Market news

-

23:30

Commodities. Daily history for Nov 16’2016:

(raw materials / closing price /% change)

Oil 45.33 -0.53%

Gold 1,225.00 +0.09%

-

23:29

Stocks. Daily history for Nov 16’2016:

(index / closing price / change items /% change)

Nikkei 225 17,862.21 +194.06 +1.10%

Shanghai Composite 3,205.41 -1.57 -0.05%

S&P/ASX 200 5,327.67 0.00 0.00%

FTSE 100 6,749.72 -43.02 -0.63%

CAC 40 4,501.14 -35.39 -0.78%

Xetra DAX 10,663.87 -71.27 -0.66%

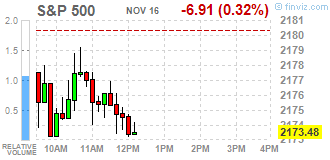

S&P 500 2,176.94 -3.45 -0.16%

Dow Jones Industrial Average 18,868.14 -54.92 -0.29%

S&P/TSX Composite 14,733.22 -22.88 -0.16%

-

23:29

Currencies. Daily history for Nov 16’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0690 -0,30%

GBP/USD $1,2440 -0,11%

USD/CHF Chf1,0019 +0,03%

USD/JPY Y109,06 -0,12%

EUR/JPY Y116,60 -0,40%

GBP/JPY Y135,67 -0,22%

AUD/USD $0,7479 -1,04%

NZD/USD $0,7069 -0,42%

USD/CAD C$1,3444 -0,83%

-

23:03

Schedule for today,Thursday, Nov 17’2016

00:30 Australia Changing the number of employed October -9.8 20

00:30 Australia Unemployment rate October 5.6% 5.6%

09:30 United Kingdom Retail Sales (MoM) October 0% 0.4%

09:30 United Kingdom Retail Sales (YoY) October 4.1% 5.3%

10:00 Eurozone Harmonized CPI October 0.4% 0.3%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) October 0.4% 0.5%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) October 0.8% 0.8%

13:30 Canada Foreign Securities Purchases September 12.74

13:30 U.S. Continuing Jobless Claims 2041 2038

13:30 U.S. Housing Starts October 1047 1155

13:30 U.S. Building Permits October 1225 1198

13:30 U.S. Philadelphia Fed Manufacturing Survey November 9.7 8

13:30 U.S. Initial Jobless Claims 254 258

13:30 U.S. CPI, m/m October 0.3% 0.4%

13:30 U.S. CPI, Y/Y October 1.5% 1.6%

13:30 U.S. CPI excluding food and energy, m/m October 0.1% 0.2%

13:30 U.S. CPI excluding food and energy, Y/Y October 2.2% 2.2%

13:50 U.S. FOMC Member Dudley Speak

15:00 U.S. Fed Chairman Janet Yellen Speaks

17:30 U.S. FOMC Member Brainard Speaks

21:45 New Zealand Retail Sales, q/q Quarter III 2.3%

21:45 New Zealand Retail Sales YoY Quarter III 6%

21:45 New Zealand PPI Input (QoQ) Quarter III 0.9%

21:45 New Zealand PPI Output (QoQ) Quarter III 0.2%

-

21:01

U.S.: Net Long-term TIC Flows , September -26.2

-

21:00

U.S.: Total Net TIC Flows, September -152.9

-

20:04

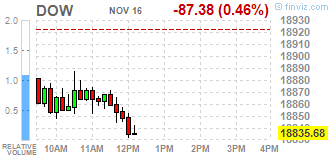

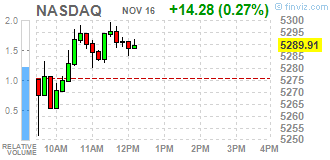

DJIA 18871.09 -51.97 -0.27%, NASDAQ 5292.05 16.43 0.31%, S&P 500 2176.02 -4.37 -0.20%

-

17:19

Wall Street. Major U.S. stock-indexes mixed

Major U.S. stock-indexes mixed. S&P and Dow were lower on Wednesday as financial stocks dropped after a seven-day rally since Donald Trump's surprise election win, while a recovery in technology shares boosted the Nasdaq. U.S. stocks have been on a tear since Trump's victory. The Dow had closed higher for seven days, with the last four at record levels. But they have given back some gains as investors look for more clarity regarding his policies and brace for higher interest rates.

