Market news

-

21:14

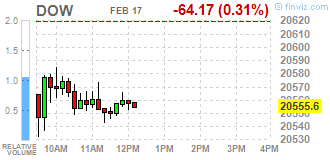

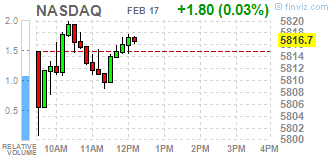

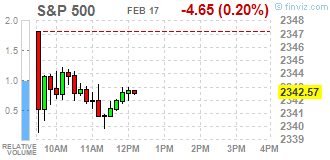

Major US stock indexes finished trading above zero

US stocks rose slightly up on Friday. As the US President promised last week that announced the tax reform in the coming weeks, Wall Street inched up to record highs in the coming days in the rally, where the financial sector, primarily banks, surpassed other sectors. But given that the reporting season draws to a close, many investors awaited more concrete signs of progress from Trump. In addition, as it became known today, the index of leading indicators from the Conference Board (LEI) for the US increased by 0.6% in January to 125.5 (2010 = 100), after rising 0.5% in December. However, the total amount of debt held by American households has grown significantly in the last quarter, recording the fastest pace in the last ten years, helped by a vast and stable increase in debt on credit cards, auto loans and student loans. In addition, in the 4th quarter of the amount of debt on the mortgage loans reached a peak since the last financial crisis. According to the report submitted by the Federal Reserve Bank of New York, the total household debt increased by $ 226 billion over the last three months of 2016.

DOW index components closed mostly in positive territory (20 of 30). Most remaining shares fell UnitedHealth Group Incorporated (UNH, -3.73%). Leaders of growth were shares of Verizon Communications Inc. (VZ, + 1.53%).

Sector S & P Index showed a mixed trend. Most of the basic materials sector fell (-0.6%). Leaders of growth were consumer goods sector (+ 1.3%).

-

20:00

DJIA -0.20% 20,577.84 -41.93 Nasdaq +0.24% 5,828.64 +13.74 S&P -0.05% 2,346.10 -1.12

-

17:14

Wall Street. Major U.S. stock-indexes slightly fell, Nasdaq little changed

U.S. stock-indexes Dow and S&P 500 slightly fell on Friday, led by bank and healthcare stocks, as investors booked profits after a record-setting few days, while gains in Kraft Heinz help limit losses on the Nasdaq. Since President Donald Trump vowed last week to announce a tax reform in the coming weeks, Wall Street has inched up to record intraday and closing highs in successive days in a rally where financials, mainly banks, outperformed other sectors. But, with a strong fourth-quarter earnings season mostly complete, many investors say they need concrete signs of progress from Trump on his policy plans to justify more gains.

Most of Dow stocks in negative area (20 of 30). Top loser - UnitedHealth Group Incorporated (UNH, -3.73%). Top gainer - The Boeing Company (BA, +2.86%).

Most of S&P sectors are also in negative area. Top loser - Basic Materials (-0.8%). Top gainer - Consumer goods (+0.7%).

At the moment:

Dow 20540.00 -54.00 -0.26%

S&P 500 2340.50 -5.00 -0.21%

Nasdaq 100 5304.75 +4.25 +0.08%

Oil 53.48 -0.27 -0.50%

Gold 1239.60 -2.00 -0.16%

U.S. 10yr 2.42 -0.04

-

17:01

European stocks closed: FTSE 100 +22.04 7299.96 +0.30% DAX -0.22 11757.02 +0.00% CAC 40 -31.88 4867.58 -0.65%

-

15:38

Trump administration considers mobilizing as many as 100,000 National Guard troops to round up unauthorized immigrants - AP

-

15:14

US Conference Board leading index rose more than expected in January

The Conference Board Leading Economic Index for theU.S. increased 0.6 percent in January to 125.5 (2010 = 100), following a 0.5 percent increase in December, and a 0.2 percent increase in November.

"The U.S. Leading Economic Index increased sharply again in January, pointing to a positive economic outlook in the first half of this year," said Ataman Ozyildirim, Director of Business Cycles and Growth Research at The Conference Board. "The January gain was broad based among the leading indicators. If this trend continues, the U.S. economy may even accelerate in the near term."

