Market news

-

23:29

Stocks. Daily history for Nov 31’2016:

(index / closing price / change items /% change)

Nikkei 225 17,425.02 0.00 0.00%

Shanghai Composite 3,101.38 -2.89 -0.09%

S&P/ASX 200 5,317.73 0.00 0.00%

FTSE 100 6,954.22 -42.04 -0.60%

CAC 40 4,509.26 -39.32 -0.86%

Xetra DAX 10,665.01 -31.18 -0.29%

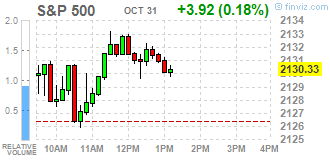

S&P 500 2,126.15 -0.26 -0.01%

Dow Jones Industrial Average 18,142.42 -18.77 -0.10%

S&P/TSX Composite 14,787.27 +1.98 +0.01%

-

19:01

DJIA 18140.47 -20.72 -0.11%, NASDAQ 5191.05 0.94 0.02%, S&P 500 2126.50 0.09 0%

-

17:18

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Monday as investors desisted from taking large positions ahead of the outcome of the U.S. election next week.

Furthermore, U.S. consumer spending rose more than expected in September as households boosted purchases of motor vehicles and inflation increased steadily, which could bolster expectations of an interest rate hike from the Federal Reserve in December. The Commerce Department said on Monday that consumer spending, which accounts for about 70% of U.S. economic activity, increased 0,5% after dipping 0,1% in August. Last month's rise in consumer spending offered a fairly strong handoff from the third quarter to the current quarter.

Most of Dow stocks in positive area (20 of 30). Top gainer - Chevron Corporation (CVX, +1.42%). Top loser - NIKE, Inc. (NKE, -3.09%).

Most of S&P sectors also in positive area. Top gainer - Utilities (+2.1%). Top loser - Basic Materials (-0.5%).

At the moment:

Dow 18088.00 -10.00 -0.06%

S&P 500 2124.25 +0.50 +0.02%

Nasdaq 100 4805.75 -0.25 -0.01%

Oil 47.13 -1.57 -3.22%

Gold 1274.20 -2.60 -0.20%

U.S. 10yr 1.84 +0.00

-

17:00

European stocks closed: FTSE 6960.79 -35.47 -0.51%, DAX 10681.29 -14.90 -0.14%, CAC 4514.69 -33.89 -0.75%

