Market news

-

23:28

Currencies. Daily history for Nov 01’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1056 +0,72%

GBP/USD $1,2242 +0,04%

USD/CHF Chf0,975 -1,43%

USD/JPY Y104,05 -0,68%

EUR/JPY Y115,07 +0,07%

GBP/JPY Y127,39 -0,64%

AUD/USD $0,7655 +0,67%

NZD/USD $0,7206 +0,82%

USD/CAD C$1,3385 -0,19%

-

23:10

Schedule for today, Wednesday, Nov 02’2016

00:30 Australia Building Permits, m/m September -1.8% -3%

05:00 Japan Consumer Confidence October 43 42.8

07:00 United Kingdom Nationwide house price index October 0.3% 0.2%

07:00 United Kingdom Nationwide house price index, y/y October 5.3% 5%

08:50 France Manufacturing PMI (Finally) October 49.7 51.3

08:55 Germany Manufacturing PMI (Finally) October 54.3 55.1

08:55 Germany Unemployment Rate s.a. October 6.1% 6.1%

08:55 Germany Unemployment Change October 1 -1

09:00 Eurozone Manufacturing PMI (Finally) October 52.6 53.3

09:30 United Kingdom PMI Construction October 52.3 51.8

12:15 U.S. ADP Employment Report October 154 165

14:30 U.S. Crude Oil Inventories October -0.553

17:15 Canada Gov Council Member Wilkins Speaks

18:00 U.S. Fed Interest Rate Decision 0.5% 0.5%

18:00 U.S. FOMC Statement

22:30 Australia AIG Services Index October 48.9

-

21:45

New Zealand: Employment Change, q/q, Quarter III 1.4% (forecast 0.6%)

-

21:45

New Zealand: Unemployment Rate, Quarter III 4.9% (forecast 5.1%)

-

15:01

US economic optimism from IBD / TIPP rose slightly in November

The data showed that economic optimism index in the US, calculated by the newspaper Investor's Business Daily and research firm TechnoMetrica Institute of Policy and Politics, rose in November by 0.1 points, or 0.2%, reaching 51.4 points. Analysts expect that figure to drop to 48.7 points. The index value above 50 indicates optimism, while below 50, pessimism. Now the index is 3.9 points higher than the 12-month average (47.5) and 7.0 points higher than in December 2007, when the economy has entered a recession. The average value of the index on record is 49.0 points.

The sub-index of the six-month economic outlook rose 1.8 points, or 3.6%, to 52.2 points, while the sub-index of the personal financial outlook for the next six months decreased by 1.0 points, or 1.7% , reaching 58.9 points. Meanwhile, the sub-index of confidence in federal economic policies fell 0.4 points, or 0.9%, to 43.1 points.

-

14:54

Change in GDT Price Index from previous event +11.4%

-

Average price (USD/MT, FAS): $3,327

-

-

14:14

US ISM manufacturing continue to improve

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management. "The October PMI registered 51.9 percent, an increase of 0.4 percentage point from the September reading of 51.5 percent. The New Orders Index registered 52.1 percent, a decrease of 3 percentage points from the September reading of 55.1 percent. The Production Index registered 54.6 percent, 1.8 percentage points higher than the September reading of 52.8 percent. The Employment Index registered 52.9 percent, an increase of 3.2 percentage points from the September reading of 49.7 percent. Inventories of raw materials registered 47.5 percent, a decrease of 2 percentage points from the September reading of 49.5 percent. The Prices Index registered 54.5 percent in October, an increase of 1.5 percentage points from the September reading of 53 percent, indicating higher raw materials prices for the eighth consecutive month. Comments from the panel are largely positive citing a favorable economy and steady sales, with some exceptions."

-

14:00

U.S.: ISM Manufacturing, October 51.9 (forecast 51.7)

-

14:00

U.S.: Construction Spending, m/m, September -0.4% (forecast 0.5%)

-

13:55

US manufacturing PMI at the highest level in a year

Operating conditions in the U.S. manufacturing sector strengthened to the greatest degree for a year during October, underpinned by faster expansions in both production and new orders. With pressure on capacity, as highlighted by a sharper increase in backlogs of work, further jobs were created.

Meanwhile, emergent inflationary pressures were evident as both input and output prices rose at solid rates. October's headline Markit Final U.S. Manufacturing Purchasing Managers' Index was slightly better than the earlier flash reading of 53.2, coming in at 53.4.

