Market news

-

21:06

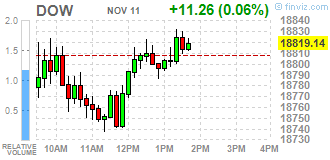

Major US stock indexes finished trading mixed

Major US stock indexes closed mixed, but close to zero. Investors scrambled to adjust their portfolios to benefit from Trump's plans to simplify regulation in the field of health and finance, as well as increased spending on infrastructure.

As shown by the preliminary results of research presented by Thomson-Reuters and Institute of Michigan, showed in November US consumers felt more optimistic about the economy than last month. According to the data, in November consumer sentiment index rose to 91.6 points versus 87.2 points last month. It was predicted that the index was 87.5 points. Recall, the index is a leading indicator of consumer sentiment. The indicator is calculated by adding 100 to the difference between the number of optimists and pessimists, expressed as a percentage.

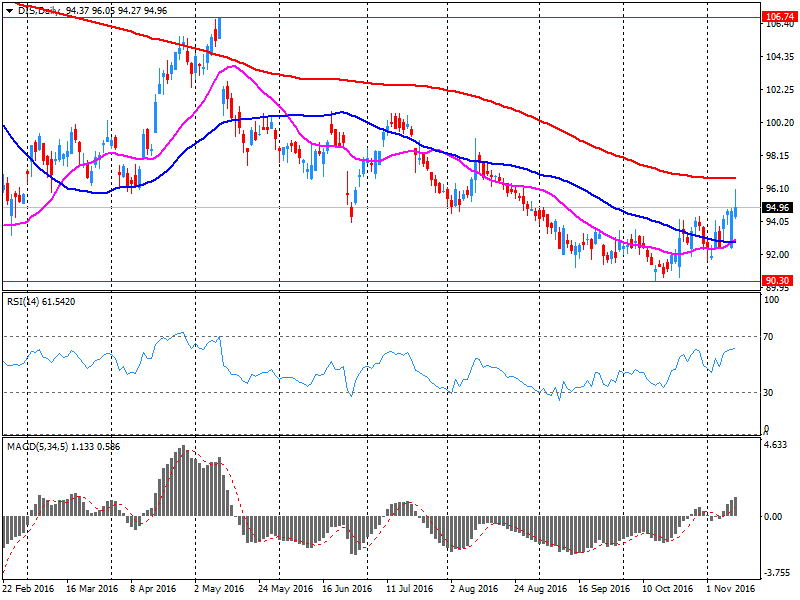

Among the corporate nature of the message should be noted on the eve of the quarterly results released by Walt Disney (DIS), which were worse than analysts' expectations. The Walt Disney Company's profit for the fourth quarter reached $ 1.10 per share, which was at $ 0.06 below the average forecast of analysts. Quarterly revenues were $ 13,142 billion. (-2.7% Y / y), while the average forecast of analysts anticipated $ 13,517 billion.

Most DOW components of the index closed in positive territory (20 of 30). More rest up shares The Walt Disney Company (DIS, + 3.11%). Outsider were shares of Pfizer Inc. (PFE, -2.78%).

Sector S & P Index showed mixed trends. The leader turned conglomerates sector (+ 4.6%). Most of the basic materials sector fell (-1.7%).

-

20:00

DJIA -0.01% 18,806.71 -1.17 Nasdaq +0.17% 5,217.77 +8.97 S&P -0.38% 2,159.23 -8.25

-

18:47

Wall Street. Major U.S. stock-indexes mixed

Major U.S stock-indexes mixed. Investors scrambled to adjust their portfolios to benefit from Trump's plans to simplify regulation in the health and financial sectors and boost spending on infrastructure.

Most of Dow stocks in positive area (17 of 30). Top gainer - The Walt Disney Company (DIS, +2.62%). Top loser - E. I. du Pont de Nemours and Company (DD, -2.40%).

S&P sectors mixed. Top gainer - Conglomerates (+3.4%). Top loser - Basic Materials (-1.8%).

