, down 2.3%, as the company posted net profit of PLN 81 mln for Q3, 16% below the PLN 96.2 mln expected by analysts and down by 40% y/y. Copper producer KGHM (WSE: KGH), genco PGE (WSE: PGE) and two banks ING BSK (WSE: ING) and ALIOR (WSE: ALR) also posted notable declines, sliding down 1.12%-1.71%.

-

15:29

Little change for gold price

Quotes of gold unchanged for the day as the strengthening of the dollar and expectations of new clues about the timing of the Fed raising rates tops the upside.

The US Dollar Index, showing the US dollar against a basket of six major currencies, traded with an increase of 0.11%, near a 9-month high. The negative impact on the value of precious metals had also the growth of US 10-year government bonds to their highest level since the beginning of June. Recall, yield growth is usually negative for gold, as the metal does not bring interest.

A further fall in prices was restrained by increasing physical demand on the eve of the Hindu festivals. At the end of the week India will celebrate the most important Hindu festival, Diwali. During this gold is traditionally presented as a gift. Recall, India is one of the world's leading gold consumer countries.

The cost of December futures for gold on COMEX rose to $ 1269.0 per ounce.

-

15:10

UK deploys hundreds of troops and aircraft to eastern Europe. UK joins biggest post-cold war buildup of Nato forces as Russian military engages in series of high-profile manoeuvres - The Guardian

-

14:17

US Pending home sales shifted higher in September

Pending home sales shifted higher in September following August's notable dip and are now at their fifth highest level over the past year, according to the National Association of Realtors. Increases in the South and West outgained declines in the Northeast and Midwest.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, grew 1.5 percent to 110.0 in September from a slight downward revision of 108.4 in August. With last month's gain, the index is now 2.4 percent higher than last September (107.4) and has now risen year-over-year for 22 of the last 25 months.

Lawrence Yun, NAR chief economist, says a robust increase in the West and a healthy bump in the South pushed pending sales upward in September. "Buyer demand is holding up impressively well this fall with Realtors® reporting much stronger foot traffic compared to a year ago 1," he said. "Although depressed inventory levels are keeping home prices elevated in most of the country, steady job gains and growing evidence that wages are finally starting to tick up are encouraging more households to consider buying a home."

-

14:00

U.S.: Pending Home Sales (MoM) , September 1.5% (forecast 1.2%)

-

13:46

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0880 ( EUR 514m) 1.0890 (403m) 1.0900 (867m) 1.0920 (362m) 1.0925-30 (406m) 1.0935 (381m) 1.0950 (713m) 1.0970 (676m) 1.1000 (1.51bln) 1.1050 (826m)

USD/JPY 102.00 (USD 1.28bln) 103.50 (838m) 103.95-104.00 (376m) 105.00-05 (439m) 106.00 (1.25bln)

GBP/USD 1.2000 ( GBP 300m) 1.2400 (551m)

AUD/USD 0.7500 (AUD 278m) 0.7540 (1.51bln) 0.7575 (1.21bln) 0.7600 (532m) 0.7620 (911m) 0.7625-35 (406m) 0.7660-63 (949m)

USD/CAD: 1.3150 (USD 290m) 1.3200 (1.29bln) 1.3300 (358m)

1.3350 (571m) 1.3500 (1.72bln) 1.3600 (1.65bln)

NZD/USD 0.7165 (NZD 286m) 0.7300-05 (333m)

-

13:32

U.S. Stocks open: Dow +0.27%, Nasdaq +0.42%, S&P +0.33%

-

13:25

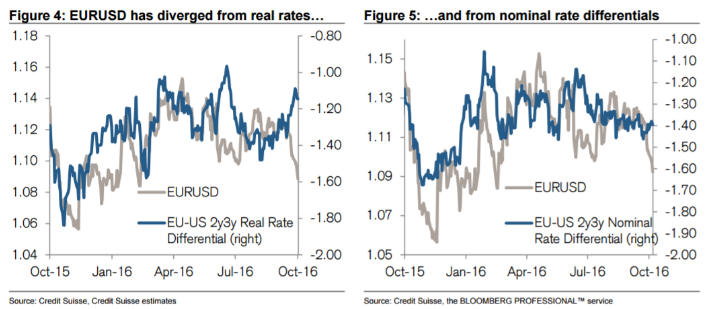

Whats next for EUR/USD, GBP/USD - Credit Suisse

"Recent data such as Germany's Ifo survey or composite PMI data have been far from shabby. And rate differentials vs. the US have largely been stable of late. Why then has EURUSD been trending lower again? We repeat our view that we believe the political environment in Europe is a major drag on the single currency.

