Market news

-

23:29

Stocks. Daily history for Dec 06’2016:

(index / closing price / change items /% change)

Nikkei 225 18,360.54 +85.55 +0.47%

Shanghai Composite 3,199.37 -5.34 -0.17%

S&P/ASX 200 5,428.69 0.00 0.00%

FTSE 100 6,779.84 +33.01 +0.49%

CAC 40 4,631.94 +57.62 +1.26%

Xetra DAX 10,775.32 +90.49 +0.85%

S&P 500 2,212.23 +7.52 +0.34%

Dow Jones Industrial Average 19,251.78 +35.54 +0.18%

S&P/TSX Composite 15,125.80 +30.63 +0.20%

-

21:07

Major US stock indices closed in the green zone

Major Wall Street stock indexes finished trading slightly higher, as conglomerates sector share growth will compensate for the loss of energy stocks after the fall in oil prices.

As it became known today, the labor productivity in the US rose sharply in the third quarter as originally anticipated, noting the fastest growth rate in two years, but the trend at the same time remained weak. The Labor Department said Tuesday that the productivity of the workforce in the non-agricultural sector of the economy, which measures the hourly output per worker, increased by 3.1% unrevised. Increased graduated from a series of three consecutive quarters of decline. Productivity fell 0.2% in the second quarter and remained unchanged compared to the third quarter of 2015.

However, new orders for manufactured goods in the United States recorded their biggest increase in nearly 1.5 years in October, giving further evidence that the manufacturing sector is gradually recovering from a prolonged downturn. The Commerce Department reported Tuesday that new orders for manufactured goods rose by 2.7% after a revised towards strengthening by 0.6% in September. It was the biggest increase since June 2015 and pointed out four consecutive months of growth. Economists had forecast an increase of industrial orders by 2.6% in October after a previously reported gain of 0.3% in September. Unfilled orders at factories rose by 0.7%, the biggest increase since July 2014, ending four consecutive months of decline.

DOW index closed mixed components (15 black, 15 red). Most remaining shares rose Verizon Communications Inc. (VZ, + 1.17%). Outsider were shares of NIKE, Inc. (NKE, -2.68%).

Almost all sectors of the S & P ended the day in positive territory. The leader turned conglomerates sector (+ 1.6%). Most utilities sector fell (-0.1%).

At the close:

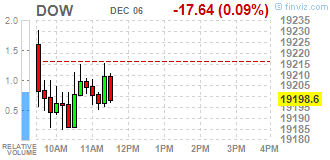

Dow + 0.18% 19,251.30 +35.06

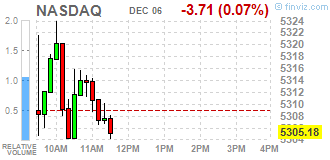

Nasdaq + 0.45% 5,333.00 +24.11

S & P + 0.34% 2,212.24 +7.53

-

20:00

DJIA +0.11% 19,237.49 +21.25 Nasdaq +0.41% 5,330.57 +21.68 S&P +0.28% 2,210.85 +6.14

