Market news

-

23:31

Australia: Leading Index, October 0.1%

-

23:30

Commodities. Daily history for Nov 15’2016:

(raw materials / closing price /% change)

Oil 45.75-0.13%

Gold 1,228.40+0.32%

-

23:29

Stocks. Daily history for Nov 15’2016:

(index / closing price / change items /% change)

Nikkei 225 17,668.15 -4.47 -0.03%

Shanghai Composite 3,206.73 -3.64 -0.11%

S&P/ASX 200 5,326.20 0.00 0.00%

FTSE 100 6,792.74 +39.56 +0.59%

CAC 40 4,536.53 +27.98 +0.62%

Xetra DAX 10,735.14 +41.45 +0.39%

S&P 500 2,180.39 +16.19 +0.75%

Dow Jones Industrial Average 18,923.06 +54.37 +0.29%

S&P/TSX Composite 14,756.10 +157.65 +1.08%

-

23:28

Currencies. Daily history for Nov 15’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0722 -0,15%

GBP/USD $1,2454 -0,28%

USD/CHF Chf1,0016 +0,37%

USD/JPY Y109,19 +0,71%

EUR/JPY Y117,07 +0,58%

GBP/JPY Y135,97 +0,43%

AUD/USD $0,7557 +0,08%

NZD/USD $0,7099 -0,23%

USD/CAD C$1,3446 -0,81%

-

23:00

Schedule for today, Wednesday, Nov 16’2016

00:30 Australia New Motor Vehicle Sales (MoM) October 2.5%

00:30 Australia New Motor Vehicle Sales (YoY) October 0.8%

00:30 Australia Wage Price Index, q/q Quarter III 0.5% 0.5%

00:30 Australia Wage Price Index, y/y Quarter III 2.1% 2.0%

09:30 United Kingdom Average Earnings, 3m/y September 2.3% 2.4%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y September 2.3% 2.4%

09:30 United Kingdom Claimant count October 0.7 2.0

09:30 United Kingdom ILO Unemployment Rate September 4.9% 4.9%

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) November 5.2

13:30 Canada Manufacturing Shipments (MoM) September 0.9% 0.1%

13:30 U.S. PPI excluding food and energy, m/m October 0.2% 0.2%

13:30 U.S. PPI excluding food and energy, Y/Y October 1.2% 1.5%

13:30 U.S. PPI, m/m October 0.3% 0.3%

13:30 U.S. PPI, y/y October 0.7% 1.2%

14:15 U.S. Capacity Utilization October 75.4% 75.5%

14:15 U.S. Industrial Production (MoM) October 0.1% 0.2%

14:15 U.S. Industrial Production YoY October -1%

15:00 U.S. NAHB Housing Market Index November 63 63

15:30 U.S. Crude Oil Inventories November 2.432

21:00 U.S. Total Net TIC Flows September 73.8

21:00 U.S. Net Long-term TIC Flows September 48.3

21:45 New Zealand Retail Sales, q/q Quarter III 2.3%

21:45 New Zealand Retail Sales YoY Quarter III 6%

21:45 New Zealand PPI Input (QoQ) Quarter III 0.9%

21:45 New Zealand PPI Output (QoQ) Quarter III 0.2%

-

20:06

DJIA 18899.81 31.12 0.16%, NASDAQ 5282.89 64.49 1.24%, S&P 500 2178.73 14.53 0.67%

-

17:00

European stocks closed: FTSE 6792.74 39.56 0.59%, DAX 10735.14 41.45 0.39%, CAC 4536.53 27.98 0.62%

