Market news

-

23:50

Japan: Current Account, bln, September 1821 (forecast 1960)

-

23:30

Commodities. Daily history for Nov 08’2016:

(raw materials / closing price /% change)

Oil 44.83 -0.33%

Gold 1,275.90 +0.11%

-

23:29

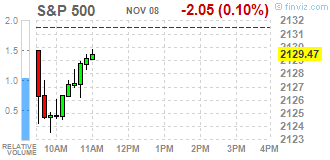

Stocks. Daily history for Nov 08’2016:

(index / closing price / change items /% change)

Nikkei 225 17,171.38 -5.83 -0.03%

Shanghai Composite 3,148.02 +14.69 +0.47%

S&P/ASX 200 5,257.79 0.00 0.00%

FTSE 100 6,843.13 +36.23 +0.53%

CAC 40 4,476.89 +15.68 +0.35%

Xetra DAX 10,482.32 +25.37 +0.24%

S&P 500 2,139.56 +8.04 +0.38%

Dow Jones Industrial Average 18,332.74 +73.14 +0.40%

S&P/TSX Composite 14,656.84 +4.39 +0.03%

-

23:28

Currencies. Daily history for Nov 08’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1026 -0,13%

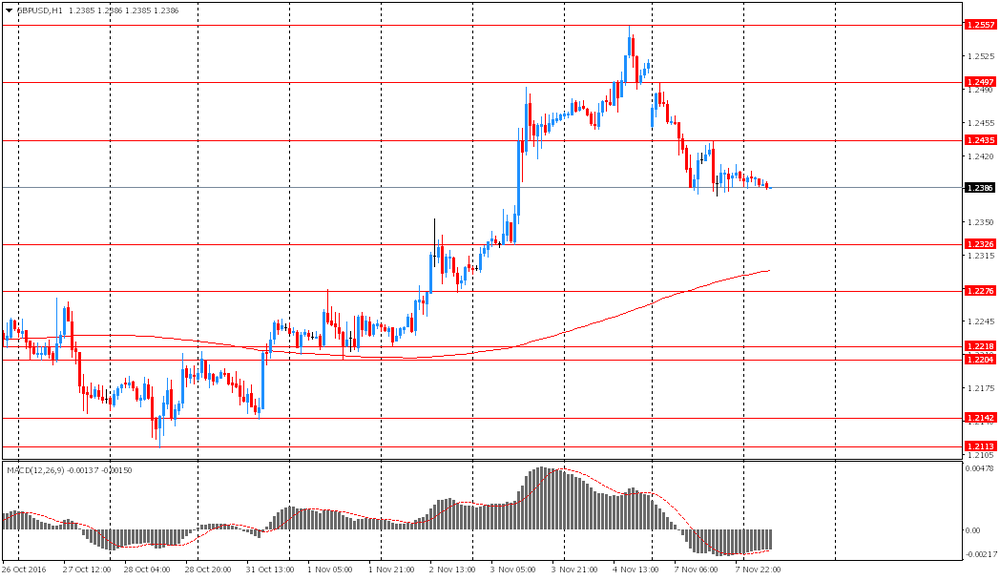

GBP/USD $1,2380 -0,13%

USD/CHF Chf0,9811 +0,71%

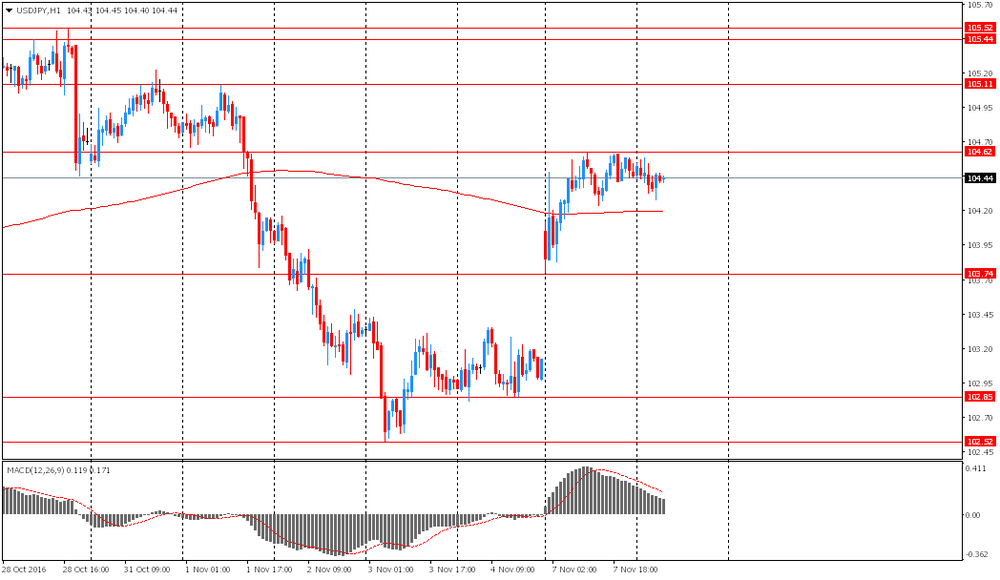

USD/JPY Y105,16 +0,68%

EUR/JPY Y115,91 +0,52%

GBP/JPY Y130,17 +0,54%

AUD/USD $0,7759 +0,43%

NZD/USD $0,7384 +0,57%

USD/CAD C$1,3286 -0,56%

-

23:02

Schedule for today, Wednesday, Nov 09’2016

01:30 China PPI y/y October 0.1% 0.8%

01:30 China CPI y/y October 1.9% 2.1%

05:00 Japan Eco Watchers Survey: Current October 44.8 44.4

05:00 Japan Eco Watchers Survey: Outlook October 48.5

09:30 United Kingdom Total Trade Balance September -4.7

15:00 U.S. Wholesale Inventories September -0.2% 0.2%

15:30 U.S. Crude Oil Inventories November 14.42

20:00 New Zealand RBNZ Interest Rate Decision 2% 1.75%

20:00 New Zealand RBNZ Rate Statement

21:00 New Zealand RBNZ Press Conference

23:50 Japan Core Machinery Orders September -2.2% -0.8%

23:50 Japan Core Machinery Orders, y/y September 11.6% 3.5%

-

21:06

Major US stock indexes finished trading in positive territory

Major US stock indexes rose modestly on Tuesday amid the election of the next President of the United States, who are today.

