Market news

-

23:28

Stocks. Daily history for Nov 07’2016:

(index / closing price / change items /% change)

Nikkei 225 17,136.53 +231.17 +1.37%

Shanghai Composite 3,133.40 +8.08 +0.26%

S&P/ASX 200 5,250.80 0.00 0.00%

FTSE 100 6,806.90 +113.64 +1.70%

CAC 40 4,461.21 +83.75 +1.91%

Xetra DAX 10,456.95 +197.82 +1.93%

S&P 500 2,131.52 +46.34 +2.22%

Dow Jones Industrial Average 18,259.60 +371.32 +2.08%

S&P/TSX Composite 14,652.45 +143.20 +0.99%

-

21:05

Major US stock indexes finished trading in positive territory

Major US stock indexes rose strongly on Monday, a day before the US presidential election as a Democrat Hillary Clinton's prospects rose after the FBI announced that he would not insist on the opening of a criminal case related to the use of her private e-mail.

Yesterday the head of the FBI James Comey said in a letter to Congress that his agency sees no reason to indict Clinton. Recall the previous week reported resumption of the FBI investigation into the email in the US presidential candidate from the Democratic Party had a negative impact on the ranking of Clinton, which triggered selling in the stock market.

Important statistics that could have an impact on market sentiment, was not published. The main focus of market participants focused on the US presidential election, scheduled for 8 November.

Oil futures rose modestly on Monday, supported by statements from OPEC. However, prices remain about $ 7 lower than the maximum of the previous month due to persistent doubts about the feasibility of OPEC plan to cut production.

All components of the DOW index closed in positive territory (30 of 30). More rest up shares JPMorgan Chase & Co. (JPM, + 3.07%).

All Sector S & P Index showed an increase. The leader turned out to be the financial sector (+ 2.3%).

At the close:

Dow + 2.07% 18,257.85 +369.57

Nasdaq + 2.37% 5,166.17 +119.80

S & P + 2.22% 2,131.37 +46.19

-

20:00

DJIA +1.77% 18,204.20 +315.92 Nasdaq +2.12% 5,153.34 +106.97 S&P +1.92% 2,125.17 +39.99

-

17:29

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes marched higher on Monday, a day before the U.S. presidential election as Democrat nominee Hillary Clinton's prospects brightened after the FBI said it would not press criminal charges related to her use of a private email server.

All Dow stocks in positive area (30 of 30). Top gainer - UnitedHealth Group Incorporated (UNH, +3.25%).

All S&P sectors also in positive area. Top gainer- Healthcare (+2.5%).

At the moment:

Dow 18146.00 +341.00 +1.92%

S&P 500 2124.00 +44.00 +2.12%

Nasdaq 100 4770.25 +112.50 +2.42%

Oil 44.37 +0.30 +0.68%

Gold 1279.20 -25.30 -1.94%

U.S. 10yr 1.83 +0.05

-

17:00

European stocks closed: FTSE 100 +113.64 6806.90 +1.70% DAX +197.82 10456.95 +1.93% CAC 40 +83.75 4461.21 +1.91%

