Market news

-

23:29

Stocks. Daily history for Nov 01’2016:

(index / closing price / change items /% change)

Nikkei 225 17,442.40 +17.38 +0.10%

Shanghai Composite 3,122.03 +21.54 +0.69%

S&P/ASX 200 5,290.47 0.00 0.00%

FTSE 100 6,917.14 -37.08 -0.53%

CAC 40 4,470.28 -38.98 -0.86%

Xetra DAX 10,526.16 -138.85 -1.30%

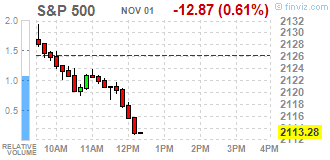

S&P 500 2,111.72 -14.43 -0.68%

Dow Jones Industrial Average 18,037.10 -105.32 -0.58%

S&P/TSX Composite 14,778.32 -8.95 -0.06%

-

19:00

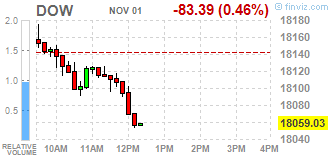

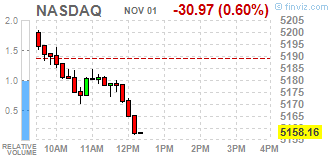

DJIA 17988.65 -153.77 -0.85%, NASDAQ 5132.75 -56.39 -1.09%, S&P 500 2104.57 -21.58 -1.01%

-

17:00

European stocks closed: FTSE 6904.34 -49.88 -0.72%, DAX 10509.83 -155.18 -1.46%, CAC 4460.61 -48.65 -1.08%

-

16:22

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes decreased on Tuesday amid uncertainty surrounding the U.S. presidential election and tepid construction spending data. Construction spending in September unexpectedly fell, which could lead to a mild downward revision to the third-quarter economic growth estimate. Another set of data showed that while U.S. factory activity increased for the second straight month in October, a gauge of new orders slipped.

Most of Dow stocks in negative area (21 of 30). Top gainer - Chevron Corporation (CVX, +1.58%). Top loser - Pfizer Inc. (PFE, -1.88%).

Almost all S&P sectors also in negative area. Top gainer - Conglomerates (+0.4%). Top loser - Utilities (-1.2%).

At the moment:

Dow 17985.00 -77.00 -0.43%

S&P 500 2109.00 -11.00 -0.52%

Nasdaq 100 4770.00 -26.75 -0.56%

Oil 46.86 0.00 0.00%

Gold 1289.40 +16.30 +1.28%

U.S. 10yr 1.86 +0.03

-

13:34

U.S. Stocks open: Dow +0.10%, Nasdaq +0.17%, S&P +0.15%

-

13:24

Before the bell: S&P futures +0.23%, NASDAQ futures +0.15%

U.S. stock-index futures advanced, supported by better-than-expected manufacturing activity reports from China. Investors await readings on U.S. manufacturing, for further indications of the health of the world's biggest economy before this week's Fed announcement.

Global Stocks:

Nikkei 17,442.40 +17.38 +0.10%

Hang Seng 23,147.07 +212.53 +0.93%

Shanghai 3,122.03 +21.54 +0.69%

FTSE 6,959.05 +4.83 +0.07%

CAC 4,499.31 -9.95 -0.22%

DAX 10,651.07 -13.94 -0.13%

Crude $47.04 (+0.38%)

Gold $1289.10 (+1.26%)

-

12:46

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

21.75

0.31(1.4459%)

7585

ALTRIA GROUP INC.

MO

66.21

0.09(0.1361%)

508

Amazon.com Inc., NASDAQ

AMZN

794

4.18(0.5292%)

16398

American Express Co

AXP

67.72

1.30(1.9572%)

152

Apple Inc.

AAPL

113.5

-0.04(-0.0352%)

41852

AT&T Inc

T

36.85

0.06(0.1631%)

1813

Barrick Gold Corporation, NYSE

ABX

17.97

0.38(2.1603%)

77471

Caterpillar Inc

CAT

83.14

-0.32(-0.3834%)

1543

Chevron Corp

CVX

105.36

0.61(0.5823%)

34884

E. I. du Pont de Nemours and Co

DD

36.85

0.06(0.1631%)

1813

Exxon Mobil Corp

XOM

83.6

0.28(0.3361%)

6700

Facebook, Inc.

FB

131.41

0.42(0.3206%)

58527

Ford Motor Co.

F

11.75

0.01(0.0852%)

23897

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.35

0.17(1.5206%)

67168

General Electric Co

GE

29.13

0.03(0.1031%)

4764

General Motors Company, NYSE

GM

31.7

0.10(0.3165%)

450

Google Inc.

GOOG

67.72

1.30(1.9572%)

152

Hewlett-Packard Co.

