Market news

-

23:28

Currencies. Daily history for Nov 31’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0976 -0,12%

GBP/USD $1,2237 +0,41%

USD/CHF Chf0,9889 +0,13%

USD/JPY Y104,76 +0,06%

EUR/JPY Y114,99 -0,06%

GBP/JPY Y128,2 +0,48%

AUD/USD $0,7604 +0,09%

NZD/USD $0,7147 -0,21%

USD/CAD C$1,3411 +0,10%

-

23:01

Schedule for today, Tuesday, Nov 01’2016

00:30 Japan Manufacturing PMI (Finally) October 50.4 51.7

01:00 China Manufacturing PMI October 50.4 50.4

01:00 China Non-Manufacturing PMI October 53.7

01:45 China Markit/Caixin Manufacturing PMI October 50.1

03:00 Japan BoJ Interest Rate Decision -0.1% -0.1%

03:00 Japan BoJ Monetary Policy Statement

03:30 Australia Announcement of the RBA decision on the discount rate 1.5% 1.5%

03:30 Australia RBA Rate Statement

06:30 Japan BOJ Press Conference

08:15 Switzerland Retail Sales (MoM) September -0.6%

08:15 Switzerland Retail Sales Y/Y September -3.0%

08:30 Switzerland Manufacturing PMI October 53.2 53.8

09:30 United Kingdom Purchasing Manager Index Manufacturing October 55.4 54.5

12:30 Canada GDP (m/m) August 0.5% 0.2%

13:45 U.S. Manufacturing PMI (Finally) October 51.5 53.2

14:00 U.S. Construction Spending, m/m September -0.7% 0.5%

14:00 U.S. ISM Manufacturing October 51.5 51.7

16:00 Canada BOC Gov Stephen Poloz Speaks

20:00 U.S. Total Vehicle Sales, mln October 17.76 17.5

21:45 New Zealand Employment Change, q/q Quarter III 2.4% 0.6%

21:45 New Zealand Unemployment Rate Quarter III 5.1% 5.1%

-

22:30

Australia: AIG Manufacturing Index, October 50.9

-

15:23

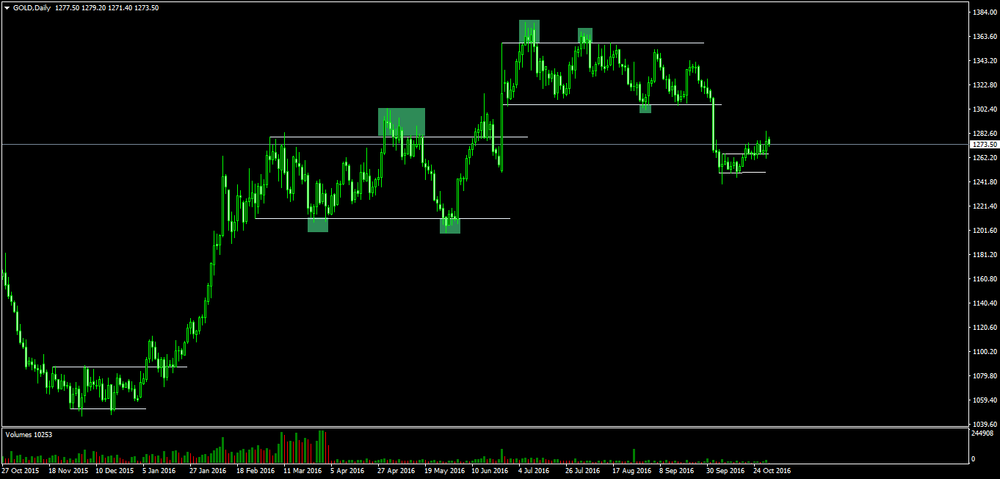

Gold prices pulled back from a multiweek high

Gold prices pulled back from a multiweek high Monday as the U.S dollar strengthened and investors took profits on a late-day rally at the end of last week, says Dow Jones.

