Market news

-

21:08

Major US stock indexes finished today's trading above zero

The major US stock indexes finished trading with an increase on the background of positive labor market data, which are preparing the ground for the first rate hikes this year. As the report of the Ministry of Labor showed, in February, job growth in the US increased more than expected, and wages steadily increased. According to the report, the number of jobs in the non-agricultural sector grew by 235,000 in February. Over the past three months, employment growth averaged 209,000 people. The sharp rise in hiring was accompanied by a steady increase in wages, while the average hourly wage rose by 6 cents, or by 0.2%. The salary growth in January was revised to 0.2% from 0.1%. The unemployment rate fell by 0.1%, to 4.7%. Economists predicted an increase in employment by 190,000.

Components of the DOW index closed mostly in positive territory (23 out of 30). More shares fell The Boeing Company (BA, -1.04%). The leader of growth is shares of General Electric Company (GE, + 2.17%).

Almost all sectors of the S & P index recorded an increase. The leader of growth was the utilities sector (+ 0.9%). Only the sector of conglomerates dropped (-0.1%).

At the close of trading:

Dow +0.22% 20,904.56 +46.37

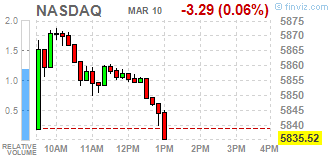

Nasdaq +0.39% 5,861.73 +22.92

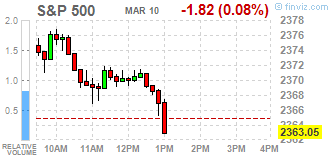

S&P +0.33% 2,372.79 +7.92

-

20:00

DJIA +0.15% 20,889.47 +31.28 Nasdaq +0.23% 5,852.10 +13.29 S&P +0.19% 2,369.32 +4.45

-

19:00

U.S.: Federal budget , February -192 (forecast -150)

-

18:10

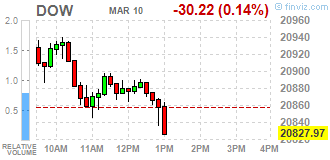

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Friday despite a solid jobs report which virtually sealed the deal for the Federal Reserve to raise interest rates next week, and potentially set the course for an aggressive tightening path this year. Data showed 235,000 jobs were added in the public and private sectors in February, far exceeding economists' average estimate of 190,000.

Most of Dow stocks in positive area (19 of 30). Top loser - The Boeing Company (BA, -1.16%). Top gainer - General Electric Company (GE, +1.92%).

Almost all of S&P sectors also in positive area. Top loser - Financials (-0.1%). Top gainer - Utilities (+0.4%).

At the moment:

Dow 20805.00 -23.00 -0.11%

S&P 500 2362.50 -0.75 -0.03%

Nasdaq 100 5374.00 +3.25 +0.06%

Oil 48.39 -0.89 -1.81%

Gold 1201.00 -2.20 -0.18%

U.S. 10yr 2.58 -0.02

-

17:00

European stocks closed: FTSE 100 +28.12 7343.08 +0.38% DAX -15.21 11963.18 -0.13% CAC 40 +11.81 4993.32 +0.24%

-

15:23

UK GDP estimate unchanged at 0.6% - NIESR

"Our monthly estimates of GDP suggest that output grew by 0.6 per cent in the three months ending in February 2017 after growth of 0.8 per cent in the three months ending in January 2017".

Rebecca Piggott, Research Fellow at NIESR, said "Our estimates suggest the economy expanded by 0.6 per cent in the three months ending in February 2017. Robust consumer spending growth has supported the economic expansion throughout 2016, but there are now signs that this support is beginning to soften. Consumer price inflation is expected to continue to increase throughout the rest of 2017, further reducing the contribution from consumer spending to economic growth. A key question is by how much and over what period of time this domestic economic weakness can be offset via contributions of net trade."

-

15:00

United Kingdom: NIESR GDP Estimate, February 0.6% (forecast 0.6%)

-

14:42

Greek Prime minister says we don't expect talks on Cyprus to resume before Turkey referendum

-

14:32

U.S. Stocks open: Dow +0.36%, Nasdaq +0.47%, S&P +0.44%

-

14:23

Before the bell: S&P futures +0.43%, NASDAQ futures +0.38%

U.S. stock-index futures extended gains after a better-than-expected February U.S. nonfarm payrolls report emphasized the strength of the labor market and bolstered the odds of the first interest rate rise this year.

Global Stocks:

Nikkei 19,604.61 +286.03 +1.48%

Hang Seng 23,568.67 +67.11 +0.29%

Shanghai 3,212.43 -4.32 -0.13%

FTSE 7,359.12 +44.16 +0.60%

CAC 5,016.11 +34.60 +0.69%

DAX 12,047.21 +68.82 +0.57%

Crude $49.64 (+0.73%)

Gold $1,198.20 (-0.42%)

-

13:51

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

35.65

0.29(0.82%)

470

ALTRIA GROUP INC.

