Market news

-

23:28

Currencies. Daily history for Dec 06’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0717 -0,43%

GBP/USD $1,2676 -0,43%

USD/CHF Chf1,01 +0,36%

USD/JPY Y114,00 +0,14%

EUR/JPY Y122,19 -0,27%

GBP/JPY Y144,5 -0,28%

AUD/USD $0,7468 -0,03%

NZD/USD $0,7118 -0,30%

USD/CAD C$1,3276 +0,04%

-

23:00

Schedule for today,Wednesday, Dec 07’2016 (GMT0)

00:30 Australia Gross Domestic Product (QoQ) Quarter III 0.5% 0.3%

00:30 Australia Gross Domestic Product (YoY) Quarter III 3.3% 2.5%

05:00 Japan Leading Economic Index (Preliminary) October 100.3

05:00 Japan Coincident Index (Preliminary) October 112.7

07:00 Germany Industrial Production s.a. (MoM) October -1.8% 0.8%

08:30 United Kingdom Halifax house price index November 1.4% 0.2%

08:30 United Kingdom Halifax house price index 3m Y/Y November 5.2% 6%

09:30 United Kingdom Industrial Production (MoM) October -0.4% 0.2%

09:30 United Kingdom Industrial Production (YoY) October 0.3% 0.5%

09:30 United Kingdom Manufacturing Production (MoM) October 0.6% 0.2%

09:30 United Kingdom Manufacturing Production (YoY) October 0.2% 0.8%

15:00 United Kingdom NIESR GDP Estimate November 0.4%

15:00 Canada Bank of Canada Rate 0.5% 0.5%

15:00 Canada BOC Rate Statement

15:00 U.S. JOLTs Job Openings October 5.486 5.5

15:30 U.S. Crude Oil Inventories December -0.884

20:00 U.S. Consumer Credit October 19.29 19.0

21:00 New Zealand RBNZ Governor Graeme Wheeler Speaks

23:50 Japan Current Account, bln October 1821 1577.2

23:50 Japan GDP, q/q (Finally) Quarter III 0.2% 0.6%

23:50 Japan GDP, y/y (Finally) Quarter III 0.7% 2.4%

-

22:30

Australia: AiG Performance of Construction Index, November 46.6

-

15:13

10 year high for US economic optimism

The IBD/TIPP Economic Optimism Index gained 3.4 points, or 6.6%, in December, posting a reading of 54.8 vs. 51.4 in November. The index is 6.2 points above its 12-month average of 48.6, 10.4 points above its reading of 44.4 in December 2007 when the economy entered the last recession, and 5.7 points above its all-time average of 49.1. Note: Index readings above 50 indicate optimism; below 50 indicate pessimism.

-

15:11

US factory orders rose above expectations

New orders for manufactured durable goods in October increased $11.0 billion or 4.8 percent to $239.4 billion, the U.S. Census Bureau announced today. This increase, up four consecutive months, followed a 0.4 percent September increase. Excluding transportation, new orders increased 1.0 percent. Excluding defense, new orders increased 5.2 percent. Transportation equipment, also up four consecutive months, led the increase, $9.5 billion or 12.0 percent to $88.2 billion.

-

15:00

U.S.: Factory Orders , October 2.7% (forecast 2.6%)

-

15:00

Canada: Ivey Purchasing Managers Index, November 56.8 (forecast 59.9)

-

14:47

American Express (AXP) acquired InAuth Inc., a leading provider of identification solutions for mobile devices

According to Business Wire, in the strategy to combat fraud American Express announced the acquisition of InAuth Inc., a leading provider of identification solutions for mobile devices, as well as intelligent solutions. InAuth technology uses some of the largest financial institutions, banks, payment processors and traders in order to reduce risks and to identify potential frauds using mobile devices.

Financial details were not disclosed.

As noted by American Express, buying InAuth complement and reinforce the company's capabilities in the field of analytical data processing and fraud prevention, which allowed it to reach its lowest level of fraud in the industry.

AXP shares close at $ 72.03 (+ 0.24%).