-

15:00

U.S.: Leading Indicators , January 0.6% (forecast 0.5%)

-

14:41

WSE: After start on Wall Street

The US markets began the last in this week trading from discounts, which was signaled by the earlier behavior of contracts. On the Warsaw market since the sixth hour of trade the supply side has gained an advantage and into the final hour of trading market entering with a slope of approx. 1.3% for the index WIG20. Moods are clearly corrective and the session begins to change in the denial of Thursday's optimism.

-

14:37

Morgan Stanley recommends selling EUR/GBP, entering the trade at 0.8650, with a target of 0.800 and a stop at 0.8800

-

14:32

U.S. Stocks open: Dow -0.29%, Nasdaq -0.12%, S&P -0.26%

-

14:10

Before the bell: S&P futures -0.29%, NASDAQ futures -0.14%

U.S. stock-index futures fell, indicating that investors decided to pause after a record-setting few sessions on Wall Street, as they looked for clarity on the U.S. President Donald Trump's tax reform and prepared for a prolonged weekend.

Global Stocks:

Nikkei 19,234.62 -112.91 -0.58%

Hang Seng 24,033.74 -73.96 -0.31%

Shanghai 24,033.74 -73.96 -0.31%

FTSE 7,286.50 +8.58 +0.12%

CAC 4,847.06 -52.40 -1.07%

DAX 11,709.76 -47.48 -0.40%

Crude $53.10 (-0.49%)

Gold $1,243.50 (+0.15%)

-

13:49

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

170.7

-0.11(-0.0644%)

8999

Amazon.com Inc., NASDAQ

AMZN

247

-2.44(-0.9782%)

9783

AMERICAN INTERNATIONAL GROUP

AIG

62.02

-0.25(-0.4015%)

2129

AT&T Inc

T

41.13

-0.12(-0.2909%)

16342

Barrick Gold Corporation, NYSE

ABX

20.52

0.02(0.0976%)

63277

Boeing Co

BA

170.7

-0.11(-0.0644%)

8999

Chevron Corp

CVX

110.09

-0.59(-0.5331%)

3139

Cisco Systems Inc

CSCO

170.7

-0.11(-0.0644%)

8999

Citigroup Inc., NYSE

C

170.7

-0.11(-0.0644%)

8999

Deere & Company, NYSE

DE

247

-2.44(-0.9782%)

9783

Ford Motor Co.

F

247

-2.44(-0.9782%)

9783

General Electric Co

GE

30.33

-0.12(-0.3941%)

4542

General Motors Company, NYSE

GM

36.72

-0.31(-0.8372%)

1302

Goldman Sachs

GS

247

-2.44(-0.9782%)

9783

Google Inc.

GOOG

822.16

-2.00(-0.2427%)

1351

Intel Corp

INTC

36.28

-0.13(-0.357%)

4111

Johnson & Johnson

JNJ

118

-0.08(-0.0678%)

903

JPMorgan Chase and Co

JPM

89.73

-0.80(-0.8837%)

10345

Merck & Co Inc

MRK

65.41

0.15(0.2299%)

300

Microsoft Corp

MSFT

247

-2.44(-0.9782%)

9783

Nike

NKE

56.05

-0.24(-0.4264%)

1373

Starbucks Corporation, NASDAQ

SBUX

56.39

-0.34(-0.5993%)

170

Tesla Motors, Inc., NASDAQ

TSLA

265.27

-3.68(-1.3683%)

64629

The Coca-Cola Co

KO

41

-0.20(-0.4854%)

11273

Twitter, Inc., NYSE

TWTR

16.4

0.05(0.3058%)

49324

UnitedHealth Group Inc

UNH

158

-5.65(-3.4525%)

76655

Verizon Communications Inc

VZ

170.7

-0.11(-0.0644%)

8999

Visa

V

87.3

-0.11(-0.1258%)

579

Walt Disney Co

DIS

110.45

-0.26(-0.2349%)

2876

Yahoo! Inc., NASDAQ

YHOO

44.83

-0.33(-0.7307%)

499

Yandex N.V., NASDAQ

YNDX

247

-2.44(-0.9782%)

9783

-

13:49

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0600-05 (EUR 693m) 1.0650 (955m) 1.0700 (887m) 1.0780 (1.33bln) 1.0950 (880m)

USD/JPY: 112.00 (USD 607m) 112.50 (350m) 114.00 (670m) 115.00 (465m)

