Market news

-

23:30

Commodities. Daily history for Nov 10’2016:

(raw materials / closing price /% change)

Oil 44.29 -0.83%

Gold 1,258.60 -0.62%

-

23:28

Stocks. Daily history for Nov 10’2016:

(index / closing price / change items /% change)

Nikkei 225 17,344.42 +1,092.88 +6.72%

Shanghai Composite 3,170.92 +42.55 +1.36%

S&P/ASX 200 5,328.84 0.00 0.00%

FTSE 100 6,827.98 -83.86 -1.21%

CAC 40 4,530.95 -12.53 -0.28%

Xetra DAX 10,630.12 -15.89 -0.15%

S&P 500 2,167.48 +4.22 +0.20%

Dow Jones Industrial Average 18,807.88 +218.19 +1.17%

S&P/TSX Composite 14,744.25 -15.66 -0.11%

-

23:28

Currencies. Daily history for Nov 10’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0891 -0,17%

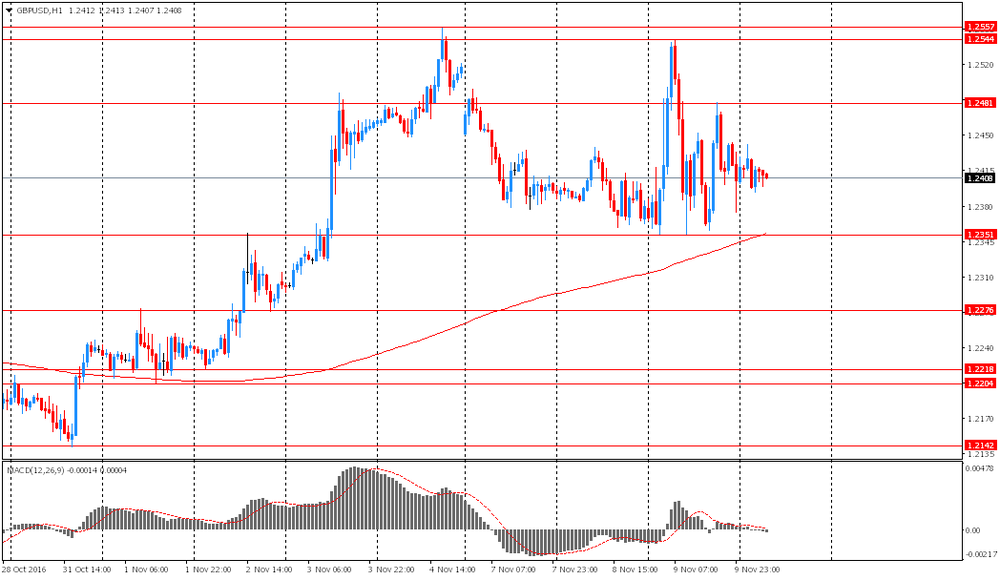

GBP/USD $1,2551 +1,16%

USD/CHF Chf0,9865 +0,22%

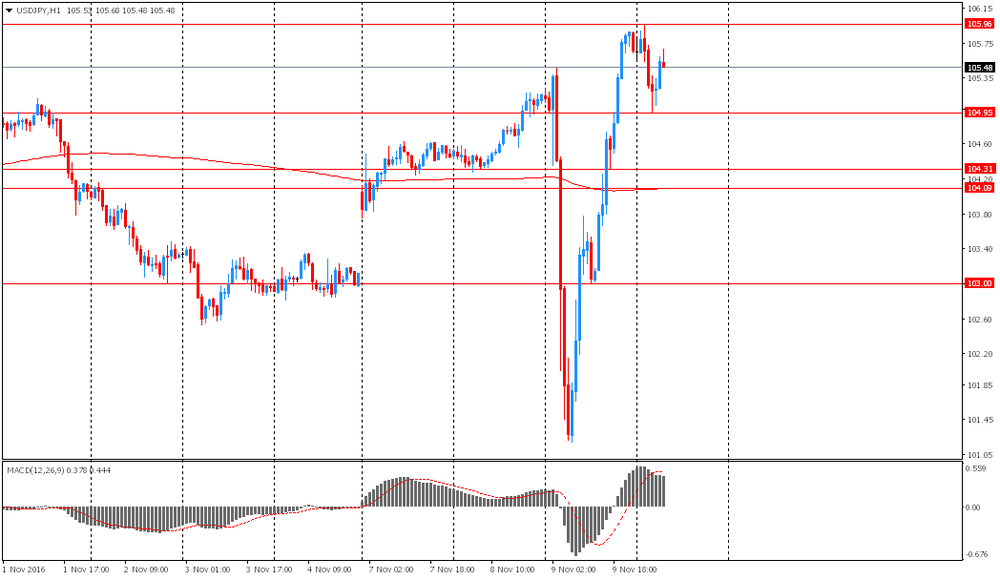

USD/JPY Y106,82 +1,09%

EUR/JPY Y116,35 +0,95%

GBP/JPY Y134,08 +2,25%

AUD/USD $0,7611 -0,29%

NZD/USD $0,7212 -0,90%

USD/CAD C$1,3467 +0,33%

-

23:00

Schedule for today, Friday, Nov 11’2016

01:00 Australia RBA Assist Gov Debelle Speaks

04:30 Japan Tertiary Industry Index September 0.0% -0.2%

07:00 Germany CPI, m/m (Finally) October 0.1% 0.2%

07:00 Germany CPI, y/y (Finally) October 0.7% 0.8%

14:00 U.S. FED Vice Chairman Stanley Fischer Speaks

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) November 87.2 87.5

15:50 Canada BOC Gov Stephen Poloz Speaks

-

21:30

New Zealand: Business NZ PMI, October 55.2

-

21:06

Major US stock indexes finished trading in different directions

Dow Jones Industrial Average index hit a record intraday high on Thursday, as investors believe that the President-elect Donald Trump will move away from austerity policies. At the same time, Nasdaq fell amid falling heavyweights Apple and Amazon, as investors poured money into other sectors that may benefit from the victory of Donald Trump on the US elections.

In addition, as reported by the Ministry of Labour, the number of Americans who applied for unemployment benefits fell more than expected last week, underscoring the resilience of the labor market. Primary applications for state unemployment benefits fell by 11,000 and reached a seasonally adjusted 254,000 for the week ended November 5. It was the 88th week in a row, when the primary circulation remained below 300,000 - the threshold associated with a healthy labor market. This is the longest period since 1970. Economists forecast that initial applications for benefits will amount to 260,000 unemployment.

