Market news

-

23:29

Stocks. Daily history for Nov 09’2016:

(index / closing price / change items /% change)

Nikkei 225 16,251.54 -919.84 -5.36%

Shanghai Composite 3,128.77 -19.12 -0.61%

S&P/ASX 200 5,156.56 0.00 0.00%

FTSE 100 6,911.84 +68.71 +1.00%

CAC 40 4,543.48 +66.59 +1.49%

Xetra DAX 10,646.01 +163.69 +1.56%

S&P 500 2,163.26 +23.70 +1.11%

Dow Jones Industrial Average 18,589.69 +256.95 +1.40%

S&P/TSX Composite 14,759.91 +103.07 +0.70%

-

21:07

Major US stock indexes finished trading in the green zone

Major US stock indexes rose on Wednesday, offset by large losses overnight, fed by the US elections. Positive market growth has made sectors that are willing to benefit from the presidency of Donald Trump.

For markets Trump victory was quite unexpected, since the race was considered the favorite, Hillary Clinton, seen as more predictable candidate. Trump position in matters of foreign policy, trade and immigration, on the contrary, is a source of concern for the markets. In his victory speech Trump promised to improve the state of the American economy and seek dialogue and partnership with other countries.

In addition, as it became known in the US wholesale inventories in September rose slightly less than previously reported. As reported on Wednesday, the Ministry of Commerce, inventories rose by 0.1% during the month. The monthly report of the Ministry of economic indicators, published last month, estimated that wholesale inventories rose 0.2% in September, as well as economists forecast.

Oil has moved into positive territory after earlier fallen by almost 4% in response to the unexpected results of the elections in the United States. The market has a gradual improvement in investor sentiment, as well as mixed data on US petroleum inventories. Analysts said although Trump victory strengthened concern about the future of economic growth and demand for oil, there is also support oil factors, such as potential changes in US policy toward Iran. US Department of Energy reported that crude oil inventories rose more than expected, but decreased stocks of gasoline and distillates. According to the report, during the week of October 29 November 4, oil stocks rose 2.4 million barrels to 485 million barrels. Analysts had expected an increase by only 1.33 million barrels.

Most DOW components of the index closed in positive territory (20 of 30). Most remaining shares rose Pfizer Inc. (PFE, + 8.58%). Outsider were shares of The Procter & Gamble Company (PG, -1.66%).

Most of the S & P sectors recorded increase. The leader turned out to be the health sector (+ 3.9%). Most utilities sector fell (-3.0%).

At the close:

Dow + 1.40% 18,588.90 +256.16

Nasdaq + 1.11% 5,251.07 +57.58

S & P + 1.11% 2,163.25 +23.69

-

19:59

DJIA +1.48% 18,604.07 +271.33 Nasdaq +0.86% 5,238.24 +44.75 S&P +1.15% 2,164.19 +24.63

-

17:52

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Wednesday, rebounding from stunning overnight losses fueled by the U.S. election as sectors that appeared poised to benefit from a Donald Trump presidency led the charge. After tremendous losses in the overnight session, the Dow and S&P 500 briefly turned positive shortly after the open. Strong gains in the heavily weighted healthcare sector and financials kept the market within striking distance of the unchanged level.

Most of Dow stocks in positive area (19 of 30). Top gainer - Pfizer Inc. (PFE, +0.80%). Top loser - UnitedHealth Group Incorporated (UNH, -2.12%).

Most of S&P sectors also in positive area. Top gainer - Healthcare (+3.2%). Top loser - Utilities (-2.4%).

At the moment:

Dow 18441.00 +156.00 +0.85%

S&P 500 2151.50 +16.00 +0.75%

Nasdaq 100 4807.25 +5.00 +0.10%

Oil 45.55 +0.57 +1.27%

Gold 1278.10 +3.60 +0.28%

U.S. 10yr 2.02 +0.16

-

17:00

European stocks closed: FTSE 100 +68.71 6911.84 +1.00% DAX +163.69 10646.01 +1.56% CAC 40 +66.59 4543.48 +1.49%