-

16:46

WSE: Session Results

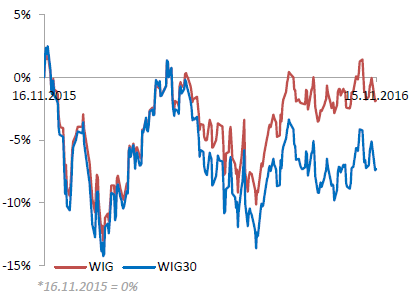

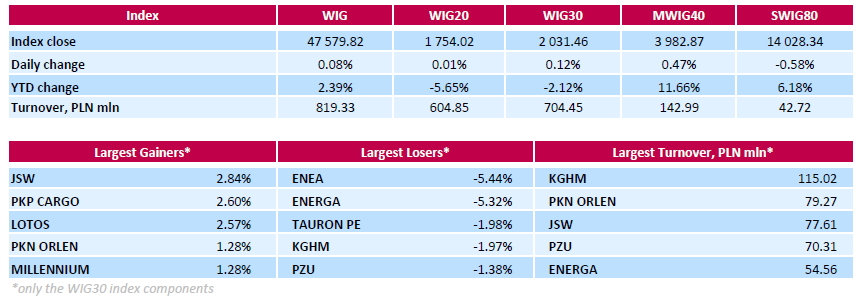

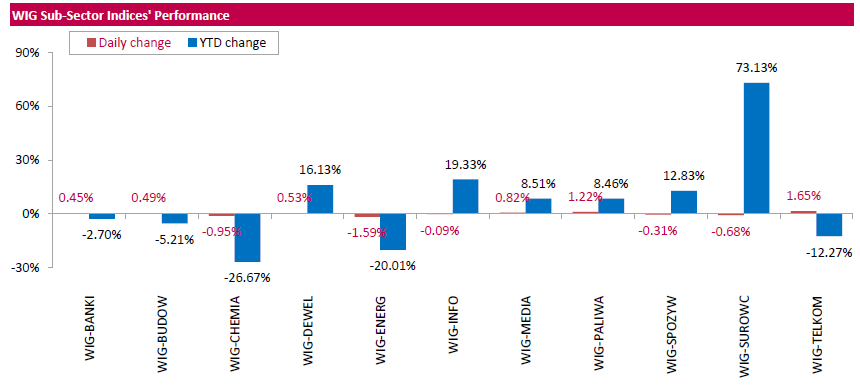

Polish equity market closed flat on Tuesday. The broad market measure, the WIG Index, edged up 0.08%. Sector performance within the WIG Index was mixed. Telecoms (+1.65%) outperformed, while utilities (-1.59%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, advanced 0.12%. 18 out of all 30 index components returned gains, with the way up led by coking coal miner JSW (WSE: JSW), which climbed by 2.84%, helped by the announcement the stock will join MSCI Poland Index at market close on November 30th. Other major outperformers were railway freight transport operator PKP CARGO (WSE: PKP), bank MILLENNIUM (WSE: MIL) and two oil refiners LOTOS (WSE: LTS) and PKN ORLEN (WSE: PKN), which added between 1.28% and 2.6%. On the contrary, utilities names ENEA (WSE: ENA) and ENERGA (WSE: ENG) were hit the hardest, down 5.44% and 5.32% respectively, as it was announced that the stocks will be removed from MSCI's benchmark country index.

-

16:18

Wall Street. Major U.S. stock-indexes mixed

U.S. stock-indexes S&P 500 and Nasdaq rose on Tuesday, helped by a recovery in tech stocks, while the Dow Jones Industrial average fell after rising for six straight days. S&P 500 and Dow had rallied in the past week since the shock victory of Donald Trump in the U.S. election on expectations of higher fiscal spending and lower regulations. However, investors remain uncertain about Trump's policies and are also keeping an eye on key appointments in his administration.

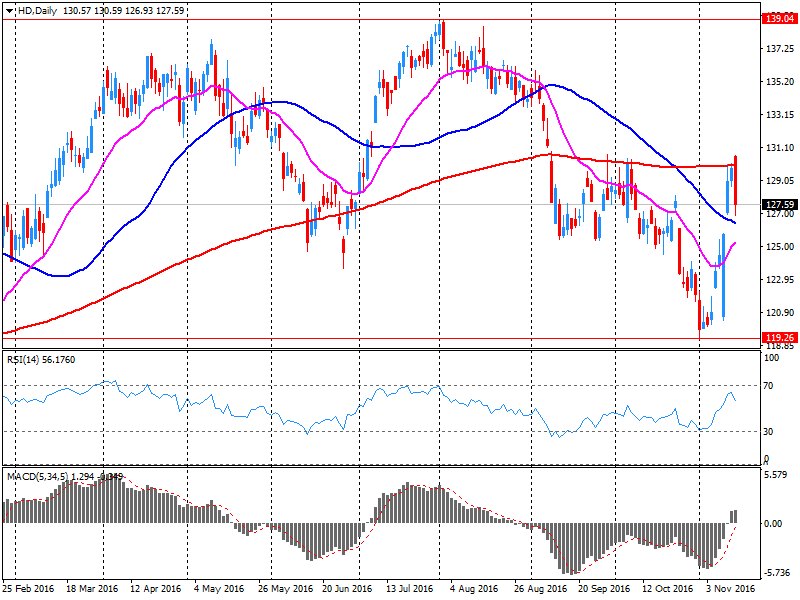

Dow stocks mixed (15 vs 15). Top gainer - Verizon Communications Inc. (VZ, +1.97%). Top loser - The Home Depot, Inc. (HD, -2.04%).

S&P sectors also mixed. Top gainer - Utilities (+1.4%). Top loser - Conglomerates (-2.1%).

At the moment:

Dow 18778.00 -44.00 -0.23%

S&P 500 2168.25 +7.75 +0.36%

Nasdaq 100 4760.50 +66.00 +1.41%

Oil 45.00 +1.68 +3.88%

Gold 1222.20 +0.50 +0.04%

U.S. 10yr 2.22 +0.00

-

15:55

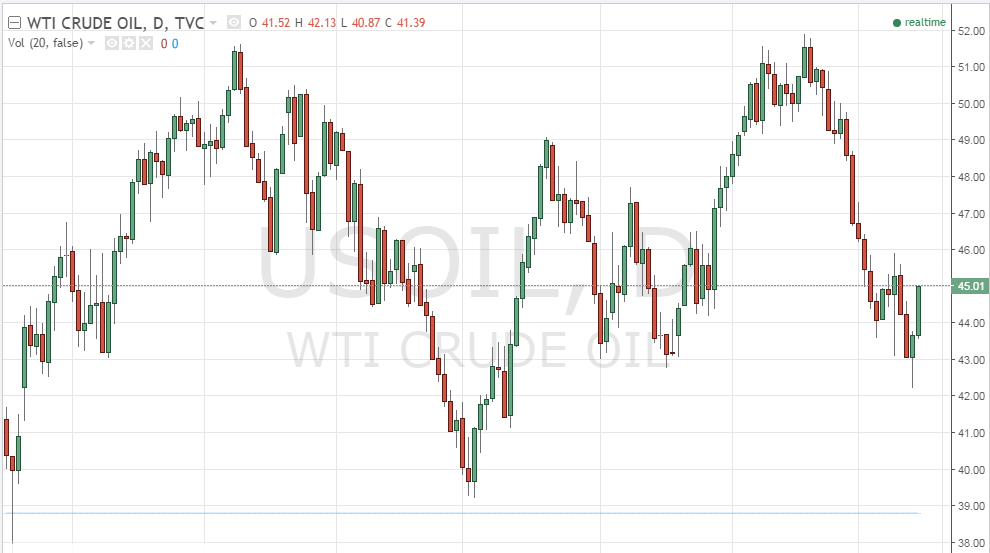

Oil rallied amid renewed expectations that OPEC will agree to cut production

Crude oil rallied, rebounding from significant recent losses amid renewed expectations that OPEC will agree to cut production.

