Market news

-

23:30

Commodities. Daily history for Feb 16’2017:

(raw materials / closing price /% change)

Oil 53.46 +0.19%

Gold 1,240.10 -0.12%

-

23:29

Stocks. Daily history for Feb 16’2017:

(index / closing price / change items /% change)

Nikkei -90.45 19347.53 -0.47%

TOPIX -2.62 1551.07 -0.17%

Hang Seng +112.83 24107.70 +0.47%

CSI 300 +19.22 3440.93 +0.56%

Euro Stoxx 50 -12.67 3311.04 -0.38%

FTSE 100 -24.49 7277.92 -0.34%

DAX -36.69 11757.24 -0.31%

CAC 40 -25.40 4899.46 -0.52%

DJIA +7.91 20619.77 +0.04%

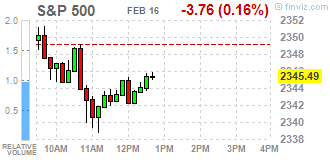

S&P 500 -2.03 2347.22 -0.09%

NASDAQ -4.54 5814.90 -0.08%

S&P/TSX +19.22 15864.17 +0.12%

-

23:28

Currencies. Daily history for Feb 16’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0673 +0,69%

GBP/USD $1,2488 +0,23%

USD/CHF Chf0,9967 -0,86%

USD/JPY Y113,23 -0,80%

EUR/JPY Y120,85 -0,12%

GBP/JPY Y141,37 -0,59%

AUD/USD $0,7693 -0,19%

NZD/USD $0,7207 -0,21%

USD/CAD C$1,3069 -0,06%

-

22:59

Schedule for today, Friday, Feb 17’2017 (GMT0)

09:00 Eurozone Current account, unadjusted, bln December 40.5

09:30 United Kingdom Retail Sales (MoM) January -1.9% 0.9%

09:30 United Kingdom Retail Sales (YoY) January 4.3% 3.4%

13:30 Canada Foreign Securities Purchases December 7.24

15:00 U.S. Leading Indicators January 0.5% 0.5%

-

21:45

New Zealand: Retail Sales YoY, Quarter IV 4.2%

-

21:45

New Zealand: Retail Sales, q/q, Quarter IV 0.8% (forecast 1%)

-

21:32

New Zealand: Business NZ PMI, January 51.6

-

21:08

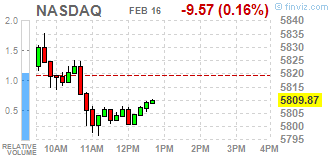

Major US stock indexes closed mostly in the red

Major US stock indexes finished trading mostly "red zone" on the background of the loss of financial and health sectors after the six-day increase.

The last rally was caused by statements of the US president's "phenomenal" tax reform, fueling optimism that it plans to expand the corporate deregulation of the economy .. However, there are fears among investors due to the fact that Trump has not yet provided any significant details about their plans.

Also today, the Labor Department reported that the number of Americans who applied for unemployment benefits rose less than expected last week. unemployment initial claims for benefits rose by 5,000 and totaled a seasonally adjusted 239,000 for the week ending 11 February. Economists had forecast an increase to 245 000. The four-week moving average of applications, which smooths weekly volatility, rose by 500 to 245,250 last week. The number of repeated applications for unemployment benefits fell by 3,000 to 2.08 million in the week ending 4 February.

At the same time, the Commerce Department said that the establishment of new homes fell in January, as the construction of multi-family facilities decreased. Bookmarks new homes fell by 2.6 percent to a seasonally adjusted annual rate of up to 1.25 million units. Bookmarks for December were revised up to 1.28 million from 1.23 million. Bookmarks of new homes rose by 10.5 percent compared to January 2016. Building permits jumped 4.6 percent to 1.29 million units, the highest level since November 2015. Economists had forecast that the tab will fall to 1.22 million, while building permits rose to 1.23 million.

DOW index components ended the session mixed (15 black, 15 red). Most remaining shares fell Chevron Corporation (CVX, -1.87%). leaders of growth were shares of Cisco Systems, Inc. (CSCO, + 2.55%).