Oil prices fell about 1.5 percent, as markets have recovered from the shock of winning Trump in the elections, and again focused on the global oversupply. Analysts say that the oil market is still facing a glut that has kept prices under pressure for most of the past two years. The Organization of Petroleum Exporting Countries (OPEC) meeting in Vienna on November 30 to hold talks on the reduction of oil production. Perhaps OPEC will try to establish cooperation with countries that are not OPEC members, but there are doubts whether they can reach an agreement.

Most DOW components of the index closed in positive territory (19 of 30). More rest up shares JPMorgan Chase & Co. (JPM, + 4.67%). Outsider were shares of The Procter & Gamble Company (PG, -3.75%).

Sector S & P Index showed mixed trends. The leader turned out to be the industrial goods sector (+ 2.0%). Most consumer goods sector fell (-2.9%).

At the close:

Dow + 1.18% 18,808.29 +218.60

Nasdaq -0.80% 5,208.80 -42.27

S & P + 0.20% 2,167.51 +4.25

-

20:00

DJIA +1.37% 18,845.13 +255.44 Nasdaq -0.47% 5,226.36 -24.71 S&P +0.39% 2,171.77 +8.51

-

19:00

U.S.: Federal budget , October -44 (forecast -80)

-

17:04

Wall Street. Major U.S. stock-indexes mixed

Major U.S. stock-indexes mixed. Dow Jones industrial average hit a record intraday high on Thursday as investors bet that President-elect Donald Trump would lead a shift away from austerity policies. The Nasdaq lost ground sharply in late morning trade on Thursday, dragged down by market heavyweights Apple and Amazon, as investors poured money into others sectors that may benefit from Donald Trump's victory in the U.S. election.

Most of Dow stocks in positive area (19 of 30). Top gainer - Pfizer Inc. (PFE, +4.39%). Top loser - The Procter & Gamble Company (PG, -3.81%).

S&P sectors mixed. Top gainer - Industrial goods (+1.8%). Top loser - Consumer goods (-2.7%).

At the moment:

Dow 18671.00 +139.00 +0.75%

S&P 500 2159.25 -1.00 -0.05%

Nasdaq 100 4727.50 -93.00 -1.93%

Oil 44.67 -0.60 -1.33%

Gold 1262.20 -11.30 -0.89%

U.S. 10yr 2.08 +0.00

-

17:00

European stocks closed: FTSE 100 -83.86 6827.98 -1.21% DAX -15.89 10630.12 -0.15% CAC 40 -12.53 4530.95 -0.28%

