Market news

-

23:51

Japan: BSI Manufacturing Index, Quarter I 1.1 (forecast 8.4)

-

23:28

Commodities. Daily history for Mar 09’02’2017:

(raw materials / closing price /% change)

Oil 49.62 -1.31%

Gold 1,200.90 -0.19%

-

23:27

Stocks. Daily history for Mar 09’2017:

(index / closing price / change items /% change)

Nikkei +64.55 19318.58 +0.34%

TOPIX +4.43 1554.68 +0.29%

Hang Seng -280.71 23501.56 -1.18%

CSI 300 -21.79 3426.94 -0.63%

Euro Stoxx 50 +20.27 3409.89 +0.60%

FTSE 100 -19.65 7314.96 -0.27%

DAX +11.08 11978.39 +0.09%

CAC 40 +21.03 4981.51 +0.42%

DJIA +2.46 20858.19 +0.01%

S&P 500 +1.89 2364.87 +0.08%

NASDAQ +1.26 5838.81 +0.02%

S&P/TSX -0.14 15496.84 +0.00%

-

23:27

Currencies. Daily history for Mar 09’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0576 +0,34%

GBP/USD $1,2167 +0,02%

USD/CHF Chf1,012 -0,25%

USD/JPY Y114,94 +0,52%

EUR/JPY Y121,57 +0,87%

GBP/JPY Y139,81 +0,51%

AUD/USD $0,7504 -0,28%

NZD/USD $0,6898 -0,20%

USD/CAD C$1,3509 +0,15%

-

23:00

Schedule for today,Friday, Mar 10’2017 (GMT0)

00:30 Australia Home Loans January 0.4% -1%

07:00 Germany Current Account January 24

07:00 Germany Trade Balance (non s.a.), bln January 18.7

07:45 France Industrial Production, m/m January -0.9% 0.5%

09:30 United Kingdom Total Trade Balance January -3.30

09:30 United Kingdom Industrial Production (MoM) January 1.1% -0.4%

09:30 United Kingdom Industrial Production (YoY) January 4.3% 3.3%

09:30 United Kingdom Manufacturing Production (MoM) January 2.1% -0.6%

09:30 United Kingdom Manufacturing Production (YoY) January 4% 3%

09:30 United Kingdom Consumer Inflation Expectations 2.8%

13:30 Canada Employment February 48.3 2.5

13:30 Canada Unemployment rate February 6.8% 6.8%

13:30 U.S. Average workweek February 34.4 34.4

13:30 U.S. Average hourly earnings February 0.1% 0.3%

13:30 U.S. Nonfarm Payrolls February 227 190

13:30 U.S. Unemployment Rate February 4.8% 4.7%

15:00 United Kingdom NIESR GDP Estimate February 0.7% 0.6%

19:00 U.S. Federal budget February 51 -150

-

21:06

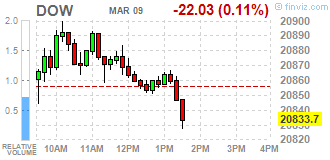

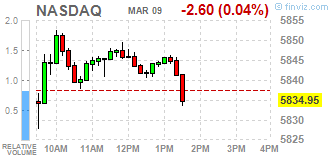

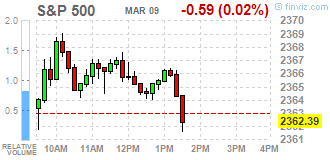

The main US stock indexes rose slightly as a result of today's trading

Major US stock indexes registered a slight increase, as shares of financial sector companies went up against the backdrop of signs of strength in the labor market and an almost certain increase in interest rates.

Investors also awaited an important report on employment in the non-agricultural sector, which could strengthen the chances of raising rates during the meeting of the Federal Reserve System on March 14-15. According to the futures market, now the probability of an increase in the rate of the Fed at the March meeting is 90.8%.

