Market news

-

23:30

Commodities. Daily history for Nov 02’2016:

(raw materials / closing price /% change)

Oil 45.57 +0.51%

Gold 1,299.10 -0.70%

-

23:28

Stocks. Daily history for Nov 02’2016:

(index / closing price / change items /% change)

Nikkei 225 17,134.68 -307.72 -1.76%

Shanghai Composite 3,102.96 -19.48 -0.62%

S&P/ASX 200 5,228.99 0.00 0.00%

FTSE 100 6,845.42 -71.72 -1.04%

CAC 40 4,414.67 -55.61 -1.24%

Xetra DAX 10,370.93 -155.23 -1.47%

S&P 500 2,097.94 -13.78 -0.65%

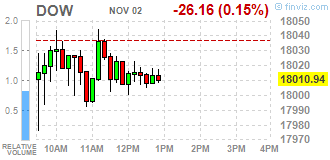

Dow Jones Industrial Average 17,959.64 -77.46 -0.43%

S&P/TSX Composite 14,594.72 -183.60 -1.24%

-

23:27

Currencies. Daily history for Nov 02’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1095 +0,35%

GBP/USD $1,2301 +0,48%

USD/CHF Chf0,973 -0,21%

USD/JPY Y103,33 -0,70%

EUR/JPY Y114,64 -0,38%

GBP/JPY Y127,08 -0,24%

AUD/USD $0,7656 +0,01%

NZD/USD $0,7285 +1,08%

USD/CAD C$1,3385 0,00%

-

23:02

Schedule for today, Thursday, Nov 03’2016

00:30 Australia Trade Balance September -2.01 -1.7

01:45 China Markit/Caixin Services PMI October 52 52.5

09:00 Eurozone ECB Economic Bulletin

09:30 United Kingdom Purchasing Manager Index Services October 52.6 52.4

10:00 Eurozone Unemployment Rate September 10.1% 10%

12:00 United Kingdom Bank of England Minutes

12:00 United Kingdom BoE Interest Rate Decision 0.25% 0.25%

12:00 United Kingdom Asset Purchase Facility 435 435

12:00 United Kingdom BOE Inflation Letter

12:30 United Kingdom BOE Gov Mark Carney Speaks

12:30 U.S. Continuing Jobless Claims 2039 2044

12:30 U.S. Unit Labor Costs, q/q (Preliminary) Quarter III 4.3% 1.3%

12:30 U.S. Nonfarm Productivity, q/q (Preliminary) Quarter III -0.6% 2%

12:30 U.S. Initial Jobless Claims 258 258

13:45 U.S. Services PMI (Finally) October 52.3 54.8

14:00 U.S. Factory Orders September 0.2% 0.2%

14:00 U.S. ISM Non-Manufacturing October 57.1 56

20:55 United Kingdom BOE Deputy Governor for Financial Stability Jon Cunliffe speaks

-

22:30

Australia: AIG Services Index, October 50.5

-

19:00

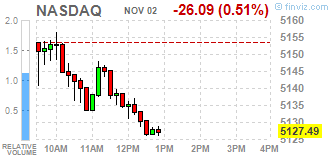

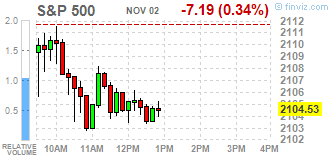

DJIA 17985.94 -51.16 -0.28%, NASDAQ 5113.52 -40.06 -0.78%, S&P 500 2100.42 -11.30 -0.54%

-

18:00

U.S.: Fed Interest Rate Decision , 0.5% (forecast 0.5%)

-

17:02

European stocks closed: FTSE 6845.42 -71.72 -1.04%, DAX 10370.93 -155.23 -1.47%, CAC 4414.67 -55.61 -1.24%

-

17:02

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell on Wednesday, with the S&P 500 headed for seventh day of losses as a tightening race for the White House rattled investors and a fall in oil also weighed on sentiment. Investors are rethinking their long-held bets of a November 8 victory for Democrat Hillary Clinton amid signs that her Republican rival Donald Trump could be closing the gap. While Clinton held a percentage point lead over Trump, according to a Reuters/Ipsos opinion poll released on Monday, some other polls showed her Republican rival ahead by 1-2 percentage points.

Most of Dow stocks in negative area (19 of 30). Top gainer - The Home Depot, Inc. (HD, +0.73%). Top loser - Pfizer Inc. (PFE, -1.38%).

All S&P sectors also in negative area. Top loser - Utilities (-1.3%).