-

16:50

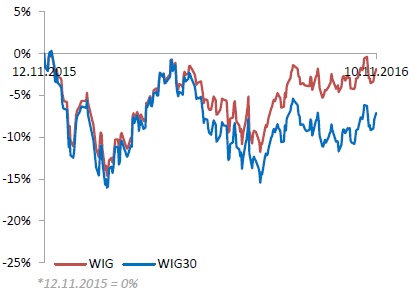

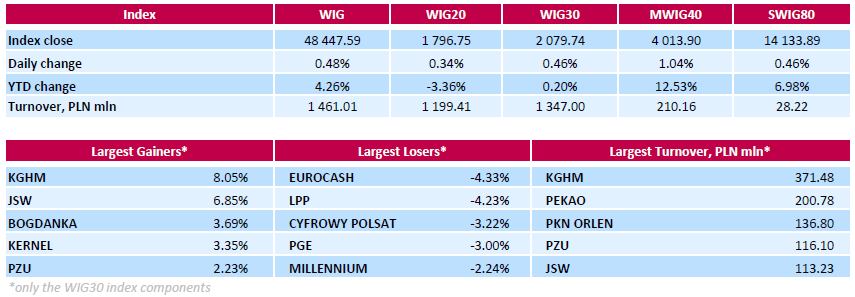

WSE: Session Results

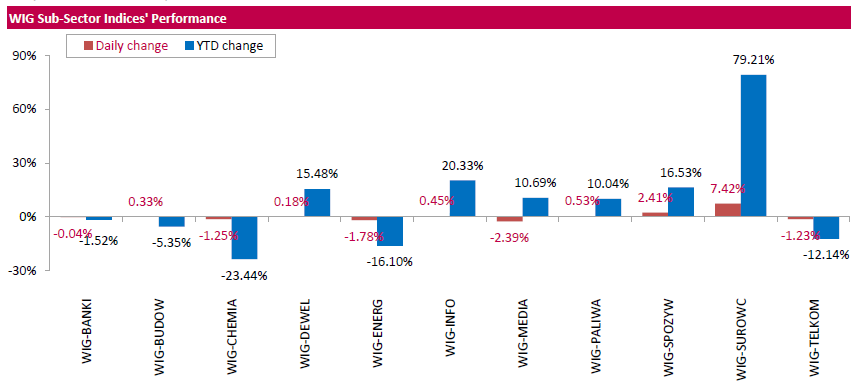

Polish equity market closed higher on Thursday. The broad market measure, the WIG index, added 0.48%. Sector-wise, materials (+7.42%) fared the best, while media (-2.39%) posted the worst result.

The large-cap stocks' measure, the WIG30 Index, advanced 0.46%. Copper producer KGHM (WSE: KGH) kept its position as a growth leader among the large-cap stocks, gaining a further 8.05%, helped by growing copper prices and better-than-expected Q3 earnings results. The company reported almost ten-fold y/y rise in Q3 net profit to PLN 329 mln, while analysts had forecast income of PLN 243.3 mln. It was followed by coking coal miner JSW (WSE: JSW) and thermal coal producer BOGDANKA (WSE: LWB), which jumped by 6.85% and 3.69%. JSW posted mixed Q3 results, as its revenues of PLN 1.67 bln exceeded analysts' expectation of PLN 1.591 bln, but its net loss of PLN 139 mln was bigger than a PLN 12.4 mln loss expected by analysts. However, in 9-month period, the company managed to cut its losses by 54% y/y to PLN 288.2 mln. BOGDANKA revealed Q3revenues of PLN 465.4 mln (-4% y/y) versus analysts forecast of PLN 438.1 mln and Q3 net income of PLN 45.2 mln (-20% y/y) versus analysts' forecast of PLN 42.2 mln. At the same time, the session's weakest name was FMCG-wholesaler EUROCASH (WSE: EUR), which lost 4.33% on the back of weaker than forecast Q3 bottom-line result. The company announced its net profit stood at PLN 58.7 mln (-16% y/y) in Q3, while analysts had expected PLN 72.5 mln. Other largest laggards were clothing retailer LPP (WSE: LPP), media group CYFROWY POLSAT (WSE: CPS) and genco PGE (WSE: PGE), dropping by 4.23%, 3.22% and 3% respectively.

-

16:00

Natural gas storage increases in line with expectations

Working gas in storage was 4,017 Bcf as of Friday, November 4, 2016, according to EIA estimates. This represents a net increase of 54 Bcf from the previous week. Stocks were 47 Bcf higher than last year at this time and 189 Bcf above the five-year average of 3,828 Bcf. At 4,017 Bcf, total working gas is above the five-year historical range.

-

15:48

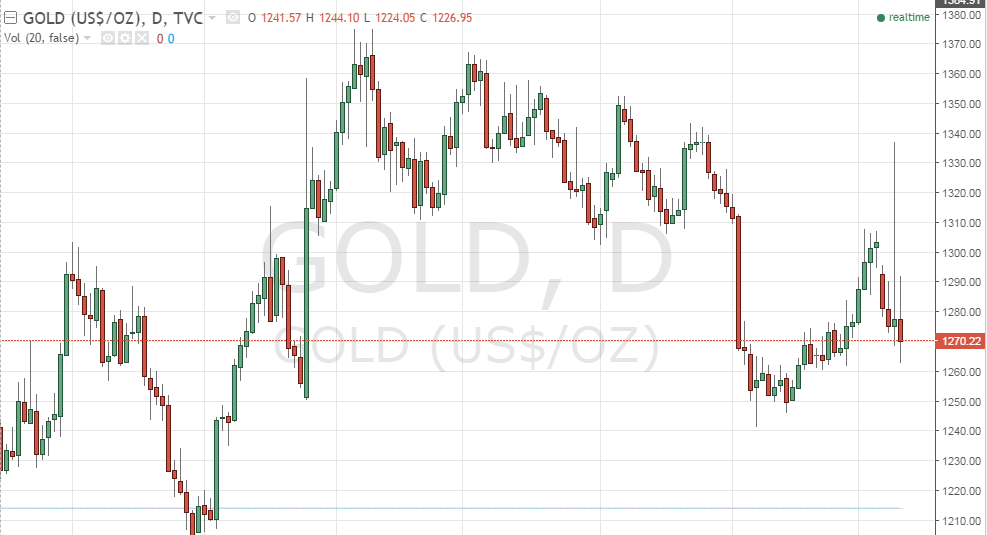

Gold continue to decline

Gold prices dropped on Thursday, reversing gains on a stronger U.S. dollar and concerns about an interest-rate increase in December, says Dow Jones.

