Market news

-

23:29

Stocks. Daily history for Dec 08’2016:

(index / closing price / change items /% change)

Nikkei 225 18,765.47 +268.78 +1.45%

Shanghai Composite 3,215.73 -6.51 -0.20%

S&P/ASX 200 5,543.64 0.00 0.00%

FTSE 100 6,931.55 +29.32 +0.42%

CAC 40 4,735.48 +40.76 +0.87%

Xetra DAX 11,179.42 +192.73 +1.75%

S&P 500 2,246.19 +4.84 +0.22%

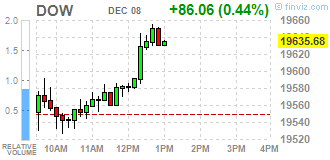

Dow Jones Industrial Average 19,614.81 +65.19 +0.33%

S&P/TSX Composite 15,295.20 +57.45 +0.38%

-

21:06

Major US stock indices closed in the green zone

Major US stock indexes continued to rally, motivated choice of Trump as president. Investors are betting on the shares of industrial and financial companies, as expected, that these sectors will derive maximum benefit from the Trump promises to spend more on infrastructure and simplify the rules.

As it became known, the number of Americans who first applied for unemployment benefits fell to a five-month high last week, indicating the strength of the labor market, underlining the steady momentum of the economy. Primary applications for unemployment benefits fell by 10,000 to a seasonally adjusted reached 258,000 for the week ending December 3, the Labor Department reported. The data for the previous week were not revised.

Oil futures rose about two percent, retreating from week low, as market participants focused on the upcoming meeting of the OPEC and non-OPEC producers, who may end the agreement on further production cuts. Recall, this Saturday, the OPEC and non-OPEC oil producers will meet in Vienna to agree on the details of the transaction, which is focused on the overall reduction in oil production of about 1.5 million. Barrels per day. This agreement will help reduce global glut in the market, which contributed to lower prices for more than two years.

DOW index components closed mostly in positive territory (16 of 30). More rest up shares The Goldman Sachs Group, Inc. (GS, + 2.42%). Outsider were shares of United Technologies Corporation (UTX, -1.20%).

Almost all sectors of the S & P showed an increase. The leader turned conglomerates sector (+ 1.9%). Decreased only the industrial goods sector (-0.3%).

At the close:

Dow + 0.32% 19,612.70 +63.08

Nasdaq + 0.44% 5,417.36 +23.60

S & P + 0.21% 2,246.04 +4.69

-

20:00

DJIA +0.36% 19,619.9 +70.37 Nasdaq +0.17% 5,403.01 +9.25 S&P +0.16% 2,244.97 +3.62

-

18:02

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Thursday, sparked by Donald Trump's election as U.S. president, roared ahead on Thursday, driving major Wall Street indexes to record highs. Investors are betting on shares of industrial and financial companies as they expect these sectors to benefit the most from Trump's promise to spend more on infrastructure and simplify regulations.

Most of Dow stocks in positive area (18 of 30). Top gainer The Goldman Sachs Group, Inc. (GS, +2.01%). Top loser - Pfizer Inc. (PFE, -0.90%).

Most S&P sectors also in positive area. Top gainer - Financials (+0.8%). Top loser - Healthcare (-0.2%).

At the moment:

Dow 19591.00 +138.00 +0.71%

S&P 500 2244.00 +12.50 +0.56%

Nasdaq 100 4866.00 +25.50 +0.53%

Oil 50.56 +0.79 +1.59%

Gold 1172.70 -4.80 -0.41%

U.S. 10yr 2.40 +0.05

-

17:00

European stocks closed: FTSE 100 +29.32 6931.55 +0.42% DAX +192.73 11179.42 +1.75% CAC 40 +40.76 4735.48 +0.87%

