Market news

-

21:05

Major US stock indexes finished trading above zero

Major stock indexes in Wall Street closed higher for a third day, helped by growth in health care stocks and technology stocks.

As shown by the preliminary results of research presented by Thomson-Reuters and Institute of Michigan in December, US consumers felt more optimistic about the economy than last month. According to the data, in December consumer sentiment index rose to 98 points versus 93.8 points last month. It was predicted that the index was 94.5 points. Recall, the index is a leading indicator of consumer sentiment. The indicator is calculated by adding 100 to the difference between the number of optimists and pessimists, expressed as a percentage.

At the same time, wholesale inventories in the US fell, as previously reported, in October, amid the surge in sales, supporting the view that investment in inventories would provide a modest boost to economic growth in the fourth quarter. The Commerce Department reported Friday that wholesale inventories fell 0.4% after rising 0.1% in September.

Oil prices added about one percent, as investors remain optimistic before the meeting of the major oil-producing countries on the reduction of production, which will be held tomorrow. On Saturday, the ministers of oil from OPEC countries will meet with the producers, not OPEC, to ask for help in the fight against global glut the market. Recall at the meeting of November 30, participants of the cartel agreed to cut production in January by 1.2 million barrels a day to 32.5 million barrels.

DOW index components closed mostly in positive territory (25 of 30). Most remaining shares rose Pfizer Inc. (PFE, + 2.52%). Outsider were shares of Caterpillar Inc. (CAT, -0.66%).

Most of the S & P sectors recorded increase. The leader turned out to be the health sector (+ 1.3%). Most of the basic materials sector fell (-0.3%).

-

20:00

DJIA +0.46% 19,704.20 +89.39 Nasdaq +0.32% 5,434.55 +17.19 S&P +0.39% 2,254.84 +8.65

-

18:15

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes hit a trifecta of records for the third day in a row on Friday as the month-long post-election rally got a boost from healthcare and technology stocks. The three main U.S. stock indexes have hit a series of record highs as investors piled into sectors such as banks and industrials, betting that President-elect Donald Trump would usher in a business-friendly environment.

Most of Dow stocks in positive area (19 of 30). Top gainer - The Coca-Cola Company (KO, +2.87%). Top loser - Caterpillar Inc. (CAT, -0.69%).

Most S&P sectors also in positive area. Top gainer - Healthcare (+1.4%). Top loser - Basic Materials (-0.4%).

At the moment:

Dow 19627.00 +63.00 +0.32%

S&P 500 2247.50 +5.00 +0.22%

Nasdaq 100 4885.25 +23.00 +0.47%

Oil 51.42 +0.58 +1.14%

Gold 1162.90 -9.50 -0.81%

U.S. 10yr 2.46 +0.08

-

17:00

European stocks closed: FTSE 100 +22.66 6954.21 +0.33% DAX +24.21 11203.63 +0.22% CAC 40 +28.59 4764.07 +0.60%

-

16:36

WSE: Session Results

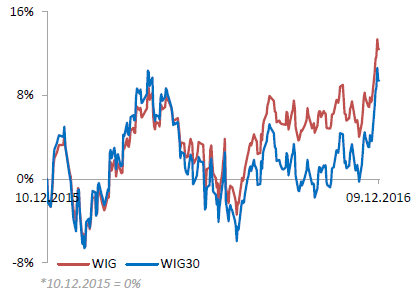

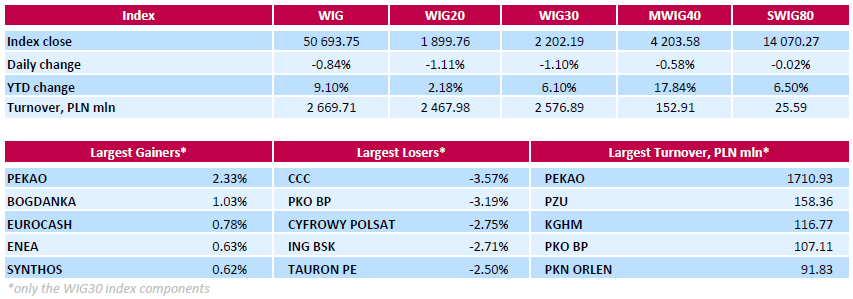

Polish equity market closed lower on Friday. The broad market measure, the WIG index, lost 0.84%. All sectors, but for chemicals (+1.09%), were down, with media (-1.93%) lagging behind.