MO

76.51

0.32(0.42%)

1739

Amazon.com Inc., NASDAQ

AMZN

856.65

3.65(0.43%)

14123

AMERICAN INTERNATIONAL GROUP

AIG

64.08

0.87(1.38%)

2595

Apple Inc.

AAPL

139.26

0.58(0.42%)

70439

AT&T Inc

T

42

0.06(0.14%)

2329

Barrick Gold Corporation, NYSE

ABX

17.79

0.07(0.40%)

79786

Boeing Co

BA

181.9

1.33(0.74%)

1408

Caterpillar Inc

CAT

92.05

0.66(0.72%)

9126

Chevron Corp

CVX

110.5

0.46(0.42%)

440

Cisco Systems Inc

CSCO

34.19

0.12(0.35%)

1659

Citigroup Inc., NYSE

C

62.2

0.65(1.06%)

57607

Exxon Mobil Corp

XOM

81.8

0.13(0.16%)

7769

Facebook, Inc.

FB

138.98

0.74(0.54%)

85536

Ford Motor Co.

F

12.55

0.05(0.40%)

44588

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.7

0.30(2.42%)

113633

General Electric Co

GE

29.83

0.17(0.57%)

55152

Goldman Sachs

GS

252.06

1.88(0.75%)

14293

Google Inc.

GOOG

843.92

5.24(0.62%)

1624

Home Depot Inc

HD

147.49

0.87(0.59%)

1290

Intel Corp

INTC

35.99

0.17(0.47%)

19426

International Business Machines Co...

IBM

178

0.82(0.46%)

470

Johnson & Johnson

JNJ

126.36

0.41(0.33%)

2453

JPMorgan Chase and Co

JPM

92.3

0.73(0.80%)

30452

Merck & Co Inc

MRK

66.14

0.25(0.38%)

1000

Microsoft Corp

MSFT

65.03

0.30(0.46%)

5809

Nike

NKE

56.54

0.18(0.32%)

510

Pfizer Inc

PFE

34.35

0.30(0.88%)

1336

Starbucks Corporation, NASDAQ

SBUX

55.21

0.02(0.04%)

8087

Tesla Motors, Inc., NASDAQ

TSLA

246.75

1.85(0.76%)

14287

The Coca-Cola Co

KO

42.16

0.13(0.31%)

1088

Twitter, Inc., NYSE

TWTR

15.27

0.05(0.33%)

5342

Visa

V

89.66

0.55(0.62%)

678

Walt Disney Co

DIS

111.44

0.41(0.37%)

913

Yandex N.V., NASDAQ

YNDX

22.88

0.03(0.13%)

800

-

13:51

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.0450 (EUR 751m) 1.0470 (252m) 1.0500 (2.3bln) 1.0520 (307m) 1.0550 (815m) 1.0570 (380m) 1.0600 (1.8bln) 1.0620 (435m) 1.0650 (497m) (1.0675 (546m) 1.0700 (665m)

USDJPY: 114.00 (USD 3.1bln) 114.50 (660m) 114.80 (410m) 115.00 (1.6bln) 115.20 (575m) 115.45-50 (1.4bln) 115.75 (300m) 116.00 (1.48bln)

AUDUSD: 0.7400 (AUD 200m) 0.7500 (1.29bln) 0.7525 (419m) 0.7550 (219m) 0.7600 (343m) 0.7635 (330m)

USDCAD: 1.3380 (USD 560m) 1.3410 (831m) 1.3475 (268m) 1.3500 (1.01bln) 1.3600 (240m)

NZDUSD: 0.7100 (NZD 337m)

EURGBP: 0.8700 (EUR 290m)

EURJPY: 121.50 (EUR 230m) 121.75-80 (378m)

-

13:39

US average hourly earnings rose less than expected in Feb. USD lower initially

In February, average hourly earnings for all employees on private nonfarm payrolls increased by 6 cents to $26.09, following a 5-cent increase in January. Over the year, average hourly earnings have risen by 71 cents, or 2.8 percent. In February, average hourly earnings of private-sector production and nonsupervisory employees increased by 4 cents to $21.86 in February.

-

13:36

US nonfarm payrolls increased by 235,000 in February, more than expected. Unemployment rate stable

Total nonfarm payroll employment increased by 235,000 in February, and the unemployment rate was little changed at 4.7 percent, the U.S. Bureau of Labor Statistics reported today. Employment gains occurred in construction,private educational services, manufacturing, health care, and mining.

