Market news

-

23:30

Commodities. Daily history for Dec 08’2016:

(raw materials / closing price /% change)

Oil 50.96 +0.24%

Gold 1,172.4 00.00%

-

23:29

Stocks. Daily history for Dec 08’2016:

(index / closing price / change items /% change)

Nikkei 225 18,765.47 +268.78 +1.45%

Shanghai Composite 3,215.73 -6.51 -0.20%

S&P/ASX 200 5,543.64 0.00 0.00%

FTSE 100 6,931.55 +29.32 +0.42%

CAC 40 4,735.48 +40.76 +0.87%

Xetra DAX 11,179.42 +192.73 +1.75%

S&P 500 2,246.19 +4.84 +0.22%

Dow Jones Industrial Average 19,614.81 +65.19 +0.33%

S&P/TSX Composite 15,295.20 +57.45 +0.38%

-

23:28

Currencies. Daily history for Dec 08’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0614 -1,29%

GBP/USD $1,2584 -0,30%

USD/CHF Chf1,0161 +0,88%

USD/JPY Y114,03 +0,24%

EUR/JPY Y121,03 -1,07%

GBP/JPY Y143,48 -0,07%

AUD/USD $0,7462 -0,24%

NZD/USD $0,7172 +0,11%

USD/CAD C$1,3189 -0,33%

-

23:00

Schedule for today,Friday, Dec 09’2016 (GMT0)

00:30 Australia Home Loans October 1.6% -1%

01:30 China PPI y/y November 1.2% 2.2%

01:30 China CPI y/y November 2.1% 2.2%

06:45 Switzerland Unemployment Rate (non s.a.) November 3.2%

07:00 Germany Current Account October 24.2

07:00 Germany Trade Balance (non s.a.), bln October 24.4

07:45 France Industrial Production, m/m October -1.1% 0.6%

09:30 United Kingdom Total Trade Balance October -5.2

15:00 U.S. Wholesale Inventories October 0.1% -0.4%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) December 93.8 94.5

-

21:06

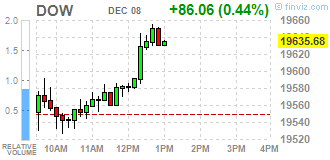

Major US stock indices closed in the green zone

Major US stock indexes continued to rally, motivated choice of Trump as president. Investors are betting on the shares of industrial and financial companies, as expected, that these sectors will derive maximum benefit from the Trump promises to spend more on infrastructure and simplify the rules.

As it became known, the number of Americans who first applied for unemployment benefits fell to a five-month high last week, indicating the strength of the labor market, underlining the steady momentum of the economy. Primary applications for unemployment benefits fell by 10,000 to a seasonally adjusted reached 258,000 for the week ending December 3, the Labor Department reported. The data for the previous week were not revised.

Oil futures rose about two percent, retreating from week low, as market participants focused on the upcoming meeting of the OPEC and non-OPEC producers, who may end the agreement on further production cuts. Recall, this Saturday, the OPEC and non-OPEC oil producers will meet in Vienna to agree on the details of the transaction, which is focused on the overall reduction in oil production of about 1.5 million. Barrels per day. This agreement will help reduce global glut in the market, which contributed to lower prices for more than two years.

DOW index components closed mostly in positive territory (16 of 30). More rest up shares The Goldman Sachs Group, Inc. (GS, + 2.42%). Outsider were shares of United Technologies Corporation (UTX, -1.20%).

Almost all sectors of the S & P showed an increase. The leader turned conglomerates sector (+ 1.9%). Decreased only the industrial goods sector (-0.3%).

At the close:

Dow + 0.32% 19,612.70 +63.08

Nasdaq + 0.44% 5,417.36 +23.60

S & P + 0.21% 2,246.04 +4.69

-

20:00

DJIA +0.36% 19,619.9 +70.37 Nasdaq +0.17% 5,403.01 +9.25 S&P +0.16% 2,244.97 +3.62

-

18:02

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Thursday, sparked by Donald Trump's election as U.S. president, roared ahead on Thursday, driving major Wall Street indexes to record highs. Investors are betting on shares of industrial and financial companies as they expect these sectors to benefit the most from Trump's promise to spend more on infrastructure and simplify regulations.

Most of Dow stocks in positive area (18 of 30). Top gainer The Goldman Sachs Group, Inc. (GS, +2.01%). Top loser - Pfizer Inc. (PFE, -0.90%).

Most S&P sectors also in positive area. Top gainer - Financials (+0.8%). Top loser - Healthcare (-0.2%).

