Market news

-

21:06

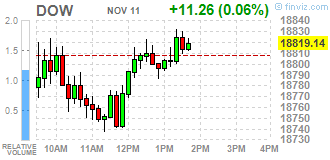

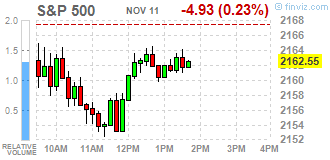

Major US stock indexes finished trading mixed

Major US stock indexes closed mixed, but close to zero. Investors scrambled to adjust their portfolios to benefit from Trump's plans to simplify regulation in the field of health and finance, as well as increased spending on infrastructure.

As shown by the preliminary results of research presented by Thomson-Reuters and Institute of Michigan, showed in November US consumers felt more optimistic about the economy than last month. According to the data, in November consumer sentiment index rose to 91.6 points versus 87.2 points last month. It was predicted that the index was 87.5 points. Recall, the index is a leading indicator of consumer sentiment. The indicator is calculated by adding 100 to the difference between the number of optimists and pessimists, expressed as a percentage.

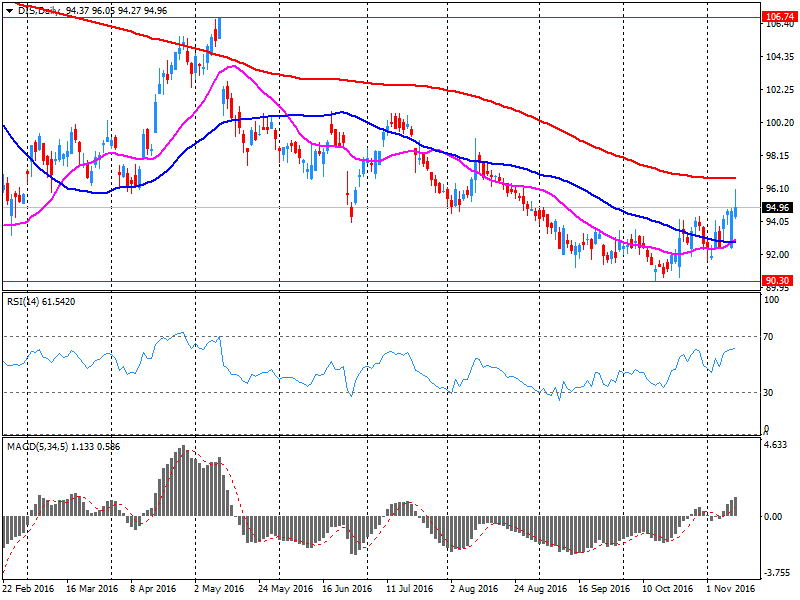

Among the corporate nature of the message should be noted on the eve of the quarterly results released by Walt Disney (DIS), which were worse than analysts' expectations. The Walt Disney Company's profit for the fourth quarter reached $ 1.10 per share, which was at $ 0.06 below the average forecast of analysts. Quarterly revenues were $ 13,142 billion. (-2.7% Y / y), while the average forecast of analysts anticipated $ 13,517 billion.

Most DOW components of the index closed in positive territory (20 of 30). More rest up shares The Walt Disney Company (DIS, + 3.11%). Outsider were shares of Pfizer Inc. (PFE, -2.78%).

Sector S & P Index showed mixed trends. The leader turned conglomerates sector (+ 4.6%). Most of the basic materials sector fell (-1.7%).

-

20:00

DJIA -0.01% 18,806.71 -1.17 Nasdaq +0.17% 5,217.77 +8.97 S&P -0.38% 2,159.23 -8.25

-

18:47

Wall Street. Major U.S. stock-indexes mixed

Major U.S stock-indexes mixed. Investors scrambled to adjust their portfolios to benefit from Trump's plans to simplify regulation in the health and financial sectors and boost spending on infrastructure.

Most of Dow stocks in positive area (17 of 30). Top gainer - The Walt Disney Company (DIS, +2.62%). Top loser - E. I. du Pont de Nemours and Company (DD, -2.40%).