Gold for December delivery was recently down 0.6% at $1,265.30 a troy ounce on the Comex division of the New York Mercantile Exchange, after trading as high as $1,280.60 earlier in the session.

The WSJ Dollar Index was recently up 0.7% at 89.53, putting pressure on gold prices. Gold is priced in the U.S. currency and becomes more expensive to foreign buyers when the dollar strengthens.

"Gold's retreat was in lockstep with the financial market and especially the equity market recovery," wrote James Steel, chief precious metals analyst at HSBC, on Wednesday.

"It looks like pricing for the December expected rate hike is on schedule ... so [the] gold rally is capped," George Gero, managing director at RBC Wealth Management, said in a Thursday note.

-

15:39

Oil is little changed

Crude oil futures fell as the dollar strengthened versus major rivals.

Oil is little changed since Donald Trump's upset victory over Hillary Clinton Tuesday night.

Traders are keeping a close eye on developments regarding OPEC and its plan to curb supplies along with Russia.

Rttnews says that Iran has balked at being part of the deal, as it seeks to boost market share in the aftermath of heavy sanctions.

WTI light sweet crude oil was down 44 cents at $44.83.

Yesterday, EIA data showed U.S. oil stockpiles rose sharply for second week.

-

14:56

WSE: After start on Wall Street

Consecutive hours of today's trading did not produce the development of the morning move. Indexes began to consolidate, and in the environment can be seen even the departure, which is a reflection from the resistance level (the German DAX) or problems over it (French CAC40). It seems that it returns slowly rational view that winning Trump does not raise a sudden global growth.

The market in the US began with a rise of 0.35%, which in the case of index DJIA is setting new historical highs

An hour before the close of trading WIG20 index was at 1,817 points (+1.51%).

-

14:35

U.S. Stocks open: Dow +0.53%, Nasdaq +0.55%, S&P +0.41%

-

14:33

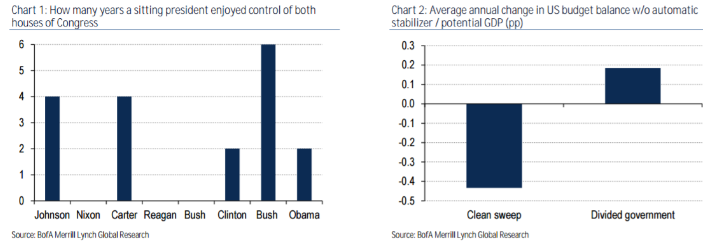

What Bank of America Merrill thinks about the dollar

"We have argued in the past few months that the significance of the US election lies in what it means for US fiscal policy. We believe the outcome of a Republican clean sweep means fiscal loosening is now a foregone conclusion. We believe this will lead to both higher rates and a higher USD.

Beyond the noise: Higher rates and higher dollar.

- A clean sweep is an exception rather than the norm in the US. There have been only 18 years since 1965 that a single party controlled the presidency as well as both houses of Congress.

- A clean sweep is a recipe for fiscal easing. During the eighteen years in which a single party controlled the presidency and both houses of Congress, US structural budget balance worsened by 0.4pp of potential GDP a year.

- Fiscal easing is bearish rates. A fiscal stimulus of 1% of GDP has been associated with 48bp increase in 10y yields. We expect 10y rates to test 2.25%-2.5% by Q1/Q2 next year.

- Higher rates is bullish for the USD. The last time the US unleashed fiscal stimulus when the economy was not in a recession was under Ronald Reagan (1981-84). This emboldened the Fed to enter a hiking cycle propelling the USD 60% higher.

- HIA 2.0 even more bullish the USD: We believe the lowest hanging fruit for the Trump administration will be tax reforms to encourage repatriation of the $2trn that US companies are sitting on. Our estimates suggest that nearly $400bn of overseas cash could be converted to USD, providing a positive USD tailwind. The only year from 2001 to 2008 in which the USD rallied was in 2005, during the first HIA.

- Deregulation: A combination of higher deficits and deregulation (lower buying of belly USTs from bank portfolios) leaves us biased towards tighter swap spreads in the 5y-10y part of the curve.

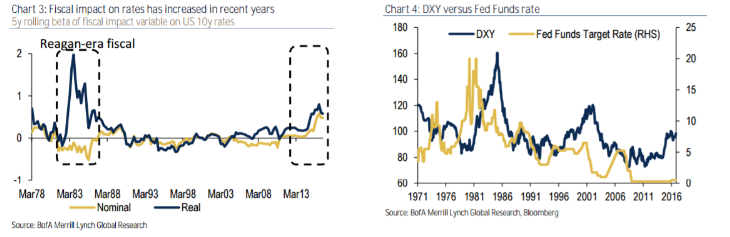

In FX, our highest conviction remains higher USD/JPY given its interest rate sensitivity. JPY is the most highly correlated to rate spreads within G10. Additionally, domestic flows are set to turn JPY-negative in 2017, further supporting our view. The biggest risk to our higher rates view is if Beijing takes advantage and pushes the RMB lower before the new president takes office. In such an event, we cannot rule out a risk-off environment that could drive down commodities, EM and inflation BEs".

