Market news

-

23:29

Stocks. Daily history for Dec 07’2016:

(index / closing price / change items /% change)

Nikkei 225 18,496.69 +136.15 +0.74%

Shanghai Composite 3,222.24 +22.59 +0.71%

S&P/ASX 200 5,488.50 +10.40 +0.19%

FTSE 100 6,902.23 +122.39 +1.81%

CAC 40 4,694.72 +62.78 +1.36%

Xetra DAX 10,986.69 +211.37 +1.96%

S&P 500 2,241.35 +29.12 +1.32%

Dow Jones Industrial Average 19,549.62 +297.84 +1.55%

S&P/TSX Composite 15,237.75 +111.95 +0.74%

-

21:06

Major US stock indices closed in the green zone

Major stock indexes in Wall Street increased significantly, by updating the record levels as investors are betting on the acceleration of economic growth at Trampe.

Many analysts believe that the rally that started after the presidential election, will continue next year. They refer to the GDP growth, continued improvement in the labor market and increase corporate profits. At the same time, market participants' attention is gradually shifting to a meeting of the Federal Reserve System, which is scheduled for December 13-14. According to the futures market, at present, the probability of a tightening of monetary policy at the Fed's December meeting was 92.7% compared with 94.9% the previous day.

Little impact on the bidding had US data. As it became known, in October, the number of vacancies decreased to 5,534,000 Browse vacancies and labor turnover (JOLTS), published by the US Bureau of Labor Statistics showed that the index for September was revised upward -.. To 5.631 million from 5.486 million analysts. expected that the number of vacancies will be up to 5.5 million. vacancy rate was 3.7 percent, unchanged compared with September. The number of jobs has changed little in the private sector and the government sector. The number of vacancies increased in the field of health and social care (139, 000), but fell in the segment of professional and business services (-187,000), the federal government (-13 000), and mining and logging (-8000).

Almost all the components of DOW index closed in positive territory (27 of 30). Most remaining shares rose NIKE, Inc. (NKE, + 3.17%). Outsider were shares of Pfizer Inc. (PFE, -1.45%).

Almost all sectors of the S & P index recorded an increase. The leader turned out to be the technology sector (+ 1.7%) and the financial sector (+ 1.7%). Reducing showed only the health sector (-1.0%).

At the close:

Dow + 1.54% 19,547.63 +295.85

Nasdaq + 1.14% 5,393.76 +60.76

S & P + 1.31% 2,241.20 +28.97

-

20:00

DJIA +1.33% 19,508.04 +256.26 Nasdaq +0.93% 5,382.38 +49.38 S&P +0.98% 2,233.93 +21.70

-

17:00

European stocks closed: FTSE 100 +122.39 6902.23 +1.81% DAX +211.37 10986.69 +1.96% CAC 40 +62.78 4694.72 +1.36%