S&P sectors mixed. Top gainer - Conglomerates (+3.4%). Top loser - Basic Materials (-1.8%).

At the moment:

Dow 18759.00 -27.00 -0.14%

S&P 500 2158.25 -9.00 -0.42%

Nasdaq 100 4738.50 -5.25 -0.11%

Oil 43.36 -1.30 -2.91%

Gold 1221.10 -45.30 -3.58%

U.S. 10yr 2.12 +0.00

-

17:00

European stocks closed: FTSE 100 -97.55 6730.43 -1.43% DAX +37.83 10667.95 +0.36% CAC 40 -41.68 4489.27 -0.92%

-

15:31

New monthly lows for gold price

Gold prices fell to a four-week low Friday as appetite for riskier investments improved after Donald Trump's victory in the U.S. presidential election, damping demand for haven assets.

Gold for December delivery was recently down 1.2% at $1,251.00 a troy ounce on the Comex division of the New York Mercantile Exchange, on track for its fifth straight day of losses. The drop took gold prices to the lowest level since Oct. 14.

The Wall Street Journal Dollar Index, which weighs the dollar against a basket of other currencies, was up 0.1% on Friday morning. As gold is priced in dollars, it becomes more expensive for holders of other currencies as the dollar appreciates.

-

15:19

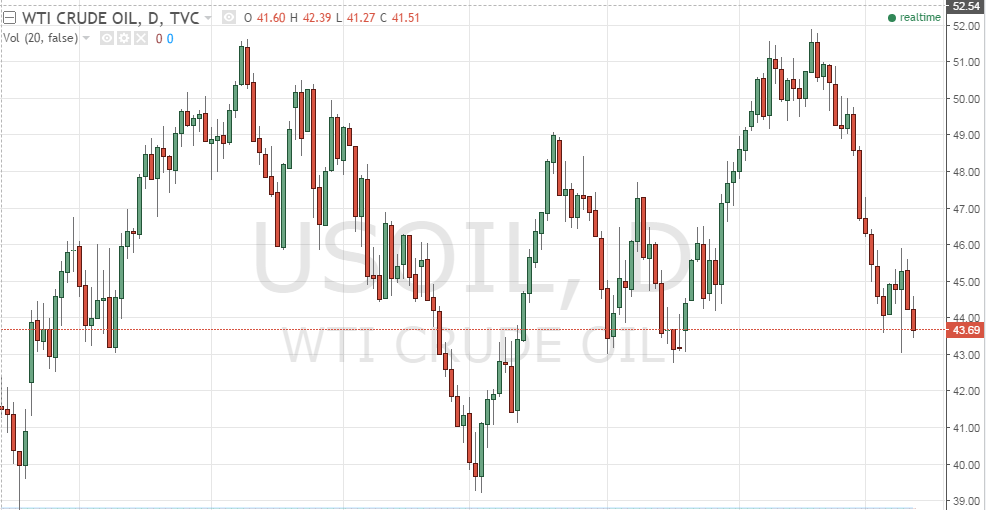

Crude oil futures fell

Crude oil futures fell for the secont time in five sessions, hurt by a stronger U.S. dollar and another build in oil inventories, according to rttnews.

WTI light sweet crude oil fell 61 cents, or 1.4%, to settle at $44.66 a barrel on the New York Mercantile Exchange.

That's after a report showed OPEC's oil production rose to record highs in October.

The International Energy Agency said OPEC crude output rose by a 230,000 barrels a day to a record high of 33.83 million barrels a day in October.

The IEA said OPEC faces a significant challenge in curbing production to meet levels discussed at a recent meeting in Algiers.

"We can't predict the outcome of the November 30 meeting, but we can see the scale of the task ahead," said the IEA.

-

15:03

US November Sentiment Index rise slightly above the 2016 average of 91.1

Surveys of Consumers chief economist, Richard Curtin: The Sentiment Index in early November erased the small October decline to climb to its highest level since mid 2016 and rise slightly above the 2016 average of 91.1.

The recent gain in sentiment was driven by an improved outlook for the economy. The most striking finding in early November was that both near and long-term inflation expectations jumped to 2.7% from last month's record matching lows of 2.4%.

