Market news

-

23:28

Stocks. Daily history for Nov 10’2016:

(index / closing price / change items /% change)

Nikkei 225 17,344.42 +1,092.88 +6.72%

Shanghai Composite 3,170.92 +42.55 +1.36%

S&P/ASX 200 5,328.84 0.00 0.00%

FTSE 100 6,827.98 -83.86 -1.21%

CAC 40 4,530.95 -12.53 -0.28%

Xetra DAX 10,630.12 -15.89 -0.15%

S&P 500 2,167.48 +4.22 +0.20%

Dow Jones Industrial Average 18,807.88 +218.19 +1.17%

S&P/TSX Composite 14,744.25 -15.66 -0.11%

-

21:06

Major US stock indexes finished trading in different directions

Dow Jones Industrial Average index hit a record intraday high on Thursday, as investors believe that the President-elect Donald Trump will move away from austerity policies. At the same time, Nasdaq fell amid falling heavyweights Apple and Amazon, as investors poured money into other sectors that may benefit from the victory of Donald Trump on the US elections.

In addition, as reported by the Ministry of Labour, the number of Americans who applied for unemployment benefits fell more than expected last week, underscoring the resilience of the labor market. Primary applications for state unemployment benefits fell by 11,000 and reached a seasonally adjusted 254,000 for the week ended November 5. It was the 88th week in a row, when the primary circulation remained below 300,000 - the threshold associated with a healthy labor market. This is the longest period since 1970. Economists forecast that initial applications for benefits will amount to 260,000 unemployment.

Oil prices fell about 1.5 percent, as markets have recovered from the shock of winning Trump in the elections, and again focused on the global oversupply. Analysts say that the oil market is still facing a glut that has kept prices under pressure for most of the past two years. The Organization of Petroleum Exporting Countries (OPEC) meeting in Vienna on November 30 to hold talks on the reduction of oil production. Perhaps OPEC will try to establish cooperation with countries that are not OPEC members, but there are doubts whether they can reach an agreement.

Most DOW components of the index closed in positive territory (19 of 30). More rest up shares JPMorgan Chase & Co. (JPM, + 4.67%). Outsider were shares of The Procter & Gamble Company (PG, -3.75%).

Sector S & P Index showed mixed trends. The leader turned out to be the industrial goods sector (+ 2.0%). Most consumer goods sector fell (-2.9%).

At the close:

Dow + 1.18% 18,808.29 +218.60

Nasdaq -0.80% 5,208.80 -42.27

S & P + 0.20% 2,167.51 +4.25

-

20:00

DJIA +1.37% 18,845.13 +255.44 Nasdaq -0.47% 5,226.36 -24.71 S&P +0.39% 2,171.77 +8.51

-

17:04

Wall Street. Major U.S. stock-indexes mixed

Major U.S. stock-indexes mixed. Dow Jones industrial average hit a record intraday high on Thursday as investors bet that President-elect Donald Trump would lead a shift away from austerity policies. The Nasdaq lost ground sharply in late morning trade on Thursday, dragged down by market heavyweights Apple and Amazon, as investors poured money into others sectors that may benefit from Donald Trump's victory in the U.S. election.

Most of Dow stocks in positive area (19 of 30). Top gainer - Pfizer Inc. (PFE, +4.39%). Top loser - The Procter & Gamble Company (PG, -3.81%).

S&P sectors mixed. Top gainer - Industrial goods (+1.8%). Top loser - Consumer goods (-2.7%).

At the moment:

Dow 18671.00 +139.00 +0.75%

S&P 500 2159.25 -1.00 -0.05%

Nasdaq 100 4727.50 -93.00 -1.93%

Oil 44.67 -0.60 -1.33%

Gold 1262.20 -11.30 -0.89%

U.S. 10yr 2.08 +0.00

-

17:00

European stocks closed: FTSE 100 -83.86 6827.98 -1.21% DAX -15.89 10630.12 -0.15% CAC 40 -12.53 4530.95 -0.28%