At the moment:

Dow 19591.00 +138.00 +0.71%

S&P 500 2244.00 +12.50 +0.56%

Nasdaq 100 4866.00 +25.50 +0.53%

Oil 50.56 +0.79 +1.59%

Gold 1172.70 -4.80 -0.41%

U.S. 10yr 2.40 +0.05

-

17:00

European stocks closed: FTSE 100 +29.32 6931.55 +0.42% DAX +192.73 11179.42 +1.75% CAC 40 +40.76 4735.48 +0.87%

-

16:58

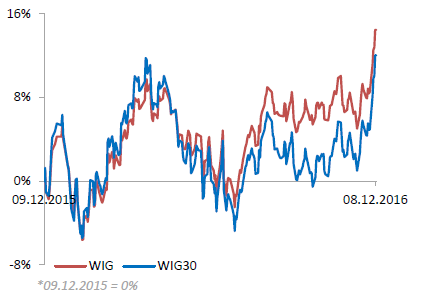

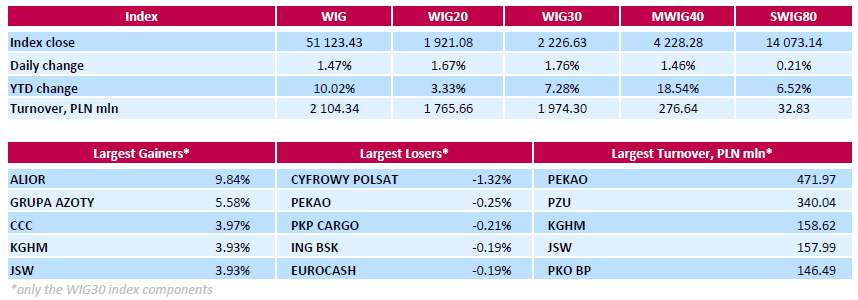

WSE: Session Results

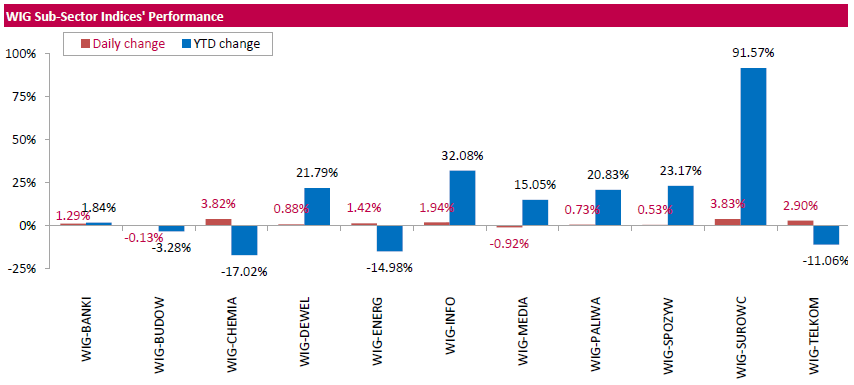

Polish equity market closed higher on Thursday. The broad market measure, the WIG Index, rose by 1.47%. The WIG sub-sector indices were mainly higher with materials (+3.83%) outperforming.

The large-cap stocks' measure, the WIG30 Index, surged by 1.76%. A majority of the index components returned gains, with the way up led by bank ALIOR (WSE: ALR), which soared by 9.84%, helped by the announcement the bank decided yesterday to terminate the negotiations and cease the plan to acquire core banking business of Raiffeisen Bank Polska. Other major advancers were chemical producer GRUPA AZOTY (WSE: ATT), footwear retailer CCC (WSE: CCC), coking coal miner JSW (WSE: JSW) and copper producer KGHM (WSE: KGH), which added between 3.93% and 5.58%. Among few decliners, media group CYFROWY POLSAT (WSE: CPS) fell the most, down 1.32%, correcting after significant gains (7.2%) earlier this month.

-

15:53

OECD: Leading index indicates stable growth

The Organization for Economic Cooperation and Development reported that the index of leading indicators suggests a steady growth momentum for the world economy.

The composite index of leading indicators remained stable at 99.8 in October, OECD said on Thursday.

LED indicates that the pace of growth accelerated in several developed economies and strengthened in the major emerging economies.

Signs of growth, which is gaining momentum, appeared in the composite index of leading indicators for the United States, Canada, Germany and France, according to the OECD.

Growth is expected to gain momentum in the emerging markets, namely China and India. At the same time, a steady growth momentum was recorded in Japan and the Euro Zone.