These increases must be replicated before they can be taken to indicate a troublesome development; thus far, the data has simply repeated the March 2016 peaks.

Nonetheless, it may be viewed as added justification for next month's expected interest rate hike. The expected small increase in interest rates had little impact on favorable buying attitudes, and still supports a 2.5% increase in real consumer spending during 2017. Unfortunately, the November data must be accompanied by the proviso that it was collected before the result of the Presidential election was known late Tuesday.

-

15:00

U.S.: Reuters/Michigan Consumer Sentiment Index, November 91.6 (forecast 87.5)

-

14:41

Morgan Stanley Advises Buy USD/CHF, Targets 1.02

-

14:39

Fischer: Case is 'Quite Strong' for Raising Rates Gradually

"In my view, the Fed appears reasonably close to achieving both the inflation and employment components of its mandate," Mr. Fischer said in remarks prepared for delivery at a conference hosted by the Central Bank of Chile. "Accordingly, the case for removing accommodation gradually is quite strong, keeping in mind that the future is uncertain and that monetary policy is not on a preset course."

-

14:33

U.S. Stocks open: Dow +0.07%, Nasdaq -0.23%, S&P -0.13%

-

14:19

Before the bell: S&P futures -0.34%, NASDAQ futures -0.64%

U.S. stock-index futures fell as investors continued to parse the implications of a Donald Trump presidency for the economy and interest rates.

Global Stocks:

Nikkei 17,374.79 +30.37 +0.18%

Hang Seng 22,531.09 -308.02 -1.35%

Shanghai 3,195.88 +24.60 +0.78%

FTSE 6,746.07 -81.91 -1.20%

CAC 4,509.08 -21.87 -0.48%

DAX 10,676.84 +46.72 +0.44%

Gold $43.76 (-2.02%)

Crude $1,259.10 (-0.58%)

-

14:15

NAB watching a bearish signal confirmation on a weekly close below bollinger bands on EUR/AUD

"EUR/AUD material bounce in the recent weeks has failed to produce a weekly close above key MT pivot at 1.45 and as such maintains our aggressive 1.36/1.38 target. We now look to future weekly closes for further confirmation of the MT downtrend.

A weekly close below the lower weekly Bollinger band around 1.4270/90 will provide confirmation of the ongoing decline and validate our 1.36/1.38 target.

Only a weekly close above 1.4500 would confirm that our downside target is too aggressive".

Copyright © 2016 NAB, eFXnews™

-

13:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

29.01

-0.09(-0.3093%)

5332

ALTRIA GROUP INC.

MO

62.2

0.48(0.7777%)

6976

Amazon.com Inc., NASDAQ

AMZN

738.75

-3.63(-0.489%)

28694

American Express Co

AXP

69.75

-0.36(-0.5135%)

500

AMERICAN INTERNATIONAL GROUP

AIG

62.98

-0.23(-0.3639%)

524

Apple Inc.

AAPL

107.05

-0.74(-0.6865%)

97223

AT&T Inc

T

36.64

0.07(0.1914%)

16707

Barrick Gold Corporation, NYSE

ABX

16

0.23(1.4585%)

99837

Caterpillar Inc

CAT

93.28

-0.17(-0.1819%)

10406

Chevron Corp

CVX

107.36

-0.43(-0.3989%)

785

Cisco Systems Inc

CSCO

30.7

-0.30(-0.9677%)

8699

Citigroup Inc., NYSE

C

53

-0.61(-1.1378%)

57533

Deere & Company, NYSE

DE

90.71

0.01(0.011%)

523

Exxon Mobil Corp

XOM

86.53

-0.52(-0.5974%)

1536

Facebook, Inc.

FB

120.25

-0.55(-0.4553%)

110136

FedEx Corporation, NYSE

FDX

183.62

0.05(0.0272%)

130

Ford Motor Co.

F

11.86

-0.08(-0.67%)

9955

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.29

0.49(3.5507%)

735096

General Electric Co

GE

30.43

0.02(0.0658%)

18724

Goldman Sachs

GS

199.09

-1.78(-0.8861%)

29510

Google Inc.