The UK's Brexit vote - and the subsequent GBP collapse - helped highlight the structural political and economic vulnerabilities that can hurt European currencies even when underlying economic data are still decent. In this context, the apparent failure of the EU and Canada to agree a free-trade deal due to the objections of Belgium's Wallonia region further underlines not only the profusion of political forces capable of hurting sentiment but also the timing randomness of their appearances.

Going into 2017 with multiple European elections scheduled, there seem to be numerous possibilities for political strife within countries (e.g., traditional vs radical parties in general elections) and between them too (e.g., the UK vs. EU-27 over Article 50). With ECB chief Draghi pointing out again this week that the best way to raise longer-term interest rates is to boost trend growth rates and productivity, it is hard to imagine how a trade policy mishaps and general political noise will help to create a constructive environment.

Still, at least on the monetary policy front, some near-term respite came through this week for EUR and GBP. Both currencies benefitted from comments by their respective central bank governors suggesting that monetary policymakers are not entirely unmoved by the loss of purchasing power and potential inflationary pressures weaker ultra-low rates, QE and ever-weaker currencies can bring about. After months (years?) of relative neglect of this dimension while central banks fought economic weakness and disinflationary pressure, even this modest acknowledgement may provide some near-term benefits. We would nonetheless see any consolidation in EUR or GBP vs. USD temporary and any material rally as a selling opportunity.

As technical-based trades, CS is short EUR/USD and run a limit order to sell GBP/USD".

Copyright © 2016 Credit Suisse, eFXnews™

-

13:22

Before the bell: S&P futures +0.41%, NASDAQ futures +0.52%

U.S. stock-index futures rose amid amid earnings reports and economic data.

Global Stocks:

Nikkei 17,336.42 -55.42 -0.32%

Hang Seng 23,132.35 -193.08 -0.83%

Shanghai 3,112.32 -3.99 -0.13%

FTSE 6,961.75 +3.66 +0.05%

CAC 4,526.52 -8.07 -0.18%

DAX 10,706.16 -3.52 -0.03%

Crude $49.21 (+0.06%)

Gold $1273.00 (+0.50%)

-

12:46

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

64.56

0.04(0.062%)

800

Amazon.com Inc., NASDAQ

AMZN

829.3

6.71(0.8157%)

32889

Apple Inc.

AAPL

115.49

-0.10(-0.0865%)

89384

AT&T Inc

T

36.5

0.07(0.1921%)

2935

Barrick Gold Corporation, NYSE

ABX

17.1

0.45(2.7027%)

43468

Boeing Co

BA

145.35

-0.19(-0.1305%)

4759

Caterpillar Inc

CAT

84.05

-0.08(-0.0951%)

1686

Cisco Systems Inc

CSCO

30.62

0.07(0.2291%)

3835

Citigroup Inc., NYSE

C

50.2

0.19(0.3799%)

12750

Facebook, Inc.

FB

131.6

0.56(0.4274%)

45279

Ford Motor Co.

F

11.85

-0.03(-0.2525%)

174210

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.6

0.02(0.189%)

9366

General Electric Co

GE

28.95

0.08(0.2771%)

3286

General Motors Company, NYSE

GM

31.65

0.07(0.2217%)

1045

Goldman Sachs

GS

177.9

0.83(0.4687%)

175

Google Inc.

GOOG

802.32

3.25(0.4067%)

10826

Intel Corp

INTC

35.02

0.10(0.2864%)

10679

International Paper Company

IP

45.88

-0.28(-0.6066%)

290

Johnson & Johnson

JNJ

114.9

0.34(0.2968%)

335

JPMorgan Chase and Co

JPM

69.34

0.21(0.3038%)

19473

Merck & Co Inc

MRK

61.09

0.22(0.3614%)

2150

Microsoft Corp

MSFT

60.83

0.20(0.3299%)

6013

Nike

NKE

52.32

0.35(0.6735%)

881

Pfizer Inc

PFE

32.54

0.14(0.4321%)

161

Starbucks Corporation, NASDAQ

SBUX

53.56

-0.07(-0.1305%)

660

Tesla Motors, Inc., NASDAQ

TSLA

210.9

8.66(4.282%)

137825

Twitter, Inc., NYSE

TWTR

18.04

0.75(4.3378%)

3295527

Verizon Communications Inc

VZ

47.72

0.09(0.189%)

800

Visa

V

82.31

0.56(0.685%)

706

Walt Disney Co

DIS

93.76

0.27(0.2888%)

1791

Yahoo! Inc., NASDAQ

YHOO

42.29

0.21(0.4991%)

541

Yandex N.V., NASDAQ

YNDX

19.93

0.98(5.1715%)

127700

-

12:43

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Tesla Motors (TSLA) target raised to $220 from $210 at RBC Capital Mkt

-

12:34

Durable goods orders down 0.1% in September

New orders for manufactured durable goods in September decreased $0.3 billion or 0.1 percent to $227.3 billion, the U.S. Census Bureau announced today. This decrease, down following two consecutive monthly increases, followed a 0.3 percent August increase. Excluding transportation, new orders increased 0.2 percent. Excluding defense, new orders increased 0.7 percent. Transportation equipment, also down following two consecutive monthly increases, drove the decrease, $0.6 billion or 0.8 percent to $77.5 billion.