At the moment:

Dow 17927.00 -12.00 -0.07%

S&P 500 2098.50 -5.25 -0.25%

Nasdaq 100 4740.50 -16.75 -0.35%

Oil 45.25 -1.42 -3.04%

Gold 1307.70 +19.70 +1.53%

U.S. 10yr 1.80 -0.02

-

16:30

WSE: Session Results

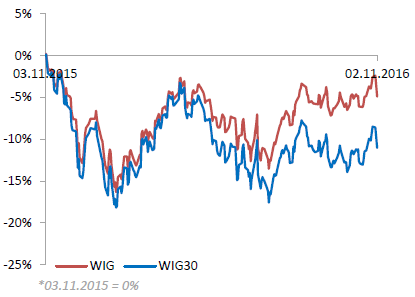

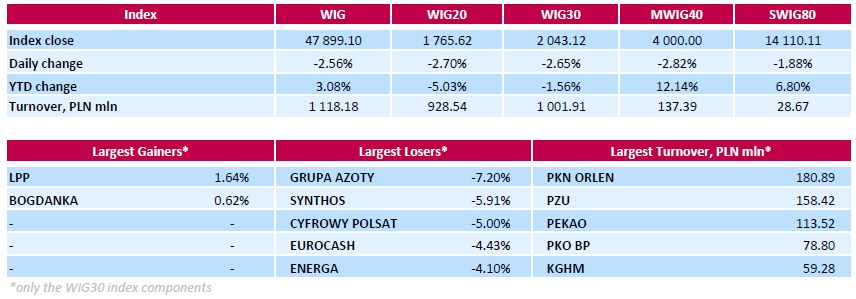

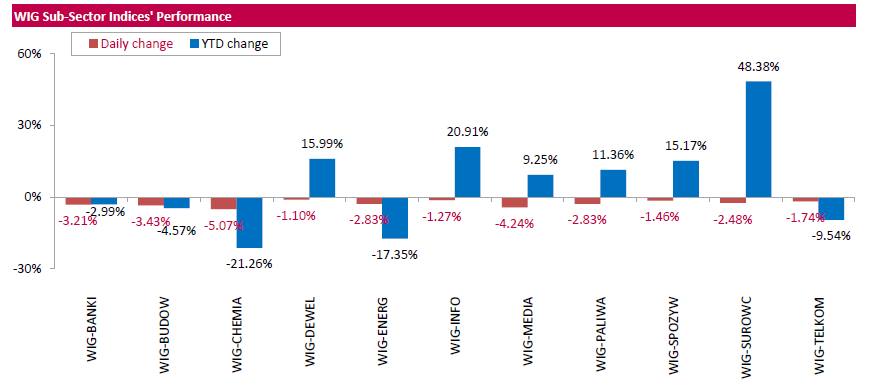

Polish equity market plunged on Wednesday. The broad market measure, the WIG Index, declined by 2.56%. All sectors in the WIG generated negative returns, with chemicals (-5.07%) and media (-4.24%) underperforming.

The large-cap companies' measure, the WIG30 Index, lost 2.65%. Only two index constituents managed to generate positive returns. Clothing retailer LPP (WSE: LPP) gained 1.62% after the company reported its monthly sales rose by 24% y/y in October and 18% y/y in ten month period. It was followed by thermal coal miner BOGDANKA (WSE: LWB), which advanced by 0.62%. At the same time, the session's biggest losers were two chemical producers GRUPA AZOTY (WSE: ATT) and SYNTHOS (WSE: SNS), which tumbled by 7.2% and 5.91% respectively. Other major decliners were media group CYFROWY POLSAT (WSE: CPS), FMCG-wholesaler EUROCASH (WSE: EUR), bank MBANK (WSE: MBK) and genco ENERGA (WSE: ENG), which slumped by 3.9%-5%.