That was a marked improvement on September's 51.5 and the best reading recorded for a year. Operating conditions have continuously improved throughout the past seven years, with October's PMI reading notable for being the highest recorded by the survey for 12 months.

-

13:48

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0800 (EUR 726m) 1.0890 (311m) 1.0900 (3.44bln) 1.0940 (518m)

USDJPY 103.00 (USD 505m) 103.25 (280m) 104.40-50 (320m) 104.75 (233m) Y105.00 (545m)

GBPUSD 1.2450 (GBP 736m)

AUDUSD 0.7550 (AUD388m) 0.7570-75 (446m) 0.7595-00 (631m) 0.7670 (416m) 0.7700(475mn)

USDCAD: 1.3400-05 (USD 885m)

EURJPY 114.00 (EUR 300m)

AUDJPY 80.00 (AUD 325m)

USDCNY 6.7500 (USD 700m)

-

13:45

U.S.: Manufacturing PMI, October 53.4 (forecast 51.7)

-

13:32

October data pointed to another challenging month for the Canadian manufacturing sector - Markit

October data pointed to another challenging month for the Canadian manufacturing sector, with production volumes stagnating amid subdued demand patterns and ongoing efforts to reduce finished goods inventories. That said, the latest survey highlighted a slight improvement in overall business conditions, driven by a renewed rise in new work and greater employment numbers.

Meanwhile, operating margins were eroded further amid falling factory gate charges and a sharper increase in manufacturers' input costs. Adjusted for seasonal influences, the Markit Canada Manufacturing Purchasing Managers' Index registered 51.1 in October, up from September's seven-month low of 50.3. The index has posted above the 50.0 no-change threshold in each month since March, but the latest reading was weaker than the survey average (52.4) and signalled only a marginal improvement in overall business conditions.

-

13:10

Orders

EUR/USD

Offers 1.1000 1.1030 1.1050 1.1080 1.1100

Bids 1.0950 1.0935 1.0900 1.0875-80 1.0850 1.0825-30 1.0800

GBP/USD

Offers 1.2280 1.2300 1.2325-30 1.2350 1.2380 1.2400

Bids 1.2230 1.2200 1.2185 1.2170 1. 1.2150 1.2130 1.2100 1.2080-85 1.2050 1.2000

EUR/GBP

Offers 0.8980 0.9000 0.9020 0.9050 0.9070 0.9100

Bids 0.8945-50 0.8920 0.8900 0.8880-85 0.8870 0.8850-55

EUR/JPY

Offers 115.75-80 116.00 116.30 116.50

Bids 115.00 114.80 114.50 114.00 113.70 113.50

USD/JPY

Offers 105.20-25 105.50-55 105.80 106.00 106.50 107.00

Bids 104.75-80 104.50 104.30 104.00 103.80-85 103.50 103.00

AUD/USD

Offers 0.7670-75 0.7700-10 0.7730 0.7750 0.7780 0.7800

Bids 0.7620 0.7600 0.7580 0.7550 0.7500 0.7480 0.7450

-

12:34

Canadian GDP up 0.2% in August, as expected

Real gross domestic product rose 0.2% in August, following a 0.4% increase in July. The output of goods-producing industries rose while service-producing industries were essentially unchanged.

The output of goods-producing industries grew 0.7% in August, with the main contribution coming from mining, quarrying and oil and gas extraction and utilities. Manufacturing and construction were also up, while the agriculture and forestry sector was down.

There was essentially no change in the output of service-producing industries in August. Wholesale trade, transportation and warehousing services, accommodation and food services as well as the public sector (education, health and public administration combined) increased. Declines were posted in the finance and insurance sector and retail trade.

-

12:30

Canada: GDP (m/m) , August 0.2% (forecast 0.2%)

-

11:51

Major European stock indices trading in the green zone

European stock indices show a slight increase, helped by news from China, as well as the financial statements of Royal Dutch Shell. However, further growth was limited by lower than expected Standard Chartered and BP Plc results.

Data provided by Caixin showed that the PMI index in the manufacturing sector of China accelerated in October to 51.2 points. In September the PMI was 50.1 points. "It seems that at the moment the economy stabilizes, this is primarily due to the policy adopted to maintain economic growth and the support policy must continue, otherwise the volume of industrial production may weaken because of the slowdown in investment.", - said CEBM Zhong Cheng-sheng Group.