Dire warnings from the IEA about the worsening global supply glut may compel Iran and others to go along will some output quotas.

Iran has balked at joining major producers Saudi Arabia and Russia in making meaningful cuts, but with oil heading near $40 it is thought Tehran will soon budge.

WTI light sweet crude oil for December was down $1.38 to $44.72 a barrel.

The American Petroleum Institute delivers its U.S. inventories survey this afternoon. The past few weeks have shown stockpiles rising at a troubling pace.

-

15:05

US business inventories rose less than expected

Sales: The U.S. Census Bureau announced today that the combined value of distributive trade sales and manufacturers' shipments for September, adjusted for seasonal and trading-day differences but not for price changes, was estimated at $1,314.6 billion, up 0.7 percent (±0.2%) from August 2016 and was up 0.8 percent (±0.4%) from September 2015.

Inventories: Manufacturers' and trade inventories, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $1,818.7 billion, up 0.1 percent (±0.1%)* from August 2016 and were up 0.6 percent (±0.6%)* from September 2015.

Inventories/Sales Ratio: The total business inventories/sales ratio based on seasonally adjusted data at the end of September was 1.38. The September 2015 ratio was 1.39.

-

15:00

U.S.: Business inventories , September 0.1% (forecast 0.1%)

-

14:56

Fed's Tarullo does not see recession risk particularly high

-

14:54

Change in GDT Price Index from previous event +4.5%. NZD/USD unchanged

-

Average price (USD/MT, FAS: )$3,519

-

-

14:52

WSE: After start on Wall Street

Published today in the US retail sales data surprise very positively both in the month of October, and the earlier one due to the revision of data from September, up from 0.6% to 1%. Data surprise no matter how we look at them. Very well performs the car sales, but without it sales rise by 0.8%.Generally in annual relation sales grew by a 4.3%. These data strengthen the dollar, because the December rate hike is clearly closer, which still should be treated as the base scenario.

The afternoon phase session on the Warsaw market has brought declines and all major segments are reporting on the red side of the market. The turnover is not especially impressive, also the day variability is not large. It seems that the better US data coupled with the re-strengthening of the dollar was badly received in the emerging markets, in Western Europe, we may not see any new downward pressure.

Wall Street opened with an increase of 0.2% and the first trades run fairly quietly. At the same time the behavior of the US market has ceased to be any signpost for the Warsaw Stock Exchange, which has chosen a completely opposite direction.

An hour before the end of the session the WIG20 index was at the level of 1,750 points (-0,22%).

-

14:32

U.S. Stocks open: Dow -0.08%, Nasdaq +0.43%, S&P +0.21%

-

14:22

December FED Rate-Hike Odds Rise to 91%

-

14:11

Before the bell: S&P futures +0.25%, NASDAQ futures +0.75%

U.S. stock-index futures advanced. Investors assessed data October retail sales in the U.S.

Global Stocks:

Nikkei 17,668.15 -4.47 -0.03%

Hang Seng 22,323.91 +101.69 +0.46%

Shanghai 3,206.73 -3.64 -0.11%

FTSE 6,789.08 +35.90 +0.53%

CAC 4,518.75 +10.20 +0.23%

DAX 10,705.27 +11.58 +0.11%

Crude $44.61 (+2.98%)

Gold $1,225.50 (+0.31%)

-

13:50

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0880 (EUR 1.12bn) 1.0900 (874m) 1.1000 (1.41bn) 1.1045-50 (E1.1bn)

USDJPY 106.00 (683m) 108.00 (990m) 108.50(490m)

GBPUSD 1.2500 (GBP 562m) 1.2550 (285m) 1.3000 (400m)

EURGBP 0.8540 (EUR 332m)

USDCHF 0.9800 (USD 200m) 0.9900 (305m 0.9950 (230m)

AUDUSD 0.7460 (AUD 225m) 0.7500 (383m) 0.7610 (210m) 0.7650 (336m) 0.7750 (658m)

USDCAD 1.3500 (632m) 1.3600 (241m) 1.3775 (200m)

NZDUSD 0.7075 (NZD 247m)

EURJPY 116.25 (EUR 279m)

AUDJPY 82.00 (AUD 902m)

EUR/SEK: 9.7700 (EUR 200m)

USDSGD 1.4150 (USD 425m) 1.4200 (600m)

-

13:49

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

Amazon.com Inc., NASDAQ

AMZN

731.53

12.46(1.7328%)

47681

American Express Co

AXP

72.17

-0.25(-0.3452%)

123

AMERICAN INTERNATIONAL GROUP

AIG

64.03

-0.42(-0.6517%)

404

Apple Inc.

AAPL

106.49

0.78(0.7379%)

109906

AT&T Inc

T

36.35

0.22(0.6089%)

5488

Barrick Gold Corporation, NYSE

ABX

117

-0.86(-0.7297%)

532

Boeing Co

BA

149.91

-0.08(-0.0533%)

1585

Caterpillar Inc

CAT

94

-0.17(-0.1805%)

6883

Chevron Corp

CVX

107.39

0.80(0.7505%)

13802

Cisco Systems Inc

CSCO

31.5

0.13(0.4144%)

1797

Citigroup Inc., NYSE

C

85.84

0.56(0.6567%)

4286

Deere & Company, NYSE

DE

117

-0.86(-0.7297%)

532

E. I. du Pont de Nemours and Co

DD

68.79

-0.28(-0.4054%)

221

Exxon Mobil Corp

XOM

85.84

0.56(0.6567%)

4286

Facebook, Inc.

FB

117.25

2.17(1.8856%)

225962

FedEx Corporation, NYSE

FDX

94

-0.17(-0.1805%)

6883

Ford Motor Co.