The large-cap stocks' measure, the WIG30 Index, fell by 1.10%. Within the WIG30 Index components, footwear retailer CCC (WSE: CCC) and bank PKO BP (WSE: PKO) recorded the biggest declines, slumping by 3.57% and 3.19%. They were followed by media group CYFROWY POLSAT (WSE: CPS), bank ING BSK (WSE: ING) and genco TAURON PE (WSE: TPE), dropping by 2.75%, 2.71% and 2.5% respectively. On the other side of the ledger, bank PEKAO (WSE: PEO) and thermal coal miner BOGDANKA (WSE: LWB) led a handful of advancers, gaining a respective 2.33% and 1.03%.

-

15:41

Oil price continue to rise

Crude oil prices rose Friday, extending gains from the previous session on hopes that OPEC's recent deal with Russia will end a global supply glut.

Reports say Saudi Arabia is cutting some oil deliveries to the U.S. and Europe starting next month, as OPEC's planned quotas kick in, says rttnews.

OPEC is trying to bring the oil market into balance as early as possible next year. Petro-states like Saudi Arabia, Russia and Venezuela have been struggling to cope with the impact of low oil prices.

WTI light sweet crude oil for January was up 47 cents at $51.32 an ounce.

A drop in U.S. crude oil inventories last week has contributed to oil's rally.

-

15:07

US wholesale inventories in line with expectations in October

The U.S. Census Bureau announced today that October 2016 sales of merchant wholesalers were $452.2 billion, up 1.4 percent from the revised September level and were up 2.2 percent from the October 2015 level.

The August 2016 to September 2016 percent change was revised from the preliminary estimate of up 0.2 percent to up 0.4 percent. October sales of durable goods were up 1.1 percent from last month and were up 2.5 percent from a year ago.

-

15:03

US consumer confidence surged in early December - UoM survey

Consumer confidence surged in early December to just one-tenth of an Index point below the 2015 peak-which was the highest level since the start of 2004. The surge was largely due to consumers' initial reactions to Trump's surprise victory. When asked what news they had heard of recent economic developments, more consumers spontaneously mentioned the expected positive impact of new economic policies than ever before recorded in the long history of the surveys. To be sure, an equal number volunteered negative judgments about prospective economic policies, but the frequency of those negative references was less than half its prior peak levels whereas positive references were about twice its prior peak says surveys of consumers chief economist, Richard Curtin.

-

15:01

U.S.: Reuters/Michigan Consumer Sentiment Index, December 98 (forecast 94.5)

-

15:00

U.S.: Wholesale Inventories, October -0.4% (forecast -0.4%)

-

14:59

WSE: After start on Wall Street

On the threshold of the final hours of the session, the Warsaw market takes on greater distance to the core markets and the WIG20 index is unresponsive to attempts to increases in the US and Germany. The reason may be the Polish zloty, losing before the weekend both to the dollar and to the euro. As a result, going into the last hour of the week the WIG20 lost 1.4 percent and locate below 1,900 points. In the index on positive territory there are only three companies, including the heavily played today, Bank Pekao.

An hour before the close of trading WIG20 index was at the level of 1,894 points (-1.40%).

-

14:56

ECB contemplated bolder stimulus before compromise - Reuters

-

14:47

Bundesbank raised forecasts for the German economy

The German economy continues its steady rise, supported by a flexible internal demand which reinforce the labor market and incomes of the population, according to the Bundesbank.