Copyright © 2016 BofAML, eFXnews™

-

14:28

Fed's Bullard Expects 'Low' Interest Rates Over Next 2-3 Years

-

14:28

Before the bell: S&P futures +0.42%, NASDAQ futures +0.53%

U.S. stock-index futures advanced as investors continued to speculate Donald Trump's policies will benefit businesses.

Global Stocks:

Nikkei 17,344.42 +1,092.88 +6.72%

Hang Seng 22,839.11 +423.92 +1.89%

Shanghai 3,170.92 +42.55 +1.36%

FTSE 6,896.12 -15.72 -0.23%

CAC 4,567.19 +23.71 +0.52%

DAX 10,686.35 +40.34 +0.38%

Gold $1,275.90 (+0.19%)

Crude $44.94 (-0.73%)

-

14:12

Canadian New House Pice Index in line with expectations

The New Housing Price Index (NHPI) rose 0.2% in September compared with the previous month. Prices rose in 11 census metropolitan areas (CMAs), with the indexes from the combined region of Toronto and Oshawa and from Vancouver contributing the most to the monthly increase.

Windsor and the combined region of Saint John, Fredericton and Moncton, which both rose 1.2% in September, posted the largest monthly price advances among the CMAs covered by the survey. Builders in Windsor reported market conditions and higher land costs as reasons for the increase. This was the largest monthly price gain in Windsor since November 2011.

In the combined region of Saint John, Fredericton and Moncton, higher construction costs were the primary reason for the advance. This was the second consecutive price increase in the region this year, and the largest since June 2010.

-

14:10

US unemployment claims continue to decline

In the week ending November 5, the advance figure for seasonally adjusted initial claims was 254,000, a decrease of 11,000 from the previous week's unrevised level of 265,000. The 4-week moving average was 259,750, an increase of 1,750 from the previous week's revised average. The previous week's average was revised up by 250 from 257,750 to 258,000.

There were no special factors impacting this week's initial claims. This marks 88 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

-

13:58

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

63.95

-0.09(-0.1405%)

5765

American Express Co

AXP

69.3

0.56(0.8147%)

2957

AMERICAN INTERNATIONAL GROUP

AIG

61.56

0.63(1.034%)

550

Apple Inc.

AAPL

110.95

0.07(0.0631%)

231756

AT&T Inc

T

37.57

0.13(0.3472%)

9665

Barrick Gold Corporation, NYSE

ABX

17.21

-0.04(-0.2319%)

134484

Boeing Co

BA

146.6

1.51(1.0407%)

1624

Caterpillar Inc

CAT

91.9

0.70(0.7675%)

35832

Chevron Corp

CVX

108.25

0.61(0.5667%)

1069

Cisco Systems Inc

CSCO

31.5

0.14(0.4464%)

3103

Citigroup Inc., NYSE

C

52.2

0.61(1.1824%)

162386

Facebook, Inc.

FB

124.04

0.86(0.6982%)

137916

Ford Motor Co.

F

11.62

0.04(0.3454%)

15230

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.75

0.68(5.2028%)

739025

General Electric Co

GE

29.82

0.19(0.6412%)

25595

General Motors Company, NYSE

GM

31.1

0.14(0.4522%)

63983

Goldman Sachs

GS

194.58

1.95(1.0123%)

40207

Google Inc.

GOOG

791.4

6.09(0.7755%)

7484

International Business Machines Co...

IBM

157.49

2.68(1.7312%)

12198

JPMorgan Chase and Co

JPM

74.05

0.80(1.0922%)

77386

McDonald's Corp

MCD

115.22

0.24(0.2087%)

585

Merck & Co Inc

MRK

64.8

0.62(0.966%)

10375

Microsoft Corp

MSFT

60.4

0.23(0.3823%)

11222

Procter & Gamble Co

PG

86.14

0.21(0.2444%)

760

Tesla Motors, Inc., NASDAQ

TSLA

191.64

1.58(0.8313%)

30891

The Coca-Cola Co

KO

42.34

0.07(0.1656%)

13245

Travelers Companies Inc

TRV

107.03

0.09(0.0842%)

254

Twitter, Inc., NYSE

TWTR

18.89

-0.24(-1.2546%)

290552

United Technologies Corp

UTX

104.67

-0.14(-0.1336%)

2009

Verizon Communications Inc

VZ

48.14

0.28(0.585%)

3183

Visa

V

83.66

0.42(0.5046%)

1700

Wal-Mart Stores Inc

WMT

71.69

0.59(0.8298%)

2724

Walt Disney Co

DIS

95.02

0.38(0.4015%)

5724

Yahoo! Inc., NASDAQ

YHOO

41.77

0.56(1.3589%)

17750

Yandex N.V., NASDAQ

YNDX

20.06

0.03(0.1498%)

3700

-

13:56

Upgrades and downgrades before the market open

Upgrades:

IBM (IBM) upgraded to Buy from Neutral at BofA/Merrill

Microsoft (MSFT) upgraded to Neutral from Underweight at Atlantic Equities

Downgrades:

Other:

-

13:50

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0845-50 (EUR 1.78bln) 1.0945-50 (1.44bn) 1.1000 (1.29bn)

USD/JPY 103.00 (USD 921m) 103.50 ( 960m) 105.00 (1.05bln)

USD/CHF: 0.9685 (USD 830m)