-

15:43

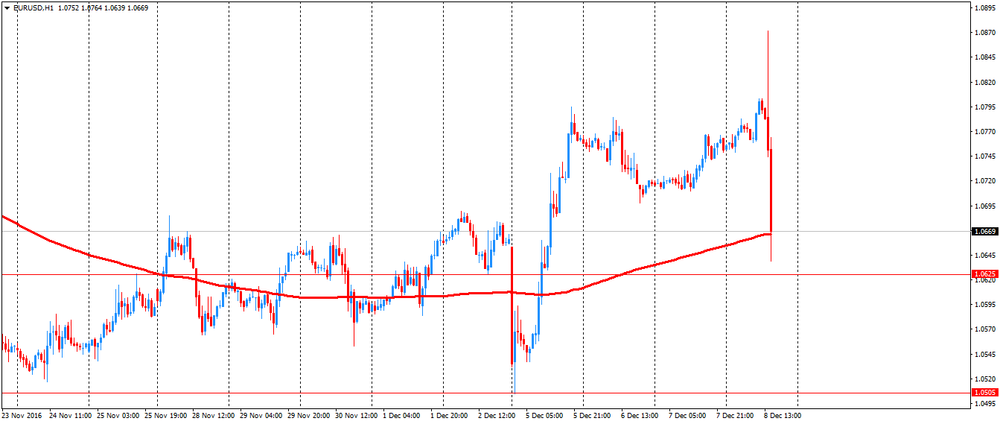

Gold price fell on stronger dollar and ECB measures

Gold for February delivery was recently down 0.3% at $1,174 a troy ounce on the Comex division of the New York Mercantile Exchange.

Earlier in the session, the The European Central Bank said it would extend the duration of its economic stimulus until the end of 2017, while gradually reducing the amount of government bonds it buys, starting in April.

Investors focused on the message's dovish element, and sent the euro lower against the dollar. A rising dollar is bearish for gold, as the metal is priced in the U.S. currency and becomes more expensive for foreign buyers when the dollar appreciates, Dow Jones says.

"The ECB is still in easing mode, U.S. rates appear to be headed higher, the dollar is stronger, and these are all short-term headwinds for gold, " said Peter Hug, global trading director at Kitco Metals.

-

15:18

Nowotny: I personally think ECB measures suffice for '17, inflation likely to rise

-

15:09

Earthquake M6.8: Ferndale, California

-

14:53

WSE: After start on Wall Street

The ECB left interest rates unchanged and for a long time they are not going to change it, as was expected. The most important, however, was information regarding the purchase of assets. Here extension shall not take half a year, but about 9 months, provided, that the whole program will be reduced from 80 million euros a month to 60 billion euros. In addition, the ECB reported that in the QE program will be bought up from the market short-term bonds in prices lower than the deposit rate. Reaction - the euro firmly down, stock markets up.

Definitely calmly to events in Europe approaching Americans. Sessions on Wall Street began with a continuation of growth in the framework of St. Claus rally. There is no technical resistance in the market, which may lead to the closing of short positions, which may further increase the growth.

An hour before the close of trading on the Warsaw market the WIG20 index was at the level of 1,923 points (+1,81%) and the turnover around the WIG20 index exceeded PLN 1.1 billion, what shows the scale of the capital, which now sweeping over our market. Half of it belongs to the duo of PZU-Pekao, but this relationship is maintained from the very beginning of the session.

-

14:33

U.S. Stocks open: Dow -0.02%, Nasdaq +0.01%, S&P -0.04%

-

14:32

-

14:29

Before the bell: S&P futures +0.09%, NASDAQ futures +0.07%

U.S. stock-index futures were flat.

Global Stocks:

Nikkei 18,765.47 +268.78 +1.45%

Hang Seng 22,861.84 +60.92 +0.27%

Shanghai 3,215.73 -6.51 -0.20%

FTSE 6,923.63 +21.40 +0.31%

CAC 4,739.73 +45.01 +0.96%

DAX 11,127.12 +140.43 +1.28%

Crude $50.10 (+0.66%)

Gold $1,174.00(-0.30%)

-

13:56

Draghi: Tapering Has Not Been Discussed Today

-

Tweaks Eligibility Criteria for Bonds

-

Confident Italian Government Knows What to Do

-

Indicates Consensus, but Not Unanimity Behind QE Decision

-

Gradually Moving Purchases to Zero Wasn't Discussed

-

'Sustained Presence' of ECB in Markets Is Message of Today's Decision

-

-

13:56

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

65.1

-0.31(-0.4739%)

1394

Amazon.com Inc., NASDAQ

AMZN

771.01

0.59(0.0766%)

20148

American Express Co

AXP

74.6

0.31(0.4173%)

665

AMERICAN INTERNATIONAL GROUP

AIG

65

0.08(0.1232%)

2081

Apple Inc.