In addition, as it became known, the number of Americans who applied for unemployment benefits last week recovered from the nearly 44-year low, but continued to point to a tightening of the labor market. Initial applications for unemployment benefits increased by 20,000 to 243,000, seasonally adjusted for the week ending March 4, the Ministry of Labor said. Appeals for the previous week were not revised and remained at the level of 223,000, which is the lowest level since March 1973.

A separate report showed that import and export prices in the US rose slightly more than expected in February. The report said that import prices rose 0.2% in February after climbing a revised upward 0.6% in January. Economists had expected that import prices would rise by 0.1% compared to the 0.4% increase originally reported for the previous month.

The components of the DOW index have mostly grown (22 out of 30). The leader of growth was the shares of Johnson & Johnson (JNJ, + 1.47%). Caterpillar Inc. shares fell more than others. (CAT, -1.84%).

The sectors of the S & P index finished the session in different directions. The conglomerate sector fell most of all (-1.4%). The leader of growth was the healthcare sector (+ 0.6%).

At closing:

DJIA +3.63 20859.36 + 0.02%

S & P 500 + 2.77 2365.75 + 0.12%

NASDAQ +1.26 5838.81 + 0.02%

-

20:00

DJIA -0.22% 20,809.26 -46.47 Nasdaq -0.19% 5,826.26 -11.29 S&P -0.13% 2,359.90 -3.08

-

18:39

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Thursday, as bank stocks climbed amid signs of strength in the labor market and a near-certain interest rate hike. The S&P financial index .SPSY rose 0.6 percent as investors turned their attention to a crucial nonfarm payrolls report on Friday that would bolster already sky-high odds of a rate hike during the Federal Reserve's meeting on March 14-15.

Most of Dow stocks in negative area (17 of 30). Top loser - Caterpillar Inc. (CAT, -2.02%). Top gainer - Johnson & Johnson (JNJ, +1.35%).

S&P sectors mixed. Top loser - Conglomerates (-1.3%). Top gainer - Healthcare (+0.6%).

At the moment:

Dow 20815.00 -8.00 -0.04%

S&P 500 2361.75 +0.75 +0.03%

Nasdaq 100 5368.50 +1.50 +0.03%

Oil 48.96 -1.32 -2.63%

Gold 1203.40 -6.00 -0.50%

U.S. 10yr 2.58 +0.03

-

17:00

European stocks closed: FTSE 100 -19.65 7314.96 -0.27% DAX +11.08 11978.39 +0.09% CAC 40 +21.03 4981.51 +0.42%

-

15:40

IMF spokesman says China's new 2017 growth target of 6.5 pct achievable; IMF believes China should focus less on high growth targets, more on reforms

-

14:32

U.S. Stocks open: Dow -0.03%, Nasdaq -0.07%, S&P -0.03%

-

14:26

Before the bell: S&P futures -0.12%, NASDAQ futures -0.08%

U.S. stock-index futures fell as oil prices dropped below $50 and investors remained cautious ahead of Friday's nonfarm payrolls data that could significantly affect expectations about the further actions of the Fed.

Global Stocks:

Nikkei 19,318.58 +64.55 +0.34%

Hang Seng 23,501.56 -280.71 -1.18%

Shanghai 3,216.58 -24.08 -0.74%

FTSE 7,293.02 -41.59 -0.57%

CAC 4,955.55 -4.93 -0.10%

DAX 11,968.64 +1.33 +0.01%

Crude $49.44 (-1.67%)

Gold $1,207.20 (-0.18%)

-

13:56

Draghi: don't anticipate that rates would have to be reduced, TLTRO to expire and no discussion about other TLTRO

-

13:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

35.67

-0.32(-0.89%)

24424

ALTRIA GROUP INC.

MO

75.9

0.06(0.08%)

93804

Amazon.com Inc., NASDAQ

AMZN

850.24

-0.26(-0.03%)

20742

Apple Inc.