Most of Dow stocks in negative area (20 of 30). Top gainer - Apple Inc. (AAPL, +2.23%). Top loser - The Goldman Sachs Group, Inc. (GS, -2.37%).

Most of S&P sectors also in negative area. Top gainer - Services (+0.4%). Top loser - Utilities (-1.1%).

At the moment:

Dow 18813.00 -67.00 -0.35%

S&P 500 2170.75 -8.50 -0.39%

Nasdaq 100 4783.25 +17.25 +0.36%

Oil 45.62 -0.19 -0.41%

Gold 1228.40 +3.90 +0.32%

U.S. 10yr 2.21 -0.02

-

17:04

European stocks closed: FTSE 6749.72 -43.02 -0.63%, DAX 10663.87 -71.27 -0.66%, CAC 4501.14 -35.39 -0.78%

-

16:45

WSE: Session Results

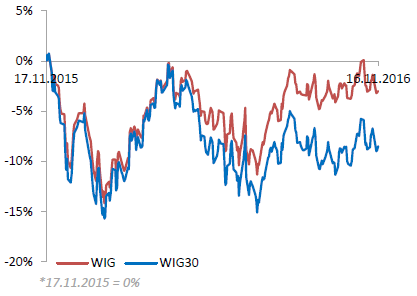

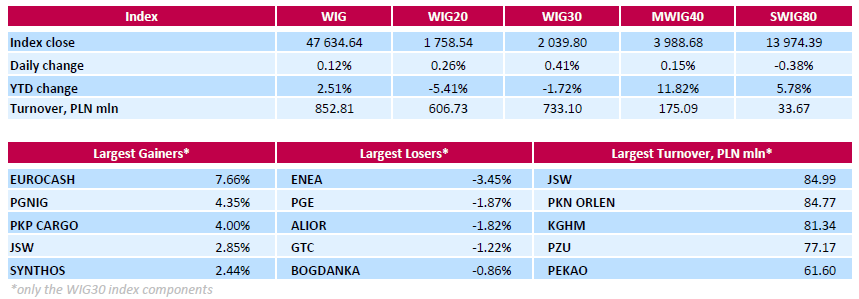

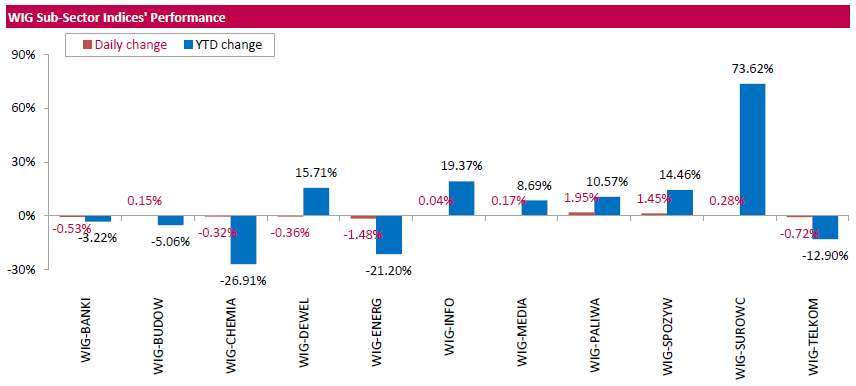

Polish equity market closed higher on Wednesday. The broad market measure, the WIG Index, rose by 0.12%. Sector performance within the WIG Index was mixed. Oil and gas sector (+1.95%) outpaced, while utilities (-1.48%) underperformed.

The large-cap stocks gained 0.41%, as measured by the WIG30 Index, with the way up led by FMCG-wholesaler EUROCASH (WSE: EUR), which surged by 7.66%. It was followed by oil and gas producer PGNIG (WSE: PGN) and railway freight transport operator PKP CARGO (WSE: PKP), jumping by 4.35% and 4% respectively. The latter reported it ended Q3 with a net loss of PLN 5.7 mln, which, however, was lower than analysts' consensus projection, calling for a loss of PLN 9 mln. Other major advancers were coking coal miner JSW (WSE: JSW), chemical producer SYNTHOS (WSE: SNS) and agricultural producer KERNEL (WSE: KER), which added between 2.26% and 2.85%. On the other side of the ledger, utilities name ENEA (WSE: ENA) kept its position as the worst performing name, tumbling by 3.45%, as it continued to suffer from yesterday's announcement the stock would be removed from MSCI Poland Index. Among other laggards were genco PGE (WSE: PGE), bank ALIOR (WSE: ALR) and property developer GTC (WSE: GTC), which lost between 1.22% and 1.87%.

