Market news

-

23:27

Stocks. Daily history for Mar 09’2017:

(index / closing price / change items /% change)

Nikkei +64.55 19318.58 +0.34%

TOPIX +4.43 1554.68 +0.29%

Hang Seng -280.71 23501.56 -1.18%

CSI 300 -21.79 3426.94 -0.63%

Euro Stoxx 50 +20.27 3409.89 +0.60%

FTSE 100 -19.65 7314.96 -0.27%

DAX +11.08 11978.39 +0.09%

CAC 40 +21.03 4981.51 +0.42%

DJIA +2.46 20858.19 +0.01%

S&P 500 +1.89 2364.87 +0.08%

NASDAQ +1.26 5838.81 +0.02%

S&P/TSX -0.14 15496.84 +0.00%

-

21:06

The main US stock indexes rose slightly as a result of today's trading

Major US stock indexes registered a slight increase, as shares of financial sector companies went up against the backdrop of signs of strength in the labor market and an almost certain increase in interest rates.

Investors also awaited an important report on employment in the non-agricultural sector, which could strengthen the chances of raising rates during the meeting of the Federal Reserve System on March 14-15. According to the futures market, now the probability of an increase in the rate of the Fed at the March meeting is 90.8%.

In addition, as it became known, the number of Americans who applied for unemployment benefits last week recovered from the nearly 44-year low, but continued to point to a tightening of the labor market. Initial applications for unemployment benefits increased by 20,000 to 243,000, seasonally adjusted for the week ending March 4, the Ministry of Labor said. Appeals for the previous week were not revised and remained at the level of 223,000, which is the lowest level since March 1973.

A separate report showed that import and export prices in the US rose slightly more than expected in February. The report said that import prices rose 0.2% in February after climbing a revised upward 0.6% in January. Economists had expected that import prices would rise by 0.1% compared to the 0.4% increase originally reported for the previous month.

The components of the DOW index have mostly grown (22 out of 30). The leader of growth was the shares of Johnson & Johnson (JNJ, + 1.47%). Caterpillar Inc. shares fell more than others. (CAT, -1.84%).

The sectors of the S & P index finished the session in different directions. The conglomerate sector fell most of all (-1.4%). The leader of growth was the healthcare sector (+ 0.6%).

At closing:

DJIA +3.63 20859.36 + 0.02%

S & P 500 + 2.77 2365.75 + 0.12%

NASDAQ +1.26 5838.81 + 0.02%

-

20:00

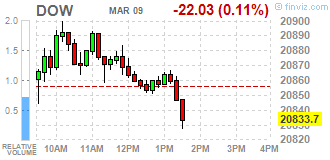

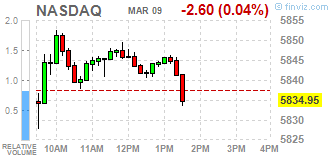

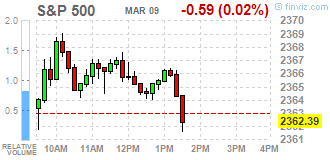

DJIA -0.22% 20,809.26 -46.47 Nasdaq -0.19% 5,826.26 -11.29 S&P -0.13% 2,359.90 -3.08

-

18:39

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Thursday, as bank stocks climbed amid signs of strength in the labor market and a near-certain interest rate hike. The S&P financial index .SPSY rose 0.6 percent as investors turned their attention to a crucial nonfarm payrolls report on Friday that would bolster already sky-high odds of a rate hike during the Federal Reserve's meeting on March 14-15.

Most of Dow stocks in negative area (17 of 30). Top loser - Caterpillar Inc. (CAT, -2.02%). Top gainer - Johnson & Johnson (JNJ, +1.35%).

S&P sectors mixed. Top loser - Conglomerates (-1.3%). Top gainer - Healthcare (+0.6%).

At the moment:

Dow 20815.00 -8.00 -0.04%

S&P 500 2361.75 +0.75 +0.03%

Nasdaq 100 5368.50 +1.50 +0.03%

Oil 48.96 -1.32 -2.63%

Gold 1203.40 -6.00 -0.50%

U.S. 10yr 2.58 +0.03

-

17:00

European stocks closed: FTSE 100 -19.65 7314.96 -0.27% DAX +11.08 11978.39 +0.09% CAC 40 +21.03 4981.51 +0.42%

-

14:32

U.S. Stocks open: Dow -0.03%, Nasdaq -0.07%, S&P -0.03%

-

14:26

Before the bell: S&P futures -0.12%, NASDAQ futures -0.08%

U.S. stock-index futures fell as oil prices dropped below $50 and investors remained cautious ahead of Friday's nonfarm payrolls data that could significantly affect expectations about the further actions of the Fed.