F

85.84

0.56(0.6567%)

4286

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.55

-0.37(-2.658%)

219831

General Electric Co

GE

30.52

0.01(0.0328%)

7367

General Motors Company, NYSE

GM

85.84

0.56(0.6567%)

4286

Goldman Sachs

GS

206.9

-2.28(-1.09%)

23809

Google Inc.

GOOG

747.58

11.50(1.5623%)

13637

Home Depot Inc

HD

128.9

1.23(0.9634%)

169060

Intel Corp

INTC

34.49

0.01(0.029%)

4305

International Business Machines Co...

IBM

158

-0.21(-0.1327%)

537

JPMorgan Chase and Co

JPM

78.7

-0.81(-1.0187%)

89684

McDonald's Corp

MCD

117

-0.86(-0.7297%)

532

Merck & Co Inc

MRK

117

-0.86(-0.7297%)

532

Microsoft Corp

MSFT

58.18

0.45(0.7795%)

42080

Nike

NKE

50.61

0.40(0.7967%)

965

Pfizer Inc

PFE

32.58

0.20(0.6177%)

14363

Procter & Gamble Co

PG

83.05

0.05(0.0602%)

360

Starbucks Corporation, NASDAQ

SBUX

54.01

0.04(0.0741%)

624

Tesla Motors, Inc., NASDAQ

TSLA

182.85

1.40(0.7716%)

13307

The Coca-Cola Co

KO

41.48

0.31(0.753%)

4026

Travelers Companies Inc

TRV

112.25

0.07(0.0624%)

918

Twitter, Inc., NYSE

TWTR

19.21

0.07(0.3657%)

102853

UnitedHealth Group Inc

UNH

151.5

-0.78(-0.5122%)

1100

Verizon Communications Inc

VZ

46.56

0.38(0.8229%)

2463

Visa

V

79.1

0.72(0.9186%)

2641

Walt Disney Co

DIS

97.65

-0.27(-0.2757%)

6602

Yahoo! Inc., NASDAQ

YHOO

40.19

0.89(2.2646%)

2276

Yandex N.V., NASDAQ

YNDX

18.2

0.39(2.1898%)

8140

-

13:41

Upgrades and downgrades before the market open

Upgrades:

Chevron (CVX) upgraded to Buy from Outperform at CLSA

Downgrades:FedEx (FDX) downgraded to Hold from Buy at Stifel

Bank of America (BAC) downgraded to Neutral from Buy at Guggenheim

Other:

Procter & Gamble (PG) resumed with a Market Perform at Wells Fargo

-

13:40

US export prices up 0.5% due to higher agricultural and nonagricultural prices

U.S. import prices advanced 0.5 percent in October, the U.S. Bureau of Labor Statistics reported today, after a 0.2-percent increase in September. The October increase was driven by higher fuel prices which more than offset declining nonfuel prices. The price index for U.S. exports increased 0.2 percent in October following a 0.3-percent advance the previous month.

U.S. export prices increased 0.2 percent in October following a 0.3-percent advance in September. In October, higher agricultural and nonagricultural prices both contributed to the overall advance. Despite the recent increases, prices for U.S. exports fell over the past year, declining 1.1 percent.

The over-the-year drop in export prices was the smallest 12-month decrease since the index fell 0.7 percent in October 2014. -

13:38

Manufacturing activity in the NY region improves

Business activity stabilized in New York State, according to firms responding to the November 2016 Empire State Manufacturing Survey. The headline general business conditions index climbed out of negative territory for the first time in four months, rising eight points to 1.5.

The new orders and shipments indexes also turned positive, rising to 3.1 and 8.5, respectively. Labor market conditions remained weak, with the number of employees and average workweek indexes both at -10.9. The inventories index fell eleven points to -23.6, pointing to a marked decline in inventory levels.

Although price indexes were lower, they remained positive, suggesting a slower pace of growth in both input prices and selling prices. Indexes for the six-month outlook conveyed somewhat less optimism about future conditions than in October.

-

13:36

-

13:34

US retail sales beat expectations. Core up 0.8% in October

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for October, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $465.9 billion, an increase of 0.8 percent (±0.5%) from the previous month, and 4.3 percent (±0.9%) above October 2015.

Total sales for the August 2016 through October 2016 period were up 3.3 percent (±0.7%) from the same period a year ago. The August 2016 to September 2016 percent change was revised from up 0.6 percent (±0.5%) to up 1.0 percent (±0.1%).

Retail trade sales were up 1.0 percent (±0.5%) from September 2016, and up 4.3 percent (±0.7%) from last year. Nonstore retailers were up 12.9 percent (±1.6%) from October 2015, while Miscellaneous stores retailers were up 9.5 percent (±4.2%) from last year.

-

13:30

U.S.: Import Price Index, October 0.5% (forecast 0.4%)

-

13:30

U.S.: Retail sales, October 0.8% (forecast 0.5%)

-

13:30

U.S.: Retail sales excluding auto, October 0.8% (forecast 0.4%)

-

13:30

U.S.: Retail Sales YoY, October 4.3%

-

13:30

U.S.: NY Fed Empire State manufacturing index , November 1.5 (forecast -3)

-

13:03

Fed's Rosengren: Right Now, a December Rate Rise Looks 'Plausible'