Most of the S & P sectors showed a decline. Most of the basic materials sector fell (-0.8%). leaders of growth were utilities sector (+ 0.6%).

At the close:

Dow + 0.04% 20,620.04 +8.18

Nasdaq -0.08% 5,814.90 -4.54

S & P -0.09% 2,347.23 -2.02

-

20:00

DJIA -0.08% 20,595.36 -16.50 Nasdaq -0.23% 5,805.92 -13.52 S&P -0.24% 2,343.52 -5.73

-

17:48

Wall Street. Major U.S. stock-indexes slightly fell

Major U.S. stock-indexes slightluy fell on Thursday due to losses in banks and health sectors, reversing course after earlier inching up enough to notch record intraday highs for the sixth straight session. The six-day streak was sparked a week back by President Donald Trump's vow of a "phenomenal" tax announcement, and fueled by optimism that his plans for corporate deregulation will expand the economy. However, worries have started to surface that Trump so far has provided no substantial details on his plans.

Most of Dow stocks in negative area (16 of 30). Top loser - Chevron Corporation (CVX, -1.33%). Top gainer - Cisco Systems, Inc. (CSCO, +2.86%).

Most of S&P sectors are also in negative area. Top loser - Conglomerates (-0.8%). Top gainer - Utilities (+0.5%).

At the moment:

Dow 20576.00 -47.00 -0.23%

S&P 500 2342.50 -8.00 -0.34%

Nasdaq 100 5297.50 -12.50 -0.24%

Oil 53.60 0.00 0.00%

Gold 1239.50 +6.40 +0.52%

U.S. 10yr 2.46 +0.04

-

17:00

European stocks closed: FTSE 100 -24.49 7277.92 -0.34% DAX -36.69 11757.24 -0.31% CAC 40 -25.40 4899.46 -0.52%

-

15:42

Fed's Fisher: We are equally concerned about inflation deviates upward or downward from the target level of 2%

-

We will not make decisions under political pressure

-

We are now in an enabling policy area

-

Interest rates rise will be gradual

-

The election results in the US seems to have played a role in the heating of the economy

-

The Fed expects the economy will grow at a good pace

-

-

15:13

ECB Nowotny: undoing financial regulation would repeat mistakes of the past

-

Could Be 'Chaos' If No Brexit Deal in 2 Years

-

-

14:41

EU official says possible to reach a Greek deal in March - Bloomberg

-

14:33

U.S. Stocks open: Dow +0.10%, Nasdaq +0.12%, S&P +0.04%

-

14:26

Before the bell: S&P futures -0.20%, NASDAQ futures -0.07%

U.S. stock-index futures fell after a recent spate of record highs, as investors looked for new catalysts to keep up Wall Street's record-setting rally.

Global Stocks:

Nikkei 19,347.53 -90.45 -0.47%

Hang Seng 24,107.70 +112.83 +0.47%

Shanghai 3,229.41 +16.43 +0.51%

FTSE 7,282.63 -19.78 -0.27%

CAC 4,904.15 -20.71 -0.42%

DAX 11,760.87 -33.06 -0.28%

Crude $53.34 (+0.43%)

Gold $1,238.30 (+0.42%)

-

13:59

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

37.8

-0.07(-0.1848%)

3147

ALTRIA GROUP INC.

MO

72.2

0.03(0.0416%)

474

Amazon.com Inc., NASDAQ

AMZN

841.75

-0.95(-0.1127%)

9469

American Express Co

AXP

79.2

-0.40(-0.5025%)

357

AMERICAN INTERNATIONAL GROUP

AIG

60.75

-0.10(-0.1643%)

9522

Apple Inc.

AAPL

135.36

-0.15(-0.1107%)

114675

AT&T Inc

T

41.1

-0.02(-0.0486%)

1241

Barrick Gold Corporation, NYSE

ABX

19.68

0.36(1.8634%)

66657

Boeing Co

BA

169.48

0.18(0.1063%)

975

Caterpillar Inc

CAT

98.89

-0.13(-0.1313%)

3592

Chevron Corp

CVX

112.64

0.07(0.0622%)

467

Cisco Systems Inc

CSCO

33.18

0.36(1.0969%)

361559

Citigroup Inc., NYSE

C

60.38

-0.12(-0.1983%)

12181

Deere & Company, NYSE

DE

108

-1.12(-1.0264%)

499

Exxon Mobil Corp

XOM

83.3

0.14(0.1684%)

2169

Facebook, Inc.