-

13:48

Option expiries for today's 10:00 ET NY cut

USD/JPY 95.00 6.06bn, 110.00 111.70 112.25, 112.60, 112.85, 114.00, 114.75

EUR/USD 1.0400, 1.0425, 1.0500/05, 1.0525, 1.0550, 1.0575/77, 1.0600, 1.0640/45/50, 1.0685 (668m), 1.0700. 1.0745/50 (767m), 1.0765, 1.0775, 1.0800 (857m), 1.0900/05

GBP/USD 1.2650, 1.2700/05, 1.2850, 1.2950, 1.3000

AUD/USD 0.7350, 0.7400 (531m), 0.7450, 0.7500/10

AUD/JPY 82.00 (646m)

AUD/NZD 1.0400 (251m), 1.0600

USD/CAD 1.3200, 1.3215, 1.3225, 1.3380. 1.3390, 1.3400, 1.3420

-

13:39

Canada's trade deficit narrowed from record high

Canada's imports fell 6.3% to $44.7 billion in October, following a record high in September related to an exceptionally large shipment destined for the Hebron offshore oil project. Import volumes decreased 6.2% and prices edged down 0.1%.

Exports increased 0.5% to $43.6 billion, as a 1.2% increase in prices was partially offset by a 0.7% decline in volumes.

Consequently, Canada's merchandise trade deficit with the world narrowed from a record $4.4 billion in September to $1.1 billion in October, the smallest since January 2016.

-

13:37

US trade deficit up $6.4 billion in September

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $42.6 billion in October, up $6.4 billion from $36.2 billion in September, revised. October exports were $186.4 billion, $3.4 billion less than September exports. October imports were $229.0 billion, $3.0 billion more than September imports.

The October increase in the goods and services deficit reflected an increase in the goods deficit of $6.3 billion to $63.4 billion and a decrease in the services surplus of $0.1 billion to $20.8 billion.

Year-to-date, the goods and services deficit decreased $8.8 billion, or 2.1 percent, from the same period in 2015. Exports decreased $58.7 billion or 3.1 percent. Imports decreased $67.5 billion or 2.9 percent. -

13:33

US nonfarm labor productivity increased

Nonfarm business sector labor productivity increased at a 3.1-percent annual rate during the third quarter of 2016, the U.S. Bureau of Labor Statistics reported today, as output increased 3.6 percent and hours worked increased 0.5 percent.

The quarterly increase in nonfarm business sector labor productivity was the first increase after three consecutive declines in the measure. From the third quarter of 2015 to the third quarter of 2016, productivity was unchanged.

-

13:30

U.S.: International Trade, bln, October -42.6 (forecast -41.8)

-

13:30

Canada: Trade balance, billions, October -1.13 (forecast -2.0)

-

13:30

U.S.: Nonfarm Productivity, q/q, Quarter III 3.1% (forecast 3.3%)

-

13:30

U.S.: Unit Labor Costs, q/q, Quarter III 0.7% (forecast 0.3%)

-

13:02

Italian Referendum Unlikely to Sway ECB, Says Blackrock

The impact of the Italian constitutional referendum is unlikely to have any effect on the European Central Bank policy, says Martin Lueck, head of capital market strategy for Germany, Austria and Eastern Europe at BlackRock, cited by Dow Jones. This because the ECB Governing Council may have already taken a decision about further stimulus measures before the referendum, in knowledge of its staff forecasts, he says. Adds that most likely outcome is for the ECB to extend its asset-purchase program to end-September 2017 amid unchanged monthly buying of EUR80 billion.

-

13:00

Orders

EUR/USD

Offers : 1.0800 1.0820 1.0850 1.0875-80 1.0900

Bids: 1.0750 1.0720 1.0700 1.0680 1.0650 1.0620 1.0600 1.0580 1.0550

GBP/USD

Offers : 1.2780-85 1.2800 1.2830 1.2850 1.2875 1.2900

Bids: 1.2725-30 1.2700 1.2680 1.2660 1.2630 1.2600 1.2585 1.2560

EUR/GBP

Offers : 0.8480-85 0.8500 0.8520 0.8550 0.8575-80 0.8600

Bids: 0.8420 0.8400 0.8380 0.8350 0.8335 0.8320 0.8300 0.8280-85 0.8250

EUR/JPY

Offers : 122.85 123.00 123.50 124.00 124.50 124.80 125.00

Bids: 122.50 122.20 122.00 121.80 121.50 121.00 120.80-85 120.50 102.20 120.00

USD/JPY

Offers : 114.00 114.20 114.3 5 114.50 114.80-85 115.00 115.25 115.45-50

Bids: 113.50-60 113.20 113.00 112.85 112.50 112.20 112.00 111.80 111.50

AUD/USD

Offers : 0.7460 0.7480-85 0.7500-05 0.7520 0.7545-50 0.7580 0.7600

Bids: 0.7420 0.7400 0.7380 0.7355-60 0.7325-30 0.7300 0.7285 0.7250

Информационно-аналитический отдел TeleTrade

-

11:17

European Commission Brexit negotiator Barnier: EU ready to receive UK notification of withdrawal - Forexlive