According to the final survey of Reuters / Ipsos States Americans, Clinton has a 90 percent chance to win the Republican candidate Donald Trump.

Many investors believe that the victory of Clinton shares will rise in the next few sessions, while due to the uncertainty of policy proposals Trump risky assets immediately after his victory will go down. Investors also pointed out that the medium and long term impact of winning each of the candidates on the economy remains unclear.

In addition, an overview of vacancies and labor turnover (JOLTS), published by the US Bureau of Labor Statistics, showed that was revised up to 5.453 million. To 5.443 million in September, the number of vacancies has increased to 5.486 million. The figure for August. Analysts had expected the number of vacancies will rise to 5.508 million. vacancy rate was 3.7% against 3.6% in August. The number of jobs has changed little in the private sector and the government sector. The number of vacancies is also slightly changed in all sectors and regions. At the same time, it became known that hiring amounted to 5.081 million. Against 5.268 million. In August. hiring rate fell in September to 3.5 percent from 3.6 percent in August. Hiring has not changed in the private sector and the government sector.

DOW index components are mainly grown (26 plus against minus 4). More rest up shares The Travelers Companies, Inc. (TRV, + 2.56%). Outsider were shares of Pfizer Inc. (PFE, -0.86%).

All business sectors S & P index closed in positive territory. The leader turned out to be the sector of consumer goods (+ 1.2%).

At the close:

Dow + 0.40% 18,332.16 +72.56

Nasdaq + 0.53% 5,193.49 +27.32

S & P + 0.38% 2,139.53 +8.01

-

20:00

DJIA +0.37% 18,327.36 +67.76 Nasdaq +0.43% 5,188.63 +22.46 S&P +0.29% 2,137.76 +6.24

-

17:00

European stocks closed: FTSE 100 +36.23 6843.13 +0.53% DAX +25.37 10482.32 +0.24% CAC 40 +15.68 4476.89 +0.35%

