Market news

-

23:30

Commodities. Daily history for Nov 07’2016:

(raw materials / closing price /% change)

Oil 44.95 +0.13%

Gold 1,281.90 +0.20%

-

23:28

Stocks. Daily history for Nov 07’2016:

(index / closing price / change items /% change)

Nikkei 225 17,136.53 +231.17 +1.37%

Shanghai Composite 3,133.40 +8.08 +0.26%

S&P/ASX 200 5,250.80 0.00 0.00%

FTSE 100 6,806.90 +113.64 +1.70%

CAC 40 4,461.21 +83.75 +1.91%

Xetra DAX 10,456.95 +197.82 +1.93%

S&P 500 2,131.52 +46.34 +2.22%

Dow Jones Industrial Average 18,259.60 +371.32 +2.08%

S&P/TSX Composite 14,652.45 +143.20 +0.99%

-

23:28

Currencies. Daily history for Nov 07’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1040 -0,90%

GBP/USD $1,2396 -0,98%

USD/CHF Chf0,9741 +0,59%

USD/JPY Y104,45 +1,27%

EUR/JPY Y115,31 +0,42%

GBP/JPY Y129,47 +0,32%

AUD/USD $0,7726 +0,70%

NZD/USD $0,7342 +0,23%

USD/CAD C$1,3361 -0,31%

-

23:04

Schedule for today, Tuesday, Nov 08’2016

00:30 Australia National Australia Bank's Business Confidence October 6

02:00 China Trade Balance, bln October 41.99 51.7

05:00 Japan Leading Economic Index (Preliminary) September 100.9

05:00 Japan Coincident Index (Preliminary) September 112

06:45 Switzerland Unemployment Rate (non s.a.) October 3.2%

07:00 Germany Current Account September 17.9

07:00 Germany Industrial Production s.a. (MoM) September 2.5% -0.2%

07:00 Germany Trade Balance (non s.a.), bln September 20.0

07:45 France Trade Balance, bln September -4.3

09:30 United Kingdom Industrial Production (MoM) September -0.4% 0.1%

09:30 United Kingdom Industrial Production (YoY) September 0.7% 0.8%

09:30 United Kingdom Manufacturing Production (MoM) September 0.2% 0.4%

09:30 United Kingdom Manufacturing Production (YoY) September 0.5% -0.2%

12:00 U.S. Presidential Election

13:15 Canada Housing Starts October 220.6

13:30 Canada Building Permits (MoM) September 10.4%

15:00 United Kingdom NIESR GDP Estimate October 0.4%

15:00 U.S. JOLTs Job Openings September 5.443

23:30 Australia Westpac Consumer Confidence November 1.1%

23:50 Japan Current Account, bln September 2000 1960

-

21:05

Major US stock indexes finished trading in positive territory

Major US stock indexes rose strongly on Monday, a day before the US presidential election as a Democrat Hillary Clinton's prospects rose after the FBI announced that he would not insist on the opening of a criminal case related to the use of her private e-mail.

Yesterday the head of the FBI James Comey said in a letter to Congress that his agency sees no reason to indict Clinton. Recall the previous week reported resumption of the FBI investigation into the email in the US presidential candidate from the Democratic Party had a negative impact on the ranking of Clinton, which triggered selling in the stock market.

Important statistics that could have an impact on market sentiment, was not published. The main focus of market participants focused on the US presidential election, scheduled for 8 November.

