Market news

-

23:29

Stocks. Daily history for Nov 08’2016:

(index / closing price / change items /% change)

Nikkei 225 17,171.38 -5.83 -0.03%

Shanghai Composite 3,148.02 +14.69 +0.47%

S&P/ASX 200 5,257.79 0.00 0.00%

FTSE 100 6,843.13 +36.23 +0.53%

CAC 40 4,476.89 +15.68 +0.35%

Xetra DAX 10,482.32 +25.37 +0.24%

S&P 500 2,139.56 +8.04 +0.38%

Dow Jones Industrial Average 18,332.74 +73.14 +0.40%

S&P/TSX Composite 14,656.84 +4.39 +0.03%

-

21:06

Major US stock indexes finished trading in positive territory

Major US stock indexes rose modestly on Tuesday amid the election of the next President of the United States, who are today.

According to the final survey of Reuters / Ipsos States Americans, Clinton has a 90 percent chance to win the Republican candidate Donald Trump.

Many investors believe that the victory of Clinton shares will rise in the next few sessions, while due to the uncertainty of policy proposals Trump risky assets immediately after his victory will go down. Investors also pointed out that the medium and long term impact of winning each of the candidates on the economy remains unclear.

In addition, an overview of vacancies and labor turnover (JOLTS), published by the US Bureau of Labor Statistics, showed that was revised up to 5.453 million. To 5.443 million in September, the number of vacancies has increased to 5.486 million. The figure for August. Analysts had expected the number of vacancies will rise to 5.508 million. vacancy rate was 3.7% against 3.6% in August. The number of jobs has changed little in the private sector and the government sector. The number of vacancies is also slightly changed in all sectors and regions. At the same time, it became known that hiring amounted to 5.081 million. Against 5.268 million. In August. hiring rate fell in September to 3.5 percent from 3.6 percent in August. Hiring has not changed in the private sector and the government sector.

DOW index components are mainly grown (26 plus against minus 4). More rest up shares The Travelers Companies, Inc. (TRV, + 2.56%). Outsider were shares of Pfizer Inc. (PFE, -0.86%).

All business sectors S & P index closed in positive territory. The leader turned out to be the sector of consumer goods (+ 1.2%).

At the close:

Dow + 0.40% 18,332.16 +72.56

Nasdaq + 0.53% 5,193.49 +27.32

S & P + 0.38% 2,139.53 +8.01

-

20:00

DJIA +0.37% 18,327.36 +67.76 Nasdaq +0.43% 5,188.63 +22.46 S&P +0.29% 2,137.76 +6.24

-

17:00

European stocks closed: FTSE 100 +36.23 6843.13 +0.53% DAX +25.37 10482.32 +0.24% CAC 40 +15.68 4476.89 +0.35%