AUD/USD: 0.7560-70 (AUD 1.28bn)

USD/CAD 1.3400 (USD 1.47bln)

AUD/JPY 78.85 (AUD 1.04bn)

-

13:30

U.S.: Initial Jobless Claims, 254 (forecast 260)

-

13:30

U.S.: Continuing Jobless Claims, 2041 (forecast 2030)

-

13:30

Canada: New Housing Price Index, MoM, September 0.2% (forecast 0.2%)

-

12:51

Orders

EUR/USD

Offers : 1.0930-35 1.0950 1.0980-85 1.1000 1.1025-30 1.1055-60 1.1085 1.1100 1.1200

Bids : 1.0900 1.0885 1.0850 1.0830 1.0800 1.0785 1.0765 1.0750

GBP/USD

Offers : 1.2460 1.2480-85 1.2500 1.2530 1.2550-60 1.2580 1.2600

Bids : 1.2420 1.2400 1.2375-80 1 .2350 1.2330 1.2300 1.2280 1.2250-55

EUR/GBP

Offers : 0.8800 0.8820-25 0.8850-55 0.8880-85 0.8900 0.8925 0.8950

Bids : 0.8750-60 0.8735 0.8700 0.8680 0.8650 0.8600

EUR/JPY

Offers : 115.70 116.00 116.30 116.50 117.00 117.30 117.50

Bids : 115.00 114.80 114.50 114.20 114.00 113.80 113.50 113.00

USD/JPY

Offers : 105.85 106.00 106.50 106.70 107.00 107.50

Bids : 105.20 105.00 104.85 104.50 104.30 104.00 103.80 103.50 103.00 102.80 102.50-55

AUD/USD

Offers : 0.7700 0.7730 0.7750 0.7765 0.7780 0.7800

Bids : 0.7650 0.7630 0.7600 0.7550 0.7520 0.7500 0.7475-80 0.7450 0.7400

-

12:01

WSE: Mid session comment

The first half of today's trading has allowed to develop the scale of increases and brought a high level of activity and not only on the values of KGHM. In the segment of blue chips the turnover counter achieved the PLN 545 million, and for the overall market almost PLN 700 million. This amount is worthy of respect, especially as the recent standards of the domestic market. Certainly, in part this is due to the published results, but mainly from the rally associated with relief after completed elections in the United States, even though the result is not fully satisfactory. The WIG20 index has recovered all the losses from the fateful Wednesday's session after a day of All Saints and reached the maximums listed previously, which may be a good place to rest after made a big move.

In Europe today also dominate positive sentiment, although the increases are slightly smaller than on the Warsaw Stock Exchange. However, this is fully justified by yesterday's attractions, which in the environment were significantly higher than in Warsaw. Traditionally, the strongest are commodity and financial companies, which behave the best in an environment of inflation and rising rates. Investors are hoping that the already observed tendencies will be reinforced by the policies of Donald Trump.

At the halfway point of today's session the index WIG20 was at the level of 1,830 points (+ 2.20%).

-

11:35

WSE will be closed on Friday, November 11, 2016.

We would like to remind that there will be no trading session (the Warsaw Stock Exchange will be closed) on Friday, November 11, 2016.

-

11:09

Russian oil companies have identified a list of Iranian fields - the deputy head of the Ministry of Energy of the Russian Federation

"Rosneft", "Gazprom", "Lukoil", "Gazprom Neft", "Zarubezhneft" and "Tatneft" had identified a list of fields of interest in Iran. This was stated by Deputy Energy Minister Kirill Molodtsov on the sidelines of the forum "The exploration, mining, processing."

Russia and Iran are discussing the possibility of an exclusive presentation of the Iranian oil and gas contracts for Russian companies. Molodcov added that the presentation date has been determined and it will be held in November.

-

10:33

Morgan Stanley lowered the rating of Qualcomm shares to "above market", maintains price target at $ 65

-

10:00

Oil is trading higher

This morning, the New York futures for Brent increased 0.73% to $ 45.62 and WTI up 1.19% to $ 46.91 per barrel. Thus, the black gold is gaining due to the release of data on the growth in US oil inventories. The reserves of black gold in the US rose by 2.4 million barrels to 485 million barrels last week, despite the fact that refineries increased production, and the volume of imports fell, reported US Energy Information Administration. According to BMI Research, Trump's position aimed at supporting the oil and gas industry, may mean that the "oil and gas production could recover faster in 2017, as the industry will get more support."

-

09:55

AstraZeneca shares falling on the back of high sales

-

09:18

Japan PM Advisor Shibayama: Gov't Has Said It Will Take Bold Action In FX If Needed, Will Not Comment On Specific Moves - Reuters

-

09:18

Italian industrial production index decreased by 0.8%

In September 2016 the seasonally adjusted industrial production index decreased by 0.8% compared with the previous month. The percentage change of the average of the last three months with respect to the previous three months was +1.2.

The calendar adjusted industrial production index increased by 1.8% compared with September 2015 (calendar working days in September 2016 being the same as in September 2015); in the period January-September 2016 the percentage change was +1.1 compared with the same period of 2015.

The unadjusted industrial production index increased by 1.9% compared with September 2015.