GBP/USD: 1.2565-70 (GBP 437m) 1.2600 (469m)

AUD/USD: 0.7400 (AUD 571m)

USD/CAD 1.2975 (USD 485m)

-

13:45

Upgrades and downgrades before the market open

Upgrades:

Credit Suisse (CS) upgraded to Overweight from Equal-Weight at Morgan Stanley

Downgrades:

Other:

-

13:33

Foreign investment in Canadian securities reached $10.2 billion in December

Foreign investment in Canadian securities reached $10.2 billion in December, largely through acquisitions of shares. At the same time, Canadian investors increased their holdings of foreign securities by $6.7 billion, led by purchases of non-US foreign shares.

As a result, international transactions in securities generated a net inflow of funds of $3.6 billion into the Canadian economy in December and a record $147.5 billion for 2016 as a whole. Moreover, foreign investment in Canadian securities has exceeded Canadian investment in foreign securities by $634.4 billion since 2009, following the global financial crisis.

-

13:30

Canada: Foreign Securities Purchases, December 10.23

-

13:07

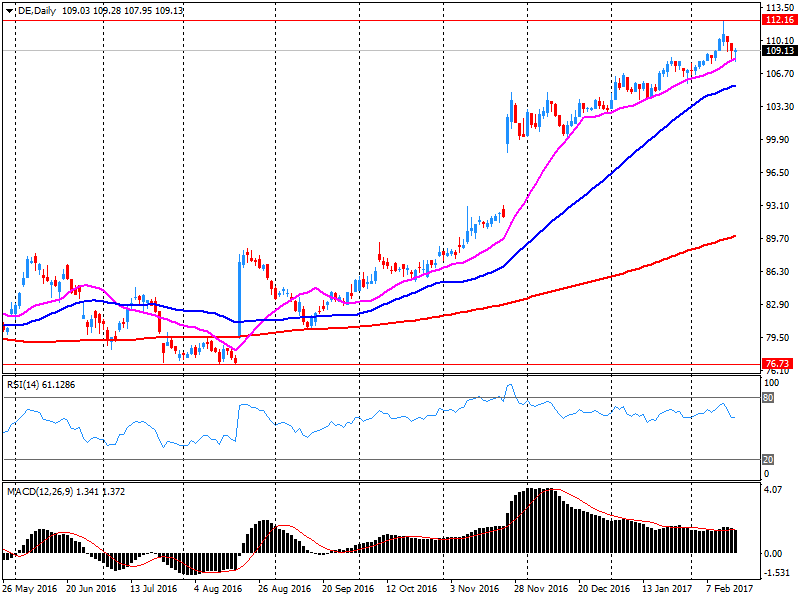

Company News: Deere (DE) posts better-than-expected quarterly results

Deere reported Q1 FY 2017 earnings of $0.61 per share (versus $0.80 in Q1 FY 2016), beating analysts' consensus estimate of $0.54.

The company's quarterly revenues amounted to $4.698 bln (-1.5% y/y), beating analysts' consensus estimate of $4.590 bln.

The company also issued upside guidance for Q2 and the full 2017 year. It projects Q2 revenues at ~$7.18 bln (+1% y/y) versus analysts' consensus estimate of $6.89 bln. In FY 2017, it expects its revenues to amount to ~$24.32 bln (+4% y/y) versus analysts' consensus estimate of $23.12 bln.

DE rose to $112.66 (+3.20%) in pre-market trading.