Global Stocks:

Nikkei 19,318.58 +64.55 +0.34%

Hang Seng 23,501.56 -280.71 -1.18%

Shanghai 3,216.58 -24.08 -0.74%

FTSE 7,293.02 -41.59 -0.57%

CAC 4,955.55 -4.93 -0.10%

DAX 11,968.64 +1.33 +0.01%

Crude $49.44 (-1.67%)

Gold $1,207.20 (-0.18%)

-

13:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

35.67

-0.32(-0.89%)

24424

ALTRIA GROUP INC.

MO

75.9

0.06(0.08%)

93804

Amazon.com Inc., NASDAQ

AMZN

850.24

-0.26(-0.03%)

20742

Apple Inc.

AAPL

138.71

-0.29(-0.21%)

378940

AT&T Inc

T

41.69

-0.08(-0.19%)

295008

Barrick Gold Corporation, NYSE

ABX

17.75

-0.07(-0.39%)

92255

Caterpillar Inc

CAT

92.9

-0.33(-0.35%)

36480

Chevron Corp

CVX

109

-0.61(-0.56%)

97141

Citigroup Inc., NYSE

C

61.25

0.14(0.23%)

146322

Exxon Mobil Corp

XOM

80.7

-0.33(-0.41%)

230022

Facebook, Inc.

FB

137.62

-0.10(-0.07%)

144798

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.25

-0.19(-1.53%)

154787

General Electric Co

GE

29.76

-0.04(-0.13%)

435768

General Motors Company, NYSE

GM

37.3

0.03(0.08%)

68276

Goldman Sachs

GS

250.54

0.30(0.12%)

21386

Google Inc.

GOOG

835

-0.37(-0.04%)

15244

Intel Corp

INTC

35.6

-0.02(-0.06%)

269532

JPMorgan Chase and Co

JPM

91.26

0.05(0.05%)

174681

Merck & Co Inc

MRK

65.69

-0.11(-0.17%)

132889

Nike

NKE

56.58

0.07(0.12%)

66508

Pfizer Inc

PFE

33.75

-0.16(-0.47%)

292426

Procter & Gamble Co

PG

90.15

0.01(0.01%)

128285

Tesla Motors, Inc., NASDAQ

TSLA

247.98

1.11(0.45%)

5168

Verizon Communications Inc

VZ

49.2

0.04(0.08%)

196041

Visa

V

89

0.04(0.05%)

675

Walt Disney Co

DIS

110.6

-0.24(-0.22%)

71956

Yandex N.V., NASDAQ

YNDX

23.09

-0.34(-1.45%)

6410

-

13:48

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Tesla (TSLA) initiated with a Mkt Perform at Bernstein; target $250

-

08:41

Major European stock exchanges started trading in the red zone: FTSE 100 7,295.32 -39.29 -0.54%, CAC 40 4.947.52 -12.96 -0.26%, Xetra DAX 11.937.56 -29.75 -0.25%

-

06:29

Global Stocks

U.K. stocks ended a highly volatile session slightly lower on Wednesday after the British government laid out plans for spending and taxes as it works to exit from the European Union. U.K. Treasury chief Philip Hammond outlined the last budget before the U.K. begins its flight out of the European Union. He said the 2017 forecast for British economic growth was upgraded, to 2% from a previous estimate of 1.4%. But growth is expected to slow in 2018.

The Dow industrials and S&P 500 closed lower for a third consecutive session Wednesday as oil prices dropped and a stronger-than-expected report on private-sector employment helped to bolster expectations for an interest-rate hike next week.

Prices in China rose less than expected in February as demand for food eased after the Lunar New Year holiday, the third piece of Chinese data that raised eyebrows this week. China's consumer-price index inched up 0.8% in February from a year earlier, compared with a 2.5% gain in January, the National Bureau of Statistics said Thursday.

-