-

15:50

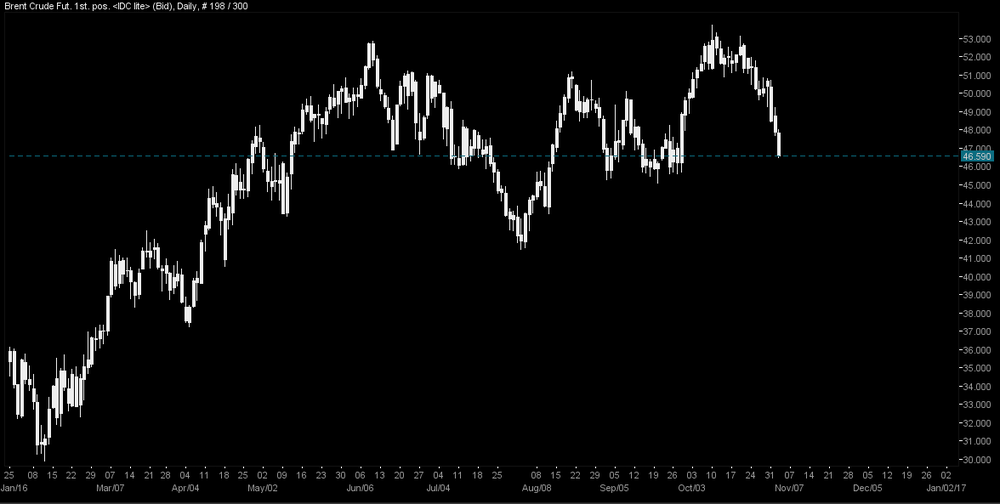

Oil continue to fall after disappointing US stocks data

Crude oil futures fell further Wednesday after industry data revealed a surprise build in U.S. oil inventories.

WTI light sweet oil was down 72 cents at $45.94 a barrel, the lowest in weeks.

The American Petroleum Institute said on Tuesday that crude oil inventories last week surged 9.3 million barrels.

However, official figures from the Energy Information Administration have defied some recent API reports.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 14.4 million barrels from the previous week. At 482.6 million barrels, U.S. crude oil inventories are at the upper limit of the average range for this time of year.

Distillate fuel inventories decreased by 1.8 million barrels last week but are well above the upper limit of the average range for this time of year. Propane/propylene inventories rose 0.3 million barrels last week and are near the upper limit of the average range. Total commercial petroleum inventories increased by 9.0 million barrels last week.

-

15:27

BNP thinks that USD correction could run further. Where to cover?

"The sharp fall in USDCHF over the past 24 hours has encouraged us to take profit on our USDCHF put spread recommendation from last week for a 1.7% gain. We recommended the trade noting a rapid increase in USD long positioning and pricing for a Fed December hike.

The USD correction could have further to run but risk reward favours covering this trade at this time. Increased pre-election financial market volatility has led rates markets to pare back pricing for a December rate hike, even as the manufacturing ISM improved in line with expectations. We have been wary heading into a period of elevated data, Fed and election-related uncertainty.

Ahead today, we expect the statement following the FOMC meeting to continue to steer markets towards pricing a December rate hike. However, with a hike in December still nearly 70% priced in, we would not expect cautious and data-contingent Fed guidance to push rate differentials much further in the dollar's favour. We look for the USD to make a more durable recovery later in November as election uncertainty passes and data continues to signal scope for renewed tightening".

Copyright © 2016 BNP Paribas™, eFXnews™

-

15:07

Bullish gold ahead of an expected FOMC decision

Gold prices continued to rise today, climbing above $1,300 an ounce for the first time in almost a month as the U.S. dollar fell the race for the U.S. presidency tightened.

Gold for December delivery rose $17.20 an ounce, or 1.34% to $1,305 in recent market action.

Less than one week ahead of the U.S. election, analysts said the appetite for gold was mounting on the possibility of a victory for Republican candidate Donald Trump, with the metal providing a safe haven. HSBC analyst James Steel says the price of the precious metal could rise to $1,500 by the end of 2016 and climb to $1,575 next year following a Trump Victory.

Gold prices also depend on the U.S. dollar, as well as Federal Reserve interest rates.

A stronger dollar will pressure gold, which is priced in the U.S. currency and becomes more expensive for foreign buyers when the dollar rises. The metal, which does not pay dividends or generate interest income, struggles when rates rise.

U.S. Federal Reserve will release its latest monetary policy statement, even as a rate increase isn't expected until December.

-

14:31

Huge rise for US crude oil inventories

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 14.4 million barrels from the previous week. At 482.6 million barrels, U.S. crude oil inventories are at the upper limit of the average range for this time of year.

Total motor gasoline inventories decreased by 2.2 million barrels last week, but are well above the upper limit of the average range. Both finished gasoline inventories and blending components inventories decreased last week.

Distillate fuel inventories decreased by 1.8 million barrels last week but are well above the upper limit of the average range for this time of year. Propane/propylene inventories rose 0.3 million barrels last week and are near the upper limit of the average range. Total commercial petroleum inventories increased by 9.0 million barrels last week.