Gold for December delivery was recently down 0.2% at $1,271.40 a troy ounce on the Comex division of the New York Mercantile Exchange.

The Wall Street Journal Dollar Index, which tracks the greenback against a basket of other currencies, was recently up 0.1% at 88.73. A stronger dollar tends to weigh on gold and other raw materials, which are priced in the U.S. currency and become more expensive for foreign buyers when the dollar rises.

Investors were also locking in gains after gold prices spiked late Friday afternoon on news that the The Federal Bureau of Investigation said it uncovered new evidence in its investigation of Democratic presidential candidate Hillary Clinton's email server. Some investors buy gold during times of political turbulence, believing it will hold its value better than other assets.

However, "these event-driven type rallies rarely last," said George Gero, a managing director at RBC Capital Markets.

-

14:29

Where To Target GBP? - ANZ

"On a trade weighted basis, sterling has fallen 8% since parliament returned on 5 September after its summer recess. The resumed fall reflected the clear rhetoric from Westminster that Brexit will proceed; Article 50 will be triggered before the end of March next year - and the UK will regain control over immigration. The UK's position on immigration is at odds with the EU's principle of free movement of people. Consequently, expectations of a hard Brexit rose and weighed heavily on sterling.

However, for the moment that expectation seems to be discounted and until new political dimensions emerge, sterling may consolidate. What shouldn't be overlooked is that the economy is performing quite well for the time being. The housing market has perked up, the 3m/3m trend in retail sales shows upward momentum in consumption (September +1.8%), the labour market is holding up well, and inflation is showing signs of accelerating.

The rule of thumb is that every 10% drop in the exchange rate raises CPI inflation by around 1.75% over two years. Our expectation is that the BoE will probably upgrade its assessment of growth and inflation in the November inflation report. Meanwhile, the autumn statement on fiscal policy is likely to be expansionary and push out the timing of when a balanced budget will be achieved whilst also providing some current fiscal stimulus.

While it is impossible to quantify the appropriate risk premium for sterling and major questions overhang longer-run growth, in the short run sterling may have adjusted sufficiently".

ANZ targets GBP/USD at 1.22 and EUR/GBP at 0.88 by year-end.

Copyright © 2016 eFXplus™

-

14:01

US Chicago Business Barometer fell to a five-month low

The MNI Chicago Business Barometer fell 3.6 points to a five-month low of 50.6 in October from 54.2 in September, suggesting economic activity in the US lost some momentum having picked up in Q3. The latest outturn marked a weak start to Q4, with the three-month trend softening to 52.1 in October from 53.8 in the three months to September.

The Barometer decline was led by a slowdown in Production, which fell 5.4 points to 54.4, giving up most of the gain seen last month but remaining above the 2016 average. New Orders also subtracted from the Barometer, falling to the lowest level since May.

-

13:51

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0800 (EUR 256m) 1.0875 (1.89bln) 1.0895 (265m) 1.1000 (794m) $1.1100 (1.2bln)

USDJPY 103.00(1.88bln) 104.00 (2.53bln) 105.00 (458m) 105.80 (225m)

GBPUSD 1.2050 (GBP 299m) 1.2235 (294m) 1.2400-04 (274m) 1.2600 (229m)

AUDUSD 0.7510 (AUD 356m) 0.7650 (207m)

USDCAD: 1.3200 (USD 231m) 1.3300 (466m) 1.3350 (767m)

NZDUSD 0.7150 (NZD 466m)

EURJPY 113.76 (EUR 240m)

USDSGD 1.3700 (USD 818m) 1.3750 (751m) 1.3800 (1.6bln) 1.3870 (490m)1.4000(1.77bln)

-

13:45

U.S.: Chicago Purchasing Managers' Index , October 50.6 (forecast 54)