-

16:50

WSE: Session Results

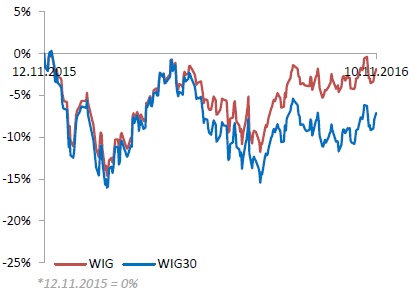

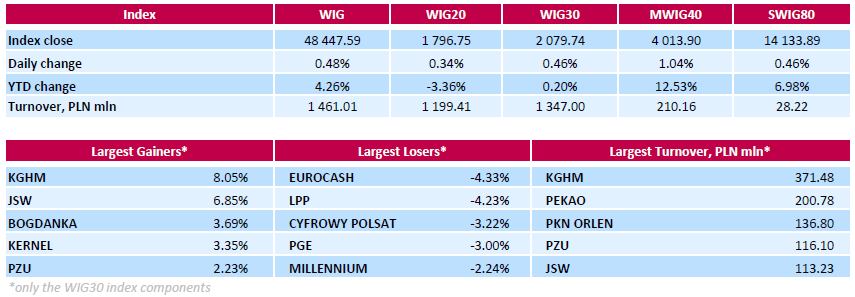

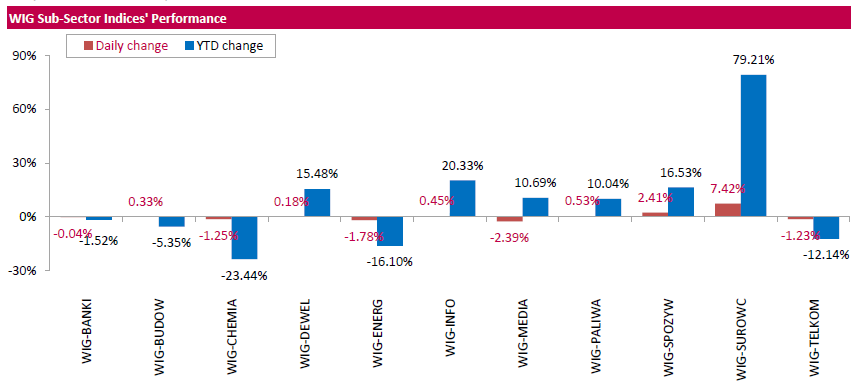

Polish equity market closed higher on Thursday. The broad market measure, the WIG index, added 0.48%. Sector-wise, materials (+7.42%) fared the best, while media (-2.39%) posted the worst result.

The large-cap stocks' measure, the WIG30 Index, advanced 0.46%. Copper producer KGHM (WSE: KGH) kept its position as a growth leader among the large-cap stocks, gaining a further 8.05%, helped by growing copper prices and better-than-expected Q3 earnings results. The company reported almost ten-fold y/y rise in Q3 net profit to PLN 329 mln, while analysts had forecast income of PLN 243.3 mln. It was followed by coking coal miner JSW (WSE: JSW) and thermal coal producer BOGDANKA (WSE: LWB), which jumped by 6.85% and 3.69%. JSW posted mixed Q3 results, as its revenues of PLN 1.67 bln exceeded analysts' expectation of PLN 1.591 bln, but its net loss of PLN 139 mln was bigger than a PLN 12.4 mln loss expected by analysts. However, in 9-month period, the company managed to cut its losses by 54% y/y to PLN 288.2 mln. BOGDANKA revealed Q3revenues of PLN 465.4 mln (-4% y/y) versus analysts forecast of PLN 438.1 mln and Q3 net income of PLN 45.2 mln (-20% y/y) versus analysts' forecast of PLN 42.2 mln. At the same time, the session's weakest name was FMCG-wholesaler EUROCASH (WSE: EUR), which lost 4.33% on the back of weaker than forecast Q3 bottom-line result. The company announced its net profit stood at PLN 58.7 mln (-16% y/y) in Q3, while analysts had expected PLN 72.5 mln. Other largest laggards were clothing retailer LPP (WSE: LPP), media group CYFROWY POLSAT (WSE: CPS) and genco PGE (WSE: PGE), dropping by 4.23%, 3.22% and 3% respectively.

-

14:56

WSE: After start on Wall Street

Consecutive hours of today's trading did not produce the development of the morning move. Indexes began to consolidate, and in the environment can be seen even the departure, which is a reflection from the resistance level (the German DAX) or problems over it (French CAC40). It seems that it returns slowly rational view that winning Trump does not raise a sudden global growth.