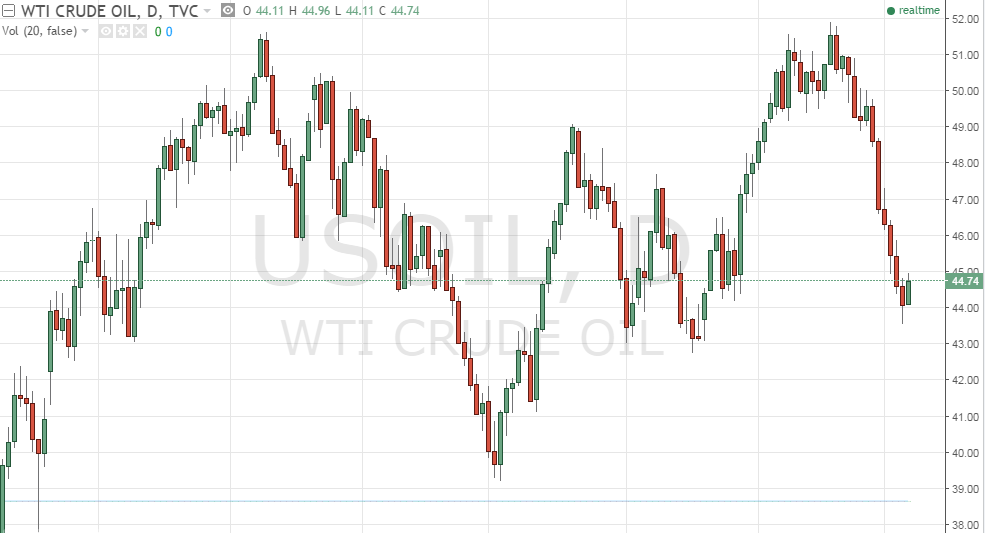

Oil futures rose modestly on Monday, supported by statements from OPEC. However, prices remain about $ 7 lower than the maximum of the previous month due to persistent doubts about the feasibility of OPEC plan to cut production.

All components of the DOW index closed in positive territory (30 of 30). More rest up shares JPMorgan Chase & Co. (JPM, + 3.07%).

All Sector S & P Index showed an increase. The leader turned out to be the financial sector (+ 2.3%).

At the close:

Dow + 2.07% 18,257.85 +369.57

Nasdaq + 2.37% 5,166.17 +119.80

S & P + 2.22% 2,131.37 +46.19

-

20:01

U.S.: Consumer Credit , September 19.3 (forecast 19)

-

20:00

DJIA +1.77% 18,204.20 +315.92 Nasdaq +2.12% 5,153.34 +106.97 S&P +1.92% 2,125.17 +39.99

-

17:29

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes marched higher on Monday, a day before the U.S. presidential election as Democrat nominee Hillary Clinton's prospects brightened after the FBI said it would not press criminal charges related to her use of a private email server.

All Dow stocks in positive area (30 of 30). Top gainer - UnitedHealth Group Incorporated (UNH, +3.25%).

All S&P sectors also in positive area. Top gainer- Healthcare (+2.5%).

At the moment:

Dow 18146.00 +341.00 +1.92%

S&P 500 2124.00 +44.00 +2.12%

Nasdaq 100 4770.25 +112.50 +2.42%

Oil 44.37 +0.30 +0.68%

Gold 1279.20 -25.30 -1.94%

U.S. 10yr 1.83 +0.05

-

17:00

European stocks closed: FTSE 100 +113.64 6806.90 +1.70% DAX +197.82 10456.95 +1.93% CAC 40 +83.75 4461.21 +1.91%