Shipments of manufactured durable goods in September, up three of the last four months, increased $2.0 billion or 0.8 percent to $234.5 billion. This followed a virtually unchanged August decrease.

Nondefense new orders for capital goods in September increased $1.0 billion or 1.5 percent to $68.2 billion. Shipments increased $1.5 billion or 2.2 percent to $71.8 billion. Unfilled orders decreased $3.6 billion or 0.5 percent to $692.8 billion. Inventories increased $0.5 billion or 0.3 percent to $170.4 billion.

-

12:32

US unemployment claims stable

In the week ending October 22, the advance figure for seasonally adjusted initial claims was 258,000, a decrease of 3,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 260,000 to 261,000. The 4-week moving average was 253,000, an increase of 1,000 from the previous week's revised average. The previous week's average was revised up by 250 from 251,750 to 252,000.

There were no special factors impacting this week's initial claims. This marks 86 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

-

12:31

U.S.: Durable goods orders ex defense, September 0.7%

-

12:30

U.S.: Initial Jobless Claims, 258 (forecast 255)

-

12:30

U.S.: Durable Goods Orders ex Transportation , September 0.2% (forecast 0.2%)

-

12:30

U.S.: Continuing Jobless Claims, 2039 (forecast 2068)

-

12:30

U.S.: Durable Goods Orders , September -0.1% (forecast 0.1%)

-

12:09

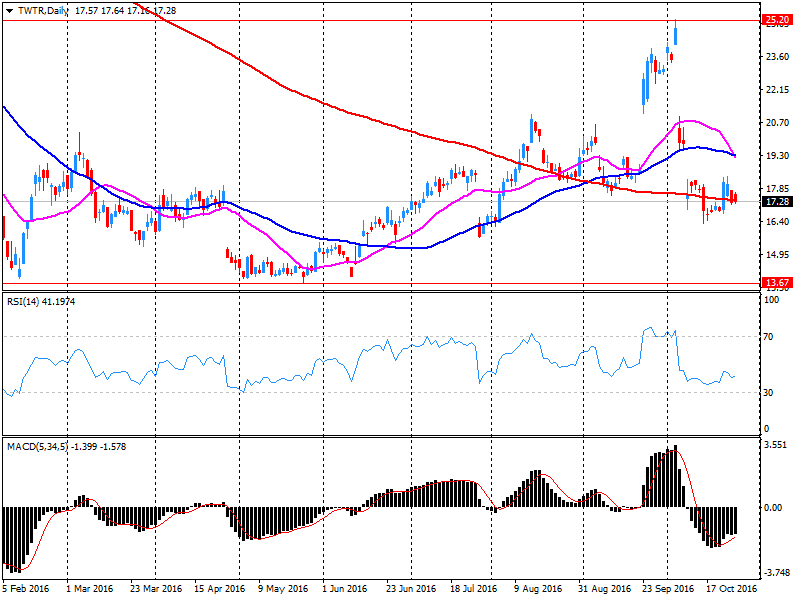

Company News: Twitter (TWTR) Q3 results beat analysts’ expectations

Twitter reported Q3 FY 2016 earnings of $0.13 per share (versus $0.10 in Q3 FY 2015), beating analysts' consensus estimate of $0.09.

The company's quarterly revenues amounted to $0.616. bln (+8.3% y/y), beating analysts' consensus estimate of $0.606 bln.

The company also announced a restructuring and reduction in force affecting approximately 9% of its positions globally.

TWTR rose to $18.25 (+5.55%) in pre-market trading.

-

12:08

The U.K. economy hasn't been knocked off course by Brexit yet. The Economy Shrug Off Brexit fears as economic indicators keep improving

-

12:06

Goldman Sachs increases target for Tesla Motors shares to $ 190 from $ 185, keeps rating "neutral”

-

12:03

UK retailers reported the strongest pace of growth since September 2015

UK retailers reported the strongest pace of growth since September 2015 over the year to October, with sales expected to expand at similar pace next month, according to the latest CBI monthly Distributive Trades Survey.