-

13:02

Orders

EUR/USD

Offers 1.0980 1.1000 1.1030 1.1050 1.1080 1.1100

Bids 1.0950 1.0920 1.0900 1.0875-80 1.0850 1.0825-30 1.0800

GBP/USD

Offers 1.2200 1.2220 1.2250 1.22801.2300 1.2325-301.2350

Bids 1.2150 1.2130 1.2100 1.2080-85 1.2050 1.2000

EUR/GBP

Offers 0.9000-05 0.9020-25 0.9050 0.9070 0.9100

Bids 0.8970 0.8950 0.8920 0.8900 0.8880-85 0.8870 0.8850-55

EUR/JPY

Offers 115.30 115.75-80 116.00 116.50

Bids 114.50 114.00 113.70 113.50 113.30 113.00

USD/JPY

Offers 105.00-05 105.50-55 105.80 106.00 106.50 107.00

Bids 104.75 104.50 104.30 104.00 103.80-85 103.50 103.00

AUD/USD

Offers 0.7620 0.7635 0.7650 0.7675-80 0.7700-10

Bids 0.7600 0.7580 0.7550 0.7500 0.7480 0.7450

-

12:41

Canadian Industrial Product Prices rose led by higher prices for energy

The Industrial Product Price Index (IPPI) rose 0.4% in September, led by higher prices for energy and petroleum products, as well as motorized and recreational vehicles. The Raw Materials Price Index (RMPI) edged down 0.1%, as lower prices for animals and animal products were largely offset by higher prices for crude energy products.

The IPPI rose 0.4% in September, after falling 0.4% in August. Of the 21 major commodity groups, 15 were up, 5 were down, and 1 was unchanged.

Higher prices for energy and petroleum products (+0.9%) in September largely contributed to the increase in the IPPI. The gain in this commodity group was primarily attributable to higher prices for light fuel oils (+2.6%), motor gasoline (+0.7%), and, to a lesser extent, heavy fuel oils (+3.3%), jet fuel (+3.5%), and diesel fuel (+0.9%). Moderating the rise in energy and petroleum products were lower prices for asphalt (except natural) (-6.3%). The IPPI excluding energy and petroleum products rose 0.3%.

-

12:40

US Personal income increased 0.3 percent in September

Personal income increased $46.7 billion (0.3 percent) in September according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $37.0 billion (0.3 percent) and personal consumption expenditures (PCE) increased $61.0 billion (0.5 percent).

Real DPI increased less than 0.1 percent in September and Real PCE increased 0.3 percent. The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.1 percent.

The increase in personal income in September primarily reflected increases in compensation of employeesand nonfarm proprietors' income.

The increase in real PCE in September primarily reflected an increase in spending for durable goods.

Personal outlays increased $59.7 billion in September (table 3). Personal saving was $797.8 billion in Septembermand the personal saving rate, personal saving as a percentage of disposable personal income, was 5.7 percent.

-

12:30

U.S.: Personal Income, m/m, September 0.3% (forecast 0.4%)

-

12:30

U.S.: PCE price index ex food, energy, Y/Y, September 1.7% (forecast 1.6%)

-

12:30

U.S.: Personal spending , September 0.5% (forecast 0.5%)

-

12:30

U.S.: PCE price index ex food, energy, m/m, September 0.1% (forecast 0.1%)

-

12:30

Canada: Industrial Product Price Index, m/m, September 0.4% (forecast 0.2%)

-

12:30

Canada: Industrial Product Price Index, y/y, September -0.5%

-

11:59

UK's May Supportive of Carney Staying On as BOE Gov Beyond 5 Yrs -- PM's Spokeswoman. GBP/USD rising

-

May Recognises Work Carney Has Done for UK And Fully Supportive of That

-

-

11:57

Major European stock indices trading in the red zone

European stocks are down moderately, continuing the trend of the previous five sessions. Pressure on the marketa put a drop in shares of energy companies in response to the news that the largest oil-producing countries have failed to agree on production cuts.

Experts note that a mediocre corporate reporting season, fears of tighter monetary policy and the upcoming US presidential election mimited the gains of stocks in recent weeks. Currently, the average projections indicate that by the end of this year, profits of companies included in the Stoxx 600 index, can be lower by 4.1 percent. Meanwhile, a report by Bank of America Corp, presented on Friday, saw the 38th consecutive weekly outflows from equity funds in the region, which is the longest series ever recorded.