-

16:58

WSE: Session Results

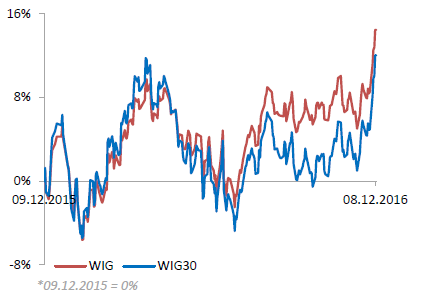

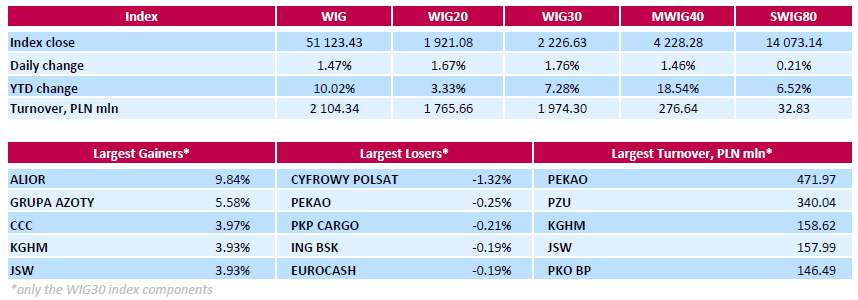

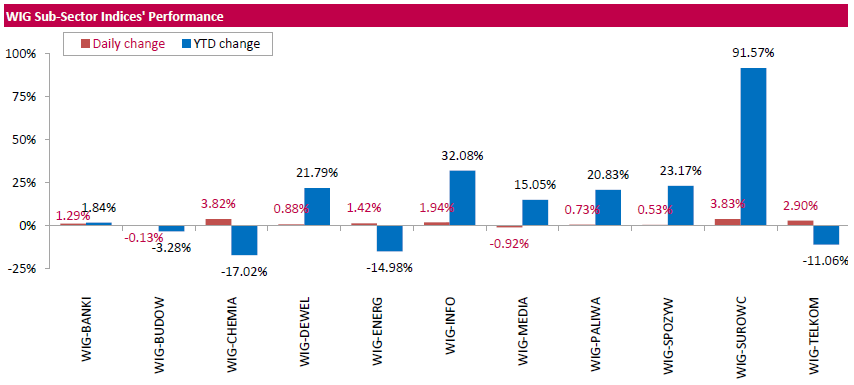

Polish equity market closed higher on Thursday. The broad market measure, the WIG Index, rose by 1.47%. The WIG sub-sector indices were mainly higher with materials (+3.83%) outperforming.

The large-cap stocks' measure, the WIG30 Index, surged by 1.76%. A majority of the index components returned gains, with the way up led by bank ALIOR (WSE: ALR), which soared by 9.84%, helped by the announcement the bank decided yesterday to terminate the negotiations and cease the plan to acquire core banking business of Raiffeisen Bank Polska. Other major advancers were chemical producer GRUPA AZOTY (WSE: ATT), footwear retailer CCC (WSE: CCC), coking coal miner JSW (WSE: JSW) and copper producer KGHM (WSE: KGH), which added between 3.93% and 5.58%. Among few decliners, media group CYFROWY POLSAT (WSE: CPS) fell the most, down 1.32%, correcting after significant gains (7.2%) earlier this month.

-

14:53

WSE: After start on Wall Street

The ECB left interest rates unchanged and for a long time they are not going to change it, as was expected. The most important, however, was information regarding the purchase of assets. Here extension shall not take half a year, but about 9 months, provided, that the whole program will be reduced from 80 million euros a month to 60 billion euros. In addition, the ECB reported that in the QE program will be bought up from the market short-term bonds in prices lower than the deposit rate. Reaction - the euro firmly down, stock markets up.

Definitely calmly to events in Europe approaching Americans. Sessions on Wall Street began with a continuation of growth in the framework of St. Claus rally. There is no technical resistance in the market, which may lead to the closing of short positions, which may further increase the growth.

An hour before the close of trading on the Warsaw market the WIG20 index was at the level of 1,923 points (+1,81%) and the turnover around the WIG20 index exceeded PLN 1.1 billion, what shows the scale of the capital, which now sweeping over our market. Half of it belongs to the duo of PZU-Pekao, but this relationship is maintained from the very beginning of the session.

-

14:33

U.S. Stocks open: Dow -0.02%, Nasdaq +0.01%, S&P -0.04%

-

14:29

Before the bell: S&P futures +0.09%, NASDAQ futures +0.07%

U.S. stock-index futures were flat.