-

16:01

Gold little changed for the day

Gold futures steadied today as the dollar was little changed versus major rivals.

The precious metal has lost some of its appeal this week as markets reacted with calm to the election of underdog Donald Trump as president. The dollar's advance to yearly highs also weighed on gold.

Dec. gold climbed $2.80, or 0.2%, to settle at $1,224.50/oz, a slight improvement from the recent multi-week low.

Upside was capped by hawkish comments from Boston Federal Reserve President Eric Rosengren.

-

15:43

Significant increase for US crude oil inventories

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 5.3 million barrels from the previous week. At 490.3 million barrels, U.S. crude oil inventories are above the upper limit of the average range for this time of year.

Total motor gasoline inventories increased by 0.7 million barrels last week, and are well above the upper limit of the average range. Finished gasoline inventories decreased while blending components inventories increased last week.

Distillate fuel inventories increased by 0.3 million barrels last week and are well above the upper limit of the average range for this time of year. Propane/propylene inventories rose 1.2 million barrels last week and are near the upper limit of the average range. Total commercial petroleum inventories increased by 7.1 million barrels last week.

-

15:30

U.S.: Crude Oil Inventories, November 5.274 (forecast 1.267)

-

15:13

US home builder sentiment steady

The nation's homebuilders continue to have a positive outlook on their market, but no more positive than last month.

Homebuilder sentiment held steady in November at 63 says the National Association of Home Builders/Wells Fargo Housing cited by cnbc. Anything above 50 is considered "positive." That confidence, however, may change in the next report.

-

15:00

U.S.: NAHB Housing Market Index, November 63 (forecast 63)

-

14:52

WSE: After start on Wall Street

Today's afternoon brought weaker readings of data from the US, signaling a weaker-than-expected condition of the industry. Zero growth in industrial production and lower-than-expected capacity utilization complement worse-than-expected PPI inflation reading. The data are in contrast with recent readings of the economy and should encourage corrective post-election mood after having increased. Contracts for US indices signaled a weaker opening on Wall Street, so the start of trading with discounts in the US market was no surprise. After the first minutes of trading on Wall Street contracts on the S&P 500 rebounded from the session lows allowing similar maneuver for European indexes. The beginning of the US session therefore leads to more stability than the confirmation of declines.

The Warsaw market still feeling the effects of a strong withdrawing from the beginning of the week and it is hard to think that the final hour will bring a major change in the balance of power. The biggest problem is the lack of strong capital on the side of the bulls. From the technical analysis point of view, today's session looks like another day of balance and wait for the stimulus for either party.

An hour before the close of trading the WIG20 index was at the level of 1,758 points (+ 0.27%).

-

14:33

U.S. Stocks open: Dow -0.28%, Nasdaq -0.36%, S&P -0.27%

-

14:28

Before the bell: S&P futures -0.33%, NASDAQ futures -0.40%

U.S. stock-index futures retreated as a selloff in Treasuries resumed, raising concerns that interest rates could rise faster than investors anticipated amid speculation that Donald Trump's policies will boost inflation.

Global Stocks:

Nikkei 17,862.21 +194.06 +1.10%

Hang Seng 22,280.53 -43.38 -0.19%

Shanghai 3,205.41 -1.57 -0.05%

FTSE 6,789.08 +35.90 +0.53%

CAC 4,490.95 -45.58 -1.00%

DAX 10,634.61 -100.53 -0.94%

Crude $45.44 (-0.81%)

Gold $1,224.90 (+0.03%)

-

14:20

US Industrial production flat in October. Capacity utilization rate declined

Industrial production was unchanged in October after decreasing 0.2 percent in September. Although the level of industrial production in September was the same as the previous estimate, revisions to the index for utilities raised the rate of change in total industrial production in August and lowered it in September.

In October, manufacturing output increased 0.2 percent, and mining posted a gain of 2.1 percent for its largest increase since March 2014. The index for utilities dropped 2.6 percent, as warmer-than-normal temperatures reduced the demand for heating.