-

08:44

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0845-50 (EUR 1.78bln) 1.0945-50 (1.44bn) 1.1000 (1.29bn)

USD/JPY 103.00 (USD 921m) 103.50 ( 960m) 105.00 (1.05bln)

USD/CHF: 0.9685 (USD 830m)

AUD/USD: 0.7560-70 (AUD 1.28bn)

USD/CAD 1.3400 (USD 1.47bln)

AUD/JPY 78.85 (AUD 1.04bn)

-

08:26

Today’s events

-

At 17:15 GMT FOMC member James Bullard will give a speech

-

At 17:50 GMT the ECB Vice-President Vitor Constancio will give a speech

-

At 20:00 GMT Andy Haldane of the Bank of England will make a speech

-

At 21:01 GMT the United States will hold an auction of 30-year bonds

-

-

08:22

Major stock exchanges trading in the green zone: FTSE + 0.8%, DAX + 0.7%, CAC40 + 0.7%, FTMIB + 0.8%, IBEX + 0.9%

-

08:17

WSE: After opening

WIG20 index opened at 1800.19 points (+0.53%)*

WIG 48720.62 1.05%

WIG30 2095.97 1.24%

mWIG40 3994.91 0.56%

*/ - change to previous close

The cash market started the new day from increase of 0.53% to the round level of 1,800 points. The movement is more modest than in the case of a derivative market and thus enables rapid increase in the scale of growth.

The publication of better than expected results for the third quarter and the increase in copper prices result in a very strong, more than 10 per cent, the growth of quotations of KGHM. The activity around the market surprised positively indeed, what encourages published by the company's results. The WIG20 index quickly moves to the next stop, which is the local maxima of the end of October.

After fifteen minutes of trading the WIG20 index reached the level of 1,817 points (+1,50%).

-

07:48

French industrial production down 1.1% in September

Over the third quarter of 2016, output grew slightly in the manufacturing industry (+0.2%) compared to the previous quarter. It was virtually stable in the overall industry (-0.1% q-o-q), due to a sharp fall in mining and quarrying; energy; water supply (-2.0%).

Output grew in the manufacture of food products and beverages (+1.7%) and bounced back strongly in the manufacture of coke and refined petroleum products (+14.9%). It was virtually stable in "other manufacturing" (+0.1%) and increased slightly in the manufacture of machinery and equipment goods(+0.3%). Conversely, it fell sharply in the manufacture of transport equipment(-2.3%).

-

07:46

USD/JPY: To Test Above 110 Before Seeing 100 Again - ANZ

"In a fundamental sense the JPY looks set to turn.

Real rates will turn from a driver of strength to weakness, while the better commodity environment will reduce the scale of the trade surplus. The key future uncertainty is likely to be the scale of outflows. Here, the recent steepening in global rates will play a key role. In the near term our indicators of liquidity suggest volatility could remain suppressed, and as such drive further JPY weakness. We will watch our indicator closely and be alert to the risk that global curves steepen to a point which tightens liquidity and drives volatility higher. For this reason, the upcycle for USD/JPY is likely to be much more shallow than usual.

As such, we expect USD/JPY to test above 110 before seeing 100 again.

We have revised our forecasts for USD/JPY higher".

(Source: eFXplus Forecasts, ANZ)

Copyright © 2016 ANZ, eFXnews™

-

07:45

France: Non-Farm Payrolls, Quarter III 0.3% (forecast 0.2%)

-

07:45

France: Industrial Production, m/m, September -1.1% (forecast -0.3%)

-

07:43

Asian session review: NZD sold as RBNZ announces downside risks for interest rates

The Australian dollar rose onpositive data from Australia. According to the data released on Thursday, the number of approved housing loans in September increased by 1.6% compared with August. The surveyed economists had expected a decrease of 1.6%. The volume of approved housing loans in September rose by 4.6% compared with August. This means that lower interest rates provide some support for the housing market.

In addition, the strengthening of commodity prices also supported the Australian dollar. Iron ore prices on Wednesday rose 4.7%, to highs since the beginning of last year. Price of iron ore increased by 3.20 US dollars to 71 US dollars.

New Zealand's dollar fell after the Reserve Bank of New Zealand decided to reduce the interest rate. The Reserve Bank of New Zealand cut its official interest rate by 25 bp from 2.0% to 1.75% The decision of the central bank was not a surprise for investors, as the probability of a rate cut was more than 80%. Lower interest rate was necessary mainly to maintain the level of inflation. According to forecasts of the RBNZ, inflation will reach the target level of 2% in the fourth quarter of 2018. Earlier, the central bank expected to achieve the goal in the third quarter of 2018. In its accompanying statement, the RBNZ leaders expressed fears of a global political uncertainty. Trump, Brexit, China - among the global uncertainties. Graeme Wheeler is also concerned about how the business will respond to global risks, in particular, he noted the risks associated with the prospects of the Chinese economy. Wheeler also said he did not need one more drop in rates in the near future.