-

16:43

WSE: Session Results

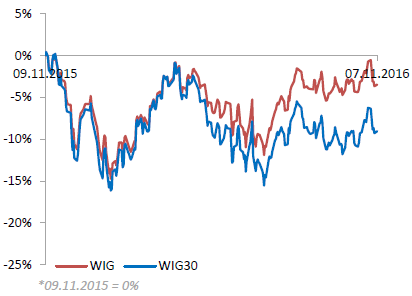

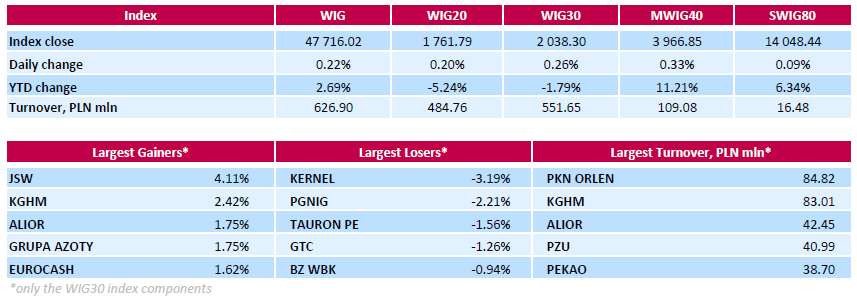

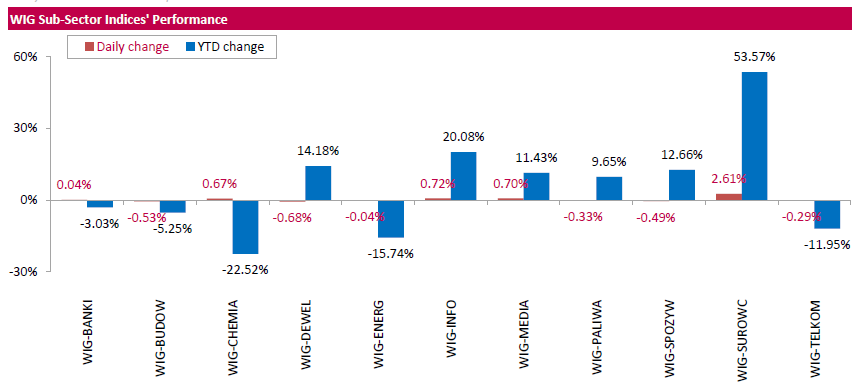

Polish equity market closed higher on Monday. The broad market measure, the WIG Index, rose by 0.22%. Sector performance within the WIG Index was mixed. Materials (+2.61%) outperformed, while developing sector (-0.68%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, advanced 0.26%. A majority of the index components returned gains, with the way up led by coking coal miner JSW (WSE: JSW) and copper producer KGHM (WSE: KGH), climbing by 4.11% and 2.42% respectively. Other major advancers were chemical producer GRUPA AZOTY (WSE: ATT), bank ALIOR (WSE: ALR) and FMCG-wholesaler EUROCASH (WSE: EUR), which surged by 1.75%, 1.75% and 1.62% respectively. At the same time, agricultural producer KERNEL (WSE: KER) topped the list of decliners with a 3.19% drop, followed by oil and gas producer PGNIG (WSE: PGN) and genco TAURON PE (WSE; TPE), which tumbled by 2.21% and 1.56% respectively.

-

15:53

Gold trading lower as US elections fears eased

Gold futures fell Monday morning as markets were soothed by news that the FBI has cleared Hillary Clinton yet again.

After taking another look at her email issue, the feds said they found nothing to charge her with any criminal wrongdoing.

Clinton, the candidate favored by Wall Street, is expected to edge protectionist Donald Trump in the U.S. election tomorrow.

Gold, which surged higher on its safe haven appeal last week as Trump narrowed the gap, is now in retreat.

According to rttnews, on Sunday, Donald Trump warned that if a company leaves Minnesota, fire their workers, and move to another country, and then ship their products back into the United States, his administration will make them pay a 35 percent tax.

-

15:29

Switzerland's currency reserves rose in October

Foreign exchange reserves in Switzerland increased indicating continued intervention by the Swiss National Bank to curb the growth of the national currency.

In October, foreign currency reserves amounted to 630.34 billion Swiss francs (644.7 billion US dollars), an increase of 2 billion francs vs September.

-

15:16

Crude oil prices inched slightly higher

Crude oil prices inched slightly higher Monday amid hopes the U.S. economy would continue to gradually improve if Hillary Clinton is elected president tomorrow.

After being cleared again by the FBI in her email scandal, Clinton is expected to edge protectionist Donald Trump.

Despite a stronger dollar, December crude oil was up 50 cents at $44.59 a barrel.

OPEC's chief insists Russia, the world's biggest energy producer, is "on board" with the cartel's plan to limit crude oil production.

Markets remain skeptical, as a number of key producers say they should be exempt. Iran is arguing they should be free to pump oil after years of crippling sanctions.

Iran is set to sign an historic $6 billion deal with France's Total SA to help develop an offshore gas field, Marketwatch reports - rttnews says.

-

15:02

U.S.: Labor Market Conditions Index, October 0.7

-

15:01

Moody's: Amazon's revenue in the next quarter is likely to grow by at least 22%

-

14:50

SNB ready to intervene in currency markets after U.S. election - Reuters

-

14:32

U.S. Stocks open: Dow +1.15%, Nasdaq +1.64%, S&P +1.17%

-

14:29

Danske Sees EUR/USD $1.13-$1.14, USD/JPY 100 on Trump Win

-

14:23

Before the bell: S&P futures +1.43%, NASDAQ futures +1.60%

U.S. stock-index futures signaled an end to a nine-day equity decline after the FBI reiterated that Hillary Clinton's handling of e-mails wasn't a crime, likely boosting her prospects in the presidential election.