-

13:00

Orders

EUR/USD

Offers 1.0825-30 1.0850 1.0865 1.0900 1.0925-30 1.0950 1.0980-85 1.1000

Bids 1.0780 1 .0750 1.0720 1.0700 1.0680 1.0650 1.0630 1.0600

GBP/USD

Offers 1.2480 1.2500 1.2530 1.2550 1.2580-85 1.2600 1.2620 1.2650 1.2685 1.2700

Bids 1.2450 1.2420 1.2400 1.2375-80 1 .2350 1.2330 1.2300

EUR/GBP

Offers 0.8680-85 0.8700 0.8730 0.8750 0.8785 0.8800

Bids 0.8650 0.8630 0.8600 0.8580-85 0.8550 0.8500 0.8450

EUR/JPY

Offers 117.00 117.30 117.50 118.00 118.45-50 119.00

Bids 116.50 116.30 116.00 115.80 115.60 115.30 115.00 114.80 114.50

USD/JPY

Offers 108.35 108.50-55 109.00 109.15-20 109.50 110.00

Bids 107.70-75 107.50 107.30 107.00106.80-75106.50 106.20106.00105.75-80105.50

AUD/USD

Offers 0.7570 0.7585 0.7600 0.7630 0.7660 0.7685 0.7700 0.7730 0.7750

Bids 0.7530 0.7500 0.7475-80 0.7450 0.7420-25 0.7400

-

12:37

Company News: Home Depot (HD) Q3 results beat analysts’ expectations

Home Depot reported Q3 FY 2016 earnings of $1.60 per share (versus $1.36 in Q3 FY 2015), beating analysts' consensus estimate of $1.58.

The company's quarterly revenues amounted to $23.154 bln (+6.1 y/y), slightly beating analysts' consensus estimate of $23.050 bln.

The company also issued guidance for FY2017, forecasting EPS of ~$6.43 (+15.9% y/y; compared to analysts' consensus estimate of $6.33 and up from $6.31 prior guidance) and revenues of $94.1 bln (+6.3% y/y; compared to analysts' consensus estimate of $94.15 bln).

HD rose to $130.07 (+1.88%) in pre-market trading. It reaffirmed FY2016 sales to be up ~4.9% y/y.

-

12:06

WSE: Mid session comment

In the first half of today's trading on the WSE, the morning booster was not specially enlarged. Thus trading, from a technical point of view, is more like stopping the decline than recovery.

In the morning we met the reading of GDP for the third quarter for the domestic economy, which grew by only 2.5% y/y vs. 3.1% in the second quarter. This is worse than forecasts indicating an increase of 2.9%. There was no greater response from the market, which for some time has been around more skeptical about growth forecasts.

A significant turnover is focus today on the companies for which will be made half-yearly revision of participation in the MSCI Poland index.

After the session on November 30, this index will leave Enea (WSE: ENA) and Energa (WSE: ENG), and index will join JSW.

While in the case of JSW and Energa such development was expected, Enea is a negative surprise. As a result, shares of the company stand out negatively, and changes in the other two are not so significant. MSCI Poland index is very important, because foreign funds invest according to it.

In the middle of today's trading the WIG20 index was at the level of 1,765 points and with the turnover of PLN 230 million.

-

12:04

Major stock indices in Europe show gains

European stocks traded higher, receiving support from oil prices, as well as a slight decline in bond yields, which stimulates the demand for risky assets.

Oil has risen by almost 2%, as investors continue to hope that the oil-producing countries will be able to reach an agreement on production cuts. It is reported that the OPEC countries are making final diplomatic efforts to strike a deal to reduce oil production, and Qatar, Algeria and Venezuela seek to resolve conflicts. The final decision should be taken at a meeting of OPEC on November 30 in Vienna. Recall, according to the results of an informal meeting in September in Algeria, OPEC agreed to reduce production in the range of 32,5-33 mln. barrels per day.

Certain influence on the dynamics of trades also provide statistical data from UK and the eurozone. The Office for National Statistics said that consumer price inflation in the UK unexpectedly weakened last month, but producer prices rose at the fastest pace in recent years, which was caused by a large-scale collapse of the pound after Brexit. According to the report, consumer prices rose in October by 0.9 percent compared to the same period of 2015. Analysts had expected an increase of 1.1 percent. Recall, consumer prices increased by 1.0 percent in September. Meanwhile, producer prices rose by 2.1 per cent per annum, which also turned out to be faster than expected (+1.7 percent). In addition, it was the largest increase since April 2012. Costs faced by manufacturers when purchasing raw materials and oil recorded a record monthly jump in October and rose by 4.6 percent. In addition, the report showed that the rate of core consumer price inflation - which excludes changes in prices for energy, food, alcohol and tobacco - has slowed the pace of growth to 1.2 percent from 1.5 percent in September. Economists had expected the index to increase again by 1.5 percent.

The revised data released by Eurostat, showed that economic growth in the euro area remained stable in the third quarter, and confirmed the preliminary estimates presented at the end of October. According to the report, the gross domestic product of 19 countries in the currency bloc rose by 0.3 percent in the third quarter relative to the previous three-month period and increased by 1.6 percent year on year. Last change coincided with forecasts. In addition, the total GDP of the European Union in the third quarter rose by 0.4 percent compared to the second quarter and 1.8 percent year on year. The pace of growth in line with that recorded in the second quarter.

The composite index of the largest companies in the region Stoxx Europe Index 600 shows an increase of 0.1 percent.

Mining companies are on the way for the biggest drop since July, the cause of which was a decline of base metals after a 13 percent rally in the last six sessions. Antofagasta and Rio Tinto fell by at least 4 percent.

The cost of Hennes & Mauritz rose 2.3 percent after the retailer reported a rise in sales in October.

EasyJet shares rose 3.4 percent, as the airline's annual profit exceeded expectations.

Capitalization of TalkTalk Telecom Group fell 6.3 percent against the backdrop of reports that full-year earnings will be near the lower boundary of the previous forecast range.

Vodafone securities fell 0.3 percent as the British mobile operator narrowed the range forecast for full-year earnings.