The survey of 126 firms, of which 60 were retailers, showed that sales for the time of year were considered to be above average and are expected to be in line with seasonal norms in November.

The volume of orders placed upon suppliers was broadly flat in October, having declined steadily during the previous six months, but orders are expected to fall further year-on-year in November.

The rise in overall sales volumes was driven by retailers of clothing, furniture & carpets, and hardware & DIY, while sales by grocers and department stores were flat.

-

12:00

Orders

EUR/USD

Offers : 1.0920-25 1.0950 1.09801.1000 1.1030 1.1050 1.1080 1.1100

Bids : 1.0900 1.0875-80 1.0850 1.0825-30 1.0800 1.0785 1.0750 1.0700

GBP/USD

Offers : 1.2225-30 1.2250 1.2280 1.2300 1.2325-30 1.2350

Bids : 1.2200 1.2180 1.2150 1.2130 1.2100 1.2080-85 1.2050 1.200

EUR/GBP

Offers : 0.8950 0.8965 0.8980 0.9000 0.9025-30 0.9050

Bids : 0.8900 0.8880-85 0.8870 0.8850-55 0.8835 0.8800

EUR/JPY

Offers : 114.20-25 114.50 114.70-75 115.00 115.40 116.00

Bids : 113.70 113.50 113.30 113.00 112.85 112.60 112.00

USD/JPY

Offers : 104.70-80 105.00 105.30 105.50 106.00

Bids : 104.30 104.00 103.80-85 103.50 103.20-25 103.00

AUD/USD

Offers : 0.7650 0.7660 0.7685 0.7700-10 0.7730-35 0.7750

Bids : 0.7620 0.7600 0.7580 0.7555-60 0.7540 0.7500

-

11:47

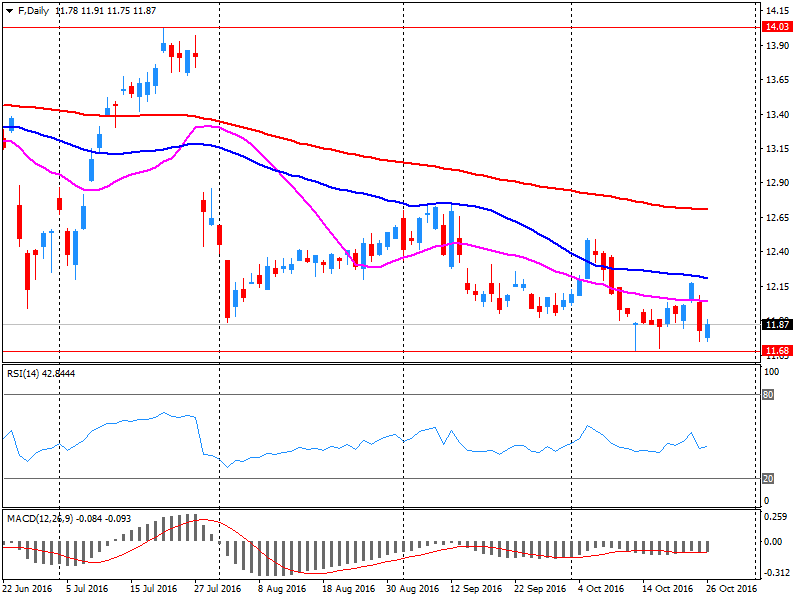

Company News: Ford Motor (F) Q3 EPS beat analysts’ estimate

Ford Motor reported Q3 FY 2016 earnings of $0.26 per share (versus $0.45 in Q3 FY 2015), beating analysts' consensus estimate of $0.20.

The company's quarterly revenues amounted to $33.331 bln (-6.9% y/y), generally in-line with analysts' consensus estimate of $33.405 bln.

F fell to $11.75 (-1.09%) in pre-market trading.