-

17:01

WSE: Session Results

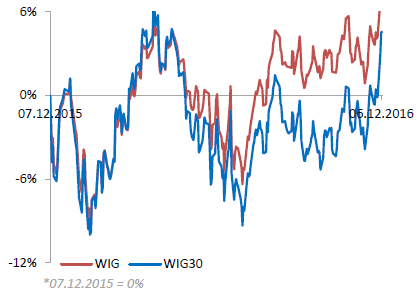

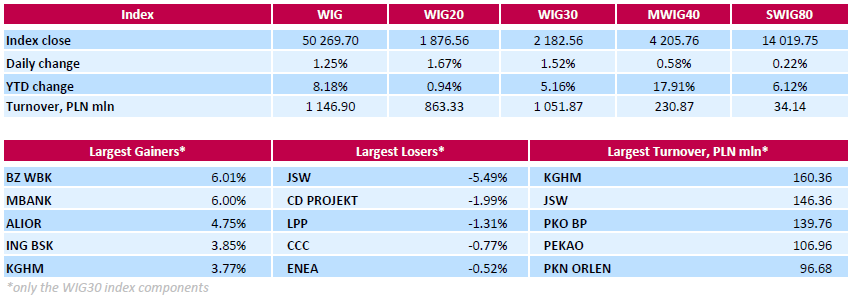

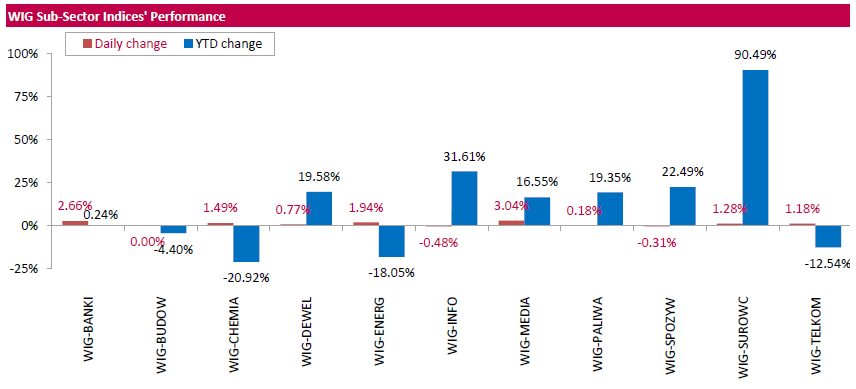

Polish equity market closed higher on Tuesday. The broad market measure, the WIG Index, rose by 1.25%. The WIG sub-sector indices were mainly higher with media (+3.04%) outperforming.

The large-cap stocks gained 1.52%, as measured by the WIG30 Index, with the way up led by four banking sectors names BZ WBK (WSE: BZW), MBANK (WSE: MBK), ALIOR (WSE: ALR) and ING BSK (WSE: ING), which surged by 3.85%-6.01%. Other major advancers were copper producer KGHM (WSE: KGH) and media group CYFROWY POLSAT (WSE: CPS), jumping by 3.77% and 3.7% respectively. The former was partially helped by announcement about an analyst recommendation upgrade. On the other side of the ledger, coking coal producer JSW (WSE: JSW) was the worst performing name, tumbling by 5.49%. The company reported that it increased its current bond program by PLN 300 mln (or $71.7 mln) to PLN 1 bln and $163.8 mln. New bonds are to be bought by state-run fund Silesia. It was followed by videogame developer CD PROJEKT (WSE: CDR) and two retailers LPP (WSE: LPP) and CCC (WSE: CCC), which lost 1.99%, 1.31% and 0.77% respectively.

-

17:00

European stocks closed: FTSE 100 +33.01 6779.84 +0.49% DAX +90.49 10775.32 +0.85% CAC 40 +57.62 4631.94 +1.26%

-

16:39

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Tuesday, as gains in financial stocks failed to make up for losses in energy stocks following a drop in oil prices. Brent crude prices fell 2,5%, the first decline in five days, after data showed an increase in output from major producers, just days after OPEC and Russia agreed to a production cut.

Most of Dow stocks in negative area (18 of 30). Top gainer - Verizon Communications Inc. (VZ, +1.54%). Top loser - NIKE, Inc. (NKE, -2.75%).

Most S&P sectors also in positive area. Top gainer - Financials (+0.5%). Top loser - Basic Materials (-0.2%).

At the moment:

Dow 19201.00 -9.00 -0.05%

S&P 500 2205.00 +0.75 +0.03%

Nasdaq 100 4778.50 -2.00 -0.04%

Oil 50.80 -0.99 -1.91%

Gold 1173.20 -3.30 -0.28%

U.S. 10yr 2.39 +0.01

-

14:52

WSE: After start on Wall Street

When Euroland markets look pretty good today, in the last minutes light shortness of breath occurs on Wall Street. If the European markets will succeed in this passage demonstrate relative strength and resistance to a possible withdrawal in the US, it would likely even more exceed the appetite of the bulls in the final phase of trade, which is worth remembering especially in the context of resistance in case of the CAC40 and the DAX .

On the Warsaw market the WIG20 index has an ideal opportunity to confirm the short-term change in sentiment and an hour before the close of trading was at the level of 1,872 points (+ 1.49%).

-

14:32

U.S. Stocks open: Dow +0.03%, Nasdaq +0.24%, S&P +0.10%

-

14:27

Before the bell: S&P futures +0.18%, NASDAQ futures +0.22%

U.S. stock-index futures advanced moderately.