FB

133.15

-0.29(-0.2173%)

30352

Ford Motor Co.

F

12.6

-0.03(-0.2375%)

4012

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.25

-0.12(-0.7807%)

171379

General Motors Company, NYSE

GM

37.09

0.01(0.027%)

375

Goldman Sachs

GS

249.7

-0.84(-0.3353%)

8691

Google Inc.

GOOG

819.6

0.62(0.0757%)

873

Home Depot Inc

HD

142.45

0.26(0.1829%)

1053

Intel Corp

INTC

36.14

0.09(0.2497%)

9986

International Business Machines Co...

IBM

181.3

-0.38(-0.2092%)

1455

Johnson & Johnson

JNJ

117.08

-0.12(-0.1024%)

2226

JPMorgan Chase and Co

JPM

90.47

-0.12(-0.1325%)

14505

McDonald's Corp

MCD

126.56

0.08(0.0632%)

738

Merck & Co Inc

MRK

65.13

-0.03(-0.046%)

700

Microsoft Corp

MSFT

64.5

-0.03(-0.0465%)

5758

Pfizer Inc

PFE

33.46

-0.05(-0.1492%)

5817

Procter & Gamble Co

PG

90.84

-0.28(-0.3073%)

6001

Tesla Motors, Inc., NASDAQ

TSLA

276.8

-2.96(-1.0581%)

36070

The Coca-Cola Co

KO

40.53

0.09(0.2225%)

5489

Twitter, Inc., NYSE

TWTR

16.72

-0.02(-0.1195%)

57138

Verizon Communications Inc

VZ

48.14

0.06(0.1248%)

4034

Walt Disney Co

DIS

109.95

-0.23(-0.2088%)

1559

Yahoo! Inc., NASDAQ

YHOO

45.56

-0.09(-0.1971%)

1153

Yandex N.V., NASDAQ

YNDX

23.35

0.21(0.9075%)

21345

-

13:53

Upgrades and downgrades before the market open

Upgrades:

Bank of America (BAC) upgraded to Outperform at Macquarie

Downgrades:

Other:

-

13:51

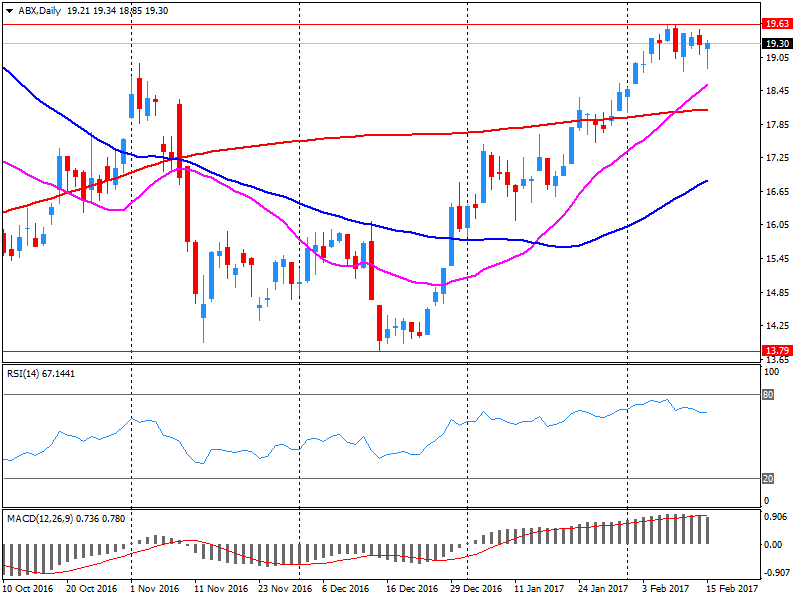

Company News: Barrick Gold (ABX) Q4 results beat analysts’ expectations

Barrick Gold reported Q4 FY 2016 earnings of $0.22 per share (versus $0.08 in Q4 FY 2015), beating analysts' consensus estimate of $0.19.