-

16:53

WSE: Session Results

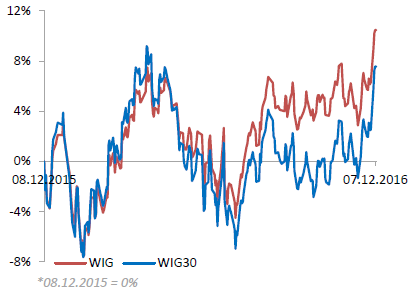

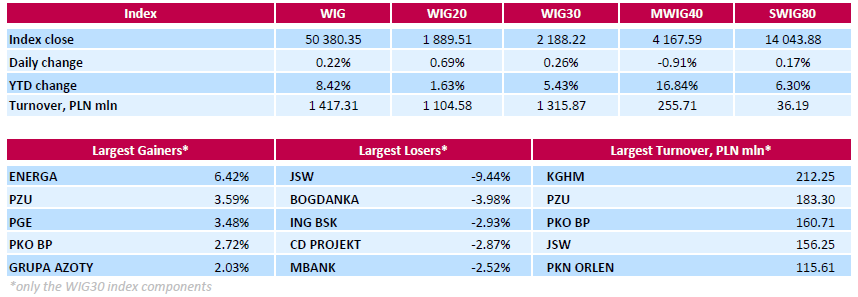

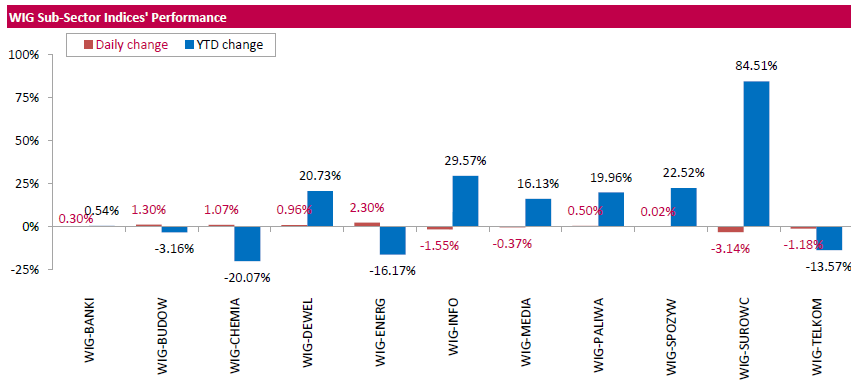

Polish equity market closed higher on Wednesday. The broad market measure, the WIG Index, rose by 0.22%. Sector performance within the WIG Index was mixed. Utilities (+2.3%) outpaced, while materials (-3.14%) underperformed.

The large-cap stocks gained 0.26%, as measured by the WIG30 Index, with the way up led by genco ENERGA (WSE: ENG), which surged by 6.42%. It was followed by insurer PZU (WSE: PZU), genco PGE (WSE: PGE), bank PKO BP (WSE: PKO) and chemical producer GRUPA AZOTY (WSE: ATT), adding between 2.03% and 3.59%. On the other side of the ledger, coking coal miner JSW (WSE: JSW) kept its position as the worst performing name, tumbling by 9.44%. Other major decliners were thermal coal miner BOGDANKA (WSE: LWB), bank ING BSK (WSE: ING) and videogame developer CD PROJEKT (WSE: CDR), which lost 3.98%, 2.93% and 2.87% respectively.

-

16:35

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Wednesday as investors assessed whether a post-election rally, which powered the major indexes to a series of record highs in the past month, had more room to run. Investors have been flocking to sectors such as financials and industrials, which are most likely to benefit from President-elect Donald Trump's proposals of more fiscal stimulus and simpler regulations.

Most of Dow stocks in positive area (19 of 30). Top gainer - American Express Company (AXP, +1.23%). Top loser - Pfizer Inc. (PFE, -2.85%).

Most S&P sectors also in positive area. Top gainer - Utilities (+0.7%). Top loser - Healthcare (-2.0%).

At the moment:

Dow 19270.00 +38.00 +0.20%

S&P 500 2213.00 +3.00 +0.14%

Nasdaq 100 4782.75 -4.00 -0.08%

Oil 50.48 -0.45 -0.88%

Gold 1178.60 +8.50 +0.73%

U.S. 10yr 2.36 -0.04

-

14:55

WSE: After start on Wall Street

In the last hour the bulls appetites grew and succeeded in meeting of the WIG20 chart with the level of 1,900 points. Contra of the supply side was readable and a four-hour growth from the region of 1,875 points was almost completely abolished in an hour. Ending a session at this level would be a signal that the overcome of the level of 1,900 points without prior correction of the growth wave may not be easy. Please note, that the size of the turnover, which is greater than yesterday, may indicate that we are dealing with the distribution phase after the increase in the WIG20 index by more than 100 points in the last days.

An hour before the close of trading on the Warsaw Stock Exchange the WIG20 index was at the level of 1,886 points (+ 0.51%).

-

14:34

U.S. Stocks open: Dow -0.05%, Nasdaq -0.17%, S&P -0.08%

-

14:28

Before the bell: S&P futures -0.08%, NASDAQ futures -0.19%

U.S. stock-index futures were flat.

Global Stocks:

Nikkei 8,496.69 +136.15 +0.74%

Hang Seng 22,800.92 +125.77 +0.55%

Shanghai 3,221.92 +22.28 +0.70%

FTSE 6,870.61 +90.77 +1.34%

CAC 4,663.21 +31.27 +0.68%

DAX 10,918.83 +143.51 +1.33%

Crude $50.33 (-1.18%)

Gold $1,173.90 (+0.32%)

-

13:57

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

31.23

0.08(0.2568%)

1595

ALTRIA GROUP INC.

MO

64.38

0.08(0.1244%)

1949

Amazon.com Inc., NASDAQ

AMZN

762.5

-2.22(-0.2903%)

5118

Apple Inc.

AAPL

109.27

-0.68(-0.6185%)

139920

AT&T Inc

T

39.41

0.06(0.1525%)

2140

Barrick Gold Corporation, NYSE

ABX

15.63

0.14(0.9038%)

22841

Boeing Co

BA

152.2

-0.04(-0.0263%)

1135

Caterpillar Inc

CAT

95.1

-0.12(-0.126%)

2965

Chevron Corp

CVX

112.79

0.03(0.0266%)

1600

Citigroup Inc., NYSE

C

57.84

-0.08(-0.1381%)

16836

Facebook, Inc.