At 104.3 percent of its 2012 average, total industrial production in October was 0.9 percent lower than its year-earlier level. Capacity utilization for the industrial sector edged down 0.1 percentage point in October to 75.3 percent, a rate that is 4.7 percentage points below its long-run (1972-2015) average.

-

14:15

U.S.: Industrial Production (MoM), October 0.0% (forecast 0.2%)

-

14:15

U.S.: Industrial Production YoY , October -0.9%

-

14:15

U.S.: Capacity Utilization, October 75.3% (forecast 75.5%)

-

13:59

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

173

-0.13(-0.0751%)

2178

ALCOA INC.

AA

29.86

-0.35(-1.1586%)

1722

ALTRIA GROUP INC.

MO

61.76

-0.05(-0.0809%)

812

Amazon.com Inc., NASDAQ

AMZN

738

-5.24(-0.705%)

22896

American Express Co

AXP

72.01

-0.46(-0.6347%)

2611

Apple Inc.

AAPL

106.3

-0.81(-0.7562%)

52645

Barrick Gold Corporation, NYSE

ABX

15.62

0.04(0.2567%)

76156

Boeing Co

BA

147.95

-0.16(-0.108%)

101

Caterpillar Inc

CAT

93.99

-0.45(-0.4765%)

8463

Chevron Corp

CVX

173

-0.13(-0.0751%)

2178

Cisco Systems Inc

CSCO

31.63

-0.07(-0.2208%)

16419

Citigroup Inc., NYSE

C

54.77

-0.68(-1.2263%)

38087

Deere & Company, NYSE

DE

90.9

-0.35(-0.3836%)

436

E. I. du Pont de Nemours and Co

DD

68.43

-0.21(-0.3059%)

1000

Exxon Mobil Corp

XOM

86.5

-0.32(-0.3686%)

503

Facebook, Inc.

FB

114.25

-2.95(-2.5171%)

505526

Ford Motor Co.

F

12

-0.04(-0.3322%)

729

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.72

-0.27(-1.9299%)

106368

General Electric Co

GE

30.65

-0.10(-0.3252%)

1967

Goldman Sachs

GS

209

-2.19(-1.037%)

26820

Google Inc.

GOOG

753.67

-4.82(-0.6355%)

3747

Home Depot Inc

HD

123.6

-0.80(-0.6431%)

15820

Intel Corp

INTC

34.9

-0.01(-0.0286%)

3506

International Paper Company

IP

47.81

0.06(0.1257%)

1625

Johnson & Johnson

JNJ

116.35

0.03(0.0258%)

1215

JPMorgan Chase and Co

JPM

78.6

-0.76(-0.9577%)

82486

Microsoft Corp

MSFT

58.75

-0.12(-0.2038%)

15336

Nike

NKE

49.98

-0.15(-0.2992%)

1800

Pfizer Inc

PFE

32.15

-0.08(-0.2482%)

14616

Starbucks Corporation, NASDAQ

SBUX

54.5

-0.09(-0.1649%)

1755

Tesla Motors, Inc., NASDAQ

TSLA

182.66

-1.11(-0.604%)

13164

The Coca-Cola Co

KO

41.3

-0.14(-0.3378%)

1255

Twitter, Inc., NYSE

TWTR

18.95

-0.03(-0.1581%)

52201

United Technologies Corp

UTX

107

-0.02(-0.0187%)

100

UnitedHealth Group Inc

UNH

151.5

-0.73(-0.4795%)

200

Verizon Communications Inc

VZ

47.33

-0.04(-0.0844%)

9159

Visa

V

78.4

-0.005(-0.0064%)

1124

Wal-Mart Stores Inc

WMT

72.2

0.78(1.0921%)

12413

Walt Disney Co

DIS

98.6

0.90(0.9212%)

45399

Yahoo! Inc., NASDAQ

YHOO

40.05

-0.16(-0.3979%)

2678

Yandex N.V., NASDAQ

YNDX

18.2

-0.07(-0.3831%)

12800

-

13:50

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0700 (EUR 525m) 1.0800 (645m) 1.0875 (253m) 1.0900 (1.22bn) 1.1000 (1.54bn)

USDJPY 105.00 (1.0bn) 106.00 (336m) 108.50 (255m)