The company's quarterly revenues amounted to $2.320 bln (+3.6% y/y), beating analysts' consensus estimate of $2.183 bln.

ABX rose to $19.62 (+1.55%) in pre-market trading.

-

13:49

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0600-05 (EUR 693m) 1.0650 (955m) 1.0700 (887m) 1.0780 (1.33bln) 1.0950 (880m)

USD/JPY: 112.00 (USD 607m) 112.50 (350m) 114.00 (670m) 115.00 (465m)

GBP/USD: 1.2565-70 (GBP 437m) 1.2600 (469m)

AUD/USD: 0.7400 (AUD 571m)

USD/CAD 1.2975 (USD 485m)

-

13:44

US building permits and housing starts mixed

Privately-owned housing units authorized by building permits in January were at a seasonally adjusted annual rate of 1,285,000. This is 4.6 percent (±2.0 percent) above the revised December rate of 1,228,000 and is 8.2 percent (±1.6 percent) above the January 2016 rate of 1,188,000. Single-family authorizations in January were at a rate of 808,000; this is 2.7 percent (±1.9 percent) below the revised December figure of 830,000. Authorizations of units in buildings with five units or more were at a rate of 446,000 in January.

Privately-owned housing starts in January were at a seasonally adjusted annual rate of 1,246,000. This is 2.6 percent (±11.0 percent)* below the revised December estimate of 1,279,000, but is 10.5 percent (±15.3 percent)* above the January 2016 rate of 1,128,000. Single-family housing starts in January were at a rate of 823,000; this is 1.9 percent (±10.8 percent)* above the revised December figure of 808,000. The January rate for units in buildings with five units or more was 421,000.

-

13:41

Results from the February Philadelphia Manufacturing Business Outlook Survey suggest that growth in regional manufacturing is broadening

The diffusion indexes for general activity, new orders, and shipments were all positive this month and increased notably from their readings last month. The surveyed firms continued to report growth in employment and work hours. Although they moderated from last month, the future indexes for growth over the next six months continued to reflect a high degree of optimism.

The index for current manufacturing activity in the region increased from a reading of 23.6 in January to 43.3 this month and has remained positive for seven consecutive months

-

13:39

US unemployment claims continue to decline

In the week ending February 11, the advance figure for seasonally adjusted initial claims was 239,000, an increase of 5,000 from the previous week's unrevised level of 234,000. The 4-week moving average was 245,250, an increase of 500 from the previous week's revised average. The previous week's average was revised up by 500 from 244,250 to 244,750.

-

13:30

U.S.: Building Permits, January 1285 (forecast 1230)

-

13:30

U.S.: Initial Jobless Claims, 239 (forecast 245)

-

13:30

U.S.: Housing Starts, January 1246 (forecast 1222)

-

13:30

U.S.: Continuing Jobless Claims, 2076 (forecast 2051)

-

13:30

U.S.: Philadelphia Fed Manufacturing Survey, February 43.3 (forecast 18)