FB

116.94

-0.37(-0.3154%)

25577

Ford Motor Co.

F

12.55

-0.01(-0.0796%)

14125

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

16

0.11(0.6923%)

121867

General Electric Co

GE

31.13

-0.04(-0.1283%)

8195

General Motors Company, NYSE

GM

35.25

0.18(0.5133%)

7220

Goldman Sachs

GS

230.61

-0.77(-0.3328%)

10111

Johnson & Johnson

JNJ

111.53

-0.53(-0.473%)

3445

JPMorgan Chase and Co

JPM

83.45

-0.24(-0.2868%)

5565

Merck & Co Inc

MRK

59.52

-0.76(-1.2608%)

2933

Microsoft Corp

MSFT

59.94

-0.01(-0.0167%)

3190

Nike

NKE

50.59

0.02(0.0395%)

502

Pfizer Inc

PFE

31.2

-0.36(-1.1407%)

40945

Starbucks Corporation, NASDAQ

SBUX

57.38

-0.06(-0.1045%)

15080

Tesla Motors, Inc., NASDAQ

TSLA

185.4

-0.45(-0.2421%)

17257

The Coca-Cola Co

KO

40.76

0.19(0.4683%)

345

Twitter, Inc., NYSE

TWTR

18.21

-0.02(-0.1097%)

43272

UnitedHealth Group Inc

UNH

158.5

1.18(0.7501%)

5094

Visa

V

77.32

0.21(0.2723%)

1995

Wal-Mart Stores Inc

WMT

69.9

0.04(0.0573%)

4098

Walt Disney Co

DIS

100.45

-0.21(-0.2086%)

3795

Yahoo! Inc., NASDAQ

YHOO

40.03

0.06(0.1501%)

802

Yandex N.V., NASDAQ

YNDX

19.36

0.12(0.6237%)

1400

-

13:56

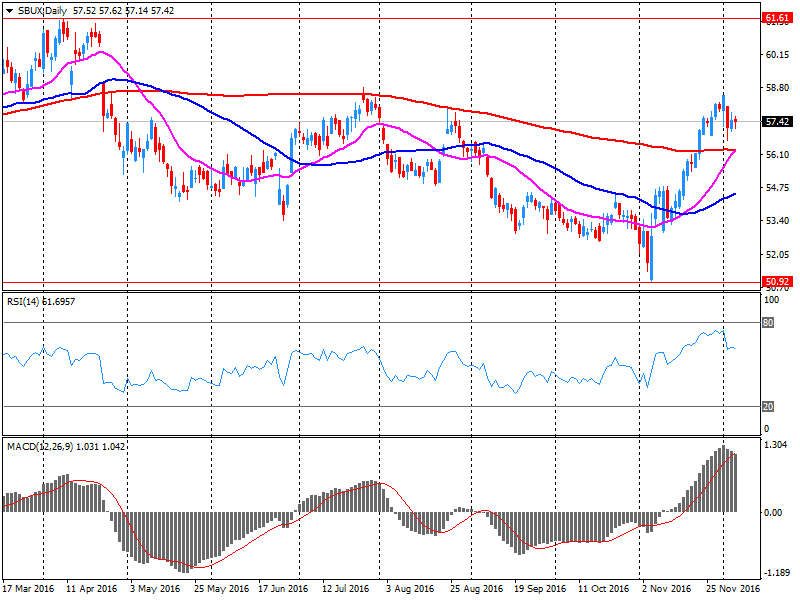

Starbucks (SBUX) introduced a five-year development plan

Starbucks has introduced a five-year development plan prepared Investor Day.

According to the strategy, the company plans to increase revenue by 10%, the rate of earnings per share - 15-20%, as well as to open about 12 thousand new stores around the world (+ 48%, to 37 thousand in all) by 2021

SBUX shares fell in premarket trading to $ 57.04 (-0.70%).

-

13:55

Upgrades and downgrades before the market open

Upgrades:

UnitedHealth (UNH) upgraded to Buy from Hold at Cantor Fitzgerald

3M upgraded (MMM) to Sector Perform at RBC Capital Mkts; target raised to $171

Downgrades:

Other:

-

12:05

WSE: Mid session comment

In the end of the forenoon phase of the session, the WIG20 index returns to the vicinity of the daily maximum. For the demand help not only limited losses suffered by the market at an earlier attempt of supply, but also growing by 1.5 percent the DAX and stronger zloty, which gained approx. 0.6 percent against the dollar.