-

14:30

U.S.: Crude Oil Inventories, October 14.42 (forecast 1.013)

-

13:49

Russian Consumer Prices Rise 0.1% from Oct 25 to Oct 31

-

13:49

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0900 (EUR 2.17bln) 1.0950 (481m) 1.1000 (1.25bln)

USD/JPY 102.00 (285m) 103.28 (300m) 103.50 (446m) 104.00 (271m), 104.50 (426m) 105.00 (222m)

GBP/USD 1.2185 (GBP 1.26bln) 1.2360 (850m) 1.2440 (201m)

AUD/USD 0.7500 (AUD 600m) 0.7550 (241m) 0.7570 (201m), 0.7620-25 (300m) 0.7635 (241m) 0.7650 (1.5bln) 0.7670-75 (354m) 0.7800 (1.12bln)

USD/CAD 1.3300 (USD 750m) 1.3325 (230m) 1.3400 (365m)

NZD/USD 0.7150 (NZD 249m) 0.7200 (300m)

AUD/JPY 79.85 (AUD 726m)

USD/CNY 6.7500 (USD 1.15bln) 6.7800 (300m)

-

13:33

U.S. Stocks open: Dow -0.29%, Nasdaq -0.17%, S&P -0.23%

-

13:24

Before the bell: S&P futures -0.10%, NASDAQ futures +0.03%

U.S. stock-index futures were flat amid rising political uncertainty, declining oil prices and ahead of this afternoon's policy statement from the Federal Reserve.

Global Stocks:

Nikkei 17,134.68 -307.72 -1.76%

Hang Seng 22,810.50 -336.57 -1.45%

Shanghai 3,102.96 -19.48 -0.62%

FTSE 6,887.05 -30.09 -0.44%

CAC 4,439.76 -30.52 -0.68%

DAX 10,438.31 -87.85 -0.83%

Crude $46.04 (-1.35%)

Gold $1,300.70 (+0.99%)

-

13:09

Orders

EUR/USD

Offers 1.1100 1.1120 1.1140 1.1155-60 1.1180 1.1200

Bids 1.1050 1.1030 1.1000 1.0980 1.0950 1.0935 1.0900

GBP/USD

Offers 1.2350 1.2380 1.2400 1.2430 1.2450 1.2500

Bids 1.2230 1.2200 1.2185 1.2170 1. 1.2150 1.2130 1.2100 1.2080-85 1.2050 1.2000

EUR/GBP

Offers 0.9050 0.9070 0.9100 0.9125-30 0.9150

Bids 0.9025-30 0.9000 0.8980-85 0.8945-500.8920 0.8900

EUR/JPY

Offers 115.00 115.20-25 115.50 115.75-80 116.00

Bids 114.50 114.30 114.00 113.85 113.50 113.00

USD/JPY

Offers 103.85 104.00 104.20 104.50 104.75 105.00 105.25 105.50

Bids 103.45-50 103.30 103.00 102.80-85 102.50 102.20 102.00

AUD/USD

Offers 0.7650 0.7670-75 0.7700-10 0.7730 0.7750 0.7780 0.7800

Bids 0.7620 0.7600 0.7580 0.7550 0.7500 0.7480 0.7450

-

13:03

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Pfizer (PFE) downgraded to Market Perform from Outperform at BMO Capital

Other:

NIKE (NKE) initiated with Neutral ratings at Wedbush

Alcoa (AA) initiated with a Neutral at Goldman

-

13:01

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

22.74

-0.26(-1.1304%)

40835

Amazon.com Inc., NASDAQ

AMZN

783

-2.41(-0.3068%)

14022

Apple Inc.

AAPL

111.27

-0.22(-0.1973%)

80716

Barrick Gold Corporation, NYSE

ABX

18.65

0.24(1.3036%)

123833

Caterpillar Inc

CAT

82.12

-0.12(-0.1459%)

1900

Chevron Corp

CVX

105.9

-0.58(-0.5447%)

6161

Citigroup Inc., NYSE

C

48.66

-0.28(-0.5721%)

25742

Facebook, Inc.

FB

130.28

0.78(0.6023%)

184049

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.96

-0.19(-1.704%)

14371

General Electric Co

GE

28.8

-0.08(-0.277%)

5038

General Motors Company, NYSE

GM

31.89

0.41(1.3024%)

198

Goldman Sachs

GS

177

-1.06(-0.5953%)

1746

Google Inc.

GOOG

780

-3.61(-0.4607%)

2637

Hewlett-Packard Co.