-

time for negotiations is less than 2 years

-

EU will be ready when Article 50 is triggered

-

goal of all 27 member states is preserving EU unity

-

non-EU members can never have same rights and benefits

-

-

10:41

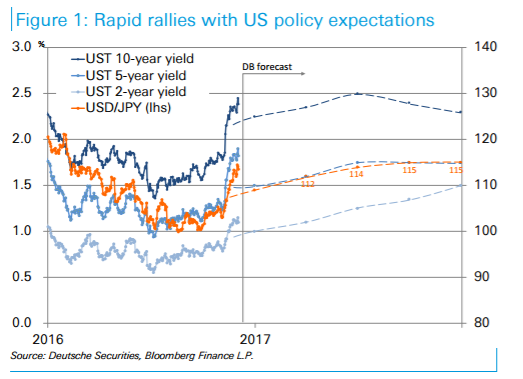

Deutsche Bank selling USD/JPY at 115

"In the short term, we may need to be alert to the risk of a correction to this USD/JPY rapid rally. The cause could be any of several factors, such as questions over the viability of US policies or politics, a weakening in emerging market or resource price trends leading to a high dollar, recurring concerns on China's capital outflow, or political uncertainties with major EU elections. On the other hand, we feel that the rally, though led largely by expectations, has not fully discounted the policies of the incoming Trump government, which remain highly indeterminate. As such, we believe the USD/JPY still has ample upside once Donald Trump takes office.

From a supply/demand perspective, we feel the USD/JPY will be underpinned at ¥110 or lower on buying on weakness by pension funds and life insurers. Some importers have seen their long-term hedge for USD buying knocked out and may move to acquire dollars at an even higher level. The USD/JPY has been steadily supported by such buyers.

Overseas USD/JPY bulls should try the upside with a close eye on these trends and on the viability of the Trump administration's policies. We believe Japanese exporters should quietly smooth their activity and undertake USD sell hedging in line with this uptrend. We do not rule out a possible upswing in the USD/JPY to over ¥115. This trend might last beyond next year and into 2018.

Based on this understanding, we recommend a tactical approach of buying at the low ¥110 level or below and selling expeditiously at over ¥115".

Copyright © 2016 DB, eFXnews™

-

10:17

Seasonally adjusted GDP rose by 0.3% in the euro area

Seasonally adjusted GDP rose by 0.3% in the euro area (EA19) and by 0.4% in the EU28 during the third quarter of 2016, compared with the previous quarter, according to an estimate published by Eurostat, the statistical office of the European Union.

In the second quarter of 2016, GDP also grew by 0.3% and 0.4% respectively. Compared with the same quarter of the previous year, seasonally adjusted GDP rose by 1.7% in the euro area and by 1.9% in the EU28 in the third quarter of 2016, after also +1.7% and +1.9% respectively in the previous quarter.

During the third quarter of 2016, GDP in the United States increased by 0.8% compared with the previous quarter (after +0.4% in the second quarter of 2016). Compared with the same quarter of the previous year, GDP grew by 1.6% (after +1.3% in the previous quarter).

Among Member States for which data are available for the third quarter of 2016, Croatia (+1.7%), Slovenia (+1.0%), Greece and Portugal (both +0.8%) recorded the highest growth compared with the previous quarter, while Lithuania recorded the lowest growth (+0.1%).

-

10:00

Eurozone: GDP (YoY), Quarter III 1.7% (forecast 1.6%)

-

10:00

Eurozone: GDP (QoQ), Quarter III 0.3% (forecast 0.3%)

-

09:43

UK: Record of FPC Meetings

At its meetings on 23 and 29 November 2016, the Financial Policy Committee (FPC):

Maintained the UK countercyclical capital buffer (CCyB) rate at 0%, and reaffirmed that it expected to maintain a UK CCyB rate at 0% until at least June 2017, absent any material change in the outlook. It continued to support the clear supervisory expectation of the Board of the Prudential Regulation Authority (PRA) that firms should not increase dividends and other distributions as a result of the UK CCyB rate being maintained at 0%.