-

16:36

WSE: Session Results

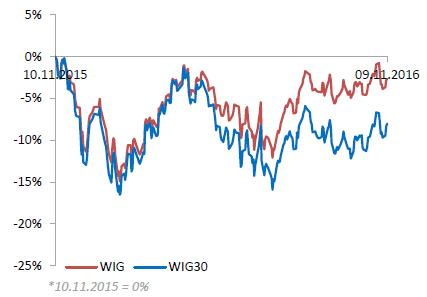

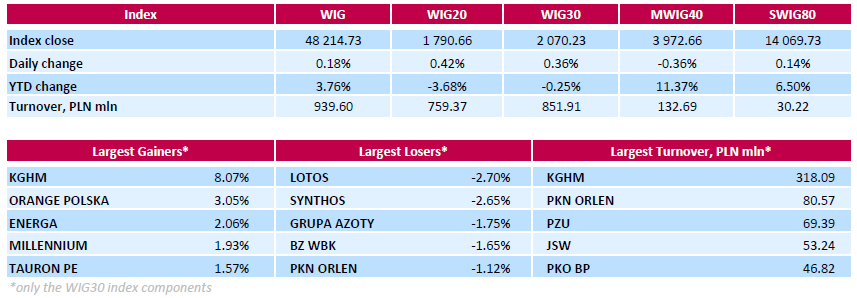

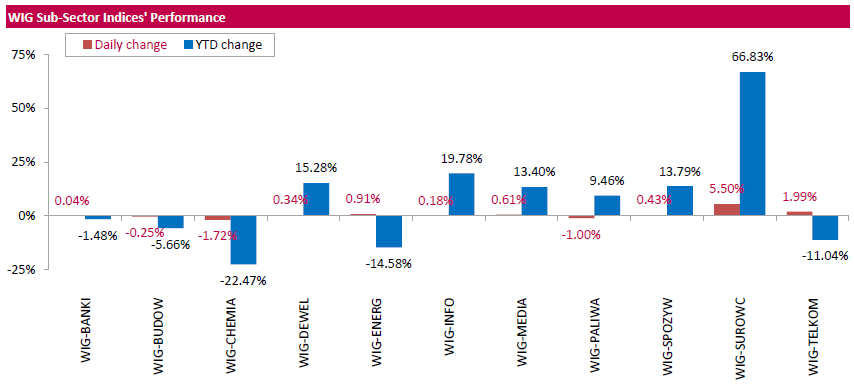

Polish equity market closed higher on Friday. The broad market measure, the WIG Index, added 0.18%. The WIG sub-sector indices were mainly higher with materials (+5.50%) outperforming.

The large-cap stocks' measure, the WIG30 index, surged b y0.36%, helped by a significant gain by copper producer KGHM (WSE: KGH). The stock climbed by 8.07% as copper prices rose to a fresh one-year high, following a victory for Donald Trump as investors expect that his presidency would stimulate the U.S. economy. Other major advancers were telecommunication services provider ORANGE POLSKA (WSE: OPL), genco ENERGA (WSE: ENG) and bank MILLENNIUM (WSE: MIL), advancing 3.05%, 2.06% and 1.93% respectively. On the country, oil refiner LOTOS (WSE: LTS) and were two chemical producers GRUPA AZOTY (WSE: ATT) and SYNTHOS (WSE: SNS) were the biggest decliners, tumbling by 2.7%, 2.65% and 1.75% respectively.

-

14:58

American Airlines Group predicts a decline in revenue by 0.5% -2.5% in the 4th quarter

-

14:45

WSE: After start on Wall Street

The market on Wall Street began boldly and Americans completely ignore the result of the elections, starting with trade from the reference level. In the coming hours we will see whether this American optimism is not a little exaggerated and did not find serious mistake buyers at current prices. This improvement in the condition of US markets and the return of the DAX at the daily maxima translates into better posture of the Warsaw Stock Exchange. Markets seem to come back from a long trip and a positive final session in Warsaw seems to be possible. However, there is no doubt, that final hour in Warsaw should pass on correlation with Wall Street and the Warsaw market seems to be sentenced to track each step, which will perform US indices.

-

14:33

U.S. Stocks open: Dow +0.33%, Nasdaq -0.13%, S&P +0.03%

-

14:27

Before the bell: S&P futures -1.15%, NASDAQ futures -1.59%

U.S. stock-index futures trimmed more than two-thirds of their declines spurred by Donald Trump's surprise presidential election win, as speculation the Republican will pursue business-friendly policies offset some of the broader uncertainty surrounding his ascent.

Global Stocks:

Nikkei 16,251.54 -919.84 -5.36%

Hang Seng 22,415.19 -494.28 -2.16%

Shanghai 3,128.77 -19.12 -0.61%

FTSE 6,856.40 +13.27 +0.19%

CAC 4,454.89 -22.00 -0.49%

DAX 10,427.32 -55.00 -0.52%

Crude $44.69 (-0.64%)

Gold $1,303.10 (+2.24%)

-

13:50

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

166.01

-5.02(-2.9352%)

22390

ALCOA INC.