The number of unemployed persons, at 7.5 million, changed little in February. The unemployment rate, at 4.7 percent, was little changed over the month but was down from 4.9 percent a year earlier.

-

13:32

Upgrades and downgrades before the market open

Upgrades:

FedEx (FDX) upgraded to Buy from Hold at Edward Jones

Downgrades:

Other:

-

13:30

U.S.: Unemployment Rate, February 4.7% (forecast 4.7%)

-

13:30

U.S.: Nonfarm Payrolls, February 235 (forecast 190)

-

13:30

U.S.: Average workweek, February 34.4 (forecast 34.4)

-

13:30

Canada: Employment , February 15.3 (forecast 2.5)

-

13:30

Canada: Unemployment rate, February 6.6% (forecast 6.8%)

-

13:30

U.S.: Average hourly earnings , February 0.2% (forecast 0.3%)

-

11:44

Norwegian Crown hits four-month low of 9.1385 Crowns per Euro , down 0.7 percent on day, on weaker-than-expected inflation data

-

10:57

Greek February EU-harmonised inflation at +1.4 pct y/y vs +1.5 pct in January

-

10:24

UK manufacturing production down 0.9% in January

In the 3 months to January 2017, total production was estimated to have increased by 1.9%, with manufacturing providing the largest contribution increasing by 2.1%, its strongest growth since May 2010.

The highly volatile pharmaceuticals sector provided the largest contribution to the manufacturing increase, along with smaller upwards contributions from a range of other manufacturing industries. In January 2017, total production decreased by 0.4% compared with December 2016 with manufacturing providing the largest downward contribution, decreasing by 0.9%.

-

10:06

Money markets show investors fully pricing European Central Bank rate hike in March 2018 - Ecbwatch

-

09:39

UK construction output fell by 0.4% in Jan

In January 2017, construction output fell by 0.4% compared with December 2016. However, output grew on a 3 month on 3 month basis by 1.8%.

Repair and maintenance fell 1.3% month-on-month in January, with decreases in public housing and non-housing repair and maintenance.

All new work showed signs of flattening out with growth of 0.1% in January 2017, but continued to grow in the latest 3 months compared with the previous 3 months at a rate of 2.1%.

Despite falling month-on-year for the 13th consecutive month, infrastructure grew month-on-month for the third time in a row, increasing 3.5% in January 2017.

-

09:38

UK trade balance deficit little changed in January

The trade deficit in goods and services in January 2017 was £2.0 billion, unchanged from December 2016.

Between the 3 months to October 2016 and the 3 months to January 2017, the total trade deficit (goods and services) narrowed by £4.7 billion to £6.4 billion.

At the commodity level, the main contributors to the narrowing of the total trade deficit in the 3 months to January 2017, were increased exports of non-monetary gold, oil, machinery and transport equipment (mainly electrical machinery, aircraft and cars) and chemicals.

-

09:31

United Kingdom: Consumer Inflation Expectations, 2.9%

-

09:30

United Kingdom: Industrial Production (YoY), January 3.2% (forecast 3.3%)

-

09:30

United Kingdom: Industrial Production (MoM), January -0.4% (forecast -0.4%)

-

09:30

United Kingdom: Manufacturing Production (MoM) , January -0.9% (forecast -0.6%)

-

09:30

United Kingdom: Total Trade Balance, January -1.97

-

09:30

United Kingdom: Manufacturing Production (YoY), January 2.7% (forecast 3%)

-

09:24

The main European stock exchanges trading in the green zone: FTSE 7344.83 +29.87 + 0.41%, DAX 12017.68 +39.29 + 0.33%, CAC 4994.51 +13.00 + 0.26%

-

09:23

French output decreased sharply again in the manufacturing industry

In January 2017, output decreased sharply again in the manufacturing industry (−1.0% as in the previous month). It diminished more moderately in the whole industry (−0.3% after −1.1%).

Over the past three months, output grew in the manufacturing industry (+0.6% q-o-q), as well as in the overall industry (+0.9% q-o-q).

Output went up in "other manufacturing" (+0.9%). It increased sharply in mining and quarrying, energy, water supply (+3.1%), in the manufacture of transport equipment (+2.3%) and in the manufacture of coke and refined petroleum products (+3.0%). Conversely, it went down in the manufacture of food products and beverages (−1.1%) and in the manufacture of machinery and equipment goods (−0.4%).

-

08:01

France: Industrial Production, m/m, January -0.3% (forecast 0.5%)

-

07:33

Here is the next step from the ECB - Danske

"The ECB kept all policy measures unchanged at today's meeting, and President Draghi had a hawkish tone during the Q&A session as he said the Governing Council discussed whether to remove the 'lower levels' from the forward guidance on policy rates, notes Danske Bank Markets.