Reviewed and agreed to maintain without change the Recommendations that it had made in June 2014 to insure against the risk of a marked loosening in underwriting standards in the owner-occupier mortgage market and a further significant rise in the number of highly indebted households. The full text of the 2014 Recommendations is in the annex of this record.

-

09:16

Eurozone Retail PMI pointed to a third straight monthly fall in sales - Markit

November's Eurozone Retail PMI survey pointed to a third straight monthly fall in sales, with downturns recorded across each of the currency area's bigthree member states. However, growth in retailers' spending on goods for resale and employment reflected a generally positive outlook towards yearend sales prospects.

At 48.6 in November, the seasonally adjusted headline Markit Eurozone Retail PMI - which tracks month-on-month changes in like-for-like retail sales in the bloc's biggest three economies combined - was unchanged from its reading in October, which was in turn its lowest since June. Sales have now fallen in five of the past six months, the exception being a marginal rise in August.

-

09:13

Euro traders preparing for no extension of quantitative easing on Thursday?

-

08:59

Option expiries for today's 10:00 ET NY cut

USD/JPY 95.00 6.06bn, 110.00 111.70 112.25, 112.60, 112.85, 114.00, 114.75

EUR/USD 1.0400, 1.0425, 1.0500/05, 1.0525, 1.0550, 1.0575/77, 1.0600, 1.0640/45/50, 1.0685 (668m), 1.0700. 1.0745/50 (767m), 1.0765, 1.0775, 1.0800 (857m), 1.0900/05

GBP/USD 1.2650, 1.2700/05, 1.2850, 1.2950, 1.3000

AUD/USD 0.7350, 0.7400 (531m), 0.7450, 0.7500/10

AUD/JPY 82.00 (646m)

AUD/NZD 1.0400 (251m), 1.0600

USD/CAD 1.3200, 1.3215, 1.3225, 1.3380. 1.3390, 1.3400, 1.3420

-

08:25

Swiss CPI fell 0.2% in November

The Swiss Consumer Price Index (CPI) fell by 0.2% in November 2016 compared with the previous month, reaching 100.1 points (December 2015=100). Inflation was -0.3% in comparison with the same month in the previous year. These are the findings from the Federal Statistical Office (FSO).

-

08:15

Switzerland: Consumer Price Index (MoM) , November -0.2%

-

08:15

Switzerland: Consumer Price Index (YoY), November -0.3% (forecast -0.2%)

-

08:02

Today’s events

-

At 10:30 GMT, Britain will hold an auction of 10-year bonds

-

At 16:30 GMT the ECB member Yves Mersch will make a speech

-

At 22:00 GMT the RBNZ Governor Graeme Wheeler will deliver a speech

-

-

07:39

Best trades for 2017 according to Societe Generale

"1. Stay long the USD in 2017, at least in 1H

Nowhere will policy rotation be as evident as in the US in 2017. The Fed path will continue to re-price higher as incoming US President Donald Trump delivers fiscal stimulus. Rising rates and USD will make it harder for non-US borrowers to refinance a wall of USD-denominated debt. Scarcity will push the USD to new cycle highs, further away from fair value.

2. EUR/USD below parity? Two option structures

We see EUR/USD heading to parity into spring. With general USD strength combining with European political uncertainty, a temporary overshoot is a distinct possibility. We recommend two risk profiles: 1) EUR/USD 6m European digital put strike 0.97 costing 13% and 2) zero-cost 6m downside seagull strikes 0.97/0.99/1.17.

3. Stay short the yen: Buy USD/JPY 6m call spread 1x1.5 strikes 118/120.5

The BoJ has its timing right. With global yields likely to rise further in 2017 (see SG FI Outlook 2017: The big hangover) and 10y JGBs credibly pegged around 0%, the yen can get much weaker still. The above structure is cost-free (indicative, spot ref: 114.30). It starts losing money only when USD/JPY breaks above 125, at which point the BoJ might struggle to defend the JGB peg (speculation about an adjustment of the long-term rate target would rise).