-

16:44

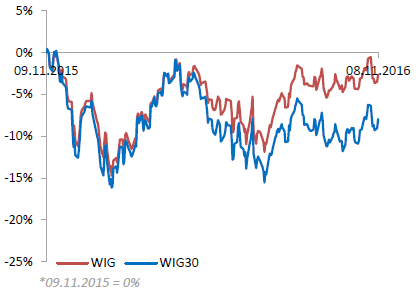

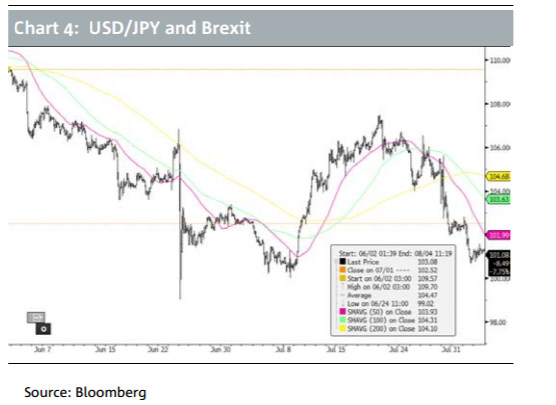

WSE: Session Results

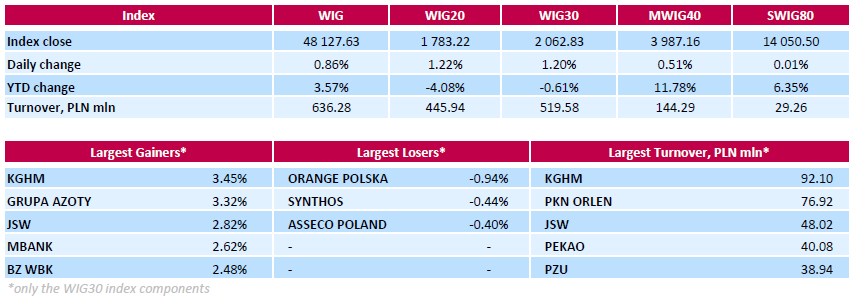

Polish equity market closed higher on Tuesday. The broad market measure, the WIG Index, surged by 0.86%. The WIG sub-sector indices were mainly higher with materials (+2.97%) outperforming.

The large-cap stocks advanced 1.20%, as measured by the WIG30 Index. Almost all Index components returned gains. Copper producer KGHM (WSE: KGH) and chemical producer GRUPA AZOTY (WSE: ATT) led the outperformers, climbing by a respective 3.45% and 3.32%. Both companies are set to post their Q3 financials tomorrow (November 9). The former will reveal its quarterly results after the market close, while the latter will post its earnings before market opens. Among other major gainers were coking coal miner JSW (WSE: JSW), property developer GTC (WSE: GTC) and two banking sector names BZ WBK (WSE: BZW) and MBANK (WSE: MBK), which added between 2.42% and 2.82%. At the same time, telecommunication services provider ORANGE POLSKA (WSE: OPL), chemical producer SYNTHOS (WSE: SNS) and IT-company ASSECO POLAND (WSE: ACP) were the only decliners, falling by 0.94%, 0.44% and 0.4% respectively.

-

16:03

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed in cautious trading on Tuesday morning as Americans headed to elect their next president, with the odds currently favoring Democrat nominee Hillary Clinton. Clinton has a 90% chance of defeating Republican nominee Donald Trump, according to the final Reuters/Ipsos States of the Nation poll released on Monday.

Dow stocks mixed (15 vs 15). Top gainer - The Procter & Gamble Company (PG, +0.80%). Top loser - International Business Machines Corporation (IBM, -1.22%).

Most of S&P sectors in negative area. Top gainer - Consumer goods (+0.4%). Top loser - Healthcare (-0.7%).

At the moment:

Dow 18192.00 0.00 0.00%

S&P 500 2125.50 -3.50 -0.16%

Nasdaq 100 4768.75 -7.00 -0.15%

Oil 45.18 +0.29 +0.65%

Gold 1284.90 +5.50 +0.43%

U.S. 10yr 1.83 +0.00

-

15:59

Latest polls give Clinton a four-point lead over Republican Trump. TV networks could call the election result as early as 4am GMT tomorrow

The new president and commander-in-chief of the world's largest military will be inaugurated and enter the White House on January 20.

-

15:51

Gold appreciates moderately while US elections are underway

Gold was steady Tuesday morning as traders waited for election results in the U.S.

December gold was up $1.80 at $1281 per ounce amid speculation Hillary Clinton will edge Donald Trump, the protectionist real estate celebrity.

Meanwhile, the Federal Reserve has hinted that interest will be hiked in December. That's putting a cap on gold prices - rttnews says.

-

15:37

U.S. Government Bonds Little Changed on Election Day

In recent trade, the yield on the benchmark 10-year U.S. Treasury notes was at 1.823%, down slightly from 1.826% on Monday. Bond yields fall when prices rise.

-

15:14

The pound goes bid as NIESR saw GDP gains

The monthly estimates of GDP suggest that output grew by 0.4 per cent in the three months ending in September 2016 after growth of 0.5 per cent in the three months ending in August 2016. Our estimates suggest that economic growth slowed in 2016Q3 to 0.4 per cent, from 0.7 per cent in 2016Q2.

James Warren, Research Fellow at NIESR, said "Our estimates suggest that economic growth slowed in 2016Q3 to 0.4 per cent, from 0.7 per cent in 2016Q2. While retail sales have been buoyant in recent months, the production sector has acted as a drag on economic growth. We estimate that output from the production sector declined by 0.2 per cent in the third quarter of this year."