AUDUSD 0.7625-30 (AUD 278m) 0.7650 (202m)

NZDUSD 0.7100-05 (NZD 343m)

USDCAD 1.3255 (USD 371m) 1.3425 (485m) 1.3500 (216m) 1.3650 (381m)

EUR/SEK: 9.8000 (EUR 329m)

-

13:43

Upgrades and downgrades before the market open

Upgrades:

Walt Disney (DIS) upgraded to Buy from Hold at Deutsche Bank

Downgrades:

Other:

Home Depot (HD) target raised to $146 from $145 at RBC Capital Mkts

-

13:36

Canadian manufacturing sales rose for the fourth consecutive month

Manufacturing sales rose for the fourth consecutive month, up 0.3% to $51.5 billion in September. The gain reflected higher sales in the transportation equipment and fabricated metal industries.

Sales were up in 12 of 21 industries, representing 70.1% of the total manufacturing sector.

In constant dollar terms sales edged down 0.2%, indicating that lower volumes of manufactured goods were sold in September. Prices for the manufacturing sector rose 0.4% in September according to the Industrial Product Price Index.

-

13:33

US producer prices unchanged in October

The Producer Price Index for final demand was unchanged in October, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices rose 0.3 percent in September and were unchanged in August. On an unadjusted basis, the final demand index increased 0.8 percent for the 12 months ended in October, the largest 12-month rise since advancing 0.9 percent in December 2014.

Within final demand in October, a 0.4-percent increase in the index for final demand goods offset a 0.3-percent decline in prices for final demand services.

Prices for final demand less foods, energy, and trade services edged down 0.1 percent in October after rising 0.3 percent in both August and September. For the 12 months ended in October, the index for final demand less foods, energy, and trade services advanced 1.6 percent, the largest increase since climbing 1.7 percent for the 12 months ended September 2014. -

13:30

Canada: Manufacturing Shipments (MoM), September 0.3% (forecast 0.1%)

-

13:30

U.S.: PPI excluding food and energy, m/m, October -0.2% (forecast 0.2%)

-

13:30

U.S.: PPI excluding food and energy, Y/Y, October 1.2% (forecast 1.5%)

-

13:30

U.S.: PPI, y/y, October 0.8% (forecast 1.2%)

-

13:30

U.S.: PPI, m/m, October 0.0% (forecast 0.3%)

-

13:06

Fed's Neel Kashkari Rolls Out Blueprint for Ending 'Too Big to Fail' Banks

-

13:00

Orders

EUR/USD

Offers 1.0730 1.0750-60 1.0780 1.0800 1.0825-30 1.0850 1.0865 1.0900 1.0925-301.0950

Bids 1.0700 1.0680 1.0650 1.0630 1.0600

GBP/USD

Offers 1.2500 1.2530 1.2550 1.2580-85 1.2600 1.2620 1.2650

Bids 1.2450 1.2435 1.2420 1.2400 1.2375-80 1 .2350 1.2330 1.2300

EUR/GBP

Offers 0.8600-05 0.8620-25 0.8660 0.8680-85 0.8700 0.8730 0.8750

Bids 0.8565-70 0.8550 0.8500 0.8480 0.8450

EUR/JPY

Offers 117.50 118.00 118.45-50 119.00 119.50 120.00

Bids 117.00 116.80 116.50 116.30 116.00 115.80 115.60 115.30 115.00

USD/JPY

Offers 109.20-25 109.35 109.50 109.80 110.00 110.20

Bids 108.75-80 108.50 108.20 108.00 107.70-75 107.50 107.30 107.00

AUD/USD

Offers 0.7570 0.7585 0.7600 0.7630 0.7660 0.7685 0.7700 0.7730 0.7750

Bids 0.7520 0.7500 0.7475-80 0.7450 0.7420-25 0.7400

-

12:05

WSE: Afternoon comment

In the first half of today's trading the WIG20 index broke out the forenoon consolidation and went on daily maxima, at which were some problems with the continuation of growth. Of course, not conducive to us is the exterior atmosphere with a predominance of red color on the main Euroland parquets and the weakening of the Polish zloty.

At the halfway point of today's quotations the WIG20 index reached the level of 1,760 points (+ 0.34%). The turnover in the index of the largest companies was amounted to PLN 270 million.