HPQ

14.4

0.05(0.3484%)

304

JPMorgan Chase and Co

JPM

68.65

-0.32(-0.464%)

2178

Microsoft Corp

MSFT

59.67

-0.13(-0.2174%)

5169

Nike

NKE

49.5

-0.12(-0.2418%)

1959

Pfizer Inc

PFE

30.78

-0.29(-0.9334%)

5884

Tesla Motors, Inc., NASDAQ

TSLA

189.9

-0.89(-0.4665%)

25116

The Coca-Cola Co

KO

42.13

0.01(0.0237%)

937

Travelers Companies Inc

TRV

105.89

-0.35(-0.3294%)

303

Twitter, Inc., NYSE

TWTR

17.51

0.02(0.1144%)

45375

Verizon Communications Inc

VZ

47.77

0.11(0.2308%)

1770

Visa

V

81.1

-0.52(-0.6371%)

3428

Yahoo! Inc., NASDAQ

YHOO

42.25

0.92(2.226%)

123122

-

12:40

-

12:22

ADP employment lower than forecast but big up revision for last month

Private sector employment increased by 147,000 jobs from September to October according to the October ADP National Employment Report.

"Job growth appears to be shifting from small to large companies due to the lessening impact the globaleconomic environment had on large companies earlier in the year," said Ahu Yildirmaz, vice president and head of the ADP Research Institute. "This is also true because large companies often have the resources to attract workers with better pay and benefit packages

The October ADP National Employment Report is the first installment of this monthly report that includes the 10 super sectors outlined by the U.S. Bureau of Labor Statistics. Prior value revised up aroung 50K jobs.

-

12:15

U.S.: ADP Employment Report, October 147 (forecast 165)

-

11:56

Major stock indices in Europe show a moderate decline

European stocks traded in the red zone, continuing the trend of the previous seven sessions. Investors' concerns about the result of the US presidential election, scheduled for 8 November and tonight's FOMC statement the main reasons.

A recent survey conducted by The Washington Post and ABC revealed that Donalt Trump votes suddenly burst forward as 46% of respondents would vote and for Clinton 45%.

However, the results of IBD / TIPP poll showed that Clinton has completely lost the advantage and would now eceiv 44% of the votes.

Final data presented by Markit Economics showed that the index of business activity in the manufacturing sector of the eurozone increased sharply in October, reaching its highest level in almost three years. Furthermore, further recovery in inflationary pressures existed, which could welcome the European Central Bank officials, who for a long time trying to accelerate growth and inflation. According to the report, the final purchasing managers' index (PMI) for the manufacturing sector rose to 33-month high in October and amounted to 53.5 points. Recall that in September, the index was at 52.6 points.

Meanwhile, a report from Markit Economics / CIPS showed that the rate of growth of activity in the UK construction sector accelerated in October, hitting 7-month high, due to an increase in housing construction. However, the slowdown in new orders and a sharp rise in prices for building materials overshadow the prospects of the sector. According to the data, the PMI index unexpectedly improved in October to 52.6 points from 52.3 points in September. Analysts had forecast a decline to 51.8 points. Although recent data showed signs that the economy has maintained its momentum in the months after the referendum, there were clear grounds to assume that next year the situation may be more difficult.

The composite index of the largest companies in the region Stoxx Europe Index 600 decreased by 0.6 percent. Almost all of the 19 industry groups show a negative dynamic, led by shares of financial firms. Automakers shares decreases against the strengthening euro. Meanwhile, VSTOXX index, which measures the predicted volatility rose 2.8 percent rising 8th day in a row, which is the longest series in more than five years.

Shares of Moller-Maersk fell 9.2 percent after a sharp drop in earnings reports. The company explained that the shipping industry is suffering from overcapacity.

Hugo Boss securities rose 6.5 percent amid reports that earnings exceeded expectations due to cost reduction and revenue growth in China.

Prices of H. Lundbeck has increased by 7 per cent after the pharmaceutical company raised its full-year outlook for earnings.

At the moment:

FTSE 100 6899.33 -17.81 -0.26%

DAX -79.76 10446.40 -0.76%

CAC 40 4444.37 -25.91 -0.58%

-

11:37

Gold Prices Rise to One-Month High

Gold prices rose to a nearly one-month high on Wednesday morning in London, as safe haven buying mounted ahead of next week's U.S. presidential elections, and investors awaited a Federal Reserve meeting later in the day.

Spot gold was trading 0.53% higher at $1,296.01 per troy ounce in midmorning European trade, nearly crossing the technically important 50-day moving average, and trading at the highest level since Oct. 3.

-

10:32

German Economic Experts say ECB should slow down its Bond purchases and end them earlier - Reuters

-

10:10

Oil is trading lower

This morning, the New York futures for Brent have fallen 0.75% to $ 46.33 and WTI -0.48% to $ 47.90 per barrel. Thus, the black gold is trading in the red zone on the background of standby US crude stocks after industry data showed an unexpected increase in inventories, highlighting the steady global oversupply of oil. The American Petroleum Institute said that the volume of oil reserves rose by 9.3 million barrels for the week ended October 28, which is more than nine times the amount expected by analysts.