Gross domestic product will grow by 1.8 percent this year, which is slightly faster than the expansion of 1.7 percent projected in June, the bank said in its semi-annual economic outlook.

Growth will continue at 1.8 percent next year, which was stronger than +1.4 percent expected in June. The Bank maintained a forecast for 2018 at 1.6 percent and predicted a 1.5 percent expansion in 2019.

The inflation forecast for 2018 was maintained at 1.7 per cent, while a higher figure of 1.9 percent was forecast for 2019. Inflation is expected to accelerate since labor costs are projected to increase strongly, the bank said. The bank added that consumer prices may rise further than expected, in particular in 2017.

-

14:32

U.S. Stocks open: Dow +0.07%, Nasdaq +0.44%, S&P +0.16%

-

14:25

Before the bell: S&P futures +0.08%, NASDAQ futures +0.27%

U.S. stock-index futures advanced as the Trump rally continued and oil prices rebounded.

Global Stocks:

Nikkei 18,996.37 +230.90 +1.23%

Hang Seng 22,760.98 -100.86 -0.44%

Shanghai 3,232.07 +16.70 +0.52%

FTSE 6,944.11 +12.56 +0.18%

CAC 4,758.17 +22.69 +0.48%

DAX 11,186.87 +7.45 +0.07%

Crude $51.39 (+1.08%)

Gold $1,169.60 (-0.24%)

-

14:22

ECB rejected Banca Monte dei Paschi di Siena for more time to raise capital. Shares suspended briefly from trading in Milan for excessive losses

The European Central Bank has rejected a request from Italian lender Banca Monte dei Paschi di Siena SpA for more time to raise capital, a person familiar with the matter said, paving the way for the government to step in and rescue the bank.

-

13:58

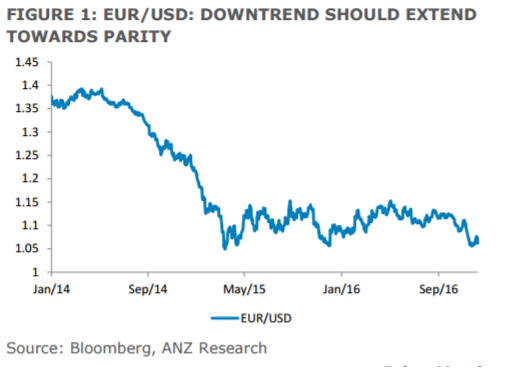

EUR/USD set to close the week in important bid area

-

13:55

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

31.3

-0.01(-0.0319%)

353

Amazon.com Inc., NASDAQ

AMZN

769.27

1.94(0.2528%)

6946

AMERICAN INTERNATIONAL GROUP

AIG

66

0.18(0.2735%)

1399

Apple Inc.

AAPL

112.35

0.23(0.2051%)

43985

AT&T Inc

T

40.2

-0.21(-0.5197%)

3971

Barrick Gold Corporation, NYSE

ABX

15.8

-0.12(-0.7538%)

104984

Cisco Systems Inc

CSCO

30.1

0.15(0.5008%)

2871

Deere & Company, NYSE

DE

103.17

-0.75(-0.7217%)

1042

Exxon Mobil Corp

XOM

88.35

0.03(0.034%)

2561

Facebook, Inc.

FB

119.15

0.24(0.2018%)

50873

Ford Motor Co.

F

13

-0.03(-0.2302%)

16205

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.8

0.20(1.2821%)

202523

Goldman Sachs

GS

241.01

-0.44(-0.1822%)

47559

Google Inc.

GOOG

778.65

2.23(0.2872%)

1716

Hewlett-Packard Co.

HPQ

16.01

-0.15(-0.9282%)

300

Intel Corp

INTC

35.85

0.15(0.4202%)

4087

International Business Machines Co...

