Market news

-

23:51

Japan: Current Account, bln, October 1720 (forecast 1577.2)

-

23:51

Japan: GDP, y/y, Quarter III 1.3% (forecast 2.4%)

-

23:50

Japan: GDP, q/q, Quarter III 0.3% (forecast 0.6%)

-

23:30

Commodities. Daily history for Dec 07’2016:

(raw materials / closing price /% change)

Oil 49.84 +0.14%

Gold 1,175.50 -0.17%

-

23:29

Stocks. Daily history for Dec 07’2016:

(index / closing price / change items /% change)

Nikkei 225 18,496.69 +136.15 +0.74%

Shanghai Composite 3,222.24 +22.59 +0.71%

S&P/ASX 200 5,488.50 +10.40 +0.19%

FTSE 100 6,902.23 +122.39 +1.81%

CAC 40 4,694.72 +62.78 +1.36%

Xetra DAX 10,986.69 +211.37 +1.96%

S&P 500 2,241.35 +29.12 +1.32%

Dow Jones Industrial Average 19,549.62 +297.84 +1.55%

S&P/TSX Composite 15,237.75 +111.95 +0.74%

-

23:28

Currencies. Daily history for Dec 07’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0751 +0,32%

GBP/USD $1,2622 -0,43%

USD/CHF Chf1,0072 -0,28%

USD/JPY Y113,76 -0,21%

EUR/JPY Y122,33 +0,11%

GBP/JPY Y143,58 -0,64%

AUD/USD $0,7480 +0,16%

NZD/USD $0,7164 +0,64%

USD/CAD C$1,3232 -0,33%

-

23:13

Schedule for today,Thursday, Dec 08’2016 (GMT0)

00:30 Australia Trade Balance October -1.23 -0.8

02:00 China Trade Balance, bln November 49.06 46.3

05:00 Japan Eco Watchers Survey: Outlook November 51.4

05:00 Japan Eco Watchers Survey: Current November 49.3

06:30 France Non-Farm Payrolls (Finally) Quarter III 0.2% 0.3%

12:45 Eurozone ECB Interest Rate Decision 0.0% 0%

13:15 Canada Housing Starts November 192.9 191.2

13:30 Eurozone ECB Press Conference

13:30 Canada Capacity Utilization Rate Quarter III 80%

13:30 Canada Building Permits (MoM) October -7% -0.7%

13:30 Canada New Housing Price Index, MoM October 0.2% 0.2%

13:30 U.S. Continuing Jobless Claims 2081 2059

13:30 U.S. Initial Jobless Claims 268 258

23:50 Japan BSI Manufacturing Index Quarter IV 2.9 3.4

-

21:06

Major US stock indices closed in the green zone

Major stock indexes in Wall Street increased significantly, by updating the record levels as investors are betting on the acceleration of economic growth at Trampe.

Many analysts believe that the rally that started after the presidential election, will continue next year. They refer to the GDP growth, continued improvement in the labor market and increase corporate profits. At the same time, market participants' attention is gradually shifting to a meeting of the Federal Reserve System, which is scheduled for December 13-14. According to the futures market, at present, the probability of a tightening of monetary policy at the Fed's December meeting was 92.7% compared with 94.9% the previous day.

Little impact on the bidding had US data. As it became known, in October, the number of vacancies decreased to 5,534,000 Browse vacancies and labor turnover (JOLTS), published by the US Bureau of Labor Statistics showed that the index for September was revised upward -.. To 5.631 million from 5.486 million analysts. expected that the number of vacancies will be up to 5.5 million. vacancy rate was 3.7 percent, unchanged compared with September. The number of jobs has changed little in the private sector and the government sector. The number of vacancies increased in the field of health and social care (139, 000), but fell in the segment of professional and business services (-187,000), the federal government (-13 000), and mining and logging (-8000).

Almost all the components of DOW index closed in positive territory (27 of 30). Most remaining shares rose NIKE, Inc. (NKE, + 3.17%). Outsider were shares of Pfizer Inc. (PFE, -1.45%).

Almost all sectors of the S & P index recorded an increase. The leader turned out to be the technology sector (+ 1.7%) and the financial sector (+ 1.7%). Reducing showed only the health sector (-1.0%).

At the close:

Dow + 1.54% 19,547.63 +295.85

Nasdaq + 1.14% 5,393.76 +60.76

S & P + 1.31% 2,241.20 +28.97

-

20:00

U.S.: Consumer Credit , October 16.02 (forecast 19.0)

-

20:00

DJIA +1.33% 19,508.04 +256.26 Nasdaq +0.93% 5,382.38 +49.38 S&P +0.98% 2,233.93 +21.70

-

17:00

European stocks closed: FTSE 100 +122.39 6902.23 +1.81% DAX +211.37 10986.69 +1.96% CAC 40 +62.78 4694.72 +1.36%

