Market news

-

23:29

Stocks. Daily history for Nov 15’2016:

(index / closing price / change items /% change)

Nikkei 225 17,668.15 -4.47 -0.03%

Shanghai Composite 3,206.73 -3.64 -0.11%

S&P/ASX 200 5,326.20 0.00 0.00%

FTSE 100 6,792.74 +39.56 +0.59%

CAC 40 4,536.53 +27.98 +0.62%

Xetra DAX 10,735.14 +41.45 +0.39%

S&P 500 2,180.39 +16.19 +0.75%

Dow Jones Industrial Average 18,923.06 +54.37 +0.29%

S&P/TSX Composite 14,756.10 +157.65 +1.08%

-

20:06

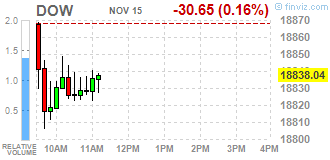

DJIA 18899.81 31.12 0.16%, NASDAQ 5282.89 64.49 1.24%, S&P 500 2178.73 14.53 0.67%

-

17:00

European stocks closed: FTSE 6792.74 39.56 0.59%, DAX 10735.14 41.45 0.39%, CAC 4536.53 27.98 0.62%

-

16:46

WSE: Session Results

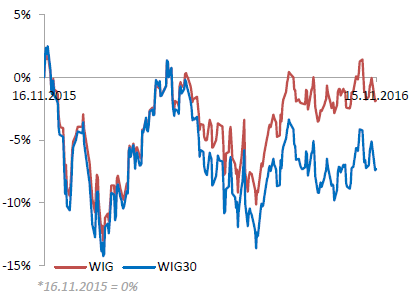

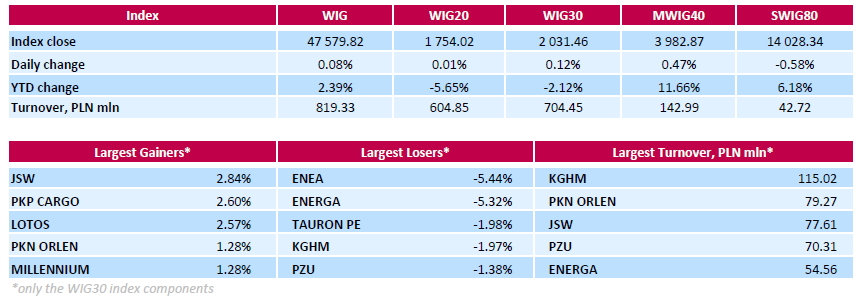

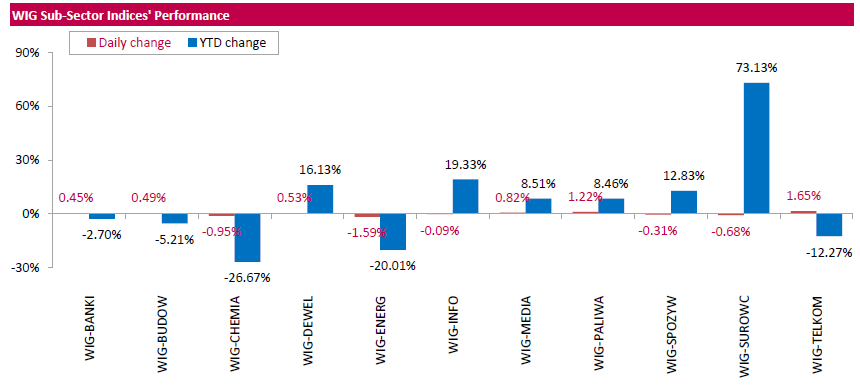

Polish equity market closed flat on Tuesday. The broad market measure, the WIG Index, edged up 0.08%. Sector performance within the WIG Index was mixed. Telecoms (+1.65%) outperformed, while utilities (-1.59%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, advanced 0.12%. 18 out of all 30 index components returned gains, with the way up led by coking coal miner JSW (WSE: JSW), which climbed by 2.84%, helped by the announcement the stock will join MSCI Poland Index at market close on November 30th. Other major outperformers were railway freight transport operator PKP CARGO (WSE: PKP), bank MILLENNIUM (WSE: MIL) and two oil refiners LOTOS (WSE: LTS) and PKN ORLEN (WSE: PKN), which added between 1.28% and 2.6%. On the contrary, utilities names ENEA (WSE: ENA) and ENERGA (WSE: ENG) were hit the hardest, down 5.44% and 5.32% respectively, as it was announced that the stocks will be removed from MSCI's benchmark country index.

