Market news

-

21:08

Major US stock indexes finished today's trading above zero

The major US stock indexes finished trading with an increase on the background of positive labor market data, which are preparing the ground for the first rate hikes this year. As the report of the Ministry of Labor showed, in February, job growth in the US increased more than expected, and wages steadily increased. According to the report, the number of jobs in the non-agricultural sector grew by 235,000 in February. Over the past three months, employment growth averaged 209,000 people. The sharp rise in hiring was accompanied by a steady increase in wages, while the average hourly wage rose by 6 cents, or by 0.2%. The salary growth in January was revised to 0.2% from 0.1%. The unemployment rate fell by 0.1%, to 4.7%. Economists predicted an increase in employment by 190,000.

Components of the DOW index closed mostly in positive territory (23 out of 30). More shares fell The Boeing Company (BA, -1.04%). The leader of growth is shares of General Electric Company (GE, + 2.17%).

Almost all sectors of the S & P index recorded an increase. The leader of growth was the utilities sector (+ 0.9%). Only the sector of conglomerates dropped (-0.1%).

At the close of trading:

Dow +0.22% 20,904.56 +46.37

Nasdaq +0.39% 5,861.73 +22.92

S&P +0.33% 2,372.79 +7.92

-

20:00

DJIA +0.15% 20,889.47 +31.28 Nasdaq +0.23% 5,852.10 +13.29 S&P +0.19% 2,369.32 +4.45

-

18:10

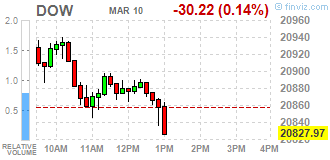

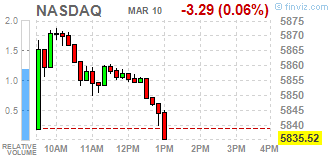

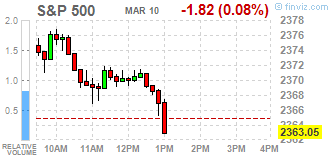

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Friday despite a solid jobs report which virtually sealed the deal for the Federal Reserve to raise interest rates next week, and potentially set the course for an aggressive tightening path this year. Data showed 235,000 jobs were added in the public and private sectors in February, far exceeding economists' average estimate of 190,000.

Most of Dow stocks in positive area (19 of 30). Top loser - The Boeing Company (BA, -1.16%). Top gainer - General Electric Company (GE, +1.92%).

Almost all of S&P sectors also in positive area. Top loser - Financials (-0.1%). Top gainer - Utilities (+0.4%).

At the moment:

Dow 20805.00 -23.00 -0.11%

S&P 500 2362.50 -0.75 -0.03%

Nasdaq 100 5374.00 +3.25 +0.06%

Oil 48.39 -0.89 -1.81%

Gold 1201.00 -2.20 -0.18%

U.S. 10yr 2.58 -0.02

-

17:00

European stocks closed: FTSE 100 +28.12 7343.08 +0.38% DAX -15.21 11963.18 -0.13% CAC 40 +11.81 4993.32 +0.24%

-

14:32

U.S. Stocks open: Dow +0.36%, Nasdaq +0.47%, S&P +0.44%

-

14:23

Before the bell: S&P futures +0.43%, NASDAQ futures +0.38%

U.S. stock-index futures extended gains after a better-than-expected February U.S. nonfarm payrolls report emphasized the strength of the labor market and bolstered the odds of the first interest rate rise this year.

Global Stocks:

Nikkei 19,604.61 +286.03 +1.48%

Hang Seng 23,568.67 +67.11 +0.29%

Shanghai 3,212.43 -4.32 -0.13%

FTSE 7,359.12 +44.16 +0.60%

CAC 5,016.11 +34.60 +0.69%

DAX 12,047.21 +68.82 +0.57%

Crude $49.64 (+0.73%)

Gold $1,198.20 (-0.42%)

-

13:51

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

35.65

0.29(0.82%)

470

ALTRIA GROUP INC.