-

16:53

WSE: Session Results

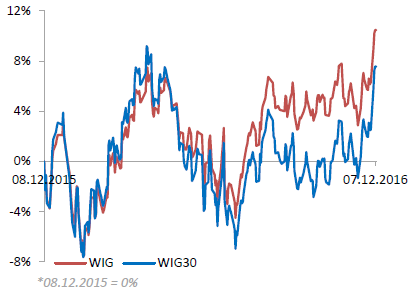

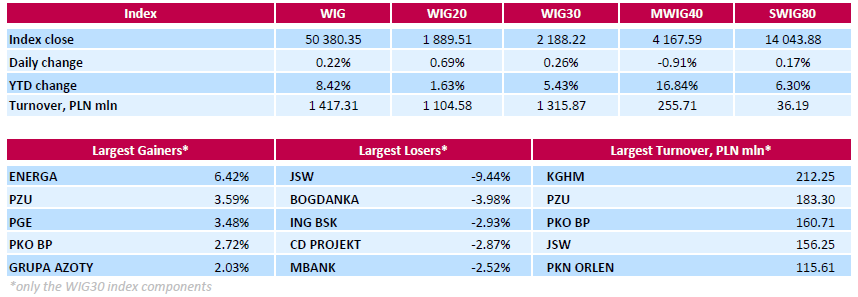

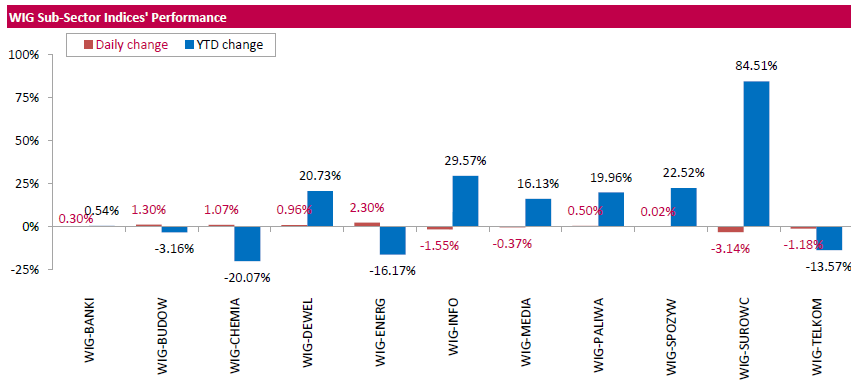

Polish equity market closed higher on Wednesday. The broad market measure, the WIG Index, rose by 0.22%. Sector performance within the WIG Index was mixed. Utilities (+2.3%) outpaced, while materials (-3.14%) underperformed.

The large-cap stocks gained 0.26%, as measured by the WIG30 Index, with the way up led by genco ENERGA (WSE: ENG), which surged by 6.42%. It was followed by insurer PZU (WSE: PZU), genco PGE (WSE: PGE), bank PKO BP (WSE: PKO) and chemical producer GRUPA AZOTY (WSE: ATT), adding between 2.03% and 3.59%. On the other side of the ledger, coking coal miner JSW (WSE: JSW) kept its position as the worst performing name, tumbling by 9.44%. Other major decliners were thermal coal miner BOGDANKA (WSE: LWB), bank ING BSK (WSE: ING) and videogame developer CD PROJEKT (WSE: CDR), which lost 3.98%, 2.93% and 2.87% respectively.

-

16:35

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Wednesday as investors assessed whether a post-election rally, which powered the major indexes to a series of record highs in the past month, had more room to run. Investors have been flocking to sectors such as financials and industrials, which are most likely to benefit from President-elect Donald Trump's proposals of more fiscal stimulus and simpler regulations.

Most of Dow stocks in positive area (19 of 30). Top gainer - American Express Company (AXP, +1.23%). Top loser - Pfizer Inc. (PFE, -2.85%).

Most S&P sectors also in positive area. Top gainer - Utilities (+0.7%). Top loser - Healthcare (-2.0%).

At the moment:

Dow 19270.00 +38.00 +0.20%

S&P 500 2213.00 +3.00 +0.14%

Nasdaq 100 4782.75 -4.00 -0.08%

Oil 50.48 -0.45 -0.88%

Gold 1178.60 +8.50 +0.73%

U.S. 10yr 2.36 -0.04

-

15:45

ECB Could Disappoint Investors Betting On More Stimulus - Dow Jones

-

15:33

US crude and gasoline inventories rose more than expected

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 2.4 million barrels from the previous week. At 485.8 million barrels, U.S. crude oil inventories are at upper limit of the average range for this time of year.

Total motor gasoline inventories increased by 3.4 million barrels last week, and are well above the upper limit of the average range. Both Finished gasoline inventories and blending components inventories increased last week.

Distillate fuel inventories increased by 2.5 million barrels last week and are above the upper limit of the average range for this time of year. Propane/propylene inventories fell 1.5 million barrels last week but are near the upper limit of the average range. Total commercial petroleum inventories increased by 1.4 million barrels last week.

-

15:30

U.S.: Crude Oil Inventories, December -2.389 (forecast -1.5)

-

15:16

-

15:05

NIESR estimates UK GDP at +0.4%

Monthly estimates of GDP suggest that output grew by 0.4 per cent in the three months ending in October 2016 after growth of 0.5 per cent in the three months ending in September 2016.

Oriol Carreras, Research Fellow at NIESR, said "Our estimates suggest the economy grew by 0.4 per cent in the three months to October. Robust consumer spending growth continues to support the economy. Looking ahead, this contribution from consumers is expected to wane over the course of next year due to a substantial rise in the rate of inflation."

NIESR's latest quarterly forecast (published 2nd November 2016) projects GDP growth of 2 per cent per annum in 2016 and 1.4 per cent in 2017. CPI inflation is expected to reach 3.8 per cent at the end of 2017

-

15:03

US JOLTS job openings little changed in October

The number of job openings was little changed at 5.5 million on the last business day of October, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were also little changed at 5.1 million and 4.9 million, respectively. Within separations, the quits rate was unchanged at

2.1 percent and the layoffs and discharges rate was also unchanged at 1.0 percent. This release includes estimates of the number and rate of job openings, hires, and separations for the nonfarm sector by industry and by four geographic regions. -

15:01

Bank of Canada holds as expected. Says total CPI inflation has picked up

The Bank of Canada today announced that it is maintaining its target for the overnight rate at 1/2 per cent. The Bank Rate is correspondingly 3/4 per cent and the deposit rate is 1/4 per cent.