-

15:11

Job openings in the US increased slightly

The number of job openings was little changed at 5.5 million on the last business day of September, the U.S. Bureau of Labor Statistics reported today. Hires edged down to 5.1 million and total separations was little changed at 4.9 million. Within separations, the quits rate was unchanged at 2.1 percent and the layoffs and discharges rate decreased to 1.0 percent. This release includes estimates of the number and rate of job openings, hires, and separations for the nonfarm sector by industry and by four geographic regions.

-

15:00

U.S.: JOLTs Job Openings, September 5.486 (forecast 5.508)

-

15:00

United Kingdom: NIESR GDP Estimate, October 0.4%

-

14:44

Fed's Evans Worries Fed Not Taking Necessary Steps to Meet Price Goal

-

14:35

U.S. Stocks open: Dow -0.21%, Nasdaq -0.24%, S&P -0.28%

-

14:29

Before the bell: S&P futures -0.25%, NASDAQ futures -0.22%

U.S. stock-index futures declined as voters head to the polls to choose a new president.

Global Stocks:

Nikkei 17,171.38 -5.83 -0.03%

Hang Seng 22,909.47 +108.07 +0.47%

Shanghai 3,148.02 +14.69 +0.47%

FTSE 6,807.43 +0.53 +0.01%

CAC 4,453.73 -7.48 -0.17%

DAX 10,439.62 -17.33 -0.17%

Crude $44.80 (-0.20%)

Gold $1,280.40 (+0.08%)

-

14:22

Trading the US Elections: Societe Generale would go long EUR on Trump, Long USD/JPY on Clinton

"What does seem clear from today's very positive reaction to a slender poll lead for Mrs Clinton, is that the market has been very nervous indeed in recent days. Trump is risk-off, Clinton is risk-on and markets will move whatever the result or more particularly, whatever the results in Florida and North Carolina.

Another consensus view (and one which I share) is that the Yuan has further to fall. Scepticism about the recent stronger data and concern about its reliance on excessive debtfinancing is a common theme but more than that, as long as the Chinese authorities can engineer a weaker currency, they will. Personally, I'm not sure that shorting CNH would ever be a favourite trade, but I'm left wanting to sell a post-election NZD and AUD rally, wanting to sell SGD, KRW and JPY under almost any circumstances.

My own favourite non-FX trade is to sell gilts regardless, my favourite FX trades are to be long the Euro on Trump, short the Yen on Clinton, and since Clinton's ahead, long USD/JPY is my best guess".

Copyright © 2016 Societe Generale, eFXnews™

-

13:57

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

24.78

-0.30(-1.1962%)

30235

Amazon.com Inc., NASDAQ

AMZN

782.6

-2.33(-0.2968%)

12294

AT&T Inc

T

36.67

-0.14(-0.3803%)

12982

Barrick Gold Corporation, NYSE

ABX

17.31

-0.04(-0.2306%)

67213

Chevron Corp

CVX

106.32

-0.53(-0.496%)

100

Cisco Systems Inc

CSCO

30.9

-0.04(-0.1293%)

961

Citigroup Inc., NYSE

C

49.5

-0.32(-0.6423%)

64910

Exxon Mobil Corp

XOM

84.6

-0.10(-0.1181%)

18607

Ford Motor Co.

F

11.5

-0.08(-0.6908%)

28947

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.25

-0.04(-0.3543%)

40070

General Electric Co

GE

29.23

-0.08(-0.2729%)

3016

General Motors Company, NYSE

GM

31.96

-0.06(-0.1874%)

331

Goldman Sachs

GS

180.13

-1.35(-0.7439%)

5182

Home Depot Inc

HD

123.85

0.10(0.0808%)

2268

Intel Corp

INTC

34.66

-0.03(-0.0865%)

5641

International Business Machines Co...

IBM

154.5

0.18(0.1166%)

1127

JPMorgan Chase and Co

JPM

69.64

-0.24(-0.3434%)

7430

Microsoft Corp

MSFT

60.47

0.05(0.0828%)

11823

Nike

NKE

50.7

-0.21(-0.4125%)

1908

Pfizer Inc

PFE

30.18

0.10(0.3324%)

3327

Procter & Gamble Co

PG

86.71

0.15(0.1733%)

360

Starbucks Corporation, NASDAQ

SBUX

54.4

-0.09(-0.1652%)

11358

Tesla Motors, Inc., NASDAQ

TSLA

193.39

0.18(0.0932%)

6796

Twitter, Inc., NYSE

TWTR

18.35

-0.06(-0.3259%)

47730

UnitedHealth Group Inc

UNH

141.11

-0.82(-0.5777%)

2115

Walt Disney Co

DIS

94.25

-0.18(-0.1906%)