-

16:38

WSE: Session Results

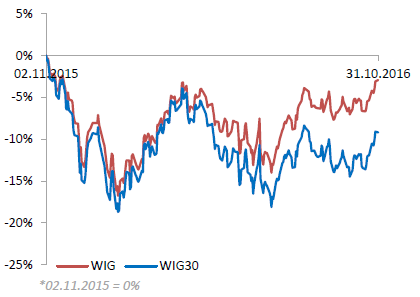

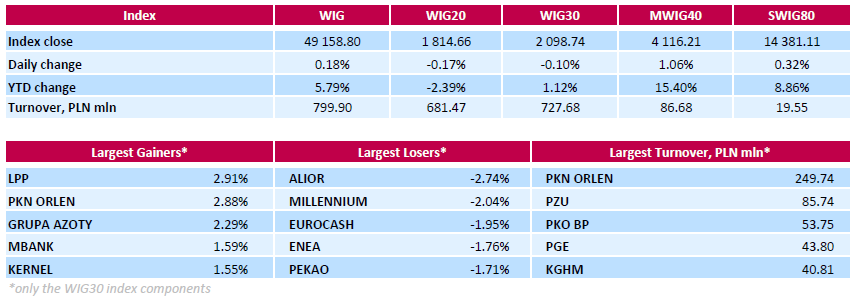

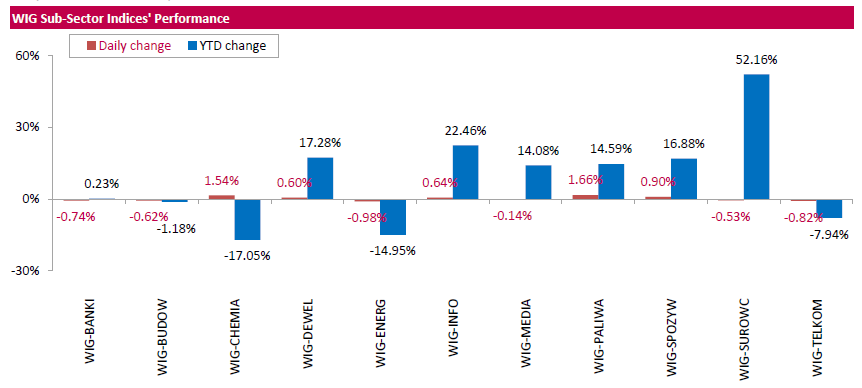

Polish equity market closed slightly higher on Monday. The broad market measure, the WIG Index, added 1.18%. Sector performance within the WIG Index was mixed. Oil and gas sector (+1.66%) outperformed, while utilities (-0.98%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, slipped 0.1%. Within the index components, clothing retailer LPP (WSE: LPP) led the gainers, jumping by 2.91%. It was followed by oil refiner PKN ORLEN (WSE: PKN), gaining 2.88%, supported by an analyst price target increase. Other major advancers were bank MBANK (WSE: MBK), agricultural producer KERNEL (WSE: KER) and two chemical producers GRUPA AZOTY (WSE: ATT) and SYNTHOS (WSE: SNS), growing between 1.5% and 2.29%. At the same time, the session's largest losers were FMCG-wholesaler EUROCASH (WSE: EUR) and two banking sector names ALIOR (WSE: ALR) and MILLENNIUM (WSE: MIL), losing between 1.95% and 2.74%. Utilities names ENEA (WSE: ENA), ENERGA (WSE: ENG) and PGE (WSE: PGE) were also beaten down heavily (the stocks tumble by 1.25%-1.76%), as the Poland's Energy Minister Krzystof Tchorzewski stated it was a mistake that country listed its state-run electric utilities, adding the main goal of these companies is providing energy security to Poland and not generating profits.

-

13:33

U.S. Stocks open: Dow -0.02%, Nasdaq +0.23%, S&P +0.10%

-

13:27

Before the bell: S&P futures +0.22%, NASDAQ futures +0.41%

U.S. stock-index futures rose as investors assessed the latest round of M&A activity (Baker Hughes (BHI) and General Electric (GE) agreed to join their oil and gas operations).

Global Stocks:

Nikkei 17,425.02 -21.39 -0.12%

Hang Seng 22,934.54 -20.27 -0.09%

Shanghai 3,101.38 -2.89 -0.09%

FTSE 6,964.84 -31.42 -0.45%

CAC 4,521.97 -26.61 -0.59%

DAX 10,672.09 -24.10 -0.23%

Crude $48.16 (-1.11%)

Gold $1273.80 (-0.23%)

-

12:57

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

66

0.12(0.1821%)

600

Amazon.com Inc., NASDAQ

AMZN

780.4

4.08(0.5256%)

29754

AMERICAN INTERNATIONAL GROUP

AIG

61.03

-0.25(-0.408%)

100

Apple Inc.

AAPL

113.78

0.06(0.0528%)

59987

AT&T Inc

T

36.65

0.14(0.3835%)

17969

Barrick Gold Corporation, NYSE

ABX

17.14

0.06(0.3513%)

22074

Chevron Corp

CVX

104.1

0.28(0.2697%)

1655

Cisco Systems Inc

CSCO

30.43

-0.16(-0.523%)

22196

Citigroup Inc., NYSE

C

49.57

0.01(0.0202%)

1000

Deere & Company, NYSE

DE

88

0.83(0.9522%)

1011

Exxon Mobil Corp

XOM

84.1

-0.68(-0.8021%)

20865

Facebook, Inc.

FB

132.06

0.77(0.5865%)

72629

Ford Motor Co.

F

11.79

0.07(0.5973%)

33896

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.03

0.10(0.9149%)

5950

General Electric Co

GE

29.63

0.41(1.4031%)

116747

General Motors Company, NYSE

GM

36.65

0.14(0.3835%)

17969

Google Inc.

GOOG

797.9

2.53(0.3181%)

8236

Hewlett-Packard Co.

HPQ

14.12

0.03(0.2129%)

875

Home Depot Inc

HD

122.6

-0.98(-0.793%)

300

Intel Corp

INTC

34.87

0.13(0.3742%)

41735

International Business Machines Co...