Economic data suggest that global economic conditions have strengthened, as the Bank anticipated in its October Monetary Policy Report (MPR). However, uncertainty, which has been undermining business confidence and dampening investment in Canada's major trading partners, remains undiminished. Following the election in the United States, there has been a rapid back-up in global bond yields, partly reflecting market anticipation of fiscal expansion in a US economy that is near full capacity. Canadian yields have risen significantly in this context.

In Canada, the dynamics of growth are largely as the Bank anticipated. Following a very weak first half of 2016, growth in the third quarter rebounded strongly, but more moderate growth is anticipated in the fourth quarter. Consumption growth was robust in the third quarter, supported by the new Canada Child Benefit, while the effects of federal infrastructure spending are not yet evident in the GDP data. Meanwhile, business investment and non-energy goods exports continue to disappoint. There have been ongoing gains in employment, but a significant amount of economic slack remains in Canada, in contrast to the United States. While household imbalances continue to rise, these will be mitigated over time by announced changes to housing finance rules.

Total CPI inflation has picked up in recent months but is slightly below expectations, largely because of lower food prices. Core inflation is close to 2 per cent because the effect of persistent economic slack is still being offset by that of past exchange rate depreciation, although the latter effect is dissipating.

-

15:00

Canada: Bank of Canada Rate, 0.5% (forecast 0.5%)

-

15:00

U.S.: JOLTs Job Openings, October 5.534 (forecast 5.5)

-

14:59

United Kingdom: NIESR GDP Estimate, November 0.4%

-

14:55

WSE: After start on Wall Street

In the last hour the bulls appetites grew and succeeded in meeting of the WIG20 chart with the level of 1,900 points. Contra of the supply side was readable and a four-hour growth from the region of 1,875 points was almost completely abolished in an hour. Ending a session at this level would be a signal that the overcome of the level of 1,900 points without prior correction of the growth wave may not be easy. Please note, that the size of the turnover, which is greater than yesterday, may indicate that we are dealing with the distribution phase after the increase in the WIG20 index by more than 100 points in the last days.

An hour before the close of trading on the Warsaw Stock Exchange the WIG20 index was at the level of 1,886 points (+ 0.51%).

-

14:54

ING Sees EUR/USD Steady Around $1.07 Before ECB

-

14:34

U.S. Stocks open: Dow -0.05%, Nasdaq -0.17%, S&P -0.08%

-

14:31

Russian spokesman: All companies supported proposals on production cuts - Forexlive

-

14:28

Before the bell: S&P futures -0.08%, NASDAQ futures -0.19%

U.S. stock-index futures were flat.

Global Stocks:

Nikkei 8,496.69 +136.15 +0.74%

Hang Seng 22,800.92 +125.77 +0.55%

Shanghai 3,221.92 +22.28 +0.70%

FTSE 6,870.61 +90.77 +1.34%

CAC 4,663.21 +31.27 +0.68%

DAX 10,918.83 +143.51 +1.33%

Crude $50.33 (-1.18%)

Gold $1,173.90 (+0.32%)

-

13:57

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

31.23

0.08(0.2568%)

1595

ALTRIA GROUP INC.

MO

64.38

0.08(0.1244%)

1949

Amazon.com Inc., NASDAQ

AMZN

762.5

-2.22(-0.2903%)

5118

Apple Inc.

AAPL

109.27

-0.68(-0.6185%)

139920

AT&T Inc

T

39.41

0.06(0.1525%)

2140

Barrick Gold Corporation, NYSE

ABX

15.63

0.14(0.9038%)

22841

Boeing Co

BA

152.2

-0.04(-0.0263%)

1135

Caterpillar Inc

CAT

95.1

-0.12(-0.126%)

2965

Chevron Corp

CVX

112.79

0.03(0.0266%)

1600

Citigroup Inc., NYSE

C

57.84

-0.08(-0.1381%)

16836

Facebook, Inc.

FB

116.94

-0.37(-0.3154%)

25577

Ford Motor Co.

F

12.55

-0.01(-0.0796%)

14125

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

16

0.11(0.6923%)

121867

General Electric Co

GE

31.13

-0.04(-0.1283%)

8195

General Motors Company, NYSE

GM

35.25

0.18(0.5133%)

7220

Goldman Sachs

GS

230.61

-0.77(-0.3328%)

10111

Johnson & Johnson

JNJ

111.53

-0.53(-0.473%)

3445

JPMorgan Chase and Co

JPM

83.45

-0.24(-0.2868%)

5565

Merck & Co Inc

MRK

59.52

-0.76(-1.2608%)

2933

Microsoft Corp

MSFT

59.94

-0.01(-0.0167%)

3190

Nike

NKE

50.59

0.02(0.0395%)

502

Pfizer Inc

PFE

31.2

-0.36(-1.1407%)

40945

Starbucks Corporation, NASDAQ

SBUX

57.38

-0.06(-0.1045%)

15080

Tesla Motors, Inc., NASDAQ

TSLA

185.4

-0.45(-0.2421%)

17257

The Coca-Cola Co

KO

40.76

0.19(0.4683%)

345

Twitter, Inc., NYSE

TWTR

18.21

-0.02(-0.1097%)

43272

UnitedHealth Group Inc

UNH

158.5

1.18(0.7501%)

5094

Visa

V

77.32

0.21(0.2723%)

1995

Wal-Mart Stores Inc

WMT

69.9

0.04(0.0573%)

4098

Walt Disney Co

DIS

100.45

-0.21(-0.2086%)

3795

Yahoo! Inc., NASDAQ

YHOO

40.03

0.06(0.1501%)