-

11:42

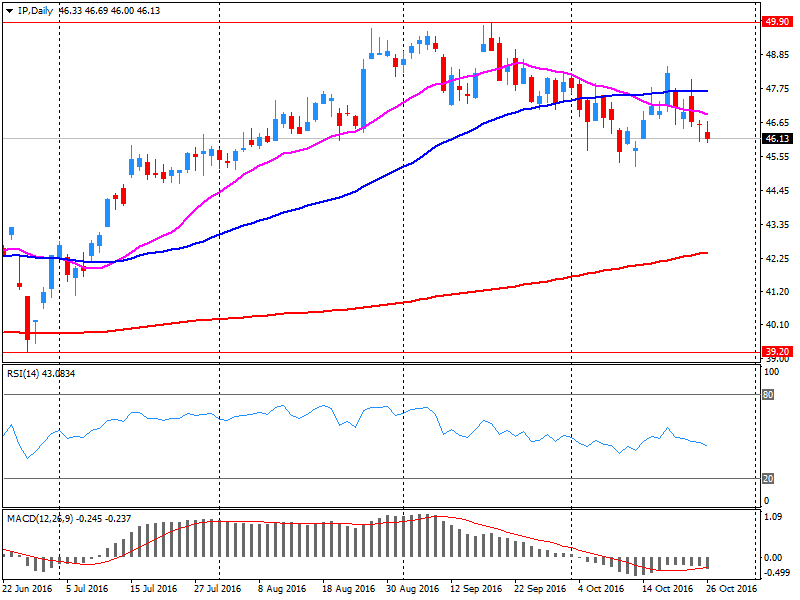

Company News: Intl Paper (IP) Q3 results miss analysts’ estimates

Intl Paper reported Q3 FY 2016 earnings of $0.91 per share (versus $0.97 in Q3 FY 2015), missing analysts' consensus estimate of $0.93.

The company's quarterly revenues amounted to $5.266 bln (-7.5% y/y), missing analysts' consensus estimate of $5.366 bln.

IP closed Wednesday's trading session at $46.16 (-0.94%).

-

11:34

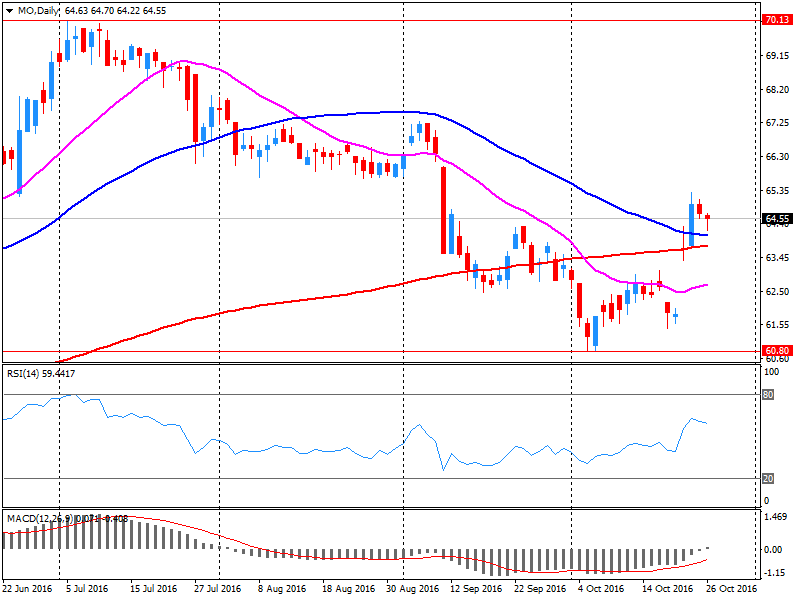

Company News: Altria (MO) Q3 results beat analysts’ forecasts

Altria reported Q3 FY 2016 earnings of $0.82 per share (versus $0.75 in Q3 FY 2015), beating analysts' consensus estimate of $0.81.

The company's quarterly revenues amounted to $5.193 bln (+4.3% y/y), beating analysts' consensus estimate of $5.111 bln.

The company reaffirmed guidance for FY2016, projecting EPS of $2.98-3.04 versus analysts' consensus estimate of $3.01

MO rose to $64.60 (+0.12%) in pre-market trading.