IBM

164.95

-0.41(-0.2479%)

793

JPMorgan Chase and Co

JPM

85.1

-0.02(-0.0235%)

16093

Microsoft Corp

MSFT

61.02

0.01(0.0164%)

34888

Pfizer Inc

PFE

31.1

0.16(0.5171%)

3153

Procter & Gamble Co

PG

83.52

0.02(0.0239%)

851

Starbucks Corporation, NASDAQ

SBUX

58.8

0.15(0.2558%)

556

Tesla Motors, Inc., NASDAQ

TSLA

190.5

-1.79(-0.9309%)

8876

The Coca-Cola Co

KO

41.36

0.38(0.9273%)

73475

Twitter, Inc., NYSE

TWTR

19.65

0.01(0.0509%)

68622

Verizon Communications Inc

VZ

51.03

-0.10(-0.1956%)

479

Visa

V

79.31

0.03(0.0378%)

2103

Walt Disney Co

DIS

103.15

-0.23(-0.2225%)

3559

Yahoo! Inc., NASDAQ

YHOO

41.58

0.17(0.4105%)

601

Yandex N.V., NASDAQ

YNDX

20

0.05(0.2506%)

11210

-

13:40

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0500 (EUR 2,03bln) 1.0575 (715m) 1.0600 (3.42bln) 1.0625 (1.36bln) 1.0650 (2.61bln) 1.0700 (1.7bln) 1.0750 (2.46bln) 1.0800 (2.89bln) 1.0850 (1.24bln)

USD/JPY 112.25 (USD 800m) 113,75 (505m) 114,.00 (407m) 114.50 (786m)

GBP/USD 1.2300 (USD 398m) 1.2500 (453m)

AUD/USD 0.7300 (2.02bln) 0.7325 (669m) 0.7400 (419m) 0,7500 (952m)

USD/CAD 1.3200 (USD 1.37bln)

-

13:27

Riksbank will have to stay relatively dovish given the European Central Bank's dovish line - Danske

Danske Bank thinks the Riksbank will have to stay relatively dovish given the European Central Bank's dovish line Thursday. It will definitely have to do more QE and, in Danske's view, also a 10bp repo rate cut, although the latter is a close call, it says. "We see near-term upside risk for the EUR/SEK, as the market is not priced for a rate-cut scenario. However, in 2017, we expect the EUR/SEK to move lower on valuation, global reflation and relatively strong growth in the Swedish economy." EUR/SEK is flat on the day at 9.6906, having dropped sharply on Thursday following the ECB decision - Dow Jones.

-

12:50

USD/JPY rises to 10-month high above 115

-

12:01

WSE: Mid session comment

The morning phase of trading on the Warsaw Stock Exchange did not bring new content. The market is still focused on the shares of Pekao (more than half of the turnover among the WIG20 companies). Support at 1,900 points holds tight and we may talk about trying to stabilize above the psychological barrier of 1,900 points. The German DAX stabilizes after morning hesitance in the area of 11200 pts. and the zloty slightly weakened.

At the halfway point of today's trading WIG20 index was at the level of 1,910 points (-0,53%).

-

11:41

Major European stock indices traded flat

European stocks were little changed after a sharp rise the previous session. The market appreciates the recent decision of the European Central Bank, and investors focus on the meeting of the Federal Reserve next week.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0,1%, to 352.43 points.

The Italian FTSE MIB stock index lost 1.1% during the trading session. Since the beginning of this week the value of the indicator soared by 6.7%, best week in five years.

The stock market virtually ignored the decision of the Italian Prime Minister Matteo Renzi to resign after constitutional reform was rejected in the referendum held on 4 December.

The European Central Bank had decided to extend quantitative easing (QE) to the end of 2017. Monthly volumes of purchase of assets within the framework of QE, however, will be reduced from April to 60 billion euros to 80 billion euros.

In addition, the ECB kept its benchmark interest rate unchanged at a record low, in line with expectations.

Against this backdrop, bank stocks rose sharply, but on Friday are correcting. Barclays shares fell by 2%, Lloyds Banking Group - 1,4%, Royal Bank of Scotland - 0,8%, HSBC - 0.2%.