802

Yandex N.V., NASDAQ

YNDX

19.36

0.12(0.6237%)

1400

-

13:56

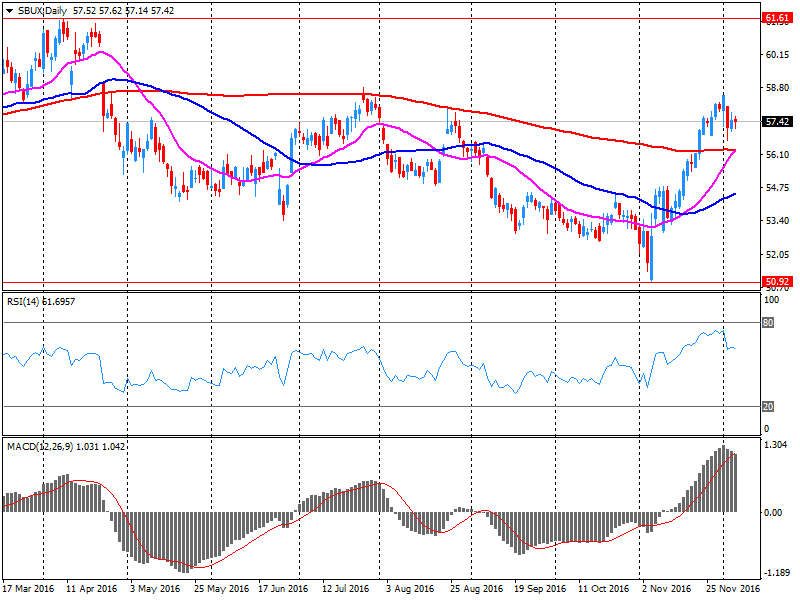

Starbucks (SBUX) introduced a five-year development plan

Starbucks has introduced a five-year development plan prepared Investor Day.

According to the strategy, the company plans to increase revenue by 10%, the rate of earnings per share - 15-20%, as well as to open about 12 thousand new stores around the world (+ 48%, to 37 thousand in all) by 2021

SBUX shares fell in premarket trading to $ 57.04 (-0.70%).

-

13:55

Upgrades and downgrades before the market open

Upgrades:

UnitedHealth (UNH) upgraded to Buy from Hold at Cantor Fitzgerald

3M upgraded (MMM) to Sector Perform at RBC Capital Mkts; target raised to $171

Downgrades:

Other:

-

13:39

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0500 (EUR 580m) 1.0650 (464m) 1.0750 (1.07bln) 1.0800 (456m)

USD/JPY 114.50 (USD 337m)

GBP/USD 1.2665 (GBP 318m) 1.2840 (595m)

AUD/USD 0.7500 (AUD 496m)

USD/CAD 1.3500 (USD 576m)

-

13:23

Bank of America Merrill Lynch expect the Bank of Canada to hold at 0.50%

"We expect the Bank of Canada (BoC) to keep policy rates on hold at 0.50% at is meeting on Wednesday as is widely expected. In the absence of a Monetary Policy Report (MPR) or press conference, the tone of the statement will be a key determinant of the market reaction. With data since the October MPR largely in line or a bit better-thanexpected, the BoC will likely maintain its assessment that risks around the inflation outlook are "roughly balanced." Additionally, the overall tone is still likely to be one of cautious optimism even as Governor Poloz noted that uncertainty remains extremely high in recent comments. Overall, the statement will suggest-as Poloz did in comments this week-that absent a material shock to their inflation outlook the bar for a cut remains relatively high.

Data: good, not great. Recent data leaves little to push the BoC off its comfortable, on-hold perch. Q3 GDP outpaced the BoC's October MPR forecasts of 3.2%, driven encouragingly by a rebound in exports from Q2 and still strong household consumption (Chart 1). The bounce in exports fits the BoC narrative the exports will help support a rebound in H2 growth, but it still wasn't enough to offset the sharp Q2 decline. Additionally, the continued weakness in business investment is likely to leave them cautious about a strong pickup in manufacturing in coming quarters. Employment data has also remained strong with the 6m trend accelerating to an above-trend 20k. On the flip side, the trade balance reached its widest level on record (about 3% of GDP) as export growth remains uneven...

Tighter financial conditions from US spillovers. The 50 basis point rise in US yield since the election has brought Canadian yields higher as well, posing some concern about a premature tightening of financial conditions. Despite the rise in US yields, the Canadian dollar trails only the British pound in its relative outperformance versus the USD since the election. It is likely too early to expect.

FX: Focus on Fed, US yields with high hurdle for near-term BoC cut. The BoC's on-hold stance is likely to have short-term little impact on USD/CAD, particularly with market pricing consistent with little (if any) BoC action through mid- 2017. However, with the OIS curve relatively flat (Chart 2), we continue to believe the market is underpricing the risks around the Canadian economy. The pricing out of cuts since the October meeting has been one reason the C$ has performed well, despite broader USD strength and additional risk premia from Trump-induced trade policy uncertainty. However, USD/CAD's inability to sustainably selloff following OPEC's surprise decision to cut production by 1.2 mn bbl/day suggests the market is more focused on the global yield story than oil price movements. Indeed, $50/bbl WTI prices are still below the full cycle breakeven costs of many Canadian producers.

We continue to expect a sustained move higher in USD/CAD towards year-end and over the course of 2017 driven by: 1) a faster pace of Fed hikes than the market is currently expecting, 2) a tepid pace of Canadian growth as capacity and competitiveness issues hamper non-energy exports leading to a BoC cut in H2 2017, and 3) increased uncertainty with respect to Canadian trade as President-elect Trump seeks to renegotiate trade deals.