-

16:43

WSE: Session Results

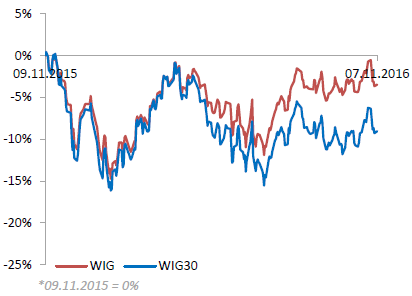

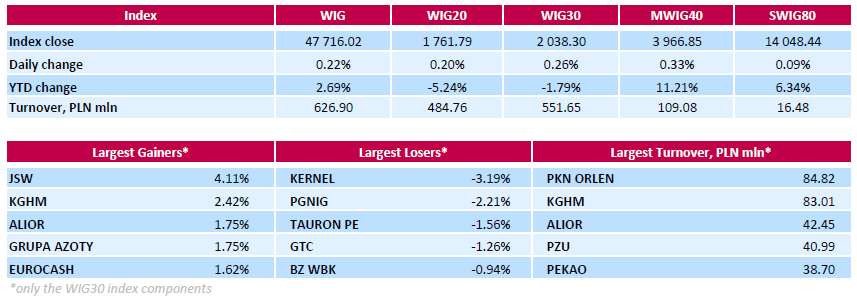

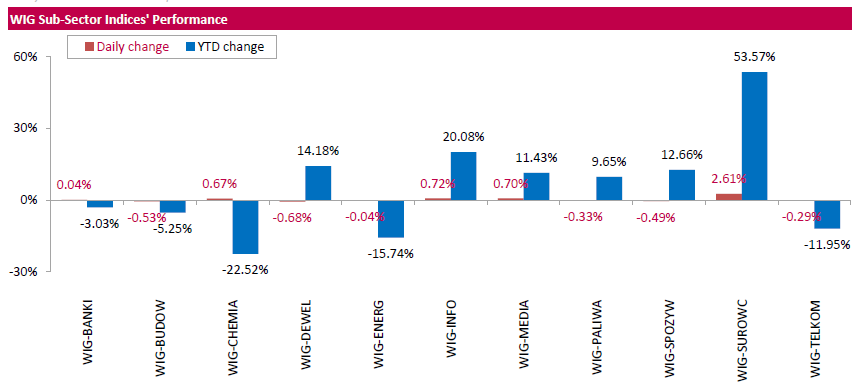

Polish equity market closed higher on Monday. The broad market measure, the WIG Index, rose by 0.22%. Sector performance within the WIG Index was mixed. Materials (+2.61%) outperformed, while developing sector (-0.68%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, advanced 0.26%. A majority of the index components returned gains, with the way up led by coking coal miner JSW (WSE: JSW) and copper producer KGHM (WSE: KGH), climbing by 4.11% and 2.42% respectively. Other major advancers were chemical producer GRUPA AZOTY (WSE: ATT), bank ALIOR (WSE: ALR) and FMCG-wholesaler EUROCASH (WSE: EUR), which surged by 1.75%, 1.75% and 1.62% respectively. At the same time, agricultural producer KERNEL (WSE: KER) topped the list of decliners with a 3.19% drop, followed by oil and gas producer PGNIG (WSE: PGN) and genco TAURON PE (WSE; TPE), which tumbled by 2.21% and 1.56% respectively.

-

15:01

Moody's: Amazon's revenue in the next quarter is likely to grow by at least 22%

-

14:32

U.S. Stocks open: Dow +1.15%, Nasdaq +1.64%, S&P +1.17%

-

14:23

Before the bell: S&P futures +1.43%, NASDAQ futures +1.60%

U.S. stock-index futures signaled an end to a nine-day equity decline after the FBI reiterated that Hillary Clinton's handling of e-mails wasn't a crime, likely boosting her prospects in the presidential election.

Global Stocks:

Nikkei 17,177.21 +271.85 +1.61%

Hang Seng 22,801.40 +158.78 +0.70%

Shanghai 3,133.40 +8.08 +0.26%

FTSE 6,787.76 +94.50 +1.41%

CAC 4,451.01 +73.55 +1.68%

DAX 10,428.27 +169.14 +1.65%

Crude $44.51 (+1.00%)

Gold $1,287.50 (-1.30%)

-

13:57

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

169.15

2.67(1.6038%)

1303

ALCOA INC.

AA

25.76

0.56(2.2222%)

8494

ALTRIA GROUP INC.

MO

64.84

0.46(0.7145%)

835

Amazon.com Inc., NASDAQ

AMZN

768.77

13.72(1.8171%)

31363

American Express Co

AXP

66.22

0.71(1.0838%)

640

AMERICAN INTERNATIONAL GROUP

AIG

58.02

0.64(1.1154%)

387

Apple Inc.

AAPL

109.92

1.08(0.9923%)

156917

AT&T Inc

T

36.82

0.32(0.8767%)

31149

Barrick Gold Corporation, NYSE

ABX

17.63

-0.64(-3.503%)

103703

Boeing Co

BA

141.7

2.16(1.5479%)

1384

Caterpillar Inc

CAT

83.67

1.36(1.6523%)

3935

Chevron Corp

CVX

106.1

1.32(1.2598%)

5405

Cisco Systems Inc

CSCO

30.62

0.43(1.4243%)

15580

Citigroup Inc., NYSE

C

48.99

0.82(1.7023%)

13360

Deere & Company, NYSE

DE

88.4

0.34(0.3861%)

1220

E. I. du Pont de Nemours and Co

DD

69.3

0.69(1.0057%)

815

Exxon Mobil Corp

XOM

84.69

1.12(1.3402%)

12049

Facebook, Inc.

FB

122.25

1.50(1.2422%)

186465

Ford Motor Co.

F

11.5

0.16(1.4109%)

52882

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.37

0.32(2.8959%)

118621

General Electric Co

GE

28.78

0.34(1.1955%)

30770

General Motors Company, NYSE

GM

31.6

0.44(1.4121%)

1825

Goldman Sachs

GS

178.65

2.73(1.5518%)

3453

Google Inc.

GOOG

775.7

13.68(1.7952%)

10025

Hewlett-Packard Co.

HPQ

14.9

0.19(1.2916%)

800

Home Depot Inc

HD

122.5

1.59(1.315%)

1781

Intel Corp

INTC

34.15

0.54(1.6067%)

15352

International Business Machines Co...