2251

Yahoo! Inc., NASDAQ

YHOO

41.15

0.10(0.2436%)

100

Yandex N.V., NASDAQ

YNDX

18.81

0.16(0.8579%)

225

-

13:54

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Goldman Sachs (GS) downgraded to Neutral from Buy at Citigroup

Bank of America (BAC) downgraded to Hold from Buy at Deutsche Bank

AT&T (T) downgraded to Perform from Outperform at Oppenheimer

Other:

-

13:49

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0920-25 (EUR 798m) 1.0990 (1.17bn) 1.1000 (1.25bn), 1.1050(330m) 1.1070-75 (1.13bn) 1.1100 (581mn)

USD/JPY 102.00 (251m) 102.50 (596m) 102.75 (450m) 103.00 (1.72bn), 103.25 (328m) 103.80 (285m) 104.30 (270m) 104.50, (341m), 105.00 (642m) 106.00 (1.95bn)

USD/CHF 1.0000 (USD 531m)

AUD/USD 0.7650 (244m) 0.7850 (222m)

NZD/USD 0.7120 (NZD 211m) 0.7300 (489m)

USD/CAD: 1.3500 (204m) 1.3600 (201m)

-

13:35

Canadian building permits decline significantly in September

Municipalities issued $6.9 billion worth of building permits in September, down 7.0% from August. Quebec, British Columbia and Ontario recorded the largest declines. The overall decrease was attributable to lower construction intentions for non-residential buildings, led by commercial structures.

The value of non-residential building permits was down 22.3% to $2.2 billion in September, following two consecutive monthly advances. All three non-residential components-commercial, institutional and industrial-posted decreases, with commercial buildings registering the largest drop. Declines were recorded in every province, except Newfoundland and Labrador. The most notable decreases occurred in Ontario and Quebec.

-

13:32

Canadian housing starts in line with expectations

The trend measure of housing starts in Canada was 199,920 units in October compared to 199,262 in September, according to Canada Mortgage and Housing Corporation (CMHC). The trend is a six-month moving average of the monthly seasonally adjusted annual rates (SAAR) of housing starts.

"In October, housing starts remained stable, as the trend remained essentially unchanged from September," said Bob Dugan, CMHC Chief Economist. "While apartment starts are on a downward trend in British Columbia after reaching an all-time high at the beginning of the year, increased construction of single, semi-detached and row units in the rest of the country have helped offset the decline."

-

13:30

Canada: Building Permits (MoM) , September -7% (forecast -4.6%)

-

13:16

Canada: Housing Starts, October 192.9 (forecast 195)

-

12:46

Orders

EUR/USD

Offers : 1.1070 1.1085 1.1100 1.1130 1.1150 1.1180 1.1200 1.1250

Bids : 1.1030 1.1000 1.0980 1.0950 1.0935 1.0900

GBP/USD

Offers : 1.2450-55 1.2485 1.2495-1.2500 1.2520 1.2550 1.2580 1.2600

Bids : 1.2400 1.2375-80 1.2365 1.2350 1.2330 1.2300 1.2280 1.2250 1.2200

EUR/GBP

Offers : 0.8925-35 0.8950 0.8980 0.9000 0.9030 0.9050 0.9070 0.9100

Bids : 0.8885 0.8860 0.8835 0.8800 0.8785 0.8750 0.8700

EUR/JPY

Offers : 115.70 116.00 116.30 116.50 116.90-117.00 117.50 118.00

Bids : 115.00 114.85 114.50 114.20 114.00 113.85 113.50 113.00

USD/JPY

Offers : 104.75-80 105.00 105.20 105.50 105.80 106.00 106.50 106.75 107.00

Bids : 104.20 104.00 103.80 103.50 103.35 103.00 102.80 102.50 102.20 102.00

AUD/USD

Offers : 0.7730-35 0.7750 0.7765 0.7780 0.7800 0.7835 0.7850

Bids : 0.7685 0.7665-70 0 0.7630 0.7600 0.7580 0.7550 0.7500

-

12:45

Zanganeh: Iran is optimistic about OPEC freeze deal

-

12:43

Bank of America reduces ArcelorMittal stock rating to "neutral" from "buy"

-

11:46

Major stock indices in Europe trading mixed

Stock indexes in Western Europe not changed significantly in anticipation of the US presidential election results.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0.08% to 334.11 points.

Polling stations in most of the Eastern United States will open at 12:00 GMT.

Meanwhile, in some cities in the state of New Hampshire vote already started.

Most public opinion polls in the United States also point to a slight Clinton advantage.

But apart from elections across the Atlantic, European investors are also interested in major European companies reports.