-

09:40

UK construction companies recorded a sustained expansion of business activity in October

UK construction companies recorded a sustained expansion of overall business activity in October, led by another solid increase in residential work. New order volumes also picked up across the construction sector, but the rate of growth eased since September and remained weaker than seen prior to this summer. This contributed to a drop in business confidence regarding the year-ahead growth outlook, with the latest reading the secondlowest since May 2013. At the same time, input costs rose at one of the fastest rates seen over the past five years, which survey respondents widely linked to the weaker pound.

At 52.6 in October, the seasonally adjusted Markit/CIPS UK Construction Purchasing Managers' Index edged up from 52.3 in September and remained above the 50.0 nochange threshold for the second month running.

The latest reading pointed to the fastest upturn in activity since March, although the rate of growth was only modest and still much softer than the average since the recovery began three-and-a-half years ago (57.3).

-

09:39

Major stock markets trading in the red zone: FTSE 100 6,887.48 -29.66 -0.43%, Xetra DAX 10,433.47 -92.69 -0.88%

-

09:30

United Kingdom: PMI Construction, October 52.6 (forecast 51.8)

-

09:12

Eurozone's manufacturing sector gathered momentum at the start of the final quarter - Markit

The rate of expansion of the eurozone manufacturing sector gathered momentum at the start of the final quarter. Growth of production, new orders, new export orders and employment all accelerated, while price pressures showed further signs of increasing.

The final Markit Eurozone Manufacturing PMI rose to a 33-month high of 53.5 in October, up from 52.6 in September and the earlier flash estimate of 53.3. This signalled the steepest rate of improvement in operating conditions since January 2014.

The Netherlands surged to the top of the Manufacturing PMI rankings in October, with growth accelerating to a 15-month peak. Germany was also a top performer, expanding at the quickest pace in almost three years.

-

09:00

Eurozone: Manufacturing PMI, October 53.5 (forecast 53.3)

-

08:58

German manucturing sector stable in October

The upturn in Germany's goods-producing sector that started almost two years ago continued in October. This was highlighted by the seasonally adjusted final Markit/BME Germany Manufacturing Purchasing Managers' Index (PMI) - a singlefigure snapshot of the performance of the manufacturing economy - posting above the neutral 50.0 threshold.

At 55.0 up from September's 54.3, the PMI was indicative of the strongest improvement in manufacturers' operating conditions since the beginning of 2014.

-

08:55

Germany: Manufacturing PMI, October 55.0 (forecast 55.1)

-

08:55

Germany: Unemployment Rate s.a. , October 6% (forecast 6.1%)

-

08:55

Germany: Unemployment Change, October -13 (forecast -1)

-

08:50

France: Manufacturing PMI, October 51.8 (forecast 51.3)

-

08:41

Spanish manufacturing sector improved at a stronger rate during October - Markit

The health of the Spanish manufacturing sector improved at a stronger rate during October amid faster rises in output and new orders. Firms took on extra staff as a result and continued to increase their input buying. Meanwhile, the rate of input cost inflation picked up and output prices were raised accordingly.

The headline Markit Spain Manufacturing PMI is a composite single-figure indicator of manufacturing performance. It is derived from indicators for new orders, output, employment, suppliers' delivery times and stocks of purchases. Any figure greater than 50.0 indicates overall improvement of the sector.

At 53.3 in October, the PMI was up from the reading of 52.3 in September to signal a stronger improvement in operating conditions in the Spanish manufacturing sector. The health of the sector has now strengthened in each of the past 35 months, with the latest improvement the greatest since April.

-

08:22

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0900 (EUR 2.17bln) 1.0950 (481m) 1.1000 (1.25bln)

USD/JPY 102.00 (285m) 103.28 (300m) 103.50 (446m) 104.00 (271m), 104.50 (426m) 105.00 (222m)

GBP/USD 1.2185 (GBP 1.26bln) 1.2360 (850m) 1.2440 (201m)

AUD/USD 0.7500 (AUD 600m) 0.7550 (241m) 0.7570 (201m), 0.7620-25 (300m) 0.7635 (241m) 0.7650 (1.5bln) 0.7670-75 (354m) 0.7800 (1.12bln)

USD/CAD 1.3300 (USD 750m) 1.3325 (230m) 1.3400 (365m)

NZD/USD 0.7150 (NZD 249m) 0.7200 (300m)

AUD/JPY 79.85 (AUD 726m)

USD/CNY 6.7500 (USD 1.15bln) 6.7800 (300m)

-

08:18

Safe heaven demand noted as uncertainty grows ahead of US elections and FOMC. CHF, JPY, Gold trading up

-

07:45

Negative start of trading expected on the major stock exchanges in Europe: DAX futures -0.7%, CAC40 -0.9%, FTSE -0.5%

-

07:36

Romania's producer prices continued to decline in September

Romania's producer prices continued to decline in September, though at a slower pace than in the previous month, figures from the National Institute of Statistics showed Wednesday.

