Market news

-

23:28

Stocks. Daily history for Nov 02’2016:

(index / closing price / change items /% change)

Nikkei 225 17,134.68 -307.72 -1.76%

Shanghai Composite 3,102.96 -19.48 -0.62%

S&P/ASX 200 5,228.99 0.00 0.00%

FTSE 100 6,845.42 -71.72 -1.04%

CAC 40 4,414.67 -55.61 -1.24%

Xetra DAX 10,370.93 -155.23 -1.47%

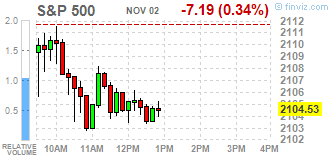

S&P 500 2,097.94 -13.78 -0.65%

Dow Jones Industrial Average 17,959.64 -77.46 -0.43%

S&P/TSX Composite 14,594.72 -183.60 -1.24%

-

19:00

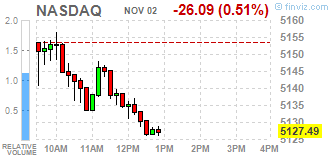

DJIA 17985.94 -51.16 -0.28%, NASDAQ 5113.52 -40.06 -0.78%, S&P 500 2100.42 -11.30 -0.54%

-

17:02

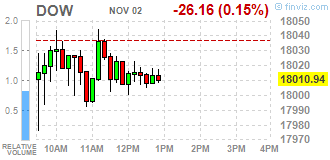

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell on Wednesday, with the S&P 500 headed for seventh day of losses as a tightening race for the White House rattled investors and a fall in oil also weighed on sentiment. Investors are rethinking their long-held bets of a November 8 victory for Democrat Hillary Clinton amid signs that her Republican rival Donald Trump could be closing the gap. While Clinton held a percentage point lead over Trump, according to a Reuters/Ipsos opinion poll released on Monday, some other polls showed her Republican rival ahead by 1-2 percentage points.

Most of Dow stocks in negative area (19 of 30). Top gainer - The Home Depot, Inc. (HD, +0.73%). Top loser - Pfizer Inc. (PFE, -1.38%).

All S&P sectors also in negative area. Top loser - Utilities (-1.3%).

At the moment:

Dow 17927.00 -12.00 -0.07%

S&P 500 2098.50 -5.25 -0.25%

Nasdaq 100 4740.50 -16.75 -0.35%

Oil 45.25 -1.42 -3.04%

Gold 1307.70 +19.70 +1.53%

U.S. 10yr 1.80 -0.02

-

17:02

European stocks closed: FTSE 6845.42 -71.72 -1.04%, DAX 10370.93 -155.23 -1.47%, CAC 4414.67 -55.61 -1.24%