-

13:01

Orders

EUR/USD

Offers: 1.0680 1.0700-05 1.0730 1.0750 1.0780 1.0800

Bids: 1.0630 1.0600 1.0585 1.0550 1.0520 1.0500

GBP/USD

Offers: 1.2500 1.2520 1.2550 1.2580 1.2600 1.2630 1.2350 1.2680 1.2700

Bids: 1.2475 1.2460 1.2450 1.2430 1.2400 1.2380 1.2345-50 1.2300

EUR/GBP

Offers: 0.8550-55 0.8585 0.8600 0.8620 0.8650

Bids: 0.8500 0.8480-85 0.8450 0.8430 0.8400

EUR/JPY

Offers: 120.80 121.00 121.35 121.50 121.80 122.00

Bids: 102.30 120.00 119.75 119.50 119.00

USD/JPY

Offers: 113.50 113.80-85 114.00-05 114.20 114.35 114.50

Bids: 113.15 113.00 112.80 112.50 112.30 112.00

AUD/USD

Offers: 0.7720 0.7735 0.7750 0.7780 0.7800 0.7820 0.7850

Bids: 0.7680 0.7660 0.7620 0.7600 0.7580 0.7550

-

12:02

WSE: Mid session comment

The forenoon phase of the session was the defense of the level of 2,200 points for the WIG20 index. Under pressure from the environment, where the German DAX was looking for the bottom at the psychological barrier of 11,700 points, the Warsaw WIG20 moved under the 2,200 pts., Although support has been only slightly affected. In the following hours trading was carried out already above the level of 2,200 points.

At the halfway point quotations WIG20 index was at the level of 2,203 points (-0,55%).

-

11:51

Major stock indices in Europe trading lower

The stock indices in Western Europe dropped, investors evaluate companies reporting and statistical data on retail sales in the UK.

UK retail sales unexpectedly fell in January, revealed data from the Office of National Statistics. Retail sales, including automotive fuel, decreased by 0.3 percent for the month in January, after falling 2.1 percent in December. Sales are expected to grow by 0.9 per cent. Excluding automotive fuel, retail sales fell by 0.2 percent, confounding expectations for an increase of 0.7 per cent. However, the decrease was slower than the 2.2 percent seen in December.

In annual terms, retail sales growth fell sharply to 1.5 percent from 4.1 percent a month earlier. Expected moderate slowdown in annual growth to 3.4 percent. Excluding automotive fuel, retail sales growth was 2.6 percent compared to 4.7 percent in December and expected growth of 3.9 percent.

The composite index of the largest companies in the region Stoxx Europe 600 fell by 0.51% to 368.23 points.

Allianz SE shares rise in price by 1.6%. Europe's biggest insurer increased its net profit in the fourth quarter by 23% and announced a new buyback program worth up to 3 billion euros.

AstraZeneca shares rose 1.6% after the company reported positive results from clinical trials of a drug for breast cancer.

The capitalization of the German drug manufacturer Stada Arzneimittel AG increased by 0.6%. The company announced that it received a third offer from an unnamed bidder, of nearly 4 billion euros.

Royal Vopak NV shares fell 8.6%. The world's largest operator of oil and chemical storage warned investors that it does not expect to increase profits in 2017.

At the moment:

FTSE 7265.78 -12.14 -0.17%

DAX 11707.18 -50.06 -0.43%

CAC 4856.12 -43.34 -0.88%

-

11:14

ECB, Lane: taper decision is data dependent, not calendar dependent

-

See Firms Scattering Staff Due to Brexit

-

Monetary Policy Will Return Inflation to Target

-

No Reason Now to Turn Off Policy Accommodation

-

Don't Expect 'Steady Surge' in Inflation

-

QE Program Is 'Open Ended'

-

Don't Expect to Have to Cut Deposit Rate Again

-

-

10:36

Despite the long delays by the Democrats in finally approving Dr. Tom Price, the repeal and replacement of ObamaCare is moving fast! @realDonaldTrump

-

10:05

Danske Bank expect AUD/USD to back down from overbought levels over the next one-three months

"AUD/USD has reversed the move after US elections, which pushed the pair as low as below 0.72 around year end. The lack of details of the US administration's economic plans has weighed on USD and supported AUD in January-February. Furthermore, improvement in Australian economic data together with a more optimistic tone from the central bank has helped AUD to return to pre-Trump levels. We recognise the support for AUD from improved global economic conditions and rising commodity prices. However, we still think the RBA wants to limit the upside in AUD and is ready to soften its tone in case the exchange rate appreciates excessively. Moreover, as the market could well price in more aggressive action by the Fed, we see relative monetary policies supporting USD versus AUD in coming months.

We expect AUD/USD to back down from overbought levels over the next one-three months.

We make a level shift to our forecast reflecting the latest moves but keep the profile unchanged, expecting short-term weakness and longer-term stabilisation in AUD.

Our 1M forecast is 0.75, 3M forecast 0.73 and 6-12M forecasts 0.74 and 0.75, respectively".

Copyright © 2017 Danske, eFXnews™

-

09:33

UK retail sales down 0.3% in January. GBP/USD dropped 50 pips instantly

In January 2017, the quantity bought in the retail industry is estimated to have increased by 1.5% compared with January 2016, the lowest growth since November 2013.