At the moment:

FTSE 100 +41.64 6794.82 + 0.62%

DAX +0.89 10694.58 + 0.01%

CAC 40 +15.30 4523.85 + 0.34%

-

11:27

Bank of England Carney: Interest rates in the UK may rise or fall depending on the situation

-

The Bank of England is ready to provide support for a technocratic government regarding Brexit

-

Downside and upside risks for the economy

-

Now we can not give clear guidance on the future direction of monetary policy

-

Society needs a clear policy in the crucial moments for the economy

-

The views of MPC members on the factors affecting the economy do not coincide

-

-

10:53

Oil buying intensifies

This morning, the New York futures for Brent rose 1.85% to $ 45.25 and WTI rose 2.33% to $ 44.33 per barrel. Thus, the black gold is trading in the green zone on the background of the US Energy Ministry forecast that show a decrease of production in December. US could reduce the amount of shale oil extraction on the fields of the largest oil and gas regions by 20 thousand barrels per day from November's level - 4.498 million barrels per day. So production could fall near the 2016 lows.

-

10:42

BOE Governor Mark Carney will step down in June 2019. Inflation report hearings

-

Blaming Monetary Policy for Inequality 'A Massive Blame-Deflection Exercise'

-

Prime Minister's Conference Speech Had No Bearing on Decision on Term of Office

-

-

10:40

EU ZEW Economic Sentiment improves

The ZEW Indicator of Economic Sentiment for Germany has increased substantially in November 2016. The index has improved by 7.6 points compared to October, now standing at 13.8 points (long-term average: 24.0 points).

The ZEW Indicator of Economic Sentiment has increased the fourth time in a row - not least due to the positive economic figures seen in the US and China. The renewed increase is indicative of a stronger economic growth in the coming six months. The election of Donald Trump as US President and the resulting political and economic uncertainties, however, have made an impact.

-

10:11

Euro Zone trade balance surplus continue to rise

The first estimate for euro area (EA19) exports of goods to the rest of the world in September 2016 was €176.7 billion, an increase of 2% compared with September 2015 (€173.2 bn). Imports from the rest of the world stood at €150.2 bn, a fall of 2% compared with September 2015 (€154.0 bn). As a result, the euro area recorded a €26.5 bn surplus in trade in goods with the rest of the world in September 2016, compared with +€19.2 bn in September 2015. Intra-euro area trade remained nearly stable at €148.3 bn in September 2016, compared with September 2015. These data are released by Eurostat, the statistical office of the European Union.

-

10:08

Euro Area GDP rose in line with expectations in Q3. EUR/USD still trading under the important weekly open

Seasonally adjusted GDP rose by 0.3% in the euro area (EA19) and by 0.4% in the EU28 during the third quarter of 2016, compared with the previous quarter, according to a flash estimate published by Eurostat, the statistical office of the European Union.

In the second quarter of 2016, GDP also grew by 0.3% and 0.4% respectively. Compared with the same quarter of the previous year, seasonally adjusted GDP rose by 1.6% in the euro area and by 1.8% in the EU28 in the third quarter of 2016, after +1.6% and +1.8% respectively in the previous quarter.

During the third quarter of 2016, GDP in the United States increased by 0.7% compared with the previous quarter (after +0.4% in the second quarter of 2016). Compared with the same quarter of the previous year, GDP grew by 1.5% (after +1.3% in the previous quarter).

-

10:01

Eurozone: ZEW Economic Sentiment, November 15.8 (forecast 14.3)

-

10:00

Eurozone: GDP (QoQ), Quarter III 0.3% (forecast 0.3%)

-

10:00

Eurozone: GDP (YoY), Quarter III 1.6% (forecast 1.6%)

-

10:00

Germany: ZEW Survey - Economic Sentiment, November 13.8 (forecast 8.1)

-

10:00

Eurozone: Trade balance unadjusted, September 26.5 (forecast 22.5)

-

09:34

UK producer prices rose in October

The price of goods bought and sold by UK manufacturers, as estimated by the Producer Price Index, rose again in the year to October 2016. This is the fourth consecutive increase following 2 years of falls and the largest increase since April 2012. Between September and October, total output prices rose 0.6%, compared with an increase of 0.3% the previous month.

Factory gate prices (output prices) for goods produced by UK manufacturers rose 2.1% in the year to October 2016, compared with a rise of 1.3% in the year to September 2016.

Core factory gate prices, which exclude the more volatile food, beverage, tobacco and petroleum products, rose 1.9% in the year to October 2016, compared with a rise of 1.4% in the year to September 2016. -

09:32

UK consumer inflation disappoints

The Consumer Prices Index (CPI) rose by 0.9% in the year to October 2016, compared with a 1.0% rise in the year to September.

Although the rate was slightly lower than in September 2016, it remained higher than the rates otherwise seen since late 2014.

The main downward contributors to the change in the rate were prices for clothing and university tuition fees, which rose by less than they did a year ago, along with falling prices for certain games and toys, overnight hotel stays and non-alcoholic beverages.

These downward pressures were offset by rising prices for motor fuels, and by prices for furniture and furnishings, which fell by less than they did a year ago.

CPIH (not a National Statistic) rose by 1.2% in the year to October 2016, unchanged from September.

-

09:31

United Kingdom: Producer Price Index - Output (MoM), October 0.6% (forecast 0.3%)

-

09:31

United Kingdom: Producer Price Index - Input (MoM), October 4.6% (forecast 2.1%)

-

09:30

United Kingdom: HICP, Y/Y, October 0.9% (forecast 1.1%)

-

09:30

United Kingdom: HICP, m/m, October 0.1% (forecast 0.3%)

-

09:30

United Kingdom: HICP ex EFAT, Y/Y, October 1.2% (forecast 1.5%)

-

09:30

United Kingdom: Producer Price Index - Input (YoY) , October 12.2% (forecast 9.1%)

-

09:30

United Kingdom: Retail prices, Y/Y, October 2.0% (forecast 2.2%)

-

09:30

United Kingdom: Retail Price Index, m/m, October 0.0% (forecast 0.1%)

-

09:30

United Kingdom: Producer Price Index - Output (YoY) , October 2.1% (forecast 1.7%)