-

16:30

WSE: Session Results

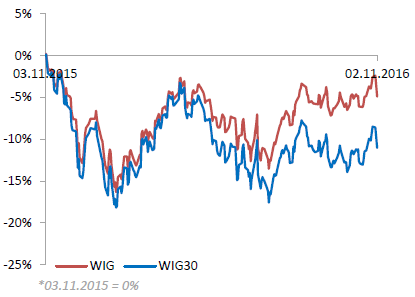

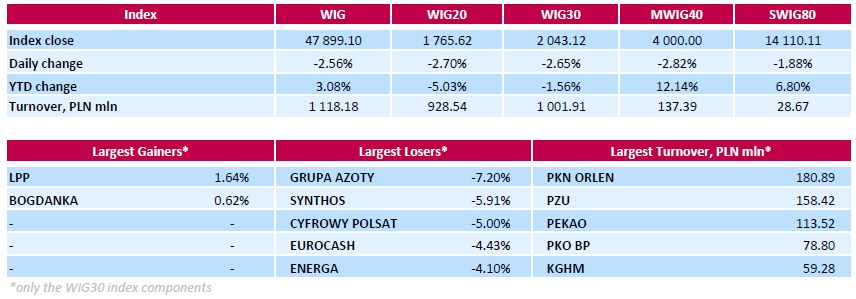

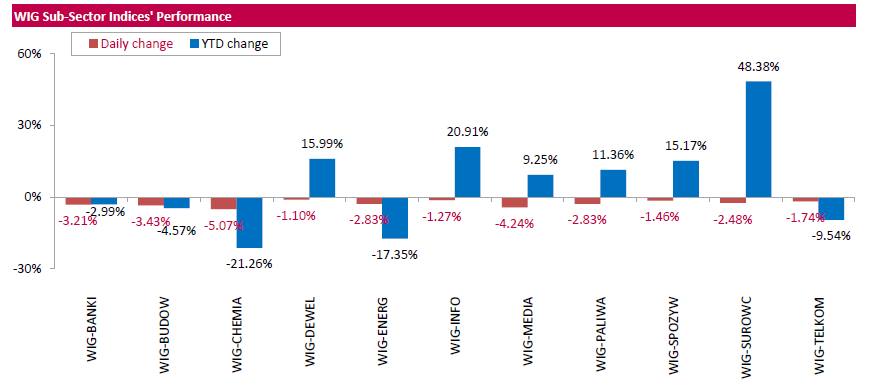

Polish equity market plunged on Wednesday. The broad market measure, the WIG Index, declined by 2.56%. All sectors in the WIG generated negative returns, with chemicals (-5.07%) and media (-4.24%) underperforming.

The large-cap companies' measure, the WIG30 Index, lost 2.65%. Only two index constituents managed to generate positive returns. Clothing retailer LPP (WSE: LPP) gained 1.62% after the company reported its monthly sales rose by 24% y/y in October and 18% y/y in ten month period. It was followed by thermal coal miner BOGDANKA (WSE: LWB), which advanced by 0.62%. At the same time, the session's biggest losers were two chemical producers GRUPA AZOTY (WSE: ATT) and SYNTHOS (WSE: SNS), which tumbled by 7.2% and 5.91% respectively. Other major decliners were media group CYFROWY POLSAT (WSE: CPS), FMCG-wholesaler EUROCASH (WSE: EUR), bank MBANK (WSE: MBK) and genco ENERGA (WSE: ENG), which slumped by 3.9%-5%.

-

13:33

U.S. Stocks open: Dow -0.29%, Nasdaq -0.17%, S&P -0.23%

-

13:24

Before the bell: S&P futures -0.10%, NASDAQ futures +0.03%

U.S. stock-index futures were flat amid rising political uncertainty, declining oil prices and ahead of this afternoon's policy statement from the Federal Reserve.

Global Stocks:

Nikkei 17,134.68 -307.72 -1.76%

Hang Seng 22,810.50 -336.57 -1.45%

Shanghai 3,102.96 -19.48 -0.62%

FTSE 6,887.05 -30.09 -0.44%

CAC 4,439.76 -30.52 -0.68%

DAX 10,438.31 -87.85 -0.83%

Crude $46.04 (-1.35%)

Gold $1,300.70 (+0.99%)

-

13:03

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Pfizer (PFE) downgraded to Market Perform from Outperform at BMO Capital

Other:

NIKE (NKE) initiated with Neutral ratings at Wedbush

Alcoa (AA) initiated with a Neutral at Goldman

-

13:01

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

22.74

-0.26(-1.1304%)

40835

Amazon.com Inc., NASDAQ

AMZN

783

-2.41(-0.3068%)

14022

Apple Inc.

AAPL

111.27

-0.22(-0.1973%)

80716

Barrick Gold Corporation, NYSE

ABX

18.65

0.24(1.3036%)

123833

Caterpillar Inc

CAT

82.12

-0.12(-0.1459%)

1900

Chevron Corp

CVX

105.9

-0.58(-0.5447%)

6161

Citigroup Inc., NYSE

C

48.66

-0.28(-0.5721%)

25742

Facebook, Inc.

FB

130.28

0.78(0.6023%)

184049

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.96

-0.19(-1.704%)

14371

General Electric Co

GE

28.8

-0.08(-0.277%)

5038

General Motors Company, NYSE

GM

31.89

0.41(1.3024%)

198

Goldman Sachs

GS

177

-1.06(-0.5953%)

1746

Google Inc.

GOOG

780

-3.61(-0.4607%)

2637

Hewlett-Packard Co.