Preliminary report submitted by Eurostat showed that in October, consumer prices in the eurozone rose by 0.5% after rising 0.4% last month. Last review confirmed the experts' predictions. A increase in prices for the fifth month in a row. The core consumer price index, which does not take into account the volatile energy and food prices, rose 0.8%, which coincided with the change in September, and forecasts.

A separate report showed that third-quarter euro-zone gross domestic product grew by 0.3 percent compared to the second quarter, when a similar increase was recorded. The latter change also coincided with forecasts. On an annualized basis, eurozone economic growth stabilized at 1.6 per cent, confirming analysts' estimates. In addition, it became known that the EU euro area expanded by 0.4 percent in quarterly terms and by 1.8 per cent compared with the same period last year. Recall in the second quarter, GDP grew by 0.4 percent and 1.8 percent respectively.

The composite index of the largest companies in the region Stoxx Europe 600 lost 0.45%. If by the end of the day the index will not be able to recover it will recorde six consecutive sesions of decline that will the longest series of losses since February.

The capitalization of BP Plc and Tullow Oil Plc fell more than 1 percent after OPEC did not complete a deal.

WPP shares rose by 3.5 percent after the world's largest advertising company reported an increase in quarterly sales.

Sika shares jumped 14.2 percent, as a Swiss court upheld the company's proposal to block the absorption of Cie de Saint-Gobain. Shares of French rival dropped by 1.4 percent.

Quotes of Centamin climbed 0.6 percent after the company said it expects gold production near the top of its forecast for 2016.

At the moment:

FTSE 100 6966.43 -29.83 -0.43%

DAX -40.23 10655.96 -0.38%

CAC 40 4511.28 -37.30 -0.82%

-

10:36

USD Gains; Risk of Trump Victory Not Seen Too High

-

10:04

Euro Area GDP rose in line with expectations

Seasonally adjusted GDP rose by 0.3% in the euro area (EA19) and by 0.4% in the EU28 during the third quarter of 2016, compared with the previous quarter, according to a preliminary flash estimate published by Eurostat, the statistical office of the European Union. In the second quarter of 2016, GDP had also grown by 0.3% in the euro area and by 0.4% in the EU28.

Compared with the same quarter of the previous year, seasonally adjusted GDP rose by 1.6% in the euro area and by 1.8% in the EU28 in the third quarter of 2016, after +1.6% and +1.8% also in the previous quarter.

-

10:03

Euro area annual inflation up 0.5%

Euro area annual inflation is expected to be 0.5% in October 2016, up from 0.4% in September 2016, according to a flash estimate from Eurostat, the statistical office of the European Union.

Looking at the main components of euro area inflation, services is expected to have the highest annual rate in October (1.1%, stable compared with September), followed by food, alcohol & tobacco (0.4%, compared with 0.7% in September), non-energy industrial goods (0.3%, stable compared with September) and energy (-0.9%, compared with -3.0% in September).

-

10:00

Eurozone: Harmonized CPI, Y/Y, October 0.5% (forecast 0.5%)

-

10:00

Eurozone: GDP (YoY), Quarter III 1.6% (forecast 1.6%)

-

10:00

Eurozone: GDP (QoQ), Quarter III 0.3% (forecast 0.3%)

-

10:00

Eurozone: Harmonized CPI ex EFAT, Y/Y, October 0.8% (forecast 0.8%)

-

09:36

UK Net lending increased - Bank of England

UK broad money, M4ex, is defined as M4 excluding intermediate other financial corporations (OFCs). M4ex increased by £15.9 billion in September, compared to the average monthly increase of £13.0 billion over the previous six months. The threemonth annualised and twelve-month growth rates were 10.0% and 7.7% respectively.

M4Lex is defined as M4 lending excluding intermediate OFCs. M4Lex increased by £8.3 billion in September, compared to the average monthly increase of £9.6 billion over the previous six months. The three-month annualised and twelve-month growth rates were 4.0% and 6.4% respectively.