AAPL

110.81

-0.22(-0.1981%)

38026

AT&T Inc

T

40.15

-0.30(-0.7417%)

40751

Barrick Gold Corporation, NYSE

ABX

15.63

-0.16(-1.0133%)

93588

Caterpillar Inc

CAT

97.14

-0.19(-0.1952%)

3906

Cisco Systems Inc

CSCO

29.9

-0.05(-0.1669%)

3125

Citigroup Inc., NYSE

C

59.4

0.34(0.5757%)

51484

Exxon Mobil Corp

XOM

87.88

-0.19(-0.2157%)

1210

Facebook, Inc.

FB

117.78

-0.17(-0.1441%)

36705

Ford Motor Co.

F

13.05

-0.01(-0.0766%)

45058

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.59

0.16(1.0369%)

112010

General Electric Co

GE

31.46

-0.14(-0.443%)

8680

General Motors Company, NYSE

GM

36.14

-0.16(-0.4408%)

19879

Goldman Sachs

GS

237.25

1.69(0.7174%)

31918

Google Inc.

GOOG

771.31

0.12(0.0156%)

2095

Intel Corp

INTC

35.37

-0.13(-0.3662%)

2449

International Business Machines Co...

IBM

163.81

-0.98(-0.5947%)

999

Johnson & Johnson

JNJ

110.52

-0.58(-0.5221%)

1297

JPMorgan Chase and Co

JPM

84.41

0.34(0.4044%)

34848

McDonald's Corp

MCD

119.2

-0.72(-0.6004%)

2366

Microsoft Corp

MSFT

61.28

-0.09(-0.1467%)

8073

Nike

NKE

52.3

0.20(0.3839%)

3940

Pfizer Inc

PFE

31.01

-0.18(-0.5771%)

15163

Procter & Gamble Co

PG

83.7

-0.48(-0.5702%)

3928

Starbucks Corporation, NASDAQ

SBUX

58.78

0.02(0.034%)

4563

Tesla Motors, Inc., NASDAQ

TSLA

192.5

-0.65(-0.3365%)

16926

The Coca-Cola Co

KO

41.14

-0.15(-0.3633%)

2459

Twitter, Inc., NYSE

TWTR

19.53

0.05(0.2567%)

148676

United Technologies Corp

UTX

109.69

0.01(0.0091%)

250

Visa

V

79.5

0.19(0.2396%)

2785

Yahoo! Inc., NASDAQ

YHOO

40.65

0.13(0.3208%)

2300

Yandex N.V., NASDAQ

YNDX

19.73

0.05(0.2541%)

1000

-

13:54

Canadian municipalities issued $7.6 billion worth of building permits in October, up 8.7% from September

Municipalities issued $7.6 billion worth of building permits in October, up 8.7% from September. Higher construction intentions for commercial structures and residential dwellings in Alberta were responsible for much of the gain, as builders filed permits in advance of the changes in the provincial Building Code.

The value of residential building permits rose 7.7% to $5.2 billion in October. This was the third consecutive monthly increase. Advances were posted in eight provinces, led by Alberta and followed by British Columbia and Ontario.

Construction intentions for non-residential buildings increased 10.7% to $2.5 billion in October, following a 21.4% drop in September. Gains were registered in eight provinces, led by Alberta. Quebec and Manitoba reported declines in the non-residential sector.

-

13:50

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0500 (EUR 1.08bln) 1.0650 (482m) 1.0750 (722m) 1.0800 (1.51bln)

USD/JPY 111.00 (USD 798m) 113.00 (820m) 113.15 (400m) 114.60 (618m) 116.05-15 (621m)

GBP/USD 1.2500 (GBP 684m)

USD/CHF 0.9950 (400m)

AUD/USD 0.7250 (416m) 0.7350 (473m)

USD/CAD 1.3450 (USD 850m)

-

13:39

Canadian capacity utilization rate rose

Canadian industries operated at 81.9% of their production capacity in the third quarter, up from 79.7% in the previous quarter. The increase was mainly attributable to the oil and gas extraction industry as operations resumed following the Fort McMurray wildfires.