-

16:44

WSE: Session Results

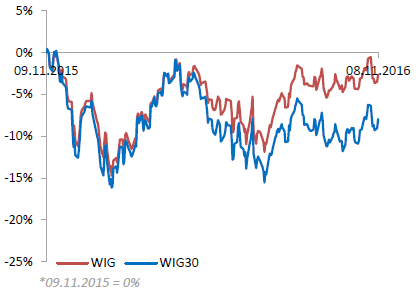

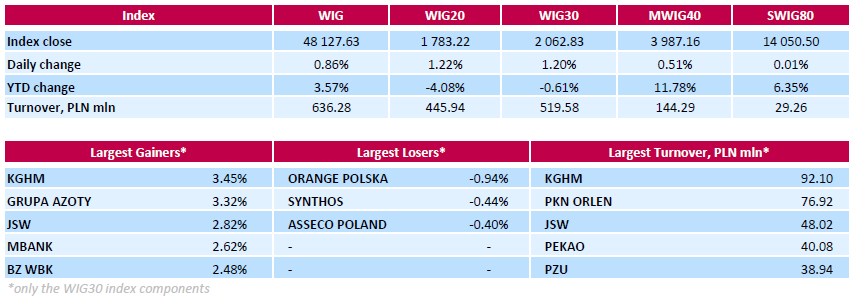

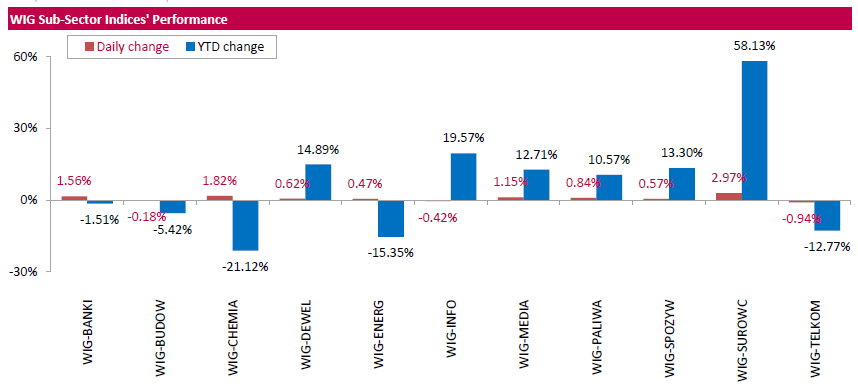

Polish equity market closed higher on Tuesday. The broad market measure, the WIG Index, surged by 0.86%. The WIG sub-sector indices were mainly higher with materials (+2.97%) outperforming.

The large-cap stocks advanced 1.20%, as measured by the WIG30 Index. Almost all Index components returned gains. Copper producer KGHM (WSE: KGH) and chemical producer GRUPA AZOTY (WSE: ATT) led the outperformers, climbing by a respective 3.45% and 3.32%. Both companies are set to post their Q3 financials tomorrow (November 9). The former will reveal its quarterly results after the market close, while the latter will post its earnings before market opens. Among other major gainers were coking coal miner JSW (WSE: JSW), property developer GTC (WSE: GTC) and two banking sector names BZ WBK (WSE: BZW) and MBANK (WSE: MBK), which added between 2.42% and 2.82%. At the same time, telecommunication services provider ORANGE POLSKA (WSE: OPL), chemical producer SYNTHOS (WSE: SNS) and IT-company ASSECO POLAND (WSE: ACP) were the only decliners, falling by 0.94%, 0.44% and 0.4% respectively.

-

16:03

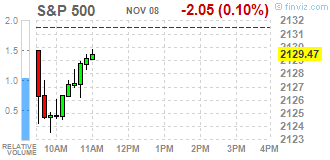

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed in cautious trading on Tuesday morning as Americans headed to elect their next president, with the odds currently favoring Democrat nominee Hillary Clinton. Clinton has a 90% chance of defeating Republican nominee Donald Trump, according to the final Reuters/Ipsos States of the Nation poll released on Monday.

Dow stocks mixed (15 vs 15). Top gainer - The Procter & Gamble Company (PG, +0.80%). Top loser - International Business Machines Corporation (IBM, -1.22%).

Most of S&P sectors in negative area. Top gainer - Consumer goods (+0.4%). Top loser - Healthcare (-0.7%).

At the moment:

Dow 18192.00 0.00 0.00%

S&P 500 2125.50 -3.50 -0.16%

Nasdaq 100 4768.75 -7.00 -0.15%

Oil 45.18 +0.29 +0.65%

Gold 1284.90 +5.50 +0.43%

U.S. 10yr 1.83 +0.00

-

14:35

U.S. Stocks open: Dow -0.21%, Nasdaq -0.24%, S&P -0.28%

-

14:29

Before the bell: S&P futures -0.25%, NASDAQ futures -0.22%

U.S. stock-index futures declined as voters head to the polls to choose a new president.