At the moment:

Dow 18759.00 -27.00 -0.14%

S&P 500 2158.25 -9.00 -0.42%

Nasdaq 100 4738.50 -5.25 -0.11%

Oil 43.36 -1.30 -2.91%

Gold 1221.10 -45.30 -3.58%

U.S. 10yr 2.12 +0.00

-

17:00

European stocks closed: FTSE 100 -97.55 6730.43 -1.43% DAX +37.83 10667.95 +0.36% CAC 40 -41.68 4489.27 -0.92%

-

14:33

U.S. Stocks open: Dow +0.07%, Nasdaq -0.23%, S&P -0.13%

-

14:19

Before the bell: S&P futures -0.34%, NASDAQ futures -0.64%

U.S. stock-index futures fell as investors continued to parse the implications of a Donald Trump presidency for the economy and interest rates.

Global Stocks:

Nikkei 17,374.79 +30.37 +0.18%

Hang Seng 22,531.09 -308.02 -1.35%

Shanghai 3,195.88 +24.60 +0.78%

FTSE 6,746.07 -81.91 -1.20%

CAC 4,509.08 -21.87 -0.48%

DAX 10,676.84 +46.72 +0.44%

Gold $43.76 (-2.02%)

Crude $1,259.10 (-0.58%)

-

13:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

29.01

-0.09(-0.3093%)

5332

ALTRIA GROUP INC.

MO

62.2

0.48(0.7777%)

6976

Amazon.com Inc., NASDAQ

AMZN

738.75

-3.63(-0.489%)

28694

American Express Co

AXP

69.75

-0.36(-0.5135%)

500

AMERICAN INTERNATIONAL GROUP

AIG

62.98

-0.23(-0.3639%)

524

Apple Inc.

AAPL

107.05

-0.74(-0.6865%)

97223

AT&T Inc

T

36.64

0.07(0.1914%)

16707

Barrick Gold Corporation, NYSE

ABX

16

0.23(1.4585%)

99837

Caterpillar Inc

CAT

93.28

-0.17(-0.1819%)

10406

Chevron Corp

CVX

107.36

-0.43(-0.3989%)

785

Cisco Systems Inc

CSCO

30.7

-0.30(-0.9677%)

8699

Citigroup Inc., NYSE

C

53

-0.61(-1.1378%)

57533

Deere & Company, NYSE

DE

90.71

0.01(0.011%)

523

Exxon Mobil Corp

XOM

86.53

-0.52(-0.5974%)

1536

Facebook, Inc.

FB

120.25

-0.55(-0.4553%)

110136

FedEx Corporation, NYSE

FDX

183.62

0.05(0.0272%)

130

Ford Motor Co.

F

11.86

-0.08(-0.67%)

9955

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.29

0.49(3.5507%)

735096

General Electric Co

GE

30.43

0.02(0.0658%)

18724

Goldman Sachs

GS

199.09

-1.78(-0.8861%)

29510

Google Inc.

GOOG

759.88

-2.68(-0.3514%)

13146

Intel Corp

INTC

34.25

-0.25(-0.7246%)

6889

International Business Machines Co...

IBM

159.75

-0.47(-0.2933%)

1671

Johnson & Johnson

JNJ

119.35

-0.19(-0.1589%)

1264

JPMorgan Chase and Co

JPM

75.95

-0.70(-0.9132%)

75001

Microsoft Corp

MSFT

58.2

-0.50(-0.8518%)

49709

Nike

NKE

50.38

-0.01(-0.0198%)

1758

Pfizer Inc

PFE

33.32

-0.17(-0.5076%)

22389

Procter & Gamble Co

PG

83.05

0.09(0.1085%)

3727

Starbucks Corporation, NASDAQ

SBUX

53.11

-0.46(-0.8587%)

7518

Tesla Motors, Inc., NASDAQ

TSLA

184.5

-0.85(-0.4586%)

8518

The Coca-Cola Co

KO

41.24

0.30(0.7328%)