-

12:00

Major stock indices in Europe trading lower

European stocks started in the green zone but soon moved into negative territory. The pressure on the indices put renewed rise in bond yields and falling oil prices. Investors' attention is also focused on corporate accountability and the political situation in the United States.

A slight effect on the dynamics of trade had statistical data from the UK. The Office for National Statistics reported that the unemployment rate declined in the first three months after Brexit, reaching at the same time the lowest value in the last 11 years. According to the data, in the period from July to September, the unemployment rate dropped to 4.8 percent from 4.9 percent in the previous three-month period. Meanwhile, the number of employed increased by 49,000 in the period from July to September, which is the weakest increase since January-February this year. The report also showed that the number of people claiming unemployment benefits rose in October by 9800, recording the largest increase since May. The number of applications for the previous month was revised to 5600 compared with the original estimate of 700. The ONS said that the total income of workers, including bonuses, increased by 2.3 percent per annum in the period from July to September. Last rate of growth coincided with a change in the previous three months. Economists had expected an increase of 2.4 percent. Excluding bonuses, earnings rose by 2.4 per cent per annum, registering the fastest growth during the year and confirming experts' assessments.

The composite index of the largest companies in the region Stoxx Europe Index 600 added 0.1 percent. Earlier today, the index showed an increase of 0.6 percent.

Capitalization of Prudential rose 1.8 percent after the insurer said it will increase the dividend on the background of the jump in sales in Asia.

Bouygues shares rose 4.9 percent, as the French conglomerate reported a higher-than-expected net profit for the first nine months of this year.

Bayer shares fell by 5 percent, pulling down shares of chemical companies.

The price of Wirecard securities, a German operator of payment systems, rose by 6.5 percent as profit forecasts for 2017 exceeded the estimates of some analysts.

Electrolux quotes jumped 1.4 percent after data showed that US shipments of household appliances rose in October. Recall, the Swedish manufacturer of dishwashers and cookers gets about a third of its revenue from North America.

Hugo Boss AG shares fell 7 percent, as the company warned of slowing the expansion of its store network.

At the moment:

FTSE 100 6778.48 -14.26 -0.21%

DAX -31.82 10703.32 -0.30%

CAC 40 4521.57 -14.96 -0.33%

-

11:50

Bullard: There would have to be a surprise at this point for the Fed not to hike in Dec - Forexlive

-

10:23

Swiss economic sentiment continues to improve

The ZEW-CS Indicator for the economic sentiment in Switzerland continues to improve in November 2016. Compared to the previous month, it increased by 3.7 points to a current reading of 8.9 points.

This marks the third successive rise of the indicator. In contrast, the assessment of the current economic situation in Switzerland deteriorates: the corresponding indicator declines by 3.2 points to a level of 14.7 points.

Almost three quarters of the surveyed experts expect the economic development to remain unchanged within the next six months. Furthermore, a large majority of 85 per cent of the respondents considers the current economic situation to be "normal".

-

10:05

Oil is trading in the red zone

This morning, the New York futures for Brent dropped 0.62% to $ 46.66 and WTI fell 0.63% to $ 45.52 per barrel. Thus, the black gold is trading lower, correcting after the recent rally. Oil rose yesterday because OPEC members are preparing to renew the efforts for reaching a production cut.

-

10:01

Switzerland: Credit Suisse ZEW Survey (Expectations), November 8.9

-

10:01

Switzerland: Credit Suisse ZEW Survey (Expectations), November 8.9

-

09:36

UK average weekly earnings rose less than expected. GBP/USD little changed

Average weekly earnings for employees in Great Britain in nominal terms (that is, not adjusted for price inflation) increased by 2.3% including bonuses and by 2.4% excluding bonuses compared with a year earlier.

-

09:34

UK unemployment rate decline in September

There were 31.80 million people in work, 49,000 more than for April to June 2016 and 461,000 more than for a year earlier.

There were 23.24 million people working full-time, 350,000 more than for a year earlier. There were 8.56 million people working part-time, 110,000 more than for a year earlier.

The unemployment rate was 4.8%, down from 5.3% for a year earlier and the lowest since July to September 2005. The unemployment rate is the proportion of the labour force (those in work plus those unemployed) that were unemployed.