With oil prices likely to move higher post-OPEC, implicitly we are assuming the recent decline in correlation between CAD and oil will continue to be displaced by rate differentials. As we have show empirically, CAD's sensitivity to rate differentials has increased in recent years. While higher oil will lend some residential demand for CAD, we expect the rate story to dominate over the coming years, underpinning our bearish view.

BofA Merrill targets USD/CAD at 1.36 by year-end and at 1.38, 1.40, 1.41, 1.43 by the end of Q1, Q2, Q3, and Q4 of 2017 respectively".

Copyright © 2016 BofAML, eFXnews™

-

13:18

NOK Could Face Pressure Ahead of Meeting of OPEC, Non-OPEC

-

12:59

Orders

EUR/USD

Offers : 1.0735 1.0750 1.0780-85 1.0800 1.0820 1.0850 1.0875-80 1.0900

Bids: 1.0700 1.0680 1.0650 1.0620 1.0600 1.0580 1.0550

GBP/USD

Offers : 1.2655-60 1.2685 1.2700 1.2725-30 1.2750 1.2780-85 1.2800

Bids: 1.2600 1.2585 1.2550-55 1.2530-35 1.2500 1.2480 1.2450

EUR/GBP

Offers : 0.8520-25 0.8550 0.8575-80 0.8600

Bids: 0.8480 0.8460 0.8430 0.8400 0.8380 0.8350

EUR/JPY

Offers : 122.60 122.85 123.00 123.50 124.00 124.50 124.80 125.00

Bids: 122.00 121.80 121.50 121.00 120.80-85 120.50

USD/JPY

Offers : 114.50 114.80-85 115.00 115.25 115.45-50

Bids: 114.00 113.80 113.50-60 113.20 113.00 112.85 112.50 112.20 112.00

AUD/USD

Offers : 0.7475-80 0.7500-05 0.7520 0.7545-50 0.7580 0.7600

Bids: 0.7420 0.7400 0.7380 0.7355-60 0.7325-30 0.7300 0.7285 0.7250

-

12:40

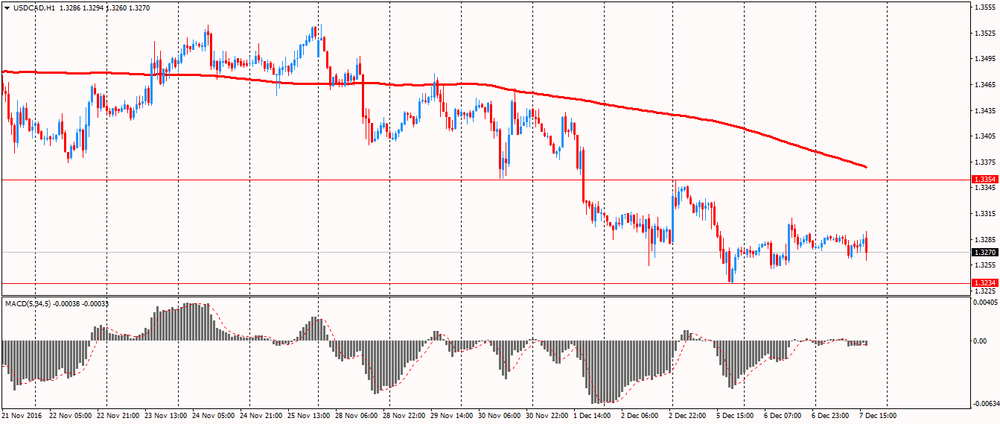

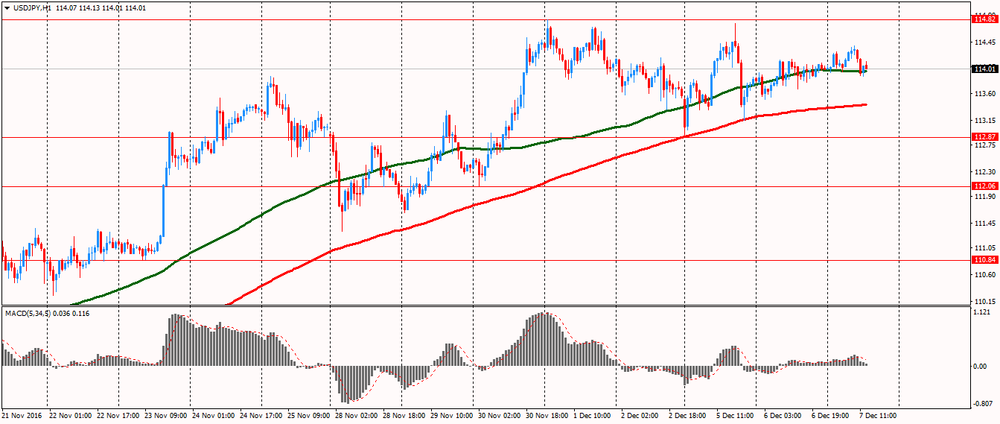

Daily technical analysis for USD / JPY

Resistance 3: Y115.83 (9 February high)

Resistance 2: Y115.26 (10 February high)

Resistance 1: Y114.82 (1 December high)

Current price: Y114.01

Support 1: Y112.87 (5 December low)

Support 2: Y112.06 (30 of November low)

Support 3: Y110.84 (23 of November low)

On the hour, four-hour and daily chart the pair is trading above the MA 200. In addition, 14-day relative strength index (RSI (14) on the D1), above the level of 70 that signals a possible reversal.

-

12:05

WSE: Mid session comment

In the end of the forenoon phase of the session, the WIG20 index returns to the vicinity of the daily maximum. For the demand help not only limited losses suffered by the market at an earlier attempt of supply, but also growing by 1.5 percent the DAX and stronger zloty, which gained approx. 0.6 percent against the dollar.

