Market news

-

15:31

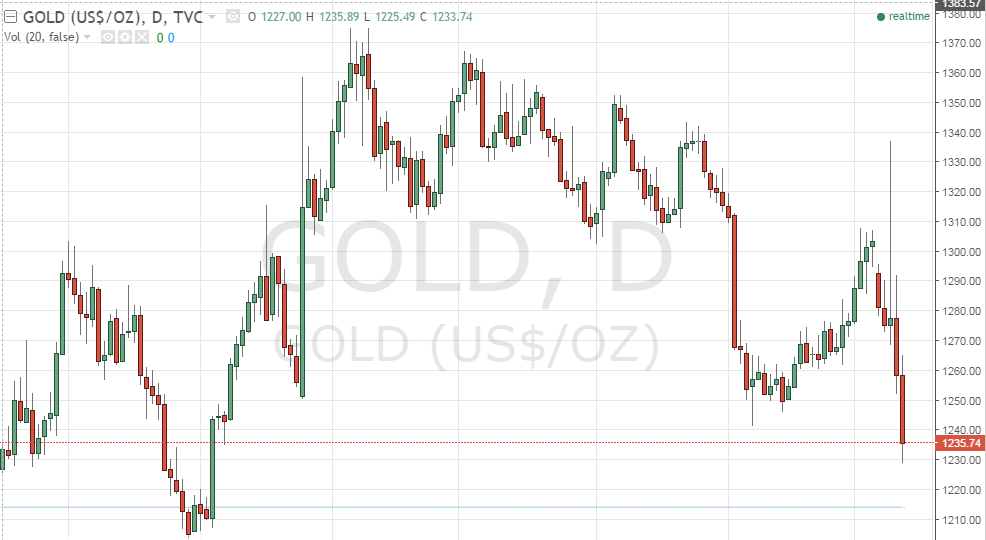

New monthly lows for gold price

Gold prices fell to a four-week low Friday as appetite for riskier investments improved after Donald Trump's victory in the U.S. presidential election, damping demand for haven assets.

Gold for December delivery was recently down 1.2% at $1,251.00 a troy ounce on the Comex division of the New York Mercantile Exchange, on track for its fifth straight day of losses. The drop took gold prices to the lowest level since Oct. 14.

The Wall Street Journal Dollar Index, which weighs the dollar against a basket of other currencies, was up 0.1% on Friday morning. As gold is priced in dollars, it becomes more expensive for holders of other currencies as the dollar appreciates.

-

15:19

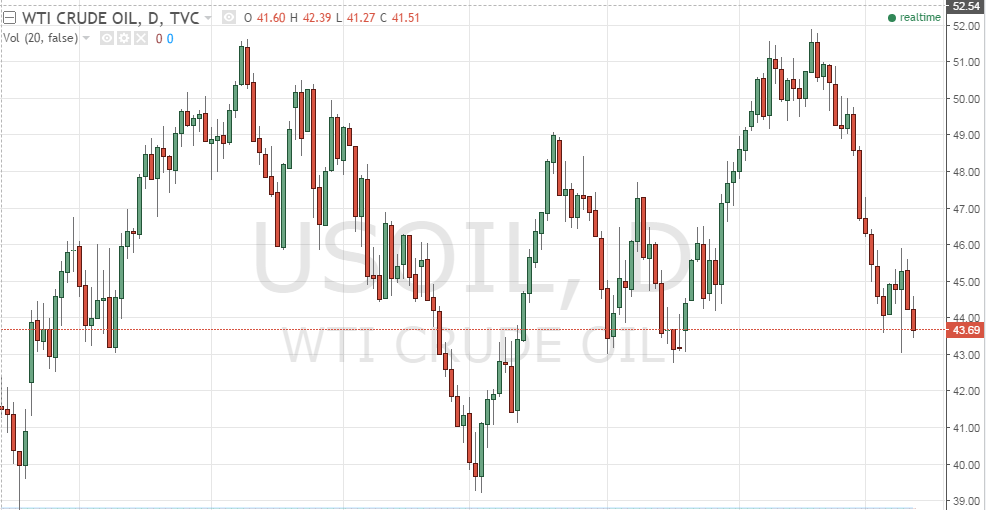

Crude oil futures fell

Crude oil futures fell for the secont time in five sessions, hurt by a stronger U.S. dollar and another build in oil inventories, according to rttnews.

WTI light sweet crude oil fell 61 cents, or 1.4%, to settle at $44.66 a barrel on the New York Mercantile Exchange.

That's after a report showed OPEC's oil production rose to record highs in October.

The International Energy Agency said OPEC crude output rose by a 230,000 barrels a day to a record high of 33.83 million barrels a day in October.

The IEA said OPEC faces a significant challenge in curbing production to meet levels discussed at a recent meeting in Algiers.

"We can't predict the outcome of the November 30 meeting, but we can see the scale of the task ahead," said the IEA.

-

13:12

OPEC raised forecasts for oil production in Russia in 2016 whith 12.000 barrels per day to 11.05 million barrels

Production growth compared to 2015 expected to reach 200 thousand barrels per day.

According to OPEC, oil production in Russia in October increased by 90 thousand barrels per day to 10.59 million barrels. The export of oil in October was unchanged compared with September.

-

10:02

Oil is trading lower

This morning, the New York futures for Brent dropped 0.74% to $ 44.38 WTI fell 0.37% to $ 45.68 per barrel. Thus, the black gold is trading in the red zone on the background of market uncertainty, which is likely to persist, if OPEC and other oil producers do not agree on a substantial production cut.

According to the monthly report of the International Energy Agency, the oversupply in the oil market will continue in 2017 if OPEC members can not agree on production cuts, and manufacturers around the world, on the contrary, will increase the volume.

According to the IEA, world oil supply in October rose by 800,000 bpd to 97.8 million bpd, largely due to the record production volume in OPEC and countries outside the cartel, such as Russia, Brazil, Canada and Kazakhstan.

-