Meanwhile, China's State Bureau of Statistics show that in October the PMI index in the non-manufacturing sector was 54.0 points, which is 0.3 points higher than in the previous month. The latter value reflects the ongoing process of expanding production sphere of the country. Meanwhile, the PMI index in the manufacturing sector was equal to 51.2 points, the highest level since July 2014. Analysts had forecast that the index will register 50.4 points, as well as in September.

Investors' attention is also on stats from Britain. The research results presented by Markit Economics / CIPS, have shown that the UK manufacturing sector has lost some momentum in October as a weaker pound strengthened the inflationary pressures in the country. According to the data, manufacturing PMI fell in October to 54.3 points compared to 55.5 points in September (revised from 55.4), which was the highest value in more than two years. It was predicted that the index will fall to 54.5 points. "The manufacturing sector remained on a solid basis in October and should return to growth in the fourth quarter," - said Dobson, economist at Markit Economics. The volume of new orders rose for the third month in a row, as the company reported an increase in demand from domestic and export customers. In addition, employment increased for the third consecutive month in October, and the pace of job growth reached an annual hihg. Inflation rose to a 69-month high, while the average selling prices increased the most since June 2011.

Trading dynamics influenced by the publication of corporate reports - this week will be released financial results for more than 70 Stoxx 600 companies, including Adidas, Commerzbank and Cie Financiere Richemont.

The composite index of the largest companies Stoxx Europe Index of 600 in the region rose by 0.1%. To date, the index was down six days in a row, which is the longest series in the last 9 months.

Shares of Standard Chartered fell 4.7 percent after third-quarter profit did not meet estimates, and revenues declined in all four divisions.

The cost of BP dropped 2.5 percent after reporting a drop in profit by 49 per cent, on low oil prices and a decline in refining margins.

Quotes of Royal Dutch Shell rose 3.9 percent after the company's adjusted earnings topped forecasts of experts.

Rio Tinto Group securities climbed 1.3 percent against the backdrop of recent Chinese business activity data.

Capitalization of Weir Group fell 5.4 percent as the company said annual profit will be lower than analysts predict, even though the favorable effect of changes in exchange rates

At the moment:

FTSE 100 +20.31 6974.53 + 0.29%

DAX +24.90 10689.91 + 0.23%

CAC 40 +8.05 4517.31 + 0.18%

-

10:21

-

09:38

The UK manufacturing sector maintained a solid rate of expansion - Markit

The UK manufacturing sector maintained a solid rate of expansion at the start of the final quarter. October saw the seasonally adjusted Markit/CIPS Purchasing Managers' Index post 54.3, down slightly from 55.5 in September, to remain well above its long-run average of 51.5.

Underpinning the improvement in operating conditions were marked expansions of new business and production. New order volumes increased for the third consecutive month and at a pace close to September's recent high. Companies reported higher demand from both domestic and export clients.

-

09:30

United Kingdom: Purchasing Manager Index Manufacturing , October 54.3 (forecast 54.5)

-

09:08

BOE FPC Member Furse Steps Down

-

09:00

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0800 (EUR 726m) 1.0890 (311m) 1.0900 (3.44bln) 1.0940 (518m)

USD/JPY 103.00 (USD 505m) 103.25 (280m) 104.40-50 (320m) 104.75 (233m), Y105.00 (545m)

GBP/USD 1.2450 (GBP 736m)

AUD/USD 0.7550 (AUD388m) 0.7570-75 (446m) 0.7595-00 (631m) 0.7670 (416m) 0.7700(475mn)

USD/CAD: 1.3400-05 (USD 885m)

EUR/JPY 114.00 (EUR 300m)

AUD/JPY 80.00 (AUD 325m)

USD/CNY 6.7500 (USD 700m)

-

08:30

Switzerland: Manufacturing PMI, October 54.7 (forecast 53.8)

-

08:21

Swiss retail sales decline 2.3% in September

Turnover in the retail sector fell by 2.7% in nominal terms in September 2016 compared with the previous year. This decline has been ongoing since January 2015. Seasonally adjusted, nominal turnover fell by 0.1% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Real turnover in the retail sector also adjusted for sales days and holidays fell by 2.3% in September 2016 compared with the previous year. Real growth takes inflation into consideration. Compared with the previous month, real, seasonally adjusted retail trade turnover registered an increase of 0.2%.