-

13:26

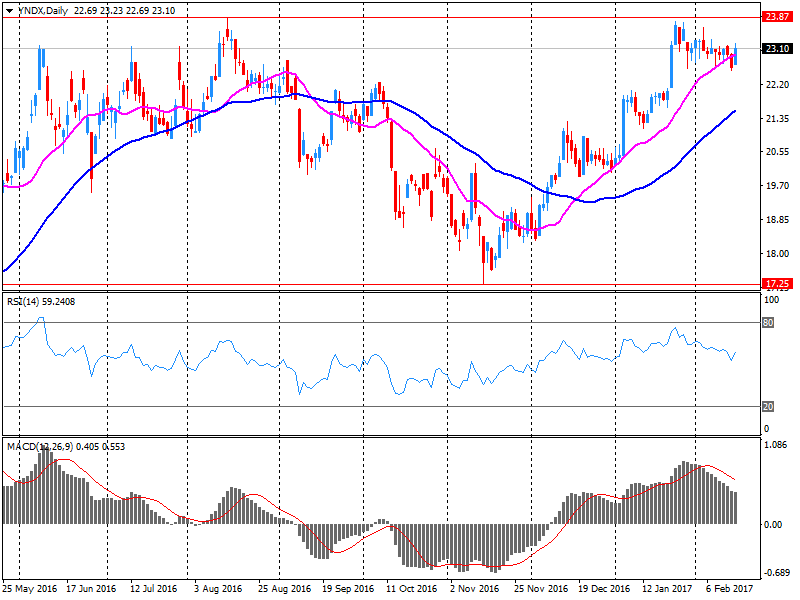

Company News: Yandex N.V. (YNDX) Q4 EPS miss analysts’ estimate

Yandex N.V. reported Q4 FY 2016 earnings of RUB9.94 per share (versus RUB11.24 in Q4 FY 2015), missing analysts' consensus estimate of RUB11.00.

The company's quarterly revenues amounted to RUB22.119 bln (+22.2% y/y), beating analysts' consensus estimate of RUB20.843 bln.

The company also issued in-line guidance for FY 2017, projecting FY17 revenues of RUB88.0-90.3 bln (+16-19% y/y) versus analysts' consensus estimate of RUB89.27 bln.

YNDX rose to $23.42 (+1.21%) in pre-market trading.

-

13:13

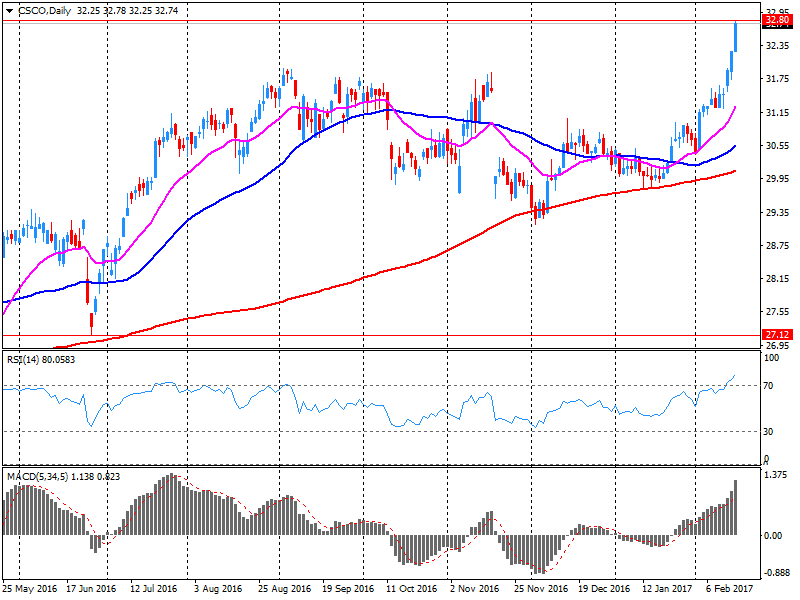

Company News: квартальная прибыль Cisco Systems (CSCO) превзошла прогнозы аналитиков

Cisco Systems reported Q2 FY 2017 earnings of $.0 57per share (versus $0.57 in Q2 FY 2016), beating analysts' consensus estimate of $0.56.

The company's quarterly revenues amounted to $11.580 bln (-2.9% y/y), generally in-line with analysts' consensus estimate of $11.557 bln.

The company also issued in-line guidance for Q3, projecting EPS of $0.57-0.59 versus analysts' consensus estimate of $0.58 and revenues at ~$11.76-12.0 bln (-2-0% y/y) versus analysts' consensus estimate of $11.87 bln .

Cisco increased quarterly cash dividend 12% to $0.29.

CSCO rose to $33.37 (+1.68%) in pre-market trading.