Shares of the French bank Credit Agricole rose 4.9% after the bank reported a rise in quarterly profit.

ArcelorMittal securities decreased by 4%. Profit of the company in the third quarter was a record since 2014, but coal prices could have a negative impact on its performance in the current quarter.

Capitalization of German postal service Deutsche Post increased by 0.6% on strong figures for the last quarter.

Securities of Vestas Wind Systems rose 1.6% after the Danish company raised annual profit forecast.

Shares of food producer Associated British Foods rose 6%. The company expects revenue and earnings to improve in the fourth quarter due to the increase in sugar prices and the positive effects of the depreciation of the pound sterling.

At the moment:

FTSE 6811.59 4.69 0.07%

DAX 10433.60 -23.35 -0.22%

CAC 4456.78 -4.43 -0.10%

-

10:22

Oil is trading flat

This morning, the New York futures for Brent rose slightly by 0.02% to $ 46.16 and WTI slightly dropped in price by 0.18% to $ 44.81 per barrel. Thus, the black gold is trading almost unchanged in anticipation of elections in the United States. Market participants consider Clinton as the candidate more predictable. Some positions Trump had on immigration and foreign policy issues are a concern for investors. At the same time, weak macroeconomic data from China put pressure on oil prices. China bought abroad 6.78 million barrels of oil in October, which is 12.9% less than in the previous month and the average daily volume this year.

-

09:40

UK manufacuring production up above expectations. The pound stable so far as we expect the US elections

This is the first quarterly estimate for Index of Production (IoP) covering data post-EU referendum. Quarterly estimate for production output decreased by 0.5% in Quarter 3 (July to Sept) 2016. The largest downward pressure came from manufacturing, which fell by 0.9%, partially offset by a rise in mining and quarrying of 4.3%.

Quarterly IoP in Gross Domestic Product preliminary estimate for Quarter 3 (July to Sept) was revised from a fall of 0.4% to a fall of 0.5%, no impact on GDP to 1 decimal place.

The monthly picture shows a decrease of 0.4% compared with August 2016. Mining and quarrying was the main sector to show a fall of 3.8%, partially offset by an increase in manufacturing of 0.6%. Users should note that we always warn against overly interpreting 1 month's figures.

The month-on-month a year ago picture shows an increase of 0.3% in September 2016 with upward increases from 3 of the 4 main sectors. The largest contribution came from water and waste management, 5.4%.

-

09:30

United Kingdom: Industrial Production (MoM), September -0.4% (forecast 0.1%)

-

09:30

United Kingdom: Industrial Production (YoY), September 0.3% (forecast 0.8%)

-

09:30

United Kingdom: Manufacturing Production (YoY), September 0.2% (forecast -0.1%)

-

09:30

United Kingdom: Manufacturing Production (MoM) , September 0.6% (forecast 0.4%)

-

09:22

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0920-25 (EUR 798m) 1.0990 (1.17bn) 1.1000 (1.25bn), 1.1050(330m) 1.1070-75 (1.13bn) 1.1100 (581mn)

USD/JPY 102.00 (251m) 102.50 (596m) 102.75 (450m) 103.00 (1.72bn), 103.25 (328m) 103.80 (285m) 104.30 (270m) 104.50, (341m), 105.00 (642m) 106.00 (1.95bn)

USD/CHF 1.0000 (USD 531m)

AUD/USD 0.7650 (244m) 0.7850 (222m)

NZD/USD 0.7120 (NZD 211m) 0.7300 (489m)

USD/CAD: 1.3500 (204m) 1.3600 (201m)

-

08:59

Major stock exchanges trading mixed: FTSE -0.1%, DAX flat, CAC40 -0.2%, FTMIB + 0.1%, IBEX flat

-

08:12

Today’s events

-

At 12:45 GMT FOMC member Charles Evans will give a speech

-

At 16:20 GMT the Bank of Canada Deputy Governor Lawrence Schembri will deliver a speech

-

At 17:00 GMT Andy Haldane of the Bank of England will deliver a speech

-

At 17:20 GMT FOMC member Charles Evans will give a speech

-

Also today, the US presidential election

-

-

07:45

France: Trade Balance, bln, September -4.8 (forecast -4.1)