-

07:45

-

07:39

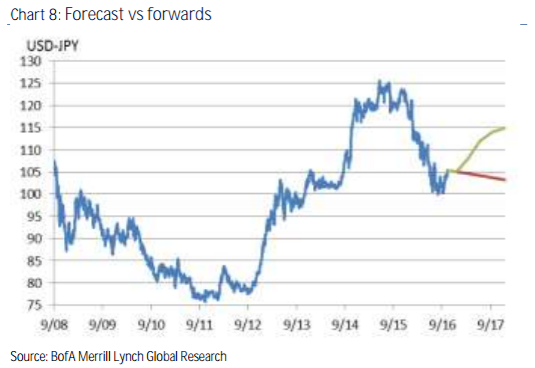

BofA Merrill buying USD/JPY dips

"Themes: JPY bulls won on the BoJ One-week implied volatility for the USD/JPY options market stands below 10, the lowest level ahead of a BoJ meeting all year. In our view, this reflects not only declining overall market volatility, but also strengthened policy sustainability since a new policy framework was introduced in September as well as recent remarks by BoJ Governor Haruhiko Kuroda indicating any major policy changes are unlikely anytime soon. Moreover, the BoJ's seemingly new communications strategy-shifting from delivering surprises to guiding expectations-will help avoid unnecessary rise in volatility. As long as the JGB curve remains stable, currency traders' incentive to trade on the BoJ's policy meetings will probably subside for some time.

The US presidential election will be the key driver of USDJPY over the short term as the election outcome will have quite binary implications on JPY. If the Republicans win the presidential race, JPY is likely to rally significantly short term amid risk-off trading. If the Democrats win, the market reaction is likely to be limited as it has been largely priced in. Gridlock in the congress would have negative implications on USD while a clean sweep - one party winning the presidential seat and congress - by either party would support the currency.

That said, we believe the case for the yen's depreciation into 2017 is strong so that we would be buyers of USD/JPY's dip rather than sellers of USD/JPY's strength.

Forecasts: JPY to weaken in 2017 .We have kept our view that 100 is where USD/JPY's long-term risk reward starts shifting upward. While the US elections pose near-term risk, we believe USD/JPY is likely to rise to 115-120 by end 2017".

Copyright © 2016 BofAML, eFXnews™

-

07:36

Asian session review: The Australian dollar rose

The New Zealand dollar rose after strong data from China. As reported today by the Chinese Federation of Logistics and Supply, the index of business activity in the manufacturing sector was 51.2 in October, higher than the previous value of 50.4. Analysts had expected the index to rise to 50.3. This indicator reached the high of more than 2 years, suggesting signs of stabilization of the Chinese economy. Also it became known, that China's service sector business activity rose in October to 54.0 points from 53.7 in September. Significant growth was observed in investment and implementation, and the expected rate of operational activity in the sector rose to 60.6.

The Australian dollar rose after the Reserve Bank of Australia left interest rates unchanged at 1.5%. The central bank made this decision against the background of concerns about the weakness of inflation and conflicting data on the labor market, as well as overheating of the property market. The central bank said that inflation data in the third quarter as a whole was in line with expectations and will remain below the target range of 2-3% for some time. RBA called the conditions in the labor market quite ambiguous. Indicators point to continued employment growth in the short term. The pace of new home price growth is lower than in 2015. RBA also expressed concern that the global economy is growing more slowly than usual. "The pace of world output and trade growth is reduced."

The Japanese yen fell slightly after the Bank of Japan left monetary policy unchanged, confounding expectations of most observers. The Governing Council of the central bank leaves the target rate of return on 10-year government bonds at zero. The Bank of Japan also left the short-term rate on deposits of commercial banks at -0.10%. Meanwhile, the central bank moved the achievement of the inflation target of 2% later in the fiscal year 2018. The bank had previously said that it will reach the target level of inflation in the 2017 fiscal year.