The 2.2 percentage point gain was the largest quarterly increase recorded by Canadian industries since industrial capacity utilization rates were first published in their current form starting in the first quarter of 1987.

-

13:36

Draghi: Extension of Purchases Allows for More Lasting Transmission

-

See Moderate, Firming Recovery, Subdued Inflationary Pressure

-

Extension of Program Calibrated to Preserve Substantial Accommodation

-

Purchases With Yield Below Deposit Rate Permitted to Extent Necessary

-

Maturity Range of Public Sector Program Broadened

-

Conducted Comprehensive Assessment of Outlook and Policy Stance

-

See Continuation of Growth Trend in 4Q

-

Will Act, If Warranted, By Using All Instruments

-

-

13:33

US unemployment claims in line with expectations

In the week ending December 3, the advance figure for seasonally adjusted initial claims was 258,000, a decrease of 10,000 from the previous week's unrevised level of 268,000. The 4-week moving average was 252,500, an increase of 1,000 from the previous week's unrevised average of 251,500.

There were no special factors impacting this week's initial claims. This marks 92 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

-

13:31

Canada: Capacity Utilization Rate, Quarter III 81.9%

-

13:30

Canada: Building Permits (MoM) , October 8.7% (forecast -0.7%)

-

13:30

Canada: New Housing Price Index, MoM, October 0.4% (forecast 0.2%)

-

13:30

U.S.: Initial Jobless Claims, 258 (forecast 258)

-

13:30

U.S.: Continuing Jobless Claims, 2005 (forecast 2059)

-

13:19

Canadian housing starts kept a steady pace in November

The trend measure of housing starts in Canada was 199,135 units in November compared to 199,641 in October, according to Canada Mortgage and Housing Corporation (CMHC). The trend is a six-month moving average of the monthly seasonally adjusted annual rates (SAAR) of housing starts.

"Housing starts kept a steady pace in November as upward trends observed in British Columbia and the Prairies offset downward trends recorded in Ontario, Quebec and the Atlantic provinces," said Bob Dugan, CMHC Chief Economist. "We're also seeing that housing starts are on track to have moderated in 2016 compared to 2015 in most centres where we detected overbuilding."

-

13:15

Canada: Housing Starts, November 184 (forecast 191.2)

-

13:01

ECB will continue to buy assets at current rates until the end of March 2017

-

until April 2017 the purchase will continue at 60 billion euros

-

we expect that rates will remain at current or lower levels for an extended period

-

we can increase the amount or duration of the QE program in the event of deterioration in prospects

-

some parameters of asset purchase program will be changed

-

the ECB will announce a change in the parameters of the purchase of assets at the press conference

-

-

12:48

ECB holds rates. EUR/USD up 90 pips so far

At today's meeting the Governing Council of the ECB decided that the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.40% respectively. The Governing Council continues to expect the key ECB interest rates to remain at present or lower levels for an extended period of time, and well past the horizon of the net asset purchases.

-

12:45

Eurozone: ECB Interest Rate Decision, 0.0% (forecast 0%)

-

12:03

WSE: Mid session comment

Today we will know the decision of the ECB, nevertheless on the markets may see continuously optimistic mood and the banking sector traditionally present high form. Italian banks index gaining approx. 2% and is at the highest levels since Brexit. The main indices in Frankfurt and Paris came over functioning for many weeks resistance. On the Warsaw market mid-morning trading phase brought new highs and the leaders of growth is all of the current information trio, PZU, Alior and Pekao.

In the middle of trade WIG20 index stood at 1,910 points (+1,11%). The turnover in the blu-chips segment was amounted to PLN 790 million.

-

11:50

Major European stock indices trading in the green zone

European stock markets at three months high while investors expect the extension of the ECB's QE program at today's meeting of the regulator. Indices are rising the fourth consecutive session, showing a record for the duration of the rally in two months.

Today will be held the last in this year's meeting of the ECB, which will discuss the timing and amount of QE program. According to analysts, the bank's management will announce the extension of the program by six months, until September 2017, maintaining the volume of purchase of assets at the same level - 80 billion euros per month.

The ECB, which aims to accelerate the growth of low prices, will report on the main decisions in the field of monetary policy at 12:45 GMT followed by a conference of Mario Draghi at 13:30 GMT.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0,2% - to 348.42 points. The index gained around 2.7% since the beginning of the week and is ready to show the best weekly gain since July.

Demand for shares of mining companies, with the regional index rose by 0.1% during the trading session reached the highest level since mid-2015, after rising metal prices on the background of dollar weakness and good data on imports into China.