Oil and mining companies rise slightly in the course of trading. BP shares increased by 0,2%, Total +0,4%, Antofagasta +0,3%, BHP Billiton +1.1%.

Shares of the German insurance company Allianz fell 0.4% after the Financial Services Authority (FCA) published Friday a proposal of rules and guidelines for insurance in case of insolvency.

Vivendi shares rose 2.1% after the French media group increased its stake in Ubisoft Entertainment to 25.15%, approaching the "hostile takeover."

At the moment:

FTSE 6937.97 6.42 0.09%

DAX 11147.95 -31.47 -0.28%

CAC 4740.93 5.45 0.12%

-

11:29

ECB announcements on Thursday support a steeper yield curve - PIMCO

The European Central Bank's announcements on Thursday support a steeper yield curve, says Andrew Bosomworth, Pimco managing director and head of German portfolio management, cited by Dow Jones. He points to the increase in the number of bonds at the front end of the yield curve which are eligible for the asset purchase program, coupled with some national central banks' revealed preference to buy shorter-maturity bonds. The ECB altered its program so that it can buy bonds down to one year of residual maturity, reducing the previous lower bound of two years.

-

11:15

UBS Expects ECB to Start Tapering in Jan 2018

-

11:15

Oil is trading higher

This morning, the New York futures for Brent rose 0.71% to $ 54.27 and WTI rose 1.08% to $ 51.39 per barrel. Thus, the black gold is traded in the green zone on a weakening US dollar. Furthermore, support for prices had a reduction of oil reserves in the United States. According to the US Energy Information Administration (EIA), last week the commercial oil reserves in the country decreased by 2.4 million barrels, exceeding the forecast. At the same time it was recorded a significant increase in strategic stocks in Cushing.

-

10:03

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0500 (EUR 2,03bln) 1.0575 (715m) 1.0600 (3.42bln) 1.0625 (1.36bln) 1.0650 (2.61bln) 1.0700 (1.7bln) 1.0750 (2.46bln) 1.0800 (2.89bln) 1.0850 (1.24bln)

USD/JPY 112.25 (USD 800m) 113,75 (505m) 114,.00 (407m) 114.50 (786m)

GBP/USD 1.2300 (USD 398m) 1.2500 (453m)

AUD/USD 0.7300 (2.02bln) 0.7325 (669m) 0.7400 (419m) 0,7500 (952m)

USD/CAD 1.3200 (USD 1.37bln)

Информационно-аналитический отдел TeleTrade

-

09:41

Bank of England inflation survey: respondents estimate inflation at 2.3%, compared to 1.8% in August

-

Median expectations of the rate of inflation over the coming year were 2.8%, compared with 2.2% in August.

-

Asked about expected inflation in the twelve months after that, respondents gave a median answer of 2.5%, compared with 2.2% in August.

-

Asked about expectations of inflation in the longer term, say in five years' time, respondents gave a median answer of 3.1%, compared to 3.0% in August.

-

By a margin of 50% to 10%, survey respondents believed that the economy would end up weaker rather than stronger if prices started to rise faster, compared with 44% to 10% in August.

-

-

09:39

UK construction output decreased by 0.6%

In October 2016, construction output was estimated to have decreased by 0.6% compared with September 2016. All new work decreased by 0.9%, with the largest downward contribution coming from infrastructure, while all repair and maintenance showed no growth.

Compared with October 2015, construction output increased by 0.7%. All new work increased by 2.9% with repair and maintenance falling by 3.2%. Within all new work total new housing was the biggest upwards contribution with an increase of 12.6%.

New orders for the construction industry in Quarter 3 2016 were estimated to have decreased by 2.4% compared with Quarter 2 (Apr to June) 2016. Public other new work fell by 24.8% while infrastructure increased by 22.4%.

-

09:37

UK trade deficit declined in October

The UK's deficit on trade in goods and services was estimated to have been £2.0 billion in October 2016, a narrowing of £3.8 billion from September 2016. Exports increased by £2.0 billion and imports decreased by £1.8 billion.