-

09:30

United Kingdom: ILO Unemployment Rate, September 4.8% (forecast 4.9%)

-

09:30

United Kingdom: Claimant count , October 9.8 (forecast 2.0)

-

09:30

United Kingdom: Average Earnings, 3m/y , September 2.3% (forecast 2.4%)

-

09:30

United Kingdom: Average earnings ex bonuses, 3 m/y, September 2.4% (forecast 2.4%)

-

08:47

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0700 (EUR 525m) 1.0800 (645m) 1.0875 (253m) 1.0900 (1.22bn), 1.1000 (1.54bn)

USD/JPY 105.00 (1.0bn) 106.00 (336m) 108.50 (255m)

AUD/USD 0.7625-30 (AUD 278m) 0.7650 (202m)

NZD/USD 0.7100-05 (NZD 343m)

USD/CAD 1.3255 (USD 371m) 1.3425 (485m) 1.3500 (216m) 1.3650 (381m)

EUR/SEK: 9.8000 (EUR 329m)

-

08:43

Major stock exchanges trading mixed: FTSE + 0.2%, DAX -0.1%, CAC40 + 0.2%, FTMIB + 0.3%, IBEX + 0.4%

-

08:24

Today’s events

-

At 14:00 GMT the Bank of England Deputy Governor for Financial Stability John Cunliffe deliver a speech

-

At 17:05 GMT the Bank of Canada Deputy Governor Timothy Lane will deliver a speech

-

At 22:30 GMT FOMC members Patrick T. Harker will deliver a speech

-

-

08:21

WSE: After opening

WIG20 index opened at 1757.61 points (+0.20%)*

WIG 47725.58 0.31%

WIG30 2040.04 0.42%

mWIG40 3983.78 0.02%

*/ - change to previous close

The night strengthening of the Polish currency is a thing of the past. On the threshold of the session on the Warsaw Stock Exchange EURPLN and USDPLN pairs gained in value. Investors on the spot market choose the optimistic scenario and ignore the weakening of the zloty. The market focuses on the belief that after days of downward pressure on the emerging markets, there is room for correction of depreciation, which element was Monday's slump on the WSE. Above all of the first line companies positively stands out in the PGNiG, Tauron (WSE: TPE), KGHM and Orange (WSE: OPL). The WIG20 index quickly enough reports around yesterday's highs.

After fifteen minutes of trading the WIG20 index was at the level 1,761 points (+ 0.41%).

-

08:07

Fed's Bullard: December Rate Rise Would Move Policy to Neutral Setting

-

Infrastructure Spending May Raise U.S. Productivity

-

Medium-Term Growth Prospects May Be Affected by Trump Policies

-

U.S. Monetary Policy Outlook Has Not Changed After Election

-

-

08:04

EUR/USD Falls to 11.5 Month Low of $1.0700

-

07:47

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.3%, CAC 40 + 0.4%, FTSE + 0.4%

-

07:28

Options levels on wednesday, November 16, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1027 (2569)

$1.0948 (2461)

$1.0882 (1085)

Price at time of writing this review: $1.0741

Support levels (open interest**, contracts):

$1.0682 (4148)

$1.0648 (4044)

$1.0599 (3896)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 65773 contracts, with the maximum number of contracts with strike price $1,1400 (6082);

- Overall open interest on the PUT options with the expiration date December, 9 is 57588 contracts, with the maximum number of contracts with strike price $1,0900 (4148);

- The ratio of PUT/CALL was 0.88 versus 0.87 from the previous trading day according to data from November, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.2803 (1223)

$1.2705 (1708)

$1.2608 (1538)

Price at time of writing this review: $1.2496

Support levels (open interest**, contracts):

$1.2391 (1461)

$1.2294 (3897)

$1.2196 (1216)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 34694 contracts, with the maximum number of contracts with strike price $1,3400 (2560);

- Overall open interest on the PUT options with the expiration date December, 9 is 36371 contracts, with the maximum number of contracts with strike price $1,2300 (3897);

- The ratio of PUT/CALL was 1.05 versus 1.04 from the previous trading day according to data from November, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:22

WSE: Before opening

Tuesday's session on the New York stock exchanges brought the seventh time in a row the historical record of the Dow Jones Industrial, which rose by 0.29 percent, the S&P 500 gain by 0.75 percent and the Nasdaq Comp. increased by 1.10 percent. Tuesday's sessions can be seen as an attempt to return to the increases, which helped macro data and a little less pressure from the debt market. In the morning, rising also the Japanese Nikkei. On the green side are also contracts for the S&P500 and DAX, thus the current atmosphere in the markets shows that the day in Europe will start from modest increases.