The price of securities of the largest Italian bank UniCredit SpA rose by 0.3% on news that the Bank has reached an agreement for the sale of 32.8% stake in the Polish bank Bank Pekao for 10.59 billion zlotys ($ 2.6 billion) .

TUI Group's share price rose 0,6%. The largest tour operator in Europe has increased the profit in 2015-2016 by 13%, despite the decline in revenue.

TUI also announced its intention to increase the dividend payout to 0.63 euros from 0.56 euros per share.

Siemens shares lost 0.2%, although the company said Wednesday that it is guided by a double-digit profit growth rates every year until 2020.

At the moment:

FTSE 6905.05 2.82 0.04%

DAX 11023.27 36.58 0.33%

CAC 4701.82 7.10 0.15%

-

11:15

Goldman Sachs: ECB Meeting Holds 2 Questions For Markets

For markets, this week's ECB holds two questions. First, will there be a formal taper decision. Second, if there is no formal announcement to this effect (our base case is for a continuation of the bond buying program at an unchanged pace through late 2017), is the backdrop to the Governing Council sufficiently caustic that President Draghi in the press conference essentially signals that a taper will soon be coming. We think markets will treat either outcome with little distinction. EUR/$ would go up, perhaps substantially. As a result, we think markets will put more weight on the tapering signal, rather than any kind of program extension (which is subject to modification anyway). We think this is no time to taper, simply because of the challenging inflation dynamics in the Euro zone, in line with our European economics team's assessment A premature taper, which a decision to this effect at this meeting would certainly be, will only complicate the ECB's task of getting the Euro zone out of lowflation and fundamentally banishing deflation risk.

-

11:05

The volume of trade between Russia and China increased by 1.6% to $ 62.4 billion

Trade turnover between Russia and China in the first 11 months of 2016 grew by 1.6% y/y and reached 62.37 billion dollars. This is stated in the report of the General Customs Administration of China released today.

During the same period, the volume of deliveries of Russian goods to China fell by 4.1% and amounted to 28.98 billion dollars. Chinese exports to the Russian Federation in January - November increased by 7.2% - to 33.39 billion dollars.

Trade turnover between Russia and China decreased by 27.8% in 2015 to 422.7 billion yuan (64.2 billion US dollars). The volume of exports of Chinese goods to Russia fell by 34.4% last year to 216.2 billion yuan (32.9 billion dollars), while imports of Russian goods to China decreased by 19.1% to 206.5 billion yuan (31.4 billion dollars).

-

10:22

BNPP: EUR/USD To Struggle To Extend Upside Much Beyond 1.08.

Our economists also note that in light of the 'no' vote, the likelihood of the ECB announcing a scaling back of asset purchases is now less likely at their meeting this Thursday, and that a change in forward guidance in order to give some sort of signal to the markets that QE cannot continue indefinitely in the current form is instead more probable. We would expect EUR/USD to struggle to extend upside much beyond 1.08.

-

09:58

Oil traded flat

This morning, New York crude oil futures for Brent and WTI are trading with little changes. Oil fell the last two days, and now consolidates amid falling US dollar and positive statistics. China (one of the largest consumers of black gold) increased its exports in November by 0.1%, imports - 6.7% compared with the same period last year. Currently, market participants are cautious, waiting for the results of the upcoming OPEC meeting Saturday with non-members of the organization from which the cartel waits cuts of 0.6 million barrels a day.

-

09:12

Morgan Stanley: Justification For A Mild EUR Weakness Over ECB The Meeting

We believe the reaction of the EUR over the ECB meeting will ultimately depend on the probability of tapering in the next 12m. In particular, EURUSD will depend on the short end rate differential between EMU and the US. Our more medium term view, beyond this ECB meeting, is that we expect EURUSD to fall based on the rate differential staying wide and broad USD strength. Our economist's assumption is that the ECB will keep rates on hold at this week's meeting but add a 6m extension to its QE purchase programme. Since the ECB will come back with results from its committees on which QE constraints to relax, investors may have to deal with a plethora of information over the press conference, including new macro economic forecasts. Here are some points we will be looking for as FX watchers and the potential impact it would have on the EUR when taking each measure in isolation. We see justification for the EUR to weaken mildly over the ECB meeting.