AAPL

138.71

-0.29(-0.21%)

378940

AT&T Inc

T

41.69

-0.08(-0.19%)

295008

Barrick Gold Corporation, NYSE

ABX

17.75

-0.07(-0.39%)

92255

Caterpillar Inc

CAT

92.9

-0.33(-0.35%)

36480

Chevron Corp

CVX

109

-0.61(-0.56%)

97141

Citigroup Inc., NYSE

C

61.25

0.14(0.23%)

146322

Exxon Mobil Corp

XOM

80.7

-0.33(-0.41%)

230022

Facebook, Inc.

FB

137.62

-0.10(-0.07%)

144798

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.25

-0.19(-1.53%)

154787

General Electric Co

GE

29.76

-0.04(-0.13%)

435768

General Motors Company, NYSE

GM

37.3

0.03(0.08%)

68276

Goldman Sachs

GS

250.54

0.30(0.12%)

21386

Google Inc.

GOOG

835

-0.37(-0.04%)

15244

Intel Corp

INTC

35.6

-0.02(-0.06%)

269532

JPMorgan Chase and Co

JPM

91.26

0.05(0.05%)

174681

Merck & Co Inc

MRK

65.69

-0.11(-0.17%)

132889

Nike

NKE

56.58

0.07(0.12%)

66508

Pfizer Inc

PFE

33.75

-0.16(-0.47%)

292426

Procter & Gamble Co

PG

90.15

0.01(0.01%)

128285

Tesla Motors, Inc., NASDAQ

TSLA

247.98

1.11(0.45%)

5168

Verizon Communications Inc

VZ

49.2

0.04(0.08%)

196041

Visa

V

89

0.04(0.05%)

675

Walt Disney Co

DIS

110.6

-0.24(-0.22%)

71956

Yandex N.V., NASDAQ

YNDX

23.09

-0.34(-1.45%)

6410

-

13:53

Draghi: risk of deflation largely disappeared. EUR/USD recovers early losses

-

Policy measures from 2016-2019 is 1.7 pct on inflation

-

Too early to declare victory on inflation front

-

Council acknowledged success of policy

-

Balance of risk has inproved

-

-

13:49

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.0535 (437m) 1.0550 (515m) 1.0575-85 (1.5bln) 1.0600-05 (1.6bln)

USDJPY: 113.95-114.00 (875m) 114.50 (492m) 115.00 (963m)

GBPUSD: 1.2000 (235m)

AUDUSD: 0.7400 (340M) 0.7450 (249m), 0.7655 (393m) 0.7675 (357m)

NZDUSD: 0.7065 (806m) 0.7100 (647m)

AUDJPY: 87.00 (298m)

-

13:48

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Tesla (TSLA) initiated with a Mkt Perform at Bernstein; target $250

-

13:46

Canadian New Housing Price Index (NHPI) edged up 0.1% in January

The New Housing Price Index (NHPI) edged up 0.1% in January compared with the previous month. The increase was largely attributable to new housing prices in Ontario.

Among the 27 metropolitan areas surveyed, new housing prices were up in 14, down in 7 and unchanged in 6.

Kitchener-Cambridge-Waterloo (+1.0%) recorded the biggest price gain. Builders in the region cited a shortage of developed land as the reason for the rise, the largest since June 2012.

Other significant price increases were observed in St. Catharines-Niagara (+0.9%) and London (+0.9%). In St. Catharines-Niagara, builders reported higher construction costs and improving market conditions as reasons for the rise. Builders in London tied the gains to higher construction costs.

-

13:45

US export and import prices rose in February

Prices for U.S. imports advanced 0.2 percent in February, the U.S. Bureau of Labor Statistics reported today, led by higher nonfuel import prices which more than offset lower fuel prices. The February rise in import prices followed a 0.6-percent increase the previous month. U.S. export prices rose 0.3 percent in February, after advancing 0.2 percent in January.