From the point of view of the Warsaw market, the WSE and the Polish zloty have recently been victims of more attractive assets from developed markets and poor attitude to other emerging markets. Although the night weakening of the dollar and strengthening of the zloty favors having increased at the opening of today's session. Bulls should help also defended yesterday the support in the area of 1,750 points.

-

07:05

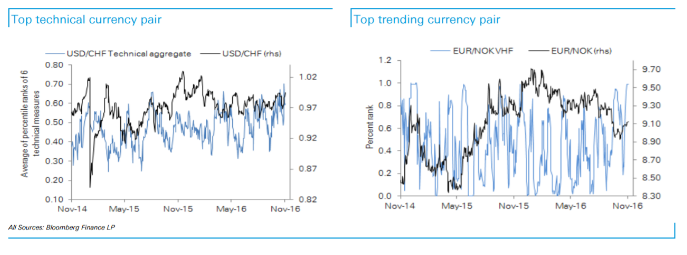

Deutsche Bank says that the best trade is to follow USD/CHF higher

"After the US election surprise, the rise in treasury yields on expectations of fiscal stimulus has led to strengthening of dollar across G10 currency pairs which has held to a rise in trendiness across G10 pairs.

Among G10 currencies, USD/CHF is our top technical currency pair. The pair is highly trending as per VHF metrics and has broken new ground to the upside. The cross is the least stretched among G10 currency pairs from a RSI perspective and has smooth price action as measured by realized vol.

EUR/USD is also trending and is breaking new ground (100 percentile) but it is relatively stretched as per RSI metrics.

Similarly USD/JPY, EUR/GBP and USD/CAD are trending according to VHF metrics and breaking new ground but are highly stretched from an RSI perspective".

Copyright © 2016 DB, eFXnews™

-

07:02

Former executive director of the Bank of Japan, Kazuo Momma: BOJ leadership still too optimistic about the time frames for achieving the inflation target

During his interview with Bloomberg TV, Kazuo Momma said he did not agree with the official version of the guidance. In addition, added that further stimulus measures , "not needed and do not needed in the foreseeable future."

-

06:55

Westpac leading economic index demonstrates a positive trend

The index of leading economic indicators from Australia, published by the University of Melbourne, rose 0.1% in October as in September. This index tracks the performance of nine indicators of economic activity, including share prices. However, today's figure was insignificant and did not affect the Australian dollar.

The leading index, which indicates the likely pace of economic activity relative to trend from three to nine months into the future, fell from + 0.63% in September to +0.43% in October. Although the growth rate slowed slightly, the index still shows a clear positive signal for the near-term economic outlook.

-

06:46

BOJ Kuroda Watching Regional Banks Suffering from Low Rates

-

06:45

Sales of New Motor Vehicle decline in Australia

-

The October 2016 trend estimate (98,997) increased by 0.3% when compared with September 2016.

-

When comparing national trend estimates for October 2016 with September 2016, sales for Passenger vehicles and Other vehicles decreased by 0.7% and 0.1% respectively. By contrast, sales for Sports utility vehicles increased by 1.4%.

-

The largest upward movement across all states and territories, on a trend basis, was in Tasmania (2.9%), continuing an upward trend which commenced in May 2016.

-

The largest downward movement across all states and territories, on a trend basis, was in the Northern Territory (-1.5%).

-

-

06:43

Australian wage index fell in the third quarter

The wage index was 0.4%, lower than the previous value, and lower than analysts forecast of 0.5% in the third quarter. In annual terms, the indicator was also lower than the forecast of 2.0%, dropping to 1.9% from the previous value of 2.1%, which was the lowest level since data collection began in 1997.

-

00:32

Australia: New Motor Vehicle Sales (MoM) , October -2.4%

-

00:32

Australia: Wage Price Index, y/y, Quarter III 1.9% (forecast 2.0%)

-

00:32

Australia: New Motor Vehicle Sales (YoY) , October 1.2%

-

00:31

Australia: Wage Price Index, q/q, Quarter III 0.5% (forecast 0.5%)

-