4. Brexit vote dust settles: selling cable volatility safely

After the post-Brexit-vote jitters, cable has reconnected with short-term rates. Sterling positioning has cleaned out its extreme shorts. The Brexit process will not be smooth, but is unlikely to deliver large surprises over the next six months. The settling dust and cable's likely future range make GBP volatility a Sell. A naked short is much too risky, while the euro moving down and then up is likely to generate EUR/GBP volatility. So we suggest directional and volatility RV implementations circumventing the issue: 1) Buy GBP/USD 6m double no-touch 1.19/1.30 for only 13% and 2) go long EUR/GBP 1y volatility swap against GBP/USD 1y volatility swap.

5. Buy SEK and NOK vs AUD and NZD...

The SEK and NOK are best positioned to benefit from the reflation theme. The NOK has some significant catching up to do in the light of the rising oil price and local forward interest rates. With SEK inflation breakevens finally recovering, the Riksbank should turn less dovish. The AUD and NZD have had a relatively good 2016 so far as investors have climbed a wall of Chinese worries - we see little upside from here. The trade costs 0.6% per quarter, an acceptable cost given the excellent entry level.

6. ... or Buy SEK and CHF vs NZD and JPY

In a rising yield environment, we prefer the CHF to JPY as a safe haven, as the JGB peg will remain a drag on the JPY. The SEK is our favourite G10 currency for 2017, while the NZD is our least preferred.

7. Kiwi weakest G10 currency against USD

We expect the NZD to fall the most against the USD in 2017, reaching 0.64 by year-end. New Zealand remains highly exposed to a slowdown in Chinese demand, and the RBNZ won't stay neutral in front of revived currency strength. Short rates already point toward a much lower NZD/USD. Downside medium-term kiwi volatility is expensive, suggesting RKO puts. Buy NZD/USD 1y put strike 0.68 RKO 0.59 for 0.98% (spot ref: 0.7135), which compares with 3.85% for the vanilla.

8. Trading more frequent intraday volatility spikes

The amplitude and frequency of black swan events in FX have increased in 2015-2016, suggesting a deep change in the nature of currency risk. Our findings (using extreme value theory), falling spot volumes, growth in electronic trading and tighter regulations point towards a durable transformation. A volatility regime with more frequent intraday volatility spikes improves the profit odds of rolling long gamma positions financed by short vega positions, especially when curves are steep. Variance/volatility swaps circumvent the spot execution risks involved in dynamic delta-hedging.

9. Regional EM: Short EMEA and LatAm against Asia (through to 1Q)

Regionally, EMEA (USD crosses) and LatAm will likely suffer more than Asia through to 1Q. While Asia is more sensitive via trade linkages, higher-beta regions with less favourable external positions (EMEA dollar crosses and LatAm) should do worse when overall risk sentiment is deteriorating. Long INR, IDR vs Sell TRY, MXN (6m carry -0.4%).

10. Short EM exposure: Long USD vs TWD and MXN Long USD-MXN:

The MXN looks to be on a downward track through to 1Q due to generalised pressure on EM currencies coupled with uncertainty regarding Trump's trade and immigration policies. Brexit and NAFTA are different animals, but price action in GBP could be instructive in terms of understanding how the peso might trade - GBP rallies have been limited and short positions have been very sticky. Long USD-TWD: This offers neutral carry and is appealing against a backdrop of EM currency weakness, Chinese growth expected to print at 6.1% in 2Q, ongoing CNY depreciation and the risk premium related to Trump's policy biases.

11. EM relative value: Short TRY-RUB, long INR-KRW, short SGD-INR

Owning positive carry relative value structures that are directional to a weaker USD are appealing. Short TRY-RUB on relative sensitivities to Trump's policies, growth and external balances, and capital outflow risks. Long INR-KRW on political risks in Korea, sensitivity to Trump's policies, and exposure to Chinese growth and FX depreciation. Short SGD-INR provides attractive vol-adjusted carry; SGD will likely underperform as long as expectations of MAS easing remain in place.

12. EM Trump basket: Short MXN, TWD, KRW vs long RUB, INR, CLP

Currencies sensitive to Trump's policies and a deterioration in risk sentiment are expected to underperform (MXN, BRL, ZAR, TRY, KRW, TWD, PHP), while those more insulated (INR, IDR, THB, RUB, CLP) should outperform. Long RUB, INR, CLP vs Sell MXN, TWD, KRW (6m carry +1.2%).