Prices for U.S. exports advanced 0.3 percent in February and have not recorded a monthly decline since the index fell 0.8 percent in August. In February, rising prices for both agricultural exports and nonagricultural exports contributed to the overall advance. Export prices increased 3.1 percent over the past

12 months, the largest over-the-year rise since the index advanced 3.6 percent between December 2010 and December 2011. -

13:43

ECB sees 2017 gdp growth at 1.8t vs 1.7 pct seen in dec, 2017 inflation at 1.7 pct vs 1.3 pct seen in Dec

-

No signs yet of upward trend in underlying inflation

-

Risks less pronounced

-

Underlying inflation to rise only gradually

-

Headline CPI to remain at levels close to 2 pct in coming months

-

Risks tilted to the downside

-

2019 inflation at 1.7 pct vs 1.7 pct seen in dec

-

2018 inflation at 1.6 pct vs 1.5 pct seen in dec

-

-

13:36

Draghi says policy measures have continued to preserve favourable conditions

-

Policy measures have continued to preserve favourable conditions

-

Substantial degree of stimulus is needed

-

Will look through transient changes in inflation

-

Data increase confidence in expansion

-

-

13:32

US initial jobless claims a little higher than expected

In the week ending March 4, the advance figure for seasonally adjusted initial claims was 243,000, an increase of 20,000 from the previous week's unrevised level of 223,000. The 4-week moving average was 236,500, an increase of 2,250 from the previous week's unrevised average of 234,250.

The advance seasonally adjusted insured unemployment rate was 1.5 percent for the week ending February 25, unchanged from the previous week's unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending February 25 was 2,058,000, a decrease of 6,000 from the previous week's revised level

-

13:30

Canada: New Housing Price Index, MoM, January 0.1%

-

13:30

U.S.: Initial Jobless Claims, 243 (forecast 235)

-

13:30

U.S.: Import Price Index, February 0.2% (forecast 0.1%)

-

13:30

Canada: Capacity Utilization Rate, Quarter IV 82.2%

-

13:30

U.S.: Continuing Jobless Claims, 2058 (forecast 2060)

-

12:46

ECB left the interest rate, QE program unchanged

"At today's meeting the Governing Council of the ECB decided that the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.40% respectively. The Governing Council continues to expect the key ECB interest rates to remain at present or lower levels for an extended period of time, and well past the horizon of the net asset purchases.

Regarding non-standard monetary policy measures, the Governing Council confirms that it will continue to make purchases under the asset purchase programme (APP) at the current monthly pace of €80 billion until the end of this month and that, from April 2017, the net asset purchases are intended to continue at a monthly pace of €60 billion until the end of December 2017, or beyond, if necessary, and in any case until the Governing Council sees a sustained adjustment in the path of inflation consistent with its inflation aim".

-

12:45

Eurozone: ECB Interest Rate Decision, 0% (forecast 0%)

-

11:37

Sterling hits seven-week low of 86.975 pence per euro, down a third of a percent on day

-

11:03

U.S. light crude oil trades below $50/barrel for first time since dec 15 after U.S crude stocks build

-

10:13

Schaeuble says calls for timely start to end of ECB's loose monetary policy

-

We have to strengthen the competitivenes of the EU's financial sector, especially after Brexit

-

We can't get around suitably regulating government bonds

-

Strengthening of banking union does not mean premature pooling of deposit insurance

-

We need an insolvency framework for states

-

U.S. Government also thinks there should be some easing of the burden for smaller banks

-

Nowhere in the world do we see a lack of debt, neither in private nor public sector

-

We support efforts to get a quick agreement on Basel iii banking regulation

-

We need to make sure that there are no undesirable side effects from banking regulation

-

-

09:23

ECB is likely to note that risks to its outlook are more balanced but also remain committed to significant monetary easing - Barclays

"The ECB is likely to note that risks to its outlook are more balanced but also remain committed to significant monetary easing, which should keep the EUR under pressure, in our view.