Global Stocks:

Nikkei 17,177.21 +271.85 +1.61%

Hang Seng 22,801.40 +158.78 +0.70%

Shanghai 3,133.40 +8.08 +0.26%

FTSE 6,787.76 +94.50 +1.41%

CAC 4,451.01 +73.55 +1.68%

DAX 10,428.27 +169.14 +1.65%

Crude $44.51 (+1.00%)

Gold $1,287.50 (-1.30%)

-

13:57

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

169.15

2.67(1.6038%)

1303

ALCOA INC.

AA

25.76

0.56(2.2222%)

8494

ALTRIA GROUP INC.

MO

64.84

0.46(0.7145%)

835

Amazon.com Inc., NASDAQ

AMZN

768.77

13.72(1.8171%)

31363

American Express Co

AXP

66.22

0.71(1.0838%)

640

AMERICAN INTERNATIONAL GROUP

AIG

58.02

0.64(1.1154%)

387

Apple Inc.

AAPL

109.92

1.08(0.9923%)

156917

AT&T Inc

T

36.82

0.32(0.8767%)

31149

Barrick Gold Corporation, NYSE

ABX

17.63

-0.64(-3.503%)

103703

Boeing Co

BA

141.7

2.16(1.5479%)

1384

Caterpillar Inc

CAT

83.67

1.36(1.6523%)

3935

Chevron Corp

CVX

106.1

1.32(1.2598%)

5405

Cisco Systems Inc

CSCO

30.62

0.43(1.4243%)

15580

Citigroup Inc., NYSE

C

48.99

0.82(1.7023%)

13360

Deere & Company, NYSE

DE

88.4

0.34(0.3861%)

1220

E. I. du Pont de Nemours and Co

DD

69.3

0.69(1.0057%)

815

Exxon Mobil Corp

XOM

84.69

1.12(1.3402%)

12049

Facebook, Inc.

FB

122.25

1.50(1.2422%)

186465

Ford Motor Co.

F

11.5

0.16(1.4109%)

52882

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.37

0.32(2.8959%)

118621

General Electric Co

GE

28.78

0.34(1.1955%)

30770

General Motors Company, NYSE

GM

31.6

0.44(1.4121%)

1825

Goldman Sachs

GS

178.65

2.73(1.5518%)

3453

Google Inc.

GOOG

775.7

13.68(1.7952%)

10025

Hewlett-Packard Co.

HPQ

14.9

0.19(1.2916%)

800

Home Depot Inc

HD

122.5

1.59(1.315%)

1781

Intel Corp

INTC

34.15

0.54(1.6067%)

15352

International Business Machines Co...

IBM

154.5

2.07(1.358%)

3311

International Paper Company

IP

44.25

0.27(0.6139%)

150

Johnson & Johnson

JNJ

116.03

0.92(0.7992%)

1270

JPMorgan Chase and Co

JPM

68.93

1.17(1.7267%)

33368

McDonald's Corp

MCD

111.85

0.81(0.7295%)

2348

Merck & Co Inc

MRK

59.24

0.42(0.714%)

12340

Microsoft Corp

MSFT

59.6

0.89(1.5159%)

45786

Nike

NKE

50.61

0.65(1.301%)

4691

Pfizer Inc

PFE

30.41

0.41(1.3667%)

9805

Procter & Gamble Co

PG

85.94

0.86(1.0108%)

9459

Starbucks Corporation, NASDAQ

SBUX

53.35

0.60(1.1374%)

24017

Tesla Motors, Inc., NASDAQ

TSLA

194.3

3.74(1.9626%)

34925

The Coca-Cola Co

KO

42.11

0.42(1.0074%)

21052

Travelers Companies Inc

TRV

115

10.33(9.8691%)

225

Twitter, Inc., NYSE

TWTR

18.27

0.25(1.3873%)

152731

Verizon Communications Inc

VZ

47.54

0.46(0.9771%)

7940

Visa

V

81.19

0.83(1.0329%)

2051

Wal-Mart Stores Inc

WMT

69.74

0.58(0.8386%)

3402

Walt Disney Co

DIS

94

1.55(1.6766%)

735

Yahoo! Inc., NASDAQ

YHOO

41.09

0.81(2.0109%)

16843

Yandex N.V., NASDAQ

YNDX

18.92

0.60(3.2751%)

12100

-

13:51

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0800 (EUR 908m) 1.0900 (338m) 1.0995-00 (632m) 1.1050 (414m), 1.1075 (798m) 1.1100 (777m) 1.1130-40 (652m)

USD/JPY 103.00 (USD 499m) 103.50 (507m) 104.00 (460m) 105.00 (340m)