GOOG

759.88

-2.68(-0.3514%)

13146

Intel Corp

INTC

34.25

-0.25(-0.7246%)

6889

International Business Machines Co...

IBM

159.75

-0.47(-0.2933%)

1671

Johnson & Johnson

JNJ

119.35

-0.19(-0.1589%)

1264

JPMorgan Chase and Co

JPM

75.95

-0.70(-0.9132%)

75001

Microsoft Corp

MSFT

58.2

-0.50(-0.8518%)

49709

Nike

NKE

50.38

-0.01(-0.0198%)

1758

Pfizer Inc

PFE

33.32

-0.17(-0.5076%)

22389

Procter & Gamble Co

PG

83.05

0.09(0.1085%)

3727

Starbucks Corporation, NASDAQ

SBUX

53.11

-0.46(-0.8587%)

7518

Tesla Motors, Inc., NASDAQ

TSLA

184.5

-0.85(-0.4586%)

8518

The Coca-Cola Co

KO

41.24

0.30(0.7328%)

10492

Twitter, Inc., NYSE

TWTR

18.33

-0.04(-0.2177%)

54789

United Technologies Corp

UTX

108.36

-0.05(-0.0461%)

806

Verizon Communications Inc

VZ

46.67

-0.02(-0.0428%)

4102

Visa

V

81.89

0.02(0.0244%)

579

Walt Disney Co

DIS

97.25

2.29(2.4115%)

290255

Yahoo! Inc., NASDAQ

YHOO

39.65

-0.51(-1.2699%)

2264

-

13:49

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0900 (EUR 1.35bn) 1.1000 (1.0bn) 1.1275 (902m) 1.1300 (1.24bn)

USD/JPY 103.00-02 (USD 946m) 104.50 (1.1bn) 104.65-70 (687m),105.00 (1.32bn) 105.30 (332m) 105.40 (300m) 105.50 (950m), 106.45-50 (976m) 106.92 (210m) 107.00 (819m) 108.00 (200m)

EUR/GBP 0.8850 (EUR 345m)

AUD/USD 0.7400 (AUD 219m) 0.7775 (250m)

USD/CAD 1.3350 (USD 429m) 1.3400 (290m) 1.3600 (201m)

EUR/JPY 115.00 (EUR 287m)

AUD/NZD 1.0420 (AUD 260m) 1.0500 (230m) 1.0650 (823m)

-

13:47

Upgrades and downgrades before the market open

Upgrades:

Walt Disney (DIS) upgraded to Equal Weight from Underweight at Barclays

Downgrades:

Walt Disney (DIS) downgraded to Hold at Pivotal Research Group; target lowered to $102

Other:

-

13:32

The ECB are in monitoring mode after Trump win says Governing concil member Lane - Forexlive

-

There's no real basis yet for firm analysis

-

Day to day changes in bond yields are not going to matter

-

We will assess what goes on by early December

-

-

13:26

Danske Bank Sees Riksbank Rate Cut Despite EUR/SEK Rally

-

13:23

Company News: Walt Disney (DIS) quarterly results miss analysts’ estimates

Walt Disney reported Q4 FY 2016 earnings of $1.10 per share (versus $1.20 in Q4 FY 2015), missing analysts' consensus estimate of $1.16.

The company's quarterly revenues amounted to $13.142 bln (-2.7% y/y), missing analysts' consensus estimate of $13.517 bln.

The company also stated it sees modest FY17 EPS growth for the year (consensus +5.8% to $6.05/share).

DIS rose to $97.00 (+2.15%) in pre-market trading.

-

13:12

OPEC raised forecasts for oil production in Russia in 2016 whith 12.000 barrels per day to 11.05 million barrels

Production growth compared to 2015 expected to reach 200 thousand barrels per day.

According to OPEC, oil production in Russia in October increased by 90 thousand barrels per day to 10.59 million barrels. The export of oil in October was unchanged compared with September.