10492

Twitter, Inc., NYSE

TWTR

18.33

-0.04(-0.2177%)

54789

United Technologies Corp

UTX

108.36

-0.05(-0.0461%)

806

Verizon Communications Inc

VZ

46.67

-0.02(-0.0428%)

4102

Visa

V

81.89

0.02(0.0244%)

579

Walt Disney Co

DIS

97.25

2.29(2.4115%)

290255

Yahoo! Inc., NASDAQ

YHOO

39.65

-0.51(-1.2699%)

2264

-

13:47

Upgrades and downgrades before the market open

Upgrades:

Walt Disney (DIS) upgraded to Equal Weight from Underweight at Barclays

Downgrades:

Walt Disney (DIS) downgraded to Hold at Pivotal Research Group; target lowered to $102

Other:

-

13:23

Company News: Walt Disney (DIS) quarterly results miss analysts’ estimates

Walt Disney reported Q4 FY 2016 earnings of $1.10 per share (versus $1.20 in Q4 FY 2015), missing analysts' consensus estimate of $1.16.

The company's quarterly revenues amounted to $13.142 bln (-2.7% y/y), missing analysts' consensus estimate of $13.517 bln.

The company also stated it sees modest FY17 EPS growth for the year (consensus +5.8% to $6.05/share).

DIS rose to $97.00 (+2.15%) in pre-market trading.

-

12:11

Major stock indices in Europe trading mixed

Financial stocks continued to rise in price on expectations that the policy of the new US president Donald Trump will be favorable for the financial sector.

During the election campaign Trump promised to increase government spending, which, according to experts, will lead to higher inflation and force the Federal Reserve to accelerate the pace of rate hikes. Against this backdrop, government bond yields are rising around the world.

In addition, the pre-election statements allow investors to make a conclusion about the possibility of significant breaks for financial sector regulation and mitigation.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0,2%, to 339.45 points.

Shares of Deutsche Bank rose 0,6%, Italian Ubi Banca by 2.3%, the British Barclays by 0.4%.

UBS Group and Credit Suisse Group AG, receiving more than 35% of its revenue from operations in the US, added 0.7% and 2.3%.

The cost of securities of the British Standard Life, working in the insurance and asset management, had jumped by 1.6%.

Fresnillo shares fell 4,9%, Randgold by 5.1% due to the decline in gold prices.

The capitalization of Allianz increased by 2.9%. The largest insurer in Europe by revenue and market value has increased net profit in the third quarter of 2016 by 37%, in particular due to the significant improvement in performance in the field of life insurance and health insurance, and confirmed the operating profit forecast for the full year.

The management company Pimco, owned by Allianz, in July-September, recorded a net inflow of funds of 4.7 billion euros.

At the moment:

FTSE 6760.03 -67.95 -1.00%

DAX 10634.21 4.09 0.04%

CAC 4494.63 -36.32 -0.80%

-

08:37

Major stock exchanges trading in the green zone: FTSE + 0.15%, DAX + 0.54%, CAC40 + 0.40%, FTMIB + 0.8%, IBEX + 0.87%

-

07:43

Positive start of trading expected on the major stock exchanges in Europe: DAX futures + 0.4%, CAC40 + 0.4%, FTSE flat

-

05:35

Global Stocks

European stock markets ended a choppy session in negative territory on Thursday, as a rally for some of the biggest post-election gainers ran out of steam in the afternoon. The pan-European benchmark had opened sharply higher, continuing a rally from Wednesday that came as investors digested how a Donald Trump presidency will impact the markets in the future. Healthcare and precious metals stocks were initially the biggest winners, but the optimism fizzled late on Thursday and dragged the overall markets lower.

Asian emerging markets sold off sharply Friday as U.S. Treasury yields rose overnight. "Global investors are favoring conditions in the U.S. market," said Alex Wijaya, senior sales trader at CMC Markets, pointing to soaring U.S. Treasury yields. "We are seeing a general flowing to the U.S."

-