-

10:44

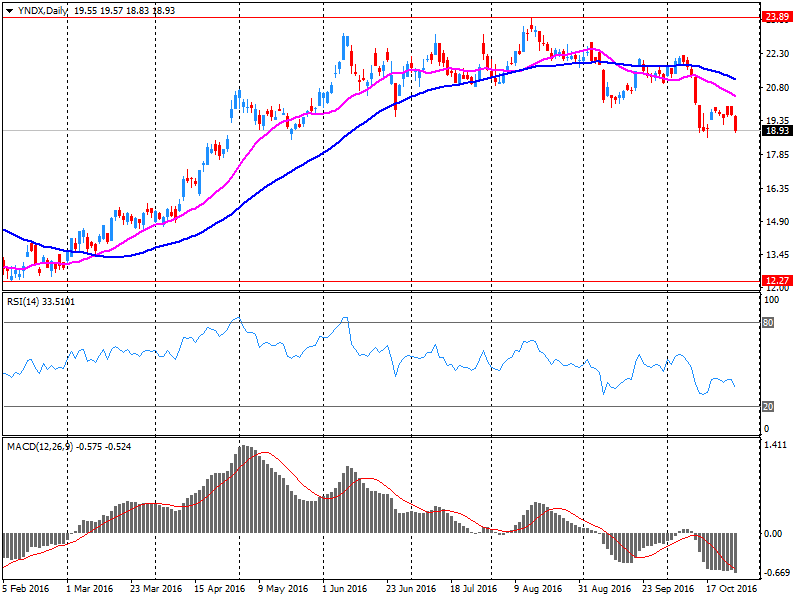

Company News: Yandex N.V. (YNDX) Q3 financials beat analysts’ estimates

Yandex N.V. reported Q3 FY 2016 earnings of RUB11.64 per share (versus RUB10.89 in Q3 FY 2015), beating analysts' consensus estimate of RUB10.51.

The company's quarterly revenues amounted to RUB19.293 bln (+25% y/y), beating analysts' consensus estimate of RUB18.755 bln.

YNDX rose to $19.78 (+4.38%) in pre-market trading.

-

10:37

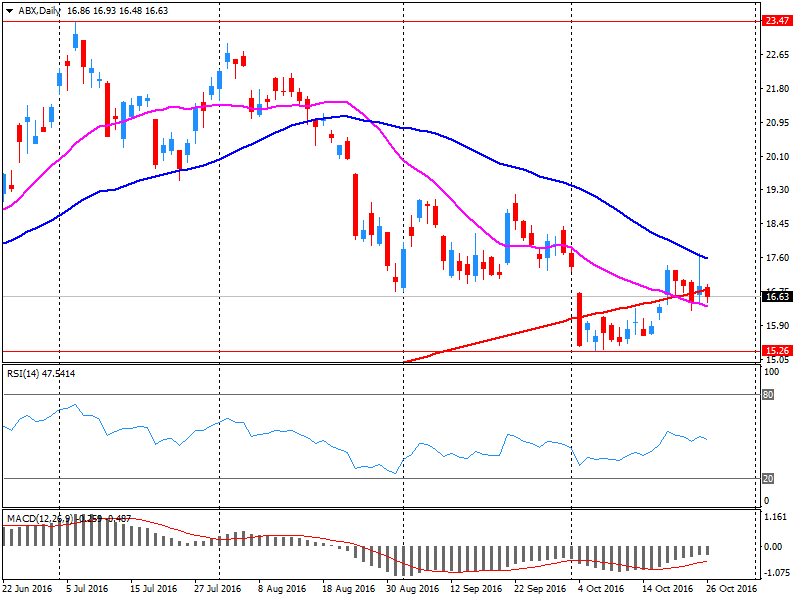

Company News: Barrick Gold (ABX) Q3 results beat analysts’ expectations

Barrick Gold reported Q3 FY 2016 earnings of $0.24 per share (versus $0.11 in Q3 FY 2015), beating analysts' consensus estimate of $0.20.

The company's quarterly revenues amounted to $2.300 bln (-0.6% y/y), beating analysts' consensus estimate of $2.234. bln.

ABX rose to $17.09 (+2.64%) in pre-market trading.

-

09:02

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0880 ( EUR 514m) 1.0890 (403m) 1.0900 (867m) 1.0920 (362m) 1.0925-30 (406m) 1.0935 (381m) 1.0950 (713m) 1.0970 (676m) 1.1000 (1.51bln) 1.1050 (826m)

USD/JPY 102.00 (USD 1.28bln) 103.50 (838m) 103.95-104.00 (376m) 105.00-05 (439m) 106.00 (1.25bln)

GBP/USD 1.2000 ( GBP 300m) 1.2400 (551m)

AUD/USD 0.7500 (AUD 278m) 0.7540 (1.51bln) 0.7575 (1.21bln) 0.7600 (532m) 0.7620 (911m) 0.7625-35 (406m) 0.7660-63 (949m)

USD/CAD: 1.3150 (USD 290m) 1.3200 (1.29bln) 1.3300 (358m)

1.3350 (571m) 1.3500 (1.72bln) 1.3600 (1.65bln)

NZD/USD 0.7165 (NZD 286m) 0.7300-05 (333m)

-

08:33

UK GDP above expectations. The pattern of growth continues to be broadly unaffected following the EU referendum. Time to buy the pound?

Change in gross domestic product (GDP) is the main indicator of economic growth. GDP was estimated to have increased by 0.5% in Quarter 3 (July to Sept) 2016 compared with growth of 0.7% in Quarter 2 (Apr to June) 2016. GDP was 2.3% higher in Quarter 3 2016 compared with the same quarter a year ago.

This is the first release of GDP covering a full quarter of data following the EU referendum. The pattern of growth continues to be broadly unaffected following the EU referendum with a strong performance in the services industries offsetting falls in other industrial groups.