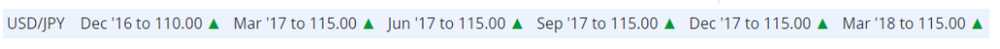

EUR / USD: during the Asian session, the pair rose to $ 1.1300

GBP / USD: during the Asian session, the pair rose to $ 1.2545

USD / JPY: on Asian session the pair fell to Y101.20

-

07:33

Options levels on thursday, November 10, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1154 (3904)

$1.1089 (2239)

$1.1039 (739)

Price at time of writing this review: $1.0926

Support levels (open interest**, contracts):

$1.0857 (3515)

$1.0834 (3018)

$1.0807 (4574)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 63564 contracts, with the maximum number of contracts with strike price $1,1400 (6747);

- Overall open interest on the PUT options with the expiration date December, 9 is 56058 contracts, with the maximum number of contracts with strike price $1,0900 (4574);

- The ratio of PUT/CALL was 0.88 versus 0.87 from the previous trading day according to data from November, 9

GBP/USD

Resistance levels (open interest**, contracts)

$1.2705 (1516)

$1.2608 (1246)

$1.2512 (1870)

Price at time of writing this review: $1.2437

Support levels (open interest**, contracts):

$1.2388 (1276)

$1.2292 (3506)

$1.2195 (951)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 32176 contracts, with the maximum number of contracts with strike price $1,3400 (2560);

- Overall open interest on the PUT options with the expiration date December, 9 is 34301 contracts, with the maximum number of contracts with strike price $1,2300 (3506);

- The ratio of PUT/CALL was 1.07 versus 1.06 from the previous trading day according to data from November, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:32

Orders for machinery and equipment in Japan continues to decline

According to data released today by the Institute of Economic and Social Research of Japan, core orders for machinery and equipment continue to decline in September for the fourth consecutive month and fell by -3.3% in relation to August. It is worth noting that the majority of analysts forecast a decline by only 0.5%. Thus data was significantly worse and showed a decline in absolute value of 843.7 billion yen. The annualized figure rose by 4.3%, while the previous year was +11.6%.

The total number of orders for machinery and equipment, including those for ships and electric power companies, fell by 0.7% in monthly terms and rose by 0.9% over the year to 972.1 billion yen.

-

07:26

Fed's Williams: FOMC can start gradually removing accommodation over the next few years, confident inflation will move towards target soon

-

07:25

WSE: Before opening

Yesterday's, initially negative, market reaction to the Trump's victory proved to be extremely short-lived. Quotations on Wall Street ended with strong increases, mainly of financial, industrial and health companies. This means that the looser regulations and more government spending are expected.

In Asia, we observe considerable increases, which results from the need to catch up the visible yesterday world optimism. In addition, for Japan market helps a stronger dollar, which leads to increases by more than 6%.

A stronger US currency is the result of expectations that the Trump policy (lower taxes, more spending) will be inflationary and consequently may lead to somewhat stronger increases in interest rates.

On the Warsaw market to global optimism they add up better than expected results from companies such as Neuca (WSE: NEU), KGHM and Ambra (WSE: AMB). Light positively look PZU and Pekao (WSE: PEO). According to earlier estimates reported Enea (WSE: ENA), Tauron (WSE: TPE) and Bogdanka (WSE: LWB). About disappointment we may speak in case of Eurocash (WSE: EUR), JSW and Agora (WSE:AGO).

-

07:17

Positive start of trading expected on the major stock exchanges in Europe: DAX + 2.1%, CAC 40 + 1.8%, FTSE + 1.5%

-

07:11

RBNZ's McDermott: Can cut rate more if needed, risks on rates still to the downside

-

07:10

RBNZ cuts rates to 1.75% as expected

The Reserve Bank of New Zeeland today reduced the Official Cash Rate (OCR) by 25 basis points to 1.75 percent.

Significant surplus capacity exists across the global economy despite improved economic indicators in some countries. Global inflation remains weak even though commodity prices have come off their lows. Political uncertainty remains heightened and market volatility is elevated.

Weak global conditions and low interest rates relative to New Zealand are keeping upward pressure on the New Zealand dollar exchange rate. The exchange rate remains higher than is sustainable for balanced economic growth and, together with low global inflation, continues to generate negative inflation in the tradables sector. A decline in the exchange rate is needed.

Domestic growth is being supported by strong population growth, construction activity, tourism, and accommodative monetary policy. Recent dairy auctions have been positive, but uncertainty remains around future outcomes. High net immigration is supporting growth in labour supply and limiting wage pressure.

House price inflation remains excessive and is posing concerns for financial stability. Although house price inflation has moderated in Auckland, it is uncertain whether this will be sustained given the continuing imbalance between supply and demand.

-

06:16

Japan: Prelim Machine Tool Orders, y/y , October -8.9%

-

05:43

Global Stocks

European stock markets traded sharply lower on Wednesday after Republican candidate Donald Trump won the U.S. presidential election, unsettling global financial markets. However, early Wednesday morning Trump emerged as the winner after securing majorities in several key swing states, including Ohio, Florida and North Carolina.

U.S. stocks rallied Wednesday, with the Dow industrials jumping 257 points, led by a surge in financial, health-care and industrial stocks, as investors bet on the infrastructure spending policy promised by President-elect Donald Trump.

Asian shares rose broadly early Thursday, as global investors chose to focus on the upsides of a Donald Trump presidency after a sharp selloff in the region the previous day.

-

00:30

Australia: Home Loans , September 1.6% (forecast -2%)

-

00:00

Australia: Consumer Inflation Expectation, October 3.2%

-