The deficit on trade in goods was £9.7 billion in October 2016, narrowing by £4.1 billion from September 2016. This narrowing reflected a £2.1 billion increase in exports to £26.8 billion and a £2.0 billion decrease in imports to £36.5 billion.

Between the 3 months to July 2016 and the 3 months to October 2016, the total trade deficit for goods and services widened by £4.7 billion to £13.2 billion.

Between the 3 months to July 2016 and the 3 months to October 2016, the deficit on trade in goods widened by £6.2 billion to £37.0 billion. Exports increased by £1.6 billion (2.0%) and imports increased by £7.7 billion (7.3%).

-

09:31

United Kingdom: Total Trade Balance, October -1.97

-

09:12

Where to target AUD? - Credit Suisse

"We noted in a previous update that although the post-Trumpian world of a stronger USD, bond yields and inflation expectations were taking AUDUSD to our forecast levels, the local picture looked mixed. In Australia, the balance of domestic risks since then has tilted decidedly to the downside.

Given prospects of further deterioration in the data, relatively sanguine pricing of RBA expectations, and a constrained fiscal policy, we downgrade our AUD forecasts vs. both the USD and NZD accordingly.

We revise our AUDUSD forecast lower to 0.72 in 3m and 0.70 in 12m.

We also revise our AUDNZD forecast lower to 1.011 in both 3m and 12m, keeping our NZDUSD forecasts unchanged".

Copyright © 2016 Credit Suisse, eFXnews™

-

08:49

Today’s events

-

At 15:15 GMT the ECB board member Benoit Coeure will deliver a speech

-

At 18:00 GMT drilling rigs operating at Baker Hughes data

-

-

08:44

Major stock markets trading up: DAX flat, CAC40 + 0.1%, FTSE + 0.1%, FTMIB + 0.2%, IBEX -0.1%

-

08:22

WSE: Before opening

WIG20 index opened at 1916.66 points (-0.23%)*

WIG 51041.72 -0.16%

WIG30 2221.58 -0.23%

mWIG40 4232.75 0.11%

*/ - change to previous close

The last session of the week the Warsaw market begins in slightly weaker mood in relation to those of the previous four days. The WIG20 index on a "good day" gives what further gained yesterday on the final fixing. The correction for the time being mainly concerns Pekao, PGE and Tauron (WSE: TPE) but on the red side is the majority of shares. After all, it is difficult to treat this 0.4 percent revocation of the main index in terms of the decline taking into consideration the distance that the index beat up from last Friday. Again, we have a solid turnover, already PLN 150 million around the WIG20.

After twenty minutes of trading the WIG20 index was at the level of 1,914 points (-0,36%).

-

07:51

French industrial production down 0.2% in October

In October 2016, output diminished again in the manufacturing industry (−0.6% after −1.4%). It decreased slightly in the whole industry (−0.2% after −1.4%).

Manufacturing output increased over the past three months (+0.8%)

Over the past three months, output grew in the manufacturing industry (+0.8% q-o-q), as well as in the overall industry (+0.7% q-o-q).

Output increased in all branches. It rose markedly in the manufacture of machinery and equipment goods (+2.5%) and in the manufacture of food products and beverages (+1.5%), and rebounded in the manufacture of coke and refined petroleum products (+18.5%). It went up slightly in mining and quarrying; energy; water supply (+0.5%). Finally, it was virtually stable in "other manufacturing" (+0.1%) and stable in the manufacture of transport equipment.

Over the year, output decreased sharply in mining and quarrying; energy; water supply (−2.5%), in the manufacture of food products and beverages (−1.7%) and in the manufacture of machinery and equipment goods (−1.5%). It diminished slightly in "other manufacturing" (−0.2%). Conversely, it increased in the manufacture of transport equipment (+0.9%) and, more moderately, in the manufacture of coke and refined petroleum products (+0.3%).