IBM

154.5

2.07(1.358%)

3311

International Paper Company

IP

44.25

0.27(0.6139%)

150

Johnson & Johnson

JNJ

116.03

0.92(0.7992%)

1270

JPMorgan Chase and Co

JPM

68.93

1.17(1.7267%)

33368

McDonald's Corp

MCD

111.85

0.81(0.7295%)

2348

Merck & Co Inc

MRK

59.24

0.42(0.714%)

12340

Microsoft Corp

MSFT

59.6

0.89(1.5159%)

45786

Nike

NKE

50.61

0.65(1.301%)

4691

Pfizer Inc

PFE

30.41

0.41(1.3667%)

9805

Procter & Gamble Co

PG

85.94

0.86(1.0108%)

9459

Starbucks Corporation, NASDAQ

SBUX

53.35

0.60(1.1374%)

24017

Tesla Motors, Inc., NASDAQ

TSLA

194.3

3.74(1.9626%)

34925

The Coca-Cola Co

KO

42.11

0.42(1.0074%)

21052

Travelers Companies Inc

TRV

115

10.33(9.8691%)

225

Twitter, Inc., NYSE

TWTR

18.27

0.25(1.3873%)

152731

Verizon Communications Inc

VZ

47.54

0.46(0.9771%)

7940

Visa

V

81.19

0.83(1.0329%)

2051

Wal-Mart Stores Inc

WMT

69.74

0.58(0.8386%)

3402

Walt Disney Co

DIS

94

1.55(1.6766%)

735

Yahoo! Inc., NASDAQ

YHOO

41.09

0.81(2.0109%)

16843

Yandex N.V., NASDAQ

YNDX

18.92

0.60(3.2751%)

12100

-

12:05

WSE: Mid session comment

Today's session runs for the time being under the sign of one piece of information, which appears before the start of trading and therefore has led to widespread gaps growth. Virtually all European markets are on the gain, increases in Western Europe exceed 1% and indices are traded on the session highs. Against this background, we may have some reservations with regard to the behavior of the WIG20, which rather revolves in the area of session lows, however it still means more than 1%.

Top behave today sectors familiar with previous good behavior, namely commodity producers and banks. Currently, the most important is the election in the US and the reaction of global markets on their outcome. When the cards will be fully lined on the table, then we may get a chance for a slightly larger directional movement in the markets. So far we have only measured with the prospect of increased volatility and nervous movements.

At the halfway point of today's session, the WIG20 index was at the level of 1,777 points (+ 1.08%). The turnover among the largest companies was amounted close to PLN 200 million.

-

12:03

Major stock indices in Europe show a positive trend

HSBC Holdings shares jumped 4.5% as the bank topped the rise of financial companies under the Stoxx 600. Its adjusted profit unexpectedly rose in Q3.

The stock price of the world's largest mining group BHP Billiton rose 4%, Anglo American +2.7%.

Securities of Rio Tinto Plc rose 3.3% as the price of diamonds from the Argyle mine in Australlia peaked.

The market capitalization of Ryanair Holdings airline rose 4.9% after improved forecast for the coming years.

PostNL shares gained 5.8% as the Dutch postal company rejected a takeover bid from Belgian competitor Bpost.

French carmaker Renault has grown by 2.4% since the end of last week, the Government of Pakistan stated that the company plans to open local production and launch it by 2018.

At this moment:

FTSE 6784.02 90.76 1.36%

DAX 10421.94 162.81 1.59%

CAC 4453.95 76.49 1.75%

-

08:42

-

08:17

WSE: After opening

WIG20 index opened at 1773.16 points (+0.85%)*

WIG 48179.18 1.19%

WIG30 2063.84 1.51%

mWIG40 3975.80 0.55%

*/ - change to previous close

The futures market opened up with considerable increase of 1.14% to 1,780 points. At the same time, contract and DAX-gained more than 1.8%. Beginning runs so the expected line of high-openings, which in the current uncertain environment, are not the best solution, because it may limit the subsequent volatility.

All components of the WIG20 are on the green side, but the leader is KGHM, which grows more than 3%.In addition to the positive sentiment also helps the cooper factor.

After fifteen minutes of trading the WIG20 index reached the level of 1,781 points (+1,33%).

Behind us a good start of the Warsaw market and before the market more difficult work on maintaining and preferably further development of a nice beginning.

-

07:44

Positive start of trading expected on the major stock exchanges in Europe: DAX + 1.4%, CAC40 + 1.4%, FTSE + 1.1%

-

07:20

WSE: Before opening

We start the new week, which for the Warsaw market once again will be shortened by one day due to the Independence Day on Friday. Furthermore, the second week of the month is known that the macroeconomic calendar is relatively empty, and its beginning goes further under the influence of Friday's report from the US labor market. Now it will be a little different, because of the Tuesday's US presidential election, which for several days very clearly attracted the attention of investors and thus overshadowed Friday's data from the US. The very opening week runs anyway quite rapidly because of the new election topic in the form of information from the FBI that there will be an investigation into the emails Hillary Clinton. The head of the agency, which last Friday reopened the case last night said that after examining new evidence, there is no basis to bring charges to Clinton. It is of course positive for the Democrat candidate, leading to market the reaction in the form of gap openings. Strongly reinforces the Mexican peso, weakens the dollar and bonds, gain shares and contracts for US indices. Therefore the morning mood is already set and the growing gap in opening in Europe and on the WSE virtually assured.

-