In Quarter 3 2016, the services industries increased by 0.8%. In contrast, output decreased in the other 3 main industrial groups with construction decreasing by 1.4%, agriculture decreasing by 0.7% and production decreasing by 0.4%, within which manufacturing decreased by 1.0%.

-

08:30

United Kingdom: GDP, q/q, Quarter III 0.5% (forecast 0.3%)

-

08:30

United Kingdom: GDP, y/y, Quarter III 2.3% (forecast 2.1%)

-

08:24

Oil is trading in a narrow range

Crude is trading with a slight increase, while remaining within a relatively tight range, after US Department of Energy data showed a reduction of oil reserves in the country. Commercial crude oil inventories for the week ended 21 October fell by 0.6 million barrels to 468.2 million barrels. Analysts, on the other hand, expected a growth rate of 1,699 million barrels up to 470.4 million barrels.

This morning the December futures for WTI crude oil on the NYMEX were up $ 0.15 at $ 49.33 a barrel. December futures for Brent oil rose by about $ 0.20.

-

08:04

Riksbank: Low repo rate for longer, Executive Board ready to extend government bond purchases in December

-

08:04

Euro Area annual growth rate of the broad monetary aggregate M3 stood at 5.0% in September

-

The annual growth rate of the broad monetary aggregate M3 stood at 5.0% in September 2016, after 5.1% in August 2016.

-

The annual growth rate of the narrower aggregate M1, which includes currency in circulation and overnight deposits, decreased to 8.5% in September, from 8.9% in August.

-

The annual growth rate of adjusted loans to households stood at 1.8% in September, unchanged from the previous month.

-

The annual growth rate of adjusted loans to non-financial corporations stood at 1.9% in September, unchanged from the previous month.

-

-

08:01

Eurozone: Private Loans, Y/Y, September 1.8% (forecast 1.9%)

-

08:00

Eurozone: M3 money supply, adjusted y/y, September 5% (forecast 5.1%)

-

08:00

UK Q3 GDP to make or break the pound. +0.3% expected vs +0.7 previous. How hard will Brexit hit?

-

07:53

Major stock markets trading in the red zone: DAX -0,2%, FTSE -0,3%, CAC40 -0,2%, FTMIB + 0,2%, IBEX -0,1%

-

07:29

BHP Billiton: Commercial Director Dean Dalla Valle leaves the company

-

07:27

Today’s events

-

At 17:00 GMT United States will hold an auction of 7-year bonds

-

At 20:00 GMT ECB member Yves Mersch will deliver a speech

-

-

07:26

Spanish employment improves in Q3

The number of employed persons increased by 226,500 in the third quarter of 2016 compared to the previous quarter (1.24%) and stands at 18,527,500. Seasonally adjusted quarterly variation is 0.77%. Employment has grown by 478,800 people in the last 12 months. The annual rate is 2.65%. Occupancy up this quarter by 8,900 people in the public sector and 217,700 in private. In the past 12 months, employment has risen by 461,300 people in the private sector and 17,500 in the public. The total number of employees grows in the third quarter by 216,800 (455,700 on year).

-

07:00

Negative start of trading expected on the major stock exchanges in Europe: DAX futures -0,5%, CAC40 -0.5%, FTSE -0.4%

-

06:28

CHF: SNB Intervention Level - Morgan Stanley

"When the SNB tells you they think the CHF is overvalued, you wouldn't think USDCHF hitting an 8 month high and approaching 1.00 would be an issue. However when the USD has been rallying this month, EURCHF has been falling to approach the 1.08 level, which we think has been a line in the sand for the SNB before.

Of course whether the SNB intervene to stop the CHF appreciating will depend on the pace of the EURCHF move but we are finding that pace is becoming increasingly related to reaching this 1.08 level. Actually the SNB doesn't hide away from the fact they have been intervening since formally removing the floor in January 2015. The SNB's VP Fritz Zurbruegg said yesterday "We don't have a fixed limit for growing the balance sheet; it's a corollary of our foreign exchange market interventions". Sight deposits, a measure of intervention, have increased by 10.8% since the start of the year.

We expect EURCHF to remain in a 1.08-1.10 range, while USD strength should push USDCHF towards 1.01 in coming weeks".

Copyright © 2016 Morgan Stanley, eFXnews

-

06:25

China's industrial profits increased less than expected

Rttnews says that China's industrial profits increased at a slower pace in September, figures from the National Bureau of Statistics showed Thursday.

Industrial profits grew only 7.7 percent year-on-year in September after expanding 19.5 percent in August. The increase in August was the fastest in three years.