-

07:45

France: Industrial Production, m/m, October -0.2% (forecast 0.6%)

-

07:40

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.6%, CAC40 + 0.5%, FTSE + 0.3%

-

07:33

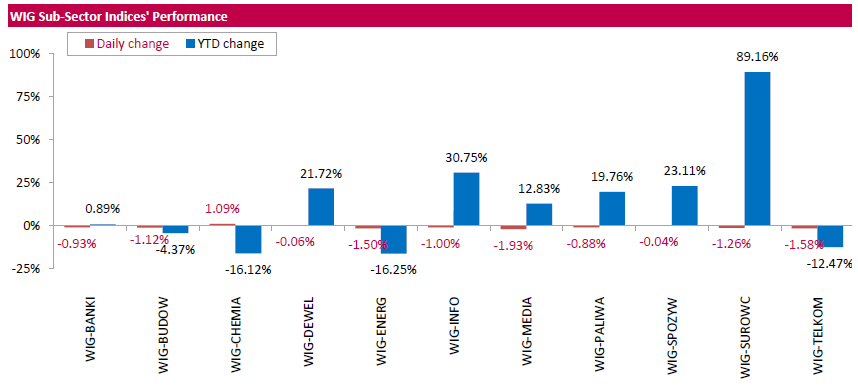

Stay short EUR/USD and sell rallies after ECB says ANZ

"The ECB delivered a bazooka. It extended QE (by €540bn), allowed the purchase of bonds with a minimum one year maturity and the purchase of bonds with yields below the deposit rate (-40bps).

The euro fell and the forthcoming political cycle suggests portfolio outflows from the euro area will continue. Further EUR underperformance vs. USD, AUD, NZD and Asia is expected.

Our forecasts assume that EUR/USD will move towards parity in coming months. If anything, the December ECB policy meeting reinforces that view. And whilst the ECB has mapped out its policy landscape for 2017, there are still material event risks facing the euro area. The elections in the Netherlands in March, elections in France -presidential election in April/May and Assembly election in June - and general election in Germany in September take place against a backdrop of rising support for populist parties. An election in Italy can't be completely discounted either. There is also the issue of bad debts in the banking system, in particular Italy, which needs to be addressed.

Against a backdrop where the FOMC will be raising interest rates we advise staying short EUR/USD and selling rallies".

Copyright © 2016 ANZ, eFXnews™

-

07:25

Options levels on friday, December 9, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0752 (5985)

$1.0704 (4430)

$1.0663 (2346)

Price at time of writing this review: $1.0622

Support levels (open interest**, contracts):

$1.0580 (4500)

$1.0542 (2604)

$1.0500 (5913)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 92464 contracts, with the maximum number of contracts with strike price $1,1400 (6406);

- Overall open interest on the PUT options with the expiration date December, 9 is 74247 contracts, with the maximum number of contracts with strike price $1,0500 (5913);

- The ratio of PUT/CALL was 0.80 versus 0.84 from the previous trading day according to data from December, 8

GBP/USD

Resistance levels (open interest**, contracts)

$1.2900 (697)

$1.2800 (1756)

$1.2700 (1873)

Price at time of writing this review: $1.2583

Support levels (open interest**, contracts):

$1.2500 (2566)

$1.2400 (1550)

$1.2300 (2186)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 35981 contracts, with the maximum number of contracts with strike price $1,3400 (2561);

- Overall open interest on the PUT options with the expiration date December, 9 is 36577 contracts, with the maximum number of contracts with strike price $1,2500 (2566);

- The ratio of PUT/CALL was 1.02 versus 1.00 from the previous trading day according to data from December, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:22

China's inflation rose more than expected. AUD/USD traded higher

China's factory gate inflation increased to a more than five-year high in November on higher commodity prices and consumer price inflation exceeded expectations due to rising food costs.

Producer price inflation accelerated notably to 3.3 percent in November from 1.2 percent in the previous month, the National Bureau of Statistics showed Friday. Inflation was expected to rise to 2.3 percent.