Global Stocks:

Nikkei 17,171.38 -5.83 -0.03%

Hang Seng 22,909.47 +108.07 +0.47%

Shanghai 3,148.02 +14.69 +0.47%

FTSE 6,807.43 +0.53 +0.01%

CAC 4,453.73 -7.48 -0.17%

DAX 10,439.62 -17.33 -0.17%

Crude $44.80 (-0.20%)

Gold $1,280.40 (+0.08%)

-

13:57

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

24.78

-0.30(-1.1962%)

30235

Amazon.com Inc., NASDAQ

AMZN

782.6

-2.33(-0.2968%)

12294

AT&T Inc

T

36.67

-0.14(-0.3803%)

12982

Barrick Gold Corporation, NYSE

ABX

17.31

-0.04(-0.2306%)

67213

Chevron Corp

CVX

106.32

-0.53(-0.496%)

100

Cisco Systems Inc

CSCO

30.9

-0.04(-0.1293%)

961

Citigroup Inc., NYSE

C

49.5

-0.32(-0.6423%)

64910

Exxon Mobil Corp

XOM

84.6

-0.10(-0.1181%)

18607

Ford Motor Co.

F

11.5

-0.08(-0.6908%)

28947

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.25

-0.04(-0.3543%)

40070

General Electric Co

GE

29.23

-0.08(-0.2729%)

3016

General Motors Company, NYSE

GM

31.96

-0.06(-0.1874%)

331

Goldman Sachs

GS

180.13

-1.35(-0.7439%)

5182

Home Depot Inc

HD

123.85

0.10(0.0808%)

2268

Intel Corp

INTC

34.66

-0.03(-0.0865%)

5641

International Business Machines Co...

IBM

154.5

0.18(0.1166%)

1127

JPMorgan Chase and Co

JPM

69.64

-0.24(-0.3434%)

7430

Microsoft Corp

MSFT

60.47

0.05(0.0828%)

11823

Nike

NKE

50.7

-0.21(-0.4125%)

1908

Pfizer Inc

PFE

30.18

0.10(0.3324%)

3327

Procter & Gamble Co

PG

86.71

0.15(0.1733%)

360

Starbucks Corporation, NASDAQ

SBUX

54.4

-0.09(-0.1652%)

11358

Tesla Motors, Inc., NASDAQ

TSLA

193.39

0.18(0.0932%)

6796

Twitter, Inc., NYSE

TWTR

18.35

-0.06(-0.3259%)

47730

UnitedHealth Group Inc

UNH

141.11

-0.82(-0.5777%)

2115

Walt Disney Co

DIS

94.25

-0.18(-0.1906%)

2251

Yahoo! Inc., NASDAQ

YHOO

41.15

0.10(0.2436%)

100

Yandex N.V., NASDAQ

YNDX

18.81

0.16(0.8579%)

225

-

13:54

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Goldman Sachs (GS) downgraded to Neutral from Buy at Citigroup

Bank of America (BAC) downgraded to Hold from Buy at Deutsche Bank

AT&T (T) downgraded to Perform from Outperform at Oppenheimer

Other:

-

12:43

Bank of America reduces ArcelorMittal stock rating to "neutral" from "buy"

-

11:46

Major stock indices in Europe trading mixed

Stock indexes in Western Europe not changed significantly in anticipation of the US presidential election results.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0.08% to 334.11 points.

Polling stations in most of the Eastern United States will open at 12:00 GMT.

Meanwhile, in some cities in the state of New Hampshire vote already started.

Most public opinion polls in the United States also point to a slight Clinton advantage.

But apart from elections across the Atlantic, European investors are also interested in major European companies reports.

Shares of the French bank Credit Agricole rose 4.9% after the bank reported a rise in quarterly profit.

ArcelorMittal securities decreased by 4%. Profit of the company in the third quarter was a record since 2014, but coal prices could have a negative impact on its performance in the current quarter.

Capitalization of German postal service Deutsche Post increased by 0.6% on strong figures for the last quarter.

Securities of Vestas Wind Systems rose 1.6% after the Danish company raised annual profit forecast.

Shares of food producer Associated British Foods rose 6%. The company expects revenue and earnings to improve in the fourth quarter due to the increase in sugar prices and the positive effects of the depreciation of the pound sterling.

At the moment:

FTSE 6811.59 4.69 0.07%

DAX 10433.60 -23.35 -0.22%

CAC 4456.78 -4.43 -0.10%

-

08:59

Major stock exchanges trading mixed: FTSE -0.1%, DAX flat, CAC40 -0.2%, FTMIB + 0.1%, IBEX flat

-

07:13

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.2%, CAC 40 + 0.2%, FTSE + 0.1%

-