The market in the US began with a rise of 0.35%, which in the case of index DJIA is setting new historical highs

An hour before the close of trading WIG20 index was at 1,817 points (+1.51%).

-

14:35

U.S. Stocks open: Dow +0.53%, Nasdaq +0.55%, S&P +0.41%

-

14:28

Before the bell: S&P futures +0.42%, NASDAQ futures +0.53%

U.S. stock-index futures advanced as investors continued to speculate Donald Trump's policies will benefit businesses.

Global Stocks:

Nikkei 17,344.42 +1,092.88 +6.72%

Hang Seng 22,839.11 +423.92 +1.89%

Shanghai 3,170.92 +42.55 +1.36%

FTSE 6,896.12 -15.72 -0.23%

CAC 4,567.19 +23.71 +0.52%

DAX 10,686.35 +40.34 +0.38%

Gold $1,275.90 (+0.19%)

Crude $44.94 (-0.73%)

-

13:58

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

63.95

-0.09(-0.1405%)

5765

American Express Co

AXP

69.3

0.56(0.8147%)

2957

AMERICAN INTERNATIONAL GROUP

AIG

61.56

0.63(1.034%)

550

Apple Inc.

AAPL

110.95

0.07(0.0631%)

231756

AT&T Inc

T

37.57

0.13(0.3472%)

9665

Barrick Gold Corporation, NYSE

ABX

17.21

-0.04(-0.2319%)

134484

Boeing Co

BA

146.6

1.51(1.0407%)

1624

Caterpillar Inc

CAT

91.9

0.70(0.7675%)

35832

Chevron Corp

CVX

108.25

0.61(0.5667%)

1069

Cisco Systems Inc

CSCO

31.5

0.14(0.4464%)

3103

Citigroup Inc., NYSE

C

52.2

0.61(1.1824%)

162386

Facebook, Inc.

FB

124.04

0.86(0.6982%)

137916

Ford Motor Co.

F

11.62

0.04(0.3454%)

15230

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.75

0.68(5.2028%)

739025

General Electric Co

GE

29.82

0.19(0.6412%)

25595

General Motors Company, NYSE

GM

31.1

0.14(0.4522%)

63983

Goldman Sachs

GS

194.58

1.95(1.0123%)

40207

Google Inc.

GOOG

791.4

6.09(0.7755%)

7484

International Business Machines Co...

IBM

157.49

2.68(1.7312%)

12198

JPMorgan Chase and Co

JPM

74.05

0.80(1.0922%)

77386

McDonald's Corp

MCD

115.22

0.24(0.2087%)

585

Merck & Co Inc

MRK

64.8

0.62(0.966%)

10375

Microsoft Corp

MSFT

60.4

0.23(0.3823%)

11222

Procter & Gamble Co

PG

86.14

0.21(0.2444%)

760

Tesla Motors, Inc., NASDAQ

TSLA

191.64

1.58(0.8313%)

30891

The Coca-Cola Co

KO

42.34

0.07(0.1656%)

13245

Travelers Companies Inc

TRV

107.03

0.09(0.0842%)

254

Twitter, Inc., NYSE

TWTR

18.89

-0.24(-1.2546%)

290552

United Technologies Corp

UTX

104.67

-0.14(-0.1336%)

2009

Verizon Communications Inc

VZ

48.14

0.28(0.585%)

3183

Visa

V

83.66

0.42(0.5046%)

1700

Wal-Mart Stores Inc

WMT

71.69

0.59(0.8298%)

2724

Walt Disney Co

DIS

95.02

0.38(0.4015%)

5724

Yahoo! Inc., NASDAQ

YHOO

41.77

0.56(1.3589%)

17750

Yandex N.V., NASDAQ

YNDX

20.06

0.03(0.1498%)

3700

-

13:56

Upgrades and downgrades before the market open

Upgrades:

IBM (IBM) upgraded to Buy from Neutral at BofA/Merrill

Microsoft (MSFT) upgraded to Neutral from Underweight at Atlantic Equities

Downgrades:

Other:

-

12:01

WSE: Mid session comment

The first half of today's trading has allowed to develop the scale of increases and brought a high level of activity and not only on the values of KGHM. In the segment of blue chips the turnover counter achieved the PLN 545 million, and for the overall market almost PLN 700 million. This amount is worthy of respect, especially as the recent standards of the domestic market. Certainly, in part this is due to the published results, but mainly from the rally associated with relief after completed elections in the United States, even though the result is not fully satisfactory. The WIG20 index has recovered all the losses from the fateful Wednesday's session after a day of All Saints and reached the maximums listed previously, which may be a good place to rest after made a big move.