Households' holdings of M4 increased by £8.2 billion in September, compared to the average monthly increase of £7.7 billion over the previous six months. The three-month annualised and twelve-month growth rates were both 6.9%.

Deposits from financial and non-financial businesses decreased by £16.8 billion in September, compared to the average monthly increase of £13.5 billion over the previous six months. The decrease was mainly in deposits from businesses in the financial services industry (£22.8 billion). The twelve-month growth rate was 6.4%.

Loans to financial and non-financial businesses decreased by £18.5 billion in September, compared to the average monthly increase of £2.5 billion over the previous six months. The decrease was mainly in loans to businesses in the financial services industry (£19.5 billion). The twelve-month growth rate was 1.1%.

-

09:31

United Kingdom: Net Lending to Individuals, bln, September 4.9 (forecast 4.6)

-

09:30

United Kingdom: Mortgage Approvals, September 62.93 (forecast 61.5)

-

09:30

United Kingdom: Consumer credit, mln, September 1405 (forecast 1500)

-

09:00

Major stock markets were traded in the red zone: FTSE -0.4%, DAX -0.4%, CAC40 -0.4%, FTMIB -0.4%, IBEX -0.6%

-

09:00

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0800 (EUR 256m) 1.0875 (1.89bln) 1.0895 (265m) 1.1000 (794m)

$1.1100 (1.2bln)

USD/JPY 103.00(1.88bln) 104.00 (2.53bln) 105.00 (458m) 105.80 (225m)

GBP/USD 1.2050 (GBP 299m) 1.2235 (294m) 1.2400-04 (274m)

1.2600 (229m)

AUD/USD 0.7510 (AUD 356m) 0.7650 (207m)

USD/CAD: 1.3200 (USD 231m) 1.3300 (466m) 1.3350 (767m)

NZD/USD 0.7150 (NZD 466m)

EUR/JPY 113.76 (EUR 240m)

USD/SGD 1.3700 (USD 818m) 1.3750 (751m) 1.3800 (1.6bln) 1.3870 (490m) 1.4000(1.77bln)

-

08:28

Euro Zone inflation expected to dictate EUR/USD price action today. +0.5% y/y expected vs +0.4% prior

-

08:22

Today’s events

-

At 15:30 GMT the United States will hold an auction of 3- and 6-month bills

-

Also today, a survey of loan officers will be held in the US

-

-

08:03

USD: How Much Is A Fed Repricing Worth? How To Position? - Nomura

"With the Fed set to hike again at the December meeting, we look at the impact a repricing of the rates curve would have on the broad USD.

Our estimates suggest that if the market prices in a pace of normalisation consistent with our economists' view (100bp by end-2018), the USD index would appreciate by about 5%

...and if the market prices in a pace similar to the FOMC's economic projection (150bp by end- 2018), the USD index would be higher by about 8%.

However, the actual amount of appreciation that can be expected under these scenarios is likely to be more contained than our estimates suggest because of the feedback loop between USD and Fed policy, where USD appreciation reduces the need for a higher policy rate. As such, because of the impact such an appreciation would have on the Fed's outlook, we believe that a pace of normalisation similar to the FOMC's expectations is very unlikely. Moreover, with these appreciations, the broad USD index would reach levels not seen since the early 2000s.

Based on the sensitivity of the underlying crosses to changes in US rates, we favour being short JPY, NOK, SEK, and EUR against USD, as our estimates suggest that they would be the crosses most affected by the repricing of the pace of policy normalisation".

Copyright © 2016 Nomura, eFXnews™

-

07:28

Carney ready to serve full term at Bank of England - FT

-

07:27

ANZ: Pricing intentions are (barely) off their lows and inflation expectations are still flat in New Zeeland

-

Business sentiment dipped in October. The level is still elevated so we are not reading too much into it.

-

Businesses remain upbeat about the economy, their own prospects, profitability and employment.