AUD/USD 0.7600-05 (AUD 475m) 0.7700 (328m)

USD/CAD 1.3190-00 (USD 930m) 1.3340-50 (550m) 1.3500 (420m) 1.3700 (601m)

EUR/JPY 114.50 (EUR 310m)

-

12:51

Orders

EUR/USD

Offers : 1.1070 1.1085 1.1100 1.1130 1.1150 1.1180 1.1200 1.1250

Bids : 1.1050 1.1030 1.1000 1.0980 1.0950 1.0935 1.0900

GBP/USD

Offers : 1.2430 1.2460 1.2485 1.2500 1.2520 1.2550 1.2580 1.2600

Bids : 1.2400 1.2380 1.2365 1.2350 1.2330 1.2300 1.2280 1.2250

EUR/GBP

Offers : 0.8930-35 0.8950 0.8980 0.9000 0.9030 0.9050 0.9070 0.9100

Bids : 0.8900 0.8885 0.8860 0.8835 0.8800 0.8785 0.8750

EUR/JPY

Offers : 116.00 116.30 116.50 116.90-117.00 117.50 118.00

Bids : 115.30 115.00 114.85 114.50 114.20 114.00 113.85 113.50 113.00

USD/JPY

Offers : 104.75-80 105.00 105.20 105.50 105.80 106.00 106.50

Bids : 104.20 104.00 103.80 103.50 103.35 103.00 102.80 102.50 102.20 102.00

AUD/USD

Offers : 0.7700-10 0.7730 0.7750 0.7780 0.7800

Bids : 0.7660 0.7630 0.7600 0.7580 0.7550 0.7500

-

12:30

Latest ABC Washington Post poll has Clinton ahead by 47% to Trump's 43% - Forexlive

-

12:05

WSE: Mid session comment

Today's session runs for the time being under the sign of one piece of information, which appears before the start of trading and therefore has led to widespread gaps growth. Virtually all European markets are on the gain, increases in Western Europe exceed 1% and indices are traded on the session highs. Against this background, we may have some reservations with regard to the behavior of the WIG20, which rather revolves in the area of session lows, however it still means more than 1%.

Top behave today sectors familiar with previous good behavior, namely commodity producers and banks. Currently, the most important is the election in the US and the reaction of global markets on their outcome. When the cards will be fully lined on the table, then we may get a chance for a slightly larger directional movement in the markets. So far we have only measured with the prospect of increased volatility and nervous movements.

At the halfway point of today's session, the WIG20 index was at the level of 1,777 points (+ 1.08%). The turnover among the largest companies was amounted close to PLN 200 million.

-

12:03

Major stock indices in Europe show a positive trend

HSBC Holdings shares jumped 4.5% as the bank topped the rise of financial companies under the Stoxx 600. Its adjusted profit unexpectedly rose in Q3.

The stock price of the world's largest mining group BHP Billiton rose 4%, Anglo American +2.7%.

Securities of Rio Tinto Plc rose 3.3% as the price of diamonds from the Argyle mine in Australlia peaked.

The market capitalization of Ryanair Holdings airline rose 4.9% after improved forecast for the coming years.

PostNL shares gained 5.8% as the Dutch postal company rejected a takeover bid from Belgian competitor Bpost.

French carmaker Renault has grown by 2.4% since the end of last week, the Government of Pakistan stated that the company plans to open local production and launch it by 2018.

At this moment:

FTSE 6784.02 90.76 1.36%

DAX 10421.94 162.81 1.59%

CAC 4453.95 76.49 1.75%

-

11:26

ANZ says that a GBP/USD recovery towards 1.28/130 is feasible but hesitant to get bullish here

"The High Court's decision that Parliament needs to support Article 50 before the government can trigger it is about the process of leaving the EU and in no way challenges the referendum's decision to leave. Should the Supreme Court uphold the High Court's decision, the government would have to bring in a new law, voted on in Parliament, to leave the EU. That could be subject to much debate over what Brexit will look like in both the House of Commons and House of Lords and it could delay PM Theresa May's plan to trigger Article 50 before the end of March 2017. Needless to say, if the Supreme Court overturns the High Court's decision, expectations of a hard Brexit will spring back.