Global Stocks:

Nikkei 18,360.54 +85.55 +0.47%

Hang Seng 22,675.15 +169.60 +0.75%

Shanghai 3,199.37 -5.34 -0.17%

FTSE 6,761.48 +14.65 +0.22%

CAC 4,604.35 +30.03 +0.66%

DAX 10,724.80 +39.97 +0.37%

Crude $50.66 (-2.18%)

Gold $1,173.70 (-0.24%)

-

14:16

Change in GDT Price Index from previous event +3.5%. NZD/USD little changed

-

Average price (USD/MT, FAS): $3,622

-

-

13:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

172.3

0.68(0.3962%)

236

ALCOA INC.

AA

30.75

-0.47(-1.5054%)

5551

Amazon.com Inc., NASDAQ

AMZN

763.25

3.89(0.5123%)

28199

AMERICAN INTERNATIONAL GROUP

AIG

64.3

0.40(0.626%)

1008

Apple Inc.

AAPL

110.21

1.10(1.0082%)

159324

AT&T Inc

T

38.66

0.03(0.0777%)

454

Barrick Gold Corporation, NYSE

ABX

15.8

0.09(0.5729%)

22649

Caterpillar Inc

CAT

94.32

-0.13(-0.1376%)

5759

Chevron Corp

CVX

112.89

-0.36(-0.3179%)

1005

Cisco Systems Inc

CSCO

29.55

0.02(0.0677%)

435

Citigroup Inc., NYSE

C

57.82

0.54(0.9427%)

14033

Exxon Mobil Corp

XOM

87.3

-0.18(-0.2058%)

4422

Facebook, Inc.

FB

117.69

0.26(0.2214%)

28372

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.63

-0.24(-1.5123%)

77649

General Electric Co

GE

31.13

0.02(0.0643%)

1920

Goldman Sachs

GS

229.95

1.40(0.6126%)

10644

Google Inc.

GOOG

764

1.48(0.1941%)

1772

Home Depot Inc

HD

130

0.32(0.2468%)

170152

Intel Corp

INTC

34.49

0.10(0.2908%)

858

Johnson & Johnson

JNJ

112.15

0.21(0.1876%)

586

JPMorgan Chase and Co

JPM

83.72

0.46(0.5525%)

9036

Microsoft Corp

MSFT

60.48

0.26(0.4317%)

896

Nike

NKE

51.35

-0.50(-0.9643%)

19122

Starbucks Corporation, NASDAQ

SBUX

57.73

0.23(0.40%)

1934

Tesla Motors, Inc., NASDAQ

TSLA

187.6

0.80(0.4283%)

3194

Twitter, Inc., NYSE

TWTR

18.38

0.15(0.8228%)

21007

United Technologies Corp

UTX

107.83

0.41(0.3817%)

225

Verizon Communications Inc

VZ

50

0.25(0.5025%)

4945

Visa

V

77.4

0.09(0.1164%)

1657

Wal-Mart Stores Inc

WMT

70.16

0.22(0.3146%)

1026

Walt Disney Co

DIS

100.2

0.24(0.2401%)

2705

Yahoo! Inc., NASDAQ

YHOO

40.35

0.15(0.3731%)

900100

Yandex N.V., NASDAQ

YNDX

19.03

-0.19(-0.9886%)

5400

-

13:52

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

NIKE (NKE) downgraded to Market Perform from Outperform at Cowen

Other:

-

12:05

WSE: Mid session comment

In the first half of today's trading the WIG20 index had only slight difficulties in overcoming the level of 1,850 points and virtually from the morning in our market we may see an extension of yesterday's movement. As expected, we are now faced with considerable turnover, which at the halfway point of the session is close to PLN 400 million in the segment of the largest companies. The increases are driven, like yesterday, by the banking sector and KGHM.

In Europe, the German and French indices gaining approx. 0.5%, while in southern Europe, Italy and Spain, growth is more than 1%, and in this respect the situation is similar to our national parquet . Just like on the WSE best present banks and less - companies of raw material and fuel.

At the halfway point of today's trading the WIG20 index was at the level of 1,866 points (+ 1.16%).