-

12:51

Orders

EUR/USD

Offers : 1.0900 1.0925-30 1.0950 1.0980-85 1.1000 1.1025-30 1.1055-60

Bids : 1.0865 1.0850 1.0830 1.0800 1.0785 1.0765 1.0750

GBP/USD

Offers : 1.2600 1.2620 1.2650 1.2685 1.2700 1.2750 1.2800

Bids : 1.2550 1.2520-25 1.2500 1.2480 1.2450 1.2420 1.2400 1.2375-80 1 .2350 1.2330 1.2300

EUR/GBP

Offers : 0.8660 0.8680 0.8700 0.8730 0.8750 0.8785 0.8800 0.8820-25 0.8850-55

Bids : 0.8625-30 0.8600 0.8585 0.8550 0.8500 0.8450

EUR/JPY

Offers : 116.50-55 117.00 117.30 117.50 118.00 118.45-50 119.00

Bids : 116.00 115.80 115.00 114.80 114.50 114.20 114.00

USD/JPY

Offers : 106.70 107.00 107.50 107.70 108.00 109.00 109.15-20 109.50

Bids : 106.20 106.00 105.75-80 105.50 105.20 105.00 104.85 104.50 104.30 104.00

AUD/USD

Offers : 0.7650-60 0.7685 0.7700 0.7730 0.7750 0.7765 0.7780 0.7800

Bids : 0.7600 0.7580 0.7550 0.7520 0.7500 0.7475-80 0.7450

-

12:11

Major stock indices in Europe trading mixed

Financial stocks continued to rise in price on expectations that the policy of the new US president Donald Trump will be favorable for the financial sector.

During the election campaign Trump promised to increase government spending, which, according to experts, will lead to higher inflation and force the Federal Reserve to accelerate the pace of rate hikes. Against this backdrop, government bond yields are rising around the world.

In addition, the pre-election statements allow investors to make a conclusion about the possibility of significant breaks for financial sector regulation and mitigation.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0,2%, to 339.45 points.

Shares of Deutsche Bank rose 0,6%, Italian Ubi Banca by 2.3%, the British Barclays by 0.4%.

UBS Group and Credit Suisse Group AG, receiving more than 35% of its revenue from operations in the US, added 0.7% and 2.3%.

The cost of securities of the British Standard Life, working in the insurance and asset management, had jumped by 1.6%.

Fresnillo shares fell 4,9%, Randgold by 5.1% due to the decline in gold prices.

The capitalization of Allianz increased by 2.9%. The largest insurer in Europe by revenue and market value has increased net profit in the third quarter of 2016 by 37%, in particular due to the significant improvement in performance in the field of life insurance and health insurance, and confirmed the operating profit forecast for the full year.

The management company Pimco, owned by Allianz, in July-September, recorded a net inflow of funds of 4.7 billion euros.

At the moment:

FTSE 6760.03 -67.95 -1.00%

DAX 10634.21 4.09 0.04%

CAC 4494.63 -36.32 -0.80%

-

11:37

Scope for EUR/GBP to Fall Towards 0.85, ING says

-

10:43

Elections results in the United States have the most serious impact on the global financial markets - Rusian Ministry of Finance deputy

Elections in the United States have the most serious impact on the global financial markets, Deputy Finance Minister Maxim Oreshkin said at the conference "Eurasian economic integration".

"With regard to external risks, the most interesting topic, of course, -. Presidential elections in the US. They have a very serious impact on the financial markets The main story, which you need to pay attention. US Treasuries are trading on the highest level this year"- he said.

-

10:02

Oil is trading lower

This morning, the New York futures for Brent dropped 0.74% to $ 44.38 WTI fell 0.37% to $ 45.68 per barrel. Thus, the black gold is trading in the red zone on the background of market uncertainty, which is likely to persist, if OPEC and other oil producers do not agree on a substantial production cut.

According to the monthly report of the International Energy Agency, the oversupply in the oil market will continue in 2017 if OPEC members can not agree on production cuts, and manufacturers around the world, on the contrary, will increase the volume.