13. CNY depreciation: Own 1y CNH seagull structure (6.80/7.13/7.50 strikes)

Our base-case scenario envisions USD/CNY rising to 7.30 by the end of 2017. The structural richness of implied volatility over realised argues for short volatility structures. Additionally, short downside volatility is appealing because there are few fundamental reasons for the CNH to trade meaningfully stronger over the next year. Owning a 1yr USD/CNH zero-cost seagull structure (6.80/7.18/7.50 strikes) offers a maximum gain of 4.2%. With no digital risk involved and limited convexity, the position can be conveniently delta-hedged. Losses are unlimited if USD/CNH trades below the 6.80 strike in one year.

14. CNY - escalating probability of free float: Buy 2yr USD-CNH call spread (7.80/8.40 strikes)

The probability of a free-floating RMB will likely rise steeply over the course of the next three years and become almost a nearcertainty by the end of 2019. We assign a 20% probability to a free float in 2017 but a 50% one if the US took major trade actions against China. In 2018, we see a 50% probability of a free float, rising to 80% by 2019. Selling topside optionality significantly reduces the cost of vanilla call options and the term premium is not high. Maximum leverage is close to 6x beyond 8.40 in two years and losses are capped at the premium paid.

15. Buy USD-SGD one-touch to position for EUR-USD parity

In 1Q17, we expect EUR/USD to break through the technical support at 1.05 and reach parity. If the pair does indeed test 1.00, USD/SGD should rise towards 1.50. The SGD has one of lowest implied vols in EM (3m implied volatility at 6.7%, against 10.0% for the EUR/USD), making it relatively cheap to express a directional USD view through options. Buy USD-SGD 3m one-touch knock-in 1.4950. The maximum leverage is 5x, while the maximum loss is the premium paid".

Copyright © 2016 Societe Generale, eFXnews™

-

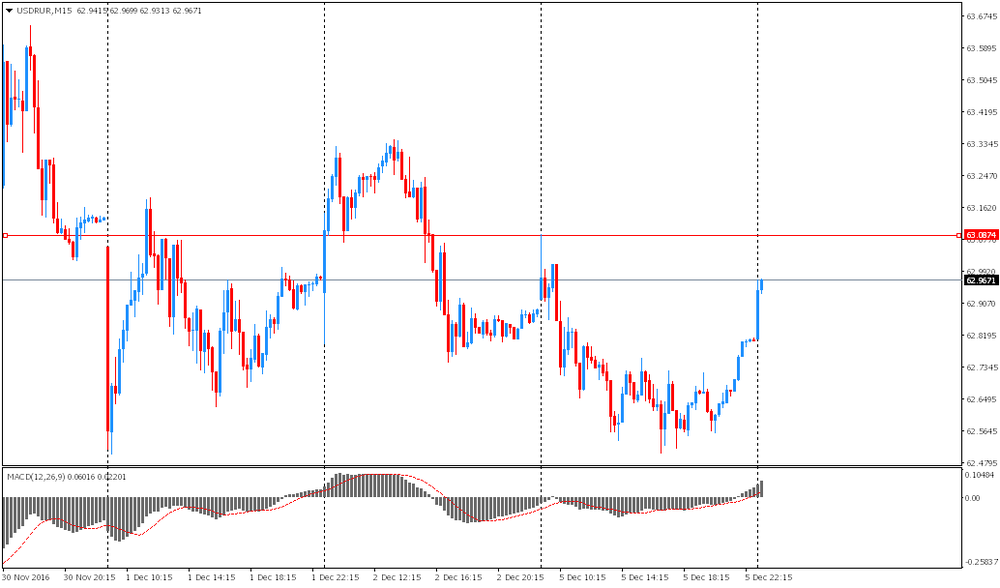

07:32

USD / RUR opened higher

After the opening USD / RUR has rose to around 62.96 on limited strengthening of the US dollar against most major currencies. In addition, the pressure on the Russian currency had a decline in oil prices during Asian trading. The pair is currently committed to the nearest resistance in the area of yesterday's high 63.00.