-

16:18

Wall Street. Major U.S. stock-indexes mixed

U.S. stock-indexes S&P 500 and Nasdaq rose on Tuesday, helped by a recovery in tech stocks, while the Dow Jones Industrial average fell after rising for six straight days. S&P 500 and Dow had rallied in the past week since the shock victory of Donald Trump in the U.S. election on expectations of higher fiscal spending and lower regulations. However, investors remain uncertain about Trump's policies and are also keeping an eye on key appointments in his administration.

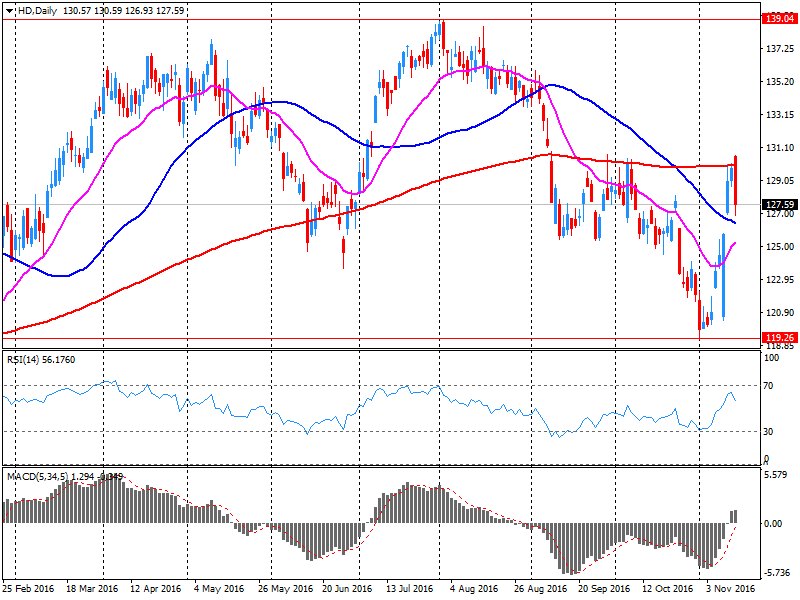

Dow stocks mixed (15 vs 15). Top gainer - Verizon Communications Inc. (VZ, +1.97%). Top loser - The Home Depot, Inc. (HD, -2.04%).

S&P sectors also mixed. Top gainer - Utilities (+1.4%). Top loser - Conglomerates (-2.1%).

At the moment:

Dow 18778.00 -44.00 -0.23%

S&P 500 2168.25 +7.75 +0.36%

Nasdaq 100 4760.50 +66.00 +1.41%

Oil 45.00 +1.68 +3.88%

Gold 1222.20 +0.50 +0.04%

U.S. 10yr 2.22 +0.00

-

14:52

WSE: After start on Wall Street

Published today in the US retail sales data surprise very positively both in the month of October, and the earlier one due to the revision of data from September, up from 0.6% to 1%. Data surprise no matter how we look at them. Very well performs the car sales, but without it sales rise by 0.8%.Generally in annual relation sales grew by a 4.3%. These data strengthen the dollar, because the December rate hike is clearly closer, which still should be treated as the base scenario.

The afternoon phase session on the Warsaw market has brought declines and all major segments are reporting on the red side of the market. The turnover is not especially impressive, also the day variability is not large. It seems that the better US data coupled with the re-strengthening of the dollar was badly received in the emerging markets, in Western Europe, we may not see any new downward pressure.

Wall Street opened with an increase of 0.2% and the first trades run fairly quietly. At the same time the behavior of the US market has ceased to be any signpost for the Warsaw Stock Exchange, which has chosen a completely opposite direction.