Global Stocks:

Nikkei 18,765.47 +268.78 +1.45%

Hang Seng 22,861.84 +60.92 +0.27%

Shanghai 3,215.73 -6.51 -0.20%

FTSE 6,923.63 +21.40 +0.31%

CAC 4,739.73 +45.01 +0.96%

DAX 11,127.12 +140.43 +1.28%

Crude $50.10 (+0.66%)

Gold $1,174.00(-0.30%)

-

13:56

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

65.1

-0.31(-0.4739%)

1394

Amazon.com Inc., NASDAQ

AMZN

771.01

0.59(0.0766%)

20148

American Express Co

AXP

74.6

0.31(0.4173%)

665

AMERICAN INTERNATIONAL GROUP

AIG

65

0.08(0.1232%)

2081

Apple Inc.

AAPL

110.81

-0.22(-0.1981%)

38026

AT&T Inc

T

40.15

-0.30(-0.7417%)

40751

Barrick Gold Corporation, NYSE

ABX

15.63

-0.16(-1.0133%)

93588

Caterpillar Inc

CAT

97.14

-0.19(-0.1952%)

3906

Cisco Systems Inc

CSCO

29.9

-0.05(-0.1669%)

3125

Citigroup Inc., NYSE

C

59.4

0.34(0.5757%)

51484

Exxon Mobil Corp

XOM

87.88

-0.19(-0.2157%)

1210

Facebook, Inc.

FB

117.78

-0.17(-0.1441%)

36705

Ford Motor Co.

F

13.05

-0.01(-0.0766%)

45058

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.59

0.16(1.0369%)

112010

General Electric Co

GE

31.46

-0.14(-0.443%)

8680

General Motors Company, NYSE

GM

36.14

-0.16(-0.4408%)

19879

Goldman Sachs

GS

237.25

1.69(0.7174%)

31918

Google Inc.

GOOG

771.31

0.12(0.0156%)

2095

Intel Corp

INTC

35.37

-0.13(-0.3662%)

2449

International Business Machines Co...

IBM

163.81

-0.98(-0.5947%)

999

Johnson & Johnson

JNJ

110.52

-0.58(-0.5221%)

1297

JPMorgan Chase and Co

JPM

84.41

0.34(0.4044%)

34848

McDonald's Corp

MCD

119.2

-0.72(-0.6004%)

2366

Microsoft Corp

MSFT

61.28

-0.09(-0.1467%)

8073

Nike

NKE

52.3

0.20(0.3839%)

3940

Pfizer Inc

PFE

31.01

-0.18(-0.5771%)

15163

Procter & Gamble Co

PG

83.7

-0.48(-0.5702%)

3928

Starbucks Corporation, NASDAQ

SBUX

58.78

0.02(0.034%)

4563

Tesla Motors, Inc., NASDAQ

TSLA

192.5

-0.65(-0.3365%)

16926

The Coca-Cola Co

KO

41.14

-0.15(-0.3633%)

2459

Twitter, Inc., NYSE

TWTR

19.53

0.05(0.2567%)

148676

United Technologies Corp

UTX

109.69

0.01(0.0091%)

250

Visa

V

79.5

0.19(0.2396%)

2785

Yahoo! Inc., NASDAQ

YHOO

40.65

0.13(0.3208%)

2300

Yandex N.V., NASDAQ

YNDX

19.73

0.05(0.2541%)

1000

-

12:03

WSE: Mid session comment

Today we will know the decision of the ECB, nevertheless on the markets may see continuously optimistic mood and the banking sector traditionally present high form. Italian banks index gaining approx. 2% and is at the highest levels since Brexit. The main indices in Frankfurt and Paris came over functioning for many weeks resistance. On the Warsaw market mid-morning trading phase brought new highs and the leaders of growth is all of the current information trio, PZU, Alior and Pekao.

In the middle of trade WIG20 index stood at 1,910 points (+1,11%). The turnover in the blu-chips segment was amounted to PLN 790 million.

-

11:50

Major European stock indices trading in the green zone

European stock markets at three months high while investors expect the extension of the ECB's QE program at today's meeting of the regulator. Indices are rising the fourth consecutive session, showing a record for the duration of the rally in two months.

Today will be held the last in this year's meeting of the ECB, which will discuss the timing and amount of QE program. According to analysts, the bank's management will announce the extension of the program by six months, until September 2017, maintaining the volume of purchase of assets at the same level - 80 billion euros per month.