HPQ

14.5

0.01(0.069%)

100

McDonald's Corp

MCD

112.72

0.15(0.1333%)

1546

Microsoft Corp

MSFT

60.03

0.11(0.1836%)

6801

Nike

NKE

50.3

0.12(0.2391%)

2994

Pfizer Inc

PFE

31.24

-0.47(-1.4822%)

292353

Procter & Gamble Co

PG

50.3

0.12(0.2391%)

2994

Starbucks Corporation, NASDAQ

SBUX

53.1

0.03(0.0565%)

3162

Tesla Motors, Inc., NASDAQ

TSLA

198.15

0.42(0.2124%)

3464

Twitter, Inc., NYSE

TWTR

17.93

-0.02(-0.1114%)

51641

Visa

V

83.01

0.50(0.606%)

3323

Yahoo! Inc., NASDAQ

YHOO

40.9

-0.65(-1.5644%)

8986

-

12:42

Upgrades and downgrades before the market open

Upgrades:

Chevron (CVX) upgraded to Overweight from Equal-Weight at Morgan Stanley

Downgrades:

Other:

Amazon (AMZN) target raised to $953 from $877 at Axiom Capital

Alcoa (AA) initiated with a Neutral at Macquarie; target $21

-

11:59

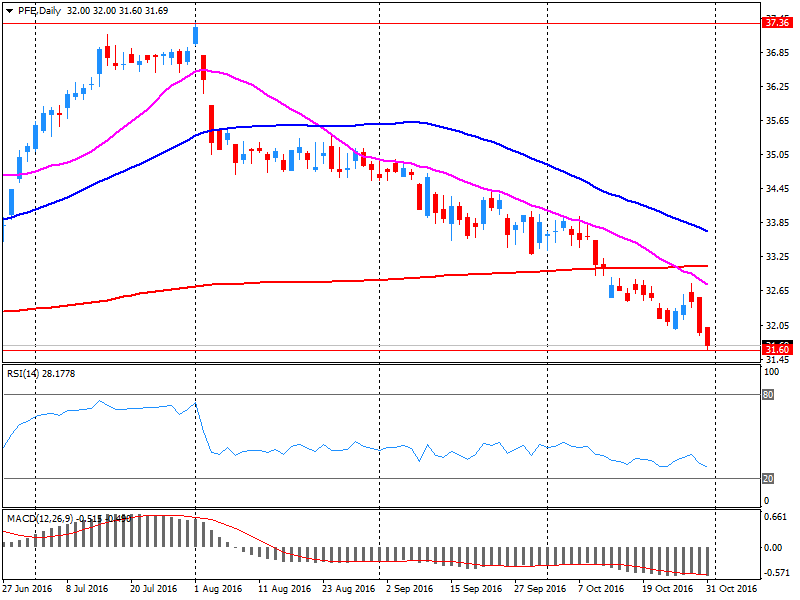

Company News: Pfizer (PFE) Q3 EPS miss analysts’ estimate

Pfizer reported Q3 FY 2016 earnings of $0.61 per share (versus $0.60 in Q3 FY 2015), missing analysts' consensus estimate of $0.62.

The company's quarterly revenues amounted to $13.045 bln (+7.9% y/y), generally matching analysts' consensus estimate of $13.028 bln.

The company also issued updated guidance for FY 2016, projecting EPS of $2.38-2.43 versus analysts' consensus estimate of $2.47 (previously $2.38-2.48) and revenues of $52.0-53.0 bln versus analysts' consensus estimate of$53.15 bln (previously $51.0-53.0 bln).

PFE fell to $$30.83 (-2.78%) in pre-market trading.

-

09:04

Major stock markets trading in the green zone: FTSE + 0.4%, DAX + 0.6%, CAC40 + 0.6%, FTMIB + 0.5%, IBEX + 0.7%

-

07:47

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.5%, CAC40 + 0.6%, FTSE + 0.2%

-

05:52

Global Stocks

European stocks finished roughly unchanged on Monday, with better-than-anticipated eurozone data serving as a pillar of support, while Spanish shares charged higher as a 10-month government impasse came to an end. IHS Markit said its manufacturing PMI for the eurozone rose to a 30-month high at 53.3, better than a 52.6 estimate from a FactSet consensus of analysts. The services PMI's nine-month high of 53.5 was ahead of a 52.4 estimate.

U.S. stocks closed lower after drifting between slight gains and losses Monday, finishing October with a loss, as stronger-than-expected consumer spending data underlined the view that the economy is growing at a steady pace, while a drop in oil prices and election uncertainty weighed on the minds of investors.

Asian markets were mixed Tuesday after the release of encouraging purchasing managers index data from China and as the Bank of Japan and Australia's central bank largely held firm on their policies. The official manufacturing PMI rose to 51.2 in October from 50.4 in September, adding to signs that the world's second-largest economy is stabilizing. China's official non-manufacturing purchasing managers index, a measure of activity outside factory gates, edged up to 54.0 in October from 53.7 in September.

-