Given the fact that the macro calendar has no more any important data today, the further course of trading seems to be dependent on the behavior of the US markets.

At the halfway point of the session the Wig20 index was at the level of 1,889 points (+0,72%). The turnover among the blue chips sector is quite substantial and at the same time was amounted to over PLN 420 million.

-

11:42

Major European stock indices trading in the green zone

European stocks rose a third straight session supported by mining companies and banks.

Investors expect the forthcoming meeting of the European Central Bank amid growing hopes for additional measures to stimulate the economy, and continue to move away from the Italian referendum results.

The markets are still recovering after Sunday Italian voters rejected constitutional changes proposed by the government, forcing the prime minister Renzi to resign.

However, there are signs that Italy will not hold early elections after the resignation of Renzi.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0,7%, to 347.12 points.

Shares of Rio Tinto rose 4.3% after Credit Suisse improved to "outperform" from "neutral."

Credit Suisse experts maintain a positive assessment for the companies of the mining sector, expecting the favorable trends in terms of demand "will continue to grow after the aggressive reduction of inventories of raw materials companies in 2014-2015".

Cost of Glencore shares jumped nearly 3%.

Capitalization of Royal Dutch Shell rose 1.2% on the information that the company will develop a major oil field in Iran.

Monte Paschi jumped today to 9,5%, UniCredit, Italy's largest bank, + 3%.

Shares of Credit Suisse Group rose by 4,3%, Deutsche Bank +3,2%, BNP Paribas +2.5%.

At the moment:

FTSE 6875.15 95.31 1.41%

DAX 10936.87 161.55 1.50%

CAC 4675.47 43.53 0.94%

-

11:05

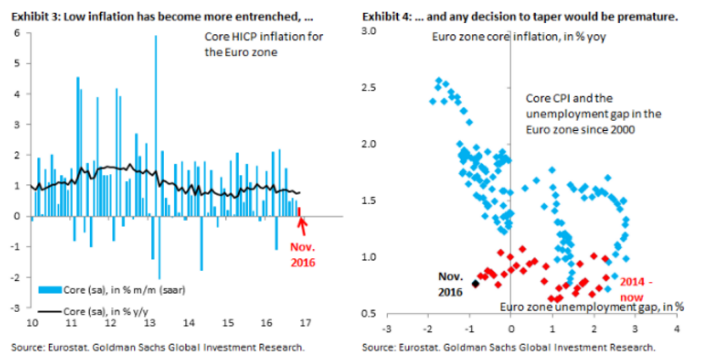

Goldman think markets will put more weight on the ECB tapering signal, rather than any kind of program extension

"For markets, this week's ECB holds two questions.

First, will there be a formal taper decision. Second, if there is no formal announcement to this effect (our base case is for a continuation of the bond buying program at an unchanged pace through late 2017), is the backdrop to the Governing Council sufficiently caustic that President Draghi in the press conference essentially signals that a taper will soon be coming. We think markets will treat either outcome with little distinction. EUR/$ would go up, perhaps substantially.

Some have been discussing scenarios that aim to split the difference for the ECB, for example tapering purchases to a monthly pace of EUR 40-50 bn, but then extending the program for longer, say through Q1 2018. We think such proposals fail to take account of how skeptical markets have become where the ECB is concerned. After all, the December 2015 meeting and the misfire in March of this year have taught markets to be extremely skeptical as to the ECB's willingness and ability to ease.

As a result, we think markets will put more weight on the tapering signal, rather than any kind of program extension (which is subject to modification anyway).

We think this is no time to taper, simply because of the challenging inflation dynamics in the Euro zone, in line with our European economics team's assessment A premature taper, which a decision to this effect at this meeting would certainly be, will only complicate the ECB's task of getting the Euro zone out of lowflation and fundamentally banishing deflation risk".

Copyright © 2016 Goldman Sachs, eFXnews™

-

10:33

RBI May Resume Rate Cut After Dust Settles on Big Note Ban

-

10:12

Oil is trading lower

This morning, the New York futures for Brent have fallen in price by 0.61% to $ 53.6 and WTI fell 0.69% to $ 50.58 per barrel. Thus, the black gold is trading in the continued negative correction after the recent rally. The reason for the decrease was the skepticism regarding the willingness of market participants, OPEC and other major oil producers countries to implement plans to limit the growth of oil production.

Also yesterday, it was reported that US crude inventories fell more than expected. According to API, crude oil inventories fell by 2.2 million barrels to 485.4 million in the week ended Dec. 2, while analysts had expected that they will fall by 1 million barrels.

-

09:36

UK industrial production down 1.3% on mining and quarrying downward pressure

In October 2016, total production is estimated to have decreased by 1.3% compared with September 2016. Mining and quarrying provided the largest downward pressure, due to ongoing maintenance reducing production in the oil and gas extraction industry. You should note that we always warn against overly interpreting 1 month's figures.

Manufacturing decreased by 0.9% on the month to October 2016, following an increase of 0.6% in the previous month. The decreases were broad-based across the sector, with the largest downward pressure coming from pharmaceuticals, which fell by 3.6%.

The month on same month a year ago picture shows a decrease in total production of 1.1% in October 2016 with decreases in 3 of the 4 main sectors. The largest downward contribution came from mining and quarrying, falling by 8.7%, mainly due to maintenance in the oil and gas industry in October 2016.