MO

76.51

0.32(0.42%)

1739

Amazon.com Inc., NASDAQ

AMZN

856.65

3.65(0.43%)

14123

AMERICAN INTERNATIONAL GROUP

AIG

64.08

0.87(1.38%)

2595

Apple Inc.

AAPL

139.26

0.58(0.42%)

70439

AT&T Inc

T

42

0.06(0.14%)

2329

Barrick Gold Corporation, NYSE

ABX

17.79

0.07(0.40%)

79786

Boeing Co

BA

181.9

1.33(0.74%)

1408

Caterpillar Inc

CAT

92.05

0.66(0.72%)

9126

Chevron Corp

CVX

110.5

0.46(0.42%)

440

Cisco Systems Inc

CSCO

34.19

0.12(0.35%)

1659

Citigroup Inc., NYSE

C

62.2

0.65(1.06%)

57607

Exxon Mobil Corp

XOM

81.8

0.13(0.16%)

7769

Facebook, Inc.

FB

138.98

0.74(0.54%)

85536

Ford Motor Co.

F

12.55

0.05(0.40%)

44588

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.7

0.30(2.42%)

113633

General Electric Co

GE

29.83

0.17(0.57%)

55152

Goldman Sachs

GS

252.06

1.88(0.75%)

14293

Google Inc.

GOOG

843.92

5.24(0.62%)

1624

Home Depot Inc

HD

147.49

0.87(0.59%)

1290

Intel Corp

INTC

35.99

0.17(0.47%)

19426

International Business Machines Co...

IBM

178

0.82(0.46%)

470

Johnson & Johnson

JNJ

126.36

0.41(0.33%)

2453

JPMorgan Chase and Co

JPM

92.3

0.73(0.80%)

30452

Merck & Co Inc

MRK

66.14

0.25(0.38%)

1000

Microsoft Corp

MSFT

65.03

0.30(0.46%)

5809

Nike

NKE

56.54

0.18(0.32%)

510

Pfizer Inc

PFE

34.35

0.30(0.88%)

1336

Starbucks Corporation, NASDAQ

SBUX

55.21

0.02(0.04%)

8087

Tesla Motors, Inc., NASDAQ

TSLA

246.75

1.85(0.76%)

14287

The Coca-Cola Co

KO

42.16

0.13(0.31%)

1088

Twitter, Inc., NYSE

TWTR

15.27

0.05(0.33%)

5342

Visa

V

89.66

0.55(0.62%)

678

Walt Disney Co

DIS

111.44

0.41(0.37%)

913

Yandex N.V., NASDAQ

YNDX

22.88

0.03(0.13%)

800

-

13:32

Upgrades and downgrades before the market open

Upgrades:

FedEx (FDX) upgraded to Buy from Hold at Edward Jones

Downgrades:

Other:

-

09:24

The main European stock exchanges trading in the green zone: FTSE 7344.83 +29.87 + 0.41%, DAX 12017.68 +39.29 + 0.33%, CAC 4994.51 +13.00 + 0.26%

-

06:29

Global Stocks

European stocks finished modestly higher Thursday, with bank shares charging up as European Central Bank Mario Draghi suggested deflationary pressures have lessened, though energy shares lost ground as oil prices slid. Draghi said the ECB removed language from his previous statements that had said the bank would act, if warranted, to achieve its inflation objectives by using all the instruments available within its mandate.

U.S. stocks eked out gains Thursday on the back of a rebound in energy shares as the bull market quietly marked its unofficial eighth birthday. Thursday marks the eighth anniversary of the bull market, based on the fact that the S&P 500 notched its bear-market closing low on March 9, 2009. The benchmark index has gone on to gain 249% since that point.

Asian stocks edged up and the dollar rose to 1-1/2-month highs versus the yen on Friday, ahead of the closely-watched U.S. non-farm payrolls report due later in the day. Shares in South Korea rose 0.3 percent and the won firmed slightly after the country's Constitutional Court upheld parliament's impeachment of President Park Geun-hye over a graft scandal involving big business.

-