During January to September, industrial profits climbed 8.4 percent, the same pace of growth as seen in January to August period.

-

06:24

UBS Consumption Indicator rose in September

The UBS Consumption Indicator rose in September. The increase from 1.53 to 1.59 points confirmed recent positive developments in private consumption. This is in sharp contrast to the picture among retailers, who recorded a 2.9 percent fall in sales year-on-year in August and thus the twentieth drop in succession. Retailers have not had any good news to report since January 2015, and the improbability of any significant improvement over the next few months is highlighted by the retail business climate index of the ETH Swiss Economic Institute (KOF). The August figure is significantly lower than the long-term average.

Despite the ailing retail sector, private consumption has shown solid development. This is primarily down to domestic tourism and the car market, with vehicle sales actually exceeding expectations recently.

-

06:23

Options levels on thursday, October 27, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1110 (3202)

$1.1028 (2111)

$1.0973 (1025)

Price at time of writing this review: $1.0911

Support levels (open interest**, contracts):

$1.0858 (3087)

$1.0824 (2311)

$1.0785 (4452)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 43015 contracts, with the maximum number of contracts with strike price $1,1300 (3692);

- Overall open interest on the PUT options with the expiration date November, 4 is 46278 contracts, with the maximum number of contracts with strike price $1,1000 (7330);

- The ratio of PUT/CALL was 1.08 versus 1.08 from the previous trading day according to data from October, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.2502 (1360)

$1.2403 (1164)

$1.2306 (1654)

Price at time of writing this review: $1.2215

Support levels (open interest**, contracts):

$1.2192 (1260)

$1.2096 (1503)

$1.1998 (924)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 32396 contracts, with the maximum number of contracts with strike price $1,2800 (1973);

- Overall open interest on the PUT options with the expiration date November, 4 is 31298 contracts, with the maximum number of contracts with strike price $1,2300 (1858);

- The ratio of PUT/CALL was 0.97 versus 0.97 from the previous trading day according to data from October, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:21

BoJ, Kuroda: Any attempt to weaken JPY would be FX intervention

-

06:20

New Zeeland trade deficit increased in September

New Zealand had a merchandise trade deficit of NZ$1.436 billion in September, Statistics New Zealand said on Thursday.

That missed forecasts for a shortfall of NZ$1.123 billion following the NZ$1.265 billion deficit in August.

Exports came in at NZ$3.47 billion, beneath forecasts for NZ$3.55 billion but up from NZ$3.38 billion in the previous month.

Imports were at NZ$4.90 billion versus expectations for NZ$4.65 billion and up from NZ$4.62 billion a month earlier.

-

06:18

Export prices in Australia advanced 3.5 percent on quarter

According to rttnews, export prices in Australia advanced 3.5 percent on quarter in the third quarter of 2016, the Australian Bureau of Statistics said on Thursday.

That beat forecasts for an increase of 2.0 percent following the 1.4 percent gain in the previous three months.

Import prices were down 1.0 percent on quarter versus expectations for a 0.8 percent decline. They were unchanged from Q2.

On a yearly basis, export prices dropped 5.4 percent and import prices fell 5.1

-

06:00

Switzerland: UBS Consumption Indicator, September 1.59

-

04:49

Global Stocks

European stocks finished lower Wednesday, with energy shares slightly paring losses as oil prices came off session lows. Investors also expressed disappointment over a new round of financial updates.

U.S. stocks closed mostly lower Wednesday as Apple Inc., the largest U.S. company by market cap, tumbled, but the Dow Jones Industrial Average bucked the trend thanks to Boeing Inc., which soared on robust earnings.

The S&P 500 SPX, -0.17% slipped 3.73 points, or 0.2%, to end at 2,139.43, while the Nasdaq Composite Index COMP, -0.63% which is heavily weighted toward technology names, fell 33.13 points, or 0.6%, to finish at 5,250.27. The Dow Jones Industrial Average DJIA, +0.17% rose 30.06 points, or 0.2%, to close at 18,199.33.

Asian shares extended losses on Thursday after disappointing earnings from technology giant Apple dragged on Wall Street, while the dollar remained shy of this week's nearly nine-month highs.

Adding to the already subdued mood, data showed profit growth in China's industrial firms slowed last month from the previous month's rapid pace as several sectors showed weak activity, suggesting the world's second-biggest economy remains underpowered.

Tokyo's Nikkei stock index .N225 percent slumped 0.5 percent, though a weaker yen underpinned shares.

-

00:31

Australia: Import Price Index, q/q, Quarter III -1%

-

00:30

Australia: Export Price Index, q/q, Quarter III 3.5%

-