The January meeting minutes noted that despite the ongoing pickup in headline inflation, members of the governing council acknowledged it was still premature to consider that a very substantial degree of monetary accommodation was no longer warranted. Much of this relates to the striking amount of excess capacity still present in the euro area economy and weighing on inflation, with most output gap estimates suggesting current output is about 2% below potential. While updated staff macroeconomic projections will likely incorporate an upside revision to 2017 inflation by at least 0.5pp (from 1.3% to 1.8%), projections for 2018 and 2019, which were 1.5% and 1.7% in the December scenario, should be unchanged. 2017

European political risk is another factor that should contribute to ECB caution and a weaker EUR. The 15 March Dutch election represents the first major European political event in 2017 and could contribute to rising fragmentation of European governments that impairs the ability of the European Council to respond decisively to EU political crises, as it did in 2011-12. This implies a weaker EUR over the coming year as the political risk premium grows and a strengthening in the historically low 12-month implied correlation between EURGBP and EURJPY".

Copyright © 2017 Barclays Capital

-

08:41

Major European stock exchanges started trading in the red zone: FTSE 100 7,295.32 -39.29 -0.54%, CAC 40 4.947.52 -12.96 -0.26%, Xetra DAX 11.937.56 -29.75 -0.25%

-

08:38

Merkel says growth prospects are better than many thought

-

Need to quickly pursue trade deals with other countries after EU-Canada agreement

-

Europe must never seal itself off

-

Should look where EU can cut bureaucracy

-

Europe has made progress on migrant crisis but still need to reform EU asylum system

-

Turkey is an important partner but it is sad to hear Turkey talking about nazi times

-

Calls for release of German-Turkish journalist held in Turkey

-

We have to base talks with Turkey and others on our values of democracy

-

Transatlantic relationship, on basis of our values, is good for everyone

-

-

08:33

German Ifo institute head Fuest says ECB should start exit from its expansive monetary policy, should reduce its monthly bond purchases of 60 bln euros by 10 bln euros per month from April

-

08:00

UK Chancellor Hammond: Cannot Rule Out Further Tax Hikes @LiveSquawk

-

07:40

Nordea Bank says markets are more vulnerable to a slightly hawkish ECB

"We do not expect any changes to the ECB monetary policy when the Governing Council meets on 9 March. Although the headline inflation was already at the target in February at 2.0%, the continuously slow core inflation (0.9% in February) and moderate inflation projections for the coming years support the ECB's current loose monetary policy stance.

We assume any discussion on exiting from the current asset purchase programme to be postponed and Draghi to repeat that tapering was not discussed at the meeting. We continue to expect the next reduction of asset purchase programme to be announced in the autumn of this year and to come into effect in January 2018. However, the recently seen favourable economic development probably starts shifting the discussion towards slightly more hawkish comments in the coming meetings.

...In an environment where longer bond yields are trading towards the lower end of their recent trading range, headline inflation has reached the ECB's target and the first ECB tapering step is around the corner, we find markets remain more vulnerable to a slightly hawkish than a dovish message. Hawkish words thus have potential to lift long yields and boost the EUR compared to the size of the opposite moves in case the ECB retained a dovish tone".

Copyright © 2017 Nordea Markets

-

07:31

Options levels on thursday, March 9, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0762 (1046)

$1.0729 (117)

$1.0679 (34)

Price at time of writing this review: $1.0531

Support levels (open interest**, contracts):

$1.0492 (514)

$1.0449 (609)

$1.0397 (1520)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 34887 contracts, with the maximum number of contracts with strike price $1,1450 (3876);

- Overall open interest on the PUT options with the expiration date June, 9 is 37578 contracts, with the maximum number of contracts with strike price $1,0350 (3876);

- The ratio of PUT/CALL was 1.08 versus 1.08 from the previous trading day according to data from March, 8

GBP/USD

Resistance levels (open interest**, contracts)

$1.2415 (196)

$1.2319 (254)

$1.2224 (77)

Price at time of writing this review: $1.2156

Support levels (open interest**, contracts):

$1.2081 (576)