-

09:30

United Kingdom: Industrial Production (YoY), October -1.1% (forecast 0.5%)

-

09:30

United Kingdom: Manufacturing Production (MoM) , October -0.4% (forecast 0.2%)

-

09:30

United Kingdom: Industrial Production (MoM), October -1.3% (forecast 0.2%)

-

09:30

United Kingdom: Manufacturing Production (YoY), October -0.4% (forecast 0.8%)

-

09:21

ING Advises Short GBP/USD Above $1.2630, Sees $1.15 in 1Q 2017

-

09:00

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0500 (EUR 580m) 1.0650 (464m) 1.0750 (1.07bln) 1.0800 (456m)

USD/JPY 114.50 (USD 337m)

GBP/USD 1.2665 (GBP 318m) 1.2840 (595m)

AUD/USD 0.7500 (AUD 496m)

USD/CAD 1.3500 (USD 576m)

-

08:46

Major stock exchanges began trading in the green zone: FTSE + 0.46%, DAX + 1.0%, CAC40 + 1.1%, FTMIB + 1.3%, IBEX + 0.83%

-

08:37

UK house price index rose in line with expectations in November

House prices in the three months to November were 0.8% higher than in the previous three months (JuneAugust). This is an improvement on the two previous months when the quarterly rate was broadly unchanged. Nonetheless, the quarterly rate of change remains well below the 3.0% increase recorded in February.

Prices in the three months to November were 6.0% higher than in the same three months a year earlier. This was the first increase for eight months and compared to 5.2% in October. Overall, the annual rate has been on a steady downward trend in recent months since reaching a peak of 10.0% in March. November's 6.0% is the highest since August 2016 (6.9%).

Martin Ellis, Halifax housing economist, said: "Despite November's pick-up, the annual rate has been on a steady downward trend in recent months since reaching a peak of 10.0% in March. Heightened affordability pressures, resulting from a sustained period of house price growth in excess of earnings rises, appear to have dampened housing demand, contributing to the slowdown in house price inflation. Very low mortgage rates and an ongoing, and acute, shortage of properties available for sale should help support price levels although annual house price growth may slow over the coming months."

-

08:30

United Kingdom: Halifax house price index, November 0.2% (forecast 0.2%)

-

08:30

United Kingdom: Halifax house price index 3m Y/Y, November 6% (forecast 6%)

-

08:26

Today’s events

-

At 10:30 GMT, Britain will hold an auction of 30-year bonds

-

At 15:00 GMT the Bank of Canada decision on the basic interest rate and the accompanying statement of the Central Bank

-

-

08:24

WSE: After opening

WIG20 index opened at 1877.73 points (+0.06%)*

WIG 50350.99 0.16%

WIG30 2185.86 0.15%

mWIG40 4209.67 0.09%

*/ - change to previous close

The German DAX gained at the opening of more than 1 percent and growing pressure from the European markets remains valid. Unfortunately, less support for the WSE provides now foreign exchange market, where the zloty is cosmetically weaker to the dollar and the euro. The WSE seems to keep distance for each pulse and after the first trades the WIG20 gained barely 0.2 percent. The beginning of trading indicates that today's session will be rather a consolidation than a simple continuation of the two-day bulls rally.

-

07:58

Saudi Arabia cut the price of oil to Asian customers to a 4 months low

This morning it was announced that the oil giant Saudi Arabia has decided to reduce the price of January contracts of its oil at $ 1.20 a barrel to its lowest level in four months. Therefore, the company is taking steps to preserve its market share. Recall that the December Aramco contracts were $ 0.75 per barrel.

-

07:33

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.3%, CAC40 + 0.2%, FTSE + 0.3%

-

07:28

WSE: Before opening

Tuesday's session on Wall Street ended with a modest but joint increases of the major indexes. In the case of the S&P500 growth was 0.3 percent while the index of US blue-chips, Dow Jones, for the eleventh time since the elections in the United States was the highest in history.

The macro calendar today does not have a data, which can be considered to be able to prejudge the fate of today's session. Markets await the ECB decision on Thursday and the Fed meeting next week, so the morning in Europe promises to be quiet.

In the case of the Warsaw market, a weakening of the dollar and the associated two-day strengthening of the zloty are combined with increases in share prices in emerging markets. The morning does not bring change to the balance of power from the Tuesday's session. Shares in emerging markets are slightly more expensive and the USDPLN currency pair changes are modest at this very moment, so we may expect some mute sessions in the segment of blue chips.

-

07:19

ANZ thinks GBP/USD stability to be short-lived

"The UK November services PMI rose to its highest level since January (55.2 vs 54.5 in October), indicating that growth continues to hold up well so far in Q4. Services account for nearly 80% of UK GDP, so that bodes well for spending and employment growth as 2017 unfolds. The economic reality (at least as far as coincident data is concerned) is that the economy has received a significant monetary stimulus via the exchange rate and additional BoE easing measures.

Given that Article 50 hasn't been triggered and the UK remains a full member of the EU, it is business as usual for now and the economy is performing well. Sterling's recent stabilisation in part reflects that, as well as some possible signs that the government is maintaining a pragmatic approach to Brexit rather than hurtling down the hard Brexit route.

Brexit minister David Davis indicated recently the government could consider making some payments to the EU in return for access to the single market. That struck a different tone from the hard Brexit ethos evident at the October Tory Party conference. Meanwhile, the market awaits the Supreme Court's decision in early January on whether the government needs to consult with Parliament before triggering Article 50. That could delay an announcement beyond March 2017. Once Article 50 is triggered, uncertainty is likely to rise and financing the BoP deficit remains a major issue. Investment spending and inward FDI may fall whilst rising inflation will eat into real incomes. Against that backdrop, GBP's decline is likely to resume.

ANZ targets GBP/USD at 1.22 by the end of Q1 2017".