"In our view, a next step from the ECB when moving in a less dovish monetary policy direction is to remove the 'lower levels' from the forward guidance. However, according to Draghi this is a very small step and in our view it also does not mean the ECB will hike policy rates in the near future," Danske argues.

"We expect the ECB to continue to communicate that policy rates will remain at present levels for an extended period of time, and well past the horizon of the QE purchases. Hence, it should not start to communicate that policy rates could be hiked before the QE purchases have stopped running," Danske projects".

Source: Danske Bank Research, efxnews.

-

07:30

Turkish Deputy PM says inflation will fall to single digits in july, year-end will probably be 7.5 pct

-

07:30

Options levels on friday, March 10, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0788 (1043)

$1.0757 (117)

$1.0712 (36)

Price at time of writing this review: $1.0593

Support levels (open interest**, contracts):

$1.0518 (514)

$1.0471 (615)

$1.0416 (1521)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 37441 contracts, with the maximum number of contracts with strike price $1,1450 (3884);

- Overall open interest on the PUT options with the expiration date June, 9 is 38006 contracts, with the maximum number of contracts with strike price $1,0350 (3877);

- The ratio of PUT/CALL was 1.02 versus 1.08 from the previous trading day according to data from March, 9

GBP/USD

Resistance levels (open interest**, contracts)

$1.2415 (198)

$1.2319 (321)

$1.2224 (81)

Price at time of writing this review: $1.2165

Support levels (open interest**, contracts):

$1.2081 (576)

$1.1985 (778)

$1.1888 (785)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 12323 contracts, with the maximum number of contracts with strike price $1,3000 (1218);

- Overall open interest on the PUT options with the expiration date June, 9 is 15256 contracts, with the maximum number of contracts with strike price $1,1500 (3120);

- The ratio of PUT/CALL was 1.24 versus 1.21 from the previous trading day according to data from March, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:29

Romanian February inflation 0.2 pct y/y vs 0.1 pct y/y in January; 0.3 pct forecast; -0.1 pct m/m

-

07:17

German wholesale trade increased by 5.0% in February

As reported by the Federal Statistical Office (Destatis), the selling prices in wholesale trade increased by 5.0% in February 2017 from the corresponding month of the preceding year. This was the highest increase of a yearly rate of change since August 2011 (+5.0%). In January 2017 and in December 2016 the annual rates of change were +4.0% and +2.8%, respectively.

From January 2017 to February 2017 the index rose by 0.5%.

-

07:16

German trade balance surplus rose due to higher exports in January

Germany exported goods to the value of 98.9 billion euros and imported goods to the value of 84.0 billion euros in January 2017. Based on provisional data, the Federal Statistical Office (Destatis) also reports that German exports rose by 11.8% and imports by 11.7% in January 2017 year on year. After calendar and seasonal adjustment, exports were up by 2.7% and imports by 0.3% compared with December 2016.

The foreign trade balance showed a surplus of 14.8 billion euros in January 2017. In January 2016, the surplus amounted to +13.2 billion euros. In calendar and seasonally adjusted terms, the foreign trade balance recorded a surplus of 18.5 billion euros in January 2017.

According to provisional results of the Deutsche Bundesbank, the current account of the balance of payments showed a surplus of 12.8 billion euros in January 2017, which takes into account the balances of trade in goods including supplementary trade items (+15.2 billion euros), services (-1.3 billion euros), primary income (+5.8 billion euros) and secondary income (-6.8 billion euros). In January 2016, the German current account showed a surplus of 14.6 billion euros.

-

07:02

Germany: Current Account , January 12.8

-

07:02

Germany: Trade Balance (non s.a.), bln, January 14.8

-

06:29

Global Stocks

European stocks finished modestly higher Thursday, with bank shares charging up as European Central Bank Mario Draghi suggested deflationary pressures have lessened, though energy shares lost ground as oil prices slid. Draghi said the ECB removed language from his previous statements that had said the bank would act, if warranted, to achieve its inflation objectives by using all the instruments available within its mandate.

U.S. stocks eked out gains Thursday on the back of a rebound in energy shares as the bull market quietly marked its unofficial eighth birthday. Thursday marks the eighth anniversary of the bull market, based on the fact that the S&P 500 notched its bear-market closing low on March 9, 2009. The benchmark index has gone on to gain 249% since that point.

Asian stocks edged up and the dollar rose to 1-1/2-month highs versus the yen on Friday, ahead of the closely-watched U.S. non-farm payrolls report due later in the day. Shares in South Korea rose 0.3 percent and the won firmed slightly after the country's Constitutional Court upheld parliament's impeachment of President Park Geun-hye over a graft scandal involving big business.

-

00:30

Australia: Home Loans , January 0.5% (forecast -1%)

-