The ECB, which aims to accelerate the growth of low prices, will report on the main decisions in the field of monetary policy at 12:45 GMT followed by a conference of Mario Draghi at 13:30 GMT.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0,2% - to 348.42 points. The index gained around 2.7% since the beginning of the week and is ready to show the best weekly gain since July.

Demand for shares of mining companies, with the regional index rose by 0.1% during the trading session reached the highest level since mid-2015, after rising metal prices on the background of dollar weakness and good data on imports into China.

The price of securities of the largest Italian bank UniCredit SpA rose by 0.3% on news that the Bank has reached an agreement for the sale of 32.8% stake in the Polish bank Bank Pekao for 10.59 billion zlotys ($ 2.6 billion) .

TUI Group's share price rose 0,6%. The largest tour operator in Europe has increased the profit in 2015-2016 by 13%, despite the decline in revenue.

TUI also announced its intention to increase the dividend payout to 0.63 euros from 0.56 euros per share.

Siemens shares lost 0.2%, although the company said Wednesday that it is guided by a double-digit profit growth rates every year until 2020.

At the moment:

FTSE 6905.05 2.82 0.04%

DAX 11023.27 36.58 0.33%

CAC 4701.82 7.10 0.15%

-

08:30

Major stock exchanges trading in the green zone: FTSE flat, DAX + 0.5%, CAC40 + 0.3%, FTMIB + 0.2%, IBEX + 0.5%

-

08:16

WSE: After opening

WIG20 index opened at 1898.82 points (+0.49%)*

WIG 50623.33 0.48%

WIG30 2200.90 0.58%

mWIG40 4169.08 0.04%

*/ - change to previous close

The cash market opens from increase to the level of 1898 points with a very good attitude of Pekao, where share price exceeds PLN 123. The star of the morning is Alior Bank after information about his withdrawal from the intention to acquire core banking of Raiffeisen Bank Poland - the share price grow in the first minutes of the session by more than 12 percent. This behavior supports the main index, which violates the level of 1900 points gaining in a similar scale to the German DAX.

After fifteen minutes of trading the WIG20 index was at the level of 1,898 points (+0,49%).

-

07:34

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.9%, CAC40 + 0.6%, FTSE + 0.9%

-

07:26

WSE: Before opening

Wall Street continues post-election boom. Wednesday's session ended with increases in most indices and the S&P500 and the Dow Jones Industrial set new highs. The next week on Wednesday after a meeting and including new macro forecasts, the message would send the US Federal Reserve. The market is at 100 percent convinced that the federal funds rate will be increased by 25 basis points.

In Asia good sentiment persists, and the only outsider is parquet in Shanghai, despite a surprisingly positive information about trade in November.

Before today's session on the Warsaw market was explained the issues of the sale of Bank Pekao and Raiffeisen Bank Poland. The package of 32.8% of the first one will take over PZU and PFR (Polish Development Fund) at a price of PLN 123 per share. The remaining 7.3% is to be placed by Pekao on the market, what today can have an impact on the listing of the shares of Pekao.

In turn, Alior Bank resigned from the acquisition of the core business of Raiffeisen Bank Poland, which by the Alior's shareholders should be accepted with relief, because there will not be the issue of shares to buy.

The main topic of the day on the international market will be the outcome of the ECB meeting. Investors expect the program to extend QE by half a year, with some modifications to facilitate its implementation.

-

06:14

Global Stocks

European stocks moved higher Tuesday as utility shares gained and banks recovered from the fallout from this weekend's referendum in Italy. Italy's political and banking woes may help European Bank President Mario Draghi convince hawkish ECB members to agree to extend the bank's eurozone stimulus efforts, including its bond-buying program. The ECB will release a policy decision Thursday.

U.S. stocks closed higher Wednesday with the Dow industrials and S&P 500 notching new records, shaking off early weakness in the health-care sector to extend gains. Health-care names tumbled early Wednesday after President-elect Donald Trump threatened to cut drug prices. "I'm going to bring down drug prices," Trump told Time in his "Person of the Year" cover story. "I don't like what has happened with drug prices."

Asian equity markets were firmly higher on Thursday, propelled by another record close on Wall Street and expectations that the European Central Bank will extend its monetary stimulus measures. Though there was no specific trigger for Wednesday's U.S. rally, market participants speculated that large orders in stock futures placed by computer programs may have accelerated buying.

-