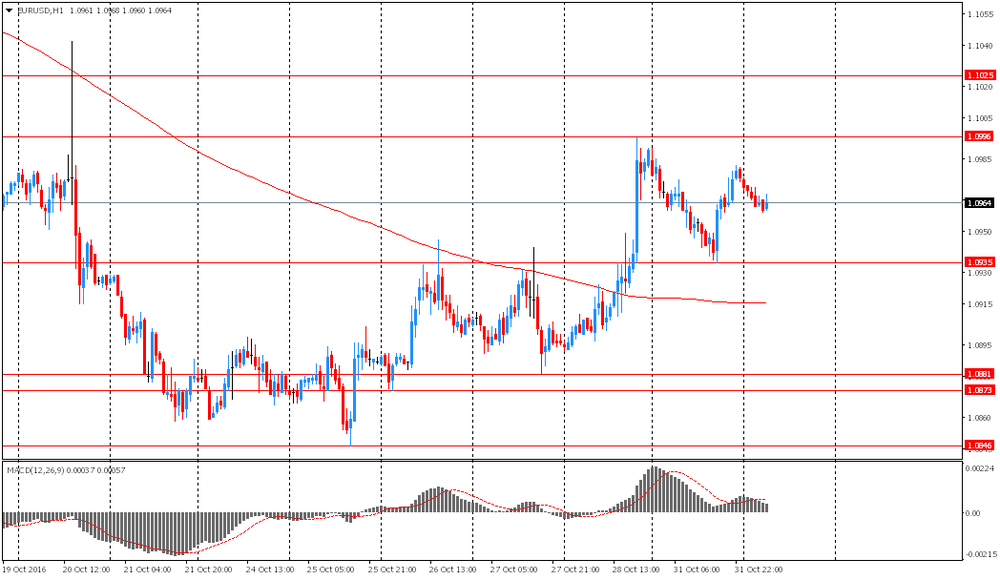

EUR / USD: during the Asian session, the pair was trading in the $ 1.0960-75 range

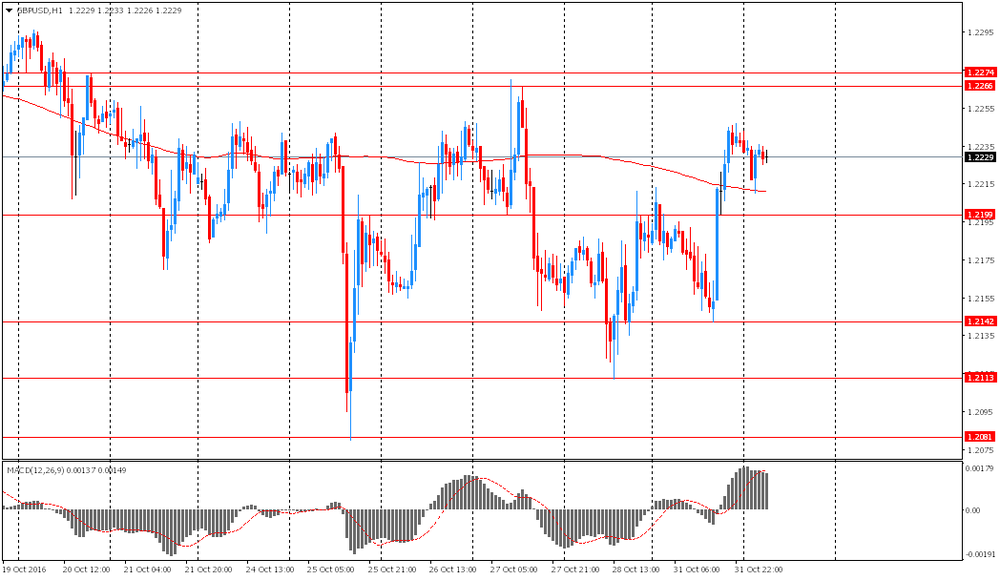

GBP / USD: during the Asian session, the pair was trading in the $ 1.2210-35 range

USD / JPY: during the Asian session, the pair was trading in the Y104.65-95 range

-

07:31

Options levels on tuesday, November 1, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1111 (3285)

$1.1070 (1927)

$1.1037 (2372)

Price at time of writing this review: $1.0975

Support levels (open interest**, contracts):

$1.0923 (5059)

$1.0887 (3367)

$1.0844 (2212)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 43223 contracts, with the maximum number of contracts with strike price $1,1300 (3654);