-

09:05

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0800 (EUR 985m) 1.0900 (544m) 1.0925 (297m) 1.0945-50 (799m),1.1000 (1.2bn) 1.1020 (1.03bn) 1.1025,(429m) 1.1045-50 (574m), 1.1075 (477m)1.1200 (535m) 1.1230 (572m) 1.1250 (1.62bn)

USD/JPY 103.00 (1.11bn) 104.10 (360m) 104.10-20 (840m), 105.00 (1.03bn) 106.00 (560m) 106.50 (646m)

GBP/USD 1.2500 (GBP 216m) 1.2560 (303m) 1.2625 (356m)

USD/CHF 0.9600 (USD 286m)

AUD/USD 0.7400 (500m) 0.7475 (218m) 0.7600 (308m) 0.7700 (352m)

USD/CAD 1.3200 (540m) 1.3350 (239m) 1.3400 (220m), 1.3600 (431m) 1.3800 (600m)

NZD/USD 0.7200 (NZD 300m) 0.7300 (400m)

EUR/JPY 116.25 (EUR 279m)

-

08:44

ECB, Lautenschlaeger: Excessive Search for Yield Could Lead to New Troubles for Finacial System

-

Must Warn Banks Against Temptation of Propping Up Profits with Too Much Risk

-

Will Conduct Review of Internal Models for Next 3 Years

-

-

08:41

Anglo American Diamond Sales Fall in Line with Seasonal Demand

-

08:36

Major stock exchanges trading in the green zone: FTSE + 0.5%, DAX + 0.3%, CAC40 + 0.4%, FTMIB + 0.4%, IBEX + 0.2%

-

08:16

WSE: After opening

WIG20 index opened at 1757.25 points (+0.19%)*

WIG 47598.31 0.12%

WIG30 2031.09 0.10%

mWIG40 3974.22 0.25%

*/ - change to previous close

The cash market opens with an increase of 0.19% to 1,757 points with modest than yesterday turnover and clear focus on declining values of KGHM. Beginning on these values are going down by more than 2%.

After fifteen minutes of trading the WIG20 was at the level of 1,762 points (+0,49%).

-

08:14

Today’s events

-

At 11:15 GMT RBA Governor Philip Lowe will deliver a speech

-

At 11:30 GMT ECB Member of the Executive Board Sabine Lautenshleger will deliver a speech

-

At 13:00 GMT the Bank of England Governor Mark Carney will deliver a speech

-

At 15:30 GMT FOMC member Eric Rosengren will give a speech

-

At 21:30 GMT the Federal Reserve Vice Chairman Stanley Fischer will deliver a speech

-

-

07:58

French CPI flat in October

In October 2016, the Consumer Prices Index (CPI) was stable over a month, after a downturn by 0.2% in September. Seasonally adjusted, it was unchanged too, after a slight rise in September. Year-on-year, the CPI grew by 0.4% as in the previous month.

This month-on-month stability came from an acceleration in energy prices, offset by a fall in food and services prices. Furthermore, manufactured product prices were unchanged.

-

07:57

Positive start of trading expected on the major stock exchanges in Europe: DAX futures flat, CAC40 + 0.2%, FTSE + 0.2%

-

07:35

Options levels on tuesday, November 15, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1028 (2140)

$1.0951 (2018)

$1.0887 (936)

Price at time of writing this review: $1.0770

Support levels (open interest**, contracts):

$1.0711 (3358)

$1.0688 (4469)

$1.0652 (4207)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 63877 contracts, with the maximum number of contracts with strike price $1,1400 (6074);

- Overall open interest on the PUT options with the expiration date December, 9 is 56637 contracts, with the maximum number of contracts with strike price $1,0900 (4469);

- The ratio of PUT/CALL was 0.87 versus 0.92 from the previous trading day according to data from November, 14

GBP/USD

Resistance levels (open interest**, contracts)

$1.2803 (1223)

$1.2705 (1605)

$1.2608 (1336)

Price at time of writing this review: $1.2489

Support levels (open interest**, contracts):

$1.2391 (1394)

$1.2294 (3745)

$1.2196 (1117)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 34390 contracts, with the maximum number of contracts with strike price $1,3000 (2642);

- Overall open interest on the PUT options with the expiration date December, 9 is 35601 contracts, with the maximum number of contracts with strike price $1,2300 (3745);

- The ratio of PUT/CALL was 1.04 versus 1.02 from the previous trading day according to data from November, 14

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:34

USD/JPY Towards 112 Initial Target; EUR/USD: 1.07 Key Now - Morgan Stanley

"USDJPY support from all sides:

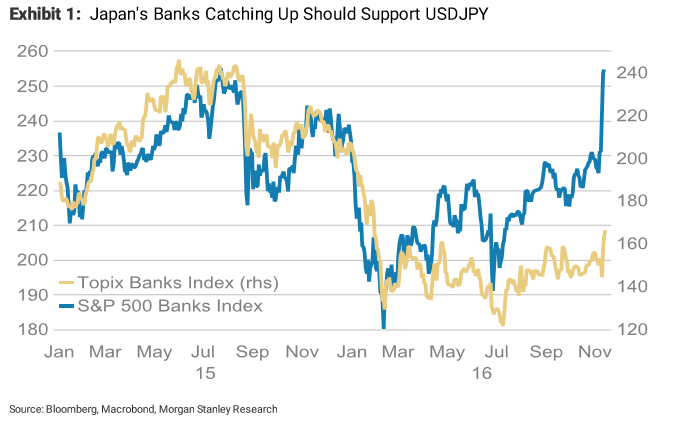

Crossing through a previous high at 107.49, we foresee an initial target of 112. We have often said that higher inflation expectations or steeper yield curves would have been required for USDJPY to turn around. However, the reason for steepening didn't need to come from the Japanese side. The correlation between global bond markets is high, meaning the US 2s10s curve hitting the highest level this year has spilled over into the Japanese curve steepening too. Steepness has been focused on the shorter end of the curve (<10y) as the BoJ's QE purchases are likely to be largest here, adding to JPY weakness.

