Market news

-

23:29

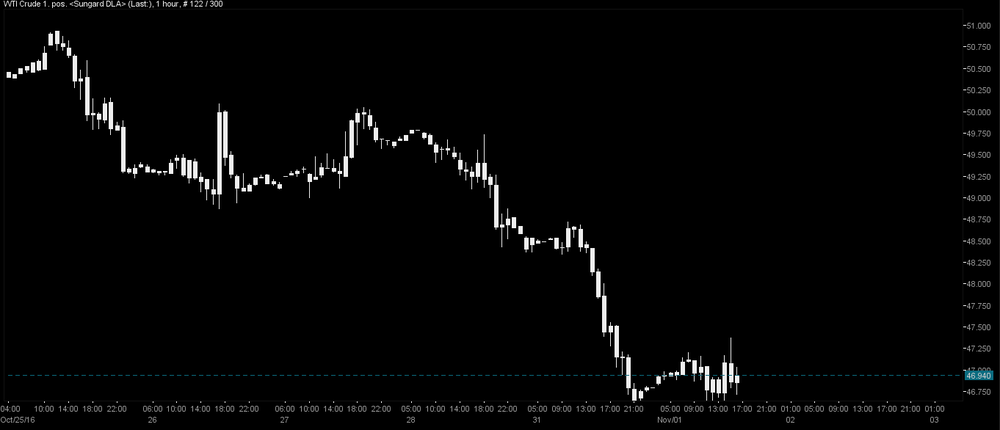

Commodities. Daily history for Nov 01’2016:

(raw materials / closing price /% change)

Oil 46.39 -0.60%

Gold 1,290.20 +0.17%

-

15:51

Gold ralied as FOMC and US elections draw near

Uncertainties always make gold appealing. The course of trading in the second part of the day was influenced by US data. US October ISM registered 51.9 percent, an increase of 0.4 percentage point from the September reading of 51.5 percent. The New Orders Index registered 52.1 percent, a decrease of 3 percentage points from the September reading of 55.1 percent. The Production Index registered 54.6 percent, 1.8 percentage points higher than the September reading of 52.8 percent.

Economic optimism index in the US, calculated by the newspaper Investor's Business Daily and research firm TechnoMetrica Institute of Policy and Politics, rose in November by 0.1 points, or 0.2%, reaching 51.4 points. Analysts expect that figure to drop to 48.7 points. The index value above 50 indicates optimism, while below 50, pessimism. Now the index is 3.9 points higher than the 12-month average (47.5) and 7.0 points higher than in December 2007, when the economy has entered a recession. The average value of the index on record is 49.0 points.

Traders were cautious ahead of Wednesday's interest rate decision from the Federal Reserve.

The Fed is expected to keep interest rates on hold while hinting at a December rate hike.

Gold futures trading up almost 15$ to $1289.

-

15:20

WTI traded in a tight range

Crude oil prices remained lower extending recent losses after OPEC and Russia failed to make concrete plans to curb production.

Rttnews says that Iran has reportedly nixed plans for a meaningful reduction in output after years of crippling sanctions.

Meanwhile, economic concerns and political uncertainty in the U.S. have markets in a cautious mood.

WTI light sweet crude oil was down 20 cents at $46.70 a barrel, the lowest in a month.

The American Petroleum Institute is out with its U.S. oil inventories survey this afternoon, while the government report is scheduled for tomorrow.

-

13:00

-

10:34

Oil is trading higher

This morning, the New York futures for Brent rose 0.43% to $ 47.06 and WTI up 0.86% to $ 49.03 per barrel. Thus, the black gold is trading in the green zone on the background of an OPEC agreed on a long-term strategy for development of the cartel, which was perceived by the market as a movement in the direction of production cuts.

-