- Overall open interest on the PUT options with the expiration date November, 4 is 46826 contracts, with the maximum number of contracts with strike price $1,1000 (6594);

- The ratio of PUT/CALL was 1.08 versus 1.09 from the previous trading day according to data from October, 31

GBP/USD

Resistance levels (open interest**, contracts)

$1.2501 (1419)

$1.2402 (1351)

$1.2305 (1928)

Price at time of writing this review: $1.2229

Support levels (open interest**, contracts):

$1.2195 (1424)

$1.2098 (2015)

$1.1999 (1027)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 32963 contracts, with the maximum number of contracts with strike price $1,2800 (1973);

- Overall open interest on the PUT options with the expiration date November, 4 is 32275 contracts, with the maximum number of contracts with strike price $1,2300 (1854);

- The ratio of PUT/CALL was 0.98 versus 0.98 from the previous trading day according to data from October, 31

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:16

RBA holds rates at +1.50%, as expected

"At its meeting today, the Board decided to leave the cash rate unchanged at 1.50 per cent.

The global economy is continuing to grow, at a lower than average pace. Labour market conditions in the advanced economies have improved over the past year, but growth in global industrial production and trade remains subdued. Economic conditions in China have steadied recently, supported by growth in infrastructure and property construction, although medium-term risks to growth remain. Inflation remains below most central banks' targets.

Commodity prices have risen over recent months, following the very substantial declines over the past few years. The higher commodity prices have supported a rise in Australia's terms of trade, although they remain much lower than they have been in recent years.

Financial markets are functioning effectively. Funding costs for high-quality borrowers remain low and, globally, monetary policy remains remarkably accommodative. Government bond yields have risen, but are still low by historical standards.

In Australia, the economy is growing at a moderate rate. The large decline in mining investment is being offset by growth in other areas, including residential construction, public demand and exports. Household consumption has been growing at a reasonable pace, but appears to have slowed a little recently. Measures of household and business sentiment remain above average".

-

07:14

Bank of Japan Trims Inflation Forecasts

The bank pushed back its forecast date for hitting 2% inflation to around fiscal 2018. Previously the bank said it would reach its target in fiscal 2017. The Japanese fiscal year ends in March.

-

07:12

Mark Carney to stay at Bank of England until June 2019

-

07:10

Bank of Japan holds interest rate at -0.10%. USD/JPY little changed

At the Monetary Policy Meeting held today, the Policy Board of the Bank of Japan decided upon the following. The Bank decided, by a 7-2 majority vote, to set the following guideline for market operations for the intermeeting period.

The short-term policy interest rate: The Bank will apply a negative interest rate of minus 0.1 percent to the Policy-Rate Balances in current accounts held by financial institutions at the Bank.

The long-term interest rate: The Bank will purchase Japanese government bonds (JGBs) so that 10-year JGB yields will remain at around zero percent.

With regard to the amount of JGBs to be purchased, the Bank will conduct purchases at more or less the current pace -- an annual pace of increase in the amount outstanding of its JGB holdings of about 80 trillion yen -- aiming to achieve the target level of the long-term interest rate specified by the guideline.

-

07:08

AUD/USD shoots higher on a less than expected RBA dovish hold

-

07:06

China's manufacturing sector growth improved strongly at the start of the fourth quarter

According to rttnews, China's manufacturing sector growth improved strongly at the start of the fourth quarter as output expanded at the fastest rate in over five-and-a-half years in October.

The seasonally adjusted Caixin factory Purchasing Managers' Index rose to 51.2 in October from 50.1 in September, survey data from IHS Markit showed Tuesday. The score was expected to remain at 50.1.

A reading above 50 indicates expansion, while a reading below 50 suggests contraction in the sector.

At the same time, the official manufacturing PMI rose to 51.2 in October from 50.4 in September, the National Bureau of Statistics reported. Similarly, the non-manufacturing PMI improved to 54.0 from 53.7 in September.

-

03:30

Australia: Announcement of the RBA decision on the discount rate, 1.5% (forecast 1.5%)

-

02:58

Japan: BoJ Interest Rate Decision, -0.1% (forecast -0.1%)

-

01:00

China: Manufacturing PMI , October 51.2 (forecast 50.4)

-

00:59

China: Non-Manufacturing PMI, October 54.0

-

00:30

Japan: Manufacturing PMI, October 51.4 (forecast 51.7)

-