The Exhibit below shows that Japan's TOPIX banks index still doesn't reflect this new curve dynamic and has been underperforming US banks. Japan's 3Q GDP beating market expectations, rising by 0.5%Q (0.2%Q expected) due to stronger net exports, suggests that a recovery is under way here, which counterintuitively is negative for the currency as more capital is exported abroad. Japan's 10y real yield falling from -0.28% for -0.47% today while US real yields rise has supported USDJPY too.

EURUSD downside limited:

As the market prices in a faster pace of Fed hikes due to expectations of higher growth and inflation, there could also be debates forming about whether the ECB will need to extend its QE programme beyond next year. The US 5y5y inflation swap has hit the highest level this year at 2.47%, allowing the eurozone's equivalent measure to also rise to 1.55%. We expect EURUSD to find support around 1.07.

The real yield differential between the eurozone and the US remains relatively supported, which we think should limit outflows from the eurozone".

Copyright © 2016 Morgan Stanley, eFXnews

-

07:23

WSE: Before opening

Monday's session in the New York stock markets brought mixed feelings. Grouping the blue-chips DJI (+ 0.11%) ended the session sixth time in a row at historical highs. In the red were the S&P 500 (-0.01%) and Nasdaq Comp. (-0.36%). Morning Asian stock markets behavior indicates a certain calming of the situation in the tense recently situation of emerging markets. Contracts in the US slightly lookup and parquets in Europe should open near yesterday's closing.

For the Warsaw market, a problem can be a depreciating copper and its impact on KGHM. A clear weakening of the Polish zloty, which during our holidays lost value, caused that the WIG20 measured in dollars lost yesterday up 4.7% and went down to the lowest levels since July. The WIG20 measured in PLN is close to the support, but the mood remains negative with the risk of continuity of declines.

The macro data calendar will be plentiful today. We will get a preliminary reading of GDP for Poland, the ZEW index in Germany and retail sales in the US. In the face of a very tense situation, the global information will not be critical, but in the case of larger deviations from expectations could attract attention.

-

07:10

Fed's Lacker: Fiscal Stimulus 'Would Bolster Case for Raising Rates'

-

07:10

Fed's Williams Hopes U.S. Continues Current Course of Free Trade

-

07:06

German GDP rose less than expected in Q3

German economic growth is losing some momentum. In the third quarter of 2016, the gross domestic product (GDP) rose 0.2% on the second quarter of 2016 after adjustment for price, seasonal and calendar variations; this is reported by the Federal Statistical Office (Destatis). In the first half of the year, the GDP had increased somewhat more, by 0.4% in the second quarter and 0.7% in the first quarter.

In a quarter-on-quarter comparison (adjusted for price, seasonal and calendar variations), positive contributions were made mainly by domestic final consumption expenditure. The final consumption expenditure of both households and government continued to increase. According to provisional results, fixed capital formation in machinery and equipment was somewhat lower and in construction somewhat higher than in the previous quarter. The development of foreign trade had a downward effect on growth. Exports were slightly down while imports were slightly up compared with the second quarter of 2016.

Economic growth decelerated somewhat also in a year-on-year comparison. The price-adjusted GDP was up by 1.5% in the third quarter of 2016 (1.7% when calendar-adjusted), following a 3.1% increase in the second quarter and a 1.5% increase in the first quarter of 2016 (1.8% and 1.9%, respectively, when calendar-adjusted).

-

07:00

Germany: GDP (QoQ), Quarter III 0.2% (forecast 0.3%)

-

07:00

Germany: GDP (YoY), Quarter III 1.5% (forecast 1.8%)

-

06:51

Consumer confidence in Australia rose

According to data from the ANZ released today, the consumer confidence index in Australia rose this week to the level of 118.2 against 117.8 the previous week. Thus the index rose by + 3.2%. According to the data:

-

it is expected that over the next 12 months the economic situation of households will improve by + 1.2%

-

general economic conditions over the next 5 years to improve by + 3.5%

-

the overall financial situation compared with the previous year worsened to -0.8%

-

-

06:49

Minutes of the November meeting of the Reserve Bank of Australia: Core inflation is expected to return to a normal level

-

Risk assessment around the inflation forecast was "broadly balanced"

-

The likelihood of economic growth in the next few quarters rising

-

The growth of the Australian dollar may complicate economic growth

-

Commodity prices have increased significantly

-

Upward revision of trade prospects are positive for the economy

-

The expected rate of unemployment decreased, but underemployment is still elevated

-

Some signs of rising wages stabilized, but there is considerable uncertainty about the strength of the labor market

-

Much of the uncertainty surrounding the consumption of households, especially the heavily indebted

-

Housing prices have increased markedly in Sydney and Melbourne

-

Sales of housing and lending slowed

-

-

05:42

Global Stocks

European shares closed modestly higher Monday, but gave up beefier gains as oil prices retreated and worries about next month's constitutional referendum weighed on Italian stocks. European equities started Monday in rally mode, with exporters getting a boost as the euro fell, still feeling the effects of Donald Trump's U.S. presidential election win last week.

The Dow Jones Industrial Average edged up to a record-high close on Monday even as the broader stock market came under pressure, with investors seeking more clarity on the policy proposals of President-elect Donald Trump's administration. "It makes sense that stocks took a breather today, as they wait for more concrete plans from the Trump administration," said Kristina Hooper, U.S. investment strategist for Allianz Global Investors.

Asian markets showed resilience Tuesday to the emerging-markets selloff that had been hitting global markets, with shares broadly mixed and Asian currencies gaining some strength.

-