In Europe today also dominate positive sentiment, although the increases are slightly smaller than on the Warsaw Stock Exchange. However, this is fully justified by yesterday's attractions, which in the environment were significantly higher than in Warsaw. Traditionally, the strongest are commodity and financial companies, which behave the best in an environment of inflation and rising rates. Investors are hoping that the already observed tendencies will be reinforced by the policies of Donald Trump.

At the halfway point of today's session the index WIG20 was at the level of 1,830 points (+ 2.20%).

-

11:35

WSE will be closed on Friday, November 11, 2016.

We would like to remind that there will be no trading session (the Warsaw Stock Exchange will be closed) on Friday, November 11, 2016.

-

10:33

Morgan Stanley lowered the rating of Qualcomm shares to "above market", maintains price target at $ 65

-

09:55

AstraZeneca shares falling on the back of high sales

-

08:22

Major stock exchanges trading in the green zone: FTSE + 0.8%, DAX + 0.7%, CAC40 + 0.7%, FTMIB + 0.8%, IBEX + 0.9%

-

08:17

WSE: After opening

WIG20 index opened at 1800.19 points (+0.53%)*

WIG 48720.62 1.05%

WIG30 2095.97 1.24%

mWIG40 3994.91 0.56%

*/ - change to previous close

The cash market started the new day from increase of 0.53% to the round level of 1,800 points. The movement is more modest than in the case of a derivative market and thus enables rapid increase in the scale of growth.

The publication of better than expected results for the third quarter and the increase in copper prices result in a very strong, more than 10 per cent, the growth of quotations of KGHM. The activity around the market surprised positively indeed, what encourages published by the company's results. The WIG20 index quickly moves to the next stop, which is the local maxima of the end of October.

After fifteen minutes of trading the WIG20 index reached the level of 1,817 points (+1,50%).

-

07:25

WSE: Before opening

Yesterday's, initially negative, market reaction to the Trump's victory proved to be extremely short-lived. Quotations on Wall Street ended with strong increases, mainly of financial, industrial and health companies. This means that the looser regulations and more government spending are expected.

In Asia, we observe considerable increases, which results from the need to catch up the visible yesterday world optimism. In addition, for Japan market helps a stronger dollar, which leads to increases by more than 6%.

A stronger US currency is the result of expectations that the Trump policy (lower taxes, more spending) will be inflationary and consequently may lead to somewhat stronger increases in interest rates.

On the Warsaw market to global optimism they add up better than expected results from companies such as Neuca (WSE: NEU), KGHM and Ambra (WSE: AMB). Light positively look PZU and Pekao (WSE: PEO). According to earlier estimates reported Enea (WSE: ENA), Tauron (WSE: TPE) and Bogdanka (WSE: LWB). About disappointment we may speak in case of Eurocash (WSE: EUR), JSW and Agora (WSE:AGO).

-

07:17

Positive start of trading expected on the major stock exchanges in Europe: DAX + 2.1%, CAC 40 + 1.8%, FTSE + 1.5%

-

05:43

Global Stocks

European stock markets traded sharply lower on Wednesday after Republican candidate Donald Trump won the U.S. presidential election, unsettling global financial markets. However, early Wednesday morning Trump emerged as the winner after securing majorities in several key swing states, including Ohio, Florida and North Carolina.

U.S. stocks rallied Wednesday, with the Dow industrials jumping 257 points, led by a surge in financial, health-care and industrial stocks, as investors bet on the infrastructure spending policy promised by President-elect Donald Trump.

Asian shares rose broadly early Thursday, as global investors chose to focus on the upsides of a Donald Trump presidency after a sharp selloff in the region the previous day.

-