IBM

152.75

0.14(0.0917%)

563

McDonald's Corp

MCD

111.48

-0.62(-0.5531%)

14083

Microsoft Corp

MSFT

36.65

0.14(0.3835%)

17969

Nike

NKE

51.07

-0.95(-1.8262%)

62411

Pfizer Inc

PFE

32.08

0.15(0.4698%)

765

Starbucks Corporation, NASDAQ

SBUX

53.54

0.01(0.0187%)

921

Tesla Motors, Inc., NASDAQ

TSLA

36.65

0.14(0.3835%)

17969

The Coca-Cola Co

KO

42.3

0.07(0.1658%)

4700

Twitter, Inc., NYSE

TWTR

17.78

0.12(0.6795%)

55952

Verizon Communications Inc

VZ

36.65

0.14(0.3835%)

17969

Walt Disney Co

DIS

93.6

-0.25(-0.2664%)

3764

Yahoo! Inc., NASDAQ

YHOO

42.24

0.46(1.101%)

500

Yandex N.V., NASDAQ

YNDX

20

-0.06(-0.2991%)

141

-

12:50

Upgrades and downgrades before the market open

Upgrades:

Ford Motor (F) upgraded to Neutral from Underperform at Daiwa

Deere (DE) upgraded to Outperform at Robert W. Baird; target raised to $100 from $86

Chevron (CVX) upgraded to Buy from Neutral at Goldman; added to Conviction Buy List

Downgrades:

Home Depot (HD) downgraded to Neutral from Overweight at Piper Jaffray

NIKE (NKE) downgraded to Underperform from Neutral at BofA/Merrill

Exxon Mobil (XOM) downgraded to Neutral from Buy at Goldman; removed from Conviction Buy List

Other:

-

11:57

Major European stock indices trading in the red zone

European stocks are down moderately, continuing the trend of the previous five sessions. Pressure on the marketa put a drop in shares of energy companies in response to the news that the largest oil-producing countries have failed to agree on production cuts.

Experts note that a mediocre corporate reporting season, fears of tighter monetary policy and the upcoming US presidential election mimited the gains of stocks in recent weeks. Currently, the average projections indicate that by the end of this year, profits of companies included in the Stoxx 600 index, can be lower by 4.1 percent. Meanwhile, a report by Bank of America Corp, presented on Friday, saw the 38th consecutive weekly outflows from equity funds in the region, which is the longest series ever recorded.

Preliminary report submitted by Eurostat showed that in October, consumer prices in the eurozone rose by 0.5% after rising 0.4% last month. Last review confirmed the experts' predictions. A increase in prices for the fifth month in a row. The core consumer price index, which does not take into account the volatile energy and food prices, rose 0.8%, which coincided with the change in September, and forecasts.

A separate report showed that third-quarter euro-zone gross domestic product grew by 0.3 percent compared to the second quarter, when a similar increase was recorded. The latter change also coincided with forecasts. On an annualized basis, eurozone economic growth stabilized at 1.6 per cent, confirming analysts' estimates. In addition, it became known that the EU euro area expanded by 0.4 percent in quarterly terms and by 1.8 per cent compared with the same period last year. Recall in the second quarter, GDP grew by 0.4 percent and 1.8 percent respectively.

The composite index of the largest companies in the region Stoxx Europe 600 lost 0.45%. If by the end of the day the index will not be able to recover it will recorde six consecutive sesions of decline that will the longest series of losses since February.

The capitalization of BP Plc and Tullow Oil Plc fell more than 1 percent after OPEC did not complete a deal.

WPP shares rose by 3.5 percent after the world's largest advertising company reported an increase in quarterly sales.

Sika shares jumped 14.2 percent, as a Swiss court upheld the company's proposal to block the absorption of Cie de Saint-Gobain. Shares of French rival dropped by 1.4 percent.

Quotes of Centamin climbed 0.6 percent after the company said it expects gold production near the top of its forecast for 2016.

At the moment:

FTSE 100 6966.43 -29.83 -0.43%

DAX -40.23 10655.96 -0.38%

CAC 40 4511.28 -37.30 -0.82%

-

10:43

Earnings Season in U.S.: Major Reports of the Week

November 1

Before the Open:

Pfizer (PFE). Consensus EPS $0.62, Consensus Revenue $13027.62 mln.

November 2

After the Close:

American Intl (AIG). Consensus EPS $1.20, Consensus Revenue $12460.00 mln.

Facebook (FB). Consensus EPS $0.96, Consensus Revenue $6912.16 mln.

November 3

After the Close:

Starbucks (SBUX). Consensus EPS $0.55, Consensus Revenue $5689.59 mln.

November 4

After the Close:

Berkshire Hathaway (BRK.B). Consensus EPS $3056.76, Consensus Revenue $57035.84 mln.

-

07:41

Negative start of trading expected on the major stock exchanges in Europe: DAX-0.1%, CAC40 -0.4%, FTSE -0.3%

-