An hour before the end of the session the WIG20 index was at the level of 1,750 points (-0,22%).

-

14:32

U.S. Stocks open: Dow -0.08%, Nasdaq +0.43%, S&P +0.21%

-

14:11

Before the bell: S&P futures +0.25%, NASDAQ futures +0.75%

U.S. stock-index futures advanced. Investors assessed data October retail sales in the U.S.

Global Stocks:

Nikkei 17,668.15 -4.47 -0.03%

Hang Seng 22,323.91 +101.69 +0.46%

Shanghai 3,206.73 -3.64 -0.11%

FTSE 6,789.08 +35.90 +0.53%

CAC 4,518.75 +10.20 +0.23%

DAX 10,705.27 +11.58 +0.11%

Crude $44.61 (+2.98%)

Gold $1,225.50 (+0.31%)

-

13:49

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

Amazon.com Inc., NASDAQ

AMZN

731.53

12.46(1.7328%)

47681

American Express Co

AXP

72.17

-0.25(-0.3452%)

123

AMERICAN INTERNATIONAL GROUP

AIG

64.03

-0.42(-0.6517%)

404

Apple Inc.

AAPL

106.49

0.78(0.7379%)

109906

AT&T Inc

T

36.35

0.22(0.6089%)

5488

Barrick Gold Corporation, NYSE

ABX

117

-0.86(-0.7297%)

532

Boeing Co

BA

149.91

-0.08(-0.0533%)

1585

Caterpillar Inc

CAT

94

-0.17(-0.1805%)

6883

Chevron Corp

CVX

107.39

0.80(0.7505%)

13802

Cisco Systems Inc

CSCO

31.5

0.13(0.4144%)

1797

Citigroup Inc., NYSE

C

85.84

0.56(0.6567%)

4286

Deere & Company, NYSE

DE

117

-0.86(-0.7297%)

532

E. I. du Pont de Nemours and Co

DD

68.79

-0.28(-0.4054%)

221

Exxon Mobil Corp

XOM

85.84

0.56(0.6567%)

4286

Facebook, Inc.

FB

117.25

2.17(1.8856%)

225962

FedEx Corporation, NYSE

FDX

94

-0.17(-0.1805%)

6883

Ford Motor Co.

F

85.84

0.56(0.6567%)

4286

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.55

-0.37(-2.658%)

219831

General Electric Co

GE

30.52

0.01(0.0328%)

7367

General Motors Company, NYSE

GM

85.84

0.56(0.6567%)

4286

Goldman Sachs

GS

206.9

-2.28(-1.09%)

23809

Google Inc.

GOOG

747.58

11.50(1.5623%)

13637

Home Depot Inc

HD

128.9

1.23(0.9634%)

169060

Intel Corp

INTC

34.49

0.01(0.029%)

4305

International Business Machines Co...

IBM

158

-0.21(-0.1327%)

537

JPMorgan Chase and Co

JPM

78.7

-0.81(-1.0187%)

89684

McDonald's Corp

MCD

117

-0.86(-0.7297%)

532

Merck & Co Inc

MRK

117

-0.86(-0.7297%)

532

Microsoft Corp

MSFT

58.18

0.45(0.7795%)

42080

Nike

NKE

50.61

0.40(0.7967%)

965

Pfizer Inc

PFE

32.58

0.20(0.6177%)

14363

Procter & Gamble Co

PG

83.05

0.05(0.0602%)

360

Starbucks Corporation, NASDAQ

SBUX

54.01

0.04(0.0741%)

624

Tesla Motors, Inc., NASDAQ

TSLA

182.85

1.40(0.7716%)

13307

The Coca-Cola Co

KO

41.48

0.31(0.753%)

4026

Travelers Companies Inc

TRV

112.25

0.07(0.0624%)

918

Twitter, Inc., NYSE

TWTR

19.21

0.07(0.3657%)

102853

UnitedHealth Group Inc

UNH

151.5

-0.78(-0.5122%)

1100

Verizon Communications Inc

VZ

46.56

0.38(0.8229%)

2463

Visa

V

79.1

0.72(0.9186%)

2641

Walt Disney Co

DIS

97.65

-0.27(-0.2757%)