-

09:04

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0500 (EUR 1.08bln) 1.0650 (482m) 1.0750 (722m) 1.0800 (1.51bln)

USD/JPY 111.00 (USD 798m) 113.00 (820m) 113.15 (400m) 114.60 (618m) 116.05-15 (621m)

GBP/USD 1.2500 (GBP 684m)

USD/CHF 0.9950 (400m)

AUD/USD 0.7250 (416m) 0.7350 (473m)

USD/CAD 1.3450 (USD 850m)

Информационно-аналитический отдел TeleTrade

-

08:30

Major stock exchanges trading in the green zone: FTSE flat, DAX + 0.5%, CAC40 + 0.3%, FTMIB + 0.2%, IBEX + 0.5%

-

08:30

Today’s events

-

At 12:45 GMT publication of the ECB's decision on the basic interest rate

-

At 13:30 GMT the ECB Press Conference

-

-

08:16

WSE: After opening

WIG20 index opened at 1898.82 points (+0.49%)*

WIG 50623.33 0.48%

WIG30 2200.90 0.58%

mWIG40 4169.08 0.04%

*/ - change to previous close

The cash market opens from increase to the level of 1898 points with a very good attitude of Pekao, where share price exceeds PLN 123. The star of the morning is Alior Bank after information about his withdrawal from the intention to acquire core banking of Raiffeisen Bank Poland - the share price grow in the first minutes of the session by more than 12 percent. This behavior supports the main index, which violates the level of 1900 points gaining in a similar scale to the German DAX.

After fifteen minutes of trading the WIG20 index was at the level of 1,898 points (+0,49%).

-

07:37

Credit Agricole: Limited Room For ECB To Extend Dovish Expectations; EUR/USD A Buy

The EUR has been broadly range-bound after rebounding from this year's lows. The main focus should turn to this week's ECB monetary policy announcement as a currency driver, especially as political uncertainty is unlikely to increase further in the short-term. As reported by "La Republica" yesterday morning Renzi may press for early elections in January/February next year in return for staying in power until then. However, according to President Mattarella early elections are technically not feasible because changes would be needed to the country's election law. We remain of the view that EUR/USD is a buy. Limited room of the ECB exceeding dovish expectations coupled with speculative short positioning close to multi-week extremes should keep the risk of further position squaring upside intact. This is especially true should the Fed fail to consider a more than anticipated hawkish forward guidance.

-

07:34

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.9%, CAC40 + 0.6%, FTSE + 0.9%

-

07:29

Japan's GDP lower than expected in the third quarter

Real gross domestic product of Japan in the third quarter was 0.3%, which is below analysts' forecast of 0.6%. The second quarter was marked by Japan's economy grew by 0.5%. On an annualized basis GDP increased by 1.3% compared with the previous quarter of +2.2%. Economists had forecast a GDP growth of 2.3%.

The yen fell slightly after the publication of GDP data, but recovered.

-

07:26

WSE: Before opening

Wall Street continues post-election boom. Wednesday's session ended with increases in most indices and the S&P500 and the Dow Jones Industrial set new highs. The next week on Wednesday after a meeting and including new macro forecasts, the message would send the US Federal Reserve. The market is at 100 percent convinced that the federal funds rate will be increased by 25 basis points.

In Asia good sentiment persists, and the only outsider is parquet in Shanghai, despite a surprisingly positive information about trade in November.

Before today's session on the Warsaw market was explained the issues of the sale of Bank Pekao and Raiffeisen Bank Poland. The package of 32.8% of the first one will take over PZU and PFR (Polish Development Fund) at a price of PLN 123 per share. The remaining 7.3% is to be placed by Pekao on the market, what today can have an impact on the listing of the shares of Pekao.

In turn, Alior Bank resigned from the acquisition of the core business of Raiffeisen Bank Poland, which by the Alior's shareholders should be accepted with relief, because there will not be the issue of shares to buy.

The main topic of the day on the international market will be the outcome of the ECB meeting. Investors expect the program to extend QE by half a year, with some modifications to facilitate its implementation.

-

07:25

Options levels on thursday, December 8, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0877 (3603)

$1.0844 (5976)

$1.0797 (3019)

Price at time of writing this review: $1.0765

Support levels (open interest**, contracts):

$1.0720 (3304)

$1.0666 (3710)

$1.0589 (6193)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 90023 contracts, with the maximum number of contracts with strike price $1,1400 (6406);

- Overall open interest on the PUT options with the expiration date December, 9 is 75479 contracts, with the maximum number of contracts with strike price $1,0600 (6193);

- The ratio of PUT/CALL was 0.84 versus 0.85 from the previous trading day according to data from December, 7

GBP/USD

Resistance levels (open interest**, contracts)

$1.2900 (705)