-

13:00

Orders

EUR/USD

Offers: 1.0635 1.0650 1.0680 1.0700-05 1.0730 1.0750

Bids: 1.0600 1.0585 1.0550 1.0520 1.0500 1.0480-85 1.0450

GBP/USD

Offers: 1.2500 1.2520 1.2550 1.2580 1.2600

Bids: 1.2465 1.2450 1.2430 1.2400 1.2380 1.2345-50

EUR/GBP

Offers: 0.8520 0.8535 0.8550-60 0.8600

Bids: 0.8480-85 0.8450 0.8430 0.8400 0.8385 0.8350

EUR/JPY

Offers: 121.00 121.35 121.50 121.80 122.00 122.50

Bids: 120.80 120.60 102.30 120.00 119.75 119.50

USD/JPY

Offers: 114.00-05 114.20 114.35 114.50 114.75-80 115.00 115.20 115.50

Bids: 113.65 113.50 113.20 113.00 112.80 112.50

AUD/USD

Offers: 0.7730 0.7750 0.7780 0.7800 0.7820 0.7850

Bids: 0.7680 0.7660 0.7620 0.7600 0.7580 0.7550

-

12:33

ECB Officials saw 'no room for complacency' at January policy meeting - Minutes

-

ECB Officials Agreed in Jan That Fundamental Economic Picture Was 'Largely Unaltered'

-

ECB Officials Saw Political Uncertainties at Global Level, Within Eurozone

-

ECB Officials Saw Insufficient Progress Toward Inflation Goal

-

-

12:01

WSE: Mid session comment

The forenoon phase of today's session brought the test of the 2,200 points level for the Warsaw WIG20 index. In overall, the Warsaw Stock Exchange performed better than European markets. Still a clear distinction deserves PGNiG, but come to this following companies as PKN Orlen. This situation may arise from changes in the currency market, where the stronger euro is favorable for the Warsaw Stock Exchange, but not for the Eurozone.

At the halfway point of quotations the WIG20 index was at the level of 2,195 points (+0,52%).

-

11:54

Major stock indices in Europe trading moderately lower

The stock indices in Western Europe trading on mixed corporate reporting after the longest rally in 19 months. Yesterday the world stock market set a new record: the composite index MSCI All-Country World has updated the 2015 highs.

Investors continue to monitor the political scene, including the US news, the campaign in France and the meeting of Foreign Ministers of G20.

Shares of mining companies are getting cheaper, the industry index falls from a high of more than two years due to the negative dynamics in the price of copper. Anglo American lost 2,6%, Antofagasta - 1,9%, Glencore - 0,4%.

Cobham shares fell more than 21% to the lowest level since the end of 2004 and can show a record one-day decline. The company reported a write-off of £ 150 million ($ 187 million) and the deterioration of the forecast for profit in 2016.

The stock price of Nestle SA fell 1.2%. The company does not reach the set target for the fourth consecutive year, and its CEO Mark Schneider said that it will take years to return to the growth rates that are expected. He also reported an increase in restructuring costs.

Air France shares jumped more than 7%. Annual operating profit of the largest air carrier in Europe exceeded expectations, the forecast for 2017 has been mixed.

AstraZeneca securities decreased by 3.5%, oil giant BP down 1.6%. Shares of the French company Capgemini, providing IT-services, rose 2.3% after the firm reported a target of increasing profits for 2017.

At the moment:

FTSE 7260.79 -41.62 -0.57%

DAX 11763.34 -30.59 -0.26%

CAC 4899.86 -25.00 -0.51%

-

11:26

Unnamed OPEC sources: OPEC could extend or deepen supply cuts at the up coming meeting

-

11:16

Crude oil is trading almost flat

This morning, the New York futures for Brent crude oil rose by 0.23% and WTI rose 0.15% to $ 53.19. Thus, the black gold prices traded slightly up, showing a sluggish trend. As reported yesterday, the Energy Information Administration, for the week ending February 10, the amount of oil reserves in the US rose by 9.5 million barrels to 518.1 million barrel mark.

-

11:15

Brazilian economic activity contracted sharply last year, marking the second consecutive year of deep economic recession, according to an index compiled by the central bank

-

09:09

Nomura staying bearish USD and looking to sell rallies

"Today's siren song in currency markets is of upcoming Fed hikes, with many investors being lured into bullish dollar positions.