In the short term, therefore, the political situation is something of a vacuum and some scaling back of hard Brexit-related bearishness towards the sterling may be prudent over the coming weeks. Sterling's most recent slide started in early October as the Conservative Party conference got underway. Sterling was trading just below 1.30 vs USD back then, so a recovery towards a 1.28-1.30 range is feasible, and possibly more likely if the Supreme Court upholds the High Court's decision.

...We highlighted this view Outlook for November, arguing that a pause for breath in sterling's decline was warranted. That was premised largely on the view that the hard Brexit story was largely discounted based on available information and recent political rhetoric. We also anticipated that the BoE was likely to revise up its inflation forecasts in the November Inflation Report and that the case for additional easing in the near term was not there. What we did not know a couple of weeks ago was what the ruling of the High Court would be.

Therefore, our expectation that sterling would trade in a 1.20- 1.25 range over the next six months or so might be vulnerable to a more sustained topside break driven by expectations of potentially greater balance returning to the Brexit debate. We therefore see upside risks to our current sterling forecasts of 1.25-1.30 vs USD in the coming months, but would be hesitant to get more bullish that that until the political and legal framework becomes clearer".

Copyright © 2016 ANZ, eFXnews™

-

10:55

Moody’s: possibility of another round of early Spanish elections remains

-

10:18

Retail sales fell by 0.2% in the Euro Area

In September 2016 compared with August 2016, the seasonally adjusted volume of retail trade fell by 0.2% in both the euro area (EA19) and the EU28, according to estimates from Eurostat, the statistical office of the European Union.

In August the retail trade volume decreased by 0.2% in the euro area and by 0.1% in the EU28. In September 2016 compared with September 2015 the calendar adjusted retail sales index increased by 1.1% in the euro area and by 2.2% in the EU28.

-

10:00

Oil is trading higher

This morning, the New York futures for Brent rose 1.52% to $ 44.75 and crude oil futures for WTI rose 1.27% to $ 46.16 per barrel. Thus, the black gold is gaining in anticipation of the presidential elections in the United States, which will take place on 8 November. Last week, oil prices fell to the lowest level since early August. Fundamentals in the oil market remained negative. According to Baker Hughes, the number of drilling rigs in the United States increased by 9, up to 450. Brent crude oil prices dropped by 15% since mid-October, when it was worth from $ 53.7. This happened against the backdrop of OPEC talks to freeze oil production, which are still ongoing.

-

10:00

Eurozone: Retail Sales (MoM), September -0.2% (forecast -0.2%)

-

10:00

Eurozone: Retail Sales (YoY), September 1.1% (forecast 1.6%)

-

09:21

Latest Eurozone Retail PMI data pointed to a further decrease in sales - Markit

Latest Eurozone Retail PMI data pointed to a further decrease in sales in October, the fourth in the past five months. Although Germany saw ongoing sales growth, it was offset by further contractions in both France and Italy.

October's headline Markit Eurozone Retail PMI - which tracks month-on-month changes in like-for-like retail sales in the bloc's biggest three economies combined - registered 48.6, down from 49.6 in September and its lowest reading since June.

Sales also decreased on an annual basis at the start of the fourth quarter, with the rate of decline the second-fastest seen in over one-and-a-half years (second only to that observed in April).

-

08:42

-

08:35

UK house price index rose in October

-

House prices in the three months to October were 5.2% higher than in the same three months of 2015

-

Prices in the last three months (AugustOctober) were 0.1% higher than in the preceding quarter

Martin Ellis, Halifax housing economist, said: "House prices in the three months to October were largely unchanged compared with the previous quarter. The annual rate of growth continued on its recent downward trend, easing to 5.2%. "Activity levels, like house price growth, have softened compared with a year ago. Home sales, however, appear to have stabilised in recent months following the distortions earlier in the year due to the changes to stamp duty in April".

-

-

08:33

Swiss CPI down 0.2% y/y

The Swiss Consumer Price Index (CPI) increased by 0.1% in October 2016 compared with the previous month, reaching 100.3 points (December 2015=100). Inflation was -0.2% in comparison with the same month in the previous year. These are the findings from the Federal Statistical Office

-

08:30

United Kingdom: Halifax house price index, October 5.2%

-

08:30

United Kingdom: Halifax house price index 3m Y/Y, October 5.2%

-

08:17

WSE: After opening

WIG20 index opened at 1773.16 points (+0.85%)*

WIG 48179.18 1.19%

WIG30 2063.84 1.51%

mWIG40 3975.80 0.55%

*/ - change to previous close

The futures market opened up with considerable increase of 1.14% to 1,780 points. At the same time, contract and DAX-gained more than 1.8%. Beginning runs so the expected line of high-openings, which in the current uncertain environment, are not the best solution, because it may limit the subsequent volatility.