According to rttnews, producer prices fell 1.5 percent year-over-year in September, following a 1.9 percent decrease in August. The measure has been falling since October 2014.

Domestic market prices dipped 1.8 percent annually in September and prices in the foreign market went down by 1.0 percent.

Month-on-month, producer prices rose 0.2 percent from August, when it dropped by 0.3 percent.

-

07:32

Options levels on wednesday, November 2, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1170 (2920)

$1.1136 (4472)

$1.1112 (2167)

Price at time of writing this review: $1.1067

Support levels (open interest**, contracts):

$1.1020 (3870)

$1.0985 (6270)

$1.0943 (4542)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 45264 contracts, with the maximum number of contracts with strike price $1,1100 (4472);

- Overall open interest on the PUT options with the expiration date November, 4 is 45466 contracts, with the maximum number of contracts with strike price $1,1000 (6270);

- The ratio of PUT/CALL was 1.00 versus 1.08 from the previous trading day according to data from November, 1

GBP/USD

Resistance levels (open interest**, contracts)

$1.2501 (1490)

$1.2402 (1414)

$1.2305 (1972)

Price at time of writing this review: $1.2251

Support levels (open interest**, contracts):

$1.2196 (1503)

$1.2098 (2125)

$1.1999 (1060)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 33356 contracts, with the maximum number of contracts with strike price $1,2800 (1973);

- Overall open interest on the PUT options with the expiration date November, 4 is 32652 contracts, with the maximum number of contracts with strike price $1,2100 (2125);

- The ratio of PUT/CALL was 0.98 versus 0.98 from the previous trading day according to data from November, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:28

Today’s events

-

At 10:30 GMT Germany will hold an auction of 10-year bonds

-

At 17:15 GMT, First Deputy Governor of the Bank of Canada, Carolyn Wilkins will deliver a speech

-

At 18:00 GMT FOMC decision on interest rate

-

At 18:00 GMT FOMC accompanying statement

-

Japan celebrates Culture Day

-

-

07:19

USD Into FOMC: 'No Tricks, No Treats'; 2 Areas Of Focus - BofA Merrill

"The November 2nd FOMC meeting should be considered a placeholder meeting.

If the Fed is successful, the meeting will likely come and go without much action in the markets. We think the Fed's objective is to signal that a hike is highly likely in December but that the path thereafter will be extraordinarily shallow. The market is pricing in a 72% chance of a December hike, which the Fed is likely to perceive as appropriate. Without a press conference or the release of the Summary of Economic Projections (SEP), the main form of communication is the statement.

There are two areas of focus: 1) statement of risks and 2) forward policy guidance.

We think the Fed will tweak both to show that Fed officials have become incrementally more comfortable with a nearterm hike than they were in the September meeting. One possibility is to change the risks statement to read "near-term risks to the outlook are roughly balanced", which would be a change from "near-term risks to the outlook appear roughly balanced". If the Fed wanted to go a step further, they could remove the word "roughly", but we think they will wait to do so until they actually deliver the hike in December. There are a number of potential changes that the Fed can make to the forward policy guidance statement. One possibility is to add the word "further" in front of strengthened to read: "the case for an increase in the federal funds rate has further strengthened". We also suspect that the Fed might want to remove the phrase "for the time being" since they are getting closer to delivering a hike. Importantly, we do not think they will turn to calendar guidance and explicitly mention that a hike is possible at the next meeting. The FOMC took this approach last October to signal a hike in December, but at the time the markets were only pricing in a 36% probability of a December hike. The Fed therefore likely felt it was prudent to take a more aggressive step toward calendar guidance in order to set market expectations. In our view, the Fed does not want to set a precedent of having to enact such strong signaling and will therefore avoid putting such language in the statement.

USD: a million risks but the Fed ain't one...