According to the IEA, world oil supply in October rose by 800,000 bpd to 97.8 million bpd, largely due to the record production volume in OPEC and countries outside the cartel, such as Russia, Brazil, Canada and Kazakhstan.

-

09:53

UK construction output increased by 0.3% compared with August 2016

The gross domestic product (GDP) preliminary estimate showed construction output decreased by 1.4%. The revision to a decrease of 1.1% has no impact on GDP to 1 decimal place.

Downward pressure on the quarterly estimates came from all repair and maintenance which decreased by 3.6%, partially offset by an increase in all new work of 0.3%.

Between Quarter 3 2016 and Quarter 3 2015, output was estimated to have increased by 0.1%. All new work increased by 2.0% while there was a fall of 3.4% in repair and maintenance.

In September 2016, construction output increased by 0.3% compared with August 2016. All new work increased by 1.2% while there was a fall in repair and maintenance of 1.4%. Users should note that we always warn against overly interpreting 1 month's figures.

-

08:40

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0900 (EUR 1.35bn) 1.1000 (1.0bn) 1.1275 (902m) 1.1300 (1.24bn)

USD/JPY 103.00-02 (USD 946m) 104.50 (1.1bn) 104.65-70 (687m),105.00 (1.32bn) 105.30 (332m) 105.40 (300m) 105.50 (950m), 106.45-50 (976m) 106.92 (210m) 107.00 (819m) 108.00 (200m)

EUR/GBP 0.8850 (EUR 345m)

AUD/USD 0.7400 (AUD 219m) 0.7775 (250m)

USD/CAD 1.3350 (USD 429m) 1.3400 (290m) 1.3600 (201m)

EUR/JPY 115.00 (EUR 287m)

AUD/NZD 1.0420 (AUD 260m) 1.0500 (230m) 1.0650 (823m)

-

08:38

Today’s events

-

At 13:00 GMT Italy will hold an auction of 30-year bonds

-

At 17:00 GMT the Federal Reserve Vice Chairman Stanley Fischer will deliver a speech

-

At 18:50 GMT the Bank of Canada Governor Stephen Poloz will deliver a speech

-

-

08:37

Major stock exchanges trading in the green zone: FTSE + 0.15%, DAX + 0.54%, CAC40 + 0.40%, FTMIB + 0.8%, IBEX + 0.87%

-

07:43

Positive start of trading expected on the major stock exchanges in Europe: DAX futures + 0.4%, CAC40 + 0.4%, FTSE flat

-

07:42

USD/JPY: A Deja Vu? - Deutsche Bank

"Trump's main goal is to make America stronger, which we consider positive from the standpoint of the US economy. Campaign promises like infrastructure investment and tax cuts were extremely aggressive, and while they are likely to revised in Congress, they should remain substantial.

The USD/JPY rose from 75 to 125 in the so-called Abe market, then dropped back to 100. We believe the basic trend is a stronger yen, and maintain our mainline scenario that the USD/JPY will slide to the mid 90s if the US economy should look to slow next year before the details of the new administration's policies are clear.

Still, we feel that we need to assess anew the impact of policies - e.g. fiscal spending, tax cuts, deregulation, Homeland Investment Act - with the surprising Republican hold on the executive and legislative branches.

The upward/downward risk balance for the USD/JPY will depend on how we view the acceleration in US growth, rising interest rates and the equity rally".

Copyright © 2016 DB, eFXnews™

-

07:40

Romania's consumer prices decreased at a slower than expected pace in October

Romania's consumer prices decreased at a slower-than-expected pace in October, figures from the National Institute of Statistics showed Friday and cited by rttnews.

The consumer price index fell 0.4 percent year-over-year in October, slower than the 0.6 percent drop in September. That was just below the 0.5 percent decline expected by economists.

Prices of non-food products slid 0.8 percent annually in October and costs for services went down by 1.1 percent. At the same time, grocery prices grew 0.5 percent.

On a monthly basis, consumer prices rose 0.4 percent in October, in line with expectations.