HPQ

14.4

0.05(0.3484%)

304

JPMorgan Chase and Co

JPM

68.65

-0.32(-0.464%)

2178

Microsoft Corp

MSFT

59.67

-0.13(-0.2174%)

5169

Nike

NKE

49.5

-0.12(-0.2418%)

1959

Pfizer Inc

PFE

30.78

-0.29(-0.9334%)

5884

Tesla Motors, Inc., NASDAQ

TSLA

189.9

-0.89(-0.4665%)

25116

The Coca-Cola Co

KO

42.13

0.01(0.0237%)

937

Travelers Companies Inc

TRV

105.89

-0.35(-0.3294%)

303

Twitter, Inc., NYSE

TWTR

17.51

0.02(0.1144%)

45375

Verizon Communications Inc

VZ

47.77

0.11(0.2308%)

1770

Visa

V

81.1

-0.52(-0.6371%)

3428

Yahoo! Inc., NASDAQ

YHOO

42.25

0.92(2.226%)

123122

-

11:56

Major stock indices in Europe show a moderate decline

European stocks traded in the red zone, continuing the trend of the previous seven sessions. Investors' concerns about the result of the US presidential election, scheduled for 8 November and tonight's FOMC statement the main reasons.

A recent survey conducted by The Washington Post and ABC revealed that Donalt Trump votes suddenly burst forward as 46% of respondents would vote and for Clinton 45%.

However, the results of IBD / TIPP poll showed that Clinton has completely lost the advantage and would now eceiv 44% of the votes.

Final data presented by Markit Economics showed that the index of business activity in the manufacturing sector of the eurozone increased sharply in October, reaching its highest level in almost three years. Furthermore, further recovery in inflationary pressures existed, which could welcome the European Central Bank officials, who for a long time trying to accelerate growth and inflation. According to the report, the final purchasing managers' index (PMI) for the manufacturing sector rose to 33-month high in October and amounted to 53.5 points. Recall that in September, the index was at 52.6 points.

Meanwhile, a report from Markit Economics / CIPS showed that the rate of growth of activity in the UK construction sector accelerated in October, hitting 7-month high, due to an increase in housing construction. However, the slowdown in new orders and a sharp rise in prices for building materials overshadow the prospects of the sector. According to the data, the PMI index unexpectedly improved in October to 52.6 points from 52.3 points in September. Analysts had forecast a decline to 51.8 points. Although recent data showed signs that the economy has maintained its momentum in the months after the referendum, there were clear grounds to assume that next year the situation may be more difficult.

The composite index of the largest companies in the region Stoxx Europe Index 600 decreased by 0.6 percent. Almost all of the 19 industry groups show a negative dynamic, led by shares of financial firms. Automakers shares decreases against the strengthening euro. Meanwhile, VSTOXX index, which measures the predicted volatility rose 2.8 percent rising 8th day in a row, which is the longest series in more than five years.

Shares of Moller-Maersk fell 9.2 percent after a sharp drop in earnings reports. The company explained that the shipping industry is suffering from overcapacity.

Hugo Boss securities rose 6.5 percent amid reports that earnings exceeded expectations due to cost reduction and revenue growth in China.

Prices of H. Lundbeck has increased by 7 per cent after the pharmaceutical company raised its full-year outlook for earnings.

At the moment:

FTSE 100 6899.33 -17.81 -0.26%

DAX -79.76 10446.40 -0.76%

CAC 40 4444.37 -25.91 -0.58%

-

09:39

Major stock markets trading in the red zone: FTSE 100 6,887.48 -29.66 -0.43%, Xetra DAX 10,433.47 -92.69 -0.88%

-

07:45

Negative start of trading expected on the major stock exchanges in Europe: DAX futures -0.7%, CAC40 -0.9%, FTSE -0.5%

-

05:46

Global Stocks

European stocks ended sharply lower on Tuesday, as several major companies turned in disappointing financial results and as investors fretted over the U.S. presidential election. "An ABC/Washington Post tracking poll put Donald Trump ahead by one point for the first time since May. Polls from battleground states have tightened significantly, leaving the race too close to call, a substantial turnaround from previous complacency over a Clinton victory," he added.

U.S. stocks fell Tuesday, with the S&P 500 dropping for a sixth consecutive session to end at a nearly four-month low as investors grappled with a tightening presidential race, economic data, corporate earnings, and the Federal Reserve's monetary policy decision. Polls show the race between Democratic nominee Hillary Clinton and Republican rival Donald Trump continues to tighten. The latest ABC News/Washington Post tracking poll showed Trump taking a one-point lead, while the RealClearPolitics polling average showed Clinton's lead narrowed to 2.2 percentage points from more than 7 points two weeks ago.

Shares were sharply sold off across Asia on Wednesday, as a new poll showing Republican candidate Donald Trump leading the U.S. presidential race spooked investors.

-