-

The economic cauldron is still boiling away nicely. However, more difficulty in accessing credit and skilled labour could tip some cold water on the fire eventually. That's a normal business cycle in operation so nothing to fret about.

-

Pricing intentions are (barely) off their lows and inflation expectations are still flat at 1.4%.

-

-

07:25

GE nears deal to combine its oil & gas business with Baker Hughes; entity resulting from deal will trade publicly - Dow Jones

-

07:24

Japan’s industrial production index decreased

Industrial output in Japan remained unchanged in September compared with the previous month, falling below forecasts. Retail sales were unchanged, reflecting the sustained weakness in consumer spending.

Industrial production index was 0.0%, after rising 1.3% in Septembe. This was reported today the Ministry of Economy, Trade and Industry of Japan. The annualized rate of industrial production also fell from 4.5% to 0.9%. Industrial production - an indicator reflecting the volume of production plants, factories and mining companies of Japan. The yen weakened after data showed a weakening of strength and health of the manufacturing sector.

-

07:21

Retail turnover in September 2016 in Germany increased 0.4%

According to provisional results of the Federal Statistical Office (Destatis), retail turnover in September 2016 in Germany increased in real terms 0.4% and in nominal terms 1.0% compared with the corresponding month of the previous year. The number of days open for sale was 26 in September 2016 and 26 in September 2015, too.

Compared with the previous year, turnover in retail trade was in the first nine months 2016 in real terms 2.1% and in nominal terms 2.2% larger than in in the corresponding period of the previous year.

-

07:00

Germany: Retail sales, real adjusted , September -1.4% (forecast 0.2%)

-

07:00

Germany: Retail sales, real unadjusted, y/y, September 0.4% (forecast 1.6%)

-

06:57

Japan's housing starts grew more than expected in September

Japan's housing starts grew more than expected in September, data from the Ministry of Land, Infrastructure, Transport and Tourism revealed Monday.

Housing starts increased 10 percent year-on-year in September, faster than the 2.5 percent rise posted in August. This was the third consecutive rise and bigger than the expected 5.2 percent expansion.

Annualized housing starts totaled 984,000 versus 956,000 in the prior month. Economists had forecast housing starts to fall to 949,000 in September.

Construction orders received by 50 big contractors expanded at a faster pace of 16.3 percent, following a 13.8 rise in August - rttnews.

-

06:00

Options levels on monday, October 31, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1118 (3522)

$1.1082 (2049)

$1.1053 (2238)

Price at time of writing this review: $1.0969

Support levels (open interest**, contracts):

$1.0950 (6639)

$1.0920 (5351)

$1.0883 (3376)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 43254 contracts, with the maximum number of contracts with strike price $1,1300 (3856);

- Overall open interest on the PUT options with the expiration date November, 4 is 47182 contracts, with the maximum number of contracts with strike price $1,1000 (6639);

- The ratio of PUT/CALL was 1.09 versus 1.10 from the previous trading day according to data from October, 28

GBP/USD

Resistance levels (open interest**, contracts)

$1.2501 (1292)

$1.2402 (1306)

$1.2304 (1871)

Price at time of writing this review: $1.2190

Support levels (open interest**, contracts):

$1.2096 (1715)

$1.1998 (1119)

$1.1899 (555)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 32661 contracts, with the maximum number of contracts with strike price $1,2800 (1973);

- Overall open interest on the PUT options with the expiration date November, 4 is 32035 contracts, with the maximum number of contracts with strike price $1,2300 (1824);

- The ratio of PUT/CALL was 0.98 versus 0.97 from the previous trading day according to data from October, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:16

Japan: Housing Starts, y/y, September 10.0% (forecast 5.1%)

-

05:16

Japan: Construction Orders, y/y, September 16.3%

-

00:30

Australia: Private Sector Credit, m/m, September 0.4%

-

00:30

Australia: Private Sector Credit, y/y, September 5.4%

-

00:00

New Zealand: ANZ Business Confidence, October 24.5

-