-

07:26

Options levels on tuesday, December 6, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0862 (5562)

$1.0838 (4774)

$1.0795 (1997)

Price at time of writing this review: $1.0742

Support levels (open interest**, contracts):

$1.0712 (3384)

$1.0655 (3412)

$1.0579 (6521)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 88888 contracts, with the maximum number of contracts with strike price $1,1400 (6407);

- Overall open interest on the PUT options with the expiration date December, 9 is 75035 contracts, with the maximum number of contracts with strike price $1,0600 (6521);

- The ratio of PUT/CALL was 0.84 versus 0.87 from the previous trading day according to data from December, 5

GBP/USD

Resistance levels (open interest**, contracts)

$1.3000 (2464)

$1.2901 (699)

$1.2803 (1776)

Price at time of writing this review: $1.2744

Support levels (open interest**, contracts):

$1.2695 (756)

$1.2598 (1320)

$1.2499 (2562)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 36519 contracts, with the maximum number of contracts with strike price $1,3400 (2561);

- Overall open interest on the PUT options with the expiration date December, 9 is 35530 contracts, with the maximum number of contracts with strike price $1,2500 (2562);

- The ratio of PUT/CALL was 0.97 versus 0.98 from the previous trading day according to data from December, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:22

Westpac cut forecast for Australian GDP

Westpac lowered the forecast of GDP for Australia in the third quarter to -0.2% and in annual terms to 2.1% (from 3.3% in the second quarter). Chief Economist Andrew Hanlan said that the 0.2% decrease in the third quarter due to net exports.

Domestic demand in the third quarter decreased by 0.4%, this is due to decreased activity of the construction of homes and business investment. The bank expects a small increase in private consumption of 0.5%, after rising 0.4% in the second quarter.

NAB and Morgan Stanley also predicted negative growth in the third quarter. The NAB said that Australia's GDP in the first quarter 2017 is projected at -0.2%, but there is some risk that the GDP for the third quarter could be up to 0.5%.

JP Morgan forecast Australian GDP unchanged in the third quarter. ANZ forecast Australian GDP in the 3rd quarter at -0.1%. CBA forecast Australian GDP for the 3rd quarter at + 0.1%.

-

07:13

Reserve Bank of Australia holds rates: Interest rates are consistent with the objectives in terms of economic growth and inflation

-

Probably some slowdown in economic growth at the end of the year, before new impulse

-

The housing market strengthened, but the situation varies across the country

-

Housing prices could be in a recovery in some markets

-

Labour market indicators more ambiguous, however, point to employment growth in the short term

-

Inflation is fairly low and remains low for a long time

-

Conditions in China's economy stabilized, medium-term risks remain

-

Probably some slowdown in GDP growth at the end of the year

-

The high Australian dollar may complicate the transition period

-

-

07:11

Australia's seasonally adjusted current account deficit narrowed

Australia's seasonally adjusted current account deficit narrowed to A$11.358 billion in the third quarter of 2016, the Australian Bureau of Statistics said on Tuesday cited by rttnews - owing to higher export commodity prices.

That follows the A$15.943 billion shortfall in the three months prior.

The balance on goods and services marked a deficit of A$4.682 billion following the A$7.381 billion shortfall in Q2.

Net exports of GDP eased 0.2 percent, unchanged from the previous quarter. The net goods and services surplus fell A$871 million (61 percent) to A$561 million.

-

07:04

Significant rise for German factory orders

Based on provisional data, the Federal Statistical Office (Destatis) reports that price-adjusted new orders in manufacturing had increased in October 2016 a seasonally and working-day adjusted 4.9% on September 2016. For September 2016, revision of the preliminary outcome resulted in a decrease of 0.3% compared with August 2016 (primary -0.6%). Price-adjusted new orders without major orders in manufacturing had increased in October 2016 a seasonally and working-day adjusted 4.3% on September 2016.

In October 2016, domestic orders increased by 6.3% and foreign orders by 3.9% on the previous month. New orders from the euro area remained unchanged from the previous month, while new orders from other countries increased by 6.3% compared to September 2016.

-

07:00

Germany: Factory Orders s.a. (MoM), October 4.9% (forecast 0.6%)

-

03:31

Australia: Announcement of the RBA decision on the discount rate, 1.5% (forecast 1.5%)

-

00:31

Australia: Current Account, bln, Quarter III -11.4 (forecast -13.7)

-

00:00

Japan: Labor Cash Earnings, YoY, October 0.1% (forecast 0.2%)

-