Consumer price inflation rose to 2.3 percent in November from 2.1 percent in October. A similar high rate was last seen in April. The pace also exceeded the expected 2.2 percent.

Nonetheless, the figure continues to remain below the government's full-year target of 3 percent, says rttnews.

-

07:16

Australian housing market improves

The trend estimate for the total value of dwelling finance commitments excluding alterations and additions rose 0.3%. Investment housing commitments rose 1.5%, while owner occupied housing commitments fell 0.5%.

In seasonally adjusted terms, the total value of dwelling finance commitments, excluding alterations and additions fell 0.2%.

In trend terms, the number of commitments for owner occupied housing finance fell 0.9% in October 2016.

In trend terms, the number of commitments for the purchase of established dwellings fell 1.0%, the number of commitments for the construction of dwellings fell 0.7%, and the number of commitments for the purchase of new dwellings fell 0.3%.

In original terms, the number of first home buyer commitments as a percentage of total owner occupied housing finance commitments rose to 13.7% in October 2016, from 13.1% in September 2016. This rise was driven by a fall in the number of non-first home buyer commitments; the number of first home buyer commitments fell slightly.

-

07:10

Swiss unemplyment rate rose in November

According to the State Secretariat of Economic Affairs (SECO) surveys, 149,228 unemployed were registered at the Regional Employment Services Centers (RAV) at the end of November 2016, 4,697 more than in the previous month.

The unemployment rate thus rose from 3.2% in October 2016 to 3.3% in the reporting month. Compared to the previous month, unemployment increased by 1,085 persons (+ 0.7%). Youth unemployment in November 2016 Youth unemployment (15 to 24 year olds) decreased by 174 persons (-0.9%) to 18'921. Compared to the previous year, this corresponds to a decrease of 1,133 persons.

-

07:04

German trade balance surplus declined slightly

Germany exported goods to the value of 101.5 billion euros and imported goods to the value of 82.2 billion euros in October 2016. Based on provisional data, the Federal Statistical Office (Destatis) also reports that German exports decreased by 4.1% in October 2016 year on year while imports were down by 2.2%. After calendar and seasonal adjustment, exports increased by 0.5% and imports by 1.3% compared with September 2016.

The foreign trade balance showed a surplus of 19.3 billion euros in October 2016. In October 2015, the surplus amounted to 21.7 billion euros. In calendar and seasonally adjusted terms, the foreign trade balance recorded a surplus of 20.5 billion euros in October 2016.

According to provisional results of the Deutsche Bundesbank, the current account of the balance of payments showed a surplus of 18.4 billion euros in October 2016, which takes into account the balances of trade in goods including supplementary trade items (+20.2 billion euros), services (-3.5 billion euros), primary income (+5.5 billion euros) and secondary income (-3.8 billion euros). In October 2015, the German current account showed a surplus of 21.7 billion euros.

-

07:01

Germany: Trade Balance (non s.a.), bln, October 19.3

-

07:01

Germany: Current Account , October 18.4

-

06:45

Switzerland: Unemployment Rate (non s.a.), November 3.3%

-

06:17

Global Stocks

European stocks on Thursday closed at an 11-month high, with German stocks hitting a 2016 peak as the euro was yanked down, after the European Central Bank said it would continue buying government bonds through next year, but at a lower amount each month beginning in April.

European stocks on Thursday closed at an 11-month high, with German stocks hitting a 2016 peak as the euro was yanked down, after the European Central Bank said it would continue buying government bonds through next year, but at a lower amount each month beginning in April.

Asian currencies were hit Friday by a perceived easing by the European Central Bank, even as the Asian stock market reaction was mostly positive. The ECB said Thursday it would extend its bond-purchase program by nine months to the end of 2017, but cut its monthly purchases to €60 billion from €80 billion, as of April.

-

01:31

China: PPI y/y, November 3.3% (forecast 2.2%)

-

01:30

China: CPI y/y, November 2.3% (forecast 2.2%)

-

00:30

Australia: Home Loans , October -0.8% (forecast -1%)

-