-

07:39

Options levels on friday, November 11, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1072 (2092)

$1.1017 (884)

$1.0976 (628)

Price at time of writing this review: $1.0913

Support levels (open interest**, contracts):

$1.0864 (3147)

$1.0834 (3472)

$1.0789 (4477)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 61939 contracts, with the maximum number of contracts with strike price $1,1200 (6387);

- Overall open interest on the PUT options with the expiration date December, 9 is 56048 contracts, with the maximum number of contracts with strike price $1,0800 (4956);

- The ratio of PUT/CALL was 0.90 versus 0.88 from the previous trading day according to data from November, 10

GBP/USD

Resistance levels (open interest**, contracts)

$1.2806 (1183)

$1.2709 (1485)

$1.2613 (1294)

Price at time of writing this review: $1.2574

Support levels (open interest**, contracts):

$1.2489 (2824)

$1.2392 (1287)

$1.2295 (3564)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 33103 contracts, with the maximum number of contracts with strike price $1,3400 (2560);

- Overall open interest on the PUT options with the expiration date December, 9 is 34232 contracts, with the maximum number of contracts with strike price $1,2300 (3564);

- The ratio of PUT/CALL was 1.03 versus 1.07 from the previous trading day according to data from November, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:36

Reuters: 15 out of 25 surveyed economists expect Bank of Japan to hold monetary policy until mid-2017

In addition, 90% of those surveyed believe in the further expansion of the stimulus from the Central Bank. Only 5 of those surveyed believe that the new policy easing may occur in April 2017. Only 3 out of 25 economists are confident that new measures will be implemented in January '17, and only one waiting for that in December this year. Also, 19 economists expect a rate cut of 0.1% or more.

-

07:31

Selling prices in German wholesale trade increased by 0.5% in October

As reported by the Federal Statistical Office (Destatis), the selling prices in wholesale trade increased by 0.5% in October 2016 from the corresponding month of the preceding year. In September and in August 2016 the annual rates of change were -0.3% and -1.2%, respectively.

From September 2016 to October 2016 the index rose by 0.4%.

-

07:20

German CPI up 0.8% y/y

Consumer prices in Germany were 0.8% higher in October 2016 compared with October 2015. This means that the inflation rate as measured by the consumer price index continues to rise in the second half of the year (August 2016: +0.4%; September 2016: +0.7%). An inflation rate of +0.8% was last recorded in October 2014. Compared with September 2016, the consumer price index rose by 0.2% in October 2016. The Federal Statistical Office (Destatis) thus confirms its provisional overall results of 28 October 2016.

The development of energy prices (-1.4% on October 2015) had a downward effect on the overall rise in prices in October 2016, as had been the case in the preceding months. However, the year-on-year decline in energy prices has continuously slowed since July 2016 (July 2016: -7.0%; August 2016: -5.9%; September 2016: -3.6%). Compared with October 2015, especially household energy prices were down (-2.3%, including charges for central and district heating: -7.5%; gas: -3.9%; heating oil: -1.4%). The prices of motor fuels were up year on year (+0.4%, including supergrade petrol: +0.7%; diesel fuel: +0.2%). Excluding energy, the inflation rate (+1.1%) was slightly lower than in September 2016 (+1.2%).

-

07:00

Germany: CPI, m/m, October 0.2% (forecast 0.2%)

-

07:00

Germany: CPI, y/y , October 0.8% (forecast 0.8%)

-

05:35

Global Stocks

European stock markets ended a choppy session in negative territory on Thursday, as a rally for some of the biggest post-election gainers ran out of steam in the afternoon. The pan-European benchmark had opened sharply higher, continuing a rally from Wednesday that came as investors digested how a Donald Trump presidency will impact the markets in the future. Healthcare and precious metals stocks were initially the biggest winners, but the optimism fizzled late on Thursday and dragged the overall markets lower.

Asian emerging markets sold off sharply Friday as U.S. Treasury yields rose overnight. "Global investors are favoring conditions in the U.S. market," said Alex Wijaya, senior sales trader at CMC Markets, pointing to soaring U.S. Treasury yields. "We are seeing a general flowing to the U.S."

-

04:32

Japan: Tertiary Industry Index , September -0.1% (forecast -0.2%)

-