-

11:51

Major stock indices in Europe traded almost flat

European stocks are stable. Investors are waiting for the European Central Bank meeting scheduled for Thursday. According to most economists, the ECB will announce the extension of the asset purchase program at the same rate - about € 80 billion per month. On the issue of the timing opinions vary, but it is assumed that the head of the ECB Mario Draghi will extend the program for at least six months.

The focus of investors were data for the euro area. In the eurozone, growth has stabilized, as originally anticipated in the third quarter, it showed on Tuesday Eurostat data. Gross domestic product expanded 0.3 percent in the third quarter, showing the same growth rate as in the second quarter. In annual terms, GDP growth was steady at 1.7 percent. However, the rate was revised from a preliminary assessment of 1.6 percent.

GDP showed that sequential growth in household spending and government spending improved slightly to 0.3 percent and 0.5 percent, respectively. At the same time, gross fixed capital formation growth slowed to 0.2 percent from 1.2 percent. Household spending had a positive contribution to economic growth, while investments were neutral. Exports rose 0.1 percent, while imports rose by 0.2 percent. As a consequence, the contribution of foreign trade to GDP growth was negative.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0.2% to 341.92 points.

The market value of Banca Monte dei Paschi di Siena, the third in terms of assets in Italy fell by 3.1%. The bank, which is experiencing significant difficulties, may be nationalized.

However, Banco Popolare SC and UniCredit shares rose 2.3% on expectations that the effects of the referendum and a change of government in the country will not be as painful for the financial industry, as expected.

Prices of mining corporations BHP Billiton and Rio Tinto fell in London trading 2.1% and 1.2%.

IG Group shares fell more than 20% due to the tightening of the rules of trade in certain derivatives in the UK.

At the moment:

FTSE 6734.26 -12.57 -0.19%

DAX 10695.10 10.27 0.10%

CAC 4585.72 11.40 0.25%

-

08:41

Major stock exchanges trading mixed: the FTSE 100 6,732.93 -13.90 -0.21%, DAX 10,692.15 7.32 0.07%, CAC 40 4,566.80 -7.52 -0.16%, IBEX 35 8,700.70 36.00 0.42%

-

08:17

WSE: After opening

WIG20 index opened at 1846.82 points (+0.06%)*

WIG 49733.41 0.17%

WIG30 2154.03 0.19%

mWIG40 4188.47 0.17%

*/ - change to previous close

The cash market began trading with a slight increase at a higher than yesterday level of turnover. Thus the WSE slightly improving yesterday's achievements and the WIG20 rises to the next round level of 1,850 points.

After fifteen minutes of trading the WIG20 index was at the level of 1,845 points (-0,05%).

-

07:25

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.6%, CAC40 + 0.5%, FTSE + 0.4%

-

07:20

WSE: Before opening

The first session of this week on the Warsaw parquet looked impressive. However, after the yesterday's fireworks, today we may expect some calming. The international situation in the morning is correct, although we must remember that the rise in Asia come from the need to catch up yesterday's gains in Europe and the USA. The session on Wall Street was quiet, where, after a higher opening further trading were marked by it maintenance, and no special expansion. In addition, the US contracts this morning slightly go down.

After a successful yesterday's sessions in Europe, we can count on the correct opening, but more larger increases may be difficult due to the proximity of resistance on the main Euroland parquets.

On the Warsaw Stock Exchange after yesterday's session revealed buy signals among the rather forgotten large companies and the bull side should only maintain the good prospect today.

-

06:20

Global Stocks

Italian stocks retreated Monday after Prime Minister Matteo Renzi's resignation announcement following defeat of a constitutional referendum, but questions remain about political uncertainty and the possibility of another eurozone crisis.

The Dow Jones Industrial Average finished at a record on Monday as solid economic data offset concerns about Europe's stability in the wake of a rejection of Italy's vote on Sunday to reform existing constitutional rules. The broader stock market rose after a survey showed that the services side of the economy grew at its fastest pace in November in a year. The Institute of Supply Management nonmanufacturing index climbed to 57.2 last month. Any reading over 50 indicates economic expansion.

Asian stocks posted their biggest rise in two weeks on Tuesday and the euro steadied as investors judged the selloff after Italy's referendum was overdone, with robust U.S. economic data also helping sentiment.

-