Month-on-month the quantity bought is estimated to have fallen by 0.3%.

The underlying pattern as suggested by the 3 month on 3 month movement decreased by 0.4%; the first fall since December 2013.

Average store prices (including fuel) increased by 1.9% on the year, the largest contribution to this increase came from petrol stations, where year-on-year average prices were estimated to have risen by 16.1%.

Online sales (excluding fuel) increased by 10.1% year-on-year, but fell on the month by 7.2%; accounting for approximately 14.6% of all retail spending.

-

09:30

United Kingdom: Retail Sales (MoM), January -0.3% (forecast 0.9%)

-

09:30

United Kingdom: Retail Sales (YoY) , January 1.5% (forecast 3.4%)

-

09:04

The current account of the euro area recorded a surplus of €31.0 billion in December 2016.

This reflected surpluses for goods (€31.7 billion), primary income (€5.3 billion) and services (€4.6 billion), which were partly offset by a deficit for secondary income (€10.6 billion).

According to the preliminary results for 2016 as a whole, the current account recorded a surplus of €364.7 billion (3.4% of euro area GDP), compared with one of €319.3 billion (3.1% of euro area GDP) in 2015. All the components of the current account increased. There were increases in the surpluses for goods (from €348.2 billion to €372.2 billion), services (from €58.9 billion to €69.1 billion) and primary income (from €42.1 billion to €52.4 billion), as well as a slight decrease in the deficit for secondary income (from €129.9 billion to €129.0 billion).

-

09:00

Eurozone: Current account, unadjusted, bln , December 47

-

08:39

Major stock markets in Europe trading mixed: FTSE -0.1%, DAX + 0.1%, CAC40 -0.1, FTMIB + 0.1%, IBEX flat

-

08:16

WSE: After opening

WIG20 index opened at 2214.85 points (-0.02%)*

WIG 58577.41 -0.06%

WIG30 2561.72 -0.11%

mWIG40 4835.11 -0.06%

*/ - change to previous close

The beginning of trading on the cash market was held in a neutral atmosphere. Flat start of the day in Europe and the correction mood at the end of the week on the core markets are not encouraged to take decisions. The level of turnover is small, indicating that investors are delaying their decisions until the balance of forces will become clearer.

After fifteen minutes of trading the WIG20 index was at the level of 2,218 points (+0,13%)

-

08:15

Japan PM Abe: Trump's FX Comments Are Related To China, Not To Japan - Livesquawk

-

07:55

Chinese Banks sold net $19.2 bln of foreign exchange in Jannuary vs $46.3 bln in December

-

07:32

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.5%, CAC40 -0.4%, FTSE -0.1%

-

07:30

Options levels on friday, February 17, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0819 (4868)

$1.0753 (3360)

$1.0705 (3070)

Price at time of writing this review: $1.0663

Support levels (open interest**, contracts):

$1.0632 (3336)

$1.0570 (5202)

$1.0488 (5792)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 70453 contracts, with the maximum number of contracts with strike price $1,0800 (4868);

- Overall open interest on the PUT options with the expiration date March, 13 is 83728 contracts, with the maximum number of contracts with strike price $1,0500 (5792);

- The ratio of PUT/CALL was 1.19 versus 1.19 from the previous trading day according to data from February, 16

GBP/USD

Resistance levels (open interest**, contracts)

$1.2702 (2337)

$1.2604 (2338)

$1.2509 (3529)

Price at time of writing this review: $1.2485

Support levels (open interest**, contracts):

$1.2395 (1921)

$1.2298 (3759)

$1.2199 (1620)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 33984 contracts, with the maximum number of contracts with strike price $1,2500 (3529);

- Overall open interest on the PUT options with the expiration date March, 13 is 37582 contracts, with the maximum number of contracts with strike price $1,2300 (3759);

- The ratio of PUT/CALL was 1.11 versus 1.12 from the previous trading day according to data from February, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:18

WSE: Before opening

Thursday's session on the New York stock exchange has brought little change, but the series of seven consecutive days growth of indices S&P and Nasdaq was interrupted. The Dow Jones Ind. rose at the close of 0.04 percent, the S&P500 fell by 0.09 percent and the Nasdaq Comp. lost 0.08 percent. The focus of investors in the US are macro data, which confirm the strong start to the year in the local economy.

In the morning, we see a slight withdrawal of futures on the S&P500 and the decline of the Japanese Nikkei, which together indicate that after a week of changing moods investors reduce optimism before the weekend.

Looking at yesterday's behavior of the Warsaw market, we may notice that the Warsaw Stock Exchange follows it's own path. The WIG20 index broke out yesterday with a large turnover the next resistance (2,200 points) and look into the area of 2,350 pts. as the target level after breaking out of consolidation in the area of 2,000 to 1,650 points.

-

07:06

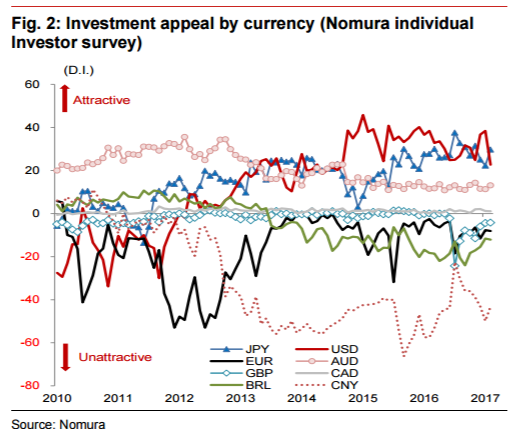

Retail investors’ views on the Japanese equity market have weakened slightly - Nomura. USD/JPY dip demand weak

"Retail investors' views on the Japanese equity market have weakened slightly, according to the latest Nomura Individual Investor Survey (6-7 February).

.....More investors see downside risks for USD/JPY than last month too. 63.9% of investors expect USD/JPY to fall over the next three months, while 53.0% expected a fall the previous month.

They do not necessarily expect a significant decline in USD/JPY, while most retail investors expected around 5 point fall in USD/JPY.

The reference level was lower at 112.45 than the 115.60 in the previous month, but the survey result showed weaker demand for dip-buying for now".

Copyright © 2017 Nomura, eFXnews™

-

07:00

Japanese Finance Minister Taro Aso to start economic dialogue with the US

During his speech today the Minister of Finance of Japan, Taro Aso announced its readiness to launch an economic dialogue with the US in April. "We will focus on economic policy, infrastructure, energy projects and trade".

-

06:58

UK Prime Minister May said to plan Brexit trigger close to March 9-10 EU Summit

-

06:57

Eleven of the 15 New Zeeland industries had higher sales volumes this quarter

Car sales continued to push the volume of total retail trade sales up, with sales rising 1.9 percent in the December 2016 quarter, Statistics NZ said today.

Motor-vehicles sales led most of the quarterly industry movements over 2016.

"More expensive cars and SUV vehicles are selling well, especially in Auckland, according to comments from car dealers and industry experts," business indicators manager Tehseen Islam said.

"Some of the increase in car sales may reflect a growing population, with net migration at record levels in 2016."

After adjusting for seasonal effects, total retail sales volumes rose 0.8 percent in the latest quarter. This follows a similar 0.8 percent rise in September, and a stronger 2.2 percent rise in the June 2016 quarter.

Eleven of the 15 industries had higher sales volumes this quarter, with the largest increases in:

-

motor-vehicle and parts retailing - up 1.9 percent

-

pharmaceutical and other store-based retailing - up 2.5 percent

-

accommodation - up 3.5 percent

-

electrical and electronic goods - up 2.0 percent.

-

-

06:30

Global Stocks

European stocks closed lower for the first time in eight sessions on Thursday, weighed down by a slide in shares of heavyweight Nestlé, as well as a retreat for banks and major oil companies. Stock markets globally, including in Europe, have rallied in recent days after interest rate-hike signals from the U.S. Federal Reserve and pledges from President Donald Trump to announce a "massive" tax plan soon.

U.S. stock indexes snapped a multi-session streak of simultaneous records Thursday, weighed down by a decline in energy stocks, with the Dow industrials the only index to gain another record high at the close.

Investors in Asia continued to reel in their risk appetite Friday, following a pullback overnight in two major U.S. stock indexes from record levels. The declines capped a week of choppy trading in the region, with spurts of interest in holding risk assets followed by moves into safe-haven assets such as the yen.

-