6602

Yahoo! Inc., NASDAQ

YHOO

40.19

0.89(2.2646%)

2276

Yandex N.V., NASDAQ

YNDX

18.2

0.39(2.1898%)

8140

-

13:41

Upgrades and downgrades before the market open

Upgrades:

Chevron (CVX) upgraded to Buy from Outperform at CLSA

Downgrades:FedEx (FDX) downgraded to Hold from Buy at Stifel

Bank of America (BAC) downgraded to Neutral from Buy at Guggenheim

Other:

Procter & Gamble (PG) resumed with a Market Perform at Wells Fargo

-

12:37

Company News: Home Depot (HD) Q3 results beat analysts’ expectations

Home Depot reported Q3 FY 2016 earnings of $1.60 per share (versus $1.36 in Q3 FY 2015), beating analysts' consensus estimate of $1.58.

The company's quarterly revenues amounted to $23.154 bln (+6.1 y/y), slightly beating analysts' consensus estimate of $23.050 bln.

The company also issued guidance for FY2017, forecasting EPS of ~$6.43 (+15.9% y/y; compared to analysts' consensus estimate of $6.33 and up from $6.31 prior guidance) and revenues of $94.1 bln (+6.3% y/y; compared to analysts' consensus estimate of $94.15 bln).

HD rose to $130.07 (+1.88%) in pre-market trading. It reaffirmed FY2016 sales to be up ~4.9% y/y.

-

12:06

WSE: Mid session comment

In the first half of today's trading on the WSE, the morning booster was not specially enlarged. Thus trading, from a technical point of view, is more like stopping the decline than recovery.

In the morning we met the reading of GDP for the third quarter for the domestic economy, which grew by only 2.5% y/y vs. 3.1% in the second quarter. This is worse than forecasts indicating an increase of 2.9%. There was no greater response from the market, which for some time has been around more skeptical about growth forecasts.

A significant turnover is focus today on the companies for which will be made half-yearly revision of participation in the MSCI Poland index.

After the session on November 30, this index will leave Enea (WSE: ENA) and Energa (WSE: ENG), and index will join JSW.

While in the case of JSW and Energa such development was expected, Enea is a negative surprise. As a result, shares of the company stand out negatively, and changes in the other two are not so significant. MSCI Poland index is very important, because foreign funds invest according to it.

In the middle of today's trading the WIG20 index was at the level of 1,765 points and with the turnover of PLN 230 million.

-

12:04

Major stock indices in Europe show gains

European stocks traded higher, receiving support from oil prices, as well as a slight decline in bond yields, which stimulates the demand for risky assets.

Oil has risen by almost 2%, as investors continue to hope that the oil-producing countries will be able to reach an agreement on production cuts. It is reported that the OPEC countries are making final diplomatic efforts to strike a deal to reduce oil production, and Qatar, Algeria and Venezuela seek to resolve conflicts. The final decision should be taken at a meeting of OPEC on November 30 in Vienna. Recall, according to the results of an informal meeting in September in Algeria, OPEC agreed to reduce production in the range of 32,5-33 mln. barrels per day.

Certain influence on the dynamics of trades also provide statistical data from UK and the eurozone. The Office for National Statistics said that consumer price inflation in the UK unexpectedly weakened last month, but producer prices rose at the fastest pace in recent years, which was caused by a large-scale collapse of the pound after Brexit. According to the report, consumer prices rose in October by 0.9 percent compared to the same period of 2015. Analysts had expected an increase of 1.1 percent. Recall, consumer prices increased by 1.0 percent in September. Meanwhile, producer prices rose by 2.1 per cent per annum, which also turned out to be faster than expected (+1.7 percent). In addition, it was the largest increase since April 2012. Costs faced by manufacturers when purchasing raw materials and oil recorded a record monthly jump in October and rose by 4.6 percent. In addition, the report showed that the rate of core consumer price inflation - which excludes changes in prices for energy, food, alcohol and tobacco - has slowed the pace of growth to 1.2 percent from 1.5 percent in September. Economists had expected the index to increase again by 1.5 percent.