Copyright © 2016 ANZ, eFXnews™

-

07:18

Options levels on wednesday, December 7, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0874 (3327)

$1.0838 (5660)

$1.0782 (3027)

Price at time of writing this review: $1.0718

Support levels (open interest**, contracts):

$1.0640 (3734)

$1.0573 (6047)

$1.0533 (3337)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 89903 contracts, with the maximum number of contracts with strike price $1,1400 (6406);

- Overall open interest on the PUT options with the expiration date December, 9 is 76027 contracts, with the maximum number of contracts with strike price $1,0450 (6106);

- The ratio of PUT/CALL was 0.85 versus 0.84 from the previous trading day according to data from December, 6

GBP/USD

Resistance levels (open interest**, contracts)

$1.2900 (745)

$1.2801 (1768)

$1.2704 (2022)

Price at time of writing this review: $1.2648

Support levels (open interest**, contracts):

$1.2598 (1224)

$1.2499 (2484)

$1.2400 (1564)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 35977 contracts, with the maximum number of contracts with strike price $1,3400 (2561);

- Overall open interest on the PUT options with the expiration date December, 9 is 36328 contracts, with the maximum number of contracts with strike price $1,2000 (2586);

- The ratio of PUT/CALL was 1.01 versus 0.97 from the previous trading day according to data from December, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:16

-

07:10

The index of construction activity in Australia increased in November

The index of activity in the construction sector of Australia, published by the Australia Industry Group (AiG) and the Association of the housing industry was 46.6 points in November, higher than the previous value of 45.9. This indicator is based on a survey of 120 companies and reflects the conditions in the construction sector in the short and medium term. Companies respond to questions relating to production, employment, supplier prices, stocks and new orders. The high value of the index is positive, or bullish for the Australian currency.

The AiG report noted that an increase of 0.7 points from October indicates a somewhat slower rate of decline in the construction industry as a whole. Softer reduction was due to a less pronounced decline in new orders and deliveries from suppliers.

-

07:08

Reserve Bank of New Zealand, Graeme Wheeler: I expect a return to target levels of inflation in the 4th quarter

During his speech before the parliamentary committee Reserve Bank of New Zealand governor said he expected the return to target levels of inflation in the 4th quarter. Responding to parliamentary questions, Wheeler noted that the country's economy is relatively stable. However, the head of the RBNZ has admitted that was concerned about the pace of growth in labor productivity, as well as indicators of GDP growth.

-

07:03

German industrial production rose less than expected in October

In October 2016, production in industry was up by 0.3% from the previous month on a price, seasonally and working day adjusted basis according to provisional data of the Federal Statistical Office (Destatis). In September 2016, the corrected figure shows a decrease of 1.6% (primary -1.8%) from August 2016.

In October 2016, production in industry excluding energy and construction was up by 0.1%.

Within industry, the production of capital goods increased by 0.5% and the production of consumer goods by 0.1%.The production of intermediate goods shows a decrease by 0.5%. Energy production was down by 0.5% in October 2016 and the production in construction increased by 1.7%.

-

07:02

Germany: Industrial Production s.a. (MoM), October 0.3% (forecast 0.8%)

-

06:58

First quarter of negative growth for Aussie GDP since 2011

The volume of activity in the Australian economy decreased 0.5 per cent in the September quarter 2016, the first quarter of negative growth since the Queensland flood affected March quarter 2011. Through the year growth remains positive at 1.8 per cent, reflecting the three previous quarters of growth.

Economic activity contracted in a number of areas this quarter. Private investment in new buildings detracted 0.3 percentage points from GDP growth, while new engineering and new and used dwellings detracted 0.2 and 0.1 percentage points respectively. Public capital expenditure detracted 0.5 percentage points from growth as it declined from elevated levels in the June quarter. Net exports detracted an additional 0.2 percentage points from growth. Australia's terms of trade rose 4.5 per cent through the September quarter.

The reduced building activity is reflected in the output of the construction industry which fell 3.6 per cent for the quarter and was the largest contributor to the fall in GDP growth on an industry basis. A number of other industries also recorded below trend growth, or declined, this quarter, including financial and insurance services, professional scientific and technical services, rental hiring and real estate services and administrative support services. The largest offset to these falls was agriculture which grew 7.5 per cent. Mining production contributed no growth, but maintained its historically high levels of production.

-

06:21

Global Stocks

European stocks moved higher Tuesday as utility shares gained and banks recovered from the fallout from this weekend's referendum in Italy. Italy's political and banking woes may help European Bank President Mario Draghi convince hawkish ECB members to agree to extend the bank's eurozone stimulus efforts, including its bond-buying program. The ECB will release a policy decision Thursday.

U.S. stocks rose Tuesday, with the Dow Jones Industrial Average finishing at an all-time high for a second day in a row, as the theme of rotational buying into new leaders such as financials and dividend-rich telecommunication shares continued. The market's momentum, however, was subdued as investors appeared to trade cautiously after the blue-chip's gauge notched an all-time high in the previous session.

Asian shares were broadly higher Wednesday, catching a lift from gains in the U.S., as a weak Japanese yen helped exporters' stocks on the Nikkei Stock Average. In Australia, gross domestic product fell 0.5% in the third quarter from the second quarter. Economists surveyed by The Wall Street Journal expected the economy to contract by 0.1%.

-

05:16

Japan: Leading Economic Index , October 101

-

05:02

Japan: Coincident Index, October 113.9

-

00:30

Australia: Gross Domestic Product (QoQ), Quarter III -0.5% (forecast 0.3%)

-

00:30

Australia: Gross Domestic Product (YoY), Quarter III 1.8% (forecast 2.5%)

-