All components of the WIG20 are on the green side, but the leader is KGHM, which grows more than 3%.In addition to the positive sentiment also helps the cooper factor.

After fifteen minutes of trading the WIG20 index reached the level of 1,781 points (+1,33%).

Behind us a good start of the Warsaw market and before the market more difficult work on maintaining and preferably further development of a nice beginning.

-

08:15

Switzerland: Consumer Price Index (YoY), October -0.2%

-

08:15

Switzerland: Consumer Price Index (MoM) , October 0.1%

-

08:00

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0800 (EUR 908m) 1.0900 (338m) 1.0995-00 (632m) 1.1050 (414m), 1.1075 (798m) 1.1100 (777m) 1.1130-40 (652m)

USD/JPY 103.00 (USD 499m) 103.50 (507m) 104.00 (460m) 105.00 (340m)

AUD/USD 0.7600-05 (AUD 475m) 0.7700 (328m)

USD/CAD 1.3190-00 (USD 930m) 1.3340-50 (550m) 1.3500 (420m) 1.3700 (601m)

EUR/JPY 114.50 (EUR 310m)

-

07:44

Positive start of trading expected on the major stock exchanges in Europe: DAX + 1.4%, CAC40 + 1.4%, FTSE + 1.1%

-

07:43

What Goldman Sachs Trade into The US Elections

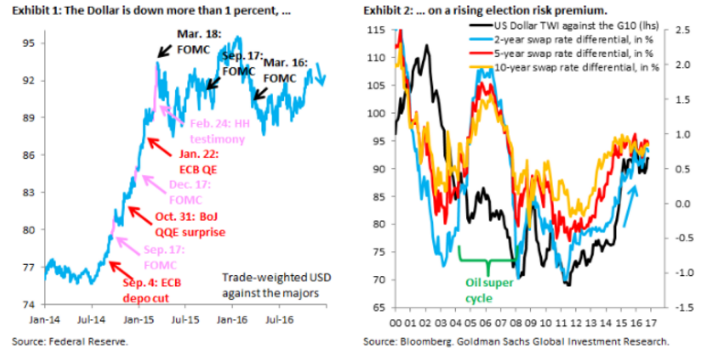

"The Dollar has fallen sharply over the past week, as polls have tightened into the upcoming election. On a trade-weighted basis versus the majors, the greenback is down more than one percent, a number that understates the decline because the fall in oil prices has weighed on the Canadian Dollar, which has a large weight in our Dollar index.

We show that recent Dollar weakness is associated with a meaningful pullback in market pricing for the Fed, with cumulative hikes through end-2017 falling to 32 bps as of Friday, down from 41 bps a week earlier. That said, the drop in the Dollar has gone beyond what rate differentials indicate, suggesting that a risk premium has formed even beyond expectations for Fed hikes.

While near-term focus in the market is on potential further declines in the Dollar in the event of a Trump victory, the likelihood of a meaningful Dollar rise in a Clinton win scenario is rising. In particular, based on the make-up of the Dollar sell-off over the past 10 days, we think the greenback could recover the most ground against the Euro and the Yen.

Although we are bearish on the Canadian Dollar, targeting 1.37 by year-end, we think it is better to steer clear of long $/CAD on a Clinton win, because there could be a material bounce in risk appetite that would drive oil prices higher, temporarily buoying CAD. Finally, RMB depreciation pressure is likely to mount again on a Clinton win, as the Dollar gains into the December FOMC, where our economists expect a hike with a large probability".

Copyright © 2016 Goldman Sachs, eFXnews™

-

07:38

Shell review for oil demand

According to the second largest oil company in the world, the demand for black gold touched the lows in five years amid growing demand by consumers for electric cars and alternative energy sources. Shell began investing primarily in natural gas and biofuels. For example, this year Shell acquired BG Group for $ 54 billion in order to strengthen its position in the gas market.