AA

26.62

0.22(0.8333%)

16206

Amazon.com Inc., NASDAQ

AMZN

763.5

-24.25(-3.0784%)

247053

American Express Co

AXP

66.5

-0.57(-0.8499%)

25152

AMERICAN INTERNATIONAL GROUP

AIG

59.01

-0.49(-0.8235%)

7046

Apple Inc.

AAPL

110.2

-0.86(-0.7744%)

1314012

AT&T Inc

T

37

0.01(0.027%)

298364

Barrick Gold Corporation, NYSE

ABX

17.95

0.80(4.6647%)

371651

Boeing Co

BA

142.68

0.48(0.3375%)

47542

Caterpillar Inc

CAT

87.25

2.57(3.035%)

140307

Chevron Corp

CVX

106

-1.29(-1.2023%)

22537

Cisco Systems Inc

CSCO

30.75

-0.25(-0.8065%)

254121

Citigroup Inc., NYSE

C

49.75

-0.16(-0.3206%)

728466

Deere & Company, NYSE

DE

89.92

0.93(1.0451%)

4980

E. I. du Pont de Nemours and Co

DD

65.51

-3.75(-5.4144%)

17125

Exxon Mobil Corp

XOM

83.63

-1.68(-1.9693%)

33043

Facebook, Inc.

FB

121.81

-2.41(-1.9401%)

885028

FedEx Corporation, NYSE

FDX

178.84

-2.47(-1.3623%)

4430

Ford Motor Co.

F

11.08

-0.40(-3.4843%)

392154

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.78

0.69(5.7072%)

829064

General Electric Co

GE

29

-0.42(-1.4276%)

151656

General Motors Company, NYSE

GM

30.6

-1.13(-3.5613%)

197877

Goldman Sachs

GS

183.43

1.51(0.83%)

71130

Google Inc.

GOOG

775

-15.51(-1.962%)

32214

Hewlett-Packard Co.

HPQ

15.09

-0.19(-1.2435%)

3935

Home Depot Inc

HD

122.5

-1.75(-1.4085%)

20825

HONEYWELL INTERNATIONAL INC.

HON

110.48

-0.14(-0.1266%)

728

Intel Corp

INTC

33.92

-0.82(-2.3604%)

131013

International Business Machines Co...

IBM

153.17

-2.00(-1.2889%)

27728

International Paper Company

IP

44.01

-0.74(-1.6536%)

464

Johnson & Johnson

JNJ

117.8

0.75(0.6408%)

39855

JPMorgan Chase and Co

JPM

70.26

0.23(0.3284%)

236064

McDonald's Corp

MCD

110.75

-3.36(-2.9445%)

17240

Merck & Co Inc

MRK

62.8

2.29(3.7845%)

48872

Microsoft Corp

MSFT

59.89

-0.58(-0.9592%)

334741

Nike

NKE

50

-1.08(-2.1143%)

34899

Pfizer Inc

PFE

32.85

2.85(9.50%)

1422583

Procter & Gamble Co

PG

85.76

-1.70(-1.9437%)

24691

Tesla Motors, Inc., NASDAQ

TSLA

188.5

-6.44(-3.3036%)

154886

The Coca-Cola Co

KO

41.81

-1.07(-2.4953%)

30855

Travelers Companies Inc

TRV

102

-6.01(-5.5643%)

16458

Twitter, Inc., NYSE

TWTR

18.03

-0.35(-1.9042%)

298996

United Technologies Corp

UTX

101

-2.37(-2.2927%)

14772

UnitedHealth Group Inc

UNH

139.1

-3.80(-2.6592%)

33026

Verizon Communications Inc

VZ

47.25

-0.40(-0.8395%)

56801

Visa

V

81.5

-1.38(-1.6651%)

32998

Wal-Mart Stores Inc

WMT

68.55

-1.24(-1.7768%)

22999

Walt Disney Co

DIS

92.41

-1.97(-2.0873%)

50806

Yahoo! Inc., NASDAQ

YHOO

40.45

-0.71(-1.725%)

53936

Yandex N.V., NASDAQ

YNDX

19

0.26(1.3874%)

6670

-

13:44

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

JPMorgan Chase (JPM) downgraded to Neutral from Outperform at Robert W. Baird; target $72

Other:

-

12:03

WSE: Mid session comment

The first half of today's trading ends for the WIG20 close to 1,764 points. The fall of the morning have not been compensated but the index rebounded strongly enough that we may talk about relatively low withdrawal vs. concern of the election results in the US. All the time important is the attitude of the core markets, which work out losses. The German DAX lost more than 1 percent, and Eurodollar gaining 0.7 percent. USDPLN pair is already in equilibrium. Now a key role should play investors from the USA, who will appear on the exchanges. The decline of the contract for the S&P500 by over 2 percent points that the mood on Wall Street are still nervous and we have to wait for the launch of the end of the panic in the markets. Decline in futures on US indices will inhibit further bulls appetites in Europe and actually force exchanges in the region to wait for the beginning of the session on Wall Street.

-

11:56

Major stock indices in Europe recover after strong losses

Stock indices in Western Europe are down due to concerns following the election of Donald Trump as the new US president.

Markets expected Hillary Clinton's victory, which tend to be viewed as more predictable. Trump's position in matters of foreign policy, trade and immigration, on the contrary, is a source of concern for the markets.

Shortly before the opening of the European session Trump delivered the victory speech, pledging to improve the condition of the American economy and seek dialogue and partnership with other countries.

Experts note that the promises to increase import duties on the goods in the United States and to review foreign trade agreements will adversely affect the world trade volume.

As a result, shares of European companies that receive most of the revenue abroad dropped.

The composite index of the largest companies in the region Stoxx Europe 600 fell 0,7% - to 332.58 points.

Before the opening futures on European indices fell by 4%.

The health sector has increased due to the reduction of risk for the US pricing practices with a Trump victory.

The value BBVA and Banco Santander, that have substantial portfolio of assets in developing countries fell by 6.2% and 2% respectively.

Credit Suisse which receives nearly two-thirds of revenue in the US, is down 1.3%.

Daimler fell by 3,4%, Volkswagen - by 3.5%.

On fears of decline in international traffic share of the Danish carrier Moeller-Maersk fell 3.4%.

Meanwhile, securities of gold mining company Randgold Resources soared 6.4% after the increase in the price of gold because of the high demand for safe assets.

At the moment:

FTSE 6817.58 -25.55 -0.37%

DAX 10354.94 -127.38 -1.22%

CAC 4421.71 -55.18 -1.23%

-

09:03

Major stock markets trading lower: FTSE -2.1%, FT 250 -2.1%, DAX -1.8%, IBEX -3.8%, FTMIB -2.4%

-

08:18

WSE: After opening

WIG20 index opened at 1761.64 points (-1.21%)*

WIG 47208.30 -1.91%

WIG30 2021.83 -1.99%

mWIG40 3892.99 -2.36%

*/ - change to previous close

The beginning on the Warsaw Stock Exchange falls under the sign about 2% revaluation, which is still far smaller dimension of punishment than in core markets.

As expected, Europe began the day of declines. Is calmer now on currencies, where EURUSD uplift was reduced to 1 percent. Also, drop the USDPLN pair is the shadow of the previous strengthening. Markets seem to take a little calmer approach to the confusion caused win. From the point of view of the WIG20 index chart, the fall is not so serious.

-

07:27

WSE: Before opening

After nearly two weeks of waiting and positioning under the results of the presidential elections in the US markets can face the truth.

At the moment, Trump won a vote of 264 to 215. In the markets, of course, panic and disbelief of those who swore that 2 black swans (first Brexit) in such a short period of time is unrealistic.

The result is a supply in markets. Contracts on the S&P500 falling by more than 3 percent, the Nikkei lost more than 5 percent. Weakening dollar. The currency pair EURUSD rising by 1.5 percent. The effects may be seen also in the zloty pairs, where USDPLN decreasing by 1.2 percent, and the EURPLN rising by 0.4 percent. The same promises a quite large discount on the Warsaw market, which will replicate the movements of the underlying markets.

-

05:49

Global Stocks

European stocks concluded a choppy trading session in positive territory on Tuesday, as investors awaited the outcome of the U.S. presidential election. A win for Democratic nominee Clinton is overall favored by the financial markets as it presents the possibility of more stability for markets compared with a victory for her opponent, Republican nominee Donald Trump.

U.S. stocks came off session highs but ended with gains Tuesday as Americans cast their votes in a historic presidential election. Although official results won't be seen for hours, Wall Street appears to be betting on a Hillary Clinton victory.

Asian equity markets tumbled Wednesday, as investors reacted to the increasing likelihood that Republican candidate Donald Trump will become the next U.S. president.

-