$1.2801 (1760)

$1.2702 (1995)

Price at time of writing this review: $1.2647

Support levels (open interest**, contracts):

$1.2597 (1204)

$1.2499 (2499)

$1.2400 (1563)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 36115 contracts, with the maximum number of contracts with strike price $1,3400 (2561);

- Overall open interest on the PUT options with the expiration date December, 9 is 36221 contracts, with the maximum number of contracts with strike price $1,1750 (2539);

- The ratio of PUT/CALL was 1.00 versus 1.01 from the previous trading day according to data from December, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:22

China's trade surplus declined in November

According to data released by the Customs General Administration of China, the trade balance was $ 44.61 bln in November, after the growth recorded in October to $ 49.06 billion. Economists had expected the growth rate to $ 46.30 billion. This indicator measures the ratio of the total exports and imports of all goods and services. A positive balance indicates a surplus, while a negative, deficit. As China's economy has a major impact on the global economy, this indicator has a specific meaning for the Forex market.

Export of goods and services from China increased by 5.9% in November, after declining in October to -7.3%.

Imports rose much higher than expected to 13.0%, after falling in the previous month by 1.4%.

-

07:14

Aussie trade balance deficit rose in October

In trend terms, the balance on goods and services was a deficit of $1,565m in October 2016, a decrease of $154m (9%) on the deficit in September 2016.

In seasonally adjusted terms, the balance on goods and services was a deficit of $1,541m in October 2016, an increase of $269m (21%) on the deficit in September 2

In seasonally adjusted terms, goods and services credits rose $389m (1%) to $27,631m. Non-rural goods rose $223m (1%) and non-monetary gold rose $198m (13%). Rural goods fell $150m (4%) and net exports of goods under merchanting fell $3m (6%). Services credits rose $121m (2%).

-

07:10

Moody's says that Australian banks demonstrated mildly deteriorating asset quality

Moody's Investors Service says that Australian banks demonstrated mildly deteriorating asset quality metrics during the six months to 31 September 2016, although they remain well capitalized to withstand an adverse shocks. At the same time, their funding profiles have improved.

"We expect that asset quality will continue to be supported by low interest rates, but that gradual pressure will be exerted by multiple headwinds," says Maadhavi Ramanayake, a Moody's Associate Analyst. "However, the banks are well capitalized to absorb any losses."

Moody's expects asset quality metrics to gradually come under further pressure as a result of multiple headwinds, including stress in resources-related sectors and regions; underemployment and weak wage growth; a worsening outlook for residential property developments; and the cumulative effects of weak milk prices on the dairy sector, notably in their New Zealand subsidiaries. Housing risks also remain elevated as house prices continued to appreciate in the key Sydney and Melbourne markets, which eroded modest improvements in housing affordability.

-

07:04

French payroll employment continued to increase

In Q3 2016, payroll employment in the non-farm market sectors continued to increase (+51,200 jobs, that is 0.3%, after +29,400 jobs in the previous quarter). This slight acceleration compared to the second quarter is due to temporary employment (+29,500 jobs, i.e. +5.0%, after −200 jobs in Q2 2016). Year-on-year, the principally market sectors created 178,700 net jobs (+1.1%).

-

06:14

Global Stocks

European stocks moved higher Tuesday as utility shares gained and banks recovered from the fallout from this weekend's referendum in Italy. Italy's political and banking woes may help European Bank President Mario Draghi convince hawkish ECB members to agree to extend the bank's eurozone stimulus efforts, including its bond-buying program. The ECB will release a policy decision Thursday.

U.S. stocks closed higher Wednesday with the Dow industrials and S&P 500 notching new records, shaking off early weakness in the health-care sector to extend gains. Health-care names tumbled early Wednesday after President-elect Donald Trump threatened to cut drug prices. "I'm going to bring down drug prices," Trump told Time in his "Person of the Year" cover story. "I don't like what has happened with drug prices."

Asian equity markets were firmly higher on Thursday, propelled by another record close on Wall Street and expectations that the European Central Bank will extend its monetary stimulus measures. Though there was no specific trigger for Wednesday's U.S. rally, market participants speculated that large orders in stock futures placed by computer programs may have accelerated buying.

-

05:16

Japan: Eco Watchers Survey: Outlook, November 53.0

-

05:01

Japan: Eco Watchers Survey: Current , November 48.6

-

04:03

China: Trade Balance, bln, November 46.3 (forecast 46.3)

-

00:30

Australia: Trade Balance , October -1.54 (forecast -0.8)

-