-

07:36

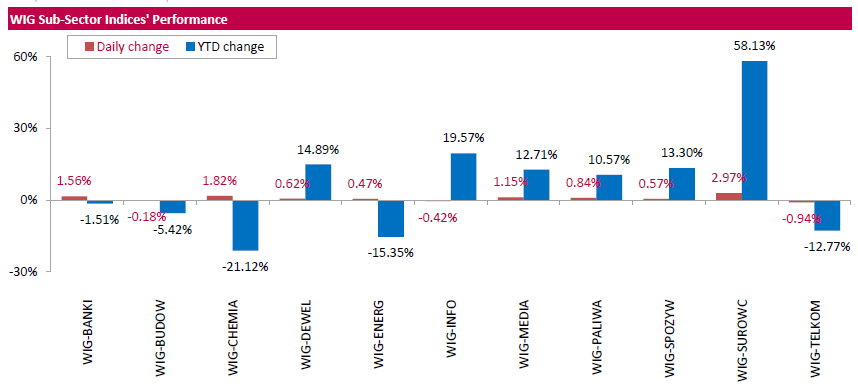

USD/JPY: targets for US Elections outcomes - NAB

"The near term direction in USD/JPY is at a cross road.

A Trump win (not our base case scenario) would put Fed hikes on the back burner and trigger a flight to safety with the JPY one of the biggest beneficiaries. This year USD/JPY has found solid support around the ¥100 mark, however under such scenario it will easily slice through this barrier. The surprise Brexit outcome saw USD/JPY trade from an intraday high of ¥106.84 to a low of ¥99.02 with the currency eventually settling 4 big figures lower relative to its previous day's close.

On a Trump victory, long term chart dynamics and recent price action suggest to us USD/JPY would likely settle around the ¥97/98 mark with an intraday low potentially a few big figures lower. Currency intervention under this scenario is also a consideration. Ahead of Brexit, Finance Minister Taro Aso warned that Japan was ready to intervene to prevent excessive yen strength, but in the event and despite the volatility and sharp currency appreciation on the day, there was no intervention. An excessive Yen appreciation will no doubt hinder Japan's already anaemic economic recovery, however unless we see a move closer to the low ¥90s, we think the MoF and BoJ will painfully sit on the sidelines.

Ten days ago - prior to the news of a fresh FBI/email probe, a Clinton win would have hauled up risk assets, sealed the deal for a December Fed hike, pushed 10y US Treasuries towards 2% and lifted USD/JPY comfortably above the ¥107 mark. With investigations into Clinton's legal affairs closed once more, then for now at least this scenario again looks conceivable".

Copyright © 2016 NAB, eFXnews™

-

07:31

Asian session review: The markets await US elections

The New Zealand dollar fell slightly in anticipation of this week's meeting of the Reserve Bank of New Zealand. Economists expect interest rate cuts. Leaders of the RBNZ made it clear that interest rates will be lowered in order to overcome the low inflation expectations and weaken the national currency. However, recent data suggest economic improvement in New Zealand. Some economists predict that the reduction in rates this week will be the last in this cycle expecting key interest rate at 1.75% from 2.00%.

A key event in the next few days will be the elections in the United States. Market participants predict Hillary Clinton victory in the presidential election and is widely perceived as a positive factor for market sentiment. If she becomes president, then investors will be able to expect a rate hike by the Federal Reserve in December. Recent public opinion polls indicate a steady but slight advantage over Trump is 3-6 percentage points. Wall Street Journal / NBC News poll published on Sunday, indicate the advantage of 4 percentage points in favor on Hillary. However, in recent weeks, Trump was closing the gap, and in the last hours both candidates continue to actively conduct election campaign.

The Australian dollar fell against on the background of the widespread strengthening of the US dollar. Also, the dynamics of the Australian currency impacted by data from Australia and China. According to the report of the National Bank of Australia, the index of confidence in business circles in Australia in October fell by 2 points from 6 to 4. NAB business confidence report - a study of current business conditions in Australia. It shows the dynamics of the Australian economy as a whole in the short term. The index of business conditions in the business sector in Australia also fell by 2 points to 6.

With regard to data from China, the trade balance rose to $ 49.06 billion in October, after rising to $ 41.99 billion a month earlier, but the figure was below economists' forecast of $ 51.80. This indicator published by the Customs General Administration of China, estimates the total ratio of exports and imports of goods and services. Exports from China in October continued to fall compared with the previous year, a decrease of 7.3%, after falling by 10.0% in September. Exports declined, albeit at a slower pace, as global demand for products from the world's second largest economy was still sluggish.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1030-50 range

GBP / USD: during the Asian session, the pair was trading in the $ 1.2385-00 range

USD / JPY: during the Asian session, the pair was trading in the Y104.25-60 range

-

07:21

Options levels on tuesday, November 8, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1198 (3787)

$1.1146 (1689)

$1.1109 (767)

Price at time of writing this review: $1.1047

Support levels (open interest**, contracts):

$1.0992 (1851)

$1.0958 (3273)

$1.0910 (3266)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 58733 contracts, with the maximum number of contracts with strike price $1,1400 (6136);