Admittedly, the dollar has bounced on yesterday's hawkish comments from Fed Chair Yellen and today's strong data, but shortterm bounces do not always translate into long-term trends. Indeed, Ms Yellen's upbeat speech on 18 January saw a similar rally in the dollar only for it to falter some days later

......At the same time, this also implies that other central banks pursuing non-conventional monetary policy, such as the ECB and BOJ, have very negative implied policy rates. But if they were to exit their policies then they should see an equivalent tightening and hence currency appreciation. This will likely be the bigger story for 2017 - US economic strength will help boost global growth and tilt the risks for the ECB and BOJ to exit their ultra-easy policies. Already the BOJ has seemingly ratcheted up its 0% 10yr target to 0.1% and inflation is picking up sharply in the euro area, which should increase the likelihood of the ECB tapering after the French elections.

We therefore favour maintaining a bearish dollar stance and would look to sell any rallies in the currency".

Copyright © 2017 Nomura, eFXnews™

-

08:42

Major stock markets in Europe trading mixed: FTSE -0.3%, DAX -0.1%, CAC40 flat, FTMIB + 0.2%, IBEX -0.1%

-

08:17

WSE: After opening

WIG20 index opened at 2185.44 points (+0.05%)*

WIG 57964.09 0.11%

WIG30 2534.23 0.13%

mWIG40 4797.83 0.05%

*/ - change to previous close

The cash market started the day from a modest increase, with modest, as the recent standards, turnover. Surrounded DAX lost cosmetically, but both beginnings can be considered as neutral towards the end of yesterday's session. After publication of the estimated results a positive posture shows PGNiG (WSE: PGN). However the market does not change its position and is located on the well-known two days levels.

After fifteen minutes of trading WIG20 index was at the level of 2,178 points (-0,25%).

-

07:35

Mixed start of trading expected on the major stock exchanges in Europe: DAX -0.1%, CAC40 + 0.1%, FTSE flat

-

07:30

Options levels on thursday, February 16, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0809 (5023)

$1.0726 (3129)

$1.0665 (3056)

Price at time of writing this review: $1.0604

Support levels (open interest**, contracts):

$1.0535 (5206)

$1.0505 (4974)

$1.0470 (5207)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 69879 contracts, with the maximum number of contracts with strike price $1,0800 (5023);

- Overall open interest on the PUT options with the expiration date March, 13 is 83083 contracts, with the maximum number of contracts with strike price $1,0500 (5207);

- The ratio of PUT/CALL was 1.19 versus 1.21 from the previous trading day according to data from February, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.2702 (2253)

$1.2603 (2116)

$1.2507 (3513)

Price at time of writing this review: $1.2470

Support levels (open interest**, contracts):

$1.2393 (1904)

$1.2296 (3705)

$1.2198 (1630)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 33362 contracts, with the maximum number of contracts with strike price $1,2500 (3513);

- Overall open interest on the PUT options with the expiration date March, 13 is 37218 contracts, with the maximum number of contracts with strike price $1,2300 (3705);

- The ratio of PUT/CALL was 1.12 versus 1.12 from the previous trading day according to data from February, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:14

WSE: Before opening

Wednesday's session on the New York stock exchanges brought growth in the major indexes. The Dow Jones Industrial rose at the close of 0.52 percent, the S&P500 was firmer by 0.50 percent and the Nasdaq Comp. gained 0.64 percent. On Wednesday, Janet Yellen repeated the arguments contained in the delivered one day before to the Senate Committee speech, that the Federal Reserve should not delay the next rate hike. Data from the US economy indicate an increase in inflationary pressures, which, together with the occurrence of Janet Yellen to Congress reinforces expectations of a rate hike in the USA.

Possible optimism may dampen somewhat mixed behavior of Asian parquets, where the weaker dollar has not been welcomed in Tokyo. Other markets are dominated by caution and fear of the risks associated with technical overbuying.

Today's calendar is almost empty and rather should not be a source of serious pulses. This can promote stability, for which the preferences were seen yesterday in Warsaw and Frankfurt.