Given the fact that the macro calendar has no more any important data today, the further course of trading seems to be dependent on the behavior of the US markets.

At the halfway point of the session the Wig20 index was at the level of 1,889 points (+0,72%). The turnover among the blue chips sector is quite substantial and at the same time was amounted to over PLN 420 million.

-

11:42

Major European stock indices trading in the green zone

European stocks rose a third straight session supported by mining companies and banks.

Investors expect the forthcoming meeting of the European Central Bank amid growing hopes for additional measures to stimulate the economy, and continue to move away from the Italian referendum results.

The markets are still recovering after Sunday Italian voters rejected constitutional changes proposed by the government, forcing the prime minister Renzi to resign.

However, there are signs that Italy will not hold early elections after the resignation of Renzi.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0,7%, to 347.12 points.

Shares of Rio Tinto rose 4.3% after Credit Suisse improved to "outperform" from "neutral."

Credit Suisse experts maintain a positive assessment for the companies of the mining sector, expecting the favorable trends in terms of demand "will continue to grow after the aggressive reduction of inventories of raw materials companies in 2014-2015".

Cost of Glencore shares jumped nearly 3%.

Capitalization of Royal Dutch Shell rose 1.2% on the information that the company will develop a major oil field in Iran.

Monte Paschi jumped today to 9,5%, UniCredit, Italy's largest bank, + 3%.

Shares of Credit Suisse Group rose by 4,3%, Deutsche Bank +3,2%, BNP Paribas +2.5%.

At the moment:

FTSE 6875.15 95.31 1.41%

DAX 10936.87 161.55 1.50%

CAC 4675.47 43.53 0.94%

-

08:46

Major stock exchanges began trading in the green zone: FTSE + 0.46%, DAX + 1.0%, CAC40 + 1.1%, FTMIB + 1.3%, IBEX + 0.83%

-

08:24

WSE: After opening

WIG20 index opened at 1877.73 points (+0.06%)*

WIG 50350.99 0.16%

WIG30 2185.86 0.15%

mWIG40 4209.67 0.09%

*/ - change to previous close

The German DAX gained at the opening of more than 1 percent and growing pressure from the European markets remains valid. Unfortunately, less support for the WSE provides now foreign exchange market, where the zloty is cosmetically weaker to the dollar and the euro. The WSE seems to keep distance for each pulse and after the first trades the WIG20 gained barely 0.2 percent. The beginning of trading indicates that today's session will be rather a consolidation than a simple continuation of the two-day bulls rally.

-

07:33

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.3%, CAC40 + 0.2%, FTSE + 0.3%

-

07:28

WSE: Before opening

Tuesday's session on Wall Street ended with a modest but joint increases of the major indexes. In the case of the S&P500 growth was 0.3 percent while the index of US blue-chips, Dow Jones, for the eleventh time since the elections in the United States was the highest in history.

The macro calendar today does not have a data, which can be considered to be able to prejudge the fate of today's session. Markets await the ECB decision on Thursday and the Fed meeting next week, so the morning in Europe promises to be quiet.

In the case of the Warsaw market, a weakening of the dollar and the associated two-day strengthening of the zloty are combined with increases in share prices in emerging markets. The morning does not bring change to the balance of power from the Tuesday's session. Shares in emerging markets are slightly more expensive and the USDPLN currency pair changes are modest at this very moment, so we may expect some mute sessions in the segment of blue chips.

-

06:21

Global Stocks

European stocks moved higher Tuesday as utility shares gained and banks recovered from the fallout from this weekend's referendum in Italy. Italy's political and banking woes may help European Bank President Mario Draghi convince hawkish ECB members to agree to extend the bank's eurozone stimulus efforts, including its bond-buying program. The ECB will release a policy decision Thursday.

U.S. stocks rose Tuesday, with the Dow Jones Industrial Average finishing at an all-time high for a second day in a row, as the theme of rotational buying into new leaders such as financials and dividend-rich telecommunication shares continued. The market's momentum, however, was subdued as investors appeared to trade cautiously after the blue-chip's gauge notched an all-time high in the previous session.

Asian shares were broadly higher Wednesday, catching a lift from gains in the U.S., as a weak Japanese yen helped exporters' stocks on the Nikkei Stock Average. In Australia, gross domestic product fell 0.5% in the third quarter from the second quarter. Economists surveyed by The Wall Street Journal expected the economy to contract by 0.1%.

-