- Overall open interest on the PUT options with the expiration date December, 9 is 51736 contracts, with the maximum number of contracts with strike price $1,0900 (4566);

- The ratio of PUT/CALL was 0.88 versus 0.87 from the previous trading day according to data from November, 7

GBP/USD

Resistance levels (open interest**, contracts)

$1.2705 (1522)

$1.2608 (1234)

$1.2511 (1842)

Price at time of writing this review: $1.2414

Support levels (open interest**, contracts):

$1.2290 (3412)

$1.2193 (918)

$1.2095 (859)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 32022 contracts, with the maximum number of contracts with strike price $1,3400 (2560);

- Overall open interest on the PUT options with the expiration date December, 9 is 33983 contracts, with the maximum number of contracts with strike price $1,2300 (3412);

- The ratio of PUT/CALL was 1.06 versus 1.05 from the previous trading day according to data from November, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:13

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.2%, CAC 40 + 0.2%, FTSE + 0.1%

-

07:12

German industrial activity significantly lower in September

In September 2016, production in industry was down by 1.8% from the previous month on a price, seasonally and working day adjusted basis according to provisional data of the Federal Statistical Office (Destatis). In August 2016, the corrected figure shows an increase of 3.0% (primary +2.5%) from July 2016.

In September 2016, production in industry excluding energy and construction was down by 1.7%. Within industry, the production of capital goods decreased by 2.4% and the production of consumer goods by 1.9%.The production of intermediate goods showed a decrease by 0.5%. Energy production was down by 3.1% in September 2016 and the production in construction decreased by 1.5%.

-

07:11

German trade balance surplus declined in September

Germany exported goods to the value of 106.4 billion euros and imported goods to the value of 82.0 billion euros in September 2016. Based on provisional data, the Federal Statistical Office (Destatis) also reports that German exports increased by 0.9% and imports decreased by 1.4% in September 2016 year on year. Compared with August 2016, exports decreased by a calendar and seasonally adjusted 0.7%, and imports by 0.5%.

The foreign trade balance showed a surplus of 24.4 billion euros in September 2016. In September 2015, the surplus amounted to 22.3 billion euros. In calendar and seasonally adjusted terms, the foreign trade balance recorded a surplus of 21.3 billion euros in September 2016.

According to provisional results of the Deutsche Bundesbank, the current account of the balance of payments showed a surplus of 24.2 billion euros in September 2016, which takes into account the balances of trade in goods including supplementary trade items (+26.2 billion euros), services (-3.6 billion euros), primary income (+4.3 billion euros) and secondary income (-2.7 billion euros). In September 2015, the German current account showed a surplus of 25.8 billion euros.

-

07:02

Germany: Current Account , September 24.2

-

07:01

Germany: Trade Balance (non s.a.), bln, September 24.4

-

07:00

Germany: Industrial Production s.a. (MoM), September -1.8% (forecast -0.2%)

-

06:57

China's trade surplus rose to $49.1 billion in October

According to rttnews, China's exports declined more-than-expected in October as seen in previous months, leaving the economy to rely on domestic demand and vulnerable property investment to attain a moderate growth.

Exports decreased 7.3 percent in October from the a year ago, data from the General Administration of Customs revealed Tuesday. Shipments were forecast to drop 6 percent after a 10 percent fall in September.

Imports fell 1.4 percent annually, bigger than the expected decrease of 1 percent, but smaller than the 1.9 percent drop registered in September.

Consequently, the trade surplus rose to $49.1 billion in October from $41.99 billion in September. But the surplus was below the expected level of $51.7 billion

-

06:55

Aso: Will be watching FX market closely for US election volatility, may need to intervene in FX as response

-

06:55

Swiss unemployment rate stable at 3.2% in October

Registered unemployment in October 2016 - According to surveys conducted by the State Secretariat for Economic Affairs (SECO) were end October 2016 144'531 unemployed registered with the regional employment centers (RAV), 1,856 more than last month.

The unemployment rate remained at 3.2% in June. Compared to the previous month, unemployment increased by 3,262 persons (+ 2.3%). Youth unemployment in October 2016 Youth unemployment (15 to 24 years) decreased by 932 persons (-4.7%) to 19'095. Compared with the previous month, this represents a decrease of 715 persons (-3.6%). Job seekers in October 2016 Total 207'512.

-

06:45

Switzerland: Unemployment Rate (non s.a.), October 3.2% (forecast 3.2%)

-

05:16

Japan: Leading Economic Index , September 100.5 (forecast 100.5)

-

05:16

Japan: Coincident Index, September 112.1

-

02:40

China: Trade Balance, bln, October 49.6 (forecast 51.7)

-

00:30

Australia: National Australia Bank's Business Confidence, October 4

-