$1.1985 (778)

$1.1888 (417)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 12039 contracts, with the maximum number of contracts with strike price $1,3000 (1195);

- Overall open interest on the PUT options with the expiration date June, 9 is 14571 contracts, with the maximum number of contracts with strike price $1,1500 (3120);

- The ratio of PUT/CALL was 1.21 versus 1.23 from the previous trading day according to data from March, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:08

Harris poll sees Emmanuel Macron winning 26 pct (+6) in first round of French presidential vote, Le Pen 25 pct (unchanged)

-

Macron winning in French presidential runoff with 65 pct (+5) to 35 pct (-5) for Le Pen

-

-

07:06

Chinese CPI down 0.2% in February

China's inflation eased more than expected on falling food prices in February, while producer price inflation accelerated at the fastest pace since 2008.

Inflation eased to 0.8 percent in February from a 32-month high of 2.5 percent in January, said the National Bureau of Statistics, cited by rttnews. Economists had forecast the rate to fall to 1.7 percent.

The government targets around 3 percent inflation for the whole year of 2017.

-

07:03

Swiss unemployment stable at 3.3% in Feb

Registered unemployment in February 2017 - According to the State Secretariat of Economic Affairs (SECO) surveys, 159'809 unemployed persons were registered at the Regional Employment Centers (RAV) at the end of February 2017, 4'657 less than in the previous month.

The unemployment rate thus fell from 3.7% in January 2017 to 3.6% in the reporting month. Compared to the previous month, unemployment fell by 1'608 persons (-1.0%). Youth unemployment in February 2017 Youth unemployment (15 to 24 year olds) decreased by 674 persons (-3.4%) to 19'108.

-

07:01

In Q4 2016 French payroll employment continued to increase

In Q4 2016, payroll employment in the non-farm market sectors continued to increase (+64,400 jobs, that is 0.4%, after +50,500 jobs in the previous quarter). This is the seventh consecutive quarter of rise. The slight speeding up in Q4 2016 is primarily due to temporary employment (+37,600 jobs, i.e. +6.1%, after +28,600 jobs). Year-on-year, the principally market sectors created 187,200 net jobs (+1.2%).

In Q4 2016, employment continued to decrease in industry and construction, at a similar pace to that in the previous quarter: 5,500 jobs were destroyed in industry (that is −0.2%) and 2,200 jobs were destroyed in construction (that is −0.2%). Year on year, industry lost 24,900 jobs (−0.8%) whereas construction shed 10,800 jobs (−0.8%).

-

06:45

Switzerland: Unemployment Rate (non s.a.), February 3.6%

-

06:30

France: Non-Farm Payrolls, Quarter IV 0.4% (forecast 0.4%)

-

06:29

Global Stocks

U.K. stocks ended a highly volatile session slightly lower on Wednesday after the British government laid out plans for spending and taxes as it works to exit from the European Union. U.K. Treasury chief Philip Hammond outlined the last budget before the U.K. begins its flight out of the European Union. He said the 2017 forecast for British economic growth was upgraded, to 2% from a previous estimate of 1.4%. But growth is expected to slow in 2018.

The Dow industrials and S&P 500 closed lower for a third consecutive session Wednesday as oil prices dropped and a stronger-than-expected report on private-sector employment helped to bolster expectations for an interest-rate hike next week.

Prices in China rose less than expected in February as demand for food eased after the Lunar New Year holiday, the third piece of Chinese data that raised eyebrows this week. China's consumer-price index inched up 0.8% in February from a year earlier, compared with a 2.5% gain in January, the National Bureau of Statistics said Thursday.

-

06:16

Japan: Prelim Machine Tool Orders, y/y , February 9.1%

-

01:31

China: CPI y/y, February 0.8% (forecast 1.7%)

-

01:30

China: PPI y/y, February 7.8% (forecast 7.7%)

-

00:00

Japan: Labor Cash Earnings, YoY, January 0.5% (forecast 0.3%)

-