-

07:30

BoJ meeting minutes 20-21 September: Many members said inflation expectations may take some time to recover

-

Some members said caution about inflation may last longer than expected

-

Many members shared the view that QQE lowered real interest rates by raising inflation expectations and push down nominal interest rates

-

One member said that it was necessary for the implementation of monetary policy to increase inflation expectations

-

-

07:20

WSE: Before opening

We start the new week, which for the Warsaw market once again will be shortened by one day due to the Independence Day on Friday. Furthermore, the second week of the month is known that the macroeconomic calendar is relatively empty, and its beginning goes further under the influence of Friday's report from the US labor market. Now it will be a little different, because of the Tuesday's US presidential election, which for several days very clearly attracted the attention of investors and thus overshadowed Friday's data from the US. The very opening week runs anyway quite rapidly because of the new election topic in the form of information from the FBI that there will be an investigation into the emails Hillary Clinton. The head of the agency, which last Friday reopened the case last night said that after examining new evidence, there is no basis to bring charges to Clinton. It is of course positive for the Democrat candidate, leading to market the reaction in the form of gap openings. Strongly reinforces the Mexican peso, weakens the dollar and bonds, gain shares and contracts for US indices. Therefore the morning mood is already set and the growing gap in opening in Europe and on the WSE virtually assured.

-

07:04

Hillary Clinton in the clear as FBI announces it has not changed mind on charges. Dollar gaps up

-

07:03

German new orders in manufacturing had decreased in September 2016

Based on provisional data, the Federal Statistical Office (Destatis) reports that price-adjusted new orders in manufacturing had decreased in September 2016 a seasonally and working-day adjusted 0.6% on August 2016. For August 2016, revision of the preliminary outcome resulted in an increase of 0.9% compared with July 2016 (primary +1.0%). Price-adjusted new orders without major orders in manufacturing had increased in September 2016 a seasonally and working-day adjusted 1.0% on August 2016.

In September 2016, domestic orders decreased by 1.1% and foreign orders decreased by 0.3% on the previous month. New orders from the euro area were down 4.5% on the previous month, while new orders from other countries increased by 2.5% compared to August 2016.

In September 2016 the manufacturers of intermediate goods saw new orders rise by 0.5% compared with August 2016. The manufacturers of capital goods showed decreases of 1.6% on the previous month. For consumer goods, an increase in new orders of 0.5% was recorded.

-

07:01

Germany: Factory Orders s.a. (MoM), September -0.6% (forecast 0.3%)

-

06:52

U.K. private sector growth picked up

According to rttnews, the U.K. private sector growth picked up in the three months to October, the latest growth indicator from the Confederation of British Industry showed Sunday.

The growth indicator rose to +8 percent from +3 percent in three months to September.

Output continued to grow at a robust pace in manufacturing and distribution, while it remained flat in consumer services. Meanwhile, business and professional services logged only a marginal growth.

A balance of +13 percent expect further increase in activity in the next three months, with predictions of healthy growth across all sectors.

"Although growth will be robust for the remainder of this year, we expect uncertainty around the UK's relationship with the EU to dampen business investment in 2017, along with a rise in inflation which will knock household spending," Rain Newton-Smith, CBI chief economist, said.

-

06:09

Options levels on monday, November 7, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1257 (3721)

$1.1214 (1916)

$1.1172 (318)

Price at time of writing this review: $1.1070

Support levels (open interest**, contracts):

$1.1026 (1930)

$1.0981 (3121)

$1.0924 (3136)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 57559 contracts, with the maximum number of contracts with strike price $1,1400 (6589);

- Overall open interest on the PUT options with the expiration date December, 9 is 50310 contracts, with the maximum number of contracts with strike price $1,0900 (4234);

- The ratio of PUT/CALL was 0.87 versus 1.04 from the previous trading day according to data from November, 4

GBP/USD

Resistance levels (open interest**, contracts)

$1.2710 (1746)

$1.2613 (1147)

$1.2518 (1827)

Price at time of writing this review: $1.2440

Support levels (open interest**, contracts):

$1.2388 (1094)

$1.2291 (3397)

$1.2194 (946)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 32078 contracts, with the maximum number of contracts with strike price $1,3400 (2559);

- Overall open interest on the PUT options with the expiration date December, 9 is 33627 contracts, with the maximum number of contracts with strike price $1,2300 (3397);

- The ratio of PUT/CALL was 1.05 versus 0.94 from the previous trading day according to data from November, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:30

Australia: ANZ Job Advertisements (MoM), October 1.0%

-

00:01

Japan: Labor Cash Earnings, YoY, September 0.2%

-