A 'placeholder' status of the November meeting means it is unlikely to have a lasting impact on the dollar. A more explicit Fed signal of a December hike at the meeting would support but not accelerate the near 3% move in the DXY since the September meeting, in our view. With the market already pricing over a 70% chance of a December hike, we are cautious on chasing the USD move from here.

Additionally, a number of risks between now and the meeting, including the US election, Italian Referendum, and the European Central Bank's December meeting area also a concern. If anything we see risks of some dollar consolidation near-term.

However, similar to the Fed's December 2015, we see risks skewed towards further USD strength in the aftermath of a December hike with the market pricing less than one additional hike by end 2017, too low relative to our expectation for June and December hikes. Furthermore, if the new administration pursues a more aggressive fiscal expansion, this would certainly tilt the balance of risks to more hikes, supporting the USD".

Copyright © 2016 BofAML, eFXnews™

-

07:17

The value of total building approved in Australia rose 2.1 per cent in September

The value of total building approved rose 2.1 per cent in September 2016, in trend terms, and has risen for 10 months, according to data released by the Australian Bureau of Statistics (ABS) today.

The result was driven by a 6.0 per cent rise in the value of non-residential building, while residential building fell 0.1 per cent.

The number of dwellings approved fell 0.6 per cent in September, in trend terms, and has fallen for four months.

-

07:15

RBNZ Inflation Expectations Unchanged at 1.7% in Third Quarter

-

07:14

Kuroda: BOJ Isn't the Only Central Bank Pushing Back Inflation Goals

-

07:06

UK house prices were unchanged in October

"After fifteen successive monthly increases UK house prices were unchanged in October (after taking account of seasonal factors). As a result, the annual rate of house price growth slowed to 4.6%, from 5.3% in September, though this is still in line with the growth rates prevailing since early 2015.

Measures of housing market activity remain fairly subdued, with the number of residential property transactions c10% below the levels recorded in the same period of 2015 in recent months. However, this weakness may still in part reflect the after-effects of the introduction stamp duty on second homes introduced in April, where buyers brought forward transactions to Q1 to avoid additional stamp duty liabilities (see chart below). Policy changes impacting the Buy to Let market may also be playing a role in dampening activity"- commenting on the figures, Robert Gardner, Nationwide's Chief Economist,.

-

07:04

New Zealand unemployment rate falls to 4.9 percent as employment grows

The unemployment rate fell to 4.9 percent in the September 2016 quarter (from a revised 5.0 percent in the previous quarter), Statistics New Zealand said today. This is the lowest unemployment rate since the December 2008 quarter. There were 3,000 fewer people unemployed than in the June 2016 quarter and 10,000 fewer over the year.

"The number of people employed in New Zealand was up 35,000, or 1.4 percent, in the September 2016 quarter," labour and income statistics manager Mark Gordon said. "This strong growth in employment, coupled with fewer unemployed people, pushed the unemployment rate below 5.0 percent for the first time in nearly eight years."

The working-age population increased by 24,000 people (0.7 percent) over the quarter, to reach 3,739,000.

"The increase in the number of people employed again exceeded population growth over the latest quarter. This resulted in the employment rate increasing 0.5 percentage points, so currently 66.7 percent of the working-age population is in some form of employment," Mr Gordon said.

-

06:59

United Kingdom: Nationwide house price index, y/y, October 4.6% (forecast 5%)

-

06:59

United Kingdom: Nationwide house price index , October 0.0% (forecast 0.2%)

-

05:46

Global Stocks

European stocks ended sharply lower on Tuesday, as several major companies turned in disappointing financial results and as investors fretted over the U.S. presidential election. "An ABC/Washington Post tracking poll put Donald Trump ahead by one point for the first time since May. Polls from battleground states have tightened significantly, leaving the race too close to call, a substantial turnaround from previous complacency over a Clinton victory," he added.

U.S. stocks fell Tuesday, with the S&P 500 dropping for a sixth consecutive session to end at a nearly four-month low as investors grappled with a tightening presidential race, economic data, corporate earnings, and the Federal Reserve's monetary policy decision. Polls show the race between Democratic nominee Hillary Clinton and Republican rival Donald Trump continues to tighten. The latest ABC News/Washington Post tracking poll showed Trump taking a one-point lead, while the RealClearPolitics polling average showed Clinton's lead narrowed to 2.2 percentage points from more than 7 points two weeks ago.

Shares were sharply sold off across Asia on Wednesday, as a new poll showing Republican candidate Donald Trump leading the U.S. presidential race spooked investors.

-

05:02

Japan: Consumer Confidence, October 42.3 (forecast 42.8)

-

00:30

Australia: Building Permits, m/m, September -8.7% (forecast -3%)

-