The revised data released by Eurostat, showed that economic growth in the euro area remained stable in the third quarter, and confirmed the preliminary estimates presented at the end of October. According to the report, the gross domestic product of 19 countries in the currency bloc rose by 0.3 percent in the third quarter relative to the previous three-month period and increased by 1.6 percent year on year. Last change coincided with forecasts. In addition, the total GDP of the European Union in the third quarter rose by 0.4 percent compared to the second quarter and 1.8 percent year on year. The pace of growth in line with that recorded in the second quarter.

The composite index of the largest companies in the region Stoxx Europe Index 600 shows an increase of 0.1 percent.

Mining companies are on the way for the biggest drop since July, the cause of which was a decline of base metals after a 13 percent rally in the last six sessions. Antofagasta and Rio Tinto fell by at least 4 percent.

The cost of Hennes & Mauritz rose 2.3 percent after the retailer reported a rise in sales in October.

EasyJet shares rose 3.4 percent, as the airline's annual profit exceeded expectations.

Capitalization of TalkTalk Telecom Group fell 6.3 percent against the backdrop of reports that full-year earnings will be near the lower boundary of the previous forecast range.

Vodafone securities fell 0.3 percent as the British mobile operator narrowed the range forecast for full-year earnings.

At the moment:

FTSE 100 +41.64 6794.82 + 0.62%

DAX +0.89 10694.58 + 0.01%

CAC 40 +15.30 4523.85 + 0.34%

-

08:36

Major stock exchanges trading in the green zone: FTSE + 0.5%, DAX + 0.3%, CAC40 + 0.4%, FTMIB + 0.4%, IBEX + 0.2%

-

08:16

WSE: After opening

WIG20 index opened at 1757.25 points (+0.19%)*

WIG 47598.31 0.12%

WIG30 2031.09 0.10%

mWIG40 3974.22 0.25%

*/ - change to previous close

The cash market opens with an increase of 0.19% to 1,757 points with modest than yesterday turnover and clear focus on declining values of KGHM. Beginning on these values are going down by more than 2%.

After fifteen minutes of trading the WIG20 was at the level of 1,762 points (+0,49%).

-

07:57

Positive start of trading expected on the major stock exchanges in Europe: DAX futures flat, CAC40 + 0.2%, FTSE + 0.2%

-

07:23

WSE: Before opening

Monday's session in the New York stock markets brought mixed feelings. Grouping the blue-chips DJI (+ 0.11%) ended the session sixth time in a row at historical highs. In the red were the S&P 500 (-0.01%) and Nasdaq Comp. (-0.36%). Morning Asian stock markets behavior indicates a certain calming of the situation in the tense recently situation of emerging markets. Contracts in the US slightly lookup and parquets in Europe should open near yesterday's closing.

For the Warsaw market, a problem can be a depreciating copper and its impact on KGHM. A clear weakening of the Polish zloty, which during our holidays lost value, caused that the WIG20 measured in dollars lost yesterday up 4.7% and went down to the lowest levels since July. The WIG20 measured in PLN is close to the support, but the mood remains negative with the risk of continuity of declines.

The macro data calendar will be plentiful today. We will get a preliminary reading of GDP for Poland, the ZEW index in Germany and retail sales in the US. In the face of a very tense situation, the global information will not be critical, but in the case of larger deviations from expectations could attract attention.

-

05:42

Global Stocks

European shares closed modestly higher Monday, but gave up beefier gains as oil prices retreated and worries about next month's constitutional referendum weighed on Italian stocks. European equities started Monday in rally mode, with exporters getting a boost as the euro fell, still feeling the effects of Donald Trump's U.S. presidential election win last week.

The Dow Jones Industrial Average edged up to a record-high close on Monday even as the broader stock market came under pressure, with investors seeking more clarity on the policy proposals of President-elect Donald Trump's administration. "It makes sense that stocks took a breather today, as they wait for more concrete plans from the Trump administration," said Kristina Hooper, U.S. investment strategist for Allianz Global Investors.

Asian markets showed resilience Tuesday to the emerging-markets selloff that had been hitting global markets, with shares broadly mixed and Asian currencies gaining some strength.

-