-

07:09

SNB to increase intervention again - BNPP

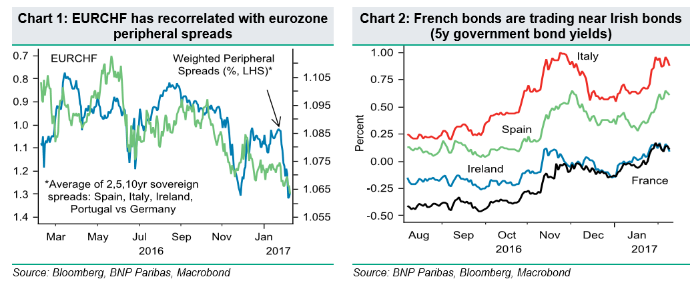

"EURCHF fell to a post-Brexit low below 1.07 at the end of January, likely on the back of reports of a large CHF M&A deal. However, the CHF has continued to rise in February, and we think the most important driver could be the spike in eurozone peripheral spreads. Eurozone peripheral spreads and EURCHF have started to reconverge (Chart 1) and, in our view, the widening of peripheral spreads is leading to safe-haven CHF demand.

However, CHF strength is likely to pressure the Swiss National Bank (SNB) to increase its FX intervention. According to our calculations, the SNB intervened in FX markets in November by approximately CHF 14bn (a record intervention) and CHF 4.9bn in January (in line with recent interventions). This month, the SNB allowed EURCHF to breach 1.07 for the first time, but we think the central bank could start increasing its interventions again, which could counter the safe-haven demand.

This outlook is consistent with our EURCHF target at 1.10 in Q2 17 and 1.12 by the end of the year, although we would not rule out a fall in the pair in the very short term".

Copyright © 2017 BNP Paribas™, eFXnews™

-

07:05

Japan Finance Minister, Taro Aso: the level of 120 on USD/JPY can not be called a weak yen

The Minister stated that the Y120 level can not be considered weak for the Japanese currency. This statement caused a strong resonance wave of discussions in the business press of Japan.

-

07:02

Fed’s Dudley: Expects To Gradually Raise Rates 'A Little Further In The Months Ahead' If Forecast Pans Out @Livesquawk

-

07:01

Australian unemployment rate was 5.7 per cent for the ninth consecutive month

Monthly trend full-time employment increased by 6,500 in Australia in January 2017, according to figures released by the Australian Bureau of Statistics (ABS) today. This was the fourth consecutive month of increasing full-time employment, after eight consecutive decreases earlier in 2016.

Total trend employment increased by 11,700 persons to 11,984,300 persons in January 2017, reflecting an increase in both full-time (6,500) and part-time (5,100) employment. Total employment growth over the year was 0.8 per cent, which was less than half the average growth rate over the past 20 years (1.8%).

"We are still seeing strong growth in part-time employment in January 2017, and in recent months, increasing growth in full-time employment. There are now around 129,800 more people working part-time than there were a year ago, and around 40,100 fewer people working full-time," said the General Manager of ABS' Macroeconomic Statistics Division, Bruce Hockman.

The trend unemployment rate was 5.7 per cent for the ninth consecutive month.

The trend participation rate was unchanged at 64.6 per cent.

-

06:29

Global Stocks

European stocks booked a seventh straight advance on Wednesday, with banks leading the gains after Federal Reserve Chairwoman Janet Yellen sparked a rally in financial stocks by hinting U.S. interest rates soon will go higher.

Stocks have done something they haven't done in more than a quarter of a century, with the Dow industrials, the S&P 500 and the Nasdaq all closing at record levels for a fifth session in a row. The last time all three benchmarks closed at records for five consecutive sessions was back on Jan. 2, 1992. They went on to do it again for a sixth day in a row in a streak that ended on Jan. 3, according to Dow Jones data.

Investors in Asia showed caution Thursday, as a weaker U.S. dollar and profit-taking sent major stock indexes lower, despite a strong overnight lead from Wall Street. After Wednesday's surge in regional equities, risk appetite cooled amid currency headwinds and broader global political uncertainty. The moves reflect a pattern of choppy trading in recent weeks.

-

00:31

Australia: Changing the number of employed, January 13.5 (forecast 10)

-

00:30

Australia: Unemployment rate, January 5.7% (forecast 5.8%